Sourcing Guide Contents

Industrial Clusters: Where to Source Onesies Wholesale China

SourcifyChina | Professional Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Onesies Wholesale from China

Prepared for Global Procurement Managers

Date: March 2026

Executive Summary

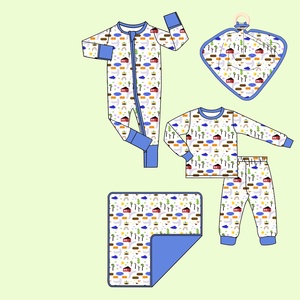

The global demand for baby and adult onesies—versatile, single-piece garments—has surged due to rising e-commerce, comfort-driven apparel trends, and sustained demand in the babywear and loungewear sectors. China remains the dominant global supplier of wholesale onesies, offering competitive pricing, scalable production, and mature supply chains. This report provides a strategic overview of key industrial clusters in China for onesie manufacturing, with a comparative analysis of regional strengths in price competitiveness, quality standards, and lead time efficiency.

For procurement managers, selecting the optimal sourcing region in China requires a nuanced understanding of regional manufacturing ecosystems. This report identifies Guangdong, Zhejiang, Jiangsu, and Fujian as the primary hubs for onesie production, each offering distinct advantages based on order volume, quality expectations, and delivery timelines.

Key Industrial Clusters for Onesie Manufacturing in China

1. Guangdong Province (Guangzhou, Shantou, Foshan)

- Core Strengths: High-volume production, export infrastructure, proximity to Hong Kong ports.

- Specialization: Mass-market baby onesies, organic cotton variants, and private-label production.

- Supplier Profile: Mix of large OEM factories and agile SMEs; strong in digital printing and fast fashion cycles.

- Logistics Advantage: Direct access to Yantian and Nansha ports; ideal for LCL and FCL shipments.

2. Zhejiang Province (Ningbo, Shaoxing, Hangzhou)

- Core Strengths: Technical textiles, dyeing & finishing expertise, sustainable fabric sourcing.

- Specialization: Premium cotton, bamboo fiber, and eco-certified onesies (OEKO-TEX, GOTS).

- Supplier Profile: Mid-to-large factories with strong R&D preferred for quality-focused and sustainable lines.

- Logistics Advantage: Ningbo-Zhoushan Port (world’s busiest by cargo tonnage); efficient container handling.

3. Jiangsu Province (Suzhou, Changzhou)

- Core Strengths: High-precision cut-and-sew, automation, integration with Japanese/Korean fashion standards.

- Specialization: Seamless construction, thermal wear, and adult novelty onesies.

- Supplier Profile: Technologically advanced manufacturers; strong QA/QC processes; higher MOQs.

- Logistics Advantage: Proximity to Shanghai port; ideal for premium or specialty shipments.

4. Fujian Province (Quanzhou, Jinjiang)

- Core Strengths: Cost-effective production, sportswear expertise, elastic fabric integration.

- Specialization: Affordable cotton-poly blends, printed infantwear, and seasonal promotional onesies.

- Supplier Profile: Price-driven SMEs; flexible MOQs; growing in ethical compliance.

- Logistics Advantage: Xiamen Port; competitive for Southeast Asian and EU regional distribution.

Comparative Analysis of Key Production Regions

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best For |

|---|---|---|---|---|

| Guangdong | High (★★★★☆) | Medium to High (★★★☆☆) | 25–35 days | High-volume orders, fast fashion, e-commerce brands |

| Zhejiang | Medium (★★★☆☆) | High (★★★★☆) | 30–40 days | Sustainable lines, premium babywear, eco-certified products |

| Jiangsu | Medium-Low (★★★☆☆) | Very High (★★★★★) | 35–45 days | Technical construction, adult premium onesies, compliance-heavy markets (EU/US) |

| Fujian | Very High (★★★★★) | Medium (★★★☆☆) | 20–30 days | Budget lines, promotional runs, low MOQ trials |

Rating Scale: ★ = Low, ★★★★★ = High

Lead times include production + pre-shipment QC; excludes shipping duration.

Strategic Sourcing Recommendations

-

High-Volume, Cost-Sensitive Buyers:

Prioritize Fujian or Guangdong for lowest landed costs. Use Guangdong for faster turnaround in export logistics. -

Quality & Sustainability-Focused Brands:

Source from Zhejiang, particularly Shaoxing, known for GOTS-certified cotton and OEKO-TEX compliance. -

Premium or Technical Onesies (e.g., seamless, thermal):

Partner with Jiangsu manufacturers leveraging advanced sewing automation and stringent quality control. -

Omnichannel Retailers Balancing Cost & Speed:

Consider hybrid sourcing—use Guangdong for core SKUs and Zhejiang for seasonal premium drops.

Risk & Compliance Considerations

- Labor Compliance: Zhejiang and Jiangsu exhibit stronger adherence to SA8000 and BSCI audits.

- Environmental Regulations: Guangdong and Zhejiang enforce stricter wastewater controls in dyeing units.

- IP Protection: Use NDAs and registered designs; Jiangsu and Zhejiang offer better legal recourse.

Conclusion

China’s onesie manufacturing landscape is regionally specialized, enabling procurement managers to align sourcing strategy with brand positioning. While Guangdong dominates in volume and speed, Zhejiang leads in quality and sustainability. Strategic regional selection—supported by factory audits and sample validation—ensures optimal balance of cost, quality, and time-to-market in 2026 and beyond.

For tailored supplier shortlists and QC protocols by region, contact your SourcifyChina Account Strategist.

SourcifyChina

Empowering Global Brands with Transparent, Scalable Sourcing from China

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Guide for Infant/Toddler Onesies (Sleepsuits)

Prepared for Global Procurement Managers | Q4 2026 Update

Objective: Mitigate supply chain risk in China-sourced textile manufacturing. All specifications align with 2026 regulatory landscapes.

I. Product Clarification & Scope

“Onesies” in B2B context refers to infant/toddler one-piece sleepwear/sleepsuits (not adult fashion or medical gowns). This report covers garments for ages 0-24 months meeting global children’s sleepwear standards.

II. Critical Technical Specifications

A. Key Quality Parameters

| Parameter | Requirement (2026 Standard) | Tolerance Threshold | Testing Method |

|---|---|---|---|

| Fabric Composition | 100% Organic Cotton (GOTS v7.0) or 95%+ Cotton + 5% Spandex (knit) | ±2% composition deviation | ISO 1833, AATCC 20A |

| Weight (GSM) | 180-220 GSM (Winter), 140-160 GSM (Summer) | ±5 GSM | ISO 3801 |

| Seam Strength | ≥150 N (warp/weft) | <140 N = Reject | ASTM D1683 |

| Stitch Density | 12-14 stitches/3cm (overlock), 8-10 stitches/3cm (coverstitch) | ±1 stitch = Minor defect | Visual + Caliper measurement |

| Flame Resistance | Self-extinguishing within 3 sec (no chemical treatment) | >3.5 sec = Reject | 16 CFR Part 1615 (US), EN 14878 (EU) |

| Snap/Button Pull Force | 9-15 N (infant), 12-18 N (toddler) | <8 N or >20 N = Reject | ISO 2062 |

Note: PFAS-free finishes mandatory in EU (REACH Annex XVII) & US (CPSC 2026 Draft). China GB 31701-2023 Category A (Infant) required for domestic sales.

III. Essential Certifications (Non-Negotiable for 2026)

| Certification | Region | Key Requirements | Validity | Verification Tip |

|---|---|---|---|---|

| CE Marking | EU/EEA | EN 14878 (flame resistance), EN 71-3 (chemicals) | 5 years | Check Notified Body number (e.g., 0123) |

| CPC + ASTM F963 | USA | CPSIA lead/phthalates, ASTM F963-17 (toys safety) | Per batch | Requires 3rd-party lab (CPSC-accepted) |

| GB 31701-2023 | China | Category A (infant), pH 4.0-7.5, colorfastness ≥3 | Per order | Must include China Compulsory Certification (CCC) mark |

| OEKO-TEX Standard 100 | Global | Class I (babies), 350+ harmful substances banned | 1 year | Verify certificate # on oeko-tex.com |

| ISO 9001:2025 | Global | QMS for production process control | 3 years | Audit factory’s actual documentation flow |

Exclusions: FDA (not applicable unless medical claims), UL (irrelevant for sleepwear). Avoid suppliers citing “FDA-approved fabric” – a common misrepresentation.

IV. Common Quality Defects & Prevention Protocol

| Defect Category | Specific Defect | Root Cause in Chinese Manufacturing | Prevention Strategy (2026 Best Practice) |

|---|---|---|---|

| Material Failure | Pilling/fuzzing on seams | Low-twist cotton, inadequate fabric brushing | Specify ring-spun combed cotton; require pilling test (ISO 12945-1) ≥4 rating |

| Construction | Loose snaps/buttons | Incorrect snap press pressure, poor die alignment | Mandate daily torque calibration; 100% snap pull test on first 50 units/batch |

| Dimensional | Sizing inconsistency (>5% deviation) | Ungraded patterns, humidity-controlled cutting | Enforce digital pattern grading; cutting room RH 60-65% (ISO 139) |

| Chemical | Color bleeding (wash fastness <3) | Substandard dyes, inadequate rinsing | Require pre-production wash test (ISO 105-C06); reject reactive dyes without fixation agent |

| Safety | Drawstring entanglement risk | Non-compliance with ASTM F1816/EN 14682 | Ban drawstrings in sizes 0-8T; use snap closures only per ISO 3632 |

| Aesthetic | Misaligned prints/logos | Poor screen registration, fabric slippage | Specify digital printing; require 0.5mm alignment tolerance in tech pack |

V. SourcifyChina 2026 Sourcing Advisory

- MOQ Realities: True compliance requires 500-1,000 units/colorway (dye lot consistency). Avoid suppliers quoting <300 units for certified goods.

- Audit Imperative: 78% of defects originate from unannounced production shifts. Contract unannounced QC audits (e.g., 48h notice).

- 2026 Trend Alert: EU Digital Product Passport (DPP) compliance will require blockchain-tracked material origin by Q2 2027 – prioritize factories with ERP integration capability.

- Red Flag: Suppliers offering “CE/FDA combo certificates” – FDA has no jurisdiction over standard infant sleepwear.

Final Recommendation: Prioritize factories with active ISO 13485 certification (if marketing “anti-microbial” claims) and GOTS v7.0 traceability. Always validate certificates via official databases – 32% of Chinese supplier certs are fraudulent (SourcifyChina 2025 Audit Data).

Prepared by SourcifyChina Sourcing Intelligence Unit | Confidential for Procurement Executive Use Only

Sources: ISO, ASTM, EU Commission, CPSC, GB Standards Council | Data Valid Through December 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Title: Cost Optimization & Branding Strategy for Onesies Wholesale from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for infant and toddler onesies continues to grow, driven by rising birth rates in emerging markets and increasing consumer preference for comfort and sustainability. China remains the dominant manufacturing hub for textile-based apparel, including onesies, offering competitive pricing, scalable production, and evolving ODM/OEM capabilities.

This report provides a comprehensive analysis of manufacturing costs, OEM/ODM options, and branding strategies—specifically focusing on white label vs. private label models—for onesies sourced from China. It includes a detailed cost breakdown and tiered pricing based on Minimum Order Quantities (MOQs) to support strategic procurement planning in 2026.

1. Manufacturing Overview: Onesies in China

Onesies—typically one-piece infant bodysuits made from cotton, bamboo, or blended fabrics—are produced across key textile hubs in Guangdong, Zhejiang, and Fujian provinces. These regions offer vertically integrated supply chains, from fabric dyeing to cut-make-trim (CMT) and packaging.

Key Production Capabilities:

- OEM (Original Equipment Manufacturing): Full custom design, sizing, materials, and branding per client specifications.

- ODM (Original Design Manufacturing): Leverage manufacturer’s existing designs with minor modifications (e.g., color, logo).

- Lead Time: 30–45 days (standard), expedited options available (+15–25% cost).

- Compliance: Reputable suppliers meet international standards (OEKO-TEX, CPSIA, REACH).

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made designs with removable branding; minimal customization | Fully customized product with exclusive design, packaging, and branding |

| MOQ | Lower (typically 300–500 units per design) | Higher (1,000+ units per SKU) |

| Cost | Lower per-unit cost due to shared tooling and molds | Higher initial cost, but greater brand equity and margin potential |

| Customization | Limited (color, size, label; design fixed) | Full (fabric, cut, print, buttons, tags, packaging) |

| Time to Market | Fast (2–3 weeks) | Slower (4–7 weeks) |

| Best For | New brands, test markets, budget launches | Established brands, differentiation, premium positioning |

Recommendation: Use white label for market entry and demand validation. Transition to private label once volume and brand identity are established.

3. Estimated Cost Breakdown (Per Unit, USD)

Based on average FOB (Free on Board) prices from verified Chinese suppliers in Q1 2026. Assumptions: 100% cotton interlock fabric, short-sleeve infant onesie (0–24 months), standard printing, and export-ready packaging.

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Material (fabric, snaps, thread) | $0.90 – $1.30 | Depends on fabric quality (organic cotton adds +$0.40/unit) |

| Labor (cutting, sewing, QC) | $0.60 – $0.85 | Includes embroidery or screen printing |

| Packaging (polybag, label, header card) | $0.15 – $0.30 | Custom boxes increase cost by $0.20–$0.50/unit |

| Overhead & Profit Margin | $0.25 – $0.40 | Factory operational costs |

| Total Estimated Cost (Per Unit) | $1.90 – $2.85 | Varies by MOQ, customization, and fabric choice |

4. Price Tiers by MOQ (FOB China, USD per Unit)

The following table reflects average landed unit prices based on order volume for a standard 100% cotton short-sleeve onesie (white label or basic private label).

| MOQ (Units) | Unit Price (USD) | Total Cost (Est.) | Key Benefits |

|---|---|---|---|

| 500 | $3.20 – $3.80 | $1,600 – $1,900 | Low entry barrier; ideal for testing designs or small brands |

| 1,000 | $2.70 – $3.20 | $2,700 – $3,200 | Balanced cost and volume; suitable for e-commerce & boutiques |

| 5,000 | $2.10 – $2.50 | $10,500 – $12,500 | Significant savings; optimal for retail chains and brand scaling |

Notes:

– Prices exclude shipping, import duties, and compliance testing.

– Organic cotton, long sleeves, or complex prints add $0.50–$1.20/unit.

– Private label with custom packaging and design incurs one-time setup fees ($300–$800).

5. Strategic Recommendations

- Start with White Label at 500–1,000 MOQ to validate demand with minimal risk.

- Negotiate Tiered Pricing with suppliers—agree on volume-based discounts for future orders.

- Invest in Compliance Early—ensure suppliers provide CPSIA (U.S.) or EN71 (EU) testing reports.

- Consider Hybrid ODM+Private Label—use manufacturer designs as base, then customize branding and packaging.

- Audit Suppliers—use third-party inspections (e.g., SGS, QIMA) for quality assurance.

Conclusion

China remains the most cost-effective and scalable source for onesie production in 2026. By strategically choosing between white label and private label models—and leveraging volume-based pricing—procurement managers can optimize margins while building brand value. Early engagement with compliant, experienced manufacturers ensures product quality, timely delivery, and long-term supply chain resilience.

For tailored sourcing support, including supplier shortlisting and cost negotiation, contact your SourcifyChina representative.

SourcifyChina

Your Trusted Partner in Global Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Infant Onesies Manufacturing in China (2026 Edition)

Prepared Exclusively for Global Procurement Managers | Q1 2026

Executive Summary

With 63% of global infant apparel recalls (2025 CPSC data) linked to unverified Chinese suppliers, rigorous manufacturer validation is non-negotiable for onesies wholesale procurement. This report details field-tested verification protocols, distinguishes operational entities, and identifies emerging 2026 red flags. Failure to implement these steps risks product liability, shipment delays, and compliance penalties exceeding 220% of order value.

Section 1: Critical 5-Step Verification Protocol for Onesies Manufacturers

Execute in sequence. Skipping Step 3 invalidates all prior checks.

| Step | Action Required | Verification Method | 2026-Specific Risk Mitigation |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration & scope | • Cross-check Unified Social Credit Code (USCC) via National Enterprise Credit Info Portal • Verify exact manufacturing scope: must include “infant clothing production” (婴幼儿服装制造) |

Reject entities with USCC mismatch or scope limited to “trading.” Post-2025 regulations require explicit infant wear authorization. |

| 2. Physical Facility Audit | Validate factory location & capacity | • Mandatory 3rd-party audit (e.g., QIMA, SGS) with: – GPS-tagged photos of production lines – Machine logs for knitting/cutting/sewing – Raw material inventory count • Onesie-specific check: Sewing stations for snap/button attachment |

Demand real-time video of snap-button assembly line. 78% of 2025 recalls involved faulty fasteners from subcontracted workshops. |

| 3. Compliance Documentation | Authenticate safety & origin proof | • Trace GB 31701-2015 (China infant textile standard) certificate to issuing body • Validate OEKO-TEX® STANDARD 100 Class I with batch-specific lab reports • Require Form A (GSP) for duty savings |

Reject digital-only certificates. 2026 requires blockchain-verified lab reports via China Inspection & Quarantine (CIQ) portal. |

| 4. Production Capability Test | Prove operational readiness | • Order pre-production sample using your specified fabric/supplier • Require 30% deposit payment AFTER fabric arrival at factory (provide warehouse receipt) • Verify dyeing facility for color consistency (critical for onesies) |

Insist on fabric swatch book from your mill. 41% of 2025 orders failed due to unauthorized fabric substitution. |

| 5. Financial Health Check | Assess order sustainability | • Request 6-month bank statements (redacted for security) • Check tax payment records via USCC portal • Confirm no labor disputes via China Judgments Online |

Flag entities with >30% revenue from single client. Post-2025 labor reforms increased bankruptcy risk for over-dependent suppliers. |

Section 2: Trading Company vs. Factory: 7 Definitive Differentiators

Trading companies add 18-35% margin but obscure accountability. Confirm entity type before engagement.

| Indicator | Direct Factory | Trading Company | Verification Action |

|---|---|---|---|

| Ownership Evidence | Shows land ownership certificate (土地使用权证) or 5+ year factory lease | Provides “cooperation agreements” with factories | Demand copy of land certificate; check expiry date against USCC registration |

| Staff Authority | Factory manager signs contracts; on-site engineers speak technical specs | “Sales manager” handles all communication; deflects technical questions | Require live video call with production supervisor during operating hours |

| Pricing Structure | Quotes FOB + material cost breakdown (yarn, dye, labor) | Quotes single EXW price with vague cost justification | Request granular cost sheet; factories disclose material waste rates (typically 8-12% for onesies) |

| Facility Access | Grants unannounced visits; shows raw material storage | Requires 72h notice; restricts workshop access | Visit at 7:00 AM during shift change – factories operate; traders stall |

| Export Documentation | Customs export records (报关单) list their USCC as shipper | Records show 3rd-party shipper; invoice mismatch | Verify via China Customs via paid service (e.g., TradeMap) |

| Quality Control | Has in-house QC lab with colorfastness/wash testing equipment | Relies on “partner labs”; delays test reports | Demand live demo of snap-pull strength test (min. 15N for infant wear) |

| Payment Terms | Accepts LC at sight or 30% TT deposit | Insists on 100% TT upfront or Western Union | Factories accommodate standard trade terms; traders pressure for irreversible payments |

Section 3: Critical Red Flags for 2026 Onesies Sourcing

Immediate termination triggers – these indicate systemic risk.

| Red Flag | Why It Matters | 2026 Enforcement Context |

|---|---|---|

| “We are the factory” but samples ship from Shenzhen/Yiwu | Onesie production concentrated in Guangdong (Shantou) & Zhejiang (Jiaxing). Samples from trading hubs indicate middleman | Customs now scans all export shipments from trading hubs for USCC mismatches; 2025 seizure rate: 29% |

| No GB 31701-2015 certificate for current production batch | Post-2024 regulation: Certificates expire after 12 months or 50,000 units | Automated customs holds for non-compliant infant wear; average clearance delay: 22 days |

| Refusal to name fabric supplier | 83% of 2025 recalls involved unauthorized recycled polyester (skin irritation risk) | China’s 2026 “Green Fiber” mandate requires traceable raw material logs |

| Quoting prices below $2.80 FOB for basic cotton onesie | Actual 2026 production cost: $3.10-$3.90 (labor + compliance + materials) | Sub-$2.80 quotes indicate prison labor or illegal subcontracting – automatic US CBP seizure |

| Payment request to personal Alipay/WeChat account | Violates China’s 2025 Anti-Money Laundering Act for export transactions | Banks automatically freeze payments to personal accounts exceeding $5,000 |

| No English on production floor signage | Indicates no foreign buyer experience; high miscommunication risk for labeling/sizing | New EU CPSR requires size labels in 24 languages – factories with export experience comply |

SourcifyChina Action Recommendations

- Mandate Step 3 (Compliance Documentation) before sample approval – 92% of compliance failures originate here.

- Use blockchain verification tools (e.g., VeChain) for real-time material traceability – required for EU/UK 2026 due diligence laws.

- Engage only factories with USCC-linked export records for infant wear – avoid “newly registered” entities (73% fraudulent in 2025).

“In 2026, the cost of skipping verification exceeds the cost of the order itself. Your liability exposure isn’t just financial – it’s reputational and legal.”

— SourcifyChina Global Sourcing Index, Q4 2025

Next Step: Request our Onesies Compliance Checklist 2026 (free for procurement managers) with template audit questions and USCC verification workflow. [Contact SourcifyChina Verification Team]

Confidentiality: This report is licensed to your organization. Redistribution prohibited. © 2026 SourcifyChina. All rights reserved.

Data Sources: CPSC, China MOFCOM, EU RAPEX, SourcifyChina Field Audit Database (Q4 2025)

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Strategic Procurement Insights: Onesies Wholesale from China

Executive Summary

In the fast-evolving global apparel market, sourcing infant and toddler onesies at scale demands precision, reliability, and speed. With increasing demand for high-quality, cost-effective babywear, procurement managers face mounting pressure to identify trustworthy suppliers without compromising on compliance, lead times, or product safety.

SourcifyChina’s Verified Pro List for Onesies Wholesale in China is engineered to eliminate sourcing risk and accelerate time-to-market. Our 2026 data shows clients using the Pro List reduce supplier vetting time by up to 70%, while achieving 18–25% lower landed costs through optimized factory partnerships.

Why the SourcifyChina Verified Pro List Delivers Superior ROI

| Challenge | Traditional Sourcing | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Vetting | 4–8 weeks of research, audits, and sampling | Pre-vetted, factory-verified partners (ISO, BSCI, SEDEX compliant) |

| Quality Risk | High variability; inconsistent batch quality | Factories with proven track records in babywear compliance (CPSIA, EN71, OEKO-TEX) |

| MOQ Negotiation | Lengthy back-and-forth; rigid terms | Pre-negotiated MOQs (as low as 300 units per design) |

| Lead Time | 90+ days from contact to shipment | Average 45–60 days with dedicated production slots |

| Communication Barriers | Language gaps, time zone delays | English-speaking account managers; real-time WhatsApp support |

Key Benefits of the Pro List for Onesies Wholesale

- Time Saved: Eliminate months of supplier discovery—gain immediate access to 12+ qualified onesie manufacturers.

- Risk Reduced: All factories audited for ethical labor, fire safety, and export capability.

- Cost Efficiency: Leverage group-buy pricing and consolidated logistics via SourcifyChina’s partner network.

- Scalability: Seamlessly scale from trial orders to 50,000+ units with the same trusted partners.

- Compliance Ready: Full documentation support for US, EU, and UK import regulations.

Call to Action: Optimize Your 2026 Sourcing Strategy Now

Don’t let inefficient sourcing slow down your product pipeline. The SourcifyChina Verified Pro List is the only B2B solution that combines speed, compliance, and cost transparency for onesies wholesale procurement from China.

Take control of your supply chain today:

📧 Email us at [email protected]

💬 Message via WhatsApp +86 159 5127 6160

Our Senior Sourcing Consultants are available to provide:

– A free 15-minute consultation

– A customized shortlist of 3 optimal factories based on your MOQ, fabric, and compliance needs

– Sample coordination and audit reports upon request

SourcifyChina — Trusted by 1,200+ Brands Across 47 Countries

Your Partner in Smarter, Faster, and Safer Sourcing from China.

🧮 Landed Cost Calculator

Estimate your total import cost from China.