The global small kitchen and personal care appliance market—driven significantly by demand for replacement and aftermarket components—is experiencing steady growth, with Grand View Research valuing the electric shaver and clipper market at USD 4.3 billion in 2023 and projecting a CAGR of 5.8% from 2024 to 2030. As brands like Oster maintain a strong foothold in professional and home grooming, the need for reliable replacement parts has intensified. With millions of Oster clippers in use across salons and households, especially in North America, consumers increasingly prioritize durable, compatible components such as blades, motors, and adjustment levers. This rising aftermarket demand has spurred a competitive manufacturing ecosystem. Based on performance, availability, and OEM partnerships, we’ve identified the top five manufacturers producing high-quality Oster clipper replacement parts trusted by professionals and consumers alike.

Top 5 Oster Clipper Replacement Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Oster Octane Replacement Parts – Genuine OEM Quality

Domain Est. 2017

Website: buybarber.com

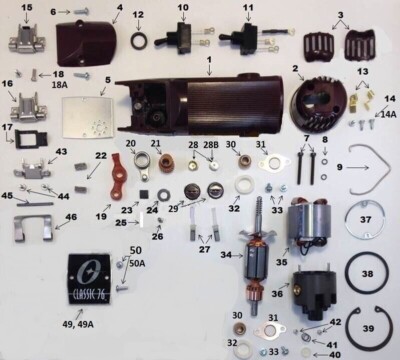

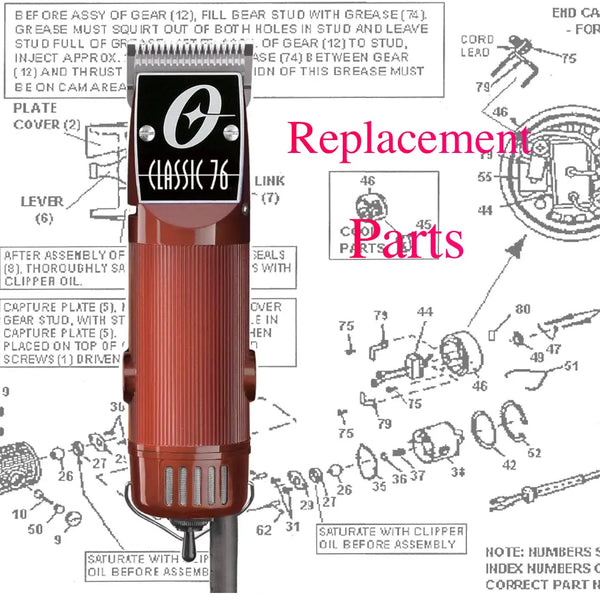

Key Highlights: This genuine item is supplied directly from the original equipment manufacturer, ensuring flawless compatibility and enduring quality for your Oster clippers….

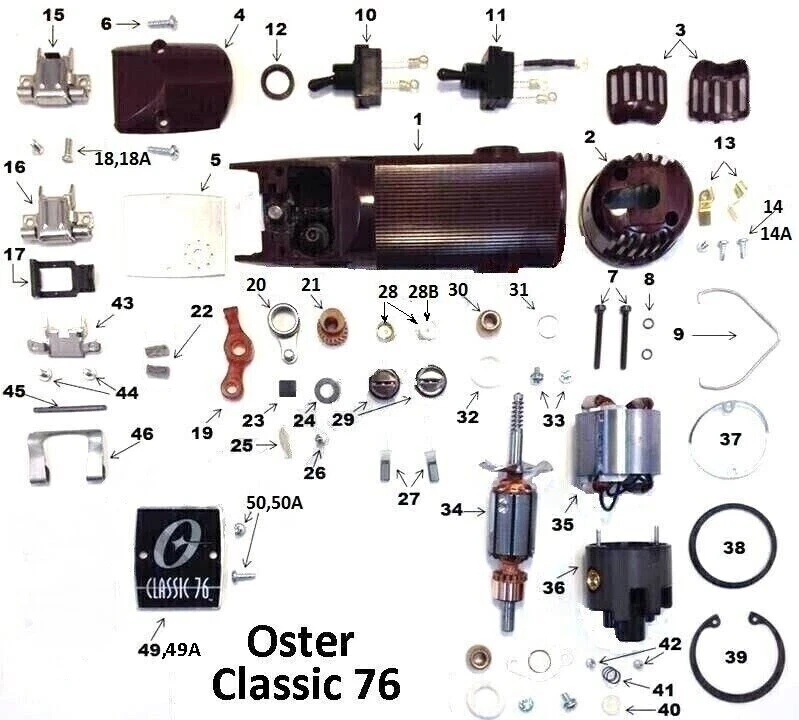

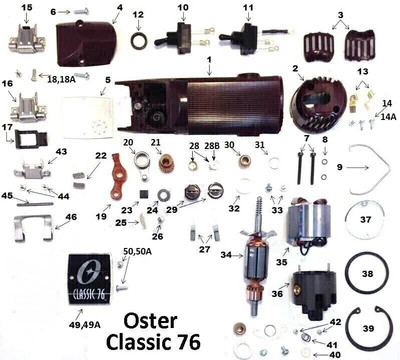

#2 Oster Clippers & Clipper Parts

Domain Est. 1999

Website: marbeck.com

Key Highlights: Oster Replacement Part 2 Speed A-5 Clipper – Housing-Burgundy. MSRP: Was: Now: (Inc. Tax). MSRP: Was: Now: $21.18. Genuine Oster Classic 76, Golden A5 Turbo ……

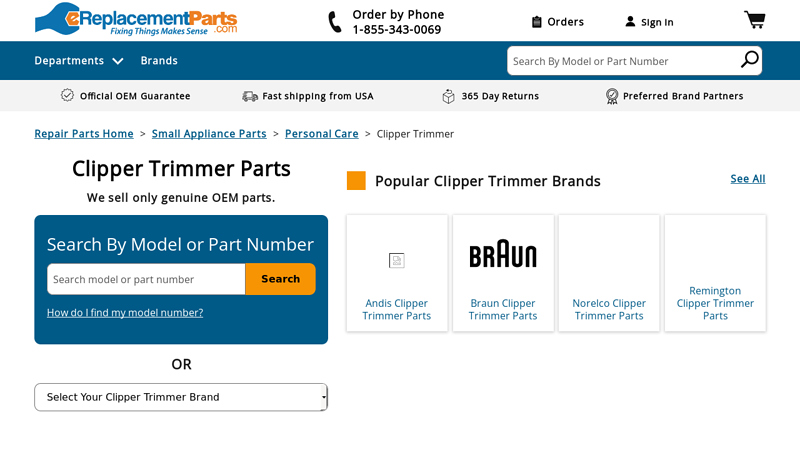

#3 Clipper Trimmer Parts – Authentic OEM Parts

Domain Est. 2004

Website: ereplacementparts.com

Key Highlights: 1–2 day deliveryGenuine Oster Pro replacement part, this product is sold in a set of two. It also includes the Brush Springs. It is used on the Clipper models shown below….

#4 Replacement Parts

Domain Est. 1995

Website: oster.com

Key Highlights: Call 1-800-334-0759 for Oster Appliances, Call 1-800-438-0935 for Oster Breadmakers, Call 1-800-339-2547 for Oster Clippers, Mon…

#5 Replacement Parts

Domain Est. 1998

Website: osterpro.com

Key Highlights: Replacement Grooming Bands · Replacement Grooming Bands ; Li-Ion Volt Replacement Battery · Li-Ion Volt Replacement Battery ; Li ION Pro 3000i Replacement Battery ……

Expert Sourcing Insights for Oster Clipper Replacement Parts

2026 Market Trends for Oster Clipper Replacement Parts: Key Insights

As we approach 2026, the market for Oster clipper replacement parts is poised for continued growth and transformation, driven by evolving consumer behavior, technological advancements, and shifting industry dynamics. This analysis explores the most significant trends expected to shape the landscape for these essential grooming accessories.

Rising Demand from Home Users and DIY Grooming

The popularity of at-home grooming continues to surge, accelerated by the lasting effects of the pandemic and the widespread availability of online tutorials. Consumers are investing in high-quality clippers like Oster models for personal and family use, leading to an increased need for replacement blades, guards, screws, and motors. By 2026, this segment is expected to represent the largest share of replacement part sales, as users extend the life of their devices through maintenance and part swaps rather than purchasing new units.

Emphasis on Sustainability and Repairability

Environmental awareness is influencing consumer choices, with more people seeking sustainable alternatives to disposable products. The “right to repair” movement is gaining momentum, encouraging brands and retailers to support product longevity. Oster’s reputation for durable, repairable clippers positions its replacement parts favorably in this climate. By 2026, sustainability will be a key purchasing factor, with customers actively seeking genuine and compatible parts to reduce electronic waste and extend the lifecycle of their grooming tools.

Growth of E-Commerce and Third-Party Marketplaces

Online platforms such as Amazon, eBay, and specialized grooming supply websites will remain dominant channels for purchasing Oster replacement parts. The convenience, competitive pricing, and user reviews available online make e-commerce the preferred method for most consumers. However, this also increases competition from third-party and generic part manufacturers. By 2026, Oster and authorized distributors will need to enhance their digital presence, improve search visibility, and combat counterfeit products to maintain market share.

Increased Competition from Compatible and Generic Parts

While genuine Oster parts are valued for quality and reliability, the market for compatible and generic replacement parts is expanding rapidly. These alternatives often offer lower prices, appealing to budget-conscious consumers and small grooming businesses. By 2026, innovation in manufacturing will narrow the performance gap between OEM and third-party parts, intensifying competition. Oster may respond by offering more affordable part kits or extended warranties to reinforce the value of genuine components.

Integration of Smart Features and IoT in Professional Tools

Although primarily affecting high-end clippers, the gradual integration of smart technology—such as usage tracking, blade wear sensors, and app connectivity—may begin influencing the replacement parts market by 2026. While most replacement parts will remain mechanical, future service models could include smart diagnostics that recommend specific part replacements. This trend will likely emerge first in professional-grade Oster models used in barbershops and veterinary clinics.

Expansion in Pet Grooming and Veterinary Sectors

The pet care industry is experiencing robust growth, with increased spending on pet grooming services and at-home pet care tools. Oster’s strong presence in the animal clipping market means replacement parts for pet clippers will see steady demand. By 2026, specialized blades and motors designed for different coat types and species will become more prevalent, driving innovation and segmentation within the replacement parts category.

Conclusion

By 2026, the Oster clipper replacement parts market will be shaped by a blend of consumer empowerment, sustainability demands, e-commerce dominance, and competitive pressures. Companies that prioritize authenticity, customer education, and digital engagement will be best positioned to succeed. As users increasingly value durability and repairability, Oster’s legacy of quality engineering will remain a key asset in maintaining trust and market leadership.

Common Pitfalls When Sourcing Oster Clipper Replacement Parts (Quality & IP Concerns)

Sourcing replacement parts for Oster clippers—popular among barbers, pet groomers, and home users—can be fraught with challenges, particularly regarding part quality and intellectual property (IP) infringement. Being aware of these pitfalls helps ensure reliable performance and avoids legal or safety risks.

Poor Quality Imitations and Counterfeits

One of the most significant risks when purchasing Oster clipper parts is encountering low-quality imitations or outright counterfeits. These parts are often manufactured using inferior materials and lack the precision engineering of genuine Oster components. As a result, they may wear out quickly, fail to fit properly, or even damage the clipper motor due to misalignment or excessive vibration. Users may experience reduced cutting performance, overheating, or complete tool failure, ultimately costing more in repairs or replacements.

Lack of Brand Authorization and Warranty Coverage

Many third-party sellers offer “compatible” Oster parts without being authorized distributors. Purchasing from these sources means losing access to manufacturer warranties and support. If a non-genuine part fails, Oster will not cover damages to the clipper under warranty, leaving the user financially responsible. Additionally, unauthorized parts may not meet safety or regulatory standards, posing potential risks during operation.

Intellectual Property Infringement Risks

Selling or distributing unlicensed Oster replacement parts may constitute trademark or patent infringement. Oster, as a registered brand under Conair Corporation, holds intellectual property rights over its clipper designs, blade configurations, and proprietary components. Third-party manufacturers who replicate these parts without licensing agreements violate IP laws. Buyers—especially commercial groomers or salons—risk supporting illegal operations, and in some jurisdictions, could face liability for using counterfeit or infringing parts in a business setting.

Misleading Product Listings and False Claims

Online marketplaces are rife with listings falsely advertising “OEM” or “genuine Oster” parts when they are, in fact, generic copies. These misleading descriptions can deceive buyers into believing they are purchasing authentic components. Terms like “Oster-style” or “fits Oster models” are often used to skirt IP laws while still implying compatibility and quality that may not exist. Careful scrutiny of seller credentials, product reviews, and packaging details is essential to avoid these traps.

Inconsistent Compatibility and Performance Issues

Even if a third-party part physically fits an Oster clipper, it may not deliver the same performance. Differences in blade sharpness, tooth alignment, or motor engagement can affect cutting precision and user comfort. For professionals, inconsistent performance undermines client satisfaction and service quality. Generic parts may also require more frequent adjustments or sharpening, increasing long-term maintenance efforts.

Conclusion

To avoid these pitfalls, always purchase Oster clipper replacement parts from authorized dealers or directly through Oster’s official channels. Verify seller authenticity, check for warranty information, and be skeptical of unusually low prices—a hallmark of counterfeit goods. Protecting yourself from substandard parts and IP violations ensures optimal clipper performance, safety, and compliance.

Logistics & Compliance Guide for Oster Clipper Replacement Parts

This guide outlines the essential logistics and compliance considerations for the distribution, handling, and sale of Oster Clipper Replacement Parts. Adherence to these guidelines ensures regulatory compliance, operational efficiency, and customer satisfaction.

Product Classification & Tariff Codes

Identify accurate Harmonized System (HS) codes for Oster clipper replacement parts (e.g., blades, guards, motors, screws). Typical classifications may fall under HS Code 8467 (Parts for tools of heading 8465–8466) or 8509 (Parts of small electric motors). Confirm with the destination country’s customs authority to avoid classification errors, delays, or penalties.

Import & Export Regulations

Comply with import/export laws in both origin and destination countries. Ensure all shipments include proper documentation, such as commercial invoices, packing lists, and certificates of origin. Verify if export licenses or import permits are required, particularly for electronic components or battery-powered parts. Maintain up-to-date knowledge of trade agreements affecting tariffs (e.g., USMCA, EU trade preferences).

Packaging & Labeling Requirements

Package parts securely to prevent damage during transit. Label all packages with:

– Product name and Oster part number

– Quantity and weight

– Country of origin

– Safety warnings (if applicable)

– Barcode/UPC for retail distribution

Ensure multilingual labeling where required by local regulations (e.g., French in Canada, Spanish in Latin America).

Regulatory Compliance

Verify that all replacement parts meet relevant safety and electromagnetic compatibility (EMC) standards, including:

– FCC (USA) for electronic components

– CE marking (EU) per Low Voltage Directive and RoHS

– ICES-003 (Canada)

– PSE (Japan), if applicable

Maintain technical documentation and test reports to demonstrate compliance upon request.

Product Authenticity & Warranty

Distribute only genuine Oster-branded replacement parts. Counterfeit or non-OEM parts may violate intellectual property laws and void user warranties. Clearly communicate warranty terms to distributors and end users, typically limited to manufacturing defects.

Transportation & Inventory Management

Use reliable freight carriers experienced in handling small, high-value components. Optimize inventory turnover with demand forecasting to reduce overstocking. Store parts in a dry, temperature-controlled environment to prevent corrosion or material degradation.

Environmental & Disposal Compliance

Adhere to environmental regulations for electronic waste (e-waste). Inform customers of proper disposal methods for worn-out parts, particularly those containing metals or plastics. Follow WEEE (EU) or state-specific e-waste laws (e.g., California) when applicable.

Recordkeeping & Audits

Retain all logistics, compliance, and sales documentation for a minimum of five years. Conduct periodic internal audits to ensure ongoing adherence to regulatory and contractual requirements. Prepare for third-party or customs audits with organized digital records.

Distributor & Retailer Guidelines

Provide authorized distributors with compliance training and updated product documentation. Require adherence to pricing policies, branding standards, and warranty procedures. Prohibit the sale of parts through unauthorized online marketplaces that may compromise authenticity.

By following this guide, stakeholders ensure the lawful, efficient, and responsible distribution of Oster Clipper Replacement Parts worldwide.

In conclusion, sourcing replacement parts for an Oster clipper requires careful consideration of compatibility, authenticity, and reliability. By identifying the exact model number and researching authorized dealers, reputable online marketplaces, or directly contacting Oster customer service, users can ensure they obtain genuine, high-quality components that maintain the clipper’s performance and longevity. While third-party alternatives may offer cost savings, prioritizing OEM (Original Equipment Manufacturer) parts helps avoid potential damage and ensures optimal functionality. Regular maintenance and timely replacement of worn parts such as blades, screws, or pivot knobs not only extend the life of the clipper but also provide a consistently smooth and efficient grooming experience. Ultimately, investing time in sourcing the right replacement parts supports both the durability of the tool and user satisfaction.