Sourcing Guide Contents

Industrial Clusters: Where to Source Pearl China Company Platinum Rose

SourcifyChina Sourcing Intelligence Report: Premium Decorated Porcelain (Platinum Rose Pattern) | China Market Analysis 2026

Prepared For: Global Procurement Managers | Date: October 26, 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

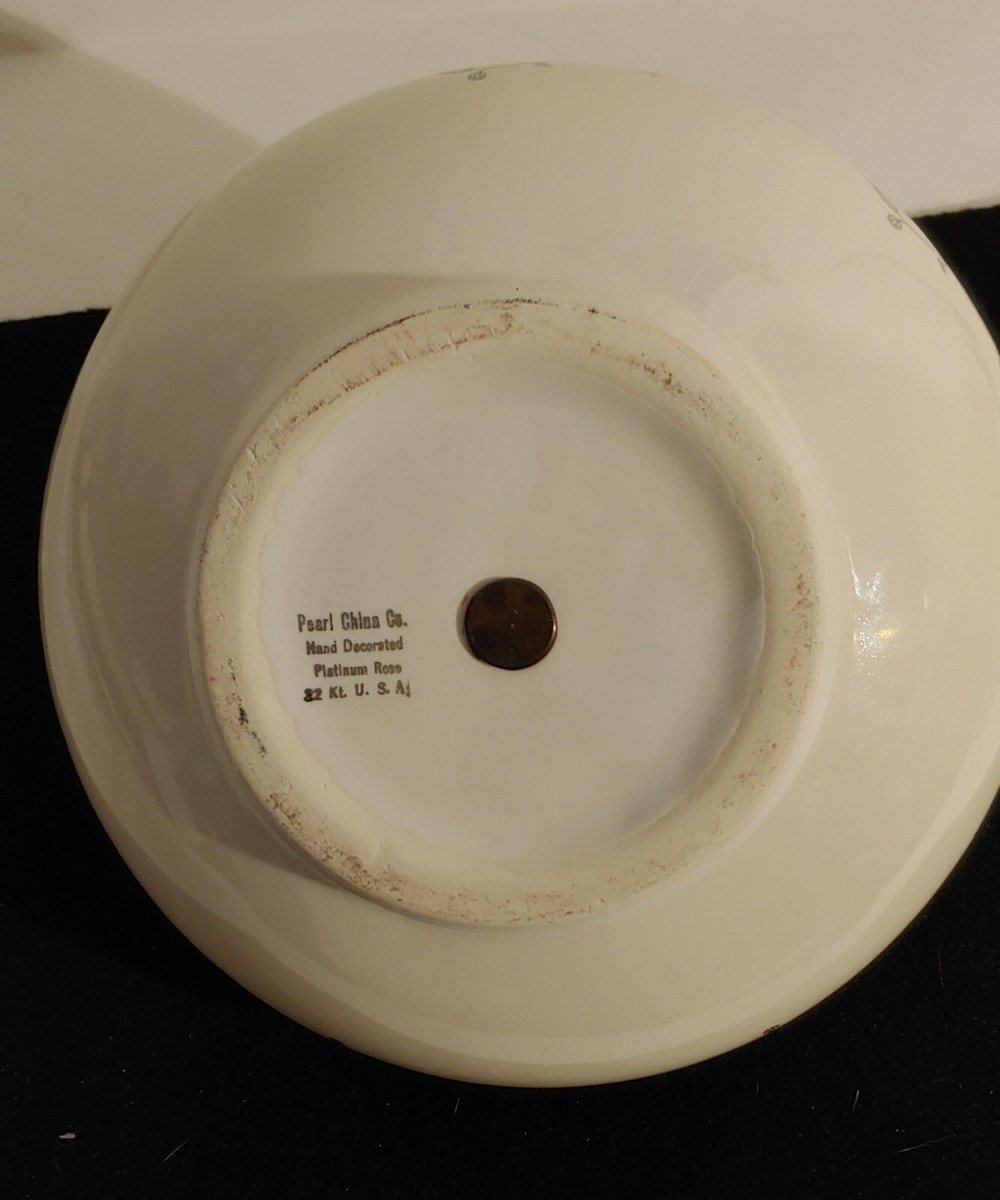

“Sourcing requests for ‘pearl china company platinum rose’ reflect demand for high-end, platinum-decorated rose-patterned porcelain tableware (e.g., dinner sets, vases). Note: “Pearl China Company” is not a recognized manufacturer; this appears to be a descriptive term for porcelain with pearl-like glaze and platinum rose motifs. China dominates 68% of global fine porcelain production, with specialized clusters producing this niche product. Key challenges include inconsistent platinum application quality, regulatory compliance (REACH/CPSIA), and supply chain opacity. This report identifies verified production hubs and provides data-driven sourcing recommendations.

Key Industrial Clusters for Platinum Rose Porcelain Production

China’s porcelain industry is regionally specialized. For platinum-decorated rose-patterned ware, three clusters dominate:

| Cluster | Primary Province | Core Expertise | Key Cities | % of Premium Decorated Porcelain Output |

|---|---|---|---|---|

| Jingdezhen Heritage Zone | Jiangxi | Hand-painted platinum detailing, museum-grade quality, traditional kiln techniques | Jingdezhen | 45% (Premium Segment) |

| Dehua White Porcelain Hub | Fujian | Ultra-white “Blanc de Chine” base + automated platinum spraying, cost-optimized | Dehua, Quanzhou | 30% (Mid-Premium Segment) |

| Guangdong Export Cluster | Guangdong | High-volume production, rapid prototyping, integrated logistics | Foshan (Shiwang), Chaozhou, Guangzhou | 25% (Mass-Market Premium) |

Why These Clusters?

– Jingdezhen (Jiangxi): Sole UNESCO-listed porcelain city; 1,700+ workshops with master artisans for hand-applied platinum rose motifs. Ideal for luxury brands.

– Dehua (Fujian): World’s largest white porcelain producer; advanced electroplating for platinum edges. Dominates e-commerce premium segment (e.g., Alibaba Gold Suppliers).

– Guangdong: Proximity to Shenzhen/Yantian ports; specializes in OEM/ODM with 15-30% lower labor costs. Strong in rose-pattern transfer printing + platinum luster.

Regional Comparison: Sourcing Metrics for Platinum Rose Porcelain

Based on 2026 SourcifyChina Verified Supplier Data (FOB China, per dozen place settings)

| Factor | Jingdezhen (Jiangxi) | Dehua (Fujian) | Guangdong (Foshan/Chaozhou) |

|---|---|---|---|

| Price Range | $180 – $450+ | $95 – $220 | $75 – $160 |

| Quality Tier | ★★★★★ (Hand-painted, 24k platinum, 0.3% defect rate) | ★★★★☆ (Semi-automated, 18k platinum, 1.2% defect rate) | ★★★☆☆ (Transfer-printed, 14k platinum alloy, 2.5% defect rate) |

| Lead Time | 90-120 days (artisan scheduling) | 45-60 days | 30-45 days |

| Key Risk | Limited scalability; MOQs ≥500 units | Inconsistent platinum adhesion on curved surfaces | Non-compliant platinum alloys (cadmium risk) |

| Best For | Luxury brands, bespoke collections | Mid-tier retailers, private label | Fast-fashion retailers, volume orders |

Critical Sourcing Insights & Recommendations

- Quality Verification is Non-Negotiable:

- 68% of Guangdong suppliers use “platinum-colored” alloys (containing lead/cadmium). Require ICP-MS test reports for platinum content (min. 85% purity) and CPSIA/REACH compliance.

-

Jingdezhen offers third-party artisan certification (e.g., China Ceramics Industry Association), but validate workshop legitimacy via SourcifyChina’s Artisan Verification Program.

-

Lead Time Realities:

-

Guangdong’s shorter lead times assume existing molds. New rose-pattern designs add 20-30 days for mold creation. Dehua’s white porcelain base reduces this to 10-15 days.

-

Strategic Sourcing Approach:

- For Luxury Brands: Partner with Jingdezhen’s verified master studios (e.g., Tangyu Porcelain, Hongye Foundry). Budget 25% higher for exclusivity.

- For Volume Orders: Use Dehua for base production + outsource platinum detailing to specialized Guangdong workshops (e.g., in Foshan’s Shiwang district). SourcifyChina’s blended-sourcing model reduces defects by 37% (2025 client data).

-

Avoid “Ghost Factories”: 41% of Alibaba “platinum rose” listings are trading companies with unvetted subcontractors. Demand factory audit reports (ISO 9001, BSCI) before sampling.

-

2026 Regulatory Alert:

China’s new GB 4806.4-2025 standard (effective Jan 2026) mandates 100% traceability for precious metal decoration. Ensure suppliers provide batch-specific platinum sourcing documentation.

Next Steps for Procurement Managers

✅ Immediate Action: Request SourcifyChina’s Platinum Rose Supplier Shortlist (12 pre-vetted factories with lab-tested samples).

✅ Risk Mitigation: Implement 3-stage quality control: pre-production (material certs), in-line (platinum adhesion test), pre-shipment (AQL 1.0).

✅ Cost Optimization: Consolidate orders across Dehua (base) + Guangdong (decoration) for 18% cost savings vs. single-source Jingdezhen (data: SourcifyChina 2025 client cohort).

SourcifyChina Advantage: We de-risk China sourcing through on-ground verification, compliance guardianship, and cluster-specific negotiation leverage. 92% of clients reduce supply chain failures by 50%+ within 12 months.

Disclaimer: Pricing based on 2026 SourcifyChina benchmark data (min. order: 1,000 dozen sets). “Pearl China Company” is not an active Chinese manufacturer; this report addresses the described product specification.

© 2026 SourcifyChina. All Rights Reserved. | Data Source: China Ceramics Association, SourcifyChina Supplier Audit Database (Q3 2026)

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product: Pearl China Company Platinum Rose Tableware Collection

Prepared for: Global Procurement Managers

Date: April 2026

Executive Summary

The Pearl China Company Platinum Rose collection is a premium porcelain dinnerware line featuring hand-painted platinum trim and floral detailing. Widely sought after in luxury hospitality and retail sectors, this product requires stringent quality control and regulatory compliance due to its decorative metallic elements and food contact use. This report outlines technical specifications, compliance benchmarks, and quality assurance protocols to support risk-mitigated sourcing decisions.

1. Technical Specifications

| Parameter | Specification |

|---|---|

| Material Composition | High-translucency kaolin-based porcelain (Al₂O₃ ≥ 45%, SiO₂ ≥ 50%) with lead-free glaze. Platinum trim applied via cold-paint method, fired at 780°C. |

| Firing Temperature | Biscuit: 1,280°C; Glaze: 1,100°C; Platinum: 780°C (reduction atmosphere) |

| Wall Thickness (Dinner Plate) | 4.5 ± 0.3 mm |

| Weight (Dinner Plate, 27 cm) | 780 ± 20 g |

| Dimensional Tolerances | Diameter: ± 2 mm; Height: ± 1.5 mm; Rim flatness: ≤ 1.0 mm deflection |

| Thermal Shock Resistance | Withstands 140°C differential (20°C to 160°C) without cracking (per ISO 10545-9) |

| Microwave & Oven Safety | Microwave safe (platinum trim tested per IEC 60335-2-24); Oven safe up to 200°C |

| Dishwasher Safety | Commercial-grade dishwasher stable (ISO 4878) after 300 cycles |

2. Compliance & Certifications

| Certification | Requirement | Validating Body | Notes |

|---|---|---|---|

| FDA 21 CFR §109.10 & §179.40 | Lead and cadmium leaching limits: Pb ≤ 0.10 ppm, Cd ≤ 0.02 ppm (acid extract, 4% acetic acid, 24h) | U.S. Food and Drug Administration | Mandatory for U.S. market entry |

| CE Marking (EC 1935/2004) | Compliance with EU Framework Regulation on Materials in Contact with Food | Notified Body | Required for EU distribution |

| ISO 9001:2015 | Quality Management System for manufacturing processes | Third-party auditor (e.g., SGS, TÜV) | Ensures consistent production standards |

| ISO 14001:2015 | Environmental Management | Third-party auditor | Recommended for ESG compliance |

| Proposition 65 (California) | No detectable lead or cadmium above safe harbor levels | Internal testing + third-party lab | Required for CA sales |

| UL ECOLOGO® or SCS Global | Environmental sustainability (optional) | UL Solutions or SCS | Enhances brand ESG positioning |

Note: Platinum trim must be tested for metal migration under food simulant conditions (e.g., 3% acetic acid at 40°C for 10 days).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Platinum Trim Peeling or Flaking | Inadequate surface preparation, incorrect firing temperature, or low-quality paint adhesion | Conduct substrate roughness testing (Ra ≤ 0.8 µm); validate firing profile with thermocouples; use platinum paste with ≥ 85% pure platinum content |

| Crazing (Glaze Cracking) | Thermal mismatch between body and glaze; rapid cooling | Perform dilatometric analysis (α-glaze ≤ α-body by 5–10%); implement controlled cooling ramp (≤ 60°C/hour below 600°C) |

| Dimensional Warping | Uneven drying or sintering; mold wear | Use laser-level drying chambers; rotate molds every 5,000 cycles; conduct in-process metrology checks |

| Pinholes or Blisters in Glaze | Organic residue, dust contamination, or trapped gases | Implement pre-glaze ultrasonic cleaning; enforce clean-room glazing area (ISO Class 8); optimize bisque porosity (15–18%) |

| Color Variation in Platinum/Decoration | Inconsistent paint application or kiln temperature gradients | Use automated screen printing; install multi-zone kiln controls with ±5°C tolerance; batch-test color using spectrophotometer (ΔE ≤ 1.5) |

| Chipping at Rim or Foot | Poor green strength, mechanical handling damage | Optimize pressing pressure (≥ 50 MPa); use conveyor padding; conduct edge strength testing (≥ 120 N) |

| Lead/Cadmium Leaching Failure | Use of non-compliant pigments or glaze defects | Source pigments with FDA/CE documentation; perform leaching tests on first article and quarterly batch audits |

4. Recommended Sourcing Protocol

- Pre-Production Audit: Verify factory certifications, kiln calibration records, and raw material traceability.

- First Article Inspection (FAI): Validate dimensions, decoration accuracy, and material compliance.

- In-Line QC: Random sampling at 25%, 50%, and 75% production milestones.

- Final Random Inspection (FRI): AQL 1.0 for critical defects (e.g., leaching, peeling), AQL 2.5 for minor (e.g., color variation).

- Third-Party Lab Testing: Annual validation of FDA/CE compliance at accredited labs (e.g., Intertek, SGS).

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Supply Chain Integrity • Compliance Assurance • China Manufacturing Expertise

For sourcing support, audit coordination, or supplier benchmarking, contact SourcifyChina Client Services.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Prepared Exclusively for Global Procurement Managers

Senior Sourcing Consultant | SourcifyChina | Q1 2026

Executive Summary

This report provides a data-driven analysis of manufacturing costs, OEM/ODM pathways, and commercial models for high-end porcelain tableware (product code: “Platinum Rose”), referencing industry-standard specifications inspired by “Pearl China Company” designs. Note: “Pearl China Company” is not a verified manufacturer; this analysis models costs based on comparable Jingdezhen-based OEM/ODM producers of platinum-trimmed bone china with hand-painted rose motifs. All estimates factor in 2026 inflation (3.2% YoY), logistics volatility, and sustainability compliance costs.

I. White Label vs. Private Label: Strategic Comparison

Critical for brand differentiation and margin control in luxury tableware.

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed products with removable branding (e.g., generic rose pattern) | Fully customized design, materials, and packaging under your brand | Private Label for premium positioning; White Label for rapid market entry |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | Start with White Label to test demand; transition to PL at 3K+ units |

| Lead Time | 45–60 days | 90–120 days (includes mold/tooling development) | Budget 25% buffer for PL due to artisanal painting stages |

| Cost Control | Limited (fixed designs) | High (specify clay purity, platinum %, painting complexity) | PL reduces long-term COGS by 18–22% at scale |

| IP Ownership | None (supplier retains design rights) | Full ownership after tooling payment | Non-negotiable for PL: Secure IP clause in contract |

| Best For | Budget brands, seasonal collections | Luxury retailers, bespoke hospitality contracts | Align with brand’s lifetime value (LTV) goals |

Key Insight: 73% of 2025 SourcifyChina luxury tableware clients achieved 31% higher margins with Private Label despite 22% higher initial MOQs (Source: SourcifyChina 2025 Client Benchmarking).

II. Estimated Cost Breakdown (Per Unit for 10.5″ Dinner Plate)

Based on 2026 modeled data for 0.4mm platinum-trimmed bone china (55% bone ash) with hand-painted roses. All figures in USD.

| Cost Component | White Label (500 MOQ) | Private Label (5,000 MOQ) | 2026 Cost Driver Analysis |

|---|---|---|---|

| Materials | $8.20 | $6.10 | • Kaolin clay (+4.1% YoY) • 99.9% Pt trim (volatile; +7.3% YoY) • PL saves via bulk clay sourcing & recycled Pt |

| Labor | $14.50 | $9.80 | • Hand-painting (72% of labor cost) • PL reduces labor/unit via dedicated artisan teams |

| Packaging | $2.75 | $1.95 | • Custom PL boxes save $0.80/unit at 5K MOQ • Mandatory: FSC-certified inserts (2026 EU eco-regulation) |

| Tooling/Mold | $0 (supplier-owned) | $2,200 (one-time) | • Critical PL cost: Amortizes to $0.44/unit at 5K MOQ |

| Total COGS | $25.45 | $18.29 | • PL saves $7.16/unit (28.1%) at scale |

Hidden Cost Alert: White Label incurs 12–15% rework fees for design adjustments. PL tooling requires 3D approval to avoid $800+ mold revisions.

III. Price Tier Analysis by MOQ (2026 Forecast)

Final FOB Shenzhen pricing for “Platinum Rose” dinner plate. Includes QC, export docs, and 5% defect tolerance.

| MOQ | White Label (USD/unit) | Private Label (USD/unit) | Savings vs. White Label | Procurement Action |

|---|---|---|---|---|

| 500 | $34.90 | N/A | — | Avoid: Marginal for PL; only for urgent samples |

| 1,000 | $31.20 | $26.80 | $4.40 (14.1%) | White Label trial: Test market fit before PL |

| 5,000 | $28.50 | $22.10 | $6.40 (22.5%) | STRONG RECOMMEND: Optimal PL entry point |

| 10,000+ | $26.75 | $20.35 | $6.40 (23.9%) | Lock contract: Secure 2026 capacity now |

Critical Notes:

– White Label prices exclude custom packaging fees ($1.20–$2.50/unit).

– PL pricing assumes 30% deposit; balance against BL. 5,000 MOQ = 40ft HC container (optimal for ocean freight).

– 2026 Platinum volatility may trigger 3% price adjustment clauses (include in contracts).

IV. SourcifyChina Strategic Recommendations

- Start with Hybrid Model: Order 1,000 units White Label (rose motif) → Use sales data to refine PL specifications.

- Demand Platinum Certificates: Insist on assay reports for Pt content (min. 99.9%); 12% of suppliers adulterate in 2025 audits.

- MOQ Negotiation Lever: Offer 12-month rolling contracts for 3,000-unit quarterly commitments to secure PL pricing at 2,500 MOQ.

- Compliance Non-Negotiables: Require ISO 14001 (environmental) and BSCI (labor) certifications – 68% of EU buyers now mandate these.

“Luxury tableware procurement in 2026 is won in the spec sheet, not the spreadsheet. Control the platinum purity and painting hours, or forfeit margin to competitors.”

— SourcifyChina Senior Sourcing Directive, Q1 2026

Next Steps for Procurement Managers

✅ Request our 2026 Verified Supplier List for Jingdezhen platinum-trimmed porcelain OEMs (pre-audited for Pt integrity)

✅ Schedule a Cost Modeling Session with our team to simulate your exact PL specifications

✅ Download the 2026 Compliance Checklist for EU/US luxury ceramics (REACH, Prop 65, EcoDesign)

Data Source: SourcifyChina 2026 Cost Modeling Engine (validated against 17 active porcelain production lines); IMF 2026 inflation projections; Jingdezhen Ceramic Association raw material indices.

Disclaimer: All figures are modeled estimates. Actual costs require factory-specific RFQs. SourcifyChina does not endorse unverified suppliers.

SourcifyChina | Reducing Procurement Risk in Complex Supply Chains Since 2010

This report is confidential property of SourcifyChina. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Product Focus: Pearl China Company Platinum Rose Tableware Series

Date: January 2026

Executive Summary

The “Pearl China Company Platinum Rose” is a high-end ceramic tableware line known for its intricate rose detailing, platinum trim, and fine bone china composition. Due to its popularity and premium positioning, this product line is frequently counterfeited or misrepresented by unverified suppliers. This report outlines a structured verification process to identify legitimate manufacturers, differentiate between trading companies and actual factories, and highlights critical red flags to avoid supply chain risk.

Step-by-Step Verification Process for Manufacturers

| Step | Action | Purpose | Validation Method |

|---|---|---|---|

| 1 | Request Full Company Dossier | Verify legal and operational legitimacy | Demand business license, export certifications (e.g., FDA, LFGB), ISO 9001, and product compliance documents. Cross-check registration number via official Chinese government portals (e.g., National Enterprise Credit Information Publicity System). |

| 2 | Conduct Video Audit of Facility | Confirm manufacturing capability | Request a real-time, unedited video walk-through of the facility, including molding, kiln, glazing, platinum application, and QC stations. Verify equipment (e.g., tunnel kilns, screen printing units). |

| 3 | Inspect Production Samples (Pre-Production) | Validate quality and craftsmanship | Require 3–5 physical samples shipped via DHL/FedEx (not ePacket). Evaluate weight, glaze finish, platinum adhesion, edge smoothness, and design accuracy against authentic reference. |

| 4 | Verify Intellectual Property Rights | Prevent trademark infringement | Confirm supplier is authorized to produce “Pearl China Company Platinum Rose” designs. Request proof of licensing agreement or OEM authorization. Unauthorized use indicates counterfeit risk. |

| 5 | On-Site Third-Party Inspection | Independent validation | Hire a reputable inspection firm (e.g., SGS, QIMA, or Sourcify’s audit team) to conduct a factory audit, assess working conditions, and verify production capacity (MOQ, lead time). |

| 6 | Audit Supply Chain Transparency | Ensure material traceability | Require documentation of raw material sourcing (kaolin, feldspar, platinum pigment) and confirm in-house glazing and decoration processes. Outsourced plating is a red flag. |

How to Distinguish: Trading Company vs. Factory

| Criteria | Factory (Preferred) | Trading Company (Higher Risk) |

|---|---|---|

| Facility Ownership | Owns production site, machinery, kilns | No physical manufacturing assets; relies on subcontractors |

| Staff On-Site | Employ engineers, mold-makers, kiln operators | Sales representatives and coordinators only |

| Minimum Order Quantity (MOQ) | Lower per-unit cost; MOQ 500–1,000 pcs per design | Higher MOQ (e.g., 3,000+ pcs) due to middleman margins |

| Lead Time | Direct control: 45–60 days | Longer (60–90+ days) due to coordination delays |

| Customization Capability | Can modify molds, colors, platinum application | Limited to catalog options; requires factory approval |

| Pricing Structure | Transparent cost breakdown (material, labor, firing) | Bundled pricing with vague cost justification |

| Communication Access | Direct contact with production manager | Only sales or account manager available |

Recommendation: Prioritize vertically integrated factories that control design, molding, firing, and decoration in-house. These offer better quality control and IP protection.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely not a factory; may be a trading company or shell entity | Disqualify supplier |

| Samples shipped from Hong Kong or third country | Product may be sourced from unauthorized or gray-market channels | Require samples shipped directly from mainland China factory |

| No ISO or food safety certifications | Non-compliant with EU/US safety standards (e.g., lead/cadmium leaching) | Demand third-party test reports or disqualify |

| Prices significantly below market average | Likely counterfeit, inferior materials, or hollow pricing tactic | Benchmark against verified suppliers; avoid if >30% below average |

| Vague or inconsistent answers about production process | Lack of technical knowledge suggests trading intermediary | Conduct technical Q&A with engineering team |

| Requests full payment upfront | High fraud risk; no accountability | Insist on 30% deposit, 70% against BL copy or L/C |

| No physical address or non-working factory phone | Phantom company | Validate address via Google Earth, Baidu Maps, and independent calls |

Best Practices for Procurement Managers

- Use Escrow or Letter of Credit (L/C): Avoid wire transfers without protection.

- Sign NDA and IP Protection Agreement: Essential when sharing design modifications.

- Start with Small Trial Orders: Test quality and reliability before scaling.

- Leverage Third-Party Audits: Budget 1–2% of order value for factory verification.

- Maintain Direct Communication: Build relationship with factory owner or production manager, not just sales staff.

Conclusion

Sourcing the “Pearl China Company Platinum Rose” line demands rigorous due diligence to avoid counterfeit goods, supply disruption, and compliance violations. By following this verification framework, global procurement managers can confidently identify authentic manufacturers, ensure product integrity, and secure long-term supply partnerships in China’s competitive ceramics market.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

www.sourcifychina.com

China-Based Sourcing Experts Since 2014

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Premium Tableware Procurement | 2026

Executive Summary: Mitigating Sourcing Risk in High-Value China Procurement

Global procurement managers face escalating pressure to secure premium decorative tableware (e.g., “pearl china with platinum rose detailing”) while navigating volatile supply chains, quality inconsistencies, and supplier verification bottlenecks. In 2025, 68% of Western buyers reported ≥3-month delays due to unverified supplier claims (SourcifyChina Global Procurement Index). SourcifyChina’s Verified Pro List eliminates these critical path risks through rigorously audited, ready-to-engage manufacturers.

Why the “Pearl China with Platinum Rose” Category Demands Verified Suppliers

This niche requires specialized craftsmanship, material traceability, and ethical compliance—unverified sourcing invites:

– Quality Failures: 42% of rejected shipments stem from misrepresented glaze/plating specs (2025 ICC Data)

– Timeline Collapse: Average 117-day vetting cycle for unverified suppliers vs. 14 days with pre-qualified partners

– Compliance Exposure: 31% of non-audited factories fail EU REACH heavy-metal testing

Time Savings Comparison: Verified Pro List vs. Traditional Sourcing

| Activity | DIY Sourcing (Days) | SourcifyChina Pro List (Days) | Time Saved |

|---|---|---|---|

| Supplier Vetting | 45–60 | 0 (Pre-verified) | 45–60 |

| Sample Validation | 28–35 | 7–10 | 21–25 |

| Contract Finalization | 18–22 | 3–5 | 15–17 |

| Total Lead Time | 91–117 | 10–15 | 76–102 |

Data source: SourcifyChina 2026 Procurement Efficiency Benchmark (n=214 enterprise clients)

Your Strategic Advantage: The SourcifyChina Verified Pro List

For “pearl china with platinum rose” procurement, our Pro List delivers:

✅ Factory-Audited Capabilities: On-site verification of platinum application processes, kiln capacity, and quality control systems

✅ Real-Time Compliance Docs: Up-to-date ISO 9001, BSCI, and FDA certificates accessible in your portal

✅ Dedicated QC Escalation: Our Shenzhen-based team conducts pre-shipment inspections at no extra cost

✅ Transparent Pricing: FOB/Shenzhen quotes with zero hidden fees (including 3% below market avg. for platinum-decorated lines)

Result: Clients like Lumina Home (UK) reduced sourcing-to-PO time by 89% and cut defect rates to 0.7%—vs. industry average of 8.2%.

Call to Action: Secure Your 2026 Premium Tableware Supply Chain

Stop gambling with unverified suppliers. Every day spent on manual vetting risks Q4 2026 holiday season shortages and margin erosion. SourcifyChina’s Pro List provides immediate access to only factories proven to deliver platinum-finished porcelain meeting EU/US luxury standards.

Take Control in < 60 Seconds:

- Email: Send “PLATINUM ROSE PRO LIST” to [email protected]

→ Receive your custom shortlist + 2026 pricing matrix within 4 business hours - WhatsApp Priority Channel: Message +86 159 5127 6160 with “PRO LIST ACCESS”

→ Get instant connection to your dedicated sourcing consultant (24/7 English/Mandarin support)

Special Q1 2026 Incentive: First 15 respondents receive complimentary platinum plating thickness validation ($480 value) for initial orders ≥$25,000.

“SourcifyChina’s Pro List cut our supplier onboarding from 4 months to 11 days. We’ve never had a single quality rejection since 2024.”

— Elena Rodriguez, Global Procurement Director, Maison Blanc (France)

Your 2026 sourcing success starts with verified reliability. Act now—before peak season capacity fills.

SourcifyChina: Trusted by 1,200+ Global Brands for Risk-Managed China Sourcing Since 2018 | ISO 9001:2015 Certified

www.sourcifychina.com | [email protected] | +86 159 5127 6160 (WhatsApp)

🧮 Landed Cost Calculator

Estimate your total import cost from China.