The global paper bandage tape market is experiencing steady growth, driven by rising demand for hypoallergenic, breathable, and eco-friendly medical adhesives. According to Grand View Research, the global adhesive tapes market—encompassing paper-based medical tapes—was valued at USD 72.3 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2030, fueled by increased healthcare spending and a growing preference for disposable medical products. Mordor Intelligence further underscores this momentum, noting that the Asia-Pacific region, in particular, is witnessing accelerated adoption of medical tapes due to expanding healthcare infrastructure and mounting awareness of wound care management. Amid this growth, paper bandage tapes have emerged as a preferred choice in both clinical and home care settings due to their superior skin compatibility and biodegradability. As demand rises, a select group of manufacturers are leading innovation through sustainable sourcing, advanced adhesive technologies, and global distribution networks—shaping the future of medical tape solutions.

Top 9 Paper Bandage Tape Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 tesa – global manufacturer of tapes and self

Domain Est. 1997

Website: tesa.com

Key Highlights: Paper tapes · Removable tapes · Sandblasting tapes · Structural adhesives · Tape dispenser · Tissue tapes · Transfer tapes · Waterproof tape · Contact us….

#2 3M Tapes

Domain Est. 1988

Website: 3m.com

Key Highlights: 3M Tapes: Anti-slip & Grip Tapes, Anti-slip & Grip Tapes, Barricade & Warning Tapes, Barricade & Warning Tapes, Bonding, Mounting & Transfer Tapes….

#3 Shop Medical Tape

Domain Est. 1994

Website: mms.mckesson.com

Key Highlights: Medline #NON280001. Medical Tape Curad® Paper Pro White 1 Inch X 10 Yard Paper NonSterile. Log in for pricing and availability. Log In to Order View ……

#4 Wound Tapes and Wraps to Secure Gauze and Dressings

Domain Est. 1995

Website: band-aid.com

Key Highlights: BAND-AID Brand wound tapes and wraps are ideal for securing gauze and other non-adhesive dressings. Our tapes and wraps come in a variety of materials….

#5 Medical Tape

Domain Est. 1995

Website: henryschein.com

Key Highlights: Shop for medical tape and surgical tape for practice’s procedures. Medical adhesive tape is offered in several types of styles and sizes….

#6 Medical & Surgical Paper Tape

Domain Est. 1996

Website: cardinalhealth.com

Key Highlights: Kendall™ hypoallergenic paper tape is breathable and gentle. Ideal for repeated applications on sensitive, fragile skin….

#7 Hy

Domain Est. 1997

#8 3M™ Micropore™ S Surgical Tape, 277X Series

Domain Est. 2007

Website: solventum.com

Key Highlights: Tape has a paper-plastic hybrid backing with silicone adhesive and is not made with natural rubber latex. Easy to use — can be torn by hand and repositioned….

#9 What is Medical Tape?

Domain Est. 2016

Website: yousantape.com

Key Highlights: Commonly used to secure bandages and dressings to the skin without leaving a sticky residue, micropore paper tape is hypoallergenic and can be ……

Expert Sourcing Insights for Paper Bandage Tape

H2: 2026 Market Trends for Paper Bandage Tape

The global paper bandage tape market is poised for steady growth and significant evolution by 2026, driven by shifting healthcare dynamics, consumer preferences, and technological advancements. Key trends shaping the landscape include:

1. Rising Demand for Hypoallergenic and Skin-Safe Solutions:

A dominant trend is the increasing consumer and clinical preference for hypoallergenic, latex-free, and gentle adhesive tapes. With growing awareness of skin sensitivities and contact dermatitis, manufacturers are reformulating adhesives and using purer paper substrates to minimize irritation—especially critical in pediatric, geriatric, and sensitive-skin applications. This shift is accelerating product innovation and premiumization.

2. Expansion in Home Healthcare and Self-Care:

The global shift toward decentralized care and aging-in-place is boosting demand for easy-to-use, reliable first-aid supplies. Paper bandage tapes, valued for their breathability, comfort, and ease of application, are seeing increased adoption in home medicine cabinets. Online retail growth further supports this trend, enabling convenient access to both branded and private-label products.

3. Sustainability and Eco-Conscious Innovation:

Environmental concerns are pushing manufacturers toward sustainable practices. By 2026, expect wider adoption of FSC-certified paper, water-based adhesives, biodegradable packaging, and reduced plastic content. Brands emphasizing eco-friendly credentials will gain competitive advantage, particularly in Europe and North America, where regulatory and consumer pressure for green products is strongest.

4. Growth in Emerging Markets:

Asia-Pacific, Latin America, and parts of Africa present significant growth opportunities due to improving healthcare infrastructure, rising disposable incomes, and expanding access to basic medical supplies. Localized production and affordable product tiers are helping global players penetrate these regions, where paper tapes offer a cost-effective alternative to synthetic options.

5. Product Differentiation and Niche Applications:

Competition is driving innovation beyond basic functionality. By 2026, expect to see more specialized paper tapes—such as those with antimicrobial coatings, enhanced water resistance, or designed for specific uses like securing medical devices or post-surgical care. Custom shapes, sizes, and printed designs (including educational or child-friendly variants) will also become more prevalent.

6. Regulatory Harmonization and Quality Standards:

Stricter regulatory oversight, particularly regarding biocompatibility and labeling (e.g., EU MDR, FDA guidelines), is pushing manufacturers to ensure higher quality control. Compliance is becoming a market entry barrier, favoring established players with robust quality systems and accelerating consolidation in some regions.

Conclusion:

By 2026, the paper bandage tape market will be characterized by innovation centered on safety, sustainability, and user experience. While facing competition from synthetic tapes, paper variants will maintain strong relevance due to their breathability and skin compatibility. Success will depend on agility in responding to consumer demands, investing in eco-design, and expanding reach in high-growth regions.

Common Pitfalls When Sourcing Paper Bandage Tape: Quality and Intellectual Property Risks

Sourcing paper bandage tape—commonly used in medical, first aid, and sports applications—requires careful attention to both product quality and intellectual property (IP) considerations. Overlooking these areas can lead to supply chain disruptions, regulatory non-compliance, brand damage, or legal disputes. Below are key pitfalls to avoid.

Poor Adhesive Performance and Skin Sensitivity

One of the most frequent quality issues with paper bandage tape is inconsistent or inadequate adhesive performance. Low-quality tapes may fail to adhere properly during use, leading to premature detachment, or may be too aggressive, causing pain or skin irritation upon removal. Be cautious of suppliers using substandard adhesives that don’t meet medical-grade safety standards or lack dermatological testing. Always verify biocompatibility certifications (e.g., ISO 10993) and conduct patch testing, especially for sensitive skin applications.

Substandard Paper Backing Material

The integrity of the paper backing directly impacts the tape’s strength, conformability, and breathability. Inferior paper may tear easily, lack flexibility, or absorb moisture too quickly, compromising performance. Some suppliers may use recycled or low-weight paper to cut costs, resulting in reduced durability. Ensure the backing meets specifications for tensile strength, porosity, and moisture resistance, and request material data sheets (MDS) for verification.

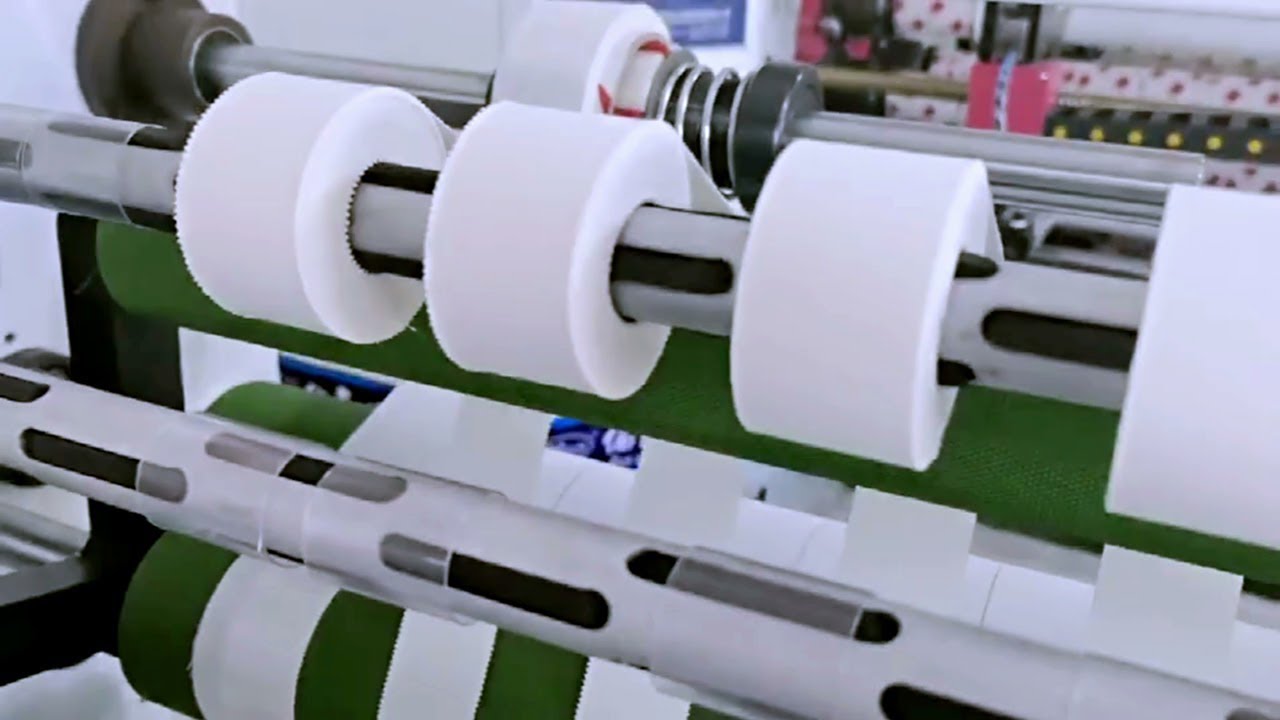

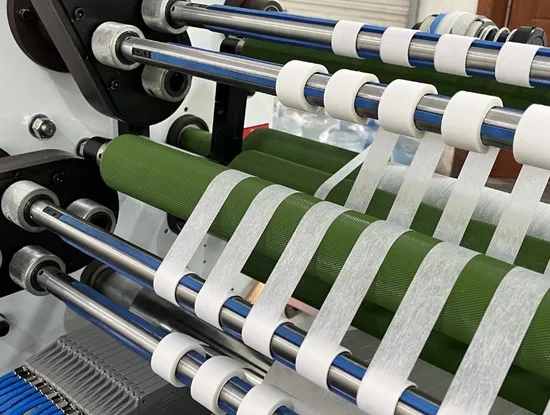

Inconsistent Coating and Slitting Quality

Inconsistent adhesive coating can result in weak spots or uneven adhesion, while poor slitting may produce tapes with jagged edges or incorrect widths. These manufacturing flaws often stem from outdated or poorly maintained equipment at the supplier’s facility. Conduct factory audits or request quality control documentation, including coating weight tests and visual inspection reports, to confirm process consistency.

Lack of Regulatory Compliance

Paper bandage tapes intended for medical use must comply with regional regulations such as FDA 510(k) in the U.S., CE marking under the EU MDR, or other local health authority requirements. A common pitfall is sourcing from suppliers who falsely claim compliance or use uncertified materials. Always validate regulatory status directly with the supplier and request evidence of approvals, technical files, and conformity assessments.

Counterfeit or IP-Infringing Products

Some suppliers may offer “branded-equivalent” tapes that closely mimic well-known patented designs or trademarks, risking intellectual property infringement. This includes copying proprietary patterns, packaging, or adhesive formulations protected by patents or trade secrets. Sourcing such products—even unknowingly—can expose your company to legal action, product seizures, or reputational harm. Conduct IP due diligence by reviewing relevant patents (e.g., adhesive composition, tape structure) and ensuring your supplier has freedom-to-operate.

Inadequate Packaging and Shelf Life

Poor packaging can lead to moisture ingress or contamination, which degrades adhesive performance and risks sterility. Additionally, tapes without clearly labeled batch numbers, expiration dates, or storage instructions may have questionable shelf life. Verify that packaging is sealed appropriately (e.g., moisture-barrier film) and that expiration testing has been conducted under real-world conditions.

Unverified Supply Chain Transparency

Many paper bandage tape suppliers outsource production to third-party manufacturers, creating opacity in the supply chain. This increases the risk of inconsistent quality or unauthorized subcontracting. Insist on supply chain mapping, including details of raw material sources and manufacturing locations, and conduct periodic audits to ensure adherence to your quality standards.

Overlooking Customization IP Rights

If you’re developing a custom paper bandage tape (e.g., unique size, color, or adhesive blend), ensure that your contractual agreements with the supplier clearly assign IP ownership to your company. Some manufacturers may claim partial rights to custom formulations or tooling, limiting your ability to switch suppliers or scale production. Include clear IP clauses in development and manufacturing contracts to protect your innovations.

By proactively addressing these quality and IP-related pitfalls, businesses can ensure reliable, compliant, and legally secure sourcing of paper bandage tape.

Logistics & Compliance Guide for Paper Bandage Tape

Overview

Paper bandage tape is a medical or first-aid supply commonly used for securing dressings, lightweight wound care, or sensitive skin applications. Due to its classification as a medical or health product in most jurisdictions, its logistics and compliance requirements involve considerations related to regulatory standards, transportation, storage, labeling, and import/export protocols.

Regulatory Compliance

Medical Device Classification

Paper bandage tape is typically classified as a Class I medical device under regulatory frameworks such as:

– U.S. FDA (Food and Drug Administration): Must be registered and listed; subject to Good Manufacturing Practices (GMP) under 21 CFR Part 820.

– EU MDR (Medical Device Regulation 2017/745): Requires CE marking, technical documentation, and compliance with general safety and performance requirements.

– Other Regions: Check local health authorities (e.g., Health Canada, TGA in Australia, PMDA in Japan) for classification and registration requirements.

Labeling Requirements

- Must include product name, intended use, manufacturer details, lot number, expiration date (if applicable), and regulatory markings (e.g., CE, FDA registration number).

- Language requirements: Labels must be in the official language(s) of the destination country.

- Include single-use symbols and storage instructions if applicable.

Sterility and Packaging

- If marketed as sterile, must comply with ISO 11607 (packaging for medical devices) and include validated sterilization methods (e.g., ethylene oxide, gamma irradiation).

- Non-sterile versions still require cleanroom manufacturing and contamination control.

Logistics & Transportation

Storage Conditions

- Store in a dry, cool environment (typically 15–30°C / 59–86°F).

- Avoid exposure to direct sunlight, high humidity, or extreme temperatures.

- Keep away from volatile chemicals or strong odors to prevent contamination.

Packaging for Shipment

- Use sealed, tamper-evident primary packaging (e.g., sterile pouches or roll wraps).

- Secondary packaging should protect against physical damage, moisture, and contamination during transit.

- Consider using desiccants if shipping to humid climates.

Transportation Modes

- Suitable for air, sea, and ground freight.

- No special hazardous material (hazmat) classification unless combined with medicated coatings (verify per UN/DOT/ICAO regulations).

- Use temperature-controlled (ambient) shipping if extended exposure to extreme conditions is expected.

Import & Export Considerations

Customs Documentation

- Commercial invoice with accurate HS (Harmonized System) code. Common codes include:

- HS 3005.90 – Wadding, gauze, bandages, etc., whether or not treated or impregnated.

- Confirm code with local customs authority as interpretations may vary.

- Packing list, bill of lading/air waybill, and certificate of origin.

Regulatory Submissions

- Import permits may be required in some countries (e.g., Brazil, India, Saudi Arabia).

- Power of Attorney (PoA) or local Authorized Representative (AR) may be needed for market access in EU, UK, or other regulated markets.

Quality Assurance

- Ensure manufacturer holds ISO 13485 certification (Quality Management for Medical Devices).

- Retain Certificates of Conformity, test reports (e.g., biocompatibility per ISO 10993), and sterility validation (if applicable).

Environmental & Disposal Compliance

Sustainability and Waste

- Paper bandage tape is generally biodegradable, but adhesives may affect compostability.

- Dispose of in accordance with local medical waste regulations if used in clinical settings.

- Non-sterile, unused tape may be disposed of as general waste in most regions.

Packaging Waste

- Optimize packaging to reduce plastic content. Use recyclable materials where possible.

- Comply with Extended Producer Responsibility (EPR) laws in applicable markets (e.g., EU packaging directives).

Summary Checklist

- [ ] Confirm medical device classification and registration

- [ ] Apply correct labeling and language

- [ ] Validate sterility and packaging if applicable

- [ ] Store and transport under controlled conditions

- [ ] Use proper HS code and customs documentation

- [ ] Secure import permits or local representation if required

- [ ] Maintain quality certifications (ISO 13485, CE, FDA listing)

- [ ] Follow local disposal and environmental regulations

Adherence to this guide ensures safe, legal, and efficient distribution of paper bandage tape across domestic and international markets. Always consult with regulatory experts or legal counsel for jurisdiction-specific compliance.

Conclusion for Sourcing Paper Bandage Tape:

In conclusion, sourcing paper bandage tape requires a careful evaluation of quality, cost, supplier reliability, and compliance with medical and environmental standards. Paper bandage tape is valued for its gentle adhesion, breathability, and hypoallergenic properties, making it ideal for sensitive skin and short-term wound care applications. When sourcing, it is essential to partner with reputable manufacturers or suppliers who adhere to ISO and FDA regulations, ensuring product safety and efficacy. Additionally, considering factors such as adhesive strength, roll length, packaging, and sustainability—such as using recyclable or biodegradable materials—can enhance both product value and environmental responsibility. By conducting thorough market research, obtaining samples, and assessing total cost of ownership, organizations can secure a reliable supply of high-quality paper bandage tape that meets both clinical requirements and operational needs.