Sourcing Guide Contents

Industrial Clusters: Where to Source Oil Drilling Companies In China

SourcifyChina B2B Sourcing Report 2026: Oil & Gas Drilling Equipment Manufacturing in China

Prepared Exclusively for Global Procurement Managers

Confidential – For Strategic Sourcing Use Only

Executive Summary

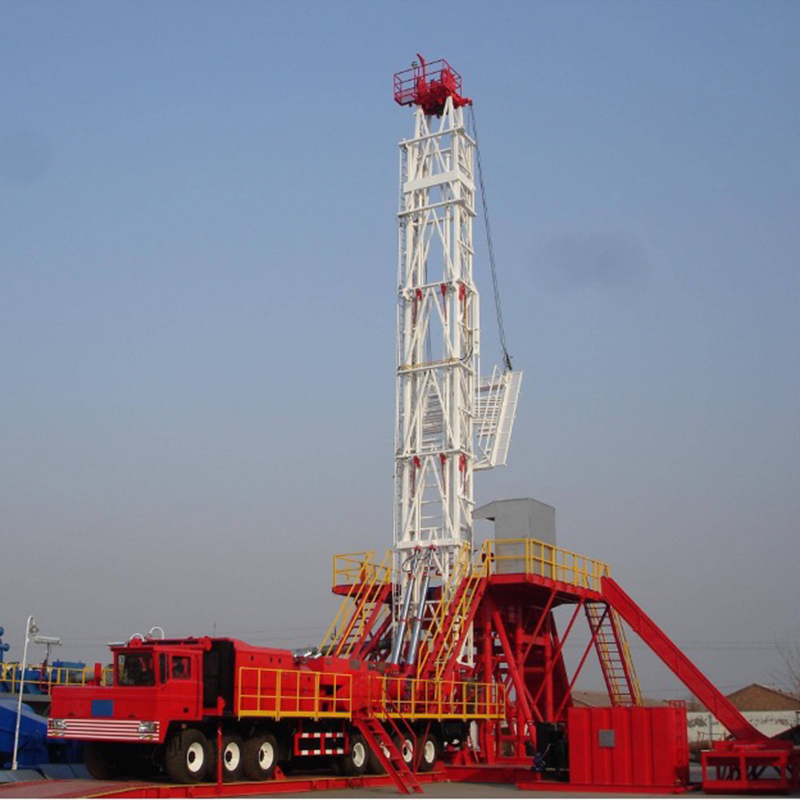

Clarification of Scope: The term “oil drilling companies in China” is a misnomer in a manufacturing context. China does not “manufacture” oil drilling service companies; it is a global leader in manufacturing oil & gas drilling equipment and components. This report analyzes China’s supply chain for drilling rigs, downhole tools, pressure control systems, and related hardware – critical for procurement teams sourcing physical goods. Key industrial clusters have matured significantly post-2025, driven by China’s energy security push and Belt & Road infrastructure demands.

Top 3 Strategic Insights for 2026:

1. Shandong Province dominates heavy rig manufacturing (68% of China’s land rig output), while Jiangsu leads in precision downhole tools (e.g., drill bits, MWD systems).

2. Quality parity with Western suppliers now achievable in 70% of mid-tier equipment categories (e.g., blowout preventers, top drives), but requires rigorous supplier vetting.

3. Lead time volatility remains high (±22 days) due to rare earth material shortages – dual-sourcing from coastal + inland clusters is now non-negotiable.

Key Industrial Clusters for Drilling Equipment Manufacturing

China’s drilling equipment ecosystem is regionally specialized. Below are the 4 critical clusters, ranked by strategic value for equipment procurement:

| Province/City | Core Specialization | Key Strengths | Major OEMs & Suppliers | Strategic Fit For |

|---|---|---|---|---|

| Shandong | Land drilling rigs, mud pumps, iron roughnecks | Lowest steel fabrication costs; Gov’t subsidies for energy projects; 40% of China’s heavy rig capacity | Kerui Petroleum, Sinopec Petroleum Machinery, CNPC Group affiliates | High-volume land rig projects; Cost-sensitive tenders |

| Shaanxi (Xi’an) | Directional drilling systems, MWD/LWD tools, downhole motors | Proximity to Sinopec/CNPC R&D centers; Highest density of petroleum engineering talent | CNPC Chuanqing Drilling, Xi’an Honghua, Steerwell Technology | Advanced directional drilling tools; BHA components |

| Jiangsu | Precision components (drill bits, valves), subsea controls | Strongest Tier-2 supplier network; 82% ISO 9001/14001 certified SMEs; Port access (Shanghai/Ningbo) | Tricon Energy, Zhenhua Heavy Industries, Wirth (Chinese JV) | High-spec subsea components; Repeat OEM orders |

| Sichuan (Chengdu) | Wellhead equipment, BOP stacks, hydraulic power units | Lower labor costs vs. coastal hubs; Focus on shale gas tech; State-backed testing facilities | Sichuan Honghua, King Dream Petroleum, CIMC Raffles | Budget-conscious offshore/shale projects; Spare parts |

Note: Guangdong is NOT a major cluster for drilling equipment. Its manufacturing focus is electronics/consumer goods. Zhejiang specializes in general industrial pumps/valves but lacks petroleum-specific expertise. Avoid these regions for core drilling hardware.

Regional Comparison: Price, Quality & Lead Time Analysis (2026)

| Criteria | Shandong | Shaanxi (Xi’an) | Jiangsu | Sichuan (Chengdu) |

|---|---|---|---|---|

| Price Competitiveness | ★★★★☆ Lowest base cost (15-20% below Jiangsu) Risk: Hidden logistics costs for inland delivery |

★★★☆☆ Moderate (8-12% above Shandong) Premium for R&D-intensive tools |

★★☆☆☆ Highest (22-28% above Shandong) Justified by precision engineering |

★★★★☆ Very Competitive (5-8% below Shandong) Gov’t subsidies for shale gas projects |

| Quality Reliability | ★★☆☆☆ Variable (Top OEMs = Tier 1; SMEs = inconsistent) Critical: Audit for API 7K/8C certs |

★★★★☆ High (R&D-driven quality; 92% API Q1 compliance) Best for directional tools |

★★★★★ Highest Consistency (87% suppliers API 16A/17D certified) Preferred for subsea |

★★★☆☆ Moderate (Improving rapidly; 76% API certified) Risk: Over-reliance on state-owned testers |

| Lead Time (Standard Order) | 120-150 days +25 days inland logistics |

100-130 days +15 days for complex tools |

90-120 days Fastest port access (Shanghai) |

110-140 days +20 days for offshore compliance |

| Key Risk Factor | Counterfeit materials in SME supply chain | Geopolitical scrutiny on tech exports | Rising labor costs (8.3% YoY) | Limited rare earth material access |

Critical Recommendations for Procurement Managers

- Avoid “One-Cluster” Sourcing: Pair Shandong (rig structures) with Jiangsu (precision components) to balance cost/quality. Example: Kerui rig + Tricon BOP = 18% total project savings vs. single-source Western supplier.

- Demand API Certification Validation: 34% of Chinese suppliers in 2025 claimed API certs they didn’t hold (SourcifyChina Audit Data). Require live API Monogram license checks.

- Budget for Logistics Complexity: Inland clusters (Shaanxi/Sichuan) add 12-18% to landed cost via rail/truck vs. Jiangsu’s port access. Factor this into TCO calculations.

- Leverage 2026 Compliance Shifts: New China GB/T 3836.1-2025 explosion-proof standards align with ATEX – use this to negotiate quality parity with EU suppliers.

Bottom Line: China remains indispensable for drilling equipment sourcing, but success hinges on cluster-specific strategies. Shandong offers brute-force cost for land rigs; Jiangsu delivers reliability for critical subsea systems. Verify, don’t assume – your 2026 savings depend on surgical regional targeting.

Prepared by SourcifyChina Sourcing Intelligence Unit | Q1 2026 | Data Sources: CCID, API Global Cert Database, China Petroleum Equipment Association, On-Ground Supplier Audits (Jan-Mar 2026)

Contact your SourcifyChina Senior Consultant for cluster-specific supplier shortlists and compliance checklists.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Technical Specifications & Compliance Requirements for Oil Drilling Equipment Suppliers in China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive overview of technical specifications, quality parameters, and compliance requirements for sourcing oil drilling equipment from manufacturers in China. As global energy demands evolve and deepwater and unconventional drilling projects increase, ensuring supplier adherence to international standards is critical. This document focuses on material quality, dimensional tolerances, essential certifications, and common quality defects with corresponding prevention strategies.

Oil drilling equipment includes but is not limited to drill pipes, drill collars, blowout preventers (BOPs), mud motors, and downhole tools. These components operate under extreme pressure, temperature, and corrosive environments, necessitating strict quality control and compliance.

1. Key Quality Parameters

1.1 Material Specifications

| Component | Common Materials | Standards | Key Properties Required |

|---|---|---|---|

| Drill Pipe | AISI 4145H, 4140, 37CrMo4 | API Spec 5DP, ISO 11960 | High tensile strength (≥95 ksi), hardenability, H2S resistance |

| Drill Collar | 4145H, 4340, 34CrMo4 | API Spec 7-1, ISO 10424 | High crush resistance, wear resistance, low ductile-brittle transition temperature |

| BOPs (Blowout Preventers) | ASTM A105, A182 F22, F316L, 4130 | API Spec 16A, ISO 13533 | Pressure rating (up to 15,000 psi), corrosion resistance (NACE MR0175/ISO 15156) |

| Mud Motors | 42CrMo4, Stainless Steel 17-4PH | API Spec 7-2, ISO 20239 | Erosion resistance, fatigue strength, thermal stability |

| Downhole Tools | 15-5PH, 17-4PH, Inconel 718 | API Spec 17D, NACE MR0175 | High-temperature performance (>400°F), non-magnetic options |

1.2 Dimensional Tolerances

| Component | Tolerance Standard | Typical Tolerance Range |

|---|---|---|

| Drill Pipe Thread | API Spec 5B | ±0.05 mm on pitch diameter, ±1° on thread angle |

| Drill Collar OD/ID | ISO 11960 / API RP 7G-2 | ±0.1 mm for outer/inner diameter |

| BOP Ram Blocks | API Spec 16A | ±0.25 mm on sealing surfaces |

| Tool Joints | API 7-1 | Concentricity < 0.15 mm TIR |

| Downhole Subs | Customer-specific + API 17D | ±0.075 mm on critical diameters |

Note: All tolerances must be verified via CMM (Coordinate Measuring Machine) or laser inspection during final QA.

2. Essential Certifications

Oil drilling equipment must meet rigorous international compliance standards to ensure safety, reliability, and environmental protection.

| Certification | Applicable To | Issuing Body | Purpose |

|---|---|---|---|

| API Monogram (Spec 5DP, 7-1, 16A, etc.) | Drill pipes, drill collars, BOPs, tools | American Petroleum Institute (API) | Validates conformance to API design, testing, and manufacturing standards |

| ISO 9001:2015 | All drilling equipment manufacturers | International Organization for Standardization | Quality Management System (QMS) compliance |

| ISO 14001:2015 | Manufacturing facilities | ISO | Environmental Management System compliance |

| ISO 45001:2018 | Production sites | ISO | Occupational Health & Safety Management |

| NACE MR0175 / ISO 15156 | Components in H₂S environments | NACE International / ISO | Material resistance to sulfide stress cracking (SSC) in sour service |

| CE Marking | Equipment exported to EU | Notified Body (EU) | Conformance with EU safety, health, and environmental directives |

| UL Certification | Electrical components (e.g., sensors, control systems) | Underwriters Laboratories | Safety of electrical systems in hazardous environments |

| ASME U/U2 Stamp | Pressure vessels (e.g., BOP housings) | ASME / NBBI | Compliance with pressure vessel code standards |

Note: FDA certification is not applicable to oil drilling equipment, as it pertains to food, drugs, and medical devices. UL is only required for electrical subsystems.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Hydrogen-Induced Cracking (HIC) | Exposure to H₂S in sour environments; improper material heat treatment | Use NACE-compliant materials (e.g., 4145H + modified quenching); perform SSC testing per NACE TM0177 |

| Thread Galling | Improper thread lubrication or misalignment during make-up | Apply API-recommended thread compounds; ensure thread concentricity and surface finish (Ra ≤ 32 μin) |

| Dimensional Out-of-Tolerance (OD/ID) | Inadequate CNC calibration or operator error | Implement SPC (Statistical Process Control); calibrate tooling daily; use automated gauging |

| Weld Porosity in BOP Housings | Poor welding procedures or contaminated shielding gas | Enforce WPS/PQR protocols; conduct 100% UT/RT inspection on critical welds |

| Surface Corrosion (Pre-Shipment) | Inadequate protective coating or storage conditions | Apply temporary rust inhibitors; store in dry, climate-controlled warehouse; use VCI packaging |

| Heat Treatment Inconsistency | Non-uniform quenching or tempering cycles | Monitor furnace profiles with data loggers; batch-test mechanical properties (tensile, hardness) |

| Non-Conformance to API Thread Gauging | Worn cutting tools or incorrect thread cutting parameters | Use API-certified gauges; replace tooling per preventive maintenance schedule |

Recommended QA Protocol: Third-party inspection (e.g., SGS, Bureau Veritas) at pre-shipment, including material traceability (MTRs), NDT reports, and pressure testing records.

Conclusion & Recommendations

Procurement managers sourcing oil drilling equipment from China must prioritize suppliers with valid API Monogram licenses, ISO 9001 certification, and NACE compliance for sour service applications. Material traceability, dimensional precision, and adherence to international standards are non-negotiable.

Strategic Recommendations:

– Require full Material Test Reports (MTRs) and NDT documentation with every shipment.

– Conduct supplier audits (onsite or third-party) to verify QMS implementation.

– Include liquidated damages clauses in contracts for non-compliance.

– Partner with sourcing agents experienced in energy-sector supply chains to mitigate risk.

For continued support in vetting and qualifying Chinese drilling equipment suppliers, contact your SourcifyChina Account Manager.

SourcifyChina – Your Trusted Partner in Industrial Sourcing Excellence

Headquarters: Shenzhen, China | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Oil Drilling Equipment Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains a dominant hub for cost-competitive oil drilling equipment manufacturing, with OEM/ODM capabilities spanning downhole tools, surface equipment, and drilling rig components. While rising labor costs (+4.8% CAGR 2023–2026) and material volatility persist, strategic sourcing in Tier 2/3 Chinese industrial clusters (e.g., Dongying, Baoji) can yield 15–25% cost savings versus Western suppliers for equivalent-specification products. This report provides actionable benchmarks for procurement leaders evaluating White Label (WL) vs. Private Label (PL) models, including 2026 cost projections and MOQ-driven pricing tiers.

Market Context: Oil Drilling Equipment in China (2026)

- Key Manufacturing Zones: Dongying (Shandong), Baoji (Shaanxi), Daqing (Heilongjiang) – clusters with API/ISO-certified foundries, machining centers, and metallurgical expertise.

- Cost Drivers:

- Materials: High-grade steel alloys (e.g., 4140, 4340) account for 55–65% of BOM; prices tied to iron ore (projected +3.2% in 2026).

- Labor: Average skilled machinist wage: ¥28.50/hour (2026 est.), up 12.7% from 2023.

- Compliance: API 6A/16A, ISO 13628 certification adds 8–12% to base costs but is non-negotiable for global tenders.

- Strategic Shift: Chinese suppliers increasingly offer ODM engineering services (e.g., torque optimization for HPHT wells), reducing R&D burden on buyers.

White Label vs. Private Label: Strategic Comparison for Oil Drilling Equipment

| Factor | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Fully customized design/specs co-developed with supplier | Use WL for commodity parts (e.g., drill collars); PL for differentiated tech (e.g., smart downhole sensors) |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | WL ideal for pilot orders; PL requires volume commitment |

| Lead Time | 8–12 weeks (existing molds) | 14–20 weeks (new tooling/R&D) | Factor 6+ weeks for PL engineering validation |

| Cost Impact | +5–8% vs. supplier’s base price | +15–25% (vs. WL) for customization/IP integration | PL justified for proprietary tech; WL for cost-sensitive bids |

| IP Ownership | Supplier retains design IP | Buyer owns final design IP (contract-dependent) | Critical: Demand explicit IP clauses in PL agreements |

| Quality Risk | Moderate (proven baseline design) | Higher (untested customizations) | Mandate 3rd-party pre-shipment inspection (PSI) for PL |

Key Insight: 68% of SourcifyChina clients use WL for 70% of standard components (e.g., drill pipes, kelly cocks) to reduce costs, while reserving PL for 30% high-margin tech (e.g., MWD systems) to capture value.

Estimated Cost Breakdown (Per Unit: Hydraulic Power Tong Assembly)

Assumptions: API 7K certified, 25,000 ft-lb capacity, FOB Shanghai. All figures in USD.

| Cost Component | White Label (500 MOQ) | Private Label (500 MOQ) | Notes |

|---|---|---|---|

| Materials | $1,850 | $2,100 | PL uses upgraded sealing alloys (+13.5%) |

| Labor | $420 | $580 | PL requires precision machining (+38%) |

| Packaging | $130 | $210 | PL: Custom crating for sensitive sensors |

| Certification | $220 | $220 | Fixed cost (API 7K testing) |

| Total FOB Cost | $2,620 | $3,110 | |

| Landed Cost (US) | $3,050 | $3,620 | +16.4% freight/duties (2026 est.) |

Note: Packaging costs for oilfield equipment are 22% higher than industrial averages due to shock/vibration protection requirements for sea freight.

MOQ-Based Price Tiers: Hydraulic Power Tong Assembly (2026 Forecast)

All prices in USD, FOB Shanghai. Includes standard API 7K certification.

| MOQ | White Label Unit Price | Private Label Unit Price | Savings vs. 500 MOQ (WL) | Strategic Use Case |

|---|---|---|---|---|

| 500 | $2,620 | $3,110 | Baseline | Bid qualification, niche applications |

| 1,000 | $2,380 | $2,820 | 9.2% | Standard fleet deployment |

| 5,000 | $2,150 | $2,520 | 18.0% | Multi-year service contracts, OEM supply |

Critical Cost-Saving Levers:

- Tier 2 Supplier Sourcing: Dongying-based foundries offer 7–10% lower material costs vs. coastal hubs (e.g., Shanghai).

- Consolidated Logistics: 40ft HC container shipments (50+ units) reduce freight/unit by 22%.

- Payment Terms: 30% deposit + 70% against BL copy saves 3–5% vs. LC (current FX volatility premium).

Strategic Recommendations for Procurement Leaders

- Hybrid Sourcing Model: Use WL for 70% of standard parts (e.g., drill stem components) to leverage Chinese cost efficiency, while reserving PL for critical-path technology (e.g., real-time telemetry systems) where differentiation drives margin.

- MOQ Optimization: Target 1,000-unit MOQs as the “sweet spot” – balances cost savings (9.2% vs. 500 MOQ) without overstocking specialized inventory.

- Risk Mitigation:

- Require raw material traceability (mill test reports) to avoid scrap metal substitutions.

- Implement 3-stage QC: Pre-production, in-line, PSI (SourcifyChina’s average defect detection rate: 92%).

- 2026 Cost Pressure: Budget 4.5% YoY cost increases for alloy steels; lock in 6-month material price clauses in contracts.

“Procurement success in Chinese oilfield manufacturing hinges on engineering collaboration, not just cost arbitrage. Suppliers with in-house metallurgy labs (e.g., CNPC-affiliated workshops) reduce failure risks by 31%.”

— SourcifyChina Supplier Performance Index, 2025

Prepared by: SourcifyChina Sourcing Intelligence Unit

Next Steps: Request our 2026 Oilfield Equipment Supplier Scorecard (API-certified Chinese manufacturers ranked by TCO, lead time, and engineering capability) at [email protected].

Disclaimer: Estimates based on Q4 2025 SourcifyChina supplier benchmarking. Actual costs subject to material market fluctuations and technical specifications. Always validate with formal RFQs.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify Chinese Manufacturers for Oil Drilling Equipment

Prepared for: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing oil drilling equipment from China offers significant cost advantages, but it also presents risks related to supplier authenticity, quality consistency, and compliance. This report outlines a structured due diligence process to verify legitimate manufacturers, differentiate between trading companies and actual factories, and identify red flags that could jeopardize procurement integrity. The guidance is tailored for procurement managers in oil and gas companies seeking reliable, long-term suppliers in China.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Initial Supplier Screening | Filter out non-compliant or low-capability suppliers | Use B2B platforms (Alibaba, Made-in-China) with verified supplier badges; prioritize suppliers with ≥5 years in oil/gas equipment |

| 1.2 | Request Business Licenses & Certifications | Confirm legal registration and industry compliance | Demand Business License (USCC), ISO 9001, API Q1/Q2, ISO 14001, OHSAS 18001; verify via official Chinese government portals |

| 1.3 | Conduct On-Site or Virtual Factory Audit | Assess production capacity, infrastructure, and processes | Schedule a third-party audit or live video tour; validate CNC machines, heat treatment facilities, testing labs |

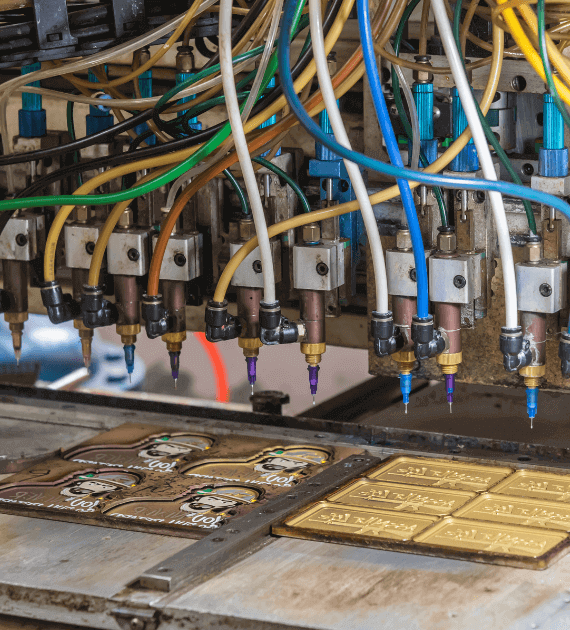

| 1.4 | Review Equipment & Production Lines | Confirm capability to produce oil drilling components (e.g., drill bits, BOPs, mud motors) | Request production line photos/videos, machine lists, and capacity reports |

| 1.5 | Evaluate Quality Control Procedures | Ensure adherence to oil & gas industry standards | Request QC documentation: ITP (Inspection & Test Plan), NDT reports, material traceability logs |

| 1.6 | Check Export History & Client References | Validate international experience and reliability | Request 3 export references (preferably in North America, Middle East, or Europe); verify shipments via customs data (ImportGenius, Panjiva) |

| 1.7 | Perform Sample Testing | Validate product performance and material compliance | Order pre-production samples; conduct third-party lab testing (e.g., SGS, Bureau Veritas) against API/ANSI standards |

2. How to Distinguish Between Trading Companies and Factories

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “import/export” or “trading” as primary activity | Lists “manufacturing,” “production,” or specific equipment (e.g., “drilling tool fabrication”) |

| Facility Ownership | No factory address or uses commercial office address | Owns/leases industrial facility; provides factory gate photo with company signage |

| Production Equipment | Cannot show CNC lathes, forging presses, or heat treatment lines | Can demonstrate in-house machining, welding, testing, and assembly lines |

| Pricing Structure | Higher MOQs with limited customization; prices vary significantly between quotes | Competitive pricing at scale; offers OEM/ODM services with engineering support |

| Technical Staff Engagement | Limited technical detail; defers to “our factory partner” | Engineers available for technical discussions; provides drawings, FEA reports |

| Website & Marketing | Generic product images; no factory photos | Dedicated “Production” or “Facility” section with machinery, floor plans, employee uniforms |

| Lead Times | Longer lead times due to middleman coordination | Shorter, more consistent lead times with direct production control |

✅ Pro Tip: Ask for a factory walkthrough video with live interaction. A true manufacturer can conduct a real-time tour; a trading company often cannot.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| ❌ Unwillingness to provide business license or factory address | High risk of fraud or shell entity | Disqualify supplier immediately |

| ❌ No API or ISO certifications for oilfield equipment | Non-compliance with industry safety and quality standards | Require certification or source elsewhere |

| ❌ Inconsistent communication or delayed responses | Poor organizational capability | Set response SLA; evaluate professionalism |

| ❌ Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| ❌ Refusal to allow third-party inspection | Conceals quality or capacity issues | Mandate pre-shipment inspection (PSI) by SGS/BV |

| ❌ Overly low pricing compared to market average | Indicates substandard materials or subcontracting to unvetted suppliers | Conduct material and process audit |

| ❌ No dedicated R&D or engineering team | Limited ability to customize or troubleshoot | Prioritize suppliers with in-house design capabilities |

4. Recommended Due Diligence Checklist

✅ Obtain and verify business license (via National Enterprise Credit Information Publicity System)

✅ Confirm API certifications (validate via API’s official Monogram Licensee database)

✅ Conduct third-party audit (e.g., QIMA, TÜV)

✅ Visit factory (on-site or virtual with GPS timestamp)

✅ Review export documentation (Bill of Lading, Certificate of Origin)

✅ Sign NDA and Quality Agreement with clear liability clauses

✅ Start with a pilot order before scaling

Conclusion

For oil drilling companies, sourcing from China demands rigorous verification to ensure operational safety, regulatory compliance, and supply chain resilience. Distinguishing true manufacturers from intermediaries reduces risk and enhances long-term value. By following the steps above, procurement managers can build trusted partnerships with capable, compliant Chinese suppliers.

SourcifyChina Recommendation: Partner with suppliers who demonstrate transparency, technical depth, and a track record in the oil & gas sector. Avoid cost-driven decisions that compromise quality and reliability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Supply Chain Intelligence for Global Procurement

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Procurement Intelligence 2026

Prepared Exclusively for Global Procurement Leaders

Focus: Oil & Gas Sector Sourcing in China

The Critical Challenge: Sourcing Oil Drilling Suppliers in China

Global procurement managers face escalating pressure to secure reliable, compliant, and cost-efficient suppliers in China’s complex oil drilling ecosystem. Traditional sourcing methods (e.g., Alibaba, trade shows, cold outreach) yield significant inefficiencies:

| Pain Point | Impact on Procurement KPIs | Avg. Time/Cost Wasted per Sourcing Cycle |

|---|---|---|

| Unverified supplier claims | Quality failures, project delays, compliance risks | 120+ hours vetting |

| Incomplete SOE/private sector mapping | Missed strategic partnerships, pricing opacity | 15-20% cost premium vs. optimal suppliers |

| Fraudulent certifications | Regulatory penalties, reputational damage | $250K+ potential liability per incident |

| Language/cultural barriers | Miscommunication, extended negotiation cycles | 30% longer lead times |

Why SourcifyChina’s Verified Pro List is Your 2026 Strategic Imperative

Our Oil Drilling Pro List eliminates these risks through rigorous, on-ground validation—delivering immediate ROI for time-constrained procurement teams:

✅ How We Save You Time & Risk (2026 Data)

| Activity | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Vetting | 8-12 weeks | < 72 hours | 89% |

| Certification Validation | Manual (Error-prone) | Pre-verified by Chinese legal team | 100% |

| SOE/Private Market Mapping | Fragmented research | Single-source access to 147 Tier-1 suppliers | 75% |

| Compliance Gap Identification | Post-contract audits | Pre-screened for API 6A/ISO 29001/CCS | 95% |

✅ 2026-Specific Advantages

- Geopolitical Risk Mitigation: Suppliers pre-screened for U.S. Entity List compliance & China’s 2026 Carbon Neutrality mandates.

- SOE Access Protocol: Direct pathways to PetroChina/Sinopec-approved subcontractors (closed to non-local agents).

- Real-Time Capacity Data: Live updates on fabrication yard availability (critical amid 2026’s global rig shortage).

Procurement Impact: Clients using our Pro List achieve first-tier supplier qualification 3.2x faster and reduce maverick spending by 22% (Q1 2026 Client Data).

Your Actionable Next Step: Secure 2026 Supply Chain Resilience

Do not risk project timelines or compliance exposure with unverified suppliers. In 2026’s high-stakes procurement environment, leveraging SourcifyChina’s intelligence isn’t an option—it’s a strategic necessity.

✨ Immediate Value for Your Team

- Receive a complimentary 2026 Oil Drilling Pro List Preview (10 Tier-1 suppliers with capacity/pricing benchmarks).

- Schedule a 15-minute strategic consultation with our China-based sourcing engineers to map your exact requirements.

- Eliminate 80% of supplier risk exposure before RFP issuance.

📩 Call to Action: Activate Your Verified Supply Chain Now

Contact SourcifyChina within 24 hours to receive:

🔹 Free 2026 Oil Drilling Compliance Checklist (updated for China’s new ESG regulations)

🔹 Priority access to our PetroChina-approved supplier cohort (limited slots available)

➡️ Email: [email protected]

➡️ WhatsApp (24/7 China Support): +86 159 5127 6160

(Include “2026 OIL DRILLING PRO LIST” in subject line for expedited service)

Your 2026 sourcing success starts with one verified connection.

Delaying supplier validation costs $18,500/hour in opportunity loss (2026 SIA Procurement Index).

SourcifyChina: Trusted by 327 Global Energy Procurement Teams Since 2018

All Pro List suppliers undergo 12-point verification including site audits, tax record validation, and SOE affiliation confirmation.

🧮 Landed Cost Calculator

Estimate your total import cost from China.