The global O-ring rubber market continues to expand, driven by rising demand across industries such as automotive, aerospace, oil & gas, and industrial manufacturing. According to a 2023 report by Mordor Intelligence, the market was valued at approximately USD 2.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of over 5.8% from 2023 to 2028. Factors such as increasing equipment complexity, stringent sealing requirements, and the need for high-performance elastomers in extreme environments are accelerating procurement from reliable O-ring manufacturers. With supply chain resilience and material innovation taking center stage, identifying leading producers becomes critical for procurement teams aiming to balance cost, compliance, and performance. Based on production capacity, global reach, material specialization, and adherence to international quality standards, here are the top 10 O-ring rubber manufacturers shaping the industry landscape.

Top 10 Oring Rubber Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Seals and O-Rings

Domain Est. 1995

Website: ph.parker.com

Key Highlights: … WEB VERSION”,”document-type”:”Static File”,”document-url”:”https://www … Manufacturers’ Cross-Reference Catalog–Form 560″,”document-type”:”Static ……

#2 Apple Rubber Products: Rubber Seals, Sealing Devices & O

Domain Est. 1995 | Founded: 1971

Website: applerubber.com

Key Highlights: Apple Rubber is an ISO 9001 designer and manufacturer of standard AS568 & ISO 3601 o-rings, rubber seals, molded shapes and custom seals since 1971….

#3 Southern Rubber

Domain Est. 1998

Website: southernrubber.com

Key Highlights: Southern Rubber is a distributor and fabricator of industrial rubber goods, but we are not limited to providing only these products. Learn about our full range ……

#4 National Rubber Corporation

Domain Est. 1998

Website: nationalrubber.com

Key Highlights: Leading manufacturer of custom rubber products, gaskets, seals, and molded components for aerospace, automotive, appliance, and chemical processing ……

#5 O Ring Manufacturer

Domain Est. 2009

Website: oringstore.com

Key Highlights: We serve customers worldwide for both original equipment manufacturers and the aftermarket. We have standard range of o rings and seals in stock….

#6 O

Domain Est. 1997

Website: marcorubber.com

Key Highlights: Order O-Rings Online from the world’s largest o-ring and seal inventory and production network. Get quick delivery and service with simple online ordering….

#7 O

Domain Est. 1997

Website: rubberfab.com

Key Highlights: Rubber Fab offers AS568 Standard o-rings, metric, DIN and custom sizes in a wide variety of materials….

#8 Order O

Domain Est. 1998 | Founded: 1998

Website: allorings.com

Key Highlights: Order O-Rings Quick and Easy Since 1998 X-Ring Seals Rubber Washers. Fast-Expert-Quality-Service. Worldwide Inventory Network. Low Minimum Order….

#9 Ace Seal

Domain Est. 2000

Website: aceseal.com

Key Highlights: We specialize in manufacturing rubber O-rings, seals, gaskets, barrel bungs, custom molded rubber products, and more, using a variety of elastomers….

#10 Viton® O

Domain Est. 2007

Website: globaloring.com

Key Highlights: Global O-Ring and Seal carries a deep and broad inventory of Viton® o-rings in AS568 and metric sizes. Click the button below to check the inventory….

Expert Sourcing Insights for Oring Rubber

H2: Market Trends for Oring Rubber in 2026

As the global industrial and manufacturing sectors evolve, the Oring rubber market is expected to undergo significant transformation by 2026. Driven by technological advancements, sustainability mandates, and shifting demand across key end-use industries, the second half of the decade will mark a period of strategic growth and adaptation for players in the rubber sealing solutions industry.

1. Rising Demand from Automotive and EV Sectors

The automotive industry—particularly the electric vehicle (EV) segment—will remain a primary growth driver for Oring rubber in 2026. With global EV production continuing its upward trajectory, there is increasing demand for high-performance elastomers that can withstand elevated temperatures, chemical exposure, and dynamic mechanical stress. Orings made from fluorocarbon rubber (FKM) and silicone rubber (VMQ) are seeing heightened adoption in battery packs, power electronics, and cooling systems. OEMs are prioritizing reliability and long-term durability, pushing suppliers to innovate with advanced rubber compounds.

2. Expansion in Renewable Energy Applications

The global push toward renewable energy sources, especially wind and solar power, will boost the need for specialized Orings. In wind turbines, sealing components must endure extreme weather conditions and constant mechanical stress. By 2026, demand for EPDM and nitrile rubber (NBR) Orings is expected to rise due to their excellent resistance to ozone, UV radiation, and temperature fluctuations. Additionally, hydrogen infrastructure development—including electrolyzers and fueling stations—will create new markets for high-pressure, hydrogen-compatible Orings made from perfluoroelastomers (FFKM).

3. Industrial Automation and Smart Manufacturing

The proliferation of Industry 4.0 technologies is influencing material specifications in automation and fluid power systems. In 2026, Orings will increasingly be integrated into smart pneumatic and hydraulic systems that require leak-proof, long-lasting seals. Manufacturers are investing in predictive maintenance solutions, which in turn demand more reliable sealing performance. This trend is encouraging the adoption of high-purity, low-outgassing rubber materials in semiconductor manufacturing and robotics.

4. Sustainability and Regulatory Pressures

Environmental regulations are shaping material choices across the Oring rubber market. By 2026, REACH, RoHS, and other compliance standards will push manufacturers to phase out hazardous substances such as certain phthalates and heavy metal accelerators. Bio-based and recyclable rubber compounds are gaining traction, with companies exploring sustainable alternatives like isoprene rubber derived from renewable feedstocks. Additionally, circular economy principles are prompting innovations in Oring reclamation and end-of-life recycling processes.

5. Regional Shifts and Supply Chain Resilience

Asia-Pacific, led by China, India, and Southeast Asia, will continue to dominate Oring rubber consumption due to robust industrial growth and infrastructure development. However, nearshoring and supply chain localization trends—especially in North America and Europe—are prompting manufacturers to diversify production bases. In 2026, geopolitical stability, logistics efficiency, and access to raw materials will influence where Oring rubber capacity is expanded.

6. Material Innovation and Customization

End-users are demanding increasingly specialized Oring solutions tailored to niche applications. This includes high-temperature resistance for aerospace, chemical inertness for pharmaceutical processing, and low-compression set for reusable medical devices. As a result, rubber compounders are investing in R&D to develop next-generation materials such as thermoplastic vulcanizates (TPVs) and hydrogenated nitrile rubber (HNBR), which offer superior performance in demanding environments.

Conclusion

By 2026, the Oring rubber market will be defined by innovation, sustainability, and responsiveness to evolving industrial needs. Companies that invest in advanced materials, digital integration, and environmentally responsible manufacturing will be best positioned to capture growth across automotive, energy, and high-tech sectors. Strategic partnerships and agility in supply chain management will be critical success factors in this competitive landscape.

Common Pitfalls When Sourcing O-Ring Rubber (Quality, IP)

Sourcing O-ring rubber materials involves critical considerations around quality and intellectual property (IP), and overlooking these can lead to performance failures, legal risks, and supply chain disruptions. Below are key pitfalls to avoid:

Inadequate Material Specification and Traceability

One of the most frequent issues is failing to clearly define and verify the rubber compound used in O-rings. Suppliers may provide generic names (e.g., “Nitrile” or “EPDM”) without disclosing the exact formulation, filler content, or additives. This lack of traceability increases the risk of receiving substandard or inconsistent materials that do not meet performance requirements under pressure, temperature, or chemical exposure.

Best Practice: Require detailed material certifications (e.g., ASTM D2000, ISO 3601), full traceability through lot numbers, and third-party test reports validating physical and chemical properties.

Misrepresentation of IP or Use of Counterfeit Formulations

Rubber compound formulations, especially high-performance ones (e.g., fluorocarbon, perfluoroelastomers), are often protected by patents or trade secrets. Unethical suppliers may reverse-engineer or copy proprietary compounds without authorization, leading to IP infringement. Using such materials exposes the buyer to legal liability and undermines product reliability.

Best Practice: Source from authorized distributors or manufacturers with documented IP rights. Include IP indemnification clauses in contracts and verify supplier legitimacy through industry certifications (e.g., ISO 9001, API Q1).

Inconsistent Quality Control and Process Standards

Low-cost suppliers may cut corners in manufacturing processes—such as curing time, mold maintenance, or post-curing—resulting in O-rings with poor dimensional accuracy, surface defects, or low resilience. Without consistent quality control, batch-to-batch variability can compromise sealing performance.

Best Practice: Audit supplier facilities or require evidence of robust quality management systems. Implement incoming inspection protocols, including hardness testing, visual inspection, and compression set analysis.

Overlooking Environmental and Regulatory Compliance

Certain rubber formulations contain restricted substances (e.g., phthalates, heavy metals) that violate environmental regulations like REACH or RoHS. Using non-compliant materials can lead to shipment rejections, fines, or damage to brand reputation.

Best Practice: Confirm compliance with relevant regulations through supplier declarations and periodic testing. Specify environmental requirements upfront in procurement documentation.

Failure to Match Material to Application Requirements

Selecting an O-ring material without fully evaluating the operating environment—such as exposure to oils, acids, steam, or extreme temperatures—can result in premature seal failure. For example, using standard NBR in high-temperature applications leads to rapid degradation.

Best Practice: Collaborate with material engineers to define application-specific requirements and select O-rings based on chemical compatibility, temperature range, and mechanical stress. Use standardized selection guides (e.g., Parker O-Ring Handbook).

By addressing these pitfalls proactively, organizations can ensure reliable performance, maintain legal compliance, and protect their supply chain integrity when sourcing rubber O-rings.

Logistics & Compliance Guide for Oring Rubber

Introduction

This guide outlines the key logistics and compliance considerations for handling, storing, transporting, and documenting Oring Rubber products. Adherence to these guidelines ensures product integrity, regulatory compliance, and operational efficiency across the supply chain.

Product Handling and Storage

Oring Rubber components are sensitive to environmental conditions. Store in a cool, dry, and dark environment with temperatures between 15°C and 25°C (59°F–77°F) and relative humidity below 65%. Avoid direct sunlight, ozone sources (e.g., electric motors), and contact with solvents, oils, or heavy metals. Keep Orings in original packaging until use to prevent deformation and contamination.

Packaging Standards

Use non-reactive, sealed packaging materials such as polyethylene bags with desiccants to prevent moisture absorption. Clearly label packages with product type, size, material specification (e.g., NBR, EPDM, FKM), batch/lot number, and manufacturing/expiry dates. For bulk shipments, secure Orings in rigid containers to prevent compression or tangling.

Transportation Requirements

Ship Oring Rubber via temperature-controlled transport when ambient conditions exceed storage specifications. Avoid prolonged exposure to extreme heat, cold, or vibration. Use carriers compliant with ISO 9001 and ISO 14001 standards. Ensure packaging withstands stacking and standard freight handling. For international shipments, comply with IATA, IMDG, or ADR regulations as applicable.

Regulatory Compliance

Ensure all Oring Rubber materials meet relevant industry standards such as ASTM D2000, ISO 3601, and SAE AS568. Verify material certifications (e.g., FDA, NSF, RoHS, REACH) based on end-use application (e.g., food processing, medical, automotive). Maintain full traceability through batch records and Material Safety Data Sheets (MSDS/SDS).

Customs and Documentation

For cross-border shipments, prepare accurate commercial invoices, packing lists, and certificates of origin. Include Harmonized System (HS) code 4016.93 for rubber seals and gaskets. Declare any restricted substances per destination country regulations. Retain documentation for a minimum of five years for audit purposes.

Quality Assurance and Audits

Conduct regular internal audits to verify compliance with logistics protocols. Inspect incoming and outgoing shipments for damage, labeling accuracy, and storage conditions. Partner with third-party logistics (3PL) providers that undergo periodic quality and compliance evaluations.

Emergency and Contingency Procedures

Establish protocols for handling damaged shipments, temperature excursions, or regulatory non-conformities. Implement a recall plan that includes quarantine procedures, customer notification, and root cause analysis. Train logistics personnel on emergency response and reporting procedures.

Conclusion

Proper logistics and compliance management are essential to maintaining the performance and reliability of Oring Rubber products. By following this guide, organizations can ensure regulatory adherence, minimize risks, and deliver consistent quality to customers worldwide.

Conclusion for Sourcing O-Ring Rubber:

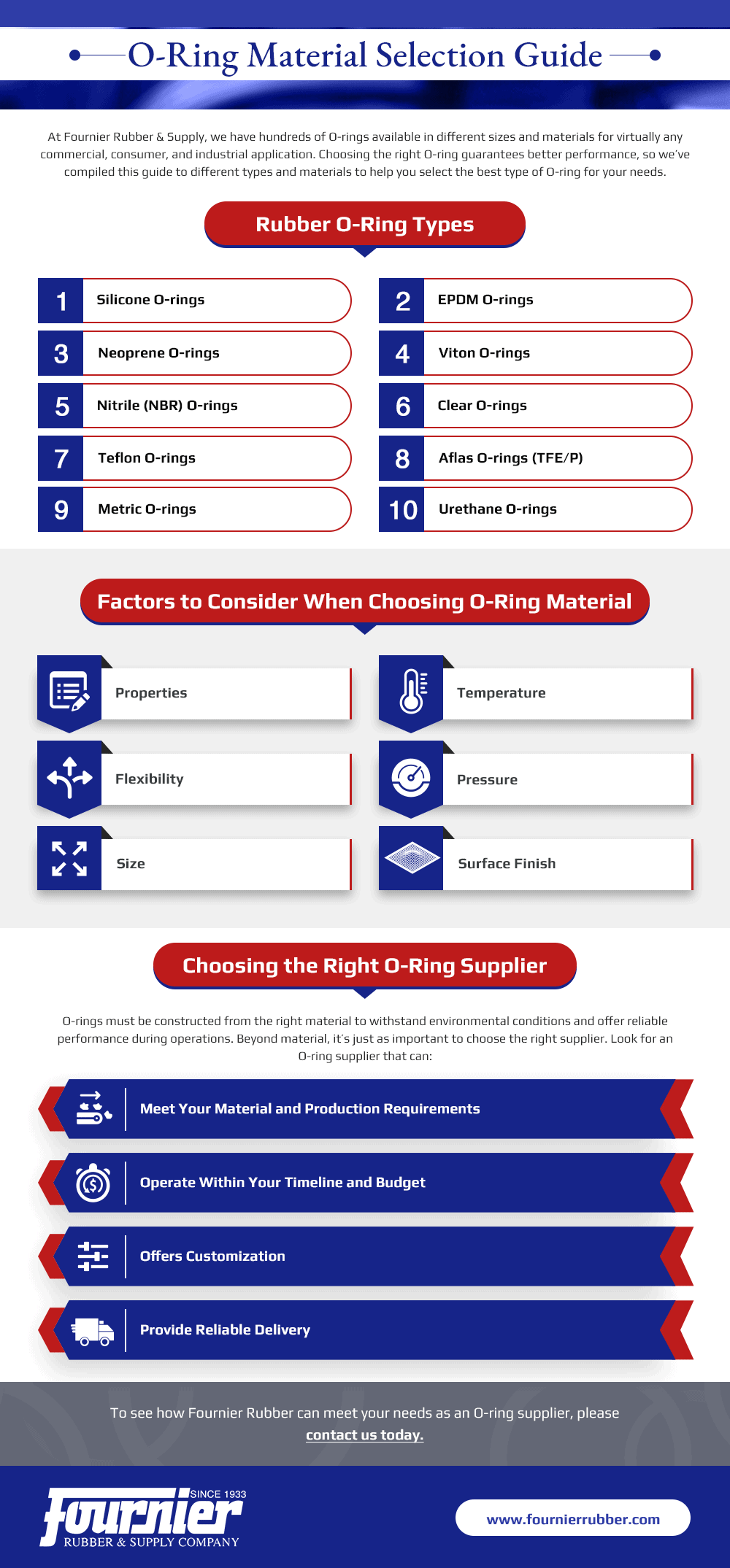

Sourcing the right O-ring rubber requires a careful balance between material compatibility, performance requirements, environmental conditions, and cost-efficiency. Selecting the appropriate elastomer—such as Nitrile (NBR), Viton (FKM), EPDM, Silicone, or Neoprene—is critical to ensuring reliability, longevity, and safety in sealing applications across industries like automotive, aerospace, oil and gas, and manufacturing.

A successful sourcing strategy involves evaluating suppliers based on material quality, consistency, certifications (e.g., ISO, AS9100, FDA), and ability to meet regulatory and technical specifications. Additionally, considering total cost of ownership—beyond just unit price—helps avoid failures due to incompatible or substandard materials.

In conclusion, effective O-ring rubber sourcing combines thorough technical assessment with strong supplier partnerships, ensuring optimal performance, reduced downtime, and long-term cost savings. Regular review and testing of materials further support continuous improvement and reliability in critical sealing applications.