The global pasteurizer market is experiencing robust growth, driven by increasing demand for safe, shelf-stable food and beverage products. According to a 2023 report by Mordor Intelligence, the market was valued at USD 3.8 billion in 2022 and is projected to grow at a CAGR of 6.4% through 2028. This expansion is fueled by stringent food safety regulations, rising consumer awareness about hygiene, and the proliferation of dairy, juice, and craft beverage industries. As automation and hygienic processing gain traction, manufacturers are investing in advanced pasteurization technologies such as high-temperature short-time (HTST) and ultra-high-temperature (UHT) systems. With innovation concentrated among key global players, the competitive landscape reflects a shift toward energy-efficient, scalable, and compliant solutions—setting the stage for the top 10 pasteurizer manufacturers leading this transformation.

Top 10 Pasteurizer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Commercial Food Processing Equipment Manufacturer

Domain Est. 1998

Website: lycomfg.com

Key Highlights: Manufacturer of industrial equipment used in food processing and production. Our machines are used for rice, dry beans, pasta, vegetables, poultry and beef….

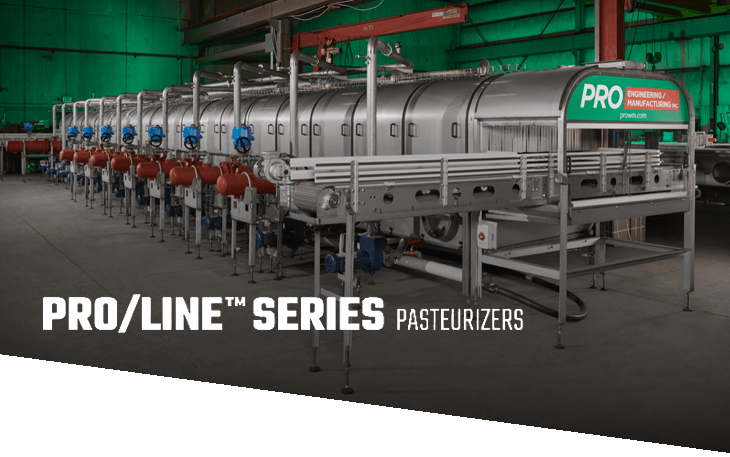

#2 PRO Engineering / Manufacturing Inc.

Domain Est. 2000 | Founded: 1977

Website: prowm.com

Key Highlights: Manufacturing, selling and servicing tunnel pasteurizers and batch pasteurizers since 1977. PRO deliveres customized pasteurizers to the beer and beverage ……

#3 Pasteurization

Domain Est. 1993

Website: tetrapak.com

Key Highlights: Pasteurization makes products safe, extends shelf life, reduces spoilage and can even alter characteristics. Our low-TCO solutions will meet your every ……

#4 Pasteurizers

Domain Est. 1995

Website: gea.com

Key Highlights: Hygienic, user-friendly pasteurization systems for applications including consumer milk, milk-mix drinks, cream, yoghurt, cheese and sour milk products….

#5 Reda spa

Domain Est. 1999

Website: redaspa.com

Key Highlights: REDA is a world leader supplier of machinery, automated plants and complete processing lines for liquid food. We serve milk, plant-based drinks, juices, wine ……

#6 Lyras

Domain Est. 2005

Website: lyras.com

Key Highlights: Save 60-90% energy and 60-80% water in treatment of liquids with Lyras’ gentle and effective pasteurization replacement, raslysation™….

#7 Tema Process – Fluid bed dryer

Domain Est. 2009

Website: temaprocess.com

Key Highlights: TEMA Process B.V. is a specialised design and manufacturing company for natural sterilization/pasteurization plants. Suitable for spices, herbs, ……

#8 American Pasteurization Company

Domain Est. 2013

Website: americanpasteurizationcompany.com

Key Highlights: American Pasteurization Company (APC) is the first company in the United States to offer High Pressure Processing (HPP) on a commercial tolling basis….

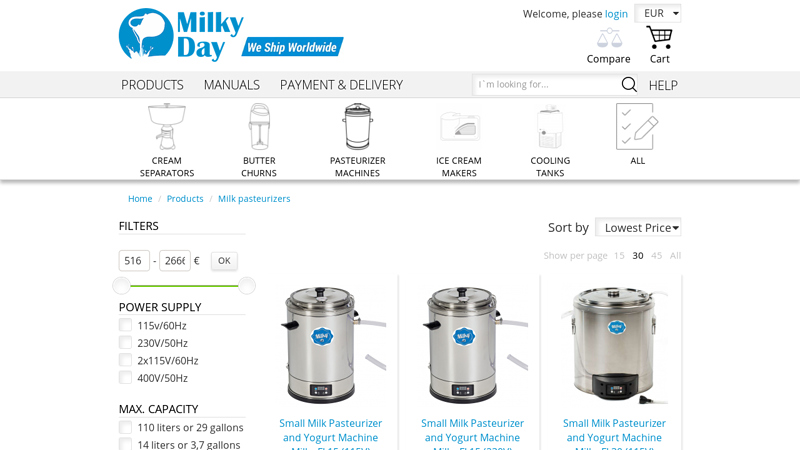

#9 Milky Day: #1 Milk Pasteurizer Online Store

Domain Est. 2015

Website: milkyday.com

Key Highlights: Free delivery 30-day returnsExperts in small milk pasteurizers ☆ Low price and a 2-year warranty! ➔ Wide range ➔ 30 days return. Buy a milk pasteurizer you need online….

#10 Universal Pasteurization & Universal Cold Storage Company …

Domain Est. 2017

Website: universalpure.com

Key Highlights: Universal Pasteurization and Universal Cold Storage announces it has changed to a new name, Universal Pure, to reflect its long-term commitment to advancing ……

Expert Sourcing Insights for Pasteurizer

2026 Market Trends for Pasteurizers: A H2 Analysis

The global pasteurizer market is poised for significant transformation by 2026, driven by evolving consumer demands, technological advancements, and stringent regulatory landscapes. Focusing on key drivers and trends, the H2 analysis highlights Health & Hygiene (H2) as the paramount force shaping the industry.

1. H2: Health & Hygiene as the Core Market Driver

The fundamental purpose of pasteurization – ensuring food and beverage safety – remains the bedrock of the market. By 2026, this H2 imperative will be amplified by:

* Heightened Consumer Awareness: Consumers are increasingly vigilant about foodborne pathogens (like Salmonella, Listeria, E. coli) and the risks of unpasteurized products, especially milk, juices, and ready-to-eat foods. High-profile recalls and illness outbreaks continue to reinforce the critical need for effective pasteurization, solidifying consumer trust in pasteurized goods.

* Stringent Global Regulations: Regulatory bodies (FDA, EFSA, etc.) are expected to maintain or tighten food safety standards. Compliance with HACCP, FSMA (Food Safety Modernization Act), and similar frameworks will mandate robust pasteurization processes, driving investment in reliable and verifiable equipment.

* Demand for Extended Shelf Life (ESL): Beyond safety, consumers demand convenience and reduced food waste. Pasteurization directly enables longer shelf life for dairy, beverages, and sauces, aligning perfectly with H2 goals of minimizing spoilage and ensuring product integrity from production to consumption.

2. Technological Advancements Enhancing H2 Efficacy and Efficiency

Innovation will focus on making H2 objectives more achievable, efficient, and sustainable:

* High-Pressure Processing (HPP) Growth: HPP, a non-thermal pasteurization method, will gain significant traction by 2026, particularly for premium juices, cold-pressed products, salsas, and ready-to-eat meats. It meets H2 goals by effectively eliminating pathogens while preserving fresh taste, nutrients, and color, appealing to health-conscious consumers seeking “clean label” options.

* Pulsed Electric Fields (PEF) Commercialization: PEF technology, offering rapid, low-temperature pasteurization with minimal impact on product quality, is expected to move beyond pilot stages into wider commercial adoption for liquid foods like juices and milk, further expanding H2 options.

* Advanced Thermal Systems: Continuous improvement in traditional thermal pasteurizers (HTST, UHT) will focus on precision, energy efficiency, and integration. Features like:

* Smart Sensors & AI/ML: Real-time monitoring of temperature, flow, and pressure with AI-driven predictive maintenance and process optimization will ensure consistent H2 compliance and reduce downtime.

* Enhanced Heat Recovery: Improved heat exchanger designs will significantly lower energy consumption and operational costs, aligning H2 with sustainability goals.

* Modular & Scalable Designs: Equipment allowing easier capacity adjustments will cater to craft producers and large-scale manufacturers alike, ensuring H2 is accessible across market segments.

3. Market Expansion Driven by H2 and Consumer Preferences

The application of pasteurization will broaden beyond traditional dairy:

* Beverage Diversification: The booming plant-based milk (almond, oat, soy), cold-pressed juices, kombucha, and functional beverages markets will be major growth engines. Pasteurization (often via UHT or HPP) is crucial for ensuring the H2 safety and shelf stability of these sensitive, often raw-ingredient-based products.

* Ready-to-Eat (RTE) & Convenience Foods: The expanding RTE meals, sauces, soups, and dips segments rely heavily on pasteurization for H2 safety and extended shelf life. Demand for convenient, safe food will drive pasteurizer adoption in these categories.

* Emerging Markets: Rapid urbanization, rising incomes, and growing awareness of food safety in regions like Asia-Pacific, Latin America, and Africa will fuel demand for pasteurized dairy and beverages, representing significant growth potential for pasteurizer manufacturers focused on H2 solutions.

4. Sustainability: The Evolving H2 Imperative

By 2026, H2 will increasingly encompass environmental hygiene and sustainability:

* Energy Efficiency as Standard: High energy consumption of thermal pasteurization will drive demand for systems with superior heat recovery, low-temperature options (HPP, PEF), and overall reduced carbon footprints. H2 compliance will extend to environmental impact.

* Water Conservation: Minimizing water usage in cleaning (CIP – Clean-in-Place) cycles will be a key design and operational focus, aligning with broader corporate sustainability goals.

* Waste Reduction: Technologies enabling longer shelf life (direct H2 benefit) and more precise processing (reducing product loss) contribute to reducing food waste, a critical sustainability metric.

Conclusion

By 2026, the pasteurizer market will be fundamentally shaped by the enduring, yet evolving, imperative of Health & Hygiene (H2). While ensuring pathogen elimination and food safety remains paramount, the definition of H2 will broaden to include nutritional preservation (via non-thermal methods like HPP/PEF), extended shelf life to reduce waste, and environmental sustainability. Success will belong to manufacturers and processors who leverage advanced, efficient, and adaptable pasteurization technologies – both thermal and non-thermal – to meet the multifaceted H2 demands of consumers, regulators, and the planet. The market will see strong growth, particularly in non-dairy beverages, RTE foods, and emerging economies, all underpinned by the non-negotiable need for safe, high-quality food.

Common Pitfalls Sourcing a Pasteurizer: Quality and Intellectual Property (IP) Concerns

When sourcing a pasteurizer—particularly for food, beverage, or pharmaceutical applications—organizations must navigate several critical risks beyond price and delivery. Two of the most significant areas of concern are product quality and intellectual property (IP) protection. Overlooking these aspects can lead to regulatory non-compliance, production downtime, brand damage, and legal disputes.

Quality-Related Pitfalls

1. Inadequate Compliance with Industry Standards

A common mistake is selecting a pasteurizer that does not meet required regulatory or industry standards (e.g., FDA, EHEDG, 3-A Sanitary Standards). Using non-compliant equipment can result in failed inspections, product recalls, or shutdowns. Always verify that the equipment is certified for your specific application and region.

2. Poor Material Construction and Sanitary Design

Low-quality pasteurizers may use substandard materials (e.g., incorrect grades of stainless steel) or have poor weld finishes, crevices, or dead legs that harbor bacteria. These design flaws compromise hygiene and make cleaning and sterilization (CIP/SIP) ineffective, increasing contamination risk.

3. Inaccurate Temperature and Flow Control

Pasteurization efficacy depends on precise time-temperature profiles. Sourcing from vendors with unreliable sensors, controllers, or flow meters can result in under-pasteurization (safety hazard) or over-pasteurization (product degradation). Validate the control system’s accuracy and data logging capabilities.

4. Lack of Validation and Documentation

Reputable suppliers provide Factory Acceptance Tests (FAT), Installation Qualification (IQ), Operational Qualification (OQ), and Performance Qualification (PQ) documentation. Skipping this due diligence leaves buyers without proof of performance or regulatory traceability.

Intellectual Property (IP) Pitfalls

1. Infringement of Patented Technologies

Some pasteurizers incorporate proprietary heat exchange designs, control algorithms, or automation systems protected by patents. Sourcing from vendors who use unlicensed technology can expose the buyer to third-party infringement claims, especially in global markets.

2. Ambiguous Ownership of Custom Designs

If a pasteurizer is customized for your process, unclear contracts may leave IP ownership ambiguous. Without explicit agreements, the supplier might retain rights to design improvements, limiting your ability to replicate, modify, or service the equipment independently.

3. Reverse Engineering and Clone Equipment

Some low-cost suppliers offer “clone” pasteurizers that mimic leading brands. These may infringe on IP and often lack reliability or technical support. Using such equipment risks legal action and operational failure.

4. Inadequate Protection of Process-Specific Configurations

Sharing sensitive process parameters (flow rates, hold times, product characteristics) with suppliers without proper non-disclosure agreements (NDAs) or data protection clauses can lead to misuse or disclosure of trade secrets.

Best Practices to Avoid Pitfalls

- Conduct thorough due diligence on suppliers, including audits and reference checks.

- Require compliance certifications and full traceability of materials and components.

- Insist on FAT and validation documentation prior to shipment.

- Perform IP clearance checks and ensure all custom designs are covered by clear IP assignment clauses.

- Use robust contracts with NDAs, warranties, and service-level agreements (SLAs).

By proactively addressing quality and IP risks, organizations can ensure they source reliable, compliant, and legally sound pasteurization systems that support long-term operational and regulatory success.

Logistics & Compliance Guide for Pasteurizer

Regulatory Compliance

Ensure all pasteurization equipment complies with applicable food safety and equipment standards. In the United States, pasteurizers must meet FDA 21 CFR Part 120 (Hazard Analysis and Critical Control Points – HACCP) requirements for juice and 21 CFR Part 1240 for milk. The equipment should also adhere to 3-A Sanitary Standards (e.g., 3-A 02-03 for pasteurizers) to guarantee cleanability and hygiene. Internationally, compliance with EU Regulation (EC) No 852/2004 on food hygiene and Codex Alimentarius standards is essential. Maintain documentation of equipment certification, calibration records, and validation reports to demonstrate adherence during audits.

Installation & Site Requirements

Install the pasteurizer on a stable, level surface with adequate clearance for maintenance and cleaning access. Ensure the site provides proper utilities: clean water supply, drainage for CIP (Clean-in-Place) systems, electrical connections meeting local codes, and, where applicable, steam or heating medium supply. The area must comply with GMP (Good Manufacturing Practices), including non-porous flooring, proper ventilation, and protection from contamination. Verify that the installation conforms to NFPA, OSHA, and local fire and safety codes.

Transportation & Handling

During transportation, secure the pasteurizer to prevent vibration, impact, or tilting. Use appropriate lifting points and rigging equipment rated for the unit’s weight. Protect heat exchanger plates, seals, and sensors with protective covers. Avoid exposure to extreme temperatures, moisture, or corrosive environments during transit. Upon delivery, inspect for shipping damage and verify contents against the packing list before acceptance.

Operational Validation & Recordkeeping

Before operation, conduct performance qualification (PQ) to verify the pasteurizer achieves the required time-temperature combination (e.g., 72°C for 15 seconds for HTST milk pasteurization). Document temperature, flow rate, and pressure readings at critical control points. Implement continuous monitoring with calibrated sensors and data logging systems. Maintain records of daily start-up checks, time-temperature logs, CIP cycles, maintenance activities, and any deviations or corrective actions per HACCP plans.

Maintenance & Sanitation

Adhere to a scheduled preventive maintenance program, including inspection and replacement of gaskets, valves, and sensors. Conduct regular CIP procedures using approved sanitizers and follow validated cleaning cycles. After each production run, flush the system and sanitize thoroughly to prevent biofilm formation. Keep detailed logs of all maintenance and cleaning activities for regulatory review.

Personnel Training & Documentation

Train all operators and maintenance personnel on safe operation, emergency shutdown procedures, and hygiene practices. Training records must be maintained and include dates, topics covered, and employee signatures. Ensure all standard operating procedures (SOPs) for operation, cleaning, and troubleshooting are up to date and accessible on-site. Retain all compliance documentation for a minimum of two years or as required by local jurisdiction.

Conclusion for Sourcing a Pasteurizer

In conclusion, sourcing a pasteurizer is a critical step in ensuring product safety, quality, and regulatory compliance, particularly in food and beverage production. After evaluating various suppliers, equipment types (e.g., batch vs. continuous, HTST vs. UHT), capacity requirements, automation levels, and budget considerations, it is evident that selecting the right pasteurizer involves a balance between performance, efficiency, and long-term operational needs.

Key factors such as ease of maintenance, energy efficiency, scalability, and integration with existing processing lines should guide the final decision. It is recommended to partner with reputable manufacturers that offer strong technical support, warranty options, and compliance with international standards (e.g., FDA, CE, 3A Sanitary Standards).

Ultimately, investing in a high-quality pasteurizer not only enhances product shelf life and safety but also supports brand reputation and operational sustainability. A well-informed sourcing decision today will provide lasting benefits in productivity, regulatory adherence, and customer satisfaction for years to come.