The global agricultural irrigation systems market is experiencing robust growth, driven by increasing water scarcity, rising demand for food production, and the adoption of precision farming technologies. According to a 2023 report by Mordor Intelligence, the market was valued at approximately USD 15.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 11.5% over the next seven years. Pasture irrigation systems, in particular, are gaining traction due to the expanding livestock sector and the need for efficient forage production in arid and semi-arid regions. With farmers increasingly prioritizing water use efficiency and yield optimization, manufacturers are innovating with smart irrigation solutions, incorporating IoT-enabled sensors, automated scheduling, and variable-rate technology. As demand intensifies, a select group of manufacturers has emerged as leaders, combining technological advancement with reliable performance to support sustainable pasture management worldwide.

Top 10 Pasture Irrigation Systems Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Keeling Company

Domain Est. 1998

Website: keelingcompany.com

Key Highlights: Agriculture & Industrial Irrigation. Agricultural irrigation is where we got our start and we are still your source for materials built for industrial use…….

#2 Drip Irrigation System & Technology

Domain Est. 2000

Website: netafimusa.com

Key Highlights: Netafim is the world’s leading drip irrigation technology company supplying multiple industries with smart drip irrigation systems that help to fight food ……

#3 All Products

Domain Est. 2001

Website: hunterirrigation.com

Key Highlights: Skip to main content. Landscape Irrigation · Landscape Lighting · Golf Irrigation · Agricultural Irrigation · Dispensing Technology · Custom Manufacturing ……

#4 Jain Irrigation Systems Ltd.

Domain Est. 1997

Website: jains.com

Key Highlights: Products We Offer · Drip Irrigation Systems · Micro & Mini Sprinklers · Sprinkler Irrigation · Filters, Dosing Pump & Injectors · PVC Pipes & Fittings · PE Pipes & ……

#5

Domain Est. 1997

Website: kifco.com

Key Highlights: Kifco manufactures Water-Reel Irrigation Traveling Systems, Companion Pumps and Avi-FoamGuard Units for avian Influenza outbreaks….

#6 Solid Set Irrigation Solutions From Nelson Irrigation

Domain Est. 1999

Website: nelsonirrigation.com

Key Highlights: Nelson sprinklers are the best option for portable pipe or permanent solid set irrigation applications because of their incredible uniformity….

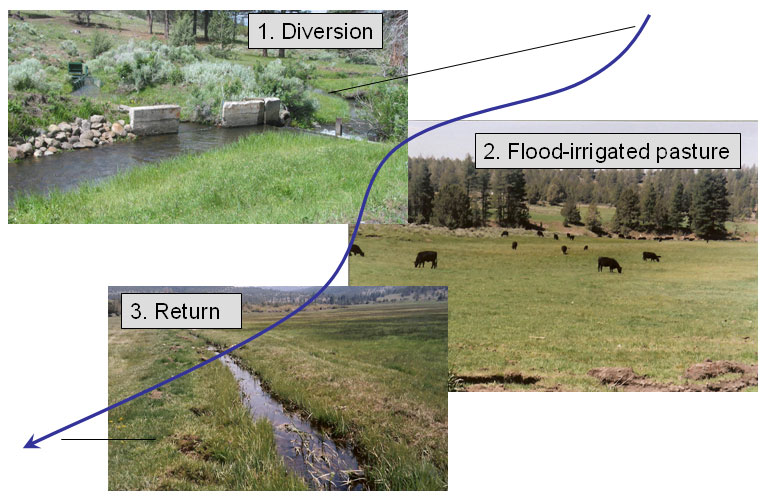

#7 Pasture Irrigation System

Domain Est. 2003

Website: k-linena.com

Key Highlights: Pasture irrigation is a supply of water throughout a pasture or field for the purpose of irrigation or to provide water for horses, cattle, sheep, or goats….

#8 Big Sprinkler

Domain Est. 2007

Website: bigsprinkler.com

Key Highlights: Big Sprinkler is your source for commercial grade sprinkler heads, pumps, and more! Shop quality products for an affordable solution for irrigating large ……

#9 Ernst Irrigation

Domain Est. 2009

Website: ernstirrigation.com

Key Highlights: 30-day returnsFor more than 100 years, Ernst has been serving the farming community in and around St. Paul and throughout the Willamette Valley and beyond….

#10 Soft Rain Irrigation

Domain Est. 2019

Website: softrainna.com

Key Highlights: Soft Rain Irrigation is an eCommerce retailer specializing in pasture management solutions, including: Originally developed in New Zealand for grass-based ……

Expert Sourcing Insights for Pasture Irrigation Systems

H2: 2026 Market Trends for Pasture Irrigation Systems

The pasture irrigation systems market in 2026 is shaped by a confluence of technological advancements, environmental pressures, economic factors, and evolving agricultural practices. Driven primarily by the need for sustainable intensification of livestock production and adaptation to climate volatility, the market exhibits several key trends:

1. Dominance of Smart and Precision Irrigation Technologies:

By 2026, smart irrigation systems integrated with IoT (Internet of Things) sensors, data analytics, and automation are no longer niche but mainstream. Soil moisture sensors, weather stations, and satellite imagery are widely deployed to enable real-time monitoring and data-driven irrigation scheduling. This shift minimizes water waste, optimizes pasture growth cycles, and reduces energy costs. Cloud-based platforms allow farmers to remotely manage systems via smartphones or tablets, enhancing operational efficiency. The trend is particularly strong in developed markets like North America, Western Europe, and Australia, but adoption is accelerating in emerging economies through government subsidies and cooperative models.

2. Water Scarcity and Regulatory Pressures Driving Efficiency:

Increasing water scarcity due to prolonged droughts and climate change has intensified regulatory scrutiny on agricultural water use. Governments and water authorities are implementing stricter water allocation policies, metering requirements, and incentives for water-efficient technologies. As a result, there is a strong market push toward high-efficiency irrigation systems such as drip irrigation for pastures (especially in high-value forage or rotational grazing systems) and precision center pivots with low-energy precision application (LEPA) or low-drift spray systems. Water reuse and integration with recycled water sources are also gaining traction in water-stressed regions.

3. Integration with Regenerative and Sustainable Farming Practices:

The growing emphasis on regenerative agriculture—focusing on soil health, carbon sequestration, and biodiversity—is influencing pasture management. Irrigation systems are being designed to support holistic planned grazing and multi-species pastures, requiring flexible and scalable solutions. There is increased demand for systems that minimize soil compaction (e.g., lightweight lateral moves), reduce runoff, and enhance nutrient cycling. Sustainability certifications and consumer demand for ethically produced livestock products are further incentivizing investments in eco-friendly irrigation infrastructure.

4. Rise of Renewable Energy Integration:

To reduce operational costs and carbon footprints, solar-powered irrigation pumps and controllers are becoming standard, especially in remote or off-grid pasture areas. By 2026, many new installations include solar PV integration as a default option. This trend is supported by falling solar panel costs and government incentives for renewable energy adoption in agriculture. Hybrid solar-diesel or solar-grid systems provide reliability while reducing fossil fuel dependency.

5. Regional Diversification and Market Expansion:

While mature markets in North America and Europe continue to upgrade infrastructure, significant growth is observed in regions like Latin America (especially Brazil and Argentina), Sub-Saharan Africa, and parts of Southeast Asia. In these areas, increasing livestock demand, expanding dairy and beef industries, and government-led agricultural development programs are driving investments in modern irrigation. However, affordability and technical support remain challenges, leading to demand for modular, scalable, and low-maintenance systems.

6. Consolidation and Digital Service Ecosystems:

The market is witnessing consolidation among equipment manufacturers, with major agtech and irrigation companies acquiring software startups to offer end-to-end digital solutions. Farmers increasingly seek bundled services that include hardware, data analytics, agronomic advice, and maintenance support. Subscription-based models for irrigation management platforms are emerging, offering predictive insights and yield optimization tools tailored to pasture productivity.

Conclusion:

By 2026, the pasture irrigation systems market is characterized by intelligence, sustainability, and integration. Success hinges on delivering solutions that balance productivity with environmental stewardship, underpinned by data, renewable energy, and adaptive management. As climate resilience becomes a top priority, the adoption of advanced irrigation technologies will be critical for the future of global pasture-based livestock systems.

Common Pitfalls Sourcing Pasture Irrigation Systems (Quality, IP)

When sourcing pasture irrigation systems, businesses and agricultural operations often encounter significant challenges related to product quality and intellectual property (IP) risks—especially when procuring from international or low-cost suppliers. Overlooking these factors can lead to system failures, reduced efficiency, legal disputes, and long-term financial losses.

Poor Quality Components and Substandard Materials

One of the most frequent pitfalls is receiving irrigation systems made with inferior materials or poor manufacturing standards. Low-cost suppliers may use thin-walled polyethylene pipes, weak connectors, or subpar UV-resistant coatings that degrade quickly under sun exposure. These deficiencies result in leaks, bursts, and shortened system lifespans, increasing maintenance costs and downtime. Additionally, inconsistent product specifications across batches can hinder system integration and performance.

Lack of Compliance with Industry Standards

Many pasture irrigation systems sourced from unveted suppliers fail to meet recognized international or regional standards (e.g., ISO, ASAE, or national water efficiency regulations). This non-compliance can impact system reliability, water distribution uniformity, and eligibility for agricultural subsidies or certifications. Buyers may also face regulatory penalties or be unable to integrate the system with existing infrastructure.

Inadequate Testing and Certification Documentation

Suppliers may provide incomplete or falsified test reports, pressure ratings, or flow performance data. Without verified third-party certifications (such as NSF, WRAS, or IAPMO), buyers have no assurance that the system will perform as advertised under real-world pasture conditions. This lack of transparency increases the risk of purchasing underperforming or unsafe equipment.

Intellectual Property Infringement Risks

Sourcing irrigation systems—especially advanced designs like center pivots, drip lines, or smart controllers—can expose buyers to IP violations if the products replicate patented technologies without authorization. Using or importing such systems may lead to legal action from original equipment manufacturers (OEMs), customs seizures, or reputational damage. This is particularly prevalent when dealing with suppliers offering “compatible” or “generic” versions of branded systems.

Limited After-Sales Support and Warranty Enforcement

Even if a system initially appears functional, poor supplier reliability often surfaces after purchase. Many low-cost vendors offer weak or unenforceable warranties, lack local technical support, and are unresponsive to claims. This makes it difficult to replace defective parts or resolve malfunctions, especially in remote farming regions where timely repairs are crucial.

Hidden Costs from System Inefficiency

Low-quality irrigation systems often have poor water distribution uniformity, leading to over- or under-watering of pastures. This inefficiency increases water and energy costs, harms pasture health, and reduces overall farm productivity. The initial cost savings are quickly offset by higher operational expenses and lost yields.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough supplier audits and request evidence of compliance with relevant standards.

– Require verifiable test reports and material certifications.

– Perform due diligence on IP status, especially for technologically advanced components.

– Prioritize suppliers with strong warranties, local support networks, and a proven track record.

– Consider partnering with reputable distributors or OEMs, even at a higher initial cost, to ensure long-term reliability and legal safety.

Investing time in vetting sources and prioritizing quality and IP compliance upfront can prevent costly failures and protect both operational efficiency and legal standing in the long run.

Logistics & Compliance Guide for Pasture Irrigation Systems

Implementing a pasture irrigation system involves careful planning beyond installation. This guide outlines key logistical considerations and regulatory compliance requirements to ensure efficient, sustainable, and legal operation.

Project Planning and Site Assessment

Before procurement or installation, conduct a thorough site assessment. Evaluate topography, soil type, water source reliability, and existing vegetation. Map field boundaries and determine the total acreage to be irrigated. This data informs system design, equipment selection, and water rights applications. Identify access points for equipment delivery and maintenance, and assess proximity to power sources for pump stations.

Equipment Procurement and Delivery Logistics

Select irrigation equipment—such as center pivots, linear moves, or drip systems—based on field layout and operational goals. Coordinate with suppliers to schedule timely delivery of components, including towers, sprinklers, pumps, control panels, and piping. Ensure delivery routes accommodate oversized loads and that storage areas are secure and close to installation sites. Confirm spare parts availability and warranty terms during procurement.

Installation and Labor Coordination

Engage certified technicians or contractors experienced in agricultural irrigation systems. Schedule installation during low-activity periods to minimize disruption to grazing rotations. Coordinate labor, equipment, and materials to align with weather forecasts and planting schedules. Ensure all electrical and plumbing work complies with local codes. Maintain detailed records of installation procedures and equipment configurations for future maintenance and compliance audits.

Water Rights and Regulatory Compliance

Verify legal water rights for agricultural use through your state’s water resource agency. Submit necessary applications for surface or groundwater extraction, including permits for well drilling if applicable. Comply with regulations from the Environmental Protection Agency (EPA), Department of Environmental Quality (DEQ), or equivalent regional bodies. Implement irrigation scheduling to avoid overuse and adhere to seasonal water restrictions or drought declarations.

Environmental and Safety Regulations

Adhere to best management practices (BMPs) to prevent runoff, erosion, and nutrient leaching into waterways. Install backflow prevention devices to protect water supplies from contamination. Follow OSHA guidelines for worker safety during installation and maintenance. Ensure all electrical components meet National Electrical Code (NEC) standards and are properly grounded.

Operational Monitoring and Recordkeeping

Monitor system performance using flow meters, soil moisture sensors, and weather data to optimize water use efficiency. Maintain logs of water usage, maintenance activities, and system adjustments. These records support compliance reporting and may be required for conservation program participation (e.g., USDA NRCS programs).

Maintenance and Long-Term Compliance

Establish a routine maintenance schedule for pumps, filters, sprinklers, and control systems. Inspect for leaks, clogs, and wear regularly. Update compliance documentation annually, including renewals of water permits and environmental certifications. Stay informed about changes in agricultural water regulations through extension services or industry associations.

By addressing logistics and compliance proactively, pasture managers can ensure reliable irrigation, protect natural resources, and maintain operational legality.

In conclusion, sourcing pasture irrigation systems requires careful consideration of several key factors, including water availability, soil type, pasture composition, climate conditions, and long-term sustainability goals. An efficient irrigation system not only enhances pasture productivity and forage quality but also contributes to more resilient grazing operations and better water management. When selecting a system, options such as sprinkler, drip, or center pivot irrigation should be evaluated based on cost, ease of maintenance, energy requirements, and suitability to the specific landscape.

Sourcing from reputable suppliers who offer durable equipment, technical support, and warranty services is essential for long-term success. Additionally, incorporating smart technologies—such as soil moisture sensors and automated controls—can optimize water use and reduce operational costs. Ultimately, investing in the right pasture irrigation system, tailored to local conditions and management objectives, supports sustainable agricultural practices and improves profitability for livestock producers. Proper planning, informed sourcing, and ongoing system management are critical to maximizing the return on investment and ensuring the health and productivity of pasturelands for years to come.