The global organic personal care market is experiencing robust growth, driven by rising consumer awareness around chemical-free ingredients and sustainable sourcing. According to a 2023 report by Grand View Research, the global organic personal care market size was valued at USD 26.3 billion and is projected to expand at a compound annual growth rate (CAGR) of 9.6% from 2023 to 2030. This surge in demand is further amplified by increased regulation on synthetic additives and a shift toward eco-conscious lifestyles, particularly in North America and Europe. As organic soap forms a key segment within this category, the need for high-quality, certified organic soap bases has become critical for formulators and brands. In response, a number of manufacturers have emerged as leaders, combining sustainable practices with scalable production and compliance with international standards such as USDA Organic, Ecocert, and COSMOS. Based on production capacity, certifications, global reach, and ingredient transparency, the following nine manufacturers represent the top suppliers of organic soap bases, poised to meet the expanding demands of a rapidly evolving market.

Top 9 Organic Soap Base Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Bulk Soap Base Manufacturers

Domain Est. 2012

Website: soapytwist.com

Key Highlights: Free deliverySoapy Twist is one stop shop for all soap and cosmetic making supplies. Get wide variety of bulk melt and pour soap bases, liquid bases, cosmetic bases, ……

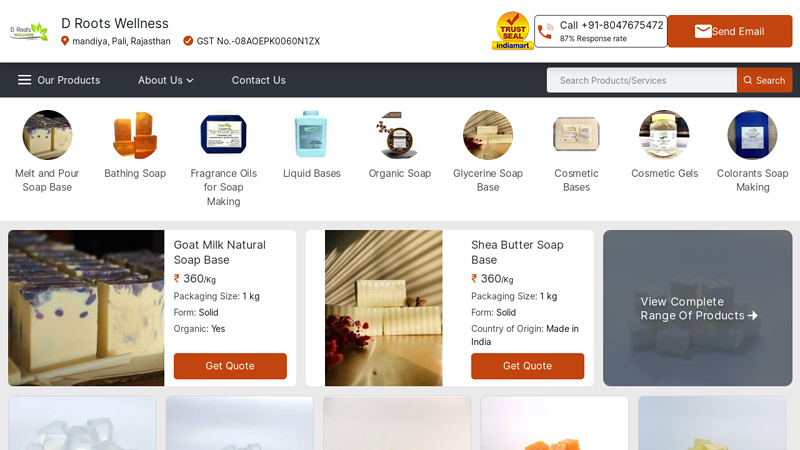

#2 Melt and Pour Soap Base and Bathing Soap Manufacturer

Domain Est. 2022

Website: drootsbotanica.in

Key Highlights: Exclusive manufacturer and exporter of premium soap bases, liquid bases, and cosmetic gels. Ethically sourced, cruelty-free, and crafted for excellence….

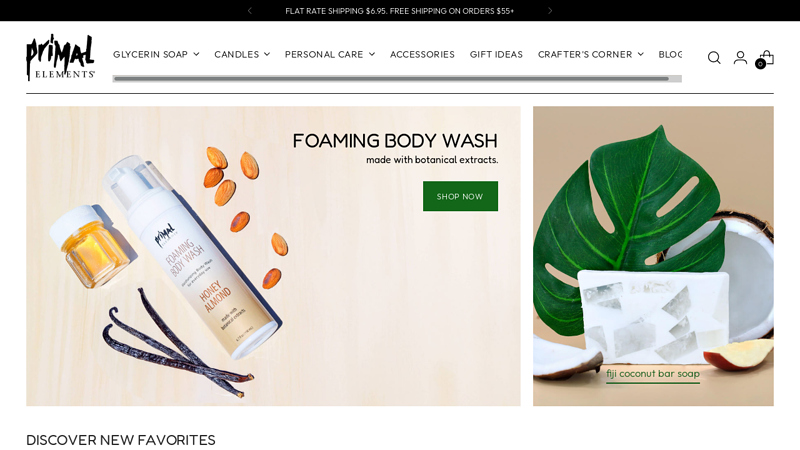

#3 Primal Elements

Domain Est. 1997

Website: primalelements.com

Key Highlights: 7-day delivery 30-day returnsPrimal Elements is dedicated to providing the highest quality glycerin soap, candles, bath, and skin care products. Shop now our luxury glycerin soapba…

#4 Bradford

Domain Est. 1997

Website: bradfordsoap.com

Key Highlights: Bradford is one of the few companies to manufacture both soap base and finished soap bars for soap and syndet formulations. Why Custom Soap Bases Matter….

#5 Vermont Soap

Domain Est. 1998

Website: vermontsoap.com

Key Highlights: Say good-bye to harmful petrochemical ingredients in your soap, and hello to natural materials. Order online from Vermont Soap!…

#6 Bulk Melt & Pour Glycerin Soap Bases

Domain Est. 1999

Website: fromnaturewithlove.com

Key Highlights: Explore premium quality, bulk specialty soap bases to create beautiful, nourishing, skin-soothing bars of professional quality soap….

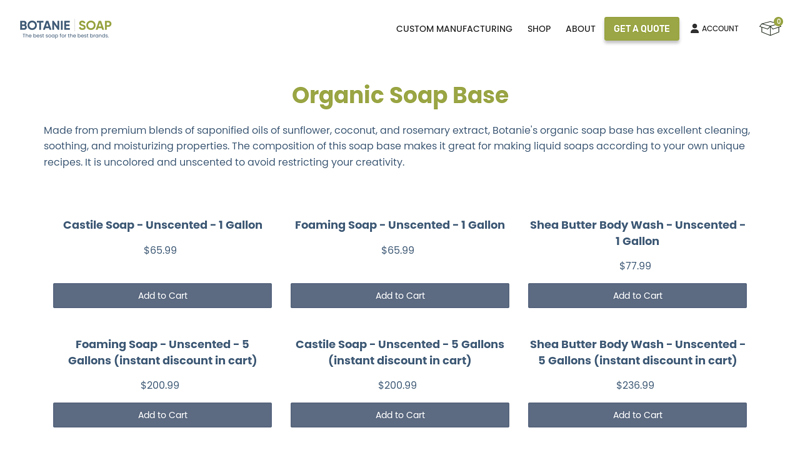

#7 Organic Soap Base

Domain Est. 2000

Website: botaniesoap.com

Key Highlights: 6-day delivery 120-day returnsOrganic soap base that we make at Botanie Soap is free from sulfates and other harsh chemicals. Explore our collection and order today….

#8 Private Label Soap Bases

Domain Est. 2009

Website: vanguardsoap.com

Key Highlights: At Vanguard Soap, we specialize in private label soap base manufacturing, giving brands full control over the formulation from the very beginning….

#9 INDIA’S No 1 Handmade Soap Making Raw Material Supplier …

Domain Est. 2018

Website: leelaherbal.com

Key Highlights: Our Products: Handmade Soap & Candle Making Raw Material, fragrance oil, clay powder ect. Food, Flavours, Liquid & Powder….

Expert Sourcing Insights for Organic Soap Base

2026 Market Trends for Organic Soap Base

The organic soap base market is poised for significant transformation by 2026, driven by evolving consumer preferences, technological advancements, and increasing regulatory scrutiny. Key trends shaping the landscape include:

Rising Consumer Demand for Transparency and Clean Labeling

Consumers are increasingly scrutinizing ingredient lists, demanding full traceability and minimal, recognizable components. By 2026, organic soap base manufacturers will prioritize transparent sourcing, third-party certifications (such as USDA Organic, COSMOS, and Ecocert), and clear labeling to build trust. There will be a notable shift away from synthetic preservatives and additives toward naturally derived alternatives like rosemary extract and vitamin E.

Expansion of Vegan and Cruelty-Free Formulations

The convergence of ethical consumerism and plant-based lifestyles will drive demand for vegan-certified organic soap bases. By 2026, glycerin and fatty acid sources will increasingly be derived from non-animal origins, with manufacturers emphasizing cruelty-free production and alignment with Leaping Bunny or PETA standards to appeal to socially conscious buyers.

Innovation in Functional and Therapeutic Ingredients

Organic soap bases are evolving beyond basic cleansing to include added skincare benefits. Anticipated trends include integration of adaptogenic botanicals (e.g., ashwagandha, reishi), prebiotics for skin microbiome support, and targeted formulations for sensitive, acne-prone, or aging skin. This functionalization will position organic soap bases as part of holistic wellness routines.

Growth in Sustainable and Zero-Waste Packaging

Environmental concerns will push brands toward compostable, refillable, or plastic-free packaging solutions by 2026. Consumers will favor soap bases supplied in bulk or with minimal carbon footprint packaging, reinforcing brand loyalty among eco-aware demographics and aligning with circular economy principles.

Regional Market Diversification and Supply Chain Localization

While North America and Western Europe remain strong markets, growth is accelerating in Asia-Pacific and Latin America due to rising disposable incomes and health awareness. To mitigate supply chain disruptions and reduce emissions, manufacturers will increasingly localize sourcing and production, boosting regional self-sufficiency in organic raw materials like coconut, olive, and shea oils.

Regulatory Harmonization and Quality Standardization

As governments tighten cosmetic regulations (e.g., EU Ecodesign for Sustainable Products Regulation), manufacturers will face stricter compliance requirements regarding ingredient safety and environmental impact. By 2026, industry-wide standardization of organic soap base definitions and production protocols is expected, enhancing consumer confidence and facilitating global trade.

Technological Advancements in Cold-Process and Waterless Formulations

Innovations in cold-process saponification and anhydrous (waterless) soap bases will gain traction, preserving more nutrients and reducing microbial contamination risks. These technologies support longer shelf life without synthetic preservatives and appeal to artisanal and premium skincare brands seeking efficacy and purity.

In summary, the 2026 organic soap base market will be defined by heightened transparency, ethical sourcing, functional benefits, and environmental stewardship. Manufacturers who proactively adapt to these trends will position themselves as leaders in the growing clean beauty economy.

Common Pitfalls Sourcing Organic Soap Base (Quality, IP)

Sourcing organic soap base seems straightforward, but hidden pitfalls can compromise your product quality, brand integrity, and even lead to legal issues. Being aware of these common traps—particularly concerning quality and intellectual property (IP)—is crucial for success.

1. Misleading or Inadequate Organic Certification

One of the biggest quality pitfalls is encountering suppliers who claim “organic” status without proper, verifiable certification. Look out for:

- “Made with Organic Ingredients” vs. “Certified Organic”: A base labeled “made with organic oils” might contain only 10-30% organic content. True certified organic soap bases (especially in regions like the EU or for USDA NOP compliance) require a much higher threshold (often 95%+) of organic agricultural ingredients.

- Lack of Recognized Certification: Accept only certifications from reputable bodies (e.g., USDA Organic, ECOCERT, COSMOS, Soil Association). Verify the certification number on the supplier’s website or the certifying body’s database.

- Scope of Certification: Ensure the specific soap base formulation is certified, not just the raw ingredients. Processing aids and manufacturing facilities must also comply.

2. Hidden Non-Organic or Synthetic Additives

Even certified bases can contain problematic additives that affect quality and purity:

- Synthetic Preservatives or Stabilizers: To extend shelf life, some suppliers add synthetics like phenoxyethanol or EDTA, which may not align with clean beauty standards despite organic certification allowances.

- Non-Organic Processing Aids: Substances used during manufacturing (e.g., certain filtration aids) might not be organic, potentially contaminating the final product.

- Fillers or Diluents: Some bases are diluted with non-organic oils, glycerin, or water to reduce cost, lowering the effective organic content and altering performance.

3. Inconsistent Quality and Performance

Organic sourcing variability can lead to batch inconsistencies:

- Natural Variation in Raw Materials: Organic oils (e.g., shea, coconut) can vary in color, scent, and texture based on harvest and region, affecting the final soap’s appearance and lather.

- Saponification Control: Poor control during the saponification process can result in bases with excess lye (skin-irritating) or unsaponified oils (rancidity, poor lather).

- Glycerin Content & Clarity: Natural glycerin retention affects moisturizing properties, but variations can impact clarity and hardness. Some suppliers remove glycerin; others add it back—know which.

4. Intellectual Property (IP) Risks: Formula Theft and Brand Dilution

When sourcing custom or unique organic bases, IP protection is often overlooked:

- Lack of Confidentiality Agreements (NDAs): Sharing your unique formula, scent blends, or ingredient specifications without an NDA exposes your innovation. Suppliers could replicate or sell your concept to competitors.

- Unprotected Custom Formulations: If you develop a proprietary blend with the supplier, ensure the contract clearly states IP ownership. Without this, the supplier might claim rights or reuse the formula.

- Trademark and Brand Confusion: Sourcing a base very similar to a competitor’s (even unintentionally) could lead to trademark disputes. Ensure your final product is distinct in name, packaging, and formulation.

5. Supply Chain Transparency and Traceability Gaps

Organic integrity relies on a transparent supply chain:

- Opaque Ingredient Sourcing: Suppliers may not disclose the origin of all components, making it hard to verify true organic status or ethical sourcing.

- Risk of Contamination: Cross-contamination with non-organic materials can occur during farming, transport, or manufacturing if proper segregation isn’t enforced.

- Lack of Documentation: Inadequate lot tracing, Certificates of Analysis (CoA), or organic transaction certificates (OTCs) make audits and compliance verification difficult.

6. Overlooking Glycerin and Moisture Content

Glycerin is a key byproduct of saponification and a natural humectant:

- “Glycerin-Rich” Claims Without Verification: Some suppliers market bases as glycerin-rich, but actual content can vary. Request CoAs showing glycerin levels.

- Moisture Imbalance: Too much moisture leads to soft, mushy soap; too little makes it brittle. Poorly dried or stored bases affect performance and shelf life.

7. Hidden Costs and Minimum Order Quantities (MOQs)

While not strictly quality or IP, these impact sourcing viability:

- High MOQs for Custom Bases: Developing a unique organic formula often requires large initial orders, tying up capital and increasing risk if the product doesn’t sell.

- Certification Costs Passed On: The cost of maintaining organic certification may be reflected in higher base prices—ensure you’re getting value.

Mitigation Strategy: Always request full documentation (CoA, organic certificates, ingredient deck), sign NDAs before sharing formulas, audit suppliers when possible, and start with small trial batches to test quality and performance before scaling. Prioritize suppliers with transparent practices and a proven track record in organic cosmetics.

H2: Logistics & Compliance Guide for Organic Soap Base

Handling and distributing organic soap base requires strict adherence to logistics best practices and regulatory compliance standards to maintain product integrity, ensure consumer safety, and meet organic certification requirements. This guide outlines key considerations for the logistics and compliance of organic soap base from manufacturing to delivery.

1. Certification & Regulatory Compliance

a. Organic Certification

– Ensure the organic soap base is certified by a recognized organic certification body (e.g., USDA Organic, COSMOS, ECOCERT, or Soil Association).

– Maintain valid certificates and documentation for audit purposes.

– Verify that all raw materials used in the soap base comply with organic standards (e.g., no synthetic additives, GMOs, or prohibited pesticides).

b. Labeling Requirements

– Labels must include:

– Organic certification logo and certifier name.

– Ingredient list (INCI names).

– Net weight.

– Batch number and expiration date.

– Manufacturer and distributor information.

– Comply with regional labeling laws (e.g., FDA in the U.S., EU Cosmetics Regulation (EC) No 1223/2009).

c. Product Safety & Notifications

– Conduct and document a Cosmetic Product Safety Assessment (CPSR) as required under EU regulations.

– Register products in the EU Cosmetic Products Notification Portal (CPNP) if selling in Europe.

– Comply with FDA Voluntary Cosmetic Registration Program (VCRP) in the U.S.

2. Storage & Handling

a. Storage Conditions

– Store in a cool, dry, well-ventilated area away from direct sunlight and extreme temperatures (ideally 15–25°C / 59–77°F).

– Protect from moisture to prevent clumping or microbial contamination.

– Use food-grade or cosmetic-grade packaging (e.g., sealed HDPE containers or vacuum-sealed bags).

b. Shelf Life & Rotation

– Adhere to the manufacturer’s recommended shelf life (typically 12–24 months).

– Implement FIFO (First In, First Out) inventory rotation to prevent expired stock.

– Monitor batch traceability through unique batch/lot numbers.

3. Transportation & Logistics

a. Temperature Control

– Use temperature-controlled transport if shipping in extreme climates to prevent melting or degradation.

– Avoid prolonged exposure to heat, especially for melt-and-pour organic bases.

b. Packaging Integrity

– Use durable, leak-proof secondary packaging (e.g., cardboard boxes with internal dividers).

– Clearly label shipments as “Organic,” “Perishable,” or “Protect from Heat” as needed.

– Include compliance documentation (e.g., Certificate of Analysis, Organic Certificate) with shipments.

c. Transport Compliance

– Follow Good Distribution Practices (GDP) for cosmetics and organic goods.

– Ensure carriers are aware of handling requirements for organic and cosmetic materials.

– For international shipping, comply with import/export regulations (e.g., phytosanitary certificates if plant-based, customs declarations).

4. Traceability & Documentation

- Maintain a full traceability system from raw materials to final product.

- Keep records of:

- Supplier certifications and material invoices.

- Batch production records.

- Certificates of Analysis (CoA) for each batch.

- Shipping and delivery logs.

- Retain documentation for a minimum of 3–5 years, depending on jurisdiction.

5. Sustainability & Ethical Logistics

- Prioritize eco-friendly packaging and shipping methods to align with organic brand values.

- Partner with carriers that offer carbon-neutral shipping options.

- Ensure ethical sourcing of raw materials (e.g., fair trade, sustainable palm oil alternatives).

6. Audits & Continuous Compliance

- Schedule regular internal audits to verify compliance with organic and cosmetic regulations.

- Prepare for unannounced inspections by certification bodies.

- Train staff on organic handling, labeling, and hygiene standards (e.g., GMP – Good Manufacturing Practices).

Conclusion

Proper logistics and compliance management for organic soap base ensures product quality, regulatory adherence, and consumer trust. By maintaining certification integrity, optimizing storage and transport, and documenting every step, businesses can operate efficiently in the competitive organic personal care market.

In conclusion, sourcing a high-quality organic soap base requires careful consideration of ingredient transparency, certification standards (such as USDA Organic, ECOCERT, or COSMOS), supplier reliability, and sustainability practices. Prioritizing ethically sourced, environmentally friendly, and skin-nourishing ingredients not only ensures superior product quality but also aligns with growing consumer demand for clean and responsible beauty products. By establishing strong partnerships with reputable suppliers and conducting thorough due diligence, businesses can create organic soaps that are safe, effective, and aligned with both health and environmental values—ultimately building trust and long-term success in the natural skincare market.