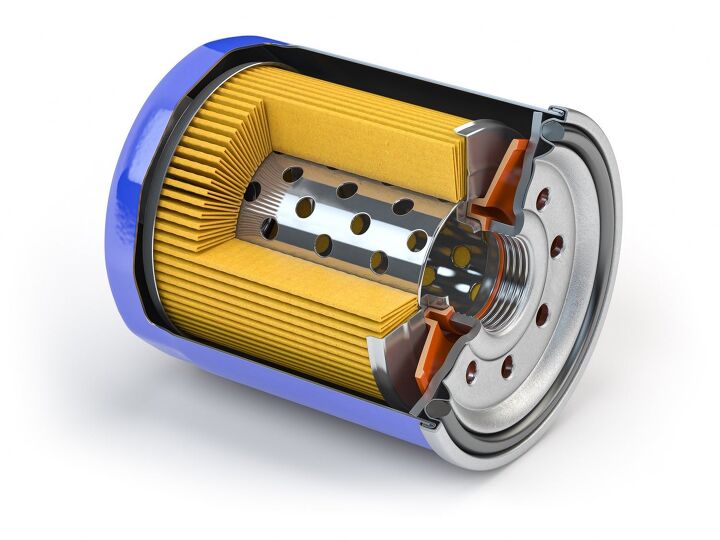

The global oil filter market is experiencing steady expansion, driven by rising vehicle production, increasing maintenance of automotive engines, and stricter emission regulations. According to Grand View Research, the global automotive oil filter market size was valued at USD 7.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is further amplified by the rising demand for high-performance filtration systems that reduce engine noise and enhance efficiency—factors that have elevated the importance of oil filter silencers. As vehicles become more advanced and noise reduction a key differentiator in ride comfort, manufacturers are increasingly integrating silencing technologies into oil filtration systems. In this evolving landscape, a select group of manufacturers have emerged as leaders in producing oil filter silencers that combine acoustic dampening with reliable filtration performance. Based on market presence, innovation, and product reliability, here are the top 8 oil filter silencer manufacturers shaping the industry today.

Top 8 Oil Filter Silencer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Filtration and Separation

Domain Est. 1996

Website: solbergmfg.com

Key Highlights: These industrial filtration products prevent airborne particles and other contaminants from entering the rest of your workspace, compromising equipment ……

#2 Pfeiffer Vacuum+Fab Solutions

Domain Est. 1996

Website: pfeiffer-vacuum.com

Key Highlights: Vacuum pumps, systems and leak detectors for high and ultra-high vacuum applications. Trusted by leaders in semiconductor industry, research, and science….

#3 Filter & Parts

Domain Est. 1995

Website: donaldson.com

Key Highlights: Our range of replacement filters and parts are designed for diesel engines and equipment, hydraulic and bulk storage tanks – plus exhaust system components….

#4 Oil Filter Silencer

Domain Est. 1998

Website: forums.dayz.com

Key Highlights: This is just a video I stumbled upon where this group uses oil filters as silencers. Sure they use an attachment that is manufactured. But I’m ……

#5 Filter Silencers (BMF)

Domain Est. 1999

Website: burgessmanning.com

Key Highlights: BMF filter silencers for engines, compressors, blowers and turbines. Reduce intake noise up to 14dB with 72-99.7% filtration efficiency….

#6

Domain Est. 2000

Website: boschrexroth.com

Key Highlights: Welcome to Bosch Rexroth. We are here to support you at every stage of your journey, offering cutting-edge automation solutions, software, and services….

#7 Replacement Burgess Manning Silencers and Filters

Domain Est. 2017

Website: burgesssilencers.com

Key Highlights: Silencers are designed to reduce or eliminate noise associated with compressors, blowers, engines and turbines….

#8

Domain Est. 2018

Website: gknpm.com

Key Highlights: Our high-performance metal components support automation, robotics, and power generation. Using advanced manufacturing, we produce sintered and forged parts for ……

Expert Sourcing Insights for Oil Filter Silencer

H2: 2026 Market Trends for Oil Filter Silencers

The global market for oil filter silencers is poised for notable evolution by 2026, driven by a confluence of technological advancements, stringent environmental regulations, and shifting automotive industry dynamics. As critical components in internal combustion engines (ICE), oil filter silencers help reduce noise and stabilize oil pressure, contributing to improved engine performance and acoustic comfort. Below is an analysis of key market trends expected to shape the oil filter silencer landscape in 2026.

-

Increasing Demand from the Automotive Sector

Despite the growth of electric vehicles (EVs), internal combustion and hybrid vehicles will remain dominant in many regions through 2026, particularly in emerging economies. This sustained demand for ICE vehicles supports continued need for oil filter silencers. Additionally, rising vehicle production in Asia-Pacific, Latin America, and Africa will drive market expansion. -

Stricter Noise Emission Regulations

Global regulatory bodies are enforcing tighter vehicle noise pollution standards. For instance, the European Union’s updated noise certification requirements and similar initiatives in the U.S. and China are compelling automakers to adopt advanced noise-dampening components. Oil filter silencers, integrated into oil filtration systems, play a growing role in meeting these acoustic standards, boosting their adoption. -

Integration with Advanced Filtration Systems

Oil filter silencers are increasingly being engineered as part of multifunctional oil filter assemblies. Manufacturers are focusing on compact, lightweight designs that combine filtration efficiency with noise reduction. By 2026, smart oil filter systems with integrated silencing capabilities and condition-monitoring sensors are expected to gain traction, especially in premium and commercial vehicle segments. -

Material Innovation and Lightweighting

To improve fuel efficiency and reduce emissions, automakers are prioritizing lightweight components. In response, oil filter silencer producers are adopting advanced materials such as high-damping polymers, composite metals, and noise-absorbing foams. These materials enhance acoustic performance while reducing overall weight, aligning with broader industry sustainability goals. -

Growth in the Aftermarket Segment

The global aftermarket for automotive parts, including oil filter silencers, is expanding due to rising vehicle ownership and longer vehicle lifespans. Consumers are increasingly aware of maintenance benefits, such as noise reduction and engine protection, driving demand for high-quality replacement silencers. E-commerce platforms are further facilitating access to aftermarket parts, particularly in developing markets. -

Regional Market Shifts

Asia-Pacific is expected to lead the oil filter silencer market by 2026, fueled by robust automotive manufacturing in China, India, and Southeast Asia. Meanwhile, North America and Europe will see steady growth driven by retrofitting older vehicles and compliance with environmental norms. Emerging markets in the Middle East and Africa will also contribute to rising demand due to expanding transportation infrastructure. -

Impact of Electrification

While electric vehicles do not require traditional oil filter silencers, the transition will be gradual. Hybrid vehicles, which still utilize internal combustion engines, will continue to need these components. Moreover, some EVs with range-extender engines or thermal management systems may incorporate oil filtration and silencing technologies, presenting niche opportunities.

Conclusion

By 2026, the oil filter silencer market will be shaped by regulatory pressures, material innovation, and sustained demand from ICE and hybrid vehicles. While electrification poses a long-term challenge, technological integration and regional growth trends will support market resilience. Companies that invest in R&D, lightweight design, and compliance-ready solutions will be best positioned to capitalize on emerging opportunities.

Common Pitfalls Sourcing Oil Filter Silencers (Quality, IP)

Sourcing oil filter silencers—critical components for reducing noise in hydraulic and lubrication systems—requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these factors can lead to performance failures, safety risks, legal exposure, and reputational damage. Below are key pitfalls to avoid:

Poor Material and Build Quality

One of the most frequent issues is selecting silencers made from substandard materials or with inadequate manufacturing tolerances. Low-quality silencers may use inferior stainless steel or porous media that degrade quickly under high pressure or temperature, leading to:

- Premature clogging or failure

- Reduced noise attenuation efficiency

- Risk of contamination due to material shedding

- Non-compliance with industry standards (e.g., ISO, DIN)

Ensure suppliers provide material certifications (e.g., MTRs) and test reports for flow rate, pressure drop, and acoustic performance.

Inadequate Ingress Protection (IP) Rating

Oil filter silencers often operate in harsh industrial environments where exposure to dust, moisture, and chemicals is common. A common mistake is sourcing silencers with insufficient IP ratings (e.g., IP54 instead of IP65/67), resulting in:

- Water or dust ingress causing internal corrosion

- Electrical component failure in integrated systems

- Reduced lifespan and reliability

Always verify that the IP rating matches the intended operating environment—especially in outdoor, washdown, or high-humidity settings.

Misrepresentation of Performance Specifications

Some suppliers exaggerate noise reduction (dB attenuation), flow capacity, or pressure ratings. This can lead to system incompatibility and underperformance. Be wary of:

- Vague or unverified performance claims

- Lack of third-party testing data

- Inconsistencies between catalog specs and actual product

Request real-world test data or conduct in-house validation before large-scale procurement.

Intellectual Property (IP) Infringement Risks

Sourcing from low-cost manufacturers, especially in regions with weak IP enforcement, can expose your business to legal risk. Pitfalls include:

- Procuring silencers that copy patented designs (e.g., internal baffle configuration, mounting interface)

- Using branded logos or technical drawings without authorization

- Lack of supplier warranties against IP infringement

Always conduct due diligence on supplier legitimacy and require contractual indemnification against IP claims.

Lack of Traceability and Certification

Reputable oil filter silencers should come with full traceability, including batch numbers, compliance certifications (e.g., CE, RoHS), and test documentation. Absence of these can result in:

- Inability to recall faulty components

- Non-compliance with regulatory audits

- Rejection in safety-critical industries (e.g., aerospace, energy)

Insist on full documentation and consider only suppliers with certified quality management systems (e.g., ISO 9001).

Conclusion

To avoid these pitfalls, prioritize suppliers with proven engineering expertise, transparent quality processes, and strong IP compliance. Conduct technical audits, request samples for testing, and include clear quality and IP clauses in procurement contracts.

Logistics & Compliance Guide for Oil Filter Silencer

Product Overview

The Oil Filter Silencer is a specialized component used in engine systems to reduce operational noise while filtering contaminants from lubricating oil. Due to its function and materials, the transportation, storage, and regulatory compliance of this product must adhere to specific guidelines to ensure safety, performance, and legal conformity.

Classification & HS Code

Correct product classification is essential for international shipping and customs clearance.

– HS Code Recommendation: 8421.23.00 (Oil filters and filter elements for internal combustion engines)

– Note: Classification may vary by country; verify with local customs authorities.

Packaging & Labeling Requirements

Proper packaging ensures product integrity during transit and compliance with safety regulations.

– Use robust, crush-resistant packaging with internal cushioning to protect the silencer unit.

– Label each package with:

– Product name and model number

– Net weight and dimensions

– Manufacturer details

– Batch or serial number

– “Fragile” and “This Way Up” handling indicators

– Include compliance labels (e.g., CE, RoHS) where applicable.

Transportation & Shipping

Oil Filter Silencers are generally non-hazardous but must be shipped under controlled conditions.

– Mode of Transport: Suitable for road, air, and sea freight.

– Stacking: Limit stack height to prevent deformation; maximum 5 layers unless otherwise specified.

– Environmental Conditions: Store and transport in dry, temperature-controlled environments (5°C to 40°C). Avoid exposure to moisture and corrosive substances.

– Documentation: Include commercial invoice, packing list, and bill of lading/air waybill.

– Export Controls: Confirm no ITAR or dual-use restrictions apply.

Regulatory Compliance

Ensure adherence to regional and international standards.

– CE Marking: Required for sale in the European Economic Area (EEA), indicating conformity with health, safety, and environmental protection standards.

– RoHS Compliance: Restriction of Hazardous Substances – ensure lead, mercury, cadmium, and other restricted materials are below threshold levels.

– REACH: Registration, Evaluation, Authorization, and Restriction of Chemicals – declare substances of very high concern (SVHC) if present above 0.1%.

– EPA & DOT (USA): No hazardous material designation required for standard oil filter silencers, but verify with EPA guidelines.

Import Considerations

Customs requirements vary by destination country.

– Provide accurate product descriptions and technical specifications.

– Prepare for possible inspections; retain test reports and compliance certificates.

– Be aware of anti-dumping duties or safeguard measures in certain markets (e.g., steel components).

Storage Guidelines

- Store in a clean, dry, indoor environment away from direct sunlight.

- Shelf life: Up to 3 years when stored properly.

- Rotate stock using FIFO (First In, First Out) method.

- Avoid contact with oils, solvents, or aggressive chemicals during storage.

End-of-Life & Recycling

- The Oil Filter Silencer contains metal components (typically steel or aluminum) and may include elastomeric seals.

- Follow WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions.

- Recommend recycling through certified metal scrap processors.

- Do not dispose of in regular landfill where regulated.

Contact & Support

For compliance documentation, safety data sheets (SDS), or logistics inquiries, contact:

– Compliance Department: [email protected]

– Logistics Support: [email protected]

– Provide product model and batch number for prompt assistance.

Note: Regulations are subject to change. Always consult the latest guidelines from relevant authorities before shipment.

Conclusion for Sourcing Oil Filter Silencer

After a comprehensive evaluation of technical requirements, supplier capabilities, cost considerations, and quality standards, sourcing an oil filter silencer requires a strategic approach that balances performance, reliability, and cost-efficiency. It is evident that selecting a reputable supplier with proven experience in manufacturing acoustic-dampening components for engine systems is critical to ensuring optimal noise reduction and long-term durability.

Key factors such as material quality, compatibility with existing engine systems, adherence to industry standards (e.g., ISO, SAE), and consistent production capacity must be prioritized during the supplier selection process. Additionally, conducting thorough due diligence—including sample testing, audit visits, and reviewing certifications—will mitigate risks related to supply chain disruptions or product failure.

In conclusion, successful sourcing of an oil filter silencer hinges on collaboration with suppliers who demonstrate technical expertise, quality assurance, and scalability. By establishing strong supplier partnerships and maintaining rigorous quality control measures, organizations can achieve enhanced engine performance, meet noise emission regulations, and support overall product reliability in demanding operating environments.