The global oil solidifying agents market is experiencing robust growth, driven by increasing industrialization, stringent environmental regulations, and rising demand for spill containment and cleanup solutions across oil & gas, manufacturing, and transportation sectors. According to Grand View Research, the global absorbent materials market—of which oil solidifying agents are a key segment—was valued at USD 2.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. Similarly, Mordor Intelligence projects steady growth in demand for spill control products, citing expanding offshore drilling activities and heightened environmental compliance as key drivers. As industries prioritize safety and ecological responsibility, oil solidifying agents have become essential tools in mitigating the environmental impact of hydrocarbon leaks. With innovation accelerating in formulation efficacy, biodegradability, and application methods, a select group of manufacturers are leading the charge in delivering high-performance solutions. Here, we spotlight the top 9 oil solidifying manufacturers shaping the future of spill response technology.

Top 9 Oil Solidifying Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Linde

Domain Est. 2008

Website: lindeus.com

Key Highlights: Linde provides services in oil recovery, energized & well injection services. As a leading supplier of nitrogen & carbon dioxide, Linde is your one-stop partner ……

#2 The leading provider of heat treatment and specialist thermal …

Domain Est. 1997

Website: bodycote.com

Key Highlights: We are the world’s largest and most respected provider of heat treatment services and specialist thermal processes, Hot Isostatic Pressing, Powdermet and ……

#3 Effective Oil Absorbents

Domain Est. 1998

Website: basicconcepts.com

Key Highlights: BCI polymers are the only oil solidifier that works on a full spectrum of hydrocarbons ranging from low-end gasoline to heavy crude oil, even FR3….

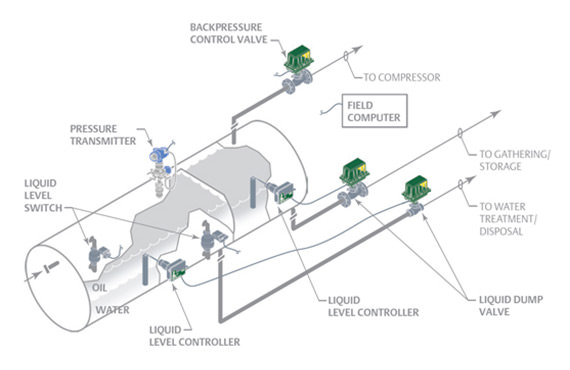

#4 Level Indication & Control and Filtration & Separation

Domain Est. 2000

Website: clarkreliance.com

Key Highlights: Clark-Reliance is the industry leader in the design, manufacture and distribution of level indication & control and filtration & separation products and ……

#5 Safe oil and gas solidifying polymers

Domain Est. 2001

Website: m2polymer.com

Key Highlights: As a quality absorbent polymer supplier, M² Polymer has over 20 years of experience in safe oil and gas solidifying polymers and over 30 years of chemical ……

#6 Crude Oil Solidification – Unexplored Opportunities

Domain Est. 2003

Website: aranca.com

Key Highlights: A few technologies have been ideally developed for easy transport of bitumen through solidification. These emerging technologies must be explored and ……

#7 Solidification Products International

Domain Est. 2004

Website: oilbarriers.com

Key Highlights: Solidification Products International is an industry leader in oil containment products that control spills, leaks, and other oil-control issues….

#8 Solidified Oil Spill →

Domain Est. 2005

Website: vancouverisland.surfrider.ca

Key Highlights: Pre-consumer plastic production pellets (nurdles) are being discharged into British Columbia waterways by plastic manufacturing facilities….

#9 FryAway Shark Tank

Domain Est. 2020

Website: fryaway.co

Key Highlights: Getting rid of used cooking oil with FryAway Shark Tank is as easy as 1, 2, 3! FryAway Cooking Oil Solidifier hardens waste oil in 3 easy steps so it can be ……

Expert Sourcing Insights for Oil Solidifying

H2: Projected Market Trends for Oil Solidifying in 2026

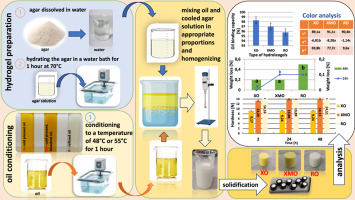

The oil solidifying market is poised for notable transformation by 2026, driven by increasing environmental regulations, advancements in waste management technologies, and rising demand for sustainable solutions in the oil and gas industry. Oil solidifying—primarily involving chemical agents that convert liquid hydrocarbons into semi-solid or solid forms for safer handling, transport, and disposal—is gaining traction as a critical method in spill remediation, tank cleaning, and offshore operations.

1. Regulatory Drivers and Environmental Compliance

Stricter environmental regulations from agencies such as the U.S. Environmental Protection Agency (EPA), International Maritime Organization (IMO), and European Union’s REACH framework are pushing industries to adopt oil solidification as a compliant disposal method. By 2026, these regulations are expected to mandate more rigorous containment and cleanup protocols for hydrocarbon spills, boosting demand for solidifying agents.

2. Growth in Oilfield Services and Offshore Activities

With continued investment in offshore drilling, especially in deepwater regions of the Gulf of Mexico, West Africa, and the North Sea, the need for rapid spill response and sludge management will drive adoption of oil solidifying technologies. The oilfield services sector is projected to increase its use of solidifying polymers and absorbent-based formulations to manage oily waste from tank cleaning and produced water.

3. Technological Advancements in Solidifying Agents

By 2026, innovations in polymer chemistry are expected to yield more efficient, eco-friendly solidifying agents. Next-generation products will likely offer faster solidification times, higher oil-to-solid conversion ratios, and biodegradability, reducing secondary environmental impacts. Companies are investing in smart formulations that can selectively solidify hydrocarbons while leaving water unaffected, enhancing efficiency in mixed-phase waste streams.

4. Expansion in Emerging Markets

Asia-Pacific and Latin America are expected to see accelerated growth in the oil solidifying market due to expanding refining capacity, aging pipeline infrastructure, and increased focus on environmental remediation. Countries like India, Indonesia, and Brazil are anticipated to implement stricter waste handling standards, creating new opportunities for solidifying solution providers.

5. Integration with Circular Economy and Waste-to-Resource Models

A growing trend by 2026 will be the integration of oil solidification into broader waste valorization strategies. Solidified oil waste may be processed for use in construction materials, fuel blending, or low-grade energy recovery, aligning with circular economy goals. This shift will encourage collaboration between waste management firms and solidifier manufacturers.

6. Competitive Landscape and Market Consolidation

The market is expected to witness increased competition and consolidation, with major chemical and environmental service companies acquiring niche solidifier technology firms. Key players such as Baker Hughes, Schlumberger, and specialized firms like New Pig Corporation and Accu-Coat Inc. are likely to expand product portfolios and geographic reach.

Conclusion

By 2026, the oil solidifying market will be shaped by regulatory pressure, technological innovation, and sustainability imperatives. The sector will transition from a reactive spill management tool to a proactive component of environmental compliance and resource recovery strategies. As industries prioritize ESG (Environmental, Social, and Governance) performance, oil solidifying is expected to become a standard practice in global oil and gas operations.

Common Pitfalls in Sourcing Oil Solidifying Agents (Quality and Intellectual Property)

Sourcing oil solidifying agents—used in applications like spill remediation, waste management, or food processing—requires careful attention to both product quality and intellectual property (IP) considerations. Overlooking these aspects can lead to performance failures, legal disputes, and reputational damage. Below are key pitfalls to avoid.

H2: Quality-Related Pitfalls

-

Inconsistent Product Performance

A frequent issue is variability in solidifying efficiency across batches. Some suppliers may use inconsistent raw materials or manufacturing processes, leading to unreliable results in real-world applications. Always demand batch-specific quality test reports and conduct independent performance validation under your operational conditions. -

Lack of Certification and Standards Compliance

Failing to verify compliance with relevant industry standards (e.g., ISO, ASTM, or environmental safety certifications) can result in the use of substandard or unsafe materials. Ensure the solidifying agent meets environmental, health, and safety (EHS) requirements, especially if used in sensitive ecosystems or regulated industries. -

Inadequate Testing for Target Oils

Not all solidifiers work equally well across different oil types (e.g., crude, diesel, vegetable oils). A common mistake is assuming broad efficacy without testing against your specific oil matrix. Always perform compatibility and efficiency testing before large-scale procurement. -

Poor Shelf Life and Storage Stability

Some agents degrade over time or under certain conditions (e.g., humidity, temperature). Sourcing without assessing stability data can lead to product failure when needed most. Request stability studies and proper storage guidelines from suppliers. -

Hidden Additives or Contaminants

Low-cost suppliers may include fillers or unlisted chemicals that compromise performance or introduce environmental hazards. Conduct third-party chemical analysis to verify purity and composition.

H2: Intellectual Property-Related Pitfalls

-

Unlicensed Use of Patented Formulations

Many effective oil solidifying agents are protected by patents. Sourcing from suppliers who use patented technologies without authorization exposes your organization to infringement claims. Conduct due diligence on the supplier’s IP rights and request documentation of licensed technology use. -

Ambiguous or Missing IP Clauses in Contracts

Procurement agreements that fail to address IP ownership, usage rights, or liability for infringement can leave your company vulnerable. Ensure contracts clearly define who owns the technology, whether you are indemnified against IP disputes, and if the product is free to use in your jurisdiction. -

Reverse-Engineered or Copycat Products

Some suppliers offer cheaper alternatives that mimic branded products but may infringe on existing patents or lack performance reliability. Be wary of unusually low prices and verify the originality and legal status of the formulation. -

Failure to Conduct Freedom-to-Operate (FTO) Analysis

Before adopting a new solidifying agent, especially in regulated markets, conduct an FTO analysis to ensure your use won’t violate existing patents. Skipping this step risks costly litigation and forced product discontinuation. -

Misrepresentation of Proprietary Claims

Some suppliers falsely claim their product is “patent-pending” or “proprietary” without proper filings. Verify IP claims through public patent databases (e.g., USPTO, EPO) to avoid being misled.

By proactively addressing these quality and IP pitfalls, organizations can mitigate risks, ensure regulatory compliance, and secure reliable, legally sound supply chains for oil solidifying agents.

Logistics & Compliance Guide for Oil Solidifying

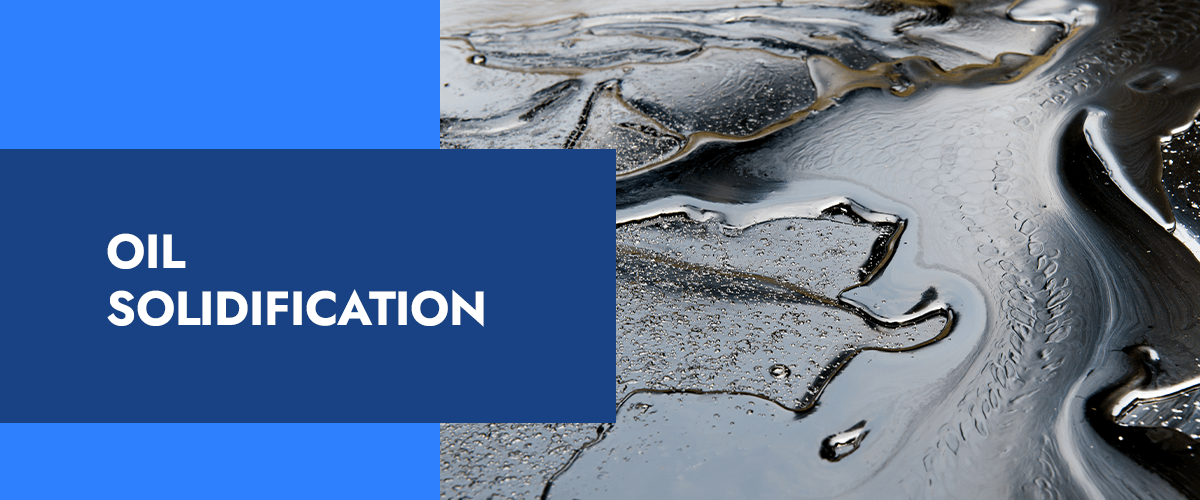

Overview of Oil Solidifying

Oil solidifying refers to the process of converting liquid waste oils into a solid or semi-solid form for safer handling, transportation, and disposal. This method is commonly used in industrial, marine, and environmental cleanup operations to manage oily waste in compliance with environmental regulations. Solidifying agents, such as polymer-based absorbents or cross-linking chemicals, are added to the oil to immobilize it, reducing risks of leakage, spillage, and environmental contamination.

Regulatory Framework and Compliance

Environmental Regulations

Oil solidification must comply with local, national, and international environmental laws. Key regulatory bodies include:

- EPA (United States Environmental Protection Agency) – Regulates hazardous waste under the Resource Conservation and Recovery Act (RCRA). Solidified oil may still be classified as hazardous waste depending on its original composition.

- IMO (International Maritime Organization) – Through MARPOL Annex I, governs the handling of oily waste from ships, including solidified forms.

- REACH and CLP (EU Regulations) – Regulate chemical use and classification in the European Union, including solidifying agents and treated waste.

- National Agencies – Countries may have additional requirements (e.g., Environment Canada, DEFRA in the UK).

Waste Classification

Before solidifying oil, determine its classification:

– Hazardous vs. Non-Hazardous: Based on flashpoint, toxicity, and chemical composition.

– Waste Codes: Use proper European Waste Catalogue (EWC) codes or equivalent national systems.

– Testing Requirements: Perform TCLP (Toxicity Characteristic Leaching Procedure) or other leachate tests to confirm stabilization effectiveness.

Logistics Planning

Storage and Handling

- Containers: Use UN-rated, leak-proof containers suitable for solid or semi-solid hazardous materials. Clearly label with contents, hazard symbols, and waste codes.

- Segregation: Store solidified oil away from incompatible materials (e.g., oxidizers, acids).

- Secondary Containment: Employ spill pallets or bunded storage to prevent environmental release.

Transportation

- Packaging Standards: Comply with DOT (49 CFR), ADR (Europe), or IATA/IMDG (for air/sea) depending on mode and region.

- Documentation:

- Waste Shipment Manifest

- Safety Data Sheets (SDS) for solidifying agents and final waste form

- Hazardous Waste Transport License (where required)

- Labeling: Mark packages with proper shipping names (e.g., “Solidified Oil Waste, Non-Spillable, UN 3082”), hazard class (usually Class 9 – Miscellaneous), and orientation arrows.

Disposal and Treatment

- Authorized Facilities: Transport solidified oil only to licensed treatment, storage, and disposal facilities (TSDFs).

- Disposal Methods: May include landfilling (if non-hazardous and approved), incineration, or recycling.

- Tracking: Maintain records of waste disposal for minimum 3–5 years (varies by jurisdiction).

Safety and Operational Procedures

Personnel Training

- Train staff on:

- Handling of solidifying agents

- PPE requirements (gloves, goggles, respirators if needed)

- Spill response and emergency procedures

- Ensure certification where required (e.g., HAZWOPER in the U.S.).

Health and Safety Measures

- Use solidifying agents in well-ventilated areas.

- Avoid inhalation of dust or fumes during mixing.

- Monitor for exothermic reactions—some agents generate heat when reacting with oil.

Environmental Monitoring and Reporting

- Conduct regular audits of solidification processes.

- Report spills or non-compliance incidents to regulatory authorities as required.

- Maintain logs of oil volumes treated, agent usage, and disposal records.

Best Practices

- Perform small-scale testing before full-scale solidification to ensure effectiveness.

- Choose non-toxic, biodegradable solidifying agents where possible.

- Optimize agent-to-oil ratio to minimize waste volume and cost.

- Partner with certified waste management vendors for compliance assurance.

Conclusion

Oil solidifying is a valuable method for managing oily waste, but it must be conducted within a robust logistics and compliance framework. Adherence to environmental regulations, proper documentation, safe handling, and responsible disposal are critical to minimizing risk and ensuring legal compliance. Regular training and process audits further support sustainable and compliant operations.

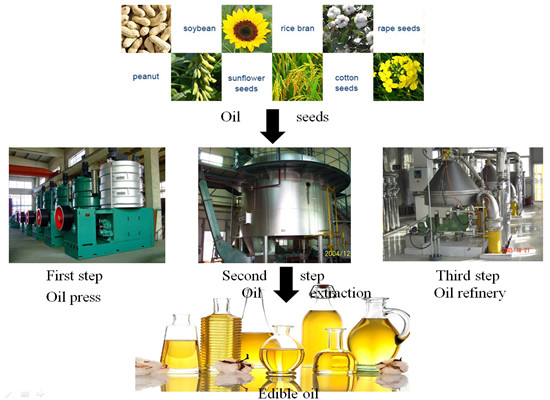

Conclusion on Sourcing Oil for Solidification Processes

Sourcing oil for solidification purposes requires a strategic approach that balances technical requirements, environmental considerations, cost-efficiency, and supply chain reliability. The selection of the appropriate oil—whether vegetable-based, animal-derived, mineral, or synthetic—depends heavily on the intended application, such as in food products, cosmetics, pharmaceuticals, or industrial manufacturing.

Key factors in sourcing include oil stability, melting point, saturation level, and compatibility with solidifying agents or processes like cooling, hydrogenation, or interesterification. Sustainability and ethical sourcing practices are increasingly critical, driven by regulatory demands and consumer preferences for environmentally responsible and traceable supply chains.

Moreover, geopolitical factors, climate variability, and market fluctuations can significantly impact oil availability and pricing. Diversifying suppliers, investing in alternative oils (e.g., algae or genetically modified high-oleic varieties), and adopting circular economy principles—such as using waste or by-product oils—can enhance resilience and sustainability.

In conclusion, effective sourcing of oil for solidification involves a holistic assessment of quality, cost, sustainability, and innovation. Companies that proactively adapt to changing market dynamics and technological advancements will be better positioned to ensure consistent product performance while meeting environmental and societal expectations.