The global cardboard packaging market is experiencing robust growth, driven by rising demand for sustainable packaging solutions across industries such as e-commerce, food & beverage, and pharmaceuticals. According to a report by Mordor Intelligence, the market was valued at USD 116.7 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. This expansion is fueled by increasing consumer preference for recyclable materials and stricter environmental regulations worldwide. As brands prioritize eco-friendly alternatives to plastic, leading package cardboard manufacturers are scaling production, investing in innovation, and enhancing supply chain efficiency to meet evolving demands. In this competitive landscape, a select group of manufacturers stand out for their production capacity, sustainability initiatives, and global reach—making them key players shaping the future of packaging.

Top 10 Package Cardboard Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Cardbox Packaging

Domain Est. 2012

Website: cardbox-packaging.com

Key Highlights: Cardbox Packaging is an international producer of high quality and sophisticated carton packaging and paper cups focused primarily on FMCG market….

#2 Custom Corrugated Packaging Solutions from Pratt Industries

Domain Est. 1999 | Founded: 1985

Website: prattindustries.com

Key Highlights: The fifth largest corrugated packaging company in the United States, producer of 100% recycled containerboard since 1985….

#3 Custom Cardboard Shipping Boxes from a Corrugated Box …

Domain Est. 2004

Website: expresspkg.com

Key Highlights: Need custom shipping boxes? Partner with a trusted corrugated box manufacturer for durable, customizable solutions….

#4 International Paper

Domain Est. 1997

Website: internationalpaper.com

Key Highlights: We transform renewable resources into innovative and sustainable packaging solutions, corrugated cardboard boxes, pulp and paper products, recycling solutions….

#5 Custom Packaging Solutions

Domain Est. 1997

Website: colbertpkg.com

Key Highlights: We produce offset and flexographic printed folding cartons, formed paper trays, pressure-sensitive roll labels and informational package inserts….

#6 Welch Packaging

Domain Est. 1999

Website: welchpkg.com

Key Highlights: Welch Packaging manufactures custom cardboard boxes, retail packaging, and e-commerce packaging. We offer design services, assembly, fulfilment, ……

#7 Clearwater Paper Corporation

Domain Est. 2008

Website: clearwaterpaper.com

Key Highlights: We are a premier independent supplier of paperboard packaging products to North American converters. Our team produces high-quality paperboard….

#8 McKinley Packaging

Domain Est. 2019

Website: mckinleypackaging.com

Key Highlights: Bringing Value To Our Customers As The Market Leader · CORRUGATED PACKAGING · PAPER · INTERIOR & SPECIALTY PACKAGING · GRAPHICS & RETAIL PACKAGING….

#9 One PaperWorks

Domain Est. 2020

Website: onepaperworks.com

Key Highlights: “We are dedicated to providing sustainable and innovative paperboard and packaging solutions, backed by a team you can count on for reliability and safety.”….

#10 Smurfit Westrock

Domain Est. 2023

Website: smurfitwestrock.com

Key Highlights: We create, design and manufacture paper-based packaging made from renewable materials that protect and promote our customers’ products. In 2024, we manufactured ……

Expert Sourcing Insights for Package Cardboard

2026 Market Trends for Packaging Cardboard

The global packaging cardboard market is poised for significant evolution by 2026, driven by a confluence of sustainability mandates, technological advancements, shifting consumer behaviors, and supply chain dynamics. Here are the key trends expected to shape the industry:

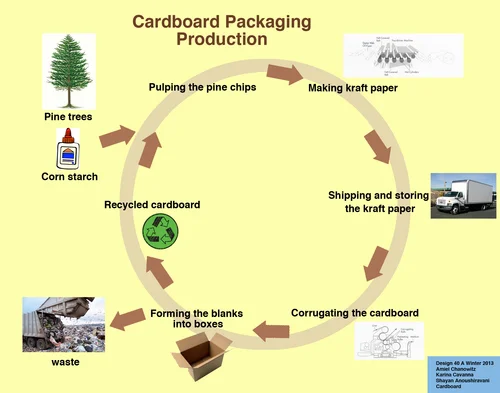

1. Dominance of Sustainability and Circularity

Sustainability will remain the paramount driver. By 2026, demand for virgin fiber will increasingly be challenged by a strong preference for recycled content. Regulations like the EU Packaging and Packaging Waste Regulation (PPWR) will mandate higher recycled content (e.g., 65% for fiber-based packaging by 2030, setting a trajectory for 2026) and improved recyclability. Brands will prioritize FSC or PEFC-certified virgin fiber, and investments in closed-loop recycling systems and chemical recycling for fiber recovery will accelerate. “Plastic-free” labeling on cardboard packaging will become a major marketing advantage.

2. Premiumization and Value-Added Functionalities

Cardboard will move beyond basic protection. Expect a surge in demand for premium, brand-enhancing solutions: high-quality printing, textured finishes, embossing, and structural innovation (e.g., reusable or multi-compartment designs). Functional enhancements like integrated QR codes for traceability, augmented reality experiences, and smart sensors for freshness monitoring (especially in food) will gain traction, adding value and engaging consumers.

3. E-commerce Packaging Optimization and Innovation

The e-commerce boom will continue to dictate design. Lightweighting (using stronger, thinner board grades) will be crucial to reduce shipping costs and emissions. Designs will focus on right-sizing, eliminating void fill, and ensuring single-box shipping. Reusable and returnable cardboard packaging systems, particularly for B2B and high-value goods, will see pilot programs and gradual adoption, driven by cost and sustainability goals.

4. Supply Chain Resilience and Regionalization

Geopolitical tensions and past disruptions will push companies towards more resilient, localized supply chains. Nearshoring and regional production of cardboard packaging will increase, reducing logistics risks and carbon footprints. This will boost regional paperboard producers and encourage investment in local recycling infrastructure to secure fiber supply. Digital twins and AI for supply chain optimization will become more common.

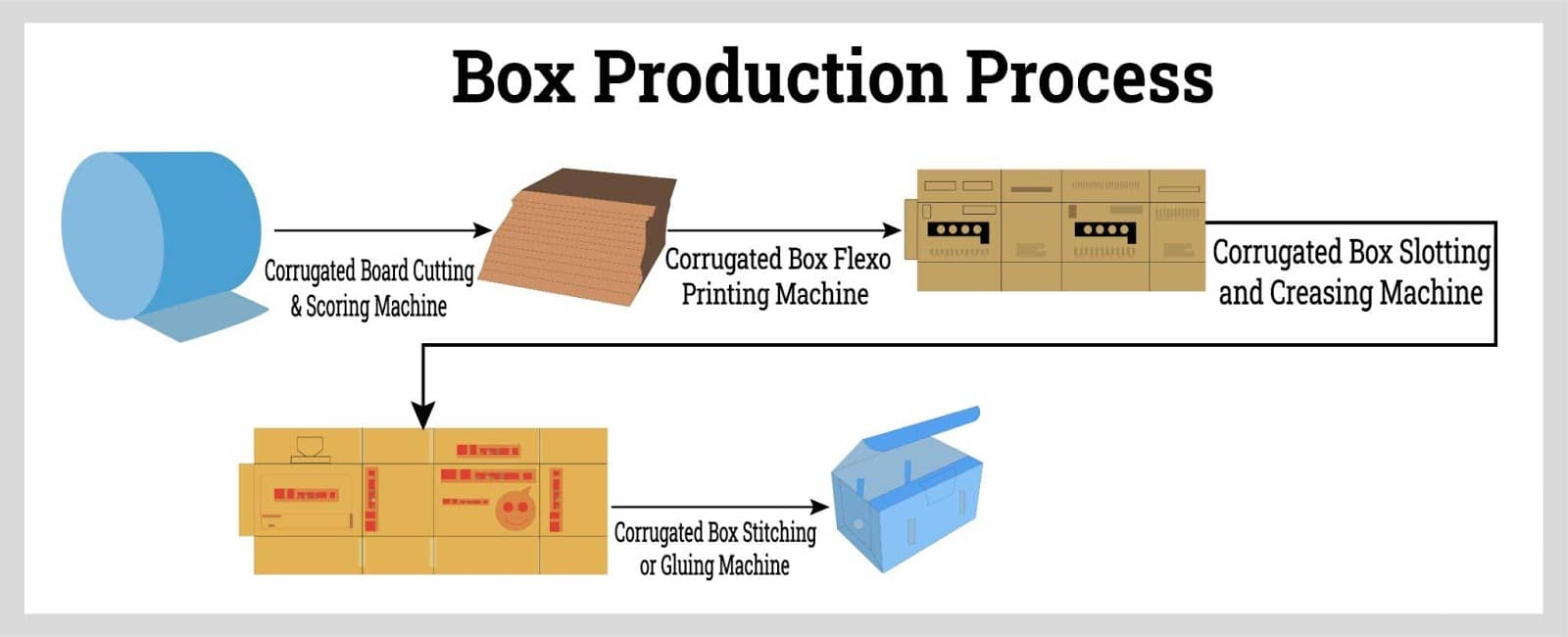

5. Technological Advancements in Production and Design

Automation and AI will transform manufacturing, improving efficiency, quality control, and predictive maintenance. Digital printing will enable mass customization, shorter runs, and rapid prototyping for brands. Advanced CAD software will facilitate complex, optimized structural designs. Investment in high-speed, energy-efficient paper machines using renewable energy will be critical for competitiveness.

6. Raw Material Sourcing and Cost Volatility

Fiber costs (both virgin and recycled) and energy prices will remain volatile. Competition for high-quality recycled fiber (OCC – Old Corrugated Containers) will intensify, potentially leading to price fluctuations. Producers will invest in advanced sorting technologies and explore alternative fibers (e.g., agricultural residues) to diversify supply and reduce reliance on traditional sources.

7. Regulatory Pressure and Standardization

Beyond recycling mandates, regulations will increasingly focus on reducing overall packaging volume (minimal packaging), restricting problematic materials (e.g., PFAS coatings), and implementing Extended Producer Responsibility (EPR) schemes with higher fees for non-recyclable or non-recycled content. Global standardization of recyclability labels (like How2Recycle) will improve consumer sorting and boost recycling rates.

Conclusion: By 2026, the packaging cardboard market will be characterized by a deep integration of sustainability into its core, driven by regulation and consumer demand. Success will depend on innovation in materials, design, and business models (like reuse), coupled with resilient, transparent, and technologically advanced supply chains. Companies that proactively embrace circularity, digitalization, and value-added solutions will lead the market.

Common Pitfalls Sourcing Package Cardboard (Quality, IP)

Sourcing package cardboard involves more than just finding the lowest price. Overlooking critical quality and intellectual property (IP) considerations can lead to product damage, customer dissatisfaction, legal disputes, and reputational harm. Below are key pitfalls to avoid:

Inadequate Quality Specifications

Failing to define clear quality standards—such as burst strength, edge crush test (ECT) values, moisture content, and recyclability—can result in subpar packaging that fails during shipping or storage. Suppliers may use lower-grade materials if specifications aren’t tightly controlled, leading to increased product damage and returns.

Lack of Material Consistency

Cardboard sourced from different batches or suppliers may vary in thickness, color, or structural integrity. Without consistent quality control and supplier audits, brands risk receiving non-uniform packaging that impacts branding and performance.

Overlooking Sustainable Sourcing Claims

Many suppliers claim eco-friendly or recyclable materials without certification. Relying on unverified sustainability statements can mislead consumers and expose companies to greenwashing accusations. Always request documentation like FSC or SFI certification.

Ignoring Intellectual Property in Design

Custom cardboard packaging often includes unique designs, logos, or structural features protected by IP. Failing to secure proper rights or verify that the supplier isn’t using infringing templates can lead to legal action, especially in international markets.

Supplier Use of Counterfeit or Unauthorized Dies/Molds

Some manufacturers reuse or replicate proprietary packaging molds without permission. If your packaging design is patented or trademarked, using a supplier that copies these without authorization can compromise your IP and invite litigation.

Insufficient Supplier Vetting

Choosing a supplier based solely on cost without auditing their production processes, quality control measures, or IP compliance history increases the risk of receiving counterfeit materials or packaging that violates third-party rights.

Poor Communication of Regulatory Requirements

Different regions have specific regulations for packaging materials (e.g., food-grade safety, ink composition). Miscommunication with suppliers can result in non-compliant packaging, leading to shipment rejections or fines.

Failure to Secure IP Ownership in Contracts

When working with suppliers to develop custom packaging, contracts must explicitly state who owns the design, structural innovations, and tooling. Without clear IP assignment clauses, suppliers may retain rights or reuse your designs for competitors.

Avoiding these pitfalls requires thorough due diligence, clear contractual agreements, and ongoing quality and compliance monitoring throughout the sourcing process.

Logistics & Compliance Guide for Package Cardboard

This comprehensive guide outlines the best practices, logistical considerations, and regulatory compliance requirements for the handling, transportation, and disposal of cardboard packaging materials.

Material Specifications and Standards

Cardboard used for packaging must meet industry-specific material standards to ensure durability and safety. Common types include corrugated fiberboard and solid bleached sulfate (SBS) board. Materials should comply with specifications such as those defined by the International Organization for Standardization (ISO) — including ISO 186 (paper sampling) and ISO 2473 (corrugated fiberboard). Additionally, cardboard should be free from contaminants and meet relevant food-grade requirements if used in direct contact with consumable products.

Environmental and Sustainability Compliance

Cardboard packaging must adhere to environmental regulations governing recyclability and sustainable sourcing. In the European Union, compliance with the Packaging and Packaging Waste Directive (94/62/EC) is mandatory, requiring minimum recycled content and recyclability targets. In the U.S., adherence to the Federal Trade Commission (FTC) Green Guides ensures accurate environmental marketing claims (e.g., “100% Recyclable” or “Made with Recycled Content”). Forest Stewardship Council (FSC) or Programme for the Endorsement of Forest Certification (PEFC) certification is recommended to verify sustainable fiber sourcing.

Transportation and Handling Logistics

Cardboard packages must be properly secured and palletized to prevent damage during transit. Use of stretch wrap, edge protectors, and dunnage ensures structural integrity. Load distribution should follow weight limits and stacking guidelines to avoid collapse. Temperature and humidity control may be necessary for moisture-sensitive contents, as cardboard absorbs moisture and loses compression strength in high-humidity environments. Consider using moisture-resistant coatings or vapor barriers when shipping through variable climates.

Labeling and Marking Requirements

All cardboard packaging must be correctly labeled in accordance with international and national regulations. Required markings typically include:

– Product identification

– Handling symbols (e.g., “This Side Up,” “Fragile”) per ISO 780

– Weight and dimensions

– Recyclability symbols (e.g., Mobius loop)

– Country of origin

– Hazard warnings (if applicable)

For international shipments, compliance with the International Maritime Dangerous Goods (IMDG) Code or International Air Transport Association (IATA) regulations may apply, depending on contents.

Waste Management and End-of-Life Compliance

Post-consumer cardboard waste must be managed in accordance with local waste regulations. Businesses are often subject to Extended Producer Responsibility (EPR) laws, such as those in the EU or Canadian provinces, which require producers to finance or manage the recycling of packaging waste. Cardboard should be separated from contaminants (plastic, food residue) to ensure effective recycling. Maintain records of waste disposal and recycling to support audit readiness and compliance reporting.

Regulatory Documentation and Audits

Maintain documentation including:

– Material Safety Data Sheets (MSDS), if applicable

– Supplier certificates of compliance (e.g., FSC, recyclability)

– Waste transfer notes

– Sustainability reports

Regular internal audits should be conducted to verify compliance with environmental standards, shipping regulations, and corporate sustainability goals.

Summary

Effective logistics and compliance for cardboard packaging require attention to material standards, environmental regulations, proper handling, accurate labeling, and responsible end-of-life management. Staying informed on evolving legislation and adopting sustainable practices enhances compliance, reduces environmental impact, and supports brand integrity.

Conclusion for Sourcing Package Cardboard

Sourcing package cardboard is a critical component in ensuring sustainable, cost-effective, and reliable packaging solutions for any business. After evaluating suppliers, material quality, environmental impact, and cost efficiency, it is clear that strategic sourcing of cardboard packaging not only supports operational needs but also aligns with corporate sustainability goals. By partnering with reputable suppliers who offer recyclable, durable, and customizable cardboard materials, companies can reduce waste, lower shipping costs, and enhance brand image. Additionally, considering factors such as lead times, minimum order quantities, and regional availability ensures supply chain resilience. In conclusion, a well-planned cardboard sourcing strategy contributes significantly to operational efficiency, environmental responsibility, and long-term business success.