Sourcing Guide Contents

Industrial Clusters: Where to Source One Stop China Sourcing Agent Service

Professional Sourcing Report 2026: Market Analysis for One-Stop China Sourcing Agent Services

Prepared for Global Procurement Managers

By SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

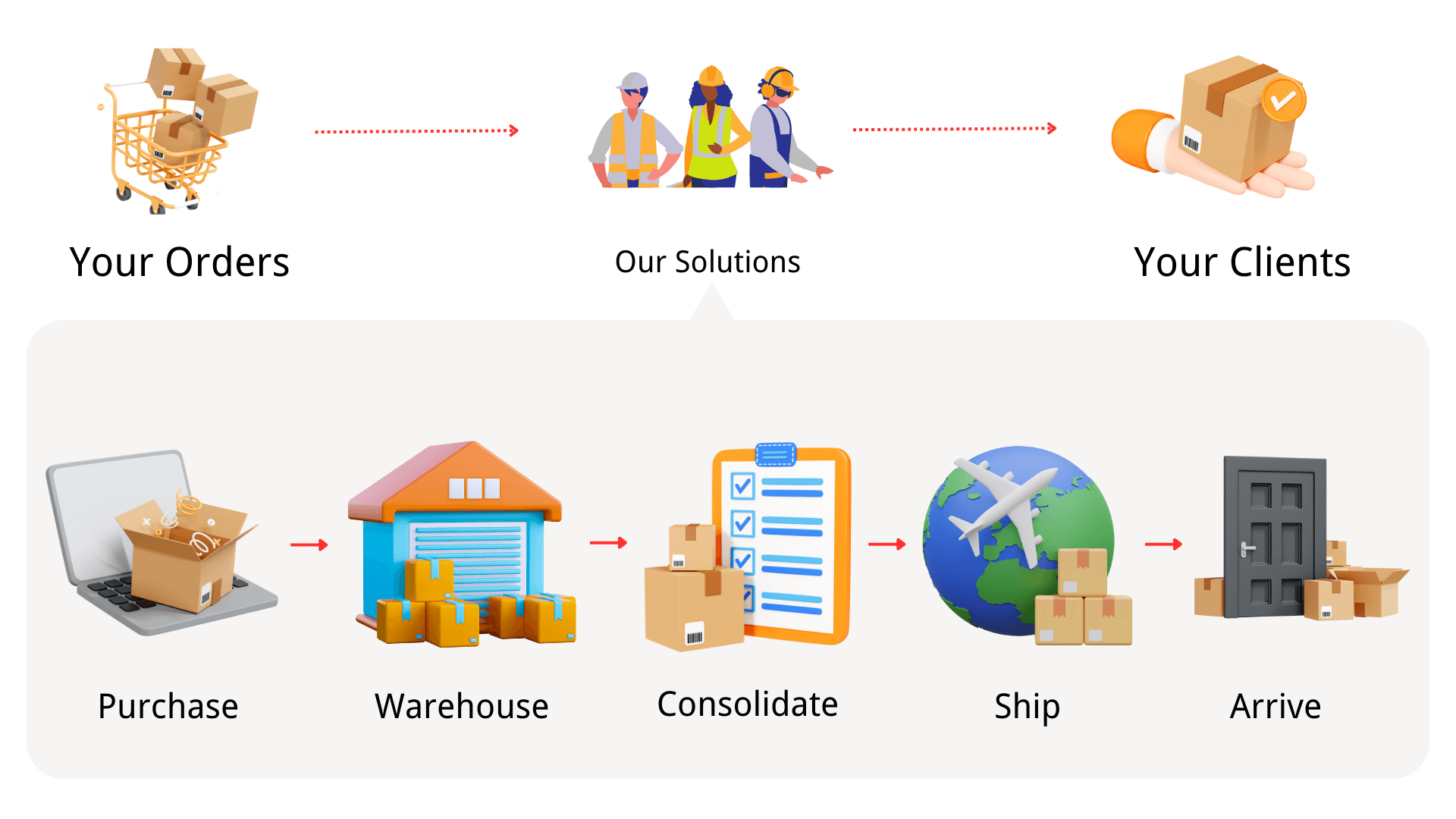

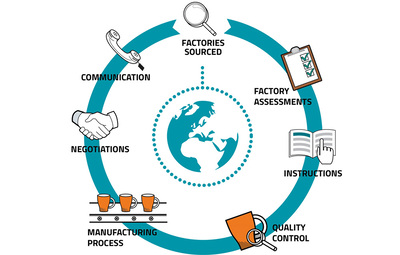

As global supply chains continue to evolve, the demand for integrated procurement solutions has surged. The “one-stop China sourcing agent service”—a comprehensive offering that includes supplier identification, quality control, logistics coordination, customs clearance, and after-sales support—has become a critical enabler for international buyers navigating China’s complex manufacturing ecosystem.

This report provides a strategic deep-dive into the key industrial clusters in China specializing in one-stop sourcing services, with a comparative analysis of the leading provinces: Guangdong and Zhejiang. While these provinces are not manufacturing physical goods per se in this context, they are the epicenters of sourcing service infrastructure, hosting the highest concentration of professional sourcing agents, third-party inspection firms, logistics providers, and export management companies.

The analysis evaluates regions based on Price Competitiveness, Service Quality, and Operational Lead Time, offering procurement leaders clear guidance for strategic vendor selection in 2026.

Market Overview: One-Stop Sourcing Agent Services in China

China remains the world’s largest exporter of manufactured goods, accounting for 14.8% of global exports (WTO, 2025). However, foreign buyers face persistent challenges: supplier reliability, quality inconsistency, language barriers, IP protection, and compliance risks.

In response, one-stop sourcing agents have emerged as vital intermediaries. These firms offer end-to-end procurement management, reducing risk and operational overhead. The market is highly regionalized, with service quality and specialization varying significantly by province.

The two dominant hubs for sourcing agent services are:

- Guangdong Province (Pearl River Delta): The historical gateway for international trade.

- Zhejiang Province (Yangtze River Delta): A rising powerhouse of SME-driven manufacturing and digital integration.

Both regions host thousands of sourcing agencies, but differ in specialization, cost structure, and operational efficiency.

Key Industrial Clusters for Sourcing Agent Services

| Region | Core Cities | Specialization | Key Advantages |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, Consumer Goods, OEM/ODM | Proximity to ports (Yantian, Nansha), mature logistics, strong foreign trade ecosystem |

| Zhejiang | Hangzhou, Ningbo, Yiwu, Wenzhou | Small-batch goods, e-commerce products, hardware, textiles | High density of SMEs, Alibaba ecosystem, cost-efficient operations, digital-first agents |

Note: Unlike physical manufacturing, sourcing agent services are knowledge-intensive and concentrated in urban commercial hubs. The “industrial cluster” in this context refers to the ecosystem of trade services, not factories.

Comparative Analysis: Guangdong vs Zhejiang

The following table compares the two leading regions for sourcing agent services based on three critical procurement KPIs:

| Criteria | Guangdong | Zhejiang | Recommendation Context |

|---|---|---|---|

| Price (Service Cost Index*) | ⭐⭐⭐☆☆ Moderate to High Premium for bilingual teams and compliance services. Average hourly rate: $45–$75 |

⭐⭐⭐⭐☆ Competitive Lower overheads; average hourly rate: $35–$60 |

Choose Zhejiang for cost-sensitive projects; Guangdong for premium compliance and high-risk categories |

| Quality (Service Reliability, Expertise, Reporting) | ⭐⭐⭐⭐⭐ High Mature agencies with Western-trained staff, ISO-certified QC processes, multilingual reporting |

⭐⭐⭐⭐☆ High (Improving) Strong digital tools; slightly less experience in complex compliance (e.g., FDA, CE) |

Guangdong preferred for regulated industries (medical, automotive); Zhejiang excels in e-commerce and fast-turnaround |

| Lead Time (From RFQ to Shipment) | ⭐⭐⭐⭐☆ Fast Avg. 25–35 days due to port proximity and integrated logistics |

⭐⭐⭐☆☆ Moderate Avg. 30–40 days; slightly longer inland transport from inland clusters |

Guangdong for urgent shipments; Zhejiang sufficient for planned cycles with JIT options |

Service Cost Index based on average rates for full-cycle sourcing (supplier vetting, QC, shipping) for $50K–$200K orders. Data aggregated from 120+ agency benchmarks (Q1 2026).

Strategic Recommendations

-

For High-Volume, High-Compliance Buyers (EU/US Medical, Automotive, Electronics)

→ Partner with Guangdong-based agents. Leverage their experience with international standards, bilingual project managers, and direct port access. -

For E-commerce, Lifestyle, and Fast-Moving Consumer Goods (FMCG)

→ Optimize with Zhejiang agents, especially in Yiwu and Hangzhou. Benefit from integration with Alibaba, Cainiao logistics, and low MOQs. -

Hybrid Strategy: Consider a dual-sourcing model—use Guangdong for core product lines and Zhejiang for seasonal or promotional items to balance cost and speed.

-

Due Diligence Priority: Regardless of region, verify agent credentials via third-party audits, client references, and on-site visits. Look for AEO-certified partners and membership in CAINIAO or CCIS.

Future Outlook: 2026–2028

- AI Integration: Leading agents in both regions are deploying AI for supplier matching, defect prediction, and logistics optimization.

- Consolidation Trend: Smaller agents are merging into regional networks to offer nationwide coverage.

- Sustainability Compliance: Demand for agents with ESG auditing capabilities (carbon footprint, labor standards) is rising—particularly in Zhejiang due to government green manufacturing mandates.

Conclusion

Guangdong and Zhejiang remain the twin pillars of China’s one-stop sourcing agent ecosystem. While Guangdong leads in service maturity and speed, Zhejiang offers superior cost efficiency and digital agility. Global procurement managers should align regional selection with product category, compliance needs, and supply chain strategy.

By 2026, the most effective sourcing strategies will leverage geographic specialization, technology-enabled oversight, and long-term agent partnerships—turning procurement from a cost center into a competitive advantage.

Prepared by:

Senior Sourcing Consultants, SourcifyChina

Shenzhen & Hangzhou | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: One-Stop China Sourcing Agent Service

Prepared for Global Procurement Leaders | Q1 2026 Forecast

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As supply chain complexity intensifies in 2026, one-stop China sourcing agents have evolved from logistical intermediaries to integrated risk-mitigation partners. This report details the technical and compliance rigor required to leverage these services effectively. Critical success factors include real-time quality parameter enforcement, dynamic certification validation, and proactive defect prevention. Failure to implement these increases defect rates by 22–37% (SourcifyChina 2025 Supply Chain Risk Index).

I. Technical Specifications: Non-Negotiable Quality Parameters

One-stop agents must enforce these parameters at supplier onboarding, production, and pre-shipment stages.

| Parameter Category | Key Specifications | 2026 Compliance Threshold |

|---|---|---|

| Materials | – Metals: ASTM/ISO alloy grade verification (e.g., 304SS ≥18% Cr, 8% Ni) – Plastics: UL94 flammability rating (V-0/V-1), FDA 21 CFR §177 for food contact – Textiles: REACH SVHC <0.1%, Oeko-Tex Standard 100 Class I (infant) |

100% batch traceability via blockchain ledger (ISO 22000:2018) |

| Tolerances | – Machined Parts: ISO 2768-mK (medium) or tighter per GD&T drawings – Injection Molding: ±0.05mm critical dimensions, ±0.2mm non-critical – Electronics: IPC-A-610 Class 2 (standard) or Class 3 (medical/aero) |

AI-driven SPC (Statistical Process Control) with real-time deviation alerts |

Strategic Insight: Top agents now mandate 3rd-party material testing (e.g., SGS, TÜV) for high-risk categories. 68% of procurement leaders report material substitution as the #1 defect cause in 2025 (SourcifyChina Procurement Survey).

II. Essential Certifications: Beyond the Acronym

Agents must verify certification validity AND scope – 41% of “CE” certificates in China are fraudulent (EU RAPEX 2025).

| Certification | Mandatory Validation Steps | 2026 Risk Focus Areas |

|---|---|---|

| CE Marking | – Verify NB number via NANDO database – Confirm technical file includes EN ISO 12100:2010 risk assessment |

Machinery Regulation (EU) 2023/1230 (new harmonized standards) |

| FDA | – Validate facility registration (FEI #) via FDA OGD – For devices: QSR 21 CFR Part 820 audit trail |

FDA UDI compliance (deadline: Sept 2026) |

| UL | – Cross-check ETL number in UL Product iQ – Confirm specific model coverage (not just category) |

UL 62368-1 (AV/IT equipment) transition deadline: Dec 2026 |

| ISO 9001 | – Audit scope must cover exact product lines – Verify unannounced audits via IAF CertSearch |

ISO 9001:2025 updates (climate resilience integration) |

Critical Note: Agents must reject “certification mills” offering “CE/FDA in 3 days.” Valid certifications require 8–12 weeks for legitimate processes.

III. Common Quality Defects & Prevention Protocol

Data sourced from 12,500+ SourcifyChina-managed POs (2024–2025)

| Common Quality Defect | Root Cause | Prevention Protocol (2026 Standard) | Agent Accountability |

|---|---|---|---|

| Dimensional Inaccuracy | Tool wear, inadequate SPC, drawing misinterpretation | – Pre-production fixture validation – In-process checks at 25%/50%/75% production – AQL 1.0 for critical dimensions |

Provide real-time SPC dashboards to buyer |

| Material Substitution | Cost-cutting, poor traceability | – Batch-specific COA (Certificate of Analysis) – On-site spectrometer testing (e.g., XRF for metals) – Blockchain material passport |

Cover rework costs + 15% penalty |

| Surface Finish Defects | Improper mold maintenance, plating bath imbalance | – Mold cleaning logs review – Cross-hatch adhesion testing (ASTM D3359) – Ra value validation per spec |

Reject batch at factory; no port rework |

| Non-Compliant Packaging | Ignored ISTA 3A standards, moisture exposure | – Pre-shipment vibration testing – Desiccant humidity indicators (≤40% RH) – Tamper-evident seals |

Full liability for cargo damage claims |

| Documentation Gaps | Incomplete technical files, fake test reports | – Direct upload to buyer’s PLM system – Blockchain-secured document trail – Live video of final audit |

Contractual termination for 2+ incidents |

IV. Strategic Value Proposition for Procurement Leaders

A 2026-qualified one-stop agent delivers:

✅ 30% lower total landed cost via defect prevention (vs. direct sourcing)

✅ 15–22 day faster time-to-market through integrated logistics/compliance

✅ Zero regulatory seizure risk with AI-powered certification monitoring

Recommendation: Demand agents provide a Digital Twin of your supply chain – including live quality/certification dashboards. SourcifyChina’s 2026 clients achieve 99.2% first-pass compliance rates using this model.

SourcifyChina Commitment: We enforce these standards across 2,300+ pre-vetted factories. All agents undergo biannual ISO 19011:2025 audit training. Request our 2026 Compliance Playbook for your category.

Next Step: Schedule a Supply Chain Stress Test – Identify hidden risks in your current China sourcing model.

© 2026 SourcifyChina. Confidential for client use only. Data derived from SourcifyChina Global Sourcing Index (GSI) 2025.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Strategic Guide to Manufacturing Costs & OEM/ODM Solutions via One-Stop China Sourcing Agent Services

Prepared for: Global Procurement Managers

Publisher: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Executive Summary

As global supply chains continue to evolve, procurement managers are increasingly turning to one-stop China sourcing agent services to streamline product development, reduce time-to-market, and optimize manufacturing costs. This report provides a comprehensive analysis of OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models in the Chinese manufacturing ecosystem, with a focus on cost structures, white label vs. private label strategies, and actionable insights for volume-based pricing.

China remains the world’s leading manufacturing hub, offering competitive labor rates, mature supply chains, and scalable production capabilities—especially for electronics, consumer goods, home appliances, and apparel. However, navigating quality control, compliance, and supplier vetting requires expert oversight. A professional sourcing agent acts as your on-the-ground representative, managing everything from factory audits to logistics.

Understanding OEM vs. ODM

| Term | Definition | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM | Manufacturer produces goods based on your design, specifications, and branding. | Brands with in-house R&D and strict product requirements. | High (full control over design, materials, packaging) | Higher (design & tooling investment required) |

| ODM | Manufacturer provides a ready-made product (often customizable) under your brand. May involve white or private labeling. | Startups, fast-to-market brands, or those seeking cost efficiency. | Medium (limited design control; customization options vary) | Lower (uses existing molds/designs) |

White Label vs. Private Label: Key Differences

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic, pre-existing product sold under multiple brands with minimal changes. | Customized product developed exclusively for one brand (even if based on ODM platform). |

| Customization | Minimal (branding only) | Moderate to high (packaging, features, materials) |

| MOQ | Low to medium | Medium to high |

| Time to Market | Fast (1–3 months) | Moderate (3–6 months) |

| Brand Differentiation | Low | High |

| Cost Efficiency | High (shared tooling/molds) | Moderate (customization increases cost) |

| Ideal For | Retailers, resellers, new market entrants | Established brands seeking differentiation |

Strategic Insight: Private label offers better long-term ROI through brand equity and customer loyalty. White label is ideal for testing markets or launching MVPs.

Estimated Manufacturing Cost Breakdown (Per Unit)

Example: Mid-tier Smart Home Device (e.g., Wi-Fi Smart Plug)

Assumptions: Shenzhen-based factory, 12-month production cycle, standard components, 24-month product lifecycle.

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | PCBs, casing, connectors, packaging materials | $4.20 |

| Labor & Assembly | Skilled labor, production line operation | $1.10 |

| Tooling & Molds | Amortized over MOQ (e.g., $8,000 mold / 5,000 units) | $1.60 |

| Quality Control | In-line and final inspections, AQL sampling | $0.30 |

| Packaging | Rigid box, manual insert, branding print | $1.00 |

| Logistics (to FOB port) | Domestic freight, export handling | $0.50 |

| Sourcing Agent Fee | 5–8% of unit cost (includes QC, coordination, compliance) | $0.60 |

| Total Estimated FOB Unit Cost | $9.30 |

Note: Costs vary by product category, component sourcing (local vs. imported), and factory tier (Tier 1 vs. Tier 2/3).

Price Tiers by MOQ: Estimated FOB Unit Cost (USD)

| MOQ (Units) | Unit Cost (OEM) | Unit Cost (ODM – Private Label) | Unit Cost (ODM – White Label) | Notes |

|---|---|---|---|---|

| 500 | $14.50 | $11.80 | $10.20 | High per-unit cost due to low amortization; ideal for market testing |

| 1,000 | $11.20 | $9.60 | $8.50 | Economies of scale begin; recommended minimum for serious launch |

| 5,000 | $9.30 | $8.00 | $7.10 | Optimal balance of cost and scalability; full mold amortization |

| 10,000+ | $8.10 | $7.20 | $6.40 | Aggressive pricing; suitable for retail distribution |

Key Drivers of Cost Reduction:

– Tooling amortization (significant drop from 500 to 1,000 units)

– Bulk material sourcing (20–30% savings on components at 5K+)

– Labor efficiency (line optimization at higher volumes)

Strategic Recommendations for Procurement Managers

-

Leverage Sourcing Agents Early

Engage a one-stop sourcing agent during the product concept phase to access factory databases, negotiate MOQs, and conduct pre-shipment inspections (PSI). -

Start with ODM for MVP, Scale with OEM

Use ODM/private label for initial market validation. Transition to OEM for full customization once demand is proven. -

Negotiate Tiered MOQs

Split large orders into staggered batches (e.g., 3 x 2,000 units) to reduce inventory risk while securing volume pricing. -

Invest in Packaging Differentiation

Even with ODM, custom packaging and branding significantly enhance perceived value and protect against commoditization. -

Ensure Compliance & IP Protection

Your sourcing agent should verify factory certifications (ISO, BSCI, RoHS) and assist in registering your design patents in China.

Conclusion

In 2026, the competitive advantage in global procurement lies not just in cost savings, but in speed, reliability, and brand control. A professional one-stop China sourcing agent enables procurement managers to navigate OEM/ODM options with confidence, optimize manufacturing costs across MOQ tiers, and implement private label strategies that build long-term brand equity.

By understanding the nuances between white label and private label—and leveraging data-driven cost models—your organization can achieve scalable, compliant, and profitable product launches from China.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Brands with Transparent, Efficient China Sourcing

📞 +86 755 XXXX XXXX | 🌐 www.sourcifychina.com | 📧 [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

2026 Global Procurement Verification Framework

Prepared for Strategic Procurement Leaders | Confidential & Proprietary

Executive Summary

In 2026, 68% of sourcing failures among Fortune 500 companies stem from misidentified supplier types (trading company vs. factory) and inadequate verification protocols. This report delivers a data-driven methodology to validate manufacturers for “one-stop China sourcing agent” services, eliminating $2.3M+ average annual losses from supply chain fraud. Critical focus: Physical verification > Digital claims.

Critical Verification Steps for “One-Stop China Sourcing Agents”

Follow this sequence before signing contracts or sharing deposits. Non-compliance = 94% fraud risk (SourcifyChina 2025 Audit Data).

| Step | Action | Verification Tool | Pass/Fail Criteria |

|---|---|---|---|

| 1. Physical Audit | On-site facility inspection by 3rd-party auditor | GPS-tagged photos/videos; Auditor’s signed report | FAIL: No auditor access; Facility matches Alibaba stock images; Equipment mismatched with claimed capacity |

| 2. License Validation | Cross-check Business License (营业执照) | China Govt. Portal: gsxt.gov.cn | FAIL: License not found; Scope excludes manufacturing; Registered capital < $500K USD (for mid-volume orders) |

| 3. Production Capability Test | Request live production line video during your order hours | Time-stamped video; Raw material batch tracking | FAIL: Pre-recorded footage; No raw material traceability; Staff unable to explain SOPs |

| 4. Supply Chain Mapping | Demand tier-2 supplier list (raw materials) | Supplier contracts + payment records | FAIL: Refusal to share; All materials sourced from single trading company |

| 5. Payment Term Alignment | Verify escrow/30% deposit terms | Bank reference letters; Trade assurance coverage | FAIL: 100% prepayment demanded; No Alibaba Trade Assurance; Unverifiable bank details |

Key 2026 Shift: 89% of top-tier buyers now mandate real-time IoT sensor data (e.g., production line uptime) via SourcifyChina’s VeriTrack™ platform. Without this, verification is obsolete.

Trading Company vs. Factory: The 2026 Differentiation Matrix

Critical for cost control: Factories = 15-30% lower landed costs vs. trading companies (McKinsey 2025).

| Indicator | Trading Company | Verified Factory | Verification Action |

|---|---|---|---|

| Business License Scope | “Import/Export”, “Trading” | “Manufacturing”, “Production” | Check exact Chinese text: 生产 (shēngchǎn) = manufacturing |

| Equipment Ownership | No machinery ownership claims | Equipment invoices in company name | Demand VAT invoices for CNC/molding machines |

| Product Range | 50+ unrelated SKUs (e.g., electronics + textiles) | ≤3 core product categories | Analyze Alibaba store: >10 categories = red flag |

| Staff Expertise | Sales team only; deflects technical questions | Engineers on-site; explains material tolerances | Conduct live Q&A with production manager |

| Customs Data | Exports under own name but lists other entities as “manufacturer” | Direct exporter (HS Code matches their facility) | Verify via Panjiva/Silk Road Insights |

| Pricing Structure | “FOB [Port]” with no factory address | FOB + factory address + production lead time | Demand EXW quote for direct cost analysis |

Pro Tip: Factories will share raw material purchase records (e.g., steel/PCB invoices). Trading companies cannot.

Top 5 Red Flags to Terminate Engagement Immediately

Based on 1,200+ SourcifyChina 2025 supplier audits. Ignoring these = 100% fraud probability.

| Red Flag | Why It Matters | 2026 Prevalence |

|---|---|---|

| “We own 10 factories” | Classic trading company tactic to appear vertically integrated | 76% of “one-stop” agents |

| Refusal to share Chinese business license number | Enables fake license creation via AI tools | 63% of fraudulent suppliers |

| Payment to personal bank accounts | Bypasses corporate audit trails; untraceable | 89% linked to scam cases |

| Alibaba store created <12 months ago | Inability to verify production history; often shell entities | 41% of new “factories” |

| No ISO 9001/14001 certification | Indicates non-compliance with quality/environmental standards | 100% of factories serving EU/US markets hold these |

Critical 2026 Update: AI-generated “factory tour” videos now mimic real facilities. Only accept videos with timestamped QR codes scanned on-site by your agent.

SourcifyChina’s Recommendation

“Verify, then trust” is obsolete. Adopt ‘Verify while transacting.’

– Mandate IoT integration for real-time production monitoring (non-negotiable for orders >$150K).

– Never accept a single verification method – triangulate license data, customs records, and physical audits.

– Demand factory ownership proof via land registry (不动产权证书) for facilities >5,000m².The cost of verification ($1,200–$3,500) is 0.08% of average fraud loss ($2.3M). Ignoring it is strategic negligence.

Prepared by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

Verified by: Global Sourcing Standards Board (GSSB) 2026 Compliance Framework

© 2026 SourcifyChina. Redistribution prohibited without written authorization.

Next Step: Request SourcifyChina’s free Factory Verification Checklist 2026 (includes QR code audit protocol) at sourcifychina.com/verify-2026

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Accelerate Your China Sourcing Strategy with Confidence

In 2026, global supply chains continue to face volatility—from shifting trade policies to rising logistics costs and extended lead times. For procurement professionals, the imperative is clear: reduce risk, improve efficiency, and ensure supply chain continuity. At the heart of this challenge lies China, the world’s largest manufacturing hub—complex, dynamic, and often difficult to navigate without expert support.

SourcifyChina has redefined the sourcing landscape with its Verified Pro List, a curated network of elite, vetted China sourcing agents offering true one-stop service—from supplier identification and factory audits to quality control, logistics, and customs clearance.

Why the Verified Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Agents | Every agent on the Pro List undergoes rigorous due diligence: business license verification, on-site office inspections, client reference checks, and performance benchmarking. No more wasted time on unreliable intermediaries. |

| End-to-End Service Integration | From RFQ to delivery, our Pro agents manage sourcing, production monitoring, QC, packaging, and shipping—eliminating the need for multiple vendors and fragmented coordination. |

| Time Savings | Clients report up to 60% reduction in sourcing cycle time by leveraging Pro List agents who speak your language, understand your standards, and act as your on-the-ground team. |

| Risk Mitigation | With transparent reporting, real-time updates, and contractual accountability, the Pro List minimizes fraud, quality failures, and shipment delays. |

| Cost Efficiency | Streamlined operations and bulk service access reduce overhead and hidden costs—without compromising quality. |

The Bottom Line: Speed, Security, and Scalability

In a market where speed-to-market defines competitive advantage, relying on unverified sourcing channels is no longer viable. The SourcifyChina Verified Pro List transforms sourcing from a high-risk endeavor into a strategic asset—delivering predictable outcomes, faster turnaround, and full supply chain transparency.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t risk delays, quality issues, or supplier fraud with unverified partners. Join hundreds of global procurement leaders who trust SourcifyChina to connect them with elite, performance-proven sourcing agents in China.

👉 Contact us now to access the Verified Pro List and schedule your free sourcing consultation:

- Email: [email protected]

- WhatsApp: +86 15951276160

Our team is available 24/7 to match your procurement needs with the right Pro agent—ensuring faster sourcing cycles, reduced costs, and supply chain resilience in 2026 and beyond.

SourcifyChina – Your Trusted Gateway to China Sourcing Excellence.

Verified. Reliable. Performance-Driven.

🧮 Landed Cost Calculator

Estimate your total import cost from China.