The global market for oil measuring containers has experienced steady growth, driven by rising demand across automotive, industrial, and laboratory sectors. According to Grand View Research, the global lubricants market—closely tied to the use of precision oil measuring tools—was valued at USD 184.5 billion in 2023 and is projected to expand at a CAGR of 3.8% from 2024 to 2030. This growth is fueled by increasing vehicle production, stricter maintenance regulations, and the need for accurate fluid handling in machinery. Parallel trends in manufacturing efficiency and quality control have elevated the importance of standardized, durable oil measuring containers, intensifying competition among suppliers. As industries prioritize precision and sustainability, leading manufacturers are innovating with advanced materials and ergonomic designs. Based on market reach, product quality, and technological advancements, the following nine companies have emerged as key players in the oil measuring container landscape.

Top 9 Oil Measuring Container Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Oil Measuring Containers

Domain Est. 1994

#2 KROHNE Group

Domain Est. 1995

Website: krohne.com

Key Highlights: We are a global manufacturer and provider of process instrumentation, measurement solutions and services. Find all company-related information….

#3 Handy Measuring Jugs

Domain Est. 1997

Website: groz-tools.com

Key Highlights: The Groz Measuring Jugs are made for measuring and dispensing liquids in industrial and automotive applications. The jugs are made from heavy-duty clear and ……

#4 Howden

Domain Est. 2001

Website: chartindustries.com

Key Highlights: We own the Howden, HV-TURBO, Turblex, Spencer and Kuehnle, Kopp and Kausch brands. Range encompasses industrial type blowers used in the power, mining and water ……

#5 6

Domain Est. 2005

Website: steelmantools.com

Key Highlights: In stock Rating 5.0 13 Made of heavy-duty polyethylene plastic it is resistant to corrosion and can be used for a wide range of automotive and industrial fluids….

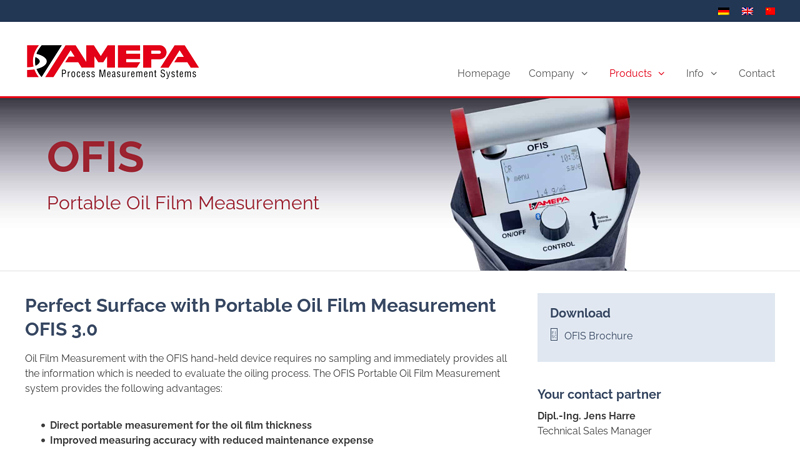

#6 Oil film measuring hand

Website: amepa.de

Key Highlights: The OFIS 3.0 is a hand-held measuring device for mobile oil film measurement designed for rough industrial environments….

#7 Measuring Containers

Domain Est. 1996

Website: wirthco.com

Key Highlights: For precise liquid measurements, we provide various measuring containers from Funnel King®, including heavy-duty options, pitchers, spout measurers, ……

#8 Accu-Pour™ Measuring Pitchers

Domain Est. 1996

Website: usplastic.com

Key Highlights: 5-day delivery 30-day returnsAccu-Pour ™ Measuring Pitchers. These measuring pitchers feature extra-strong construction, and they are chemical-resistant to a wide variety of chemic…

#9 Dynaline Measuring Container

Domain Est. 1996

Website: kmstools.com

Key Highlights: Bright white polyethylene is transluscent, and oil and chemical resistant · Ideal for measuring chemicals, lubricants, powders and more · Wide bases offers ……

Expert Sourcing Insights for Oil Measuring Container

2026 Market Trends for Oil Measuring Containers

The oil measuring container market is poised for continued evolution in 2026, driven by technological advancements, shifting consumer preferences, and growing regulatory pressures. While remaining a fundamental tool in automotive, industrial, and foodservice sectors, the market is adapting to new demands for precision, sustainability, and digital integration.

Rising Demand for Precision and Multi-Functionality

Consumers and professionals alike are increasingly seeking oil measuring containers that offer enhanced accuracy and added utility. In 2026, products featuring laser-etched measurement scales, anti-drip spouts, and temperature-resistant materials are expected to dominate. Multi-compartment containers that allow for the measurement and temporary storage of different fluids (e.g., oil, coolant, transmission fluid) will gain traction, particularly in the automotive aftermarket. This trend reflects a broader shift toward convenience and error reduction in maintenance tasks.

Sustainability and Material Innovation

Environmental concerns are reshaping product design. By 2026, manufacturers are likely to prioritize recyclable plastics such as rPET and explore biodegradable alternatives to traditional polypropylene. Lightweighting—reducing material use without compromising durability—will be a key focus to lower carbon footprints during transport and manufacturing. Additionally, reusable and refillable systems may emerge, especially in commercial and industrial settings, aligning with circular economy principles and corporate sustainability goals.

Integration with Digital Tools and Smart Features

Although still in early stages, the integration of smart technology into oil measuring containers is expected to gain momentum. In 2026, we may see pilot products incorporating QR codes or NFC tags that link to mobile apps for maintenance tracking, fluid recommendations, or instructional videos. While fully digital smart containers remain niche, the convergence of physical tools with digital diagnostics—such as Bluetooth-enabled dipsticks paired with measurement jugs—could begin influencing high-end and professional markets.

Growth in E-Commerce and Direct-to-Consumer Channels

The distribution landscape is shifting, with e-commerce platforms becoming a primary sales channel for oil measuring containers. In 2026, brands that offer detailed online product information, customer reviews, and compatibility guides will have a competitive edge. Subscription models for replacement or premium-grade containers may also emerge, particularly targeting fleet operators and industrial users seeking supply chain efficiency.

Regional Market Diversification

Demand will vary significantly by region. Mature markets like North America and Western Europe will emphasize high-quality, sustainable, and innovative designs. Meanwhile, emerging economies in Asia-Pacific and Latin America will drive volume growth due to expanding automotive ownership and infrastructure development. Localized product adaptations—such as dual-unit measurements (metric/imperial) or region-specific fluid compatibility—will be crucial for global suppliers.

In summary, the 2026 oil measuring container market will be defined by a blend of functional sophistication, environmental responsibility, and digital connectivity. Manufacturers who anticipate these trends and invest in user-centric innovation are best positioned to capture value in an increasingly competitive and conscious marketplace.

Common Pitfalls When Sourcing Oil Measuring Containers (Quality, IP)

Sourcing oil measuring containers—especially those used in critical applications requiring precision and traceability—can be fraught with challenges. Overlooking key quality and intellectual property (IP) aspects can lead to inaccurate measurements, compliance failures, and legal risks. Below are common pitfalls to avoid:

Inadequate Material Quality and Chemical Resistance

Selecting containers made from substandard or incompatible materials is a frequent issue. Low-grade plastics or metals may degrade when exposed to certain oils, leading to contamination, inaccurate volume readings, or even safety hazards. Always verify that materials meet relevant standards (e.g., FDA, USP Class VI) and are resistant to the specific oils being measured.

Lack of Calibration and Traceability

Many suppliers offer measuring containers without proper calibration documentation or traceability to national/international standards (e.g., NIST). This undermines measurement accuracy and can invalidate results in regulated environments. Ensure containers come with a certificate of calibration and are compliant with ISO or ASTM standards.

Poor Manufacturing Tolerances

Low-cost suppliers may cut corners on dimensional accuracy, resulting in volume discrepancies. Even small deviations can accumulate in repeated use. Confirm that the manufacturer adheres to tight tolerance specifications and performs routine quality control checks.

Misrepresentation of IP-Protected Designs

Some suppliers copy patented or trademarked designs of reputable measuring containers (e.g., specific spout configurations, graduation markings, or ergonomic features). Sourcing such products risks infringing on intellectual property rights, potentially leading to legal action or supply chain disruptions. Always verify the legitimacy of design features and request IP clearance documentation if necessary.

Incomplete or Missing Documentation

A lack of user manuals, material safety data sheets (MSDS), compliance certifications, or IP disclaimers can expose buyers to regulatory and legal vulnerabilities. Ensure all required documentation is provided and up to date.

Overlooking Environmental and Regulatory Compliance

Containers may not meet regional environmental regulations (e.g., REACH, RoHS) or industry-specific requirements (e.g., ATEX for explosive environments). Failing to verify compliance can result in rejected shipments or fines.

Supplier Reliability and Long-Term Support

Choosing suppliers without a proven track record may result in inconsistent quality, discontinued products, or lack of after-sales support. This can be especially problematic if replacement parts or recalibration services are needed. Conduct due diligence on supplier reputation, quality management systems (e.g., ISO 9001), and ongoing support capabilities.

Avoiding these pitfalls requires thorough vetting of suppliers, clear specifications, and attention to both technical quality and legal considerations surrounding IP and compliance.

Logistics & Compliance Guide for Oil Measuring Containers

This guide outlines essential logistics and regulatory compliance considerations for transporting, storing, and using oil measuring containers. Adherence to these guidelines ensures safety, legal compliance, and accurate measurement across the supply chain.

Regulatory Standards and Certifications

Oil measuring containers must comply with relevant national and international standards to ensure accuracy and safety. Key certifications include:

– OIML R96: International standard for measuring systems for liquid fuel delivered from stationary tanks.

– NTEP (National Type Evaluation Program): Required in the U.S. for containers used in commercial transactions involving fuel.

– Weights and Measures Act (UK): Ensures containers meet metrological accuracy for trade use.

– ATEX/IECEx: Required if containers are used in potentially explosive atmospheres (e.g., near fuel depots).

Ensure all containers are stamped or labeled with certification marks and undergo periodic recalibration as required by local authorities.

Material and Construction Requirements

Oil measuring containers must be constructed from materials compatible with petroleum products and resistant to corrosion:

– Stainless Steel (Grade 304/316): Preferred for durability and chemical resistance.

– HDPE (High-Density Polyethylene): Acceptable for certain non-critical applications, but verify chemical compatibility.

Containers must be sealed, leak-proof, and equipped with proper venting to prevent pressure buildup. Transparent sight gauges (if used) must be impact-resistant and chemically inert.

Labeling and Marking

Proper labeling ensures traceability and safe handling:

– Clearly marked capacity (e.g., “5 Gallons” or “20 Liters”) and measurement graduations.

– Manufacturer name, model number, serial number, and date of manufacture.

– Safety warnings (e.g., “Flammable,” “Keep Away from Heat”).

– Regulatory certification marks (e.g., NTEP, OIML).

– Handling symbols (e.g., “Do Not Tilt,” “Protect from Sunlight”).

Transportation and Handling

During transit, oil measuring containers must be secured to prevent damage and spills:

– Use pallets or crates with non-slip bases and edge protectors.

– Secure containers upright using straps or shrink wrap to prevent rolling or tipping.

– Avoid exposure to extreme temperatures; store and transport below 50°C (122°F).

– Segregate from incompatible materials (e.g., oxidizers, acids).

– Comply with DOT 49 CFR (U.S.), ADR (Europe), or other local hazardous materials transport regulations if containers are pre-filled with oil.

Storage Conditions

Store oil measuring containers in a dry, well-ventilated area:

– Keep away from direct sunlight and heat sources to prevent material degradation and vapor pressure buildup.

– Stack only as high as recommended by the manufacturer to avoid collapse.

– Store empty containers with lids tightly sealed to prevent contamination.

– Implement FIFO (First In, First Out) inventory practices to ensure older units are used first.

Calibration and Maintenance

Maintain measurement accuracy through regular maintenance:

– Calibrate containers annually or per local metrology authority requirements.

– Inspect for dents, cracks, leaks, or damaged graduations before each use.

– Clean containers using approved solvents; avoid abrasive cleaners that can damage markings.

– Keep calibration records on file for audit and compliance purposes.

Environmental and Safety Compliance

Adhere to environmental and occupational safety standards:

– Follow EPA, OSHA, or equivalent regulations regarding fuel handling and spill prevention.

– Use secondary containment (e.g., spill trays) when storing or using containers.

– Train personnel in proper handling, spill response, and disposal procedures.

– Dispose of damaged or obsolete containers according to local hazardous waste regulations.

Documentation and Traceability

Maintain comprehensive records to support compliance:

– Certificate of Conformance (CoC) for each container.

– Calibration logs with dates, results, and technician details.

– Shipping manifests and handling records for traceability.

– Safety Data Sheets (SDS) if containers are shipped with residual oil.

By following this guide, organizations can ensure the safe, legal, and efficient use of oil measuring containers throughout their lifecycle.

In conclusion, sourcing the appropriate oil measuring container is a critical step in ensuring accuracy, safety, and efficiency in various applications, whether in automotive, industrial, or food service environments. The ideal container should be selected based on material durability, precise measurement markings, ease of use, and compatibility with the type of oil being handled. Additionally, considerations such as spill prevention, temperature resistance, and regulatory compliance play a vital role in making a responsible and cost-effective choice. By carefully evaluating suppliers, quality standards, and specific operational needs, organizations can secure a reliable oil measuring solution that enhances performance, reduces waste, and supports long-term operational success.