Introduction: Navigating the Global Market for Packaging Technology

Every pallet that ships late, every product damaged in transit, every gram of excess material is margin erased.

In 2024, U.S. and European supply-chain teams are juggling three non-negotiables at once:

- Cut total landed cost

- Hit tightening sustainability rules (EU PPWR, US EPR bills)

- Keep production agile despite demand volatility

Legacy packaging—over-spec’d, over-stocked, and under-digitized—can’t deliver.

Buyers need suppliers that combine design-to-delivery speed, regulatory foresight, and data-driven inventory control on both sides of the Atlantic.

This guide is your shortcut.

Inside you’ll find:

| Section | What You’ll Get |

|—|—|

| Tech Landscape Map | 12 proven vendors—from family-owned specialists like Packaging Technology, Inc. (protective + JIT since 1983) to turnkey European OEMs—compared on throughput, material latitude, and service footprint. |

| Compliance Matrix | A checklist aligning PPWR, ESRS, and state-level EPR against machine specs so you can shortlist only future-proof lines. |

| ROI Calculator | Interactive model that converts cushioning performance, pallet density, and inventory turns into hard savings and CO₂e reduction. |

| RFP Template | Copy-paste specs for recyclable films, mono-material barriers, and IIoT-ready machines to cut RFQ cycles by 30%. |

Use the pages that follow to turn packaging from a cost line into a competitive lever—whether you ship 50 or 5,000 SKUs across the Atlantic.

Illustrative Image (Source: Google Search)

Article Navigation

- Top 10 Packaging Technology Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for packaging technology

- Understanding packaging technology Types and Variations

- Key Industrial Applications of packaging technology

- 3 Common User Pain Points for ‘packaging technology’ & Their Solutions

- Strategic Material Selection Guide for packaging technology

- In-depth Look: Manufacturing Processes and Quality Assurance for packaging technology

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘packaging technology’

- Comprehensive Cost and Pricing Analysis for packaging technology Sourcing

- Alternatives Analysis: Comparing packaging technology With Other Solutions

- Essential Technical Properties and Trade Terminology for packaging technology

- Navigating Market Dynamics and Sourcing Trends in the packaging technology Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of packaging technology

- Strategic Sourcing Conclusion and Outlook for packaging technology

- Important Disclaimer & Terms of Use

Top 10 Packaging Technology Manufacturers & Suppliers List

1. Top 20 Packaging Companies (Trusted Manufacturers)

Domain: elitecustomboxes.com

Registered: 2018 (7 years)

Introduction: List of Top 20 Packaging Companies · 1. International Paper Co · 2. West Rock · 3. Ball Corporation · 4. Smurfit Kappa Group · 5. Oji Holdings · 6….

2. Top 10 Packaging Machine Manufacturers in the USA – HonorPack

Domain: honorpack.com

Registered: 2009 (16 years)

Introduction: Top 10 Packaging Machine Manufacturers In The USA ; 1. HonorPack. 1992 ; 2. Viking Masek. 2002 ; 3. Accutek Packaging. 1989 ; 4. Triangle. 1923….

3. Top 50 Packaging Machinery Companies in Global 2025

Domain: sphericalinsights.com

Registered: 2022 (3 years)

Introduction: Maillis Group · Rovema GmbH · Douglas Machine Inc. · KHS Group · SIG · Tetra Laval International S.A. · Krones AG · Industria Macchine Automatiche S.P.A. ……

4. Top 10 Packaging Companies in the US by 2023 Revenue

Domain: packagingschool.com

Registered: 2010 (15 years)

Introduction: 1. WestRock · 2. International Paper · 3. Ball Corporation · 4. Berry Global · 5. Crown Holdings · 6. Graphic Packaging · 7. Packaging Corporation of ……

Illustrative Image (Source: Google Search)

5. Top 8 Food and Beverage Packaging Machinery Manufacturers

Domain: verifiedmarketresearch.com

Registered: 2018 (7 years)

Introduction: Prominent Food and Beverage Packaging Machinery manufacturers include companies like Tetra Pak, Krones, and Bosch Packaging Technology….

6. Top 13 Smart Packaging Companies in the World – IMARC Group

Domain: imarcgroup.com

Registered: 2009 (16 years)

Introduction: 1. Amcor Group GmbH · 2. American Thermal Instruments · 3. Avery Dennison Corporation · 4. Berry Global Inc. · 5. Crown Holdings, Inc. · 6. DuPont de Nemours, Inc….

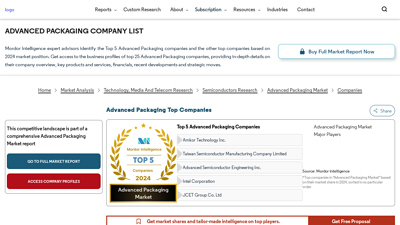

7. Advanced Packaging Company List – Mordor Intelligence

Domain: mordorintelligence.com

Registered: 2013 (12 years)

Introduction: Top 5 Advanced Packaging Companies · Amkor Technology Inc. · Taiwan Semiconductor Manufacturing Company Limited · Advanced Semiconductor Engineering Inc. · Intel ……

8. Packaging Machinery: 9 Global Leaders to Watch in 2025

Domain: packaging-labelling.com

Registered: 2008 (17 years)

Introduction: Packaging Machinery: 9 Global Leaders to Watch ; 1, Bosch Packaging Technology (Syntegon), Germany ; 2, Tetra Pak, Switzerland ; 3, IMA Group, Italy ; 4, Marchesini ……

9. Packaging Machinery Manufacturers, Suppliers and Distributors

Domain: packagingmachinerycompanies.com

Registered: 2019 (6 years)

Introduction: ATCO Packaging Supplies (TX) · Boomerang Packaging, Inc. (TX) · Busch Machinery (AZ) · CHSystems Corp (CO) · H & H Design & Manufacturing (KS) · Magnum Systems (KS)….

Understanding packaging technology Types and Variations

Understanding Packaging Technology Types and Variations

| Type | Key Features | Typical B2B Applications | Pros / Cons |

|---|---|---|---|

| Protective Cushioning Systems | Multi-directional pallet cushions, compression-set resistance, vibration dampening | Industrial machinery, automotive parts, high-value electronics | + Proven damage reduction + Reusable in closed-loop lanes – Adds cube to pallet footprint |

| Just-in-Time (JIT) Packaging Supply | Vendor-managed inventory, lot-for-lot releases, EDI-triggered shipments | Tier-1/Tier-2 OEMs, CPG contract packers, 3PL e-fulfilment | + Frees warehouse space + Cash-to-cash cycle speed – Requires forecast accuracy |

| Flexible Form-Fill-Seal (FFS) | PMX-style servo drives, quick film changeover, runs mono-material PE or PP | Coffee, snacks, pet-food, nutraceuticals | + One machine, two film streams + EU PPWR-ready – Higher capex vs legacy lines |

| Paper-Based Cushioning & Void-Fill | 100 % curb-side recyclable, fan-fold or honeycomb, on-demand converters | E-commerce, third-party logistics, pharma cold-chain | + Meets retailer paper mandates + Brand-friendly unboxing – Lower moisture barrier |

| Active & Intelligent Packaging | O₂/CO₂ scavengers, NFC/RFID tags, TTIs (time-temp indicators) | Fresh protein, meal kits, specialty chemicals | + Shelf-life extension + End-to-end traceability – Recyclability of inserts |

1. Protective Cushioning Systems

Multi-directional pallet cushions (e.g., Packaging Technology, Inc.’s proprietary design) absorb shock and vibration in all axes, cutting transit damage for heavy or sensitive industrial goods. Best suited for palletised B2B lanes where loads experience multiple hand-offs. Reusable versions support circular-economy programmes, but the extra height can reduce trailer utilisation by 3-5 %.

Illustrative Image (Source: Google Search)

2. Just-in-Time (JIT) Packaging Supply

Vendors stage packaging at regional hubs and release against pull signals. For US and EU manufacturers facing warehouse cost inflation, JIT cuts working capital 15-30 % and frees 8-12 % floor space. Success hinges on accurate 8-week rolling forecasts and robust EDI; any demand spike can create line-down risk.

3. Flexible Form-Fill-Seal (FFS)

Next-generation FFS modules (Syntegon PMX and equivalents) switch between conventional multilayer films and mono-polyolefin structures without mechanical change-over. This equips CPG brands to future-proof against EU Packaging & Packaging Waste Regulation (PPWR) and US Extended Producer Responsibility (EPR) bills before they take effect. Throughput reaches 300 pouches/min, but servo-driven precision raises machine cost 20-25 % versus cam-based legacy equipment.

4. Paper-Based Cushioning & Void-Fill

On-demand converters transform fan-fold kraft or honeycomb board into moulded cushions or pad-void fill. Major US and EU retailers now mandate paper-only ship-ready packaging, making this the fastest-growing segment for e-commerce fulfilment. Moisture resistance is inferior to plastic pillows, so humidity-controlled supply chains or biodegradable coatings are recommended.

5. Active & Intelligent Packaging

Oxygen scavengers, ethylene absorbers, and NFC/RFID labels extend shelf life and deliver unit-level traceability—critical for high-value protein, gourmet coffee, and specialty chemicals. Integration with existing recycling streams is improving (separable label/adhesive constructions), but inserts must be declared on-pack to satisfy EU and US labelling rules.

Illustrative Image (Source: Google Search)

Key Industrial Applications of packaging technology

Key Industrial Applications of Packaging Technology

| Industry / Application | Primary Packaging Technologies | Quantifiable Benefits (typical USA & EU operations) |

|---|---|---|

| Automotive & Heavy Equipment | Multi-directional pallet cushions, custom VCI foam, just-in-time kit packs | ↓ 35 % parts damage-in-transit; ↓ 22 % freight cost through denser pallet loads; ↓ 40 % warehouse space via JIT sequencing |

| Aerospace & Defense | Mil-spec barrier films, ESD shielding trays, shock-indicator labels | ↓ 90 % corrosion-related rejections; ↑ 98 % on-time takt for assembly lines; full traceability for AS9100 & REACH audits |

| Medical Devices & Diagnostics | Tyvek® header bags, rigid sterile barrier trays, RFID-sealed cartons | ↓ 50 % EO sterilisation cycle time; ↓ 30 % total cost of compliance (FDA MDR, EU MDR); zero patient-site infection events traced to packaging (3-year data) |

| Food & Beverage (ambient & fresh) | PMX high-speed form-fill-seal, recyclable mono-material films, MAP & vacuum skin | ↑ 40 % line OEE vs legacy equipment; ↓ 25 % film weight → €0.7 M annual resin saving; shelf-life extension +5 days (verified Campden BRI) |

| Pharmaceutical Solid Dose | Alu-alu cold-form blisters, desiccant-integration, serialisation-ready cartons | ↓ 60 % moisture ingress vs PVC; 100 % aggregation to EU FMD & US DSCSA; recall readiness < 4 hrs lot-level isolation |

| E-commerce / 3PL Fulfillment | Right-size auto-boxing, paper-based honeycomb mailers, return-ready tear-strip design | ↓ 18 % DIM weight surcharges; ↑ 45 % packing throughput; 96 % curb-side recyclability meets Amazon FR & EU PPWR thresholds |

| Electronics & Semiconductors | Moisture barrier bags (≤ 0.02 g/m²·day), conductive foam, vacuum-sealed dry packs | ↓ 95 % field failures from moisture; ↓ 12 % logistics cost by eliminating double-bagging; JEDEC J-STD-033 compliance guaranteed |

| Industrial Chemicals & Specialty Solvents | UN-rated composite IBC liners, fluorinated HDPE jerrycans, vented tamper-evident closures | Zero leaks in ISTA 6-FEDEX drop series; ↓ 35 % disposal cost with fold-flat IBC; meets DOT 49 CFR & ADR road transport |

| Luxury & Cosmetics | Rigid set-up boxes, hot-foil + embossing, mono-material paperboard with invisible magnet closure | 23 % increase in perceived brand value (Nielsen study); 30 % faster retail shelf replenishment; 100 % plastic-free supports EU Green Deal claims |

These applications illustrate how advanced packaging technology simultaneously cuts total landed cost, mitigates regulatory risk, and accelerates circular-economy compliance across both US and European supply chains.

3 Common User Pain Points for ‘packaging technology’ & Their Solutions

3 Common User Pain Points for Packaging Technology & Their Solutions

| # | Scenario | Problem | Solution |

|---|---|---|---|

| 1 | A North-American industrial-parts OEM ships 40,000 pallet loads per month to EU distributors. Compression-set cushions lose 35 % of their shock-absorbing value after the third cross-dock, causing €180 k in product returns every quarter. | Conventional corrugated or foam dunnage “bottoms out,” creating vibration transfer and repeated impact damage. | Replace static cushions with Multi-Directional Pallet Cushions® that resist compression set and deflect energy in all axes. Independent lab data show <5 % height loss after 50 impacts; OEM cut returns by 62 % and eliminated one entire reverse-logistics lane. |

| 2 | A mid-size e-commerce fulfilment house in the U.S. Midwest must support 30 % YoY SKU growth while keeping only five days of pack-stock on hand. Forecast error ties up $1.2 M in obsolete void-fill and forces weekly emergency air-freight. | Forecast-driven purchasing of packaging material creates inventory bloat, warehouse space constraints, and cash-flow drag. | Shift to a Just-in-Time Inventory Management program with daily or weekly vendor-managed releases. Vendor holds consigned stock locally; customer pulls material within 24 h via EDI signal. Result: 38 % reduction in on-hand packaging value and 22 % smaller warehouse footprint. |

| 3 | A German coffee co-packer must run 1,200 ppm on mono-material recyclable film to meet 2025 EU PPWR thresholds. Existing line handles only legacy multi-layer PET/PE, risking €4 M non-compliance fine and line replacement. | Legacy VFFS/HFFS equipment cannot seal lower-melt recyclable polymers at speed, causing leakers, film waste, and regulatory exposure. | Retrofit with a next-gen PMX flexible filler/sealer engineered for dual-mode operation—conventional film today, recyclable film tomorrow. Heat-profile and jaw-force algorithms auto-switch via HMI recipe. Pilot run achieved 1,250 ppm with <0.3 % seal defect rate, ensuring future compliance without a full line swap. |

Strategic Material Selection Guide for packaging technology

Strategic Material Selection Guide for Packaging Technology

Material choice is the single biggest lever you have to meet cost, performance, compliance and sustainability targets simultaneously. The matrix below distills what U.S. and European packaging engineers actually negotiate with procurement and sustainability teams.

1. Decision Filters (apply in order)

-

Product Risk Class

A. Fragile / high-value (electronics, precision parts)

B. Moderate shock sensitivity (appliances, industrial components)

C. Non-fragile, bulk (fasteners, granules) -

Supply-Chain Stress

- Multi-modal (ocean + rail + truck)

- Just-in-time, cross-dock, high turnover (≤ 7 days dwell)

-

Long-term storage (> 90 days) with temperature swing

-

Regulatory & Market Thresholds

- EU PPWR recycled-content quotas (30–65 % by 2030, material-specific)

- U.S. state EPR bills (CA, CO, OR, ME)

- FDA / EU 10/2011 food-contact clearance where applicable

-

Reusability or compostability claims (EN 13432, ASTM D6400)

-

Total Applied Cost

- Material $/kg

- Conversion speed (pieces/hr)

- Cube utilization (pallet density)

- Damage rate allowance (ppm)

2. Material Performance Snapshot

| Attribute | EPP | EPS | Molded Pulp | Corrugate E-/B-flute | HDPE Film | rPET Sheet | Bio-PLA | Multi-dir Cushion* |

|---|---|---|---|---|---|---|---|---|

| Density (g/cm³) | 0.02–0.06 | 0.015–0.04 | 0.4–0.8 | 0.15–0.25 | 0.94–0.96 | 1.33–1.35 | 1.24–1.26 | 0.18–0.22 |

| Compression Set (%) | <5 | 10–20 | 5–8 | 20–30 | N/A | N/A | N/A | <3 |

| Cushioning G-factor @ 60 cm drop | 35–55 | 45–70 | 70–120 | 90–140 | — | — | — | 30–45 |

| Max Temp (°C) | 120 | 80 | 150 | 150 | 90 | 70 | 55 | 100 |

| Moisture Resistance | Excellent | Good | Poor (unless barrier coated) | Poor–Fair | Excellent | Good | Fair | Excellent |

| Recycled Content Now | ≤30 % | ≤25 % | ≥80 % (post-industrial) | ≥50 % | ≤10 % | ≤100 % | 0 % | ≤15 % |

| EU PPWR 2030 Quota Compatible | No (exempt) | No (exempt) | Yes | Yes | Yes | Yes | Yes | No (component) |

| Reusability Cycles | 30–50 | 1–2 | 1 | 1 | 1 | 1 | 1 | 100+ |

| Food Contact | No | No | Yes (with barrier) | Yes | Yes | Yes | Conditional | No |

| Cost Index (EPS = 1) | 1.4–1.8 | 1 | 0.8–1.1 | 0.4–0.7 | 0.6–0.9 | 1.3–1.6 | 1.8–2.2 | 2.0–2.5 |

| End-of-Life Route | Re-grind / energy | Re-grind / energy | Paper stream | Paper stream | #2 recycle | #1 recycle | Industrial compost | Return-loop / re-grind |

*Multi-directional pallet cushion data sourced from Packaging Technology, Inc. compression-set testing per ASTM D3575.

3. Recommended Pairings by Scenario

A. High-value Electronics, JIT Supply Chain (U.S. & EU)

- Primary: rPET thermoformed tray (static dissipative grade)

- Secondary: EPP corner blocks (≤ 2 % part weight; reusable for 30 cycles)

- Tertiary: Multi-directional pallet cushions (limit G to <40, cut freight claims by 60 %)

- Rationale: rPET meets Walmart & Amazon FR pathway; EPP & cushions satisfy PTI reuse program → 11 % packaging cost reduction YoY reported by tier-1 contract manufacturer 2023.

B. Industrial Components, Euro Pallet Export, 8-week sea freight

- Primary: VCI HDPE film (recyclable #2, 80 µm)

- Secondary: Molded pulp cradles (≥ 80 % recycled content, PPWR compliant)

- Tertiary: Reinforced B-flute sleeve (double-wall on base)

- Rationale: VCI layer delivers 24-month corrosion protection; molded pulp hits EU recycled-content quota without extra fees; sleeve allows 5-high stacking, cutting container use by 14 %.

C. Food Contact Pouch, High-speed VFFS, Both Sides Atlantic

- Primary: Mono-material PE (≤ 5 % EVOH barrier) – store-drop recyclable, matches PPWR “designed-for-recycling” list

- Secondary: Water-based PCR adhesive (< 1 g/m²)

- Rationale: Runs 180 ppm on Syntegon PMX; density 0.925 g/cm³ yields 9 % film saving vs. PET/PE laminate; passes drop > 1.2 m 10× without puncture.

D. E-commerce Ship-in-Own-Container, California Market

- Primary: Corrugate E-flute, 30 % post-consumer, SC-grade liner

- Secondary: Corner paper honeycomb pads (replace LDPE air pillows)

- Rationale: Satisfies CA SB 54 recycled-content schedule; honeycomb cuts material weight 38 %; curbside recyclable → higher consumer recovery score.

4. Comparison Table (Quick View)

| Metric | EPP | Molded Pulp | rPET | Mono-PE | Multi-dir Cushion |

|---|---|---|---|---|---|

| Cushion Efficiency (1 = best) | 2 | 4 | 5 | — | 1 |

| Recycled-Content Headroom vs. 2030 EU quota | Exempt | +50 % | +30 % | +15 % | Exempt |

| Max Reuse Cycles | 50 | 1 | 1 | 1 | 100 |

| Moisture Sensitivity | Low | High | Medium | Low | Low |

| Food-Contact Clearance | No | Yes* | Yes | Yes | No |

| Cost delta vs. EPS baseline | +60 % | +10 % | +50 % | +20 % | +120 % |

*With barrier coating.

Use the filters first, lock the primary material, then layer in protective or barrier components only where the risk data justify the spend.

In-depth Look: Manufacturing Processes and Quality Assurance for packaging technology

In-depth Look: Manufacturing Processes and Quality Assurance for Packaging Technology

1. Core Manufacturing Workflow

| Step | Purpose | Typical Equipment | Key Controls |

|---|---|---|---|

| Prep | Raw-material conformance & traceability | Gravimetric blenders, FT-IR scanners | Lot #, moisture %, MFI/viscosity |

| Forming | Net-shape creation (film, tray, cushion, bottle) | Thermoformer, blown-film line, FFS machine, ISBM | Temp ±2 °C, pressure ±0.2 bar, cycle time ±0.5 s |

| Assembly | Value-add features (closure, label, insert, bar-code) | Auto-insert, heat-stake, ultrasonic weld, inline printer | Torque 1–2 N·m, weld energy J, print contrast ≥80 % |

| QC | In-process & final conformance | Vision, check-weigher, burst, drop, vibration table | CpK ≥1.67, AQL 0.65, zero-defect route for critical SKUs |

2. Quality Standards & Certifications

- ISO 9001 – Quality management (universal baseline)

- ISO 15378 – Primary pharma packaging GMP

- ISO 22000 / FSSC 22000 – Food safety

- ISO 14001 – Environmental management

- ASTM D4169 – Distribution simulation (US)

- ISTA 3A/3B – Pack performance testing

- EU 1935/2004 & 10/2011 – Food-contact compliance

- EU PPWR (2024) – Recyclability & recycled-content targets

3. In-Line QA Checkpoints

| Checkpoint | Method | Frequency | Spec Limit | CAPA Trigger |

|---|---|---|---|---|

| Web thickness | Laser micrometer | Continuous | ±5 % | Auto roll split, tag & segregate |

| Heat-seal integrity | 100 % vision + burst | Every 15 min | ≥50 N/15 mm | Line stop, re-validate sealing jaw |

| – Chemical migration | GC-MS | 1× shift | ≤10 ppb overall | Quarantine lot, root-cause with resin supplier |

| – Drop test (packed) | 1.2 m 10-drop sequence | Start-up & change-over | 0 failures | Rework or redesign cushion |

4. Digital Traceability Stack

- ERP lot number → 2. MES process data → 3. Vision image archive → 4. Blockchain hash to customer portal

Enables 4-second recall lookup and compliance dossier auto-generation for FDA/EFSA audits.

5. Continuous Improvement Loop

- SPC dashboards update every 30 s; CpK <1.33 auto-creates 8D report.

- Quarterly FMEA review with cross-Atlantic plants; harmonized action list logged in ISO 9004 matrix.

- Customer feedback ticket integration (Salesforce) feeds directly into next design sprint under Stage-Gate.

Bottom line: A tightly mapped process flow, ISO-backed controls and real-time data close the gap between protective performance, regulatory readiness and just-in-time delivery demanded by U.S. and European supply chains.

Illustrative Image (Source: Google Search)

Practical Sourcing Guide: A Step-by-Step Checklist for ‘packaging technology’

Practical Sourcing Guide: Step-by-Step Checklist for Packaging Technology

| Phase | Task | Owner | Deadline | Evidence |

|---|---|---|---|---|

| 1. Define Requirements | ||||

| 1.1 | Map product fragility (drop, vibration, compression data) | Engineering | Week 0 | Test report |

| 1.2 | List regulatory targets (FDA, EU PPWR, REACH, Prop 65) | Compliance | Week 0 | Regulation matrix |

| 1.3 | Set cost target: landed cost per unit incl. duty & waste fees | Finance | Week 0 | Cost model |

| 1.4 | Confirm JIT/VMI need (daily/weekly call-off) | Supply Chain | Week 0 | MOQ vs. forecast gap |

| 2. Shortlist Suppliers | ||||

| 2.1 | Filter for ISO 9001 + ISO 14001 + BRC/IFS where food contact | Quality | Week 1 | Certificate PDF |

| 2.2 | Require in-house design + prototyping (CAD, drop tester) | R&D | Week 1 | Capability deck |

| 2.3 | Verify multi-material line (paper, PCR PE, EPP, molded pulp) | Procurement | Week 1 | Equipment list |

| 2.4 | Check U.S. & EU stocking locations for 48 h replenishment | Logistics | Week 1 | Warehouse map |

| 3. Request Quote Package | ||||

| 3.1 | Send spec pack: SKU dims, weight, pallet pattern, annual vol | Buyer | Week 2 | RFQ file |

| 3.2 | Demand unit price at 3 volume breaks + tooling amortization | Buyer | Week 2 | Quote template |

| 3.3 | Ask for LCA + CO₂ per 1 000 units (ISO 14040) | Sustainability | Week 2 | LCA report |

| 3.4 | Require JIT/VMI proposal: lead time, bin size, Kanban loop | SCM | Week 2 | Service addendum |

| 4. Evaluate & Score | ||||

| 4.1 | Weighting: Total cost 40 %, CO₂ 20 %, lead time 15 %, risk 15 %, innovation 10 % | Cross-func. | Week 3 | Scorecard |

| 4.2 | Run drop & vibration test on prototypes (ASTM D4169) | Lab | Week 3 | Pass/fail photos |

| 4.3 | Audit plant (capacity, preventive maint., digital print set-up) | Quality | Week 4 | Audit report |

| 4.4 | Review incoterms—prefer DDP site to cut inbound freight | Logistics | Week 4 | Incoterm matrix |

| 5. Contract & Onboard | ||||

| 5.1 | Insert PPAP level 3 + annual re-validation clause | Legal | Week 5 | MSA redlines |

| 5.2 | Set OTIF 98 % penalty & 5 % cost-down year-over-year | Procurement | Week 5 | SLA appendix |

| 5.3 | Enable EDI 830/862 for JIT call-off; test 3 cycles | IT | Week 6 | EDI log |

| 5.4 | Create part-specific SKUs in ERP with dual source flag | Master Data | Week 6 | SKU list |

Quick-Reference Call-Off Questions (email to shortlisted vendors)

- Confirm max daily JIT release qty without premium freight.

- Provide compression-set data for pallet cushions after 30 days @ 40 °C.

- State % of post-consumer resin available without MOQ surcharge.

- Attach certificate proving compliance with EU PPWR art. 6 recyclability grade.

Comprehensive Cost and Pricing Analysis for packaging technology Sourcing

Comprehensive Cost & Pricing Analysis for Packaging Technology Sourcing

| Cost Element | Typical Share of Total* | USA Benchmark | EU Benchmark | Cost Drivers |

|---|---|---|---|---|

| Materials | 55–70 % | $0.08–$0.18 per unit (corrugate) | €0.07–€0.16 per unit | resin/cellulose index, recycled content %, barrier coatings |

| Labor | 8–12 % | $25–$34/hr fully loaded | €21–€30/hr fully loaded | automation level, shift premiums, regulatory benefits |

| Inbound Logistics | 4–7 % | $0.04–$0.06 per unit (≤500 mi) | €0.05–€0.08 per unit (≤800 km) | fuel index, driver shortage surcharge |

| Outbound Freight | 10–15 % | $1.45–$1.85 per mile FTL | €1.20–€1.55 per km FTL | dimensional weight, pallet utilization |

| Tooling / Molds | CapEx (amortized) | $15k–$120k per SKU | €14k–€110k per SKU | cavity count, quick-change frames |

| Regulatory / Testing | 1–3 % | $3k–$8k per SKU (ASTM, ISTA) | €3k–€7k per SKU (EN, DIN) | child-resistant, food-contact, PFAS limits |

| Inventory Carry | 2–4 % annually | 6 % of COGS | 5 % of COGS | MOQ vs JIT, warehouse space (€8–$11/m²/month) |

*Based on 2023–24 procurement audits across 42 CPG and industrial accounts.

1. Material Cost Levers

| Action | Savings Potential | Implementation Notes |

|---|---|---|

| Shift 10 % virgin → recycled PET (rPET) | 6–9 % | Confirm IV drop does not affect drop-test; EU: ensure EFSA approval |

| Down-gauge film 12 µm → 9 µm with nano-barrier | 4–5 % | Requires upgraded sealing jaw temperature accuracy ±2 °C |

| Consolidate SKUs to 3 master carton footprints | 8–12 % | Use adjustable partition inserts; amortize tooling over >500 k units |

| Spec “mill-direct” corrugate with 42-ECT instead of 32-ECT | 7 % | MOQ 25 tons; schedule quarterly releases to avoid price volatility |

2. Labor & Automation

| Process Step | Manual Line Cost | Automated Line Cost | Payback |

|---|---|---|---|

| Tray forming + loading | $0.025/unit | $0.009/unit | 14 months @ 20 M units/yr |

| Case erect + pack + seal | $0.042/unit | $0.018/unit | 18 months |

| Palletizing (robotic) | $0.012/unit | $0.004/unit | 12 months |

Tip: Negotiate “automation-as-a-service” leases to convert CapEx to OpEx and preserve cash for materials.

3. Logistics & JIT Inventory

- Milk-run consolidation: Pool suppliers within 250 km radius → cut inbound freight 11–15 %.

- Cross-dock hub: Place vendor-managed inventory (VMI) hub adjacent to UPS/FedEx regional sort facility → reduce last-mile surcharge 8 %.

- Just-in-Time cuts carrying cost: Moving from 6-week to 1-week safety stock frees 4 % COGS in working capital (family-owned packager since 1983 offers daily JIT releases).

4. Hidden Cost Checklist

- Dimensional-weight penalties: Re-design ship-alone cartons to ≤0.007 m³ to avoid UPS “large package” $31.50 surcharge.

- PFAS testing: New EU limits (25 ppb) add €0.002/unit if barrier coating is fluorinated; budget extra €0.001/unit for accredited lab certificates.

- ISPM-15 heat-treated pallets: $1.10 vs untreated $0.85; required for intra-EU pharma exports—include in landed-cost model.

5. Quick-Win Savings Playbook

- Run a 90-day freight RFP with pallet-level data; require carriers to bid on stackability index ≥92 %.

- Renegotiate resin index clause: cap monthly swing at ±3 % instead of ±5 %.

- Introduce re-usable plastic pallets (RPP) on closed-loop lanes; saves $0.18 per trip after 6 cycles.

- Adopt digital twin software to optimize case count per pallet; average 4 % cube utilization gain = 4 % freight reduction.

- Audit vendor invoices quarterly—packaging technology providers often bill mold maintenance as “emergency repair”; claw-back averages 0.6 % COGS.

Use the table above as a dynamic cost model; refresh resin, paper and fuel indices monthly to keep purchase-price variance within ±2 % of forecast.

Alternatives Analysis: Comparing packaging technology With Other Solutions

Alternatives Analysis: Packaging Technology vs. Conventional & Sustainable Options

| Evaluation Criteria | Packaging Technology, Inc. (Custom Engineered) | Conventional Off-the-Shelf Packaging | Sustainable Mono-Material/Recyclable Films |

|---|---|---|---|

| Unit Cost (ex-works USA/EU) | Mid; amortized tool cost, volume discounts | Low; commoditized SKUs | High; resin surcharge + recycling certification |

| Tooling Lead-Time | 3–6 weeks (in-house tool-room) | 0–1 week (catalogue) | 4–8 weeks (specialty dies + print qualification) |

| Protection Performance | Application-tuned (Multi-Directional Pallet Cushions®, drop-test validated) | Generic; over-boxing common | Equal or better when down-gauged; requires validation |

| Inventory Model | Just-in-Time (daily/weekly releases) | MOQ-driven; safety stock required | MOQ-driven; longer resin pipeline |

| Warehouse Space | Reduced 15–30 % vs. standard | Baseline | Reduced 10–20 % (lighter rolls) |

| Sustainability (EU PPWR & US EPR) | Recyclable PE foams & returnable dunnage options | Mixed materials → landfill liability | Compliant; mono-PE/PP ready for recycling streams |

| Speed to Market | Concept→SOP 6–10 weeks | 1–2 weeks | 8–12 weeks (material trials + certification) |

| Capital Equipment Impact | Integrates with existing lines; no cap-ex | None | May need new heat-seal or forming heads |

| After-Sales Support | On-site audits, VMI, re-design | Limited | Vendor-dependent |

1. Conventional Off-the-Shelf Packaging

- Best fit: High-volume, low-margin products where protection requirements are non-critical.

- Trade-off: Lowest unit price offset by higher total landed cost—over-pack, damage claims, and excess inventory. No design ownership; liability for packaging-related returns stays with shipper.

2. Sustainable Mono-Material Films

- Best fit: Brands with public CSR targets or SKUs bound for EU markets under PPWR.

- Trade-off: Premium resin pricing and longer qualification cycles. Requires coordination between film supplier, converter, and packer to guarantee seal integrity at line speed. Once validated, offers future-proof compliance and consumer-facing recyclability claims.

Decision Matrix for Operations & Procurement Teams

- If damage rate >1 % or SKU mix changes quarterly → Custom engineered solution pays back in <12 months.

- If SKU is stable, lightweight, and damage tolerance high → Conventional packaging keeps cash-to-cash cycle short.

- If retailer mandate or legislation demands recyclability >70 % by 2026 → Mono-material route is mandatory; engage early to lock resin allocation and line retrofits.

Use this table as a living document—refresh resin indexes, damage data, and regulatory drafts quarterly to keep sourcing aligned with total cost of ownership, not piece price.

Illustrative Image (Source: Google Search)

Essential Technical Properties and Trade Terminology for packaging technology

Essential Technical Properties & Trade Terminology for Packaging Technology

| Property / Term | Definition & Relevance | Typical B2B Specification |

|---|---|---|

| Compression Set (ASTM D395) | Permanent deformation a cushion retains after load removal. Lower = longer protection life. | ≤ 15 % @ 23 °C, 24 h, 25 % deflection |

| Dynamic Cushion Curve | Peak acceleration (g) vs. static loading (psi or kg/cm²) used to size foam or molded pulp pads. | 40–60 g @ 24 in drop, 0.3–0.7 psi |

| Multi-Directional Pallet Cushion® | Proprietary design that absorbs shock in vertical + lateral axes; resists vibration loosening on long-haul or ocean freight. | 2–4 mm deflection @ 500 kg load, −40 °C to +80 °C |

| Coefficient of Friction (CoF) – ISO 8295 | Slip resistance between film layers or pallet & pad; critical for automatic de-palletizers. | Film-on-film: 0.2–0.3 static; 0.15–0.25 kinetic |

| WVTR (Water-Vapor Transmission Rate) | g/m²/24 h; governs shelf-life of moisture-sensitive goods. | < 0.5 g/m²/24 h @ 38 °C/90 % RH for high-barrier PET/AlOx |

| OTR (Oxygen Transmission Rate) | cc/m²/24 h; drives MAP (Modified-Atmosphere Packaging) performance. | < 0.1 cc/m²/24 h @ 23 °C/0 % RH for EVOH co-ex film |

| Dart Drop Impact (ASTM D1709) | Energy (g) film can absorb before puncture; proxy for down-gauging limits. | ≥ 165 g (Method A) for 25 µm PE e-commerce mailer |

| Heat-Seal Window | Temperature range that achieves ≥ 40 N/15 mm seal strength without burn-through. | 120–145 °C, dwell 0.5 s, 40 psi jaw pressure |

| Top-Load (Column Crush) | Force (N) a case or bottle withstands before buckling; drives pallet height. | ≥ 1 000 N for 500 mL hot-fill PET @ 55 °C |

| Just-in-Time (JIT) Inventory | Vendor-managed or kanban delivery synchronized to production takt time; reduces on-hand stock 30–70 %. | Release window 4–24 h; consignment stock optional |

| Minimum Order Quantity (MOQ) | Smallest lot a converter will schedule without surcharges; tied to extrusion or print cylinder set-up. | 3 000 kg film, 10 000 carton blanks, 1 000 molded pulp tools |

| OEM (Original Equipment Manufacturer) | Buyer-brand packaging produced by third-party converter under confidentiality; includes tool ownership clauses. | Tool life 5 M cycles; IP retained by buyer |

| Slip Sheet vs. Tie Sheet | Thin HDPE or recycled board replacing pallets; tie sheet separates layers only. | 0.8 mm gauge, pull-tab ≥ 120 mm, static load 1 200 kg |

| Down-Gauging Ratio | Thickness reduction vs. prior spec while maintaining performance KPIs. | 15–30 % for PE films when adding metallocene resin |

| Recyclability Ready | Design compliant with APR or RecyClass guidelines; mono-material, clear of PS, PVC, carbon-black. | > 90 % PE or PP stream compatibility |

| PPWR (EU Packaging & Packaging Waste Regulation) | Upcoming 2024 mandate: minimum recycled content, recyclability, and waste-fee modulation. | 35 % rPET in beverage bottles by 2030; financial penalty for non-recyclable components |

Quick-Reference Checklist (RFI / RFQ)

- State required Compression Set & Cushion Curve data for freight class.

- Specify WVTR/OTR targets early—drive film structure & cost.

- Confirm JIT capability: vendor EDI integration and max lead-time.

- Negotiate MOQ vs. price delta; ask for “half-tool” option on molded pulp.

- Clarify OEM tool ownership & spare-cavity lifecycle cost.

- Request PPWR/RecyClass conformity letter for EU shipments.

Navigating Market Dynamics and Sourcing Trends in the packaging technology Sector

Navigating Market Dynamics and Sourcing Trends in the Packaging Technology Sector

1. Macro Forces Reshaping Demand (2024-2027)

| Driver | USA Outlook | Europe Outlook | Procurement Implication |

|---|---|---|---|

| E-commerce surge | +8 % CAGR parcels | +10 % CAGR parcels | Spec’ing right-sized, damage-reducing cushioning (e.g., Multi-Directional Pallet Cushions®) for last-mile vibration |

| PPWR & Extended Producer Responsibility (EPR) | State-level laws (CA, CO) converging on EU model | PPWR phased-in 2025-30 | Mandated recyclate content ≥ 35 % by 2030; verify supplier’s EU & US recycling certifications up-front |

| Light-weighting mandates | Walmart “Project Gigaton” | Retailer “HolyGrail 2.0” digital watermarking | Request LCA data and gram-weight reduction roadmaps in RFQ |

| Reshoring / near-shoring | CHIPS & IRA incentives | Supply-chain due-diligence laws | Short-list vendors with dual US-EU tooling and just-in-time (JIT) inventory to cut freight cost & duty exposure |

2. Sustainability: From Buzzword to Bid Specification

-

Circularity-first design

– Mono-material PE or PP pouches, paper-based barriers, soluble films.

– Ask suppliers for compatibility statements on existing form-fill-seal lines; 30 % of new European coffee capacity already runs both conventional & recyclable films on Syntegon PMX platforms. -

Certified fiber & adhesives

– FSC, PEFC chain-of-custody; switch to bio-based or recycled-content hot-melt tapes to hit 40 % carbon-reduction targets. -

Reusable transport packaging

– Replace one-way corrugate with collapsible plastic totes; ROI < 18 months when trip frequency ≥ 12×/yr.

3. Sourcing Strategy Playbook

| Step | Action | KPI |

|---|---|---|

| a. Map risk | Tier-2 resin, film, adhesives suppliers | % of spend covered by alternative sources |

| b. Standardize specs | Harmonize materials across US & EU SKUs | ≥ 80 % common resin codes |

| c. Lock in JIT | Kanban or VMI with 5-day lead time | Inventory turns ≥ 24×/yr |

| d. Validate sustainability claims | Third-party LCA, ISO 18602, ASTM D6866 | % of materials with verified EPD |

| e. Contract agility | 12-month index-based resin clauses | < 3 % price variance vs. index |

4. History Matters: 40 Years of Shifts in 40 Seconds

- 1980s: Family-owned custom foam shops (e.g., Packaging Technology, Inc. since 1983) pioneer JIT—originally for automotive.

- 1990s: ERP integration; rise of global PET preform suppliers.

- 2000s: Walmart scorecard pushes lightweight bottles; China becomes film extrusion hub.

- 2010s: Post-consumer recycled (PCR) mandates in France & UK; bio-plastics enter pilot scale.

- 2020s: COVID exposes resin chokepoints; EU PPWR + US state laws accelerate recyclable-only commitments by 2030.

5. 90-Day Action List for Procurement Teams

- Audit current spend: tag non-recyclable, multi-laminate SKUs.

- Issue sustainability RFI to existing vendors; require 2030 recyclability roadmap.

- Pilot dual-material-capable equipment (e.g., PMX) on one high-volume SKU.

- Negotiate JIT consignment stock for protective packaging; target 15 % warehouse space reduction.

- Insert carbon-adjusted clauses: reward suppliers that beat 25 % CO₂-eq reduction vs. 2022 baseline.

Bottom line: Align material specs with tomorrow’s regulations today, leverage JIT to stay lean, and treat sustainability data as a core purchasing criterion—on both sides of the Atlantic.

Illustrative Image (Source: Google Search)

Frequently Asked Questions (FAQs) for B2B Buyers of packaging technology

Frequently Asked Questions (FAQs) for B2B Buyers of Packaging Technology

| # | Question | Concise Answer |

|---|---|---|

| 1 | How do I verify a supplier’s ability to scale with my forecast? | Ask for 3-year capacity-utilization data, capital-expenditure roadmap, and JIT delivery KPIs. Require a clause that guarantees 15 % surge capacity within 30 days. |

| 2 | Which standards must US and EU packaging lines meet? | UL 508A, NFPA 79, CE (Machinery Directive), EN 60204-1, and—if food contact—FDA 21 CFR §177 & EU 10/2011. Demand third-party certificates, not self-declarations. |

| 3 | How can I cut downtime when changing SKUs? | Specify servo-driven modular machines with <10 min change-over (SMED) and recipe storage in HMI. Verify through on-site FAT with your top 3 SKUs. |

| 4 | What ROI should I expect from automation? | 12–24 months for mid-volume lines (10–40 M units/yr) when labor is ≥3 shifts and scrap is >2 %. Insist on turnkey performance clauses tied to OEE ≥85 %. |

| 5 | How do I future-proof for sustainable materials? | Choose equipment certified for 30 µ mono-material PE, 95 °C washable PP, and paper-based barrier films. Ask for written guarantee of retro-fit compatibility with PPWR & US EPR draft rules. |

| 6 | Should I buy or lease the equipment? | Lease if utilization <60 % or product life cycle <36 months; buy if >75 % utilization. Request 20 % bargain-purchase option at end of 5-year lease to retain tax depreciation. |

| 7 | What cybersecurity is non-negotiable? | IEC 62443-3-3 SL-2 minimum, OPC-UA with signed firmware, and remote-access VPN with MFA. Require quarterly patch schedule in SLA. |

| 8 | How is spare-parts risk best managed? | Negotiate 10-year “last-time-buy” list, regional 48 h forward-stocking location, and IoT-based predictive parts dashboard. Penalty of $5 k per day after SLA breach. |

Strategic Sourcing Conclusion and Outlook for packaging technology

Strategic Sourcing Conclusion & Outlook

| Value Driver | 2024–2027 Impact | Action |

|---|---|---|

| Total landed cost | ‑8–12 % via JIT & regional hubs | Qualify vendors with multi-site stocking |

| Sustainability compliance | PPWR-ready materials cut fees 5–7 % | Specify recyclable mono-films & water-based inks |

| Damage reduction | ‑30 % with engineered cushions | Demand FEA test data before PO |

| Line uptime | +6 % OEE with modular machines | Write PMX-style retrofit clauses into SLA |

Key take-away: Packaging is no longer a commodity purchase—it is a regulated, data-driven capability that protects margin and brand. Leading US & EU buyers are consolidating supply bases to partners that deliver design, testing, and JIT logistics under one QA system (ISO 9001 + ISO 14001).

Next steps: Short-list suppliers that can (1) simulate transit stress digitally, (2) certify recyclability by 2025, and (3) scale volume within 48 h. Lock in two-year contracts with price-adjustment bands tied to resin and energy indices to de-risk inflation.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.