The global organic herbicides market is experiencing robust growth, driven by rising consumer demand for sustainable agriculture and increased regulatory scrutiny on synthetic agrochemicals. According to a 2023 report by Mordor Intelligence, the market was valued at USD 1.15 billion in 2022 and is projected to grow at a CAGR of 12.4% through 2028. This surge is fueled by expanding organic farmland, growing awareness of environmental health, and supportive government policies promoting eco-friendly farming practices. As demand escalates, a new wave of innovation has emerged among manufacturers specializing in plant-based, biodegradable weed control solutions. Below, we spotlight the top eight organic herbicide manufacturers leading this transformation, selected based on market presence, product efficacy, innovation, and sustainability credentials.

Top 8 Organic Herbicides Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 CropLife America

Domain Est. 2000

Website: croplifeamerica.org

Key Highlights: CropLife America represents the manufacturers, formulators and distributors of organic and non-organic pesticides. Regulatory Integrity. CropLife America ……

#2 Vestaron

Domain Est. 2009

Website: vestaron.com

Key Highlights: Vestaron is leading a revolution in crop protection with new peptide technology. Our insecticides deliver powerful new modes of action to rival traditional ……

#3 Natural Crop Science, Rajkot

Domain Est. 2022

Website: naturalcropscience.com

Key Highlights: Established in year 2022, “Natural Crop Science” is manufacturer and wholesaler Agriculture Herbicide, Neem Pesticide, Systemic And Fungicide etc….

#4

Domain Est. 1999

Website: beyondpesticides.org

Key Highlights: Beyond Pesticides offers the latest information on the hazards of pesticides and least-toxic alternatives, as well as ongoing projects including children’s ……

#5 Organic Weed Control, Management and Prevention

Domain Est. 2003

Website: arbico-organics.com

Key Highlights: $1,000 delivery · 30-day returnsThese herbicides work by using environmentally-friendly active ingredients like citric acid, botanical oils, ammonium nonanoate, iron (Fe), d-limon…

#6 Grazon® Extra Herbicide

Domain Est. 2017

Website: corteva.com

Key Highlights: With three active ingredients, Grazon Extra sets the standard for foliar herbicides on hard-to-kill noxious and woody weeds, saving time and money with its ……

#7 Harpe Bio

Domain Est. 2020

Website: harpebio.com

Key Highlights: Harpe’s biological herbicides control weeds, including those with resistance to today’s synthetic chemistries, by harnessing nature’s unique combination of ……

#8 OMRI Lists

Domain Est. 1998

Expert Sourcing Insights for Organic Herbicides

H2: 2026 Market Trends for Organic Herbicides

The global organic herbicides market is poised for significant growth by 2026, driven by increasing consumer demand for sustainable agriculture, stricter environmental regulations, and rising awareness of the harmful effects of synthetic agrochemicals. Several key trends are shaping the trajectory of this market:

-

Regulatory Support and Sustainability Initiatives

Governments and international bodies are tightening regulations on synthetic herbicides due to their environmental and health risks. Policies promoting organic farming—such as the EU’s Farm to Fork Strategy and the U.S. National Organic Program—are incentivizing farmers to adopt organic alternatives. By 2026, compliance with these regulations will be a major driver for organic herbicide adoption. -

Technological Advancements in Bio-Based Formulations

Innovation in biochemistry and biotechnology is enabling the development of more effective and reliable organic herbicides. Companies are investing in plant-based extracts (e.g., clove oil, vinegar, and corn gluten meal), microbial herbicides, and essential oil-derived compounds. Enhanced formulation technologies, such as nano-encapsulation, are improving the stability, efficacy, and residual activity of these products. -

Expansion of Organic Agriculture

The global organic farmland area continues to grow, increasing demand for compatible weed management solutions. As organic food sales rise—projected to exceed $300 billion by 2026—farmers are seeking effective tools to control weeds without compromising certification. This expansion is particularly evident in North America, Europe, and parts of Asia-Pacific. -

Consumer and Retailer Pressure

End consumers are increasingly concerned about food safety and environmental impact, prompting retailers and food brands to source ingredients from chemical-free farming. This “farm-to-table” accountability is pushing supply chains to adopt organic herbicides as part of integrated weed management systems. -

Rise of Integrated Weed Management (IWM)

Organic herbicides are becoming a key component of IWM strategies that combine mechanical, cultural, and biological controls. By 2026, holistic approaches will be more prevalent, reducing reliance on any single method and improving long-term sustainability. -

Regional Market Growth

North America and Europe remain dominant markets due to established organic sectors and regulatory frameworks. However, emerging economies in Latin America, India, and Southeast Asia are showing rapid growth, supported by government support programs and increasing export demand for organic produce. -

Challenges in Efficacy and Cost

Despite progress, organic herbicides often face criticism for lower efficacy and higher costs compared to synthetic options. By 2026, ongoing R&D and economies of scale are expected to narrow this performance gap, making organic solutions more competitive.

In conclusion, the 2026 outlook for organic herbicides is highly favorable, characterized by innovation, regulatory tailwinds, and shifting consumer preferences. As stakeholders across the agricultural value chain prioritize sustainability, organic herbicides will play an increasingly central role in modern weed control.

Common Pitfalls Sourcing Organic Herbicides (Quality, IP)

Sourcing effective and compliant organic herbicides presents unique challenges beyond conventional agrochemical procurement. Key pitfalls revolve around verifying true quality and navigating complex intellectual property (IP) landscapes, which can significantly impact efficacy, regulatory compliance, and long-term supply security.

Quality Assurance Challenges

Ensuring the consistent quality and efficacy of organic herbicides is difficult due to inherent variability in natural source materials and less standardized manufacturing processes compared to synthetic counterparts.

- Ingredient Variability: Organic herbicides often rely on plant extracts (e.g., clove oil, citric acid, vinegar) or microbial agents. The potency of these active ingredients can fluctuate significantly based on the source plant’s genetics, growing conditions, harvest time, and extraction methods, leading to inconsistent field performance.

- Lack of Standardization: Unlike synthetic herbicides with precisely defined chemical compositions, organic formulations may have variable concentrations of active compounds. Suppliers might not consistently test or disclose the exact concentration of key actives, making batch-to-batch reliability a major concern.

- Efficacy and Residual Activity: Organic herbicides frequently act as contact killers with limited residual control. Buyers may overestimate their performance based on marketing claims, leading to inadequate weed control and potential crop damage if application timing or coverage is suboptimal.

- Adulteration and Mislabeling: The premium pricing of organic inputs creates incentives for adulteration. Products might be diluted with water or non-approved substances, or mislabeled regarding organic certification status (e.g., claiming OMRI Listed without valid listing).

Intellectual Property (IP) and Sourcing Complexity

The IP landscape for organic herbicides is intricate, involving patents on formulations, methods of use, and biological strains, which can restrict sourcing options and create dependency.

- Patented Formulations and Processes: Many effective organic herbicides are protected by patents covering specific blends of natural ingredients, encapsulation technologies, or synergistic combinations. Sourcing these requires licensing agreements, limiting buyers to single suppliers and potentially increasing costs.

- Strain-Specific Microbial Herbicides: Bioherbicides based on specific fungal or bacterial strains (e.g., Phomopsis, Colletotrichum) are often proprietary. The IP rights to the isolated and optimized strain belong to the developer, creating sole-source dependencies and vulnerability to supply disruptions.

- Trade Secrets: Key manufacturing processes or “secret sauce” ingredient ratios are often protected as trade secrets rather than patents, making it impossible to replicate or source alternatives, even if the individual components are natural.

- Certification and Approval Dependencies: The ability to use a herbicide organically depends on its approval by bodies like OMRI (Organic Materials Review Institute) or equivalent national programs. A supplier’s IP might include the certification itself, and changes in formulation (even minor ones driven by IP updates) can invalidate the certification, halting use unexpectedly. Sourcing requires constant verification of current certification status.

- Geographical Restrictions: IP rights and organic certification approvals are often territorial. A herbicide approved and patented in one region may not be legally available or certified for use in another, complicating global sourcing strategies.

Avoiding these pitfalls requires rigorous due diligence on supplier quality control processes, independent verification of active ingredient concentrations and certification status, careful review of IP rights and licensing terms, and a clear understanding of the inherent performance limitations of organic herbicide modes of action.

H2: Logistics & Compliance Guide for Organic Herbicides

1. Regulatory Compliance Overview

Organic herbicides must comply with national and international organic standards to be legally marketed and used in organic agriculture. Key regulatory bodies include:

-

United States Department of Agriculture (USDA) National Organic Program (NOP): Only herbicides listed on the National List of Synthetic Substances Allowed for Use in Organic Production (7 CFR Part 205) are permitted. Active ingredients like acetic acid, citric acid, and clove oil may be allowed under specific conditions.

-

European Union (EU) Organic Regulation (Regulation (EU) 2018/848): Permitted substances are listed in Annex II. Herbicides must be derived from natural sources and not synthetically processed unless approved.

-

Canada Organic Standards (CAN/CGSB-32.310): Aligns closely with NOP; only designated non-synthetic or approved synthetic substances are allowed.

Ensure all products are reviewed and certified by an accredited organic certification body (e.g., OMRI – Organic Materials Review Institute, or equivalent in your region).

2. Product Classification & Labeling Requirements

- Accurate Labeling: Labels must clearly state:

- “For Organic Use” or “OMRI Listed” (if applicable).

- Active and inert ingredients with concentrations.

- EPA registration number (if applicable in the U.S.).

-

Directions for use, precautionary statements, and storage instructions.

-

Claims Compliance: Avoid misleading terms such as “natural” unless accompanied by proper organic certification. Claims must align with regulatory definitions.

3. Sourcing & Supply Chain Management

-

Raw Material Sourcing: Source plant-based or naturally derived active ingredients (e.g., corn gluten meal, essential oils) from certified organic suppliers when possible.

-

Supplier Audits: Conduct audits to ensure suppliers comply with organic integrity standards and do not use prohibited substances.

-

Documentation: Maintain records of Certificates of Analysis (COA), organic certificates, and chain-of-custody documentation for all inputs.

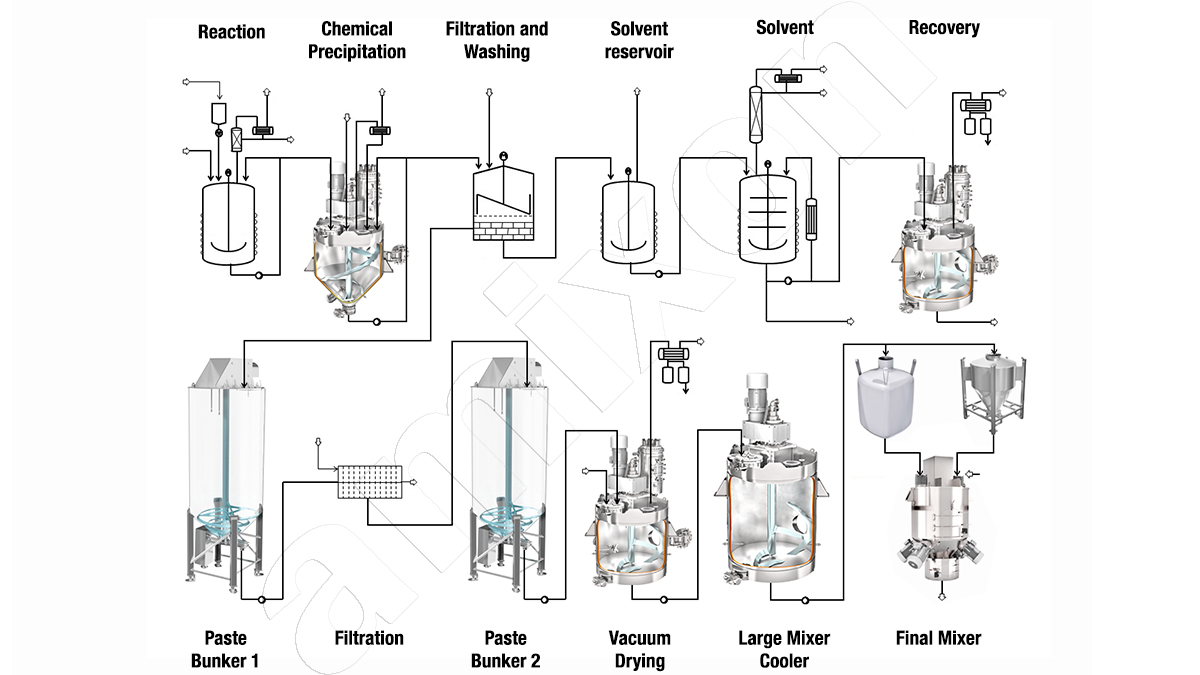

4. Manufacturing & Formulation

-

Facility Certification: Manufacturing facilities should be inspected and approved by an organic certifier if producing under organic compliance.

-

Cross-Contamination Prevention: Implement strict segregation and cleaning protocols to prevent contamination with synthetic pesticides or non-compliant substances.

-

Formulation Transparency: Avoid non-approved synthetic surfactants or preservatives. Use only inert ingredients approved under organic standards.

5. Transportation & Storage Logistics

-

Temperature Control: Some organic herbicides (e.g., essential oil-based formulations) are sensitive to heat or freezing. Store and transport within recommended temperature ranges.

-

Segregation: Keep organic herbicides separate from conventional pesticides during transport and warehousing to prevent contamination.

-

Container Integrity: Use food-grade or chemically compatible packaging to prevent degradation or leaching.

-

Shelf Life Monitoring: Track expiration dates and implement FIFO (First In, First Out) inventory practices.

6. Import/Export Compliance

- Country-Specific Regulations: Verify herbicide approval status in destination countries. For example:

- In the EU, products may require authorization under Regulation (EC) No 1107/2009.

-

In Canada, compliance with the Pest Control Products Act (PCPA) is mandatory.

-

Customs Documentation: Provide safety data sheets (SDS), organic certificates, and import permits as required.

-

Phytosanitary & Biosecurity: Ensure packaging and containers meet ISPM 15 standards if made of wood; avoid introducing invasive species through packaging materials.

7. Safety & Environmental Compliance

-

Worker Safety: Train handlers on proper use of PPE and safe handling procedures based on SDS.

-

Environmental Impact: Assess runoff risk and potential effects on non-target organisms. Follow buffer zone requirements near water bodies.

-

Spill Management: Maintain spill kits and protocols for containment and cleanup, especially for acidic formulations.

8. Recordkeeping & Audits

-

Retention Period: Maintain compliance records (e.g., sales, sourcing, certifications) for a minimum of 5 years, as required by most organic programs.

-

Internal Audits: Conduct regular audits to ensure ongoing compliance with organic standards.

-

Traceability: Implement batch tracking systems to enable rapid recall if non-compliance is detected.

9. Marketing & Certification Maintenance

-

Certification Renewal: Renew organic input certifications annually (e.g., OMRI listing) and update formulations with certifiers before changes.

-

Advertising Compliance: Ensure all marketing materials reflect current certification status and do not exaggerate benefits.

By following this H2-level guide, stakeholders in the organic herbicide supply chain can ensure regulatory compliance, maintain product integrity, and support sustainable agricultural practices. Always consult local regulators and certification bodies for jurisdiction-specific requirements.

In conclusion, sourcing organic herbicides presents a sustainable and environmentally responsible alternative to synthetic weed control methods. As demand for safer agricultural practices grows, organic herbicides—derived from natural sources such as plant extracts, essential oils, and microbial agents—offer effective weed management with reduced risks to human health, soil quality, and ecosystems. While challenges remain, including variability in efficacy, shorter residual activity, and higher costs, advancements in formulation and application techniques are steadily improving their performance.

Sourcing these products involves careful consideration of ingredient transparency, certification standards (such as OMRI or USDA Organic), and supplier reliability. Ultimately, integrating organic herbicides into pest management strategies supports long-term soil health, biodiversity, and compliance with organic farming regulations. With continued research, investment, and responsible sourcing practices, organic herbicides can play a vital role in the future of sustainable agriculture.