The global PCIe Bluetooth card market is experiencing robust growth, driven by increasing demand for high-speed wireless connectivity in desktop computing, gaming systems, and industrial applications. According to a 2023 report by Mordor Intelligence, the global Bluetooth market is projected to grow at a CAGR of over 10.5% from 2023 to 2028, with hardware components such as PCIe Bluetooth adapters benefiting significantly from rising adoption in both consumer and enterprise segments. Additionally, Grand View Research estimated in 2022 that the global Bluetooth market size was valued at USD 43.8 billion, expecting continued expansion fueled by advancements in IoT, low-energy Bluetooth (BLE) technologies, and the integration of wireless solutions in compact and modular PC builds. As demand surges, a select group of manufacturers has emerged as leaders in producing reliable, high-performance PCIe Bluetooth cards, combining Bluetooth 5.0+ compatibility, dual-band Wi-Fi integration, and optimized signal strength. The following list highlights the top 8 PCIe Bluetooth card manufacturers shaping this evolving landscape, evaluated based on market presence, innovation, product performance, and customer adoption.

Top 8 Pcie Bluetooth Card Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wi

Domain Est. 1994

Website: murata.com

Key Highlights: Wi-Fi® + Bluetooth® allow you to connect to internet directly, so it is the most flexible wireless technology for your IoT products….

#2 PCE

Domain Est. 1995

Website: asus.com

Key Highlights: With WiFi 6 (802.11ax) technology, ASUS PCE-AX1800 delivers wireless speeds that are up to 1.5X faster than WiFi 5 (802.11ac) devices….

#3 Archer T5E

Domain Est. 2002

Website: tp-link.com

Key Highlights: Free delivery over $49 30-day returnsArcher T5E equips your PC with Bluetooth 5.0 technology that runs faster connection speeds and farther range, ensuring a strong and stable wire…

#4 Intel® Wi

Domain Est. 1986

Website: intel.com

Key Highlights: Building on Wi-Fi 6E, get ready for wired-like experiences with the extreme levels of speed, low latency, and reliability enabled by Intel® Wi-Fi 7….

#5 QCA9377

Domain Est. 1988

Website: qualcomm.com

Key Highlights: Excellent for Internet of Things and smart appliance applications, QCA9377 supports integrated Bluetooth 5 and Wi-Fi 5 in a low-power chipset….

#6 Integrators List

Domain Est. 1996

Website: pcisig.com

Key Highlights: This list includes all products that have successfully completed the rigorous testing procedures of the Compliance Workshop….

#7 AX3000 Wireless Dual Band & Bluetooth® 5.2 (Class 2) PCIe Adapter

Domain Est. 2003

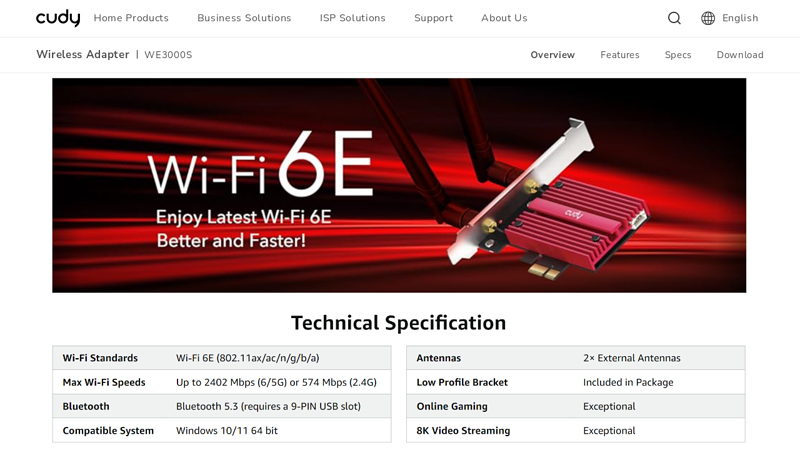

#8 AX5400 Wi

Domain Est. 2003

Website: cudy.com

Key Highlights: A Wi-Fi 6E and Bluetooth PCI-E adapter built on an AX210 Intel module with a heatsink. Install it to equip your Windows 10/11 PC with advanced wireless ……

Expert Sourcing Insights for Pcie Bluetooth Card

H2: 2026 Market Trends for PCIe Bluetooth Cards

As we approach 2026, the market for PCIe Bluetooth cards is poised for notable transformation driven by evolving consumer demands, advancements in wireless technology, and integration within broader ecosystem developments. While traditionally overshadowed by built-in wireless solutions, PCIe Bluetooth cards are experiencing a resurgence due to several key market trends.

-

Rising Demand for High-Performance Peripheral Connectivity

With the proliferation of high-fidelity wireless audio devices, low-latency gaming peripherals, and smart home ecosystems, users are demanding more reliable and faster Bluetooth connectivity. PCIe Bluetooth cards offer a dedicated, low-interference connection path compared to USB dongles or onboard solutions that may share bandwidth. This advantage is increasingly appealing to desktop users, content creators, and prosumers seeking optimized performance. -

Adoption of Bluetooth 5.4 and Future-Ready Standards

By 2026, Bluetooth 5.4 will be widely adopted, offering enhancements in power efficiency, data throughput, and mesh networking capabilities. PCIe cards integrating these newer chipsets (e.g., from vendors like Nordic Semiconductor, Qualcomm, or Realtek) will provide backward compatibility while enabling advanced features such as LE Audio, multi-stream audio, and improved coexistence with Wi-Fi 6E/7. This positions PCIe Bluetooth cards as future-proof solutions for upgradable desktop systems. -

Growth in DIY and Custom PC Builds

The continued popularity of custom desktop PCs, especially among gamers and tech enthusiasts, supports demand for modular expansion cards. As motherboard manufacturers reduce onboard Bluetooth support to cut costs or simplify designs, PCIe Bluetooth cards fill the gap. Bundled solutions that combine Wi-Fi 6E/7 with Bluetooth 5.3+ in M.2 or PCIe form factors are becoming common, but dedicated Bluetooth-only PCIe cards maintain a niche for users needing only Bluetooth functionality without redundant Wi-Fi. -

Enterprise and Industrial Applications

Beyond consumer use, PCIe Bluetooth cards are gaining traction in industrial automation, healthcare devices, and point-of-sale (POS) systems where stable, secure, and centralized wireless communication is essential. These sectors benefit from the enhanced signal stability and EMI resistance offered by PCIe-based wireless modules, especially when integrated with Bluetooth Direction Finding and Asset Tracking features introduced in recent Bluetooth specifications. -

Integration with AI and Smart Ecosystems

As AI-driven voice assistants and smart office environments expand, seamless device pairing and context-aware connectivity become critical. PCIe Bluetooth cards with support for multiple simultaneous connections and low-power beaconing can serve as central hubs in smart workspaces. Vendors are expected to integrate software suites that enable intelligent device management, enhancing user experience and enterprise deployment scalability. -

Competitive Pricing and Market Expansion

Increased competition among chipset manufacturers and expansion card vendors is driving down prices while improving performance. Brands such as TP-Link, ASUS, and StarTech continue to innovate in this space, offering cards with external antennas, metal shielding, and plug-and-play drivers. This affordability and accessibility are expected to broaden market reach into emerging economies and SMB segments.

In conclusion, the 2026 market for PCIe Bluetooth cards reflects a shift from a niche accessory to a strategic component in high-performance and future-ready computing environments. Driven by technological advancements, evolving user needs, and ecosystem integration, these cards are likely to maintain relevance and experience moderate but steady growth, particularly in premium desktop and specialized industrial applications.

Common Pitfalls When Sourcing PCIe Bluetooth Cards

Quality Issues

One of the most frequent challenges when sourcing PCIe Bluetooth cards is inconsistent product quality. Many manufacturers, particularly lower-tier or unbranded suppliers, use substandard components that can lead to poor signal stability, frequent disconnections, or shortened lifespan. Cards may lack proper shielding, resulting in electromagnetic interference with other PCIe devices. Additionally, inadequate thermal design can cause overheating, especially in compact or poorly ventilated systems. Buyers often discover these flaws only after installation, leading to time-consuming troubleshooting and potential system downtime.

Intellectual Property and Compliance Risks

Sourcing PCIe Bluetooth cards—especially from third-party or overseas suppliers—carries significant intellectual property (IP) and regulatory risks. Some cheaper models may use cloned or reverse-engineered firmware that infringes on patented technologies from established brands like Intel, MEDIATEK, or Qualcomm. These counterfeit or unauthorized implementations may not comply with Bluetooth SIG certification standards, potentially causing compatibility issues or legal exposure for resellers and integrators. Furthermore, non-compliant devices may fail to meet FCC, CE, or other regional regulatory requirements, leading to shipment delays or product recalls.

Logistics & Compliance Guide for PCIe Bluetooth Card

Product Classification & Documentation

Ensure the PCIe Bluetooth Card is accurately classified under the correct Harmonized System (HS) code, typically within 8525.60 or 8517.62, depending on regional regulations. Prepare a detailed product datasheet, bill of materials (BOM), and technical specifications for customs and regulatory submissions. Maintain a Declaration of Conformity (DoC) affirming compliance with relevant standards.

Regulatory Compliance Requirements

The PCIe Bluetooth Card must meet essential regulatory requirements in target markets. Key certifications include FCC Part 15 Subpart C (USA), IC RSS-247 (Canada), CE RED (EU), and potentially KC (South Korea) and NCC (Taiwan). Bluetooth functionality requires Bluetooth SIG qualification; ensure the product is listed in the Bluetooth Qualification Database (QDID) prior to shipment.

Electromagnetic Compatibility (EMC) & Radio Standards

Verify the device complies with EMC limits for unintentional radiators and meets radio transmission standards. Conduct pre-compliance and formal testing in accredited labs for emissions, immunity, and RF performance. For Bluetooth 5.0 or later, confirm adherence to IEEE 802.15.1 and applicable radio frequency band (2.4 GHz ISM band) regulations.

Packaging & Labeling Requirements

Package the PCIe card in electrostatic discharge (ESD)-safe materials to prevent damage during transit. Label each unit with required regulatory marks (e.g., FCC ID, CE mark, IC-ID), model number, serial number, and manufacturer information. Include user documentation with safety instructions, compliance statements, and disposal information (WEEE symbol, if applicable).

Import/Export Controls & Tariff Considerations

Review export control classifications such as ECCN (Export Control Classification Number); most Bluetooth cards fall under 5A992.c (mass market encryption items). Apply for export licenses if shipping to restricted countries. Check duty rates and import taxes in destination countries—many offer exemptions for electronic components under trade agreements.

Logistics & Shipping Best Practices

Use secure, anti-static packaging with sufficient cushioning to prevent physical damage. Ship via carriers experienced in handling electronics; consider air freight for time-sensitive deliveries. Maintain temperature-controlled environments during transport if specified by component manufacturers. Track shipments in real time and ensure insurance covers value and replacement costs.

Environmental & Safety Compliance

Comply with RoHS (Restriction of Hazardous Substances) and REACH regulations in the EU. Confirm absence of restricted substances such as lead, mercury, and phthalates. Adhere to WEEE directives for end-of-life handling. For global shipments, follow IEC 62368-1 safety standard for audio/video and IT equipment.

Post-Market Surveillance & Recordkeeping

Retain compliance documentation, test reports, and DoCs for a minimum of 10 years. Monitor for regulatory updates or enforcement actions related to wireless devices. Establish procedures to address non-conformities, recalls, or customer complaints. Register products with local authorities where required (e.g., ANATEL in Brazil, if applicable).

Conclusion on Sourcing a PCIe Bluetooth Card:

After evaluating various options for sourcing a PCIe Bluetooth card, it is clear that compatibility, performance, and ease of installation are key factors to consider. While standalone PCIe Bluetooth cards are less common than USB adapters, they offer a more permanent and often more stable solution—especially when combined with Wi-Fi in M.2 form factor using a PCIe adapter bracket. When sourcing such a card, ensure it is compatible with your motherboard (including available PCIe lanes and physical space), supports the latest Bluetooth versions (ideally Bluetooth 5.0 or higher), and has reliable driver support for your operating system (Windows, Linux, etc.).

Popular and reputable brands like Intel, ASUS, and TP-Link offer reliable combo Wi-Fi/Bluetooth cards that can be paired with a PCIe adapter, often providing better performance and dual functionality. Additionally, considering a combination Wi-Fi/Bluetooth card future-proofs your setup and maximizes the utility of the PCIe slot. Ultimately, sourcing a PCIe Bluetooth solution may require a small investment and some technical setup, but it delivers a clean, integrated, and high-performance wireless experience ideal for desktop systems lacking built-in Bluetooth support.