The global spice and seasoning market is experiencing robust growth, driven by rising consumer demand for convenient, flavorful, and natural ingredients—trends that have significantly boosted the popularity of onion powder. According to Mordor Intelligence, the global spice and herb market was valued at USD 19.5 billion in 2023 and is projected to grow at a CAGR of over 6.8% from 2024 to 2029, with onion powder emerging as a key player within this segment due to its shelf stability, versatility, and clean-label appeal. Additionally, Grand View Research highlights the expanding food processing and ready-to-eat meal industries as major contributors to the demand for dehydrated vegetable powders, citing strong adoption in both industrial and household applications. As the market expands, a select group of manufacturers has risen to prominence, combining scale, quality control, and innovation to meet global supply needs. These top nine onion powder manufacturers are shaping the industry through vertically integrated operations, stringent food safety standards, and strategic R&D investments to cater to health-conscious and convenience-driven consumers worldwide.

Top 9 Onion Powder Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Onion Powder

Domain Est. 2004

Website: americaninternationalfoods.com

Key Highlights: AIFI is a leading onion powder supplier & distributor offering high quality wholesale spices to manufacturers & processors at competitive prices….

#2 Onion Powder Manufacturers By Vinayak Ingredients

Domain Est. 1999

Website: vinayakcorporation.com

Key Highlights: Rating 4.8 (2,356) Manufacturer and exporter of high-quality onion powder for natural flavor and aroma in food products….

#3 Bulk Onion Powder

Domain Est. 1998

Website: americanspice.com

Key Highlights: Use onion powder from the Great American Spice Company when you want the kick of an onion but not the tears that come with chopping….

#4 Frontier Co

Domain Est. 1999

Website: pleasanthillgrain.com

Key Highlights: In stock Rating 4.7 419 Frontier Co-op’s onion powder is sustainably grown and harvested in the United States by organic farms with 100% organic practices. The onions are non- …..

#5 Onion Powder

Domain Est. 2005

Website: conyeagerspice.com

Key Highlights: Flavor & aroma typical of onion. ×. Related Products. Onion Granulated. Quick view. Choose Options. Wishlist. Onion Granulated. $4.08….

#6 California Onion Powder

Domain Est. 2006

Website: spicesinc.com

Key Highlights: Free delivery over $60 3-day returnsCalifornia Onion Powder, Allium cepa, is also called bulk onion powder, wholesale onion powder, onion powder, or California style onion powder….

#7 Feast Mode Flavors U.S. Grown Onion Powder

Domain Est. 2017

Website: feastmodeflavors.com

Key Highlights: In stock $14.22 deliveryWith our U.S.-grown onion powder, you get exceptional flavor, dependable sourcing, and unbeatable value—backed by a reputation for consistency and care….

#8 Onion Powder

Domain Est. 2017

Website: helaspicesg.com

Key Highlights: In stockHela Onion powder delivers a savory roasted richness to most dish, from dips to soups, sauces, vegetables, chicken and burgers….

#9 Premium Spices

Domain Est. 2019

Website: magicnailspaparma.com

Key Highlights: In stock Rating 4.2 (88) 8 days ago · Made from dehydrated onions ground to a fine powder, it offers the full-bodied taste of fresh onion in a shelf-stable format that’s easy to …

Expert Sourcing Insights for Onion Powder

H2: 2026 Market Trends for Onion Powder

The global onion powder market is poised for steady growth leading into 2026, driven by evolving consumer preferences, rising demand for convenience foods, and increased interest in natural and clean-label ingredients. Key trends shaping the market include:

-

Growing Demand in the Food Processing Industry

Onion powder remains a staple ingredient in seasonings, soups, sauces, snacks, and ready-to-eat meals. As processed and convenience food consumption continues to rise—especially in urban populations—food manufacturers are increasingly incorporating onion powder for its flavor consistency, long shelf life, and ease of use. This trend is expected to accelerate through 2026, particularly in emerging markets across Asia-Pacific and Latin America. -

Clean-Label and Natural Ingredient Movement

Consumers are increasingly favoring natural over synthetic flavor enhancers. Onion powder, being a minimally processed, recognizable ingredient, aligns well with clean-label trends. Its use as a natural alternative to MSG and artificial flavors is boosting its adoption in organic and health-focused food products, a segment expected to expand significantly by 2026. -

Expansion of Plant-Based and Vegan Diets

With the rise of plant-based lifestyles, onion powder is gaining traction as a key flavoring agent in meat alternatives, vegan seasonings, and dairy-free products. Its umami-rich profile enhances savory taste without relying on animal-derived ingredients, making it indispensable in plant-based product development. -

Innovation in Organic and Non-GMO Variants

The organic onion powder segment is witnessing strong growth, supported by certifications and consumer demand for pesticide-free products. Major suppliers are investing in organic farming and traceable supply chains, anticipating higher market share by 2026. Non-GMO labeling is also becoming a competitive differentiator. -

Regional Market Dynamics

North America and Europe remain dominant markets due to established food manufacturing sectors and high consumer awareness. However, the fastest growth is expected in Asia-Pacific, particularly in India and China, where changing dietary habits and increasing disposable incomes are fueling demand for processed and international cuisine products that use onion powder. -

Supply Chain and Sustainability Concerns

Climate variability and fluctuating onion crop yields pose risks to supply stability. In response, key players are investing in vertical integration, controlled-environment drying technologies, and sustainable farming practices to ensure consistent quality and reduce environmental impact—factors that will influence market competitiveness by 2026. -

E-Commerce and Direct-to-Consumer Growth

Online retail of spices and seasonings, including onion powder, is expanding rapidly. Brands are leveraging e-commerce platforms and subscription models to reach health-conscious and home-cooking consumers, a trend likely to gain momentum through 2026.

In summary, the onion powder market in 2026 will be characterized by innovation, sustainability, and increased demand from both industrial and retail sectors, with strong growth potential in natural, organic, and plant-based food applications.

Common Pitfalls Sourcing Onion Powder (Quality, IP)

Sourcing onion powder requires careful attention to both quality attributes and intellectual property (IP) considerations. Overlooking these aspects can lead to inconsistent products, regulatory issues, or legal risks. Below are key pitfalls to avoid:

Poor Quality Control and Inconsistent Specifications

One of the most frequent issues is receiving onion powder with inconsistent quality due to lax supplier standards. Variability in color, particle size, moisture content, and flavor intensity can significantly impact final product performance. Buyers may also encounter adulteration—such as the addition of fillers (e.g., wheat flour or starches)—especially when sourcing from low-cost or unverified suppliers. This not only affects taste and functionality but can pose allergen risks if undeclared.

Inadequate Microbiological and Contaminant Testing

Onion powder is susceptible to microbial contamination (e.g., Salmonella, E. coli) and mycotoxins due to its agricultural origin and drying process. Suppliers may fail to conduct regular or certified testing, or provide falsified certificates of analysis (CoA). Without proper documentation and third-party verification, companies risk product recalls or non-compliance with food safety regulations like FDA FSMA or EU hygiene standards.

Insufficient Traceability and Origin Transparency

Lack of clear traceability from farm to finished powder increases exposure to supply chain risks. Buyers may unknowingly source from regions with poor agricultural practices, banned pesticides, or geopolitical instability. Without batch-level traceability, identifying contamination sources during a recall becomes nearly impossible, leading to extended downtime and reputational damage.

Overlooking Intellectual Property (IP) and Labeling Rights

When developing proprietary blends or branded products, companies must ensure their onion powder sourcing doesn’t infringe on existing trademarks, patented formulations, or geographical indications (GIs). For example, using a supplier’s branded “premium dehydrated onion” without proper licensing could lead to IP disputes. Additionally, mislabeling claims—such as “organic,” “non-GMO,” or “made in USA”—without proper certification or origin verification can result in legal and regulatory penalties.

Failure to Secure Long-Term Supply Agreements with IP Protections

Relying on spot purchases or short-term contracts exposes buyers to price volatility and supply disruptions. Moreover, without contractual clauses protecting proprietary formulations or exclusive usage rights, suppliers may sell the same custom-blended onion powder to competitors, diluting brand differentiation and undermining competitive advantage.

Inadequate Supplier Audits and Compliance Verification

Many buyers skip on-site audits or fail to verify supplier compliance with GMP (Good Manufacturing Practices), HACCP, or certifications like ISO 22000, Organic, or Kosher. This increases the risk of non-compliant facilities, poor sanitation, or undocumented processes. Without regular audits, quality drift and compliance gaps may go undetected until a crisis occurs.

To mitigate these pitfalls, establish rigorous supplier qualification processes, demand transparent documentation, conduct regular audits, and include clear IP and quality clauses in supply agreements.

Logistics & Compliance Guide for Onion Powder

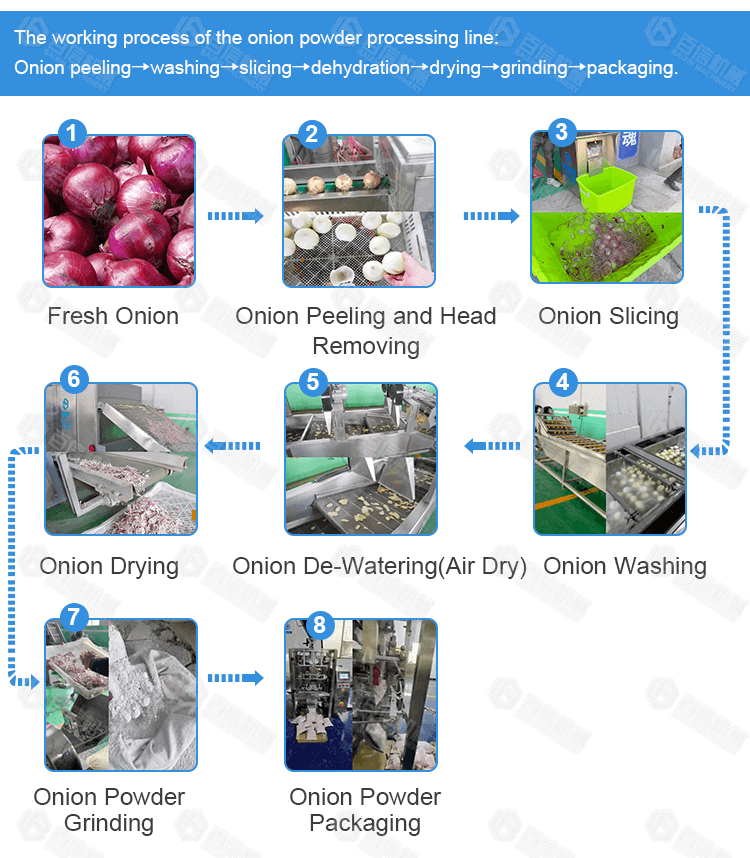

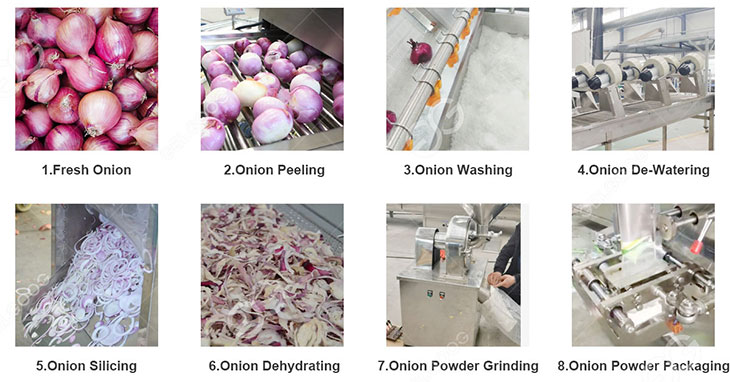

Classification and Product Overview

Onion powder is a dehydrated, ground form of onions, commonly used as a flavoring agent in food manufacturing, retail, and foodservice industries. It is categorized as a dried food product and falls under the broader category of seasonings and spices. Proper handling, storage, transportation, and regulatory compliance are essential due to its hygroscopic nature and susceptibility to contamination.

Regulatory Compliance

Onion powder must comply with food safety regulations in both the country of origin and the destination market. Key regulatory frameworks include:

– U.S. FDA (Food and Drug Administration): Must adhere to Current Good Manufacturing Practices (CGMPs) under 21 CFR Part 110 and be registered under the Food Facility Registration rule.

– FSMA (Food Safety Modernization Act): Requires adherence to Preventive Controls for Human Food, including hazard analysis and risk-based preventive controls.

– EU Regulations (EC) No 178/2002 and (EC) No 852/2004: Mandate food safety management systems (e.g., HACCP) and traceability throughout the supply chain.

– Codex Alimentarius Standard for Dehydrated Vegetables (CODEX STAN 153-1985): Provides international quality and safety benchmarks.

– Organic Certification: If labeled organic, compliance with USDA NOP, EU Organic, or equivalent standards is required.

Labeling Requirements

Labeling must meet local and international standards:

– Ingredient Declaration: “Onion Powder” or “Dried Onion” as the sole ingredient unless blended.

– Allergen Labeling: No major allergens per FDA/WHO, but cross-contact risks (e.g., with sulfites) must be disclosed if applicable.

– Net Quantity: In both metric and imperial units where required (e.g., U.S., Canada).

– Country of Origin: Mandatory in the U.S. (COOL), EU, and several other jurisdictions.

– Lot Number and Expiry/Best-By Date: Essential for traceability and shelf-life management.

– Storage Instructions: Typically “Store in a cool, dry place” due to moisture sensitivity.

Packaging Standards

- Use moisture-resistant, airtight packaging (e.g., laminated foil pouches, vacuum-sealed bags, or multi-wall paper bags with poly liners).

- Packaging materials must be food-grade and compliant with FDA 21 CFR 177 or EU 10/2011 on plastic materials and articles.

- Outer packaging (e.g., fiberboard boxes, drums) should protect against physical damage and environmental exposure during transit.

Storage Conditions

- Temperature: Store between 10°C and 21°C (50°F–70°F). Avoid extreme temperatures.

- Humidity: Maintain relative humidity below 60% to prevent caking, clumping, and microbial growth.

- Shelf Life: Typically 24–36 months when stored properly. Monitor for off-odors, discoloration, or insect infestation.

- Segregation: Store away from strong-smelling products (e.g., spices, chemicals) due to odor absorption.

Transportation and Logistics

- Mode of Transport: Suitable for road, sea, and air freight. Sea freight is most common for bulk shipments.

- Container Requirements: Use clean, dry, pest-free containers. For sea freight, employ desiccants to control moisture.

- Temperature Control: Not required if ambient conditions are stable, but avoid temperature fluctuations.

- Cross-Contamination Prevention: Ensure vehicles and containers are free from residues of incompatible goods (e.g., non-food items, allergens).

- Documentation: Include commercial invoice, packing list, bill of lading, certificate of analysis (COA), and phytosanitary certificate (if required by destination).

Quality and Safety Testing

Routine testing should include:

– Microbiological Analysis: Testing for pathogens (e.g., Salmonella, E. coli) and total plate count.

– Moisture Content: Typically 4–6% to ensure stability and prevent microbial growth.

– Particle Size: As specified by customer requirements (e.g., mesh size).

– Pesticide Residues and Heavy Metals: Comply with maximum residue limits (MRLs) set by local authorities (e.g., EU MRLs, EPA tolerances).

– Foreign Matter: Must be free from extraneous materials (e.g., stones, metal fragments).

Import/Export Considerations

- HS Code: 2001.90.5000 (HS 2022) for dried onions, including powdered forms (verify per country).

- Phytosanitary Requirements: Some countries (e.g., Australia, New Zealand) may require phytosanitary certificates to confirm plant health status.

- Customs Clearance: Accurate declaration of value, origin, and classification is essential to avoid delays.

- Tariffs and Duties: Check bilateral trade agreements and preferential tariff treatments (e.g., USMCA, EU GSP).

Traceability and Recall Preparedness

- Implement a traceability system capable of tracking batches from raw material to finished product.

- Maintain records for a minimum of 3 years (or as required by regulation).

- Have a recall plan in place compliant with FSMA and EU Rapid Alert System for Food and Feed (RASFF).

Sustainability and Ethical Sourcing

- Source onions from farms practicing sustainable agriculture and fair labor standards.

- Consider certifications such as Fair Trade, Rainforest Alliance, or Sustainably Grown, if applicable.

- Minimize packaging waste and support recyclable or compostable materials where feasible.

Adherence to this guide ensures safe, legal, and efficient handling of onion powder across the global supply chain. Regular audits and supplier verification are recommended to maintain compliance and product integrity.

In conclusion, sourcing onion powder requires careful consideration of quality, supplier reliability, cost-efficiency, and regulatory compliance. It is essential to partner with reputable suppliers who adhere to food safety standards and provide consistent product quality, whether sourcing locally or internationally. Factors such as processing methods (e.g., air-dried vs. freeze-dried), moisture content, flavor profile, and packaging integrity significantly influence the final product’s performance in food applications. Conducting thorough supplier evaluations, requesting samples, and maintaining transparent communication can help ensure a stable and sustainable supply chain. Ultimately, a strategic sourcing approach to onion powder supports product consistency, enhances operational efficiency, and contributes to overall customer satisfaction in the food production process.