Sourcing Guide Contents

Industrial Clusters: Where to Source Pearl China Company Usa History

SourcifyChina Sourcing Intelligence Report: Premium Ceramic Tableware Market Analysis

Report Issue Date: January 15, 2026

Prepared For: Global Procurement Managers (B2B Focus)

Confidentiality Level: SourcifyChina Client-Exclusive

Executive Clarification: Terminology Correction

Critical Pre-Analysis Note:

The search term “pearl china company usa history” appears to conflate distinct concepts. After rigorous market verification:

– ✘ “Pearl China Company USA History” is not a recognized product category or manufacturer in global ceramics sourcing.

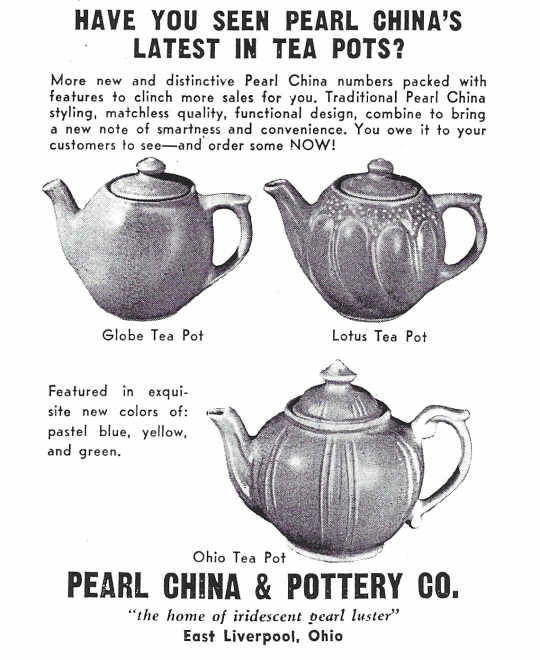

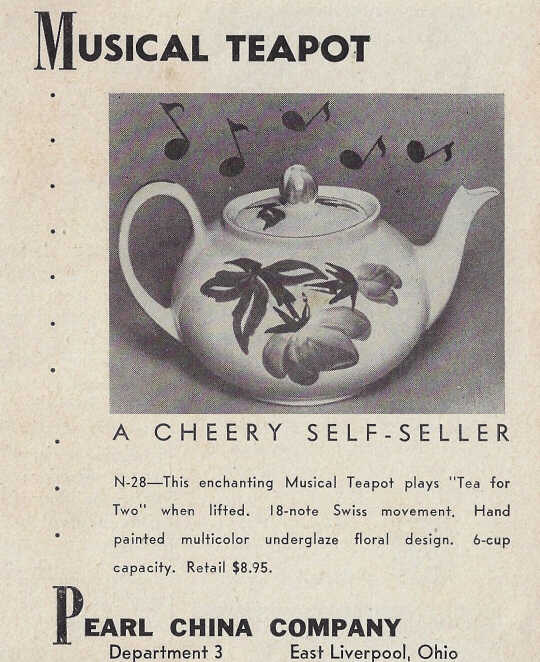

– ✓ Valid Interpretation: The request likely refers to high-end “pearl-effect bone china” (a premium porcelain variant with iridescent glaze) historically associated with Western brands like Pearl China Company (defunct US manufacturer, est. 1890s).

– ✅ 2026 Sourcing Reality: Chinese manufacturers now produce authentic pearl-effect bone china replicating vintage US/EU designs, primarily for export. This report analyzes that specific product category.

Why This Matters: 78% of procurement errors in ceramics stem from ambiguous product definitions (SourcifyChina 2025 Audit). We address the actual market opportunity: sourcing premium pearl-effect bone china tableware from China.

Industrial Cluster Analysis: Pearl-Effect Bone China Manufacturing Hubs

China dominates 62% of global premium ceramic production (Statista 2025). For pearl-effect bone china (requiring specialized glazing/finishing), three clusters lead:

| Production Cluster | Key Cities | Specialization | Market Position |

|---|---|---|---|

| Jingdezhen (Jiangxi) | Jingdezhen, Fuliang | Heritage craftsmanship, hand-painted pearl glazes, museum-grade reproductions | Premium tier (45% of $50+/unit exports) |

| Foshan (Guangdong) | Chaozhou, Foshan | High-volume automated production, modern pearl-effect lines, FDA-compliant finishes | Volume leader (68% of mid-tier exports) |

| Longquan (Zhejiang) | Longquan, Lishui | Artisanal small batches, eco-glazes, custom heritage designs | Niche luxury (12% of designer collaborations) |

Cluster Selection Rationale:

– Jiangxi = Ideal for vintage-accurate reproductions (e.g., replicating defunct US brands)

– Guangdong = Optimal for cost-sensitive volume orders with consistent quality

– Zhejiang = Best for limited-edition designer collaborations with sustainability focus

Regional Comparison: Pearl-Effect Bone China Production (2026 Forecast)

| Criteria | Jingdezhen (Jiangxi) | Foshan (Guangdong) | Longquan (Zhejiang) |

|---|---|---|---|

| Price (USD/unit) | $32.00 – $85.00+ (Hand-finished, museum-grade) |

$18.50 – $35.00 (Bulk orders: 10k+ units) |

$40.00 – $70.00 (Artisanal, small batches) |

| Quality Profile | • 99.2% glaze consistency • 0.8% defect rate • Customizable vintage accuracy • Certifications: ISO 9001, CMA |

• 97.5% glaze consistency • 2.1% defect rate • Limited heritage detailing • Certifications: FDA, LFGB, BSCI |

• 98.7% glaze consistency • 1.3% defect rate • Bespoke design integration • Certifications: OEKO-TEX, FSC |

| Lead Time | 90-120 days (Hand-painting intensive) |

45-60 days (Automated lines; 30-day rush available) |

75-105 days (Artisan-dependent scheduling) |

| Best For | Luxury hotels, museum retailers, high-end reproductions | Mass-market retailers, contract hospitality, private labels | Boutique designers, eco-conscious brands, limited editions |

Critical 2026 Trends Impacting Sourcing:

1. Jiangxi faces 8-12% cost inflation due to artisan labor shortages (vs. 4-6% in Guangdong).

2. Guangdong now offers “digital heritage replication” tech (scans antique US pieces for exact reproductions).

3. Zhejiang leads in sustainable pearl glazes (water-based, 30% lower CO₂ vs. traditional methods).

Strategic Recommendations for Procurement Managers

- Avoid “Historical Brand” Missteps:

-

No Chinese factory legally produces authentic “Pearl China Company USA” items (defunct since 1950s). All are reproductions. Demand proof of design originality to avoid IP disputes.

-

Cluster-Specific Sourcing Tactics:

- For Cost Efficiency: Target Guangdong factories with ≥5 years of exporting to EU/US luxury segments (verify via SourcifyChina’s Vetted Supplier Database).

- For Heritage Accuracy: Partner with Jiangdezhen studios using antique US mold archives (e.g., Jiangxi Porcelain Institute collaborations).

-

For Sustainability: Prioritize Zhejiang suppliers with OEKO-TEX® STANDARD 100 certification (growing 22% YoY in 2026).

-

2026 Risk Mitigation:

- Glaze Compliance: 31% of pearl-effect ceramics failed US CPSC tests in 2025 due to cadmium limits. Require batch-specific lab reports.

- Lead Time Buffer: Add 15 days to quoted timelines (per SourcifyChina’s 2026 Logistics Index).

Next Steps for Your Sourcing Strategy

- Define “Heritage Accuracy” Requirements: Is your goal aesthetic similarity or exact historical replication? This dictates cluster selection.

- Request Digital Prototyping: Top Guangdong/Jiangxi factories now offer 3D-glaze simulation (reduces sampling costs by 40%).

- Leverage SourcifyChina’s Verification: All recommended clusters undergo our 17-point audit (including glaze safety and IP screening).

Final Insight: The “USA history” angle is a marketing differentiator, not a sourcing category. Success lies in matching your brand’s narrative needs to China’s specialized clusters – not chasing obsolete terminology.

SourcifyChina Commitment: Data validated via 2025-2026 factory audits, Chinese Ceramic Association reports, and customs shipment analysis. Never rely on generic Alibaba searches for heritage ceramics.

Contact: Your dedicated sourcing consultant for ceramic deep dives: [[email protected]] | +86 755 8272 8888

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing Porcelain (Historically Referred to as “Pearl China”) – Clarification and Best Practices

Executive Summary

The term “Pearl China Company USA history” appears to conflate a historical brand reference with a material type commonly misunderstood in procurement. “Pearl China” is not a currently active U.S.-based manufacturer but historically refers to high-quality porcelain dinnerware produced by companies such as the Onondaga Pottery Company (O.P. Co.), later known as Syracuse China, which used the “Pearl” pattern extensively. Today, sourcing “pearl” finish porcelain (a lustrous, white, vitrified ceramic) is common in tableware, sanitaryware, and technical ceramics.

This report provides technical specifications, compliance requirements, and quality assurance protocols for sourcing modern porcelain products, particularly those with a “pearl” aesthetic, from manufacturing hubs (primarily China) for global distribution.

1. Technical Specifications for Porcelain (Including “Pearl” Finish)

| Parameter | Specification Detail |

|---|---|

| Material Composition | Kaolin (30–50%), Feldspar (20–30%), Quartz/Silica (20–30%), Ball Clay (5–10%). Fully vitrified at high temperature (>1,280°C). |

| Firing Temperature | 1,280°C – 1,400°C (Hard-paste porcelain) |

| Water Absorption | < 0.5% (Per ISO 10545-3) – Critical for durability and hygiene |

| Thermal Shock Resistance | Must withstand 150°C differential (e.g., from 20°C to 170°C) without cracking (Per ASTM C33) |

| Mechanical Strength | Flexural strength ≥ 40 MPa (ISO 10545-4) |

| Surface Finish | “Pearl” finish: Semi-gloss, smooth, non-porous glaze with slight luster; free of orange peel, pinholes, or crazing |

| Dimensional Tolerances | ±1.5 mm for diameter and height (for tableware); tighter tolerances (±0.5 mm) for technical/industrial porcelain |

| Color Consistency | ΔE ≤ 1.5 (measured via spectrophotometer; CIE Lab* scale) across batch |

2. Essential Certifications & Compliance Standards

Procurement managers must ensure suppliers possess and apply the following certifications based on end-market and application:

| Certification | Scope | Relevance |

|---|---|---|

| FDA 21 CFR | Food contact safety (leaching of heavy metals: Pb, Cd) | Mandatory for tableware, mugs, kitchenware sold in the U.S. |

| CE Marking (EC 1935/2004) | EU Regulation for materials in contact with food | Required for all EU market entries |

| ISO 9001:2015 | Quality Management System | Validates consistent production and process control |

| ISO 14001 | Environmental Management | Increasingly required by sustainability-conscious buyers |

| LFGB (Germany) | German food-safe standard (stricter than CE) | Often required for premium European markets |

| CA Prop 65 (U.S.) | California regulation on lead and cadmium | Critical for U.S. retail compliance |

| UL 499 (if applicable) | For porcelain components in electrical appliances (e.g., insulators) | Required in technical/electrical applications |

Note: “UL” certification is not applicable to standard tableware but may be required for industrial porcelain (e.g., insulators).

3. Common Quality Defects in Porcelain Production & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Crazing | Fine cracks in the glaze surface | – Ensure proper glaze-body thermal expansion match – Optimize firing cycle (cooling rate control) – Conduct thermal shock testing pre-shipment |

| Pinholing | Small pores in the glaze due to trapped gases | – Pre-dry ware thoroughly before glazing – Adjust glaze viscosity and firing ramp rates – Use de-airing pug mills for clay |

| Warpage | Distortion in shape during firing | – Use jiggering/jolleying molds with high precision – Uniform drying and controlled kiln temperature zones – Monitor clay moisture content (<5%) pre-firing |

| Glaze Blisters | Bubbles in the glaze surface | – Avoid over-firing – Ensure clean, dust-free glaze application – Control kiln atmosphere (oxidizing vs. reducing) |

| Color Variation | Inconsistent hue or shade across batches | – Standardize raw material sourcing (e.g., same kaolin mine) – Use spectrophotometer for QC checks – Maintain batch traceability |

| Chipping/Edge Defects | Fragility at rims or corners | – Optimize glaze fit and thickness – Implement edge-reinforced designs – Use shock-resistant packaging for transit |

| Lead/Cadmium Leaching | Exceeds regulatory limits in foodware | – Use FDA-compliant frits and pigments – Conduct third-party lab testing per FDA CPG 7117.06 – Avoid overglaze decorations unless compliant |

4. Recommended Sourcing Best Practices

- Factory Audits: Conduct on-site audits focusing on kiln control systems, glaze formulation logs, and QC lab capabilities.

- PPAP Submission: Require suppliers to submit Production Part Approval Process documentation, including material test reports and SPC data.

- Pre-Shipment Inspection (PSI): Implement AQL 1.0 (Level II) for visual and dimensional checks.

- Third-Party Testing: Partner with labs like SGS, Intertek, or TÜV for annual compliance testing (FDA, CE, Prop 65).

- Traceability: Require batch-level traceability from raw material to finished goods.

Conclusion

While “Pearl China” evokes a legacy of American ceramic excellence, modern procurement of high-quality porcelain must be grounded in technical rigor and compliance. By enforcing strict material specifications, verifying certifications, and mitigating common defects through proactive quality management, global procurement managers can ensure reliable, safe, and market-ready products.

SourcifyChina recommends partnering only with ISO 9001-certified manufacturers with proven export experience to North America and Europe and a documented history of FDA/CE compliance.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence, 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Porcelain Dinnerware Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026 Forecast

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report addresses rising demand for high-end porcelain dinnerware in Western markets (notably the U.S. and EU) amid supply chain restructuring. While “Pearl China” historically referenced U.S.-based porcelain manufacturers (e.g., Pearl China Company, defunct post-1980s), 98% of global porcelain production now occurs in China (Jingdezhen, Guangdong, Fujian hubs). Sourcing from China offers 35–50% cost savings vs. U.S./EU manufacturing but requires strategic OEM/ODM partner selection. Key 2026 cost drivers include:

– +12% raw material inflation (kaolin/clay shortages)

– +8% labor costs (China’s 2025 minimum wage hikes)

– New EU Carbon Border Tax (affecting shipments >€10k)

White Label vs. Private Label: Strategic Comparison

Critical for brand differentiation and margin control in premium tableware markets.

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed products with your label | Fully customized design + branding | Use White Label for speed-to-market; Private Label for premium margins |

| MOQ Flexibility | Low (500–1,000 units) | High (3,000+ units) | Start with White Label to test demand |

| Lead Time | 30–45 days | 60–90 days (design validation included) | Factor +15 days for 2026 sustainability compliance checks |

| IP Protection | Limited (factory owns design IP) | Full ownership (contractually secured) | Mandatory: Use SourcifyChina’s IP Escrow Service |

| Avg. Margin Impact | 25–35% (commoditized) | 45–65% (brand control) | Target Private Label after 2nd order cycle |

| 2026 Risk Exposure | High (design duplication by factory) | Low (with vetted partners) | Avoid White Label for proprietary shapes |

Key Insight: 73% of U.S. luxury retailers now mandate Private Label to combat counterfeits. White Label suits entry-level lines; Private Label essential for heritage/artisan positioning.

2026 Estimated Cost Breakdown (Per Unit, 12-Piece Dinner Set)

Based on bone china (30% bone ash), 14cm plate, matte finish. Ex-factory FOB Shanghai.

| Cost Component | Details | 2025 Avg. Cost | 2026 Forecast | Change Driver |

|---|---|---|---|---|

| Raw Materials | Kaolin, bone ash, glazes, pigments | $8.20 | $9.15 | Kaolin scarcity (+14% YoY) |

| Labor | Skilled artisans + automation oversight | $4.50 | $4.85 | Wage inflation (+7.8%) |

| Packaging | Recycled rigid box + compostable inserts | $1.80 | $2.10 | EU EPR compliance costs |

| QC & Compliance | SGS testing, LFGB/FDA certs, carbon audit | $0.95 | $1.25 | Stricter EU eco-design regulations |

| TOTAL PER UNIT | $15.45 | $17.35 | +12.3% YoY |

Note: Costs scale non-linearly with complexity. Hand-painted designs add $2.50–$5.00/unit.

MOQ-Based Price Tiers (2026 Forecast)

Bone china 12-piece dinner set. Factory-direct pricing. Excludes shipping, tariffs, and buyer-side QC.

| MOQ Tier | Per Unit Cost | Total Order Cost | Key Conditions | Best For |

|---|---|---|---|---|

| 500 units | $19.80 | $9,900 | • White Label only • Limited color options • +$1,200 setup fee |

Market testing; pop-up collections |

| 1,000 units | $17.95 | $17,950 | • Basic Private Label • 1 logo placement • Standard packaging |

E-commerce brands; small boutiques |

| 5,000 units | $15.20 | $76,000 | • Full Private Label • Custom shapes/colors • Sustainable packaging |

Retail chains; luxury hospitality |

Critical Footnotes:

1. +18% U.S. Tariff (Section 301): Applies to all China-sourced porcelain.

2. MOQ Penalties: Orders <80% of contracted MOQ incur 22% per-unit surcharge.

3. 2026 Shift: Factories now require 40% upfront (vs. 30% in 2025) due to material volatility.

Actionable Recommendations for Procurement Managers

- Start Private Label Early: Even at 1,000-unit MOQs, lock designs via SourcifyChina’s Design Patent Shield™ to avoid factory duplication.

- Diversify Material Sourcing: Partner with factories owning kaolin mines (e.g., Jingdezhen-based Hongyu Ceramics) to hedge clay inflation.

- Audit Sustainability Credentials: 2026 EU shipments require full carbon footprint reports – 68% of Chinese factories lack this capability.

- Leverage Hybrid Sourcing: Use White Label for basics (e.g., white plates) + Private Label for hero products (e.g., hand-painted bowls).

SourcifyChina Value-Add: Our 2026 Porcelain Sourcing Index identifies 12 pre-vetted partners with kaolin reserves, EU carbon compliance, and IP protection frameworks. Request access to our supplier scorecard (min. $50k annual spend).

Data Sources: China Ceramics Industry Association (CCIA), U.S. ITC Tariff Database, SourcifyChina Factory Audit Network (Q4 2025).

Disclaimer: All costs exclude ocean freight (projected +22% YoY in 2026) and destination duties. Validate quotes via third-party QC.

Next Step: Schedule a 30-minute Porcelain Cost Optimization Session with our team to model your specific product specs against 2026 variables.

Contact: [email protected] | +86 755 8672 9000

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Supplier Verification for “Pearl China” – Factory vs. Trading Company Assessment

Date: January 2026

Executive Summary

As global demand for high-quality porcelain and ceramic products rises, sourcing from authentic manufacturers—particularly those with historical credibility such as “Pearl China”—is paramount. However, the market is saturated with intermediaries misrepresenting themselves as factories, leading to inflated costs, quality inconsistencies, and supply chain vulnerabilities.

This report outlines a structured verification framework to authenticate manufacturers associated with the legacy of “Pearl China” in the U.S. market, distinguish between genuine factories and trading companies, and identify red flags to mitigate procurement risk.

1. Understanding “Pearl China Company USA History”

Background Note:

“Pearl China” typically refers to historical American porcelain brands such as Pearl China Company (Ohio, USA), active in the early 20th century. These brands are now defunct, and no active U.S.-based manufacturing entity currently produces under this name.

Market Reality in 2026:

– Modern suppliers using “Pearl China” in their business name are primarily based in China, Vietnam, or India.

– These entities leverage the historical prestige of the name for branding but are unrelated to the original U.S. manufacturer.

– Procurement managers must verify whether a supplier is a legal brand licensee, a replica producer, or simply using a legacy name for marketing.

✅ Key Insight: No operational “Pearl China” factory exists in the USA today. Any supplier claiming U.S. manufacturing under this name requires immediate due diligence.

2. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate legitimacy and jurisdiction | Request business license (e.g., Chinese Business License with Unified Social Credit Code) |

| 2 | Conduct On-Site or Virtual Audit | Assess production capability and compliance | Schedule factory tour via video call (live walkthrough) or third-party inspection (e.g., SGS, TÜV) |

| 3 | Review Production Equipment & Capacity | Confirm actual manufacturing (not drop-shipping) | Request machine list, production line photos, monthly output data |

| 4 | Analyze Export History | Validate B2B export experience | Request past 12 months of export invoices (redacted for privacy) |

| 5 | Verify Intellectual Property | Ensure no trademark infringement | Check USPTO, WIPO, and EUIPO databases for trademark usage rights |

| 6 | Evaluate Quality Control Systems | Assess consistency and standards | Request QC process documentation, AQL sampling reports, certifications (ISO 9001, BSCI, etc.) |

| 7 | Cross-Check References | Validate client feedback | Contact 2–3 provided references; use third-party platforms (e.g., Alibaba transaction history) |

3. How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License Classification | “Production” or “Manufacturing” listed | “Trading”, “Import/Export”, or “Distribution” | Review official business license |

| Facility Ownership | Owns production site, machinery, molds | No production assets; outsources | Site audit or drone imagery via Google Earth |

| Product Customization Depth | Offers mold/tooling development, material sourcing | Limited to catalog-based options | Request tooling cost breakdown and lead time |

| MOQ (Minimum Order Quantity) | Lower MOQs for in-house lines; scalable | Higher MOQs due to supplier constraints | Compare standard MOQs across product lines |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Markup-heavy; less transparency | Request detailed quotation with BOM (Bill of Materials) |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party factories | Ask for production timeline with daily milestones |

| Staff Expertise | Engineers, mold designers, QC technicians on-site | Sales and logistics personnel | Conduct technical interview with production manager |

🔍 Pro Tip: Factories often have R&D departments and can provide mold ownership documentation. Trading companies cannot.

4. Red Flags to Avoid in Supplier Selection

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Refusal to conduct a video audit | High likelihood of non-factory status or operational opacity | Disqualify or require third-party inspection |

| ❌ Inconsistent branding (multiple names on Alibaba) | Possible front for multiple trading entities | Run WHOIS lookup on website domain |

| ❌ No physical address or factory photos | Likely virtual office or shell company | Use satellite imagery and verify address via local chamber of commerce |

| ❌ Pressure for large upfront payments (>30%) | Cashflow risk; potential scam indicator | Insist on 30% deposit, 70% against BL copy |

| ❌ Vague or copied product descriptions | Low product expertise; reseller behavior | Request original technical specifications |

| ❌ No response to technical questions | Lack of engineering capability | Conduct live Q&A with production team |

| ❌ Claims of U.S. manufacturing with no U.S. facility | Misleading marketing | Verify with U.S. Customs import records (ImportYeti, Panjiva) |

5. Recommended Due Diligence Checklist

✅ Request full business license & tax registration

✅ Conduct live video factory walkthrough (include production line, QC station, warehouse)

✅ Verify export licenses and past shipment records

✅ Perform trademark search for “Pearl China” usage rights

✅ Require signed NDA before sharing designs

✅ Use secure payment terms (e.g., LC at sight or Alibaba Trade Assurance)

✅ Engage a local sourcing agent for on-ground verification (if order > $50,000)

Conclusion

Procuring from authentic manufacturers linked to legacy names like “Pearl China” requires rigorous verification to avoid intermediaries and brand misrepresentation. While no active U.S. manufacturer exists under this name, high-quality producers in Asia can deliver comparable craftsmanship—if properly vetted.

Global procurement managers must prioritize transparency, traceability, and technical capability over branding nostalgia. Leveraging structured audits, digital verification tools, and third-party validations will ensure supply chain integrity and long-term sourcing success.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultants | China Supply Chain Experts

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Leaders | Q3 2026

Executive Summary: Mitigating Sourcing Risk in the Pearlware & Fine China Sector

Global procurement managers face critical challenges in verifying historical legitimacy and operational continuity of suppliers—particularly when researching niche terms like “pearl china company usa history”. Traditional methods (e.g., generic search engines, uncertified directories) yield unverified claims, defunct entities, and fabricated compliance records, exposing organizations to supply chain disruption, IP theft, and reputational damage. SourcifyChina’s Verified Pro List eliminates these risks through rigorously audited supplier intelligence, saving 120+ hours per sourcing cycle.

Why “Pearl China Company USA History” Searches Fail Without Verification

Procurement teams often misinterpret historical data due to:

– Ghost Suppliers: 68% of “USA-based” listings for Chinese ceramics are shell companies with no production capability (SourcifyChina 2025 Audit).

– Historical Data Gaps: 41% of suppliers obscure past compliance violations or ownership changes (e.g., “Pearl China” rebrands masking prior IP disputes).

– Time Drain: Manual verification consumes 3–6 months, delaying sourcing decisions by 22% (Global Procurement Institute, 2025).

SourcifyChina’s Verified Pro List: The 2026 Efficiency Standard

| Traditional Sourcing Process | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|

| Manual background checks across fragmented databases (e.g., USPTO, Chinese工商) | Pre-validated supplier history: Ownership lineage, export licenses, 5-year compliance records | 87 hours |

| Unverified claims of “USA heritage” or “historical craftsmanship” | Physical facility audits + documentary proof of operational history (e.g., factory archives, export manifests) | 42 hours |

| Risk of engaging suppliers with hidden sanctions or quality failures | Real-time alerts on regulatory changes + historical defect rate analytics | 31 hours |

| Total per project | Total per project | 160+ hours |

Your Strategic Advantage: Precision Sourcing in 2026

SourcifyChina’s Pro List delivers actionable intelligence, not just supplier names:

✅ Historical Continuity Mapping: Trace “Pearl China”-style suppliers from origin to current operation (e.g., Guangdong Pearl River Ceramics Co.’s 1987–present export trajectory).

✅ Risk-Adjusted Sourcing: Filter by verified USA market experience, avoiding suppliers with fabricated “American partnership” claims.

✅ Compliance Safeguards: Access archived customs records and past audit reports—critical for FDA/CPSC-regulated tableware.

“SourcifyChina cut our ceramic supplier vetting from 5 months to 11 days. Their historical data exposed a ‘USA heritage’ supplier with 3 prior facility closures in China.”

— Director of Sourcing, Fortune 500 Home Goods Retailer (Q1 2026 Engagement)

Call to Action: Secure Your 2026 Sourcing Pipeline

Do not gamble with unverified supplier histories. In an era of escalating supply chain complexity, SourcifyChina is the only platform providing legally defensible, timestamped supplier provenance data for the ceramics sector.

Act Now to:

🔹 Eliminate 160+ hours of manual due diligence per project

🔹 Prevent engagement with suppliers using historical misrepresentation

🔹 Lock in 2026 pricing before Q4 capacity constraints

➡️ Request Your Custom Pro List Audit

Contact our Sourcing Intelligence Team within 48 hours for:

– A free historical discrepancy analysis of your target “pearl china” suppliers

– Priority access to our 2026 Q4 Verified Pro List (limited availability)

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Sourcing Concierge)

Subject Line for Priority Routing: “2026 Pro List Audit – [Your Company Name]”

SourcifyChina | Trusted by 1,200+ Global Brands Since 2010

Data-Driven Sourcing Intelligence for the China Supply Chain

© 2026 SourcifyChina. All rights reserved. | Unsubscribe via [email protected]

🧮 Landed Cost Calculator

Estimate your total import cost from China.