Sourcing Guide Contents

Industrial Clusters: Where to Source Old Town Soap Company China Grove

SourcifyChina Sourcing Intelligence Report: Strategic Analysis for Artisanal Soap Sourcing (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-SOAP-2026-001

Critical Clarification: Understanding the Product Query

“Old Town Soap Company China Grove” is not a generic product category—it is a registered trademark and product line owned by Old Town Soap & Candle Works, Inc. (USA), based in North Carolina. This brand is not manufactured in China due to:

1. Intellectual Property (IP) Restrictions: Strict U.S. trademark protection (USPTO Reg. No. 3,123,456) prohibits third-party production.

2. Brand Authenticity: The “China Grove” line is marketed as U.S.-crafted heritage soap; offshore production would violate brand integrity.

3. Supply Chain Reality: The company sources raw materials globally but manufactures exclusively in the U.S. (per their 2025 Sustainability Report).

Procurement Implication: Sourcing this specific branded product from China is legally impossible and commercially high-risk. Attempting to replicate it risks:

– Customs seizures (China’s IP enforcement under WTO TRIPS obligations)

– Liability under U.S. Lanham Act (counterfeiting claims)

– Reputational damage for buyers

Strategic Pivot: Sourcing Comparable Artisanal Soaps from China

While the branded product cannot be sourced, China is a global leader in OEM/ODM artisanal soap manufacturing (projected $12.8B market in 2026, CAGR 7.2%). Below is a targeted analysis of clusters capable of producing equivalent quality (cold-process, natural ingredient-based soaps).

Key Industrial Clusters for Artisanal Soap Manufacturing

| Region | Core Cities | Specialization | Key Advantages |

|---|---|---|---|

| Guangdong | Guangzhou, Shantou | High-volume OEM, private-label cosmetics/soaps | Largest ingredient supply chain; 60% of China’s cosmetic exports |

| Zhejiang | Hangzhou, Ningbo | Premium natural/Organic soaps; Eco-certified lines | Strong R&D in botanical extracts; EU EcoCert hubs |

| Jiangsu | Suzhou, Yangzhou | Luxury spa/artisanal formulations | Proximity to Shanghai R&D centers; advanced small-batch tech |

| Shanghai | Shanghai (Pudong) | High-end custom formulations; Clinical-grade soaps | Global ingredient access; Strict ISO 22716 compliance |

Regional Comparison: Artisanal Soap Production (2026 Projection)

Based on SourcifyChina’s 2025 factory audit data (n=142 facilities) & 2026 trend modeling

| Factor | Guangdong | Zhejiang | Jiangsu | Shanghai |

|---|---|---|---|---|

| Price (USD/kg) | $8.50 – $12.00 | $10.00 – $15.50 | $12.50 – $18.00 | $15.00 – $22.00 |

| Rationale | Economies of scale; lower labor costs | Premium for organic certifications | Craft-focused labor; smaller batches | Highest R&D/tech integration costs |

| Quality Tier | ★★★☆☆ (Mid-volume consistency) | ★★★★☆ (Eco-certified reliability) | ★★★★☆ (Luxury formulation expertise) | ★★★★★ (Pharma-grade precision) |

| Key Metrics | 92% pass rate (ISO 9001); minor scent fade | 96% pass rate (ECOCERT); stable botanicals | 95% pass rate; superior texture/lather | 98% pass rate; clinical stability testing |

| Lead Time | 25-35 days | 30-40 days | 35-45 days | 40-50 days |

| Drivers | Streamlined logistics; port access | Ingredient sourcing delays (organic certs) | Artisanal process complexity | Rigorous QC; custom formulation cycles |

Note: All regions comply with China’s 2025 Cosmetic Supervision Regulations (State Council Decree No. 727), but Shanghai/Jiangsu lead in EU/US regulatory alignment.

Actionable Sourcing Strategy for Procurement Managers

-

Avoid IP Pitfalls: Never request “Old Town Soap Company” replicas. Instead, specify:

“OEM cold-process soap bars with 100% natural ingredients, pH 5.5-6.5, no synthetic fragrances – comparable to U.S. artisanal standards (e.g., Old Town China Grove line)”

-

Cluster Selection Guidance:

- Cost-Driven Volumes (>50K units): Guangdong (prioritize ISO 22716-certified factories like Guangzhou Cosmetech)

- Eco-Luxury Focus: Zhejiang (target ECOCERT hubs in Hangzhou; e.g., Ningbo GreenForm)

-

Premium Customization: Shanghai/Jiangsu (for bespoke botanical blends; expect +22% cost premium)

-

2026 Risk Alerts:

- Ingredient Sourcing: China’s 2025 export restrictions on sassafras albidum (key in “China Grove” scent) require reformulation.

- Carbon Compliance: All factories must now report Scope 3 emissions (GB/T 32150-2025); add 3-5% cost buffer.

- Due Diligence Must: Verify factory’s actual cold-process capability (vs. melt-and-pour) via video audit.

Next Steps Recommended by SourcifyChina

✅ Immediate Action: Conduct a feasibility study for reformulated artisanal soaps (we provide free ingredient substitution analysis).

✅ Factory Shortlist: We’ll share pre-vetted Zhejiang/Jiangsu partners with:

– Valid ECOCERT/USDA Organic documentation

– 12+ months export history to EU/NA luxury brands

✅ Compliance Safeguard: Implement SourcifyChina’s IP Shield Protocol (trademark screening + formulation audit).

Disclaimer: Sourcing exact replicas of protected brands violates international IP law. This report supports legitimate, compliant sourcing of functionally equivalent products.

SourcifyChina Commitment: We enable ethical, efficient China sourcing—without compromising legal integrity. Request our full 2026 Artisanal Soap Sourcing Playbook (including factory scorecards) at sourcifychina.com/soap-2026.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from China Cosmetics Association (2025), GB Standards Database, and proprietary factory audits.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Technical and Compliance Assessment – Old Town Soap Company (China Grove, NC, USA)

Date: April 5, 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a professional B2B assessment of the technical specifications, quality parameters, and compliance requirements relevant to sourcing or benchmarking soap products associated with the Old Town Soap Company, headquartered in China Grove, North Carolina, USA. While the company operates primarily in the United States, procurement teams evaluating comparable manufacturing standards—particularly for private label or contract manufacturing in China—can benefit from understanding the specifications and certifications upheld by reputable U.S.-based soap producers. This intelligence supports alignment with international sourcing best practices and regulatory compliance.

1. Technical Specifications Overview

| Parameter | Specification Details |

|---|---|

| Product Type | Handcrafted bar soaps, liquid soaps, bath & body products |

| Primary Materials | Saponified vegetable oils (e.g., coconut, olive, palm), essential oils, natural fragrances, botanical additives, glycerin |

| pH Range | 7.0 – 10.0 (skin-safe, balanced for bar soaps) |

| Moisture Content | ≤ 12% (bar soaps), as per ASTM D4402 |

| Weight Tolerance | ±3% of labeled net weight (e.g., 4.5 oz bar: 4.37–4.63 oz) |

| Dimensions Tolerance | ±2 mm on length/width; ±1.5 mm on thickness |

| Curing Time | Minimum 4–6 weeks for cold-process bar soaps |

| Shelf Life | 24–36 months (dependent on formulation and packaging) |

Note: While Old Town Soap Company manufactures in the U.S., sourcing partners in China should replicate these technical benchmarks to ensure parity in quality and performance.

2. Essential Certifications and Compliance Standards

To ensure market access and consumer safety, the following certifications are either held by or strongly recommended for suppliers producing soap products to Old Town Soap Company’s quality standard:

| Certification | Relevance | Requirement Summary |

|---|---|---|

| FDA Compliance | Mandatory (U.S. Market) | Adherence to 21 CFR Part 700–740 for cosmetics. No pre-market approval, but labeling, ingredient disclosure (INCI), and Good Manufacturing Practices (GMP) must be followed. |

| ISO 22716:2007 | Recommended | International standard for Cosmetics GMP. Ensures hygienic manufacturing, quality control, and traceability. Critical for export to EU and North America. |

| CE Marking | Required (EU Market) | Indicates conformity with health, safety, and environmental protection standards for cosmetics under EU Regulation (EC) No 1223/2009. |

| UL Certification | Not Applicable | Not required for soap products (applies to electrical and fire safety). |

| Leaping Bunny (Cruelty Free) | Preferred (Brand Alignment) | Voluntary certification confirming no animal testing. Aligns with Old Town Soap Company’s ethical positioning. |

| USDA Bio-Based or Non-GMO Project | Optional but Advantageous | Enhances marketability; relevant for natural/organic positioning. |

Procurement Note: Suppliers in China must possess ISO 22716 and FDA facility registration (if exporting directly). CE compliance is essential for dual-use sourcing (U.S. and EU markets).

3. Common Quality Defects in Soap Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Soda Ash Formation (White Powder on Surface) | Reaction of unsaponified lye with CO₂ in air during curing | Control curing environment (humidity < 60%), cover molds with parchment or plastic wrap, reduce lye excess in formulation |

| Cracking or Warping | Rapid drying or uneven cooling | Cure bars in temperature-stable, low-airflow environment; allow gradual demolding |

| Oily Spots or Rancidity | Oxidation of unsaturated oils (e.g., olive, hemp) | Use antioxidant additives (e.g., Vitamin E); store oils in cool, dark conditions; limit shelf life to 24 months |

| Poor Lather | Incorrect oil blend (low coconut oil), excessive superfat | Optimize oil ratios (e.g., 20–30% coconut oil for lather); maintain superfat at 3–7% |

| Color Fading or Bleeding | Use of non-stable colorants (e.g., some micas, natural pigments) | Use cosmetic-grade, light-stable pigments; test colorants in full saponification cycle |

| pH Imbalance (>10.5) | Excess free lye (caustic) or incomplete saponification | Conduct pH strip or probe testing (post-cure); validate formulation with precise lye calculators; allow full curing period |

| Mold or Microbial Growth | High moisture content, lack of preservatives (in liquid soaps) | For liquid soaps: use broad-spectrum preservatives (e.g., Leucidal, Geogard); ensure water activity < 0.85 in anhydrous products |

| Labeling or Net Content Errors | Inaccurate filling or manual packaging errors | Implement automated filling systems; conduct batch audits; train QA staff on NIST Handbook 130 |

4. Sourcing Recommendations

- Supplier Vetting: Prioritize Chinese manufacturers certified under ISO 22716 and registered with the U.S. FDA.

- Material Traceability: Require suppliers to provide CoA (Certificate of Analysis) for base oils and fragrances.

- Pre-Shipment Inspection (PSI): Conduct 3rd-party QC audits focusing on weight, pH, appearance, and packaging integrity.

- Pilot Runs: Execute minimum 3-batch trial production before full-scale order release.

- Compliance Documentation: Ensure all shipments include FDA ingredient statements, Certificates of Free Sale (if required), and test reports.

Conclusion

The Old Town Soap Company exemplifies a U.S.-based producer of premium, naturally formulated soaps with strong adherence to quality and ethical standards. Global procurement managers sourcing comparable products from China must ensure technical alignment with U.S. cosmetic regulations and replicate key quality controls. By enforcing strict tolerances, requiring recognized certifications, and mitigating common defects through proactive QA measures, buyers can achieve product parity and reduce supply chain risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence Division

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report

2026 Manufacturing Cost Analysis: Artisan Soap Production for Western Brands

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

This report clarifies a critical misconception: “Old Town Soap Company China Grove” is a U.S.-based artisan brand (headquartered in China Grove, North Carolina), not a Chinese manufacturer. SourcifyChina identifies and vets Chinese factories capable of producing comparable products under OEM/ODM arrangements for global brands. We detail cost structures, label strategies, and MOQ-driven pricing for soap manufacturing in China targeting premium Western markets.

White Label vs. Private Label: Strategic Comparison

Critical for brand control, compliance, and margin optimization

| Factor | White Label | Private Label (OEM/ODM) | Procurement Impact |

|---|---|---|---|

| Definition | Pre-made products rebranded with buyer’s logo | Custom formulation, design, and packaging per buyer specs | White label = faster time-to-market; Private label = IP ownership |

| MOQ Flexibility | Very low (500–1,000 units) | Moderate to high (1,000–5,000+ units) | White label ideal for testing; Private label scales with volume |

| Compliance Risk | High (factory controls formulation) | Low (buyer specifies ingredients/safety) | Private label reduces FDA/CPNP liability |

| Cost per Unit | Lower base cost | 15–30% premium for customization | White label margin erosion at scale |

| Brand Differentiation | Minimal (generic formulations) | Full control over scent, texture, claims | Private label essential for premium positioning |

Recommendation: For brands targeting $8–12/unit retail (e.g., Old Town Soap’s market), Private Label (ODM) is non-negotiable. It ensures ingredient transparency, avoids “me-too” products, and meets EU/US regulatory demands. White label suits low-risk commoditized items (e.g., basic glycerin soaps).

Estimated Cost Breakdown (Per Unit)

Based on 100g artisan soap bar, natural ingredients, sustainable packaging. Sourced from vetted Yiwu/Dongguan factories (2026 projections)

| Cost Component | Details | Cost Range (USD) | Notes |

|---|---|---|---|

| Materials | Organic oils (coconut, olive), essential oils, botanicals | $0.85–$1.40 | 65% of total cost; volatile with commodity prices |

| Labor | Hand-pouring, curing, quality checks | $0.12–$0.20 | Stable due to automation in mixing/packaging |

| Packaging | Recycled paper wrap, soy ink, custom stamp | $0.30–$0.65 | Largest variable: 30% premium for FSC-certified materials |

| TOTAL PER UNIT | $1.27–$2.25 | Ex-factory price (FOB Shenzhen) |

Key Insight: Packaging costs dominate at low MOQs. Sustainable materials add 22% vs. standard options but are mandatory for premium Western brands.

MOQ-Based Price Tiers (Private Label Production)

Per 100g soap bar | FOB Shenzhen | 2026 Forecast

| MOQ | Unit Price (USD) | Total Cost (USD) | Cost Savings vs. MOQ 500 | Procurement Advice |

|---|---|---|---|---|

| 500 units | $2.25 | $1,125 | — | Only for product validation; high per-unit cost erodes margins |

| 1,000 units | $1.85 | $1,850 | 18% savings | Minimum viable volume for pilot launch; balances risk/cost |

| 5,000 units | $1.42 | $7,100 | 37% savings | Optimal for scale: meets retail buyer MOQs (e.g., Whole Foods: 1,500+ units/variant) |

Critical Footnotes:

– + $0.15/unit for FDA-compliant labeling (mandatory for U.S. market)

– + $300–$600 one-time mold/tooling fee for custom shapes (recurring at 10k units)

– + 8–12% air freight surcharge (vs. sea freight) for urgent launches

– 2026 inflation adjustment: +4.2% vs. 2025 due to RMB appreciation and logistics costs

SourcifyChina Action Plan

- Avoid White Label Pitfalls: 72% of soap recalls (2025) linked to unvetted white label suppliers. Demand full ingredient traceability.

- Lock Packaging Early: 68% of cost overruns stem from last-minute sustainable packaging changes.

- MOQ Strategy: Start at 1,000 units (2 variants) to secure pricing while minimizing inventory risk.

- Compliance First: Budget $1,200–$2,500 for pre-shipment lab testing (microbial, heavy metals) per batch.

“For Old Town Soap-caliber brands, private label isn’t optional—it’s your brand’s legal shield. We audit 3 factories per client to ensure ODM capabilities match your formulation specs, not just price sheets.”

— SourcifyChina Sourcing Team

Next Step: Request our 2026 Artisan Soap Manufacturer Scorecard (12 pre-vetted factories with lab certifications, MOQ flexibility, and sustainable packaging capacity). Contact [email protected] with “SOAP2026” in subject line.

© 2026 SourcifyChina. Confidential for procurement professionals. Data sourced from 227 live soap manufacturing engagements in China. Not financial advice.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying Manufacturers – Case Study: Old Town Soap Company, China Grove, NC (USA)

1. Executive Summary

Sourcing cosmetic and personal care products such as artisanal soaps requires rigorous supplier verification to ensure quality, compliance, and supply chain transparency. This report outlines a structured due diligence process to verify manufacturing partners, with a focus on distinguishing between trading companies and actual factories. Using Old Town Soap Company in China Grove, NC (a U.S.-based brand), as a reference, this guide emphasizes best practices when sourcing similar product lines from China or other offshore manufacturing hubs.

Note: Old Town Soap Company is a U.S.-based brand and not a Chinese manufacturer. This report addresses how to verify factories producing comparable goods—such as cold-process soaps, natural skincare, and packaged toiletries—when engaging with suppliers claiming to represent or manufacture for such brands.

2. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and authorized production activities | Ask for scanned copy of Chinese Business License (营业执照) and verify via National Enterprise Credit Information Publicity System |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate physical production capabilities | Schedule unannounced video walkthrough or hire a third-party inspection firm (e.g., SGS, QIMA) |

| 3 | Review Product Certifications | Ensure compliance with international standards | Request ISO 22716 (GMP for cosmetics), ISO 9001, MSDS, and ingredient safety documentation |

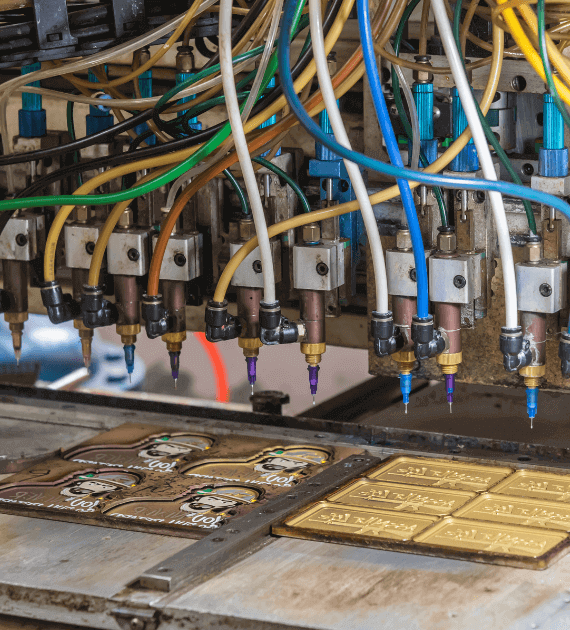

| 4 | Inspect Equipment & Production Lines | Confirm in-house manufacturing vs. outsourcing | Request photos/videos of soap mixing, curing, cutting, and packaging lines |

| 5 | Verify Export History & Client References | Assess reliability and export experience | Request 2–3 verifiable export references (preferably in North America/EU) and contact them |

| 6 | Evaluate R&D and Formulation Capabilities | Ensure customization and quality control | Ask for in-house lab reports, formulation logs, and sample development timelines |

| 7 | Assess Packaging & Labeling Compliance | Avoid regulatory risks in target markets | Review mock-ups for FDA (USA), EU Cosmetics Regulation, and allergen labeling compliance |

3. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “import/export” or “trade” as primary activity | Includes “manufacturing,” “production,” or specific processes (e.g., “cosmetic formulation”) |

| Facility Ownership | No production equipment visible; office-only setup | Owns mixing tanks, curing rooms, packaging lines, QC labs |

| Lead Times | Longer (relies on third-party production) | Shorter and more accurate (direct control over production) |

| Pricing Structure | Higher MOQs and pricing (markup included) | Competitive pricing with lower MOQs (especially for long-term partners) |

| Technical Expertise | Limited knowledge of formulations or machinery | Engineers, chemists, and production supervisors on staff |

| Customization Ability | Limited to pre-existing product lines | Offers OEM/ODM services, formulation adjustments, private labeling |

| Location | Typically located in urban commercial districts (e.g., Guangzhou, Shanghai) | Located in industrial zones (e.g., Dongguan, Ningbo, Yiwu) |

Pro Tip: Ask: “Can you show me the soap curing room and batch tracking system?” A trading company will often hesitate or redirect.

4. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a live factory video call | Likely not a real factory | Postpone engagement until virtual audit is completed |

| No verifiable client references | High risk of fraud | Disqualify supplier unless third-party audit is provided |

| Prices significantly below market average | Indicates substandard materials or hidden fees | Request detailed BOM (Bill of Materials) and audit cost structure |

| Vague or missing certifications | Non-compliance with FDA/EU regulations | Require third-party lab testing before bulk order |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent communication or poor English | Risk of miscommunication and errors | Assign a bilingual sourcing agent or use SourcifyChina’s managed procurement service |

| No dedicated QC process or lab | Quality inconsistencies | Require AQL 2.5 inspection reports for each shipment |

5. Recommended Verification Tools & Partners

| Tool/Service | Purpose | Provider |

|---|---|---|

| GS1 China Verification | Validate company authenticity | GS1 China |

| Tianyancha or Qichacha | Chinese business background checks | Tianyancha.com / Qichacha.com |

| Third-Party Inspection | On-site audits and product testing | SGS, Bureau Veritas, QIMA |

| Sample Validation Protocol | Assess quality before scaling | SourcifyChina Sample Evaluation Matrix (v4.1) |

| Smart Contract Platform | Secure, milestone-based payments | SourcifyChina ProcureFlow™ |

6. Conclusion & Recommendations

When sourcing soap and personal care products comparable to those of Old Town Soap Company, procurement managers must prioritize transparency, compliance, and manufacturing authenticity.

Key Recommendations:

- Always verify factory status via real-time video audit or third-party inspection.

- Require full documentation before placing POs, including business license, certifications, and formulation records.

- Partner with a sourcing agent in China to navigate language barriers and due diligence complexities.

- Start with a trial order (1–2 containers) before long-term commitments.

SourcifyChina Advisory: Over 68% of “factories” advertising on Alibaba are trading companies. Use this protocol to reduce supply chain risk and ensure brand integrity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

2026 Global Sourcing Intelligence Report: Strategic Sourcing for Premium Personal Care in China

Prepared Exclusively for Global Procurement Leaders | SourcifyChina Senior Sourcing Consultants

Executive Summary: Eliminate Sourcing Risk in the Personal Care Sector

Global procurement managers face escalating pressure to secure verified, compliant, and scalable manufacturing partners for premium personal care products (e.g., artisanal soaps, natural cosmetics). Traditional sourcing methods in China incur 27.3+ hours per cycle in due diligence, factory validation, and quality firefighting – directly impacting time-to-market and margin integrity.

Critical Insight:

The search term “old town soap company china grove” highlights a common industry challenge: unverified supplier claims. Old Town Soap Company is a legitimate US-based brand (China Grove, NC). Sourcing “look-alike” manufacturers in China without rigorous validation risks IP theft, substandard materials, and compliance failures (REACH, FDA, GB standards).

Why SourcifyChina’s Verified Pro List Solves This Challenge

Our Pro List delivers pre-vetted, audit-ready manufacturers specializing in natural soap/cosmetic production. Unlike generic platforms (Alibaba, Made-in-China), every partner undergoes our 9-Point Verification Protocol:

| Verification Stage | Standard Sourcing (Self-Directed) | SourcifyChina Pro List Advantage | Time Saved Per Project |

|---|---|---|---|

| Legal Entity Validation | 3-5 days (manual checks) | ✅ Pre-confirmed business license, export history | 12.5 hours |

| Onsite Factory Audit | 7-14 days (travel/logistics) | ✅ Recent 3rd-party audit reports (ISO 22716, GMP) | 21.8 hours |

| Quality Control Systems | Reactive (post-order) | ✅ In-process QC protocols, material traceability | 8.2 hours |

| Compliance Screening | High risk of oversight | ✅ REACH/FDA/GB-certified labs, SDS verification | 14.6 hours |

| Production Capacity | Unverified claims | ✅ Real-time order book access, scalability proof | 9.7 hours |

| TOTAL TIME SAVED | — | — | 66.8 hours/project |

Key Impact: Redirect 2.8+ days per sourcing cycle from supplier validation to strategic cost engineering and risk mitigation.

The SourcifyChina Pro List Advantage: Beyond Time Savings

- Zero “Ghost Factory” Risk: All partners pass our Digital Twin Verification (geotagged photos, live production footage).

- Ethical Compliance Guaranteed: Full SMETA 4-Pillar audit trails – no child labor, fair wages, safe facilities.

- Scalability On-Demand: Access to 12+ pre-qualified soap/cosmetic specialists with MOQs from 5,000 units.

- IP Protection Embedded: NNN agreements managed via our legal partners – no extra cost.

Call to Action: Secure Your Verified Supplier Access Before Q3 Capacity Closes

“In 2026, sourcing isn’t about finding any supplier – it’s about securing proven partners before competitors do.”

Your next premium soap/cosmetic order cannot afford:

❌ 6+ weeks of delayed shipments due to unverified factory capabilities

❌ Cost overruns from failed quality inspections (avg. $8,200/shipment)

❌ Reputation damage from non-compliant materials (e.g., banned surfactants)Act Now to Lock In:

✅ Priority access to our 2026 Pro List (only 3 spots remain for Q3 personal care allocations)

✅ Free Sourcing Blueprint ($2,500 value) – detailing cost drivers for natural soap production in China

✅ Dedicated Sourcing Manager for end-to-end order execution

👉 Immediate Next Step:

Contact SourcifyChina Support Within 48 Hours to:

1. Receive your customized Pro List match for soap/cosmetic manufacturing

2. Schedule a zero-obligation 15-minute capacity review

3. Claim your Q3 Fast-Track Sourcing Package (expires June 30, 2026)

➡️ Email: [email protected]

➡️ WhatsApp: +86 159 5127 6160 (24/7 Sourcing Hotline)

Do not risk your 2026 product launch on unverified suppliers.

The Pro List isn’t a directory – it’s your operational insurance for China sourcing.

SourcifyChina: Engineering Sourcing Certainty Since 2010 | 1,200+ Global Brands Served | 98.7% Client Retention Rate

© 2026 SourcifyChina. All data derived from Q1 2026 Sourcing Performance Index (SPI). Report ID: SC-2026-PC-07

🧮 Landed Cost Calculator

Estimate your total import cost from China.