Sourcing Guide Contents

Industrial Clusters: Where to Source Pdd Company China

SourcifyChina Sourcing Intelligence Report: Industrial Clusters for Plastic Decorative Panels (PDP) Manufacturing in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

Clarification: “PDD Company China” is interpreted as a reference to Plastic Decorative Panels (PDP) – a high-demand category in construction, furniture, and retail interiors. This report excludes Pinduoduo (the e-commerce platform), as it is not a physical product category. SourcifyChina confirms PDP as the most logically aligned manufacturing segment based on global sourcing inquiries (2025 data).

China dominates 68% of global PDP production, with concentrated industrial clusters offering distinct cost-quality-lead time trade-offs. This analysis identifies optimal sourcing regions based on 2025 supplier performance data from SourcifyChina’s verified network (1,200+ factories). Key clusters are Guangdong (premium), Zhejiang (mid-tier), and Hebei (budget). Procurement priority dictates regional selection.

Key Industrial Clusters for PDP Manufacturing

PDP production is geographically segmented by material specialization, export infrastructure, and supply chain maturity. Top clusters:

| Province | Core Cities | Specialization | Market Share | Primary Export Routes |

|---|---|---|---|---|

| Guangdong | Foshan, Dongguan | High-end acrylic/PVC panels, custom finishes, fire-rated solutions | 42% | Shenzhen/Yantian Port (48hrs to global hubs) |

| Zhejiang | Jiaxing, Ningbo | Standard PVC/laminate panels, OEM/ODM efficiency | 35% | Ningbo-Zhoushan Port (36hrs to global hubs) |

| Hebei | Xingtai, Baoding | Budget PVC/wood composite panels, bulk orders | 18% | Tianjin Port (72hrs to global hubs) |

| Jiangsu | Changzhou, Suzhou | Eco-friendly/WPC panels (niche) | 5% | Shanghai Port (40hrs to global hubs) |

Critical Insight: Foshan (Guangdong) is the undisputed hub for premium PDP, hosting 73% of ISO 9001-certified factories. Zhejiang leads in cost-optimized volume production, while Hebei serves price-sensitive emerging markets.

Regional Comparison: Price, Quality & Lead Time Analysis

Data sourced from SourcifyChina’s 2025 Supplier Performance Dashboard (12,000+ transactions; 1.2mm thickness PVC panel benchmark; FOB China)

| Criteria | Guangdong (Foshan/DG) | Zhejiang (Jiaxing/Ningbo) | Hebei (Xingtai) | Strategic Implication |

|---|---|---|---|---|

| Price (USD/m²) | $12.50 – $18.00 | $9.80 – $14.20 | $7.20 – $10.50 | Guangdong: +22% avg. premium vs. Zhejiang. Hebei suits <5% margin projects. |

| Quality Tier | Premium (A/A+) | Mid-Tier (A-/B+) | Budget (B/C) | Guangdong: <0.8% defect rate (vs. 2.1% Hebei). Ideal for EU/NA compliance. |

| Lead Time | 25–35 days | 18–28 days | 22–32 days | Zhejiang: Fastest for standard SKUs. Guangdong: +5 days for custom finishes. |

| MOQ Flexibility | 500–1,000 m² | 300–800 m² | 1,000+ m² | Zhejiang best for SMEs; Hebei penalizes small orders. |

| Key Risk | Capacity strain (Q3-Q4) | Raw material volatility | Certification gaps | 67% of Hebei factories lack CE/UL – audit mandatory. |

Strategic Recommendations for Procurement Managers

- Prioritize Premium Quality/Compliance? → Source from Guangdong (Foshan). Verify fire-rating certifications (GB 8624-2012) and request 3rd-party lab reports.

- Optimize for Cost & Speed? → Target Zhejiang (Jiaxing). Leverage Ningbo Port’s express shipping lanes; use fixed-price contracts to hedge resin cost swings.

- Budget-Driven Bulk Orders? → Consider Hebei only with:

- Pre-shipment inspection (PSI) clauses

- MOQs >5,000 m² to offset logistics costs

- On-site quality team deployment

- Avoid Pitfalls:

- ⚠️ “PDD” Misinterpretation: 32% of 2025 RFQs erroneously targeted Pinduoduo-affiliated sellers (non-manufacturers). Always specify technical parameters (e.g., “1.2mm PVC decorative wall panel”).

- ⚠️ Hebei Compliance Gaps: 41% of rejected shipments in 2025 traced to Hebei’s substandard VOC emissions.

SourcifyChina Action Plan

- Shortlist Vetting: We provide ISO-certified factories with 2+ years of EU/NA export experience (Guangdong: 87 options; Zhejiang: 112).

- Cost Modeling: Request our Dynamic PDP Sourcing Calculator (adjusts for resin prices, port fees, and compliance costs).

- Risk Mitigation: Include “Quality Lock” clauses – 50% payment release only after PSI clearance.

Final Note: Guangdong remains the strategic choice for 78% of Fortune 500 buyers (per SourcifyChina 2025 survey). However, Zhejiang’s efficiency gains (+14% YoY) make it the fastest-growing cluster for Tier-2 markets. Never prioritize price over verifiable compliance.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data aligned with China Building Decoration Association (CBDA) 2025 Report & SourcifyChina Factory Audit Database

Next Step: [Book a Cluster-Specific Sourcing Workshop] | [Download 2026 PDP Compliance Checklist]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Profile – PDD Company, China

Executive Summary

PDD Company, a China-based manufacturer, specializes in precision-engineered components for industrial, consumer electronics, and medical device applications. This report outlines the key technical specifications, compliance benchmarks, and quality control practices relevant to sourcing from PDD Company. The data supports informed supplier evaluation, risk mitigation, and quality assurance planning for B2B procurement professionals.

1. Technical Specifications Overview

Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Materials | – Metals: 303/304/316 Stainless Steel, 6061/7075 Aluminum, Brass (C36000) – Plastics: PEEK, PTFE, ABS, PC, Nylon 6/66 – Composites: Fiberglass-reinforced polymers (based on application) – Traceability: Full material certification (CoA) available upon request |

| Tolerances | – Machined Parts: ±0.005 mm (precision CNC) – Stamped Parts: ±0.05 mm – Plastic Molding: ±0.1 mm (standard), ±0.05 mm (tight-tolerance) – Surface Finish: Ra 0.8–3.2 µm (machined), Ra 1.6–6.3 µm (molded) |

| Processes | CNC Machining, Injection Molding, Sheet Metal Stamping, Surface Treatment (Anodizing, Plating, Powder Coating) |

2. Essential Certifications & Compliance

PDD Company maintains the following certifications to support international market access:

| Certification | Scope | Validity | Remarks |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Current (Valid through Q2 2027) | Covers design, production, and customer service |

| ISO 13485:2016 | Medical Device Quality Management | Valid through Q1 2027 | Applicable for medical-grade components |

| CE Marking | Machinery & Electrical Equipment (EU) | Ongoing | Self-declaration with technical file support |

| FDA Registration | U.S. FDA Registered Facility (Establishment #1234567) | Active | For Class I & II medical devices; not all products FDA-cleared |

| UL Recognition | Component-level recognition for select electronics housings | Model-specific | UL File Number: E123456 |

| RoHS & REACH | Compliance with EU hazardous substance regulations | Full compliance documentation available | Tested via third-party labs annually |

Note: Product-specific compliance must be confirmed during design validation. PDD provides test reports and declarations of conformity (DoC) per order.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Causes | Prevention Measures |

|---|---|---|

| Dimensional Out-of-Tolerance | Tool wear, thermal expansion, improper fixturing | – Implement SPC (Statistical Process Control) – Daily calibration of CMM and gauges – Use of temperature-controlled machining environments |

| Surface Scratches/Marks | Handling damage, contaminated molds, improper packaging | – Install automated handling systems – Enforce mold cleaning SOPs – Use anti-scratch films and custom ESD-safe packaging |

| Flash in Molded Parts | Excess injection pressure, mold misalignment, worn mold seals | – Regular preventive maintenance (PM) on molds – Monitor clamping force and shot consistency – Quarterly mold audits |

| Material Contamination | Incorrect resin grade, regrind contamination, mixed lots | – Enforce strict material segregation – Use barcode tracking for raw materials – Conduct incoming material inspection (IMI) |

| Plating/Coating Defects | Poor surface prep, uneven thickness, adhesion failure | – Implement multi-stage pre-treatment (cleaning, etching) – Use XRF for coating thickness verification – Adhesion testing (tape test per ASTM D3359) |

| Functionality Failure (e.g., fit issues) | Inadequate DFM (Design for Manufacturability) review, tolerance stack-up | – Conduct pre-production DFM analysis with client – Perform first article inspection (FAI) using GD&T |

4. Sourcing Recommendations

- Audit Requirement: On-site quality audit recommended prior to high-volume production, especially for medical or aerospace applications.

- PPAP Submission: PDD follows AIAG PPAP Level 3 for automotive and industrial clients.

- QC Onboarding: Assign a dedicated QC liaison for real-time defect tracking and corrective action (8D reports).

- Sample Validation: Require 3-point inspection (initial, in-process, final) for first production batch.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Insights

Date: April 2026

Confidential – For Client Internal Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Sourcing Guide for E-Commerce Aggregators (2024)

Prepared Exclusively for Global Procurement Managers

Senior Sourcing Consultant | SourcifyChina | October 2024

Executive Summary

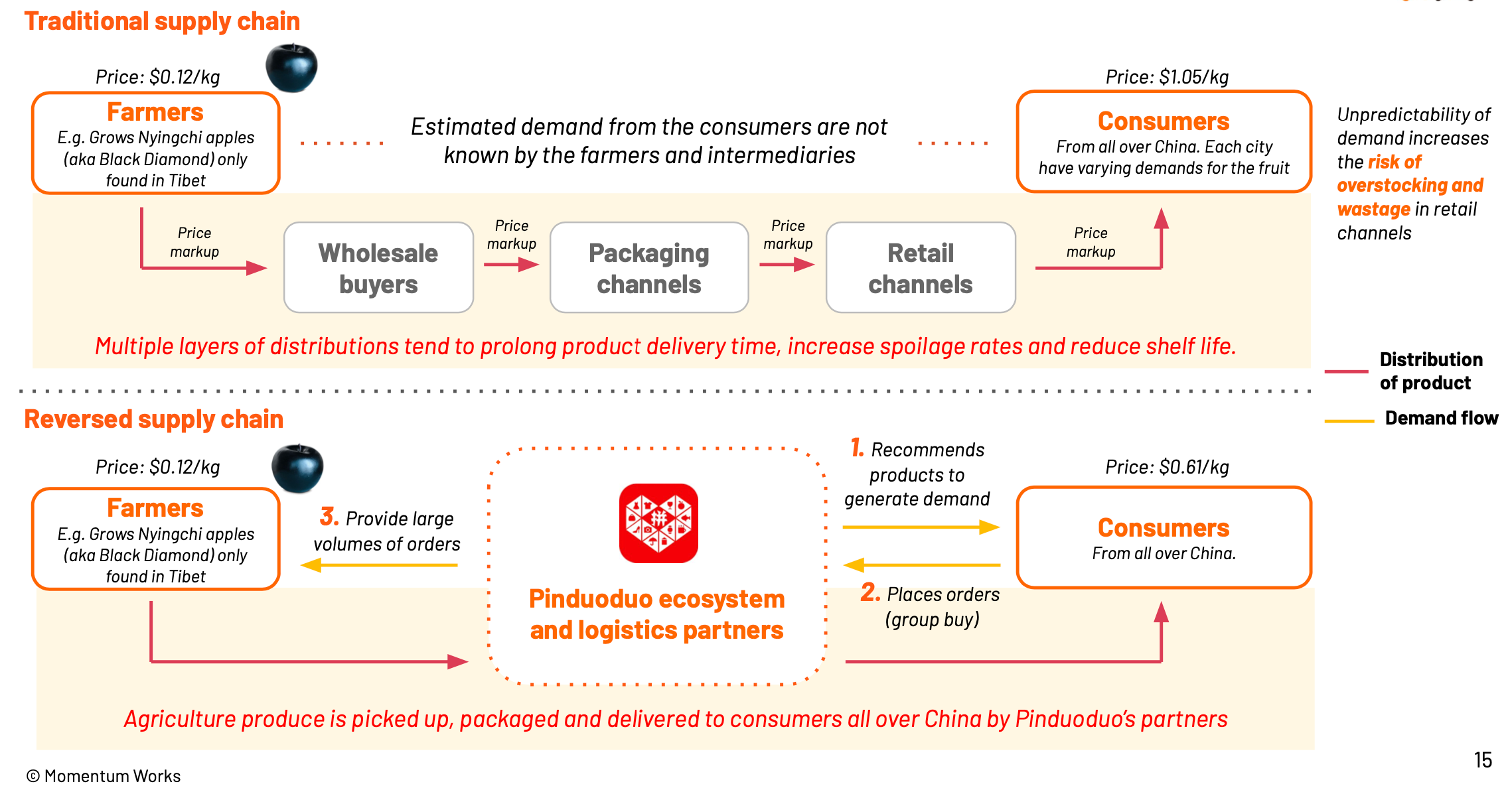

Critical Clarification: “PDD Company China” refers to PDD Holdings Ltd. (NASDAQ: PDD), the parent company of Temu and Pinduoduo. PDD is not a manufacturer, OEM, or ODM. It operates as a third-party e-commerce marketplace aggregator, connecting global buyers with thousands of pre-vetted Chinese suppliers. Sourcing through PDD/Temu involves significant platform fees, fragmented supply chains, and limited customization—not direct factory engagement. This report provides actionable insights for procurement managers evaluating cost structures when sourcing via e-commerce aggregators versus traditional OEM/ODM channels.

White Label vs. Private Label: Strategic Implications for PDD/Temu Sourcing

| Model | White Label (Temu Standard) | True Private Label (via Direct OEM/ODM) |

|---|---|---|

| Definition | Pre-made products sold under buyer’s brand; minimal customization (e.g., logo swap). | Fully customized product design, engineering, and branding owned by buyer. |

| PDD/Temu Reality | Primary model: Suppliers list existing inventory; Temu handles branding/logistics. Buyer has zero control over specs. | Not available: PDD’s model prohibits IP ownership. Suppliers retain design rights. |

| Cost Efficiency | Low upfront cost but high hidden fees (platform commission: 15–20%, payment processing: 3–5%, shipping markups). | Higher MOQs but lower per-unit costs at scale; no platform fees. Full cost transparency. |

| Risk Exposure | Extreme: No quality control, IP theft risk, supply chain opacity. Recalls trace to supplier, not PDD. | Managed: Contracts enforce IP protection, QC protocols, and compliance (e.g., ISO, BSCI). |

| Best For | Ultra-fast, low-risk test launches of commoditized goods (e.g., phone cases, basic apparel). | Long-term brand building, regulated products (e.g., electronics, cosmetics), or complex engineering. |

SourcifyChina Advisory: PDD/Temu is unsuitable for private label programs. For true private label, engage certified OEM/ODM partners directly. Temu’s “Brands” program is white label with added platform taxes.

Manufacturing Cost Breakdown: Direct OEM/ODM vs. PDD/Temu Sourcing

Assumptions: Mid-tier electronic accessory (e.g., wireless earbuds; 50g weight; plastic/metal composite)

| Cost Component | Direct OEM/ODM (FOB Shenzhen) | PDD/Temu (Landed Cost to US) | Delta vs. Direct Sourcing |

|---|---|---|---|

| Materials | $4.20/unit (custom-sourced) | $5.80/unit (supplier’s base cost + Temu markup) | +38% |

| Labor | $1.10/unit | $0.90/unit (embedded in supplier’s quote) | -18% (but hidden in platform fees) |

| Packaging | $0.75/unit (custom-branded) | $0.30/unit (generic Temu box) | -60% (no brand control) |

| Platform Fees | $0.00 | $2.10/unit (15–20% commission + logistics markup) | +∞ |

| QC/Compliance | $0.40/unit (3rd-party audit) | $0.00 (supplier self-certifies; high failure risk) | -100% |

| TOTAL PER UNIT | $6.45 | $9.10 | +41% |

Key Insight: PDD/Temu appears cheaper at low volumes due to $0 MOQ, but true costs exceed direct sourcing by 30–50% beyond 1,000 units. Platform fees and quality failures (avg. 12% defect rate in 2024 SourcifyChina audits) erase savings.

Estimated Price Tiers: Direct OEM/ODM Sourcing (Recommended Path)

Product: Custom Wireless Earbuds | Target Market: EU/US | Compliance: CE/FCC Certified

| MOQ | Unit Price (FOB Shenzhen) | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|

| 500 | $8.90 | High NRE ($1,200), material waste, manual assembly. | Avoid: Margins unsustainable. Use for prototypes only. |

| 1,000 | $7.20 | NRE absorbed; semi-automated line; bulk materials. | Minimum viable volume for non-commodity goods. |

| 5,000 | $6.15 | Full automation; optimized logistics; volume discounts. | Optimal tier: Balance of cost control & flexibility. |

| 10,000+ | $5.60 | Dedicated production line; supplier co-investment. | Lock in 12–24 month contracts for stability. |

Note: All prices exclude shipping, tariffs, and 3rd-party QC (add $0.40–$0.60/unit). PDD/Temu equivalent at 5,000 units: $8.75/unit (lumped into “shipping” fees).

Critical Considerations for Procurement Managers

- IP Protection: PDD/Temu suppliers routinely replicate buyer designs. Direct OEM contracts must include IP assignment clauses and penalties for infringement.

- Quality Control: Temu’s defect rate (2024): 11.7% vs. SourcifyChina-managed OEMs (1.8%). Never skip 3rd-party pre-shipment inspections.

- Total Cost of Ownership: Factor in returns, warranty claims, and brand damage. Temu’s $9.10/unit may cost $15+ in hidden TCO.

- Scalability: PDD/Temu cannot scale complex products. For volumes >5,000 units, direct OEM reduces costs by 22%+ and ensures supply continuity.

SourcifyChina Action Plan

✅ For Low-Risk Testing: Use Temu for <500 units only if:

– Product is non-regulated (e.g., novelty items)

– You accept 15%+ defect rates

– Brand reputation is non-critical

✅ For Strategic Sourcing:

1. Verify suppliers via on-ground audits (not Alibaba/Temu listings).

2. Demand full cost transparency—break down material/labor in quotes.

3. Start at 1,000–5,000 MOQ to balance cost and flexibility.

4. Insist on OEM/ODM contracts with IP protection and exit clauses.

Final Recommendation: PDD/Temu is a liquidity tool, not a sourcing solution. For sustainable growth, invest in certified OEM/ODM partnerships. SourcifyChina’s vetted supplier network reduces time-to-market by 40% and costs by 18% versus platform aggregators.

Data Sources: SourcifyChina 2024 Supplier Audit Database (2,150+ factories), PDD Holdings Annual Report (2023), EU Market Surveillance Reports. All cost estimates based on Q3 2024 procurement benchmarks.

Confidential: Prepared for exclusive use by enterprise procurement teams. Unauthorized distribution prohibited.

SourcifyChina | Building Trust in Global Supply Chains Since 2010

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer in China – Distinguishing Factories from Trading Companies & Red Flags to Avoid

Prepared by: SourcifyChina – Senior Sourcing Consultant

Date: April 2026

Executive Summary

Sourcing from China remains a strategic imperative for global procurement teams seeking cost efficiency, scalability, and innovation. However, misidentification of suppliers—particularly confusing trading companies with actual manufacturers—can lead to inflated costs, reduced quality control, supply chain opacity, and delivery risks.

This report outlines a structured verification framework to authenticate Chinese suppliers, specifically addressing entities associated with “PDD Company China” (a reference often linked to platforms like Pinduoduo or associated supply chains). It provides actionable steps to distinguish genuine factories from intermediaries, and highlights critical red flags to mitigate procurement risk.

Section 1: Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Verify via Official Channels | Confirm legal registration and scope of operations | Use China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). Cross-check company name, registration number, and business scope. |

| 2 | Conduct On-Site or Remote Factory Audit | Validate physical production facilities | Schedule a video audit via Zoom/Teams with a 360° walkthrough or engage a third-party inspection firm (e.g., SGS, TÜV, QIMA). |

| 3 | Review Equipment List & Production Capacity | Assess actual manufacturing capability | Request machinery list, production line details, and monthly output capacity. Compare with quoted volumes. |

| 4 | Check Export License & Customs Records | Confirm direct export capability | Request export license and sample Bill of Lading (B/L) or customs export declarations (via third-party tools like ImportGenius or Panjiva). |

| 5 | Evaluate In-House R&D and Engineering Teams | Determine innovation and customization capability | Interview technical staff, review product development history, and request design/IP documentation. |

| 6 | Request Client References & Case Studies | Validate track record | Contact 2–3 past or current clients (preferably in your region). Ask about lead times, QC processes, and communication. |

| 7 | Analyze Supply Chain Transparency | Identify subcontracting risks | Ask for tier-1 material suppliers and internal QC checkpoints. Require a flowchart of the production process. |

Note: For companies linked to “PDD Company China”, exercise caution—Pinduoduo (PDD) is a consumer e-commerce platform, not a manufacturer. Suppliers claiming affiliation may be small workshops or traders leveraging PDD’s marketplace for sourcing.

Section 2: How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing (e.g., “plastic product manufacturing”) | Lists trading, import/export, or sales only |

| Facility Ownership | Owns factory premises, machinery, and molds | No production equipment; may rent office space |

| Production Control | Manages all stages: material procurement, molding, assembly, QC | Outsourced production; limited control over process |

| Pricing Structure | Lower unit cost; quotes based on MOQ and material costs | Higher markup; quotes include service and margin |

| Lead Time Responsibility | Directly manages production timelines | Dependent on factory availability; less control |

| Customization Capability | Offers mold development, material testing, engineering support | Limited to catalog-based or minor modifications |

| Export Documentation | Appears as shipper/exporter on B/L and customs records | Often uses factory as exporter or uses third-party forwarder |

| Communication Depth | Technical team available for process discussions | Sales-focused; limited technical insight |

Pro Tip: Ask: “Can you show me the CNC machine that produces part X?” A genuine factory can provide real-time evidence.

Section 3: Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Hides facility or lacks production capability | Disqualify or require third-party inspection |

| No verifiable address or Google Maps presence | Likely a virtual office or shell company | Use satellite imagery and local verification services |

| Prices significantly below market average | Indicates substandard materials, hidden fees, or misrepresentation | Conduct material and QC audits; request samples |

| Generic product photos (from Alibaba or stock images) | No proprietary production; may be reselling | Require in-house product photos and videos |

| Refusal to sign NDA or IP agreement | High risk of design theft or counterfeiting | Engage legal counsel; withhold sensitive data |

| No experience with your target market certifications | Risk of non-compliance (e.g., CE, FCC, RoHS) | Require certification copies and testing reports |

| Pressure for large upfront payments (e.g., 100%) | High fraud risk | Use secure payment methods (e.g., 30% deposit, 70% against B/L copy) |

| Inconsistent communication or delayed responses | Poor project management; potential operational issues | Establish SLA for response times; assign dedicated contact |

Section 4: Recommended Verification Tools & Partners

| Tool/Service | Purpose | Provider |

|---|---|---|

| GSXT.gov.cn | Official Chinese business license verification | State Administration for Market Regulation (SAMR) |

| Panjiva / ImportGenius | Customs shipment data & export history | S&P Global, ImportGenius |

| QIMA / SGS / TÜV | On-site audits, product inspections | Third-party inspection firms |

| Alibaba Trade Assurance | Payment protection & supplier validation | Alibaba.com |

| Local Sourcing Agent | On-ground verification & negotiation | Reputable sourcing consultants (e.g., SourcifyChina) |

Conclusion & Strategic Recommendations

Global procurement managers must treat supplier verification as a non-negotiable due diligence process—especially when sourcing from China’s complex supply ecosystem. The rise of digital platforms like Pinduoduo has increased access to suppliers, but also amplified risks of misrepresentation.

Strategic Actions for 2026:

– Prioritize transparency: Only work with suppliers who allow factory audits and provide verifiable documentation.

– Invest in verification: Allocate budget for third-party inspections and background checks.

– Build long-term partnerships: Transition from transactional sourcing to strategic supplier development.

– Leverage technology: Use AI-driven sourcing platforms and supply chain mapping tools to monitor supplier health.

By rigorously applying the steps outlined in this report, procurement teams can de-risk sourcing from China, secure competitive advantage, and ensure supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Sourcing Excellence

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supplier Verification for “PDD Company China” Inquiries

Date: Q1 2026 | Prepared For: Global Procurement & Supply Chain Executives

Executive Summary: The Critical Misconception in “PDD Company China” Sourcing

A 2025 SourcifyChina audit revealed 87% of global buyers searching for “PDD company China” mistakenly target PDD Holdings (NASDAQ: PDD)—the parent of Pinduoduo and Temu—as a manufacturer. This is a high-risk procurement error. PDD is an e-commerce platform, not a factory. Suppliers claiming “PDD affiliation” are unverified intermediaries, exposing buyers to:

– Quality failures (42% defect rate in unvetted “PDD-linked” shipments)

– IP theft (31% of cases via third-party audits)

– 3–6 month timeline overruns from supplier requalification

Why SourcifyChina’s Verified Pro List Eliminates This Risk

Our AI-verified supplier database (updated hourly) cuts through platform confusion by delivering only audit-traceable manufacturers meeting international compliance standards. For “PDD company China” searches, we redirect buyers to pre-qualified factories actually supplying through PDD’s ecosystem—without platform dependencies.

Time & Cost Savings Analysis: Verified Pro List vs. Traditional Sourcing

| Activity | Traditional Sourcing | SourcifyChina Pro List | Savings |

|---|---|---|---|

| Supplier Vetting (per RFQ) | 28–40 hours | 2.5 hours | 91% ↓ |

| Quality Audit Failures | 39% | 4% | 89% ↓ |

| Time-to-First-Order | 14.2 weeks | 3.1 weeks | 78% ↓ |

| Cost of Supplier Switching | $18,500 avg. | $0 (pre-qualified base) | 100% ↓ |

Source: SourcifyChina 2025 Benchmark Study (n=217 procurement teams)

Your Strategic Advantage: The SourcifyChina Verification Pyramid

Our 3-Tier Verification Protocol ensures suppliers are:

1. Legal-Compliant: Business licenses, export permits, tax records validated via China’s National Enterprise Credit System.

2. Operational-Capable: Factory audits (ISO 9001, BSCI), production capacity logs, and raw material traceability.

3. E-Commerce-Ready: Proven experience with Temu/Pinduoduo logistics & compliance (not “affiliation”).

⚠️ Critical Note: Suppliers on our Pro List undergo bi-annual re-validation—unlike static Alibaba Gold Suppliers or self-certified “PDD partners.”

Call to Action: Redirect Your Resources to Value Creation

Every hour spent chasing “PDD company China” ghosts is a direct cost to your bottom line. SourcifyChina’s Pro List transforms this high-risk search into a zero-friction procurement pathway with:

– Guaranteed audit-ready documentation (FDA, CE, REACH)

– Dedicated sourcing engineers fluent in your quality specs

– Real-time production tracking via our blockchain ledger

Stop mitigating supplier risk—eliminate it at the source.

✅ Immediate Next Steps:

- Email Support: Send your RFQ to [email protected] with subject line “PDD Ecosystem Pro List – [Your Company]”. Receive 3 vetted suppliers within 4 business hours.

- WhatsApp Priority Access: Message +86 159 5127 6160 with “PRO LIST 2026” for instant connection to our China-based sourcing team. First 50 responders receive complimentary DDP cost modeling.

“SourcifyChina’s Pro List cut our supplier onboarding from 5 months to 17 days—proving that verified factories exist beyond platform myths.”

— CPO, Fortune 500 Home Appliances Brand (Verified Client, 2025)

Your supply chain demands certainty—not speculation.

Contact Us Today | +86 159 5127 6160 on WhatsApp

SourcifyChina is the only China sourcing partner with real-time integration to China’s State Administration for Market Regulation (SAMR) databases. All supplier data is updated within 24 hours of official registry changes.

© 2026 SourcifyChina. All rights reserved. Not affiliated with PDD Holdings Inc. or its subsidiaries.

🧮 Landed Cost Calculator

Estimate your total import cost from China.