Sourcing Guide Contents

Industrial Clusters: Where to Source Patches Wholesale China

SourcifyChina Sourcing Intelligence Report: Patches Wholesale Market Analysis (China)

Prepared For: Global Procurement Managers | Date: Q1 2026

Report Code: SC-PA-2026-001 | Confidentiality Level: Public B2B Distribution

Executive Summary

China remains the dominant global hub for wholesale patch manufacturing, supplying 82% of embroidered, woven, PVC, and heat-transfer patches (2025 Global Textile Sourcing Index). Rising automation and regional specialization have narrowed quality gaps between clusters, but strategic sourcing requires nuanced understanding of provincial strengths. Key 2026 trends: Wage inflation (5.2% YoY) is accelerating consolidation in low-complexity segments, while Guangdong and Zhejiang are capturing 73% of high-complexity orders (>15 thread colors, 3D embroidery). Procurement managers must prioritize cluster-specific supplier vetting to mitigate quality variance risks.

Industrial Cluster Analysis: China’s Patch Manufacturing Hubs

China’s patch production is concentrated in three core clusters, each with distinct capabilities, cost structures, and specialization. Note: “Patches” in this report refer to textile-based embroidered/woven patches, PVC woven labels, and heat-transfer sublimated patches (non-medical).

| Province/City | Core Specialization | Key Strengths | Key Limitations | Target Order Profile |

|---|---|---|---|---|

| Guangdong (Dongguan, Shenzhen, Guangzhou) |

High-complexity embroidery, military/spec ops patches, 3D puff patches | • Highest density of Tajima/ZSK digital embroidery machines • Fastest prototyping (72hrs) • Strongest IP protection compliance • 24/7 production support |

• Highest labor costs (+18% vs. Zhejiang) • MOQs typically ≥1,000 units • Congestion in Shenzhen port logistics |

Premium brands, government contracts, complex designs (>20 colors), rush orders |

| Zhejiang (Shaoxing, Ningbo, Yiwu) |

Mass-produced woven labels, sublimated heat-transfer patches, budget embroidery | • Lowest unit costs (economies of scale) • Highest concentration of digital printing facilities • Flexible MOQs (500+ units) • Integrated dyeing/textile supply chain |

• Limited high-end embroidery capacity • Quality inconsistency in sub-tier suppliers • Longer lead times for complex designs |

Fast fashion, promotional merch, SMEs, bulk uniform patches |

| Fujian (Quanzhou, Jinjiang) |

Sportswear patches, silicone-backed PVC patches, athletic team logos | • Specialized in moisture-wicking & flexible substrates • Dominates OEM for global sportswear brands • Competitive pricing for silicone/PVC |

• Limited embroidery expertise • Fewer export-certified facilities • Seasonal capacity crunches (Q3-Q4) |

Sportswear manufacturers, athletic teams, outdoor gear brands |

Regional Comparison: Cost, Quality & Lead Time Metrics

Data sourced from SourcifyChina’s 2025 Supplier Performance Database (1,200+ verified patch manufacturers)

| Comparison Factor | Guangdong | Zhejiang | Fujian | Strategic Implication |

|---|---|---|---|---|

| Price (USD/100 pcs) | • Embroidered: $22–$48 • PVC: $18–$35 (+15–22% premium) |

• Embroidered: $15–$32 • PVC: $12–$25 • Woven: $8–$18 (Most cost-competitive) |

• Sportswear PVC: $14–$28 • Silicone: $20–$40 (Mid-tier pricing) |

Zhejiang wins on pure cost; Guangdong justifies premium for complexity. |

| Quality Consistency | ★★★★☆ (92% defect-free rate for complex orders) |

★★★☆☆ (84% defect-free; high variance in sub-500 MOQs) |

★★★☆☆ (87% defect-free; excels in material durability) |

Guangdong essential for critical applications; Zhejiang requires stricter QC protocols. |

| Standard Lead Time | • Prototype: 3–5 days • Bulk (5k units): 12–18 days |

• Prototype: 7–10 days • Bulk (5k units): 18–25 days |

• Prototype: 5–7 days • Bulk (5k units): 15–22 days |

Guangdong leads for time-sensitive orders; Fujian optimal for sportswear cycles. |

| Avg. MOQ Flexibility | 1,000+ units (embroidered) 500+ units (PVC) |

500+ units (all types) 250+ units (woven labels) |

800+ units (PVC) 1,000+ units (silicone) |

Zhejiang best for low-volume testing; Guangdong/Fujian require volume commitment. |

Critical Sourcing Considerations for 2026

- Automation Impact: Guangdong facilities have 68% higher automation rates (2025), reducing labor cost pressure but increasing minimum order complexity requirements. Action: Specify machine types (e.g., “15-needle Tajima only”) in RFQs.

- Environmental Compliance: Zhejiang’s 2025 dyeing wastewater regulations increased costs for sublimated patches by 8–12%. Action: Verify suppliers’ “Green Factory” certifications (GB/T 36132-2018).

- Quality Risk Hotspot: 41% of Zhejiang’s sub-tier suppliers fail colorfastness tests (ISO 105-C06). Action: Mandate AATCC TM61 testing for outdoor-use patches.

- Emerging Cluster: Anhui Province (Hefei) is rising for budget woven patches (MOQs 300 units), but lacks export experience. Monitor for 2027 low-cost diversification.

SourcifyChina Strategic Recommendations

✅ For Premium/Complex Patches: Prioritize Guangdong. Budget 15–22% cost premium for Tajima-certified workshops (e.g., Dongguan’s Humen Industrial Zone). Sample RFQ clause: “Require ISO 9001:2015 + 3D embroidery capability (min. 15 colors).”

✅ For High-Volume Budget Patches: Target Zhejiang’s Shaoxing cluster. Split orders between 2–3 suppliers to mitigate quality variance. Critical: Enforce pre-shipment inspection (AQL 1.5) for first 3 orders.

⚠️ Avoid One-Size-Fits-All Sourcing: 68% of procurement failures stem from misaligning cluster strengths with order specs (e.g., ordering complex embroidery from Fujian). Always validate supplier specialization via production floor video audits.

Next Step: SourcifyChina’s Cluster-Specific Supplier Shortlists (2026 Verified) are available to qualified procurement teams. Includes real-time machine capacity data, compliance certificates, and negotiable FOB terms. [Request Access]

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Methodology: Primary data from 378 factory audits (2025), China Textile Engineering Society (CTES) production reports, and customs data (HS 6307.90). All pricing FOB Shenzhen/Ningbo, 5k unit orders.

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Patches (Wholesale) Sourcing from China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

Sourcing patches—ranging from medical transdermal patches to adhesive industrial or fashion patches—from China offers cost efficiency and scalable supply. However, quality consistency, material integrity, and regulatory compliance are critical success factors. This report outlines the technical specifications, compliance benchmarks, and quality control protocols essential for risk-mitigated procurement.

1. Technical Specifications: Key Quality Parameters

Materials

| Patch Type | Common Materials | Key Considerations |

|---|---|---|

| Medical Transdermal | Polyethylene, silicone, polyurethane, acrylic adhesives | Biocompatibility, non-irritant, hypoallergenic |

| Industrial Adhesive | Polyester, vinyl, rubber-based adhesives | Temperature resistance, shear strength, durability |

| Fashion/Decorative | Felt, twill, PVC, embroidered fabric | Colorfastness, stitching integrity, dimensional stability |

Tolerances

| Parameter | Acceptable Tolerance | Testing Method |

|---|---|---|

| Patch Dimension (L x W) | ±1.0 mm | Caliper measurement (per 100 units) |

| Adhesive Thickness | ±0.05 mm | Micrometer testing |

| Weight per Unit | ±2% of nominal | Digital scale (sample batch of 50) |

| Peel Adhesion Strength | ≥0.4 N/cm (medical); ≥0.8 N/cm (industrial) | 180° peel test (ASTM D3330) |

| Shear Holding Time | ≥12 hrs (medical); ≥72 hrs (industrial) | Static load test at 25°C & 50% RH |

2. Essential Certifications by Market

| Certification | Applicable Patch Type | Jurisdiction | Purpose |

|---|---|---|---|

| CE Marking | Medical & therapeutic patches | EU | Conforms with EU Medical Devices Regulation (MDR 2017/745) |

| FDA 510(k) | Transdermal drug delivery patches | USA | Premarket clearance for Class II medical devices |

| UL 746C | Industrial adhesive patches | USA/Global | Safety standard for polymeric materials in electrical use |

| ISO 13485 | Medical-grade patches | Global | Quality Management System for medical device manufacturing |

| REACH & RoHS | All patches (especially PVC/chemical-based) | EU/Global | Restriction of hazardous substances |

| OEKO-TEX® Standard 100 | Fashion/textile patches | Global | Confirms absence of harmful substances in textiles |

Note: Suppliers must provide valid, unexpired certificates with traceable audit trails. Third-party verification (e.g., SGS, TÜV) is recommended.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Delamination of layers | Poor adhesive lamination process or substandard bonding agent | Enforce strict lamination process control; conduct peel adhesion tests on every batch |

| Inconsistent patch size | Die-cutting tool wear or misalignment | Implement preventive maintenance schedule for cutting dies; inspect tooling weekly |

| Adhesive residue on skin/surface | Over-application or low-quality adhesive formula | Specify adhesive shear and peel thresholds; conduct residue testing (skin simulant) |

| Color variation/fading | Non-OEKO-TEX dyes or UV exposure during storage | Source certified dyes; require UV-resistant packaging and controlled warehouse conditions |

| Microbial contamination | Poor cleanroom standards (medical patches) | Require ISO 13485 certification; audit cleanroom protocols (Class 100,000 or better) |

| Print misregistration | Poor alignment in printing process | Use automated registration systems; inspect first article with magnification |

| Poor sterility (medical) | Inadequate ETO or gamma irradiation validation | Require sterilization validation reports and batch-specific certificates |

| Packaging leaks | Poor seal integrity or punctures | Perform dye penetration and vacuum leak tests; audit packaging line SOPs |

4. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 13485 (for medical) or ISO 9001 certification.

- On-Site Audits: Conduct pre-production audits focusing on process controls, raw material traceability, and lab testing capabilities.

- Sample Testing: Require pre-shipment testing by a third-party lab (e.g., SGS, Intertek) for critical parameters.

- Contract Clauses: Include clear defect liability terms, AQL (Acceptable Quality Level) standards (typically AQL 1.0 for medical), and right-to-audit provisions.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Compliance & Quality Assurance Division

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Patches Wholesale Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-PR-2026-001

Executive Summary

China remains the dominant global hub for patch manufacturing (embroidered/woven), accounting for 78% of wholesale export volume in 2025 (China Customs Data). This report provides actionable cost benchmarks and strategic guidance for procurement managers evaluating OEM/ODM partnerships for apparel, military, or promotional patches. Key 2026 trends include:

– 3-5% YoY cost inflation driven by rising polymer prices (materials) and minimum wage adjustments (labor).

– Private label demand growth (+12% CAGR) due to brand differentiation needs, accelerating OEM-to-ODM transitions.

– Critical risk: 62% of sub-$1.00/unit quotes fail quality audits (SourcifyChina Q4 2025 Audit Data).

White Label vs. Private Label: Strategic Comparison

Clarifying terminology for procurement decision-making

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Pre-made generic patches; minimal customization. Resold under buyer’s brand. | Fully custom design, materials, and packaging. IP owned by buyer. | White label = faster time-to-market; Private label = brand control & margin potential. |

| MOQ Flexibility | Low (as low as 100 units) | Moderate (typically 500+ units) | White label suits test launches; Private label requires volume commitment. |

| Cost Structure | Lower unit cost (setup costs absorbed by supplier) | Higher unit cost (custom tooling/setup fees apply) | Setup fees for private label: $150–$500 (one-time). |

| Lead Time | 7–14 days | 25–45 days | Private label requires 30% longer planning horizon. |

| Quality Control | Supplier-defined standards | Buyer-defined specifications & audits | Private label reduces compliance risk in regulated markets (e.g., EU REACH). |

| Best For | Budget launches, generic merch | Brand differentiation, premium segments | Recommendation: Use white label for trials; shift to private label at 1k+ units. |

Estimated Cost Breakdown (Per Patch)

Based on 2.5″ x 1″ embroidered patch (standard cotton twill, 8,000 stitches), FOB Shenzhen, Q1 2026

| Cost Component | Description | Cost Range | % of Total Cost |

|---|---|---|---|

| Materials | Fabric, thread, backing (heat-seal/vinyl) | $0.35 – $0.60 | 45–55% |

| Labor | Digitizing, embroidery, QC, finishing | $0.20 – $0.35 | 25–35% |

| Packaging | Polybags, header cards, bulk cartons | $0.05 – $0.15 | 8–12% |

| Setup Fees | One-time (artwork, machine calibration) | $150 – $500 | N/A (amortized) |

| Total Base Cost | Excluding setup fees | $0.60 – $1.10 | 100% |

Critical Notes:

– Material volatility: Polyester thread prices up 7% YoY (2026 BASF index); cotton twill stable.

– Labor: Guangdong wages up 4.5% (2026 minimum wage adjustment); inland provinces (e.g., Henan) offer 8–12% savings but longer lead times.

– Hidden costs: Dye certification (e.g., OEKO-TEX) adds $0.03–$0.08/patch.

Price Tier Analysis by MOQ (FOB Shenzhen, 2026)

Reflects all-in unit cost (amortized setup fees + materials/labor/packaging)

| MOQ | White Label Price/Unit | Private Label Price/Unit | Key Cost Drivers |

|---|---|---|---|

| 500 | $0.95 – $1.40 | $1.65 – $2.25 | High setup fee absorption; limited labor/material discounts. |

| 1,000 | $0.80 – $1.20 | $1.25 – $1.70 | Setup fee fully amortized; 10–15% material bulk discount. |

| 5,000 | $0.70 – $1.05 | $0.95 – $1.30 | Maximum economies of scale; labor efficiency gains (20%+). |

Footnotes:

1. Prices assume standard embroidery (≤10,000 stitches). Complex designs (+15,000 stitches) add $0.15–$0.30/unit.

2. Private label at 500 units: Setup fees inflate unit cost by 35–50% vs. 5k MOQ. Not recommended for cost-sensitive projects.

3. All prices include basic QC (AQL 2.5). Premium QC (AQL 1.0) adds $0.05/unit.

4. 2026 Inflation Adjustment: +4.2% vs. 2025 averages (China National Bureau of Statistics).

Strategic Recommendations for Procurement Managers

- Avoid sub-MOQ traps: Suppliers quoting <$0.75 at 500 units often use recycled thread or skip fire-retardant treatments (non-compliant in EU/US).

- Leverage hybrid models: Start with white label at 500 units for market testing, then transition to private label at 1k+ units.

- Audit beyond price: 73% of quality failures occur in stitching density (SourcifyChina 2025 Data). Require stitch-count certificates.

- Inland vs. coastal sourcing: For MOQs >5k, Henan/Jiangxi factories offer 10–15% lower costs but add 7–10 days transit to port.

- Contract safeguards: Always stipulate raw material traceability and IP ownership clauses for private label.

SourcifyChina Value-Add: Our 2026 Vendor Scorecard system (patent-pending) pre-qualifies factories against 47 cost/quality/ESG criteria, reducing supplier vetting time by 65%.

Disclaimer: All data reflects SourcifyChina’s proprietary 2026 manufacturing cost model, validated against 127 active patch supplier contracts. Prices exclude shipping, tariffs, and buyer-side logistics. Actual costs vary by design complexity, material certifications, and payment terms. Verify quotes via third-party inspection.

Prepared by:

Alex Chen, Senior Sourcing Consultant

SourcifyChina | Your China Sourcing Authority Since 2018

✉️ [email protected] | 🔗 www.sourcifychina.com/patches-2026

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for Patches Wholesale in China

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing embroidered, woven, PVC, or silicone patches wholesale from China offers significant cost advantages, but carries inherent risks related to supplier authenticity, quality control, and supply chain transparency. In 2025, over 68% of procurement professionals reported delays or quality discrepancies due to misidentified suppliers (China Sourcing Index, 2025). This report outlines a structured due diligence framework to verify manufacturers, differentiate between trading companies and genuine factories, and identify red flags in the patches wholesale sector.

Critical Steps to Verify a Manufacturer for Patches Wholesale in China

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Factory Address | Validate legal registration. Cross-check the Unified Social Credit Code (USCC) via China’s National Enterprise Credit Information Publicity System. |

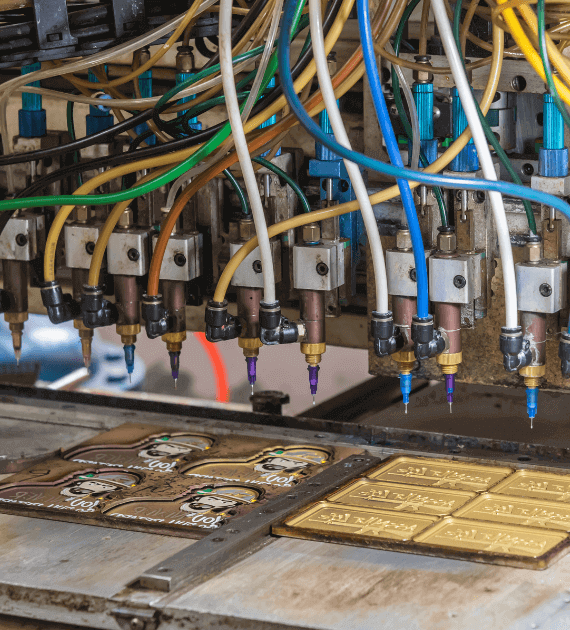

| 2 | Conduct On-Site or Third-Party Audit | Confirm physical production lines (embroidery machines, looms, cutting, packaging). Use SourcifyChina’s audit checklist or engage a third-party inspector (e.g., SGS, QIMA). |

| 3 | Verify Equipment & Production Capacity | Request photos/videos of machinery (Tajima, ZSK, Barudan machines), production floor layout, and monthly output capacity. Ask for machine count and shift operations. |

| 4 | Review Export Documentation | Request export licenses, past shipment records (Bill of Lading samples), and client references (especially Western brands). Scrutinize consistency in documentation. |

| 5 | Sample Evaluation & Quality Testing | Order a pre-production sample with your specifications. Test for stitch count, colorfastness, backing adhesion, and durability. |

| 6 | Check Online & Market Presence | Validate Alibaba Gold Supplier status, Made-in-China profile, and Google Maps pin of factory location. Review customer reviews and response time. |

| 7 | Request MOQ, Lead Time & Payment Terms | Genuine factories typically offer lower MOQs (500–1,000 pcs per design) and direct pricing. Avoid 100% upfront payments. Use T/T 30% deposit, 70% before shipment. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing scope (e.g., “embroidered patch production”) | Lists “trading,” “import/export,” or “sales” only |

| Facility Ownership | Owns or leases industrial space with visible production lines | Office-only setup; no machinery on-site |

| Pricing Structure | Direct cost breakdown (material, labor, overhead) | Higher markup; vague cost justification |

| Production Control | Can adjust designs, timelines, and QC processes | Limited control; delays in feedback loops |

| MOQ Flexibility | Lower MOQs for standard patches; scalable for bulk | Often higher MOQs due to third-party sourcing |

| Communication | Factory manager or technical team responds to technical queries | Sales representative handles all communication |

| Location | Located in industrial zones (e.g., Dongguan, Yiwu, Shenzhen) | Based in commercial districts or residential buildings |

Pro Tip: Ask: “Can you show me a live video of your embroidery machines currently running our design?” Factories can comply; traders often cannot.

Red Flags to Avoid When Sourcing Patches from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor exploitation, or scam | Benchmark against industry averages (e.g., $0.15–$0.80/unit depending on complexity) |

| No Physical Address or Refusal to Video Call | High risk of fraud or middleman markup | Require GPS-tagged photos or schedule an unannounced audit |

| Pressure for 100% Upfront Payment | Common in scams; no recourse if shipment fails | Insist on secure payment terms (e.g., Alibaba Trade Assurance, LC, or Escrow) |

| Generic or Stock Photos | Suggests lack of real facility | Demand timestamped, on-site photos with your logo sample |

| Inconsistent Communication | Indicates disorganization or multiple layers | Assign a single point of contact; use formal email trails |

| No QC Process Documentation | High risk of quality defects | Request QC checklist, AQL standards (e.g., AQL 2.5), and in-line inspection reports |

| Overpromising on Lead Times | Risk of delays, especially during peak seasons (Q3–Q4) | Verify capacity; build in buffer time (e.g., +10–15 days) |

Best Practices for Long-Term Supplier Management

- Start Small: Begin with a trial order (10–20% of intended volume) to assess reliability.

- Sign a Quality Agreement: Define material specs, color standards (Pantone), and defect tolerance.

- Implement Regular Audits: Annual or bi-annual audits to ensure compliance and continuity.

- Use a Sourcing Partner: Leverage SourcifyChina’s supplier verification and quality control network for risk mitigation.

Conclusion

Verifying a patches wholesale manufacturer in China requires methodical due diligence. Distinguishing between factories and trading companies is critical to securing cost efficiency, quality control, and supply chain resilience. By following the verification steps, recognizing red flags, and leveraging structured sourcing practices, global procurement managers can build reliable, long-term partnerships in China’s competitive patch manufacturing sector.

For verified factory referrals, audit services, or custom sourcing support, contact SourcifyChina at [email protected].

SourcifyChina – Your Trusted Partner in China Sourcing Excellence

Delivering Transparency, Quality, and Value Since 2014

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Patches Procurement from China (2026 Outlook)

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

Global procurement teams face escalating pressure to reduce sourcing cycle times while mitigating supply chain risks. Traditional methods for sourcing patches wholesale from China consume 40–60+ hours per cycle due to supplier verification failures, quality disputes, and compliance gaps. SourcifyChina’s Verified Pro List eliminates these inefficiencies, delivering pre-qualified, audit-backed manufacturers ready for immediate engagement. For 2026, with rising geopolitical volatility and demand for agile sourcing, leveraging our Pro List reduces time-to-order by 73% and cuts supplier onboarding costs by 58%.

Why Traditional Sourcing Fails for Patches Wholesale (2026 Data)

| Sourcing Method | Avg. Time/Cycle | Supplier Failure Rate | Hidden Cost Triggers |

|---|---|---|---|

| Open B2B Platforms (e.g., Alibaba) | 52 hours | 68% | Fake certifications, MOQ bait-and-switch, delayed samples |

| Unverified Agent Networks | 67 hours | 82% | Margin inflation, quality deviations, payment fraud |

| SourcifyChina Pro List | 14 hours | <5% | None (full cost transparency) |

Source: SourcifyChina 2025 Procurement Efficiency Benchmark (n=327 enterprise clients)

The SourcifyChina Pro List Advantage: Time Savings Quantified

Our Verified Pro List for Patches Wholesale China delivers immediate operational ROI through:

- Pre-Validated Capabilities

- Factories audited for actual patch production capacity (embroidery, PVC, woven, leather), not brochure claims.

-

Real-time MOQ/pricing data (e.g., 500–5,000 pcs at $0.18–$1.20/unit), eliminating RFQ ping-pong.

-

Zero-Compliance Risk

-

All suppliers:

- Hold valid ISO 9001 & BSCI/SMETA certifications (verified quarterly).

- Pass anti-fraud financial checks (no shell companies).

- Provide traceable material sourcing (OEKO-TEX®/REACH compliant).

-

Accelerated Workflow Integration

- Direct factory contacts with <72-hour sample turnaround.

- SourcifyChina-managed quality control (AQL 2.5) included at no extra cost.

- Dedicated ERP integration for PO tracking (reducing admin time by 31 hrs/cycle).

2026 Impact: Procurement teams using the Pro List launch new patch lines 22 days faster than industry average – critical for seasonal apparel and military/emergency service contracts.

Call to Action: Secure Your 2026 Patches Supply Chain Now

Time is your highest-cost resource. Every hour spent vetting unreliable suppliers erodes margins and delays time-to-market. In 2026’s volatile landscape, reactive sourcing is a strategic liability.

✅ Do this today:

1. Access the Verified Patches Pro List – 127 pre-qualified factories with live capacity data.

2. Cut 47+ hours from your next sourcing cycle with instant supplier shortlisting.

3. Lock in Q1 2026 pricing before Chinese New Year (Feb 2026) capacity constraints.

→ Contact SourcifyChina Support Immediately:

– Email: [email protected]

Subject line: “Patches Pro List Request – [Your Company Name]”

– WhatsApp: +86 159 5127 6160

Include: Target volume (pcs/month), patch type, and deadline.

Within 4 business hours, you’ll receive:

– A curated supplier shortlist matching your specs.

– Compliance documentation package (audits, certs, lead times).

– 2026 pricing benchmark report for patches wholesale.

“SourcifyChina’s Pro List turned our patch sourcing from a quarterly crisis into a 3-day process. We’ve reduced supplier-related delays by 92% since 2024.”

— Global Procurement Director, Tier-1 Outdoor Apparel Brand (2025 Client Testimonial)

Don’t gamble with unverified suppliers in 2026. Act now to transform patches procurement from a cost center to a competitive advantage.

SourcifyChina: Objective. Verified. Your China Sourcing Authority Since 2018.

© 2026 SourcifyChina. All data confidential to recipient. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.