The global fiber optic cable market is experiencing robust expansion, driven by escalating demand for high-speed data transmission, the rollout of 5G networks, and increasing investments in broadband infrastructure. According to a report by Mordor Intelligence, the fiber optic cable market was valued at USD 10.2 billion in 2023 and is projected to grow at a CAGR of over 9.5% from 2024 to 2029. Similarly, Grand View Research estimates that the market size surpassed USD 11.4 billion in 2023 and is expected to expand at a CAGR of 9.8% through 2030, fueled by surging internet penetration and the proliferation of data centers. As orange fiber optic cables—commonly used for indoor and patch applications due to their durable jacketing and TIA-598 color-coding standard—become increasingly critical in structured cabling systems, a select group of manufacturers are leading innovation, scalability, and quality. Based on market presence, production capacity, and technological advancement, here are the top 9 orange fiber optic cable manufacturers shaping the industry’s future.

Top 9 Orange Fiber Optic Cable Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 What are Orange Fiber Optic Cables?

Domain Est. 1998

Website: cables.com

Key Highlights: OM1 Orange Optical Fiber Cables Datacomm Cables (Cables.com) is a premiere manufacturer of premium quality OM1 62.5u/125 Fiber Optic Cables. ……

#2 Fiber Optic Patch Cables

Domain Est. 2000

Website: fibertronics.com

Key Highlights: 2–12 day deliveryFibertronics Inc. offers a wide selection of high-quality fiber optic patch cables, with many models in stock and available for immediate shipment….

#3 Fiber Optic Connection (FOC)

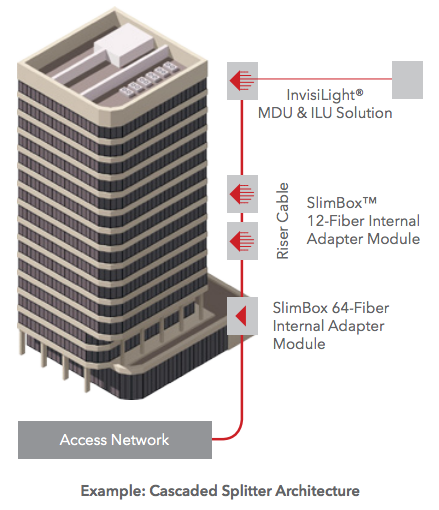

Domain Est. 1993

Website: wholesale.orange.com

Key Highlights: Guaranteed fibre connectivity Each fibre order have a 10 or 20-year Orange commitment life time….

#4 Our purpose

Domain Est. 1993

Website: orange.com

Key Highlights: That’s why we deploy secure networks across the globe, from fiber and 4G/5G mobile networks to satellite links and undersea cables. We support you every ……

#5 Orange Marine

Domain Est. 1993

Website: marine.orange.com

Key Highlights: Global cable ship owner specialized in the laying and maintenance of submarine cables….

#6 Fiber Optic Cables

Domain Est. 1994

Website: commscope.com

Key Highlights: CommScope designs and manufactures a comprehensive line of fiber optic cables—from outside plant to indoor/outdoor and fire-rated indoor fiber ……

#7 Fiber Made in Orange, California

Domain Est. 1996

Website: shaxon.com

Key Highlights: We manufacture fiber optic cables to customer need in Orange CA making us a one stop shop for all your fiber optic needs….

#8 FiberOptic Supply

Domain Est. 1998

Website: fiberopticsupply.com

Key Highlights: 1–2 day delivery · 30-day returnsWe offer fiber optic materials from Test Equipment, Bulk Cable and Fusion Splicers to Tools, Patch Cables and Consumables….

#9 1000ft Orange 12 Fiber Multimode Fiber Optic Cable

Domain Est. 1999

Expert Sourcing Insights for Orange Fiber Optic Cable

H2: 2026 Market Trends for Orange Fiber Optic Cable

The global fiber optic cable market is poised for substantial growth by 2026, driven by increasing demand for high-speed internet, 5G network deployment, and digital transformation across industries. Within this landscape, orange fiber optic cables—typically indicating single-mode fiber (SMF) in industry color-coding standards—will play a critical role in supporting next-generation telecommunications infrastructure. Below are key market trends expected to shape the demand and deployment of orange fiber optic cables through 2026:

-

Expansion of 5G and Fixed Wireless Access (FWA) Networks

Telecom operators worldwide are accelerating 5G rollouts, necessitating dense fiber backhaul networks. Orange single-mode cables are essential for long-haul and metropolitan networks due to their low attenuation and high bandwidth capacity. As 5G small cells require fiber connectivity, demand for orange SMF cables will rise, particularly in urban and suburban deployments. -

Government-Led Broadband Initiatives

National broadband expansion programs—such as the U.S. BEAD Program, the EU’s Digital Decade 2030, and India’s BharatNet—are investing heavily in fiber-to-the-home (FTTH) infrastructure. Orange-labeled single-mode cables are the standard choice for these long-distance, high-capacity networks, ensuring future-proof connectivity and supporting gigabit-speed services. -

Data Center Interconnect (DCI) Growth

Hyperscale data centers are expanding rapidly to meet cloud computing and AI demands. Orange fiber optic cables are widely used in DCI applications due to their ability to transmit data over long distances with minimal signal loss. The compound annual growth rate (CAGR) of the DCI market is expected to exceed 12% through 2026, directly boosting demand for high-performance single-mode fiber. -

Shift Toward Higher Fiber Count Cables

Network operators are deploying fiber cables with higher strand counts (e.g., 144F, 288F, or more) to future-proof infrastructure. While the outer jacket may vary, internal single-mode fibers often follow TIA-598 color codes, where orange indicates 50/125 µm multimode fiber in some cases—but in modern long-haul SMF cables, orange may be used for identification in breakout or distribution cables. Clarification of color standards remains important to avoid misidentification. -

Advancements in Bend-Insensitive Fiber (BIF)

Orange-jacketed single-mode fibers increasingly incorporate bend-insensitive technology (e.g., ITU-T G.657.A1/A2), enabling easier installation in tight spaces such as buildings and cabinets. This trend supports FTTH and enterprise network growth, making orange-labeled cables more versatile and widely adopted. -

Sustainability and Material Innovation

Environmental concerns are pushing manufacturers to develop low-carbon, recyclable fiber optic cables. By 2026, leading suppliers may introduce bio-based jacketing materials or reduced-diameter cables (e.g., micro cables) with orange identification for SMF, aligning with green telecom initiatives. -

Supply Chain Localization and Resilience

Geopolitical factors and supply chain disruptions have prompted countries to localize fiber optic manufacturing. This shift is expected to increase regional production of standardized components, including orange-jacketed cables, enhancing supply reliability and reducing dependency on foreign suppliers.

Conclusion

By 2026, the demand for orange fiber optic cables—especially those indicating single-mode fiber—will be driven by 5G, broadband expansion, data center growth, and technological innovation. While the color coding serves as a practical identifier, the performance characteristics of the underlying fiber (e.g., G.652.D or G.657.A2) will remain the primary determinant of adoption. Market players must align with evolving standards, invest in scalable infrastructure, and ensure compliance with global interoperability requirements to capitalize on these trends.

Common Pitfalls When Sourcing Orange Fiber Optic Cable (Quality and IP)

Sourcing orange fiber optic cable—commonly used for multimode applications such as OM1 and OM2—can be deceptively complex. While the color coding simplifies identification, several critical pitfalls related to quality and intellectual property (IP) can compromise network performance and expose buyers to legal and operational risks. Being aware of these issues ensures reliable, compliant, and future-proof installations.

Poor Cable Quality and Performance Inconsistencies

One of the most frequent issues when sourcing orange fiber optic cables is receiving substandard products that fail to meet industry performance standards. Low-cost suppliers may cut corners by using inferior glass fibers, improper jacketing materials, or inconsistent manufacturing processes. This can lead to higher attenuation, modal dispersion, and reduced bandwidth—especially problematic in high-speed multimode applications. Buyers should verify that cables are certified to relevant standards (e.g., ISO/IEC 11801, TIA-568) and request test reports (e.g., OTDR traces) for batch validation.

Misrepresentation of Fiber Specifications

Suppliers may mislabel or exaggerate fiber specifications, such as claiming OM3 or OM4 performance while delivering OM1 or OM2-grade orange cables. Since OM1 cables (typically orange with a 62.5µm core) are obsolete for modern high-bandwidth needs, using them unknowingly can result in network bottlenecks. Always confirm the exact fiber type (core/cladding size, bandwidth, and distance ratings) and ensure it matches your project requirements. Visual inspection and certification documentation are essential.

Lack of Genuine Product Certification and Traceability

Many non-reputable vendors offer cables without proper certification from recognized bodies (e.g., UL, ETL, RoHS). Counterfeit or uncertified cables may not meet fire safety codes (e.g., plenum or riser ratings), posing safety hazards in commercial buildings. Additionally, the absence of lot traceability makes it difficult to address defects or recalls. Insist on verifiable certifications and batch-specific documentation to ensure compliance and accountability.

Intellectual Property (IP) Infringement Risks

Reputable fiber optic technologies are often protected by patents and trademarks. Sourcing cables from manufacturers that replicate proprietary designs—such as specific cable geometries, connector types, or branding—can expose buyers to IP infringement liability. For example, using cables that mimic well-known brand trademarks (like Corning’s or CommScope’s) without authorization violates IP laws. Always purchase from authorized distributors or directly from brand owners to avoid legal exposure.

Inadequate Warranty and Support

Low-cost suppliers may offer limited or no warranty, leaving buyers without recourse if the cable fails prematurely. Reputable manufacturers typically provide long-term warranties (e.g., 20–25 years) backed by technical support and replacement policies. Skipping proper warranty terms increases long-term costs and downtime risk. Evaluate the supplier’s support infrastructure before committing to large purchases.

Counterfeit or Gray Market Products

Orange fiber optic cables are common targets for counterfeiting due to high demand and brand recognition. Gray market imports—originally intended for other regions—may not comply with local regulations or lack proper support. These products often lack performance consistency and can void equipment warranties. Conduct due diligence on suppliers, verify authenticity through official channels, and avoid deals that seem too good to be true.

By addressing these pitfalls proactively—through rigorous supplier vetting, specification verification, and attention to IP and compliance—organizations can ensure they source reliable, high-performance orange fiber optic cables that support robust and scalable network infrastructures.

Logistics & Compliance Guide for Orange Fiber Optic Cable

Product Classification & Regulatory Compliance

Orange fiber optic cable is typically used in telecommunications and data networking infrastructure. Before shipping or handling, ensure compliance with relevant regulations:

- ITC/HS Code: Classify under 8544.70.00 (Fiber-optic cables) for international trade reporting.

- RoHS Compliance: Confirm the cable meets the Restriction of Hazardous Substances Directive (EU RoHS), especially if destined for the European market.

- REACH Compliance: Ensure no restricted chemical substances are present above threshold levels.

- REACH & Conflict Minerals: Verify sourcing of raw materials, particularly for halogen-free or low-smoke zero-halogen (LSZH) variants.

Packaging & Handling Standards

Proper packaging ensures product integrity during transit:

- Reel Specifications: Ship on durable wooden or plastic reels rated for the cable’s weight and length.

- Protective Wrapping: Use UV-resistant wrapping and end caps to prevent moisture ingress and physical damage.

- Labeling: Clearly mark reels with:

- Product name and part number

- Length (in meters/feet)

- Manufacturer details

- “Fragile” and “This Side Up” indicators

- Lot or batch number for traceability

Transportation & Storage Conditions

Maintain optimal conditions to preserve cable performance:

- Temperature Range: Store and transport between -10°C to +60°C. Avoid prolonged exposure to direct sunlight.

- Humidity: Keep relative humidity below 85% to prevent jacket degradation.

- Bending Radius: Never exceed the minimum bend radius (typically 10–20x cable diameter) during handling.

- Stacking: Limit stack height to prevent crushing; use pallets and avoid direct ground contact.

Import/Export Documentation

Prepare accurate documentation for cross-border shipments:

- Commercial Invoice

- Packing List

- Certificate of Origin

- Bill of Lading or Air Waybill

- RoHS/REACH Compliance Certificate (if requested)

- FCC Declaration of Conformity (for U.S. market)

Note: Some countries may require additional certifications (e.g., CE marking for Europe, KC for South Korea).

Environmental & Safety Regulations

- WEEE Compliance: If sold in the EU, ensure proper labeling for end-of-life recycling.

- Transport Safety: Fiber optic cables are generally non-hazardous, but glass fibers require safe handling procedures to avoid injury.

- Waste Disposal: Follow local regulations for electronic waste; do not incinerate PVC-jacketed cables.

Traceability & Quality Assurance

- Maintain batch records for at least 5 years.

- Implement serial or QR code tracking on reels for full supply chain visibility.

- Conduct periodic audits of logistics partners to ensure compliance with handling protocols.

Special Considerations for Orange-Jacketed Cables

- Color Significance: Orange typically denotes multimode fiber (OM1/OM2); verify specifications match application needs.

- UV Resistance: While orange jackets often include UV stabilizers, prolonged outdoor exposure should still be minimized unless rated for OSP (Outside Plant) use.

Adhering to this guide ensures safe, compliant, and efficient logistics for orange fiber optic cable across global supply chains.

Conclusion:

Sourcing orange fiber optic cable proves to be a reliable and strategic choice for establishing high-performance, durable, and standard-compliant network infrastructure. The orange jacket, which typically indicates multimode fiber (such as OM1, OM2, or laser-optimized OM3/OM4 variants), ensures easy identification and compatibility within structured cabling systems. This color coding simplifies installation, maintenance, and troubleshooting, reducing the likelihood of errors in complex network environments.

Moreover, orange fiber optic cables are widely available from reputable manufacturers and suppliers, offering a balance of cost-efficiency and performance suitable for short- to medium-distance data transmission, especially in LANs, data centers, and enterprise networks. Their compatibility with existing multimode fiber equipment and the support for high bandwidth applications—especially with newer laser-optimized grades—make them a future-ready solution for organizations seeking scalable connectivity.

In conclusion, sourcing orange fiber optic cable supports network reliability, simplifies infrastructure management, and aligns with industry standards. When procured from certified vendors ensuring quality materials and testing, these cables provide a cost-effective and efficient foundation for current and evolving communication needs.