The global outboard motor market is experiencing steady growth, driven by rising recreational boating activities, increased marine tourism, and advancements in fuel-efficient and electric propulsion technologies. According to Grand View Research, the global outboard motors market was valued at USD 6.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is further supported by emerging demand in coastal and inland waterway regions, as well as a shift toward lightweight, high-performance engines. While Johnson is no longer an active standalone manufacturer—having ceased production in 2007 with its legacy now part of the Outboard Marine Corporation (OMC) portfolio—the brand remains a notable reference in the historical landscape of outboard motors. In this context, the following list highlights the top eight current manufacturers that represent the evolution and innovation trajectory Johnson pioneered, now leading the market with advanced technologies, reliability, and global distribution.

Top 8 Outboard Boat Motors Johnson Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

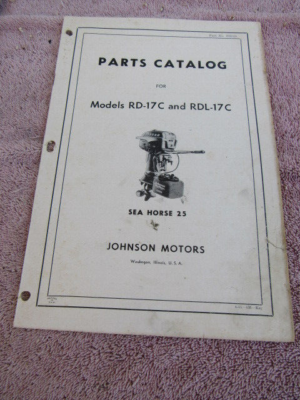

#1 Find Johnson Evinrude Outboard Motor Parts by Year: 1955

Domain Est. 1999

Website: marineengine.com

Key Highlights: Drill down from the year, horsepower, model number and engine section to get an online inventory of genuine OEM and aftermarket Johnson Evinrude outboard parts….

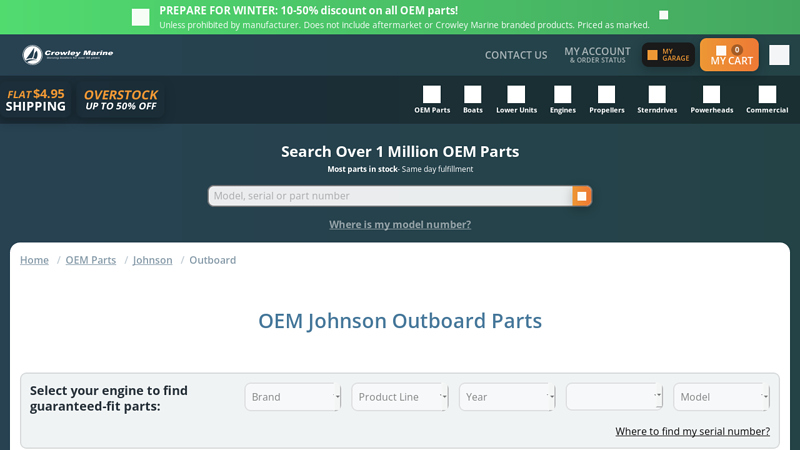

#2 OEM Johnson Outboard Parts

Domain Est. 2001

Website: crowleymarine.com

Key Highlights: Johnson Outboard OEM parts for sale. Flat $4.95 shipping & competitive prices. Serving boaters for over 50 years….

#3 BRP

Domain Est. 1995

Website: brp.com

Key Highlights: Discover BRP, the world leader in the snowmobile, all-terrain & side-by-side vehicle, 3-wheel motorcycle and personal watercraft industries….

#4 Evinrude

Domain Est. 1997

Website: evinrude.com

Key Highlights: Find the engine your boat deserves with Evinrude’s unparalleled line of outboard motors, parts, and accessories, available at dealers nationwide….

#5 Johnson Marine Supplies

Domain Est. 1999 | Founded: 1955

Website: johnson-marine.com

Key Highlights: Welcome to Johnson Marine Supplies. Southern California’s Boat Dealer for Avalon Pontoons, Scout Fishing Boats and Chris-Craft Boats. Since 1955, Johnson Marine ……

#6 Humminbird Fishing Electronics & Mapping

Domain Est. 1999

Website: humminbird.johnsonoutdoors.com

Key Highlights: From your trolling motor to your fish finder and shallow water anchor, we created the One-Boat Network to help you do more of what you love to do….

#7 BRP exits outboard motor business

Domain Est. 2002

Website: boatingindustry.com

Key Highlights: Canadian company BRP stunned the recreational boating industry with their announcement it will immediately stop making Evinrude outboards….

#8 genuine johnson outboard motor parts

Website: promtparts.co.nz

Key Highlights: At PROMT Parts, we are proud to offer a wide selection of genuine Johnson outboard motor parts in New Zealand….

Expert Sourcing Insights for Outboard Boat Motors Johnson

H2: 2026 Market Trends for Outboard Boat Motors – Johnson

As the marine propulsion industry evolves, Johnson outboard boat motors are expected to face both challenges and opportunities in 2026. While Johnson, historically a strong contender in the outboard motor market, currently holds a smaller market share compared to dominant brands like Yamaha, Mercury, and Evinrude (though Evinrude ceased operations in 2020), the 2026 outlook reflects broader industry shifts that will influence its positioning. Key trends shaping the Johnson outboard motor market include electrification, sustainability demands, technological integration, and changing consumer preferences.

-

Shift Toward Electric and Hybrid Propulsion

By 2026, the marine industry is projected to see accelerated adoption of electric outboard motors, driven by environmental regulations and consumer interest in sustainable boating. While Johnson has not recently released electric models under its brand, its parent company (if applicable—note: Johnson Outboards is currently marketed by Outboard Marine Corporation and has limited presence compared to past decades) may need to respond to this trend. If Johnson fails to innovate in the electric space, it risks losing relevance among eco-conscious boaters and in regions with strict emission standards, such as California and the European Union. -

Consolidation and Brand Positioning

Johnson’s market presence has diminished over the past two decades due to industry consolidation and the dominance of a few major players. In 2026, the brand may continue to serve niche or budget-friendly markets, particularly in developing regions or among recreational anglers seeking affordable, reliable motors. There is potential for Johnson to be repositioned as a value-oriented alternative to premium brands, leveraging its legacy reputation for durability. -

Digital Integration and Smart Features

The integration of digital technologies—such as Bluetooth connectivity, GPS synchronization, mobile app diagnostics, and remote monitoring—is becoming standard in modern outboard motors. By 2026, consumer expectations will likely demand these smart features even in mid-range models. Johnson will need to partner with technology providers or refresh its product line to remain competitive in this domain. -

Growth in Recreational Boating and Emerging Markets

Recreational boating is expected to grow globally, with increased interest in coastal tourism, freshwater fishing, and personal watercraft. Emerging markets in Southeast Asia, Latin America, and parts of Africa may present growth opportunities for cost-effective brands like Johnson. These regions often prioritize affordability and ease of maintenance over high-end features, aligning with Johnson’s traditional strengths. -

Aftermarket and Service Network Expansion

A robust aftermarket and service network will be crucial for Johnson’s competitiveness in 2026. As legacy engines remain in use, demand for spare parts, repairs, and retrofits will persist. Expanding service partnerships and digital support tools could help Johnson retain customer loyalty and extend the lifecycle of its products. -

Regulatory and Environmental Pressures

Stricter emissions standards, such as EPA Tier 3 and EU Recreational Craft Directive (RCD) updates, will continue to shape product development. Johnson motors will need to meet or exceed these standards, likely requiring a shift to four-stroke or alternative fuel technologies. Non-compliance could limit market access in environmentally regulated regions.

Conclusion:

While Johnson outboard motors may not lead the innovation curve in 2026, the brand has the potential to maintain a foothold in budget-conscious and emerging markets. Success will depend on strategic modernization, possible electrification initiatives, and leveraging its heritage for brand trust. Without significant investment in R&D and digital capabilities, however, Johnson risks being overshadowed by more agile and technologically advanced competitors in the global outboard motor landscape.

Common Pitfalls Sourcing Outboard Boat Motors: Johnson (Quality and Intellectual Property)

Sourcing Johnson outboard motors—especially given the brand’s legacy and current market landscape—can present several risks related to quality assurance and intellectual property (IP) concerns. Being aware of these pitfalls is crucial for buyers, distributors, and resellers.

Quality Inconsistencies and Counterfeit Products

One of the most significant challenges when sourcing Johnson outboard motors is ensuring consistent quality. Since the Johnson brand was discontinued by its original manufacturer, Outboard Marine Corporation (OMC), and later acquired by other entities, many current products branded as “Johnson” are manufactured under license or by third parties. This can lead to:

- Inferior Components: Some manufacturers may use lower-grade materials or outdated designs to reduce costs, resulting in reduced durability and performance.

- Lack of OEM Standards: Unlike original Johnson motors produced by OMC, newly manufactured versions may not adhere to the same engineering or safety standards, increasing the risk of mechanical failure.

- Counterfeit or Replica Units: The popularity of the Johnson name has led to counterfeit motors, especially in international markets. These replicas often lack proper testing, certifications, and safety features, posing risks to end users.

Buyers should verify product authenticity through official distributors, request certification documentation (e.g., ISO, CE, or EPA compliance), and inspect build quality carefully.

Intellectual Property (IP) and Brand Misuse

The Johnson brand name is now owned by different entities depending on the region, often licensed for use on motors manufactured by third-party OEMs. This creates several IP-related risks:

- Unauthorized Use of Trademarks: Some suppliers may falsely claim their products are “genuine Johnson” motors, leveraging brand recognition without proper licensing. This not only violates trademark laws but also misleads consumers.

- Gray Market Imports: Motors sourced from unauthorized channels may infringe on regional IP rights or distribution agreements, potentially leading to legal liability or customs seizures.

- Licensing Ambiguity: Without clear verification of licensing agreements between the manufacturer and the current Johnson trademark holder (e.g., Bombardier Recreational Products, which previously held rights, or current regional licensees), sourcing decisions could inadvertently support IP infringement.

To mitigate these risks, conduct due diligence on suppliers, confirm trademark licensing status, and source only through authorized channels or reputable partners with documented rights to distribute Johnson-branded products.

Conclusion

Sourcing Johnson outboard motors requires careful attention to both product quality and intellectual property legitimacy. Ensuring authenticity, verifying manufacturer credentials, and confirming legal brand usage are essential steps to avoid financial loss, legal complications, and reputational damage.

Logistics & Compliance Guide for Outboard Boat Motors: Johnson

Overview of Johnson Outboard Motors

Johnson outboard motors, once a prominent brand in the marine propulsion industry, are now part of the broader Evinrude and Bombardier legacy. Though production of new Johnson motors ceased in 2007, many used and legacy units remain in operation globally. This guide outlines the logistics and compliance considerations for the distribution, import/export, maintenance, and disposal of Johnson outboard motors.

Regulatory Compliance Requirements

Environmental Regulations

Johnson outboard motors, particularly two-stroke models, are subject to environmental regulations due to emissions and fuel/oil discharge concerns. Key regulatory frameworks include:

– U.S. Environmental Protection Agency (EPA): All outboard motors sold or operated in the U.S. must comply with EPA emission standards. Legacy Johnson motors may not meet current Tier 3 standards, restricting their use in certain waterways.

– California Air Resources Board (CARB): Imposes stricter emission standards. Johnson motors not certified by CARB may not be legally operated in California.

– International Maritime Organization (IMO) and European Union Recreational Craft Directive (RCD): Govern emissions and safety for motors used in EU waters. Importers of used Johnson motors must verify compliance or restrict usage accordingly.

Customs and Import/Export Compliance

When shipping Johnson outboard motors internationally:

– Harmonized System (HS) Code: Typically 8407.80 (spark-ignition internal combustion engines). Accurate classification is essential for duty assessment.

– Import Restrictions: Some countries restrict or ban the import of used two-stroke engines due to environmental concerns. Verify local regulations before shipping.

– Documentation: Required documents include commercial invoice, bill of lading, packing list, and proof of origin. For used motors, a declaration of conformity or emissions compliance may be requested.

– Export Controls: While outboard motors are generally not subject to ITAR or EAR restrictions, dual-use components (e.g., advanced electronics) should be reviewed.

Logistics Considerations

Packaging and Transportation

- Proper Packaging: Use original crates or custom wooden crates with foam padding to prevent damage. Cover motors with waterproof wraps to protect against moisture.

- Horizontal vs. Vertical Transport: Outboard motors must be stored and transported in an upright position to prevent oil leakage and internal damage.

- Weight and Dimensions: Johnson motors range from 25 lbs (small models) to over 400 lbs (V6 models). Use appropriate lifting equipment and secure loads during transit.

- Shipping Modes:

- Ocean Freight: Use FCL (Full Container Load) for large shipments; palletize and secure motors to prevent shifting.

- Air Freight: Suitable for urgent spare parts; costly for full motors.

- Ground Transport: Use enclosed trailers to protect from weather and debris.

Storage and Handling

- Store motors in dry, temperature-controlled environments to prevent corrosion.

- Apply fogging oil to engines before long-term storage.

- Keep tilt/trim systems in neutral position and support the lower unit if stored for extended periods.

Safety and Handling Regulations

DOT and IATA Guidelines

- Road Transport (DOT): Ensure motors are securely fastened. Batteries (if attached) must be disconnected and protected from short circuits.

- Air Transport (IATA): Motors containing residual fuel or oil are classified as dangerous goods. Remove all fuel and oil before air shipment; declare as “machinery, internal combustion engines, fuel removed.”

Hazardous Materials

- Residual fuel and oil are flammable. Clean and drain all fluids before transport or disposal.

- Dispose of used oil and filters in accordance with local hazardous waste regulations.

End-of-Life and Disposal Compliance

Recycling and Waste Management

- WEEE (Waste Electrical and Electronic Equipment): Applies in the EU. Motors with electronic components (e.g., CDI units) must be recycled through approved facilities.

- Universal Waste Rules (U.S. EPA): Batteries, mercury switches (in older tilt systems), and oil must be handled as universal waste.

- Scrap Metal Recycling: Aluminum and stainless steel components can be recycled. Remove hazardous parts first.

Documentation for Disposal

Maintain records of proper disposal, including:

– Recycling certificates

– Waste manifests

– Proof of de-fueling and decommissioning

Maintenance and Repair Compliance

Service and Parts Distribution

- Only use EPA/CARB-compliant replacement parts when servicing legacy Johnson motors.

- Technicians should follow OEM service manuals and safety guidelines.

- Keep records of emissions-related repairs for regulatory audits (especially in regulated regions like California).

Warranty and Liability

Note: Johnson motors are no longer under manufacturer warranty. Distributors and repair shops assume liability for parts and service. Clearly disclose the “as-is” condition of used motors.

Conclusion

Handling Johnson outboard motors—especially legacy models—requires careful attention to environmental, transportation, and regulatory standards. Despite discontinued production, proper logistics and compliance ensure safe handling, legal operation, and responsible disposal. Always consult local, national, and international regulations before shipping, selling, or servicing these units.

In conclusion, sourcing Johnson outboard boat motors requires careful consideration of availability, condition, compatibility, and support. While Johnson motors were once a leading brand in the marine industry, their production ceased in the early 2000s when the brand was phased out in favor of Evinrude and other powertrain solutions. As a result, most available Johnson outboards today are used, refurbished, or sourced through secondary markets such as online classifieds, marine salvage yards, or auctions.

When sourcing a Johnson outboard, it is essential to verify the motor’s age, maintenance history, and parts availability. Due to the discontinuation of the brand, finding OEM parts may be challenging, making aftermarket or recycled components a necessity. Additionally, consulting with marine mechanics familiar with older two-stroke and four-stroke Johnson models can help ensure reliability and performance.

For those seeking vintage appeal or cost-effective marine propulsion, a well-maintained Johnson outboard can be a practical choice. However, buyers should weigh the benefits against potential long-term maintenance challenges and consider modern alternatives if ongoing support and fuel efficiency are priorities. Ultimately, sourcing a Johnson outboard motor can be a viable option with thorough research, proper due diligence, and access to knowledgeable marine resources.