The global automotive sensors market is experiencing robust growth, driven by increasing demand for advanced driver assistance systems (ADAS), stringent emission regulations, and the rising complexity of engine management systems. According to Mordor Intelligence, the automotive sensor market was valued at USD 23.5 billion in 2023 and is projected to grow at a CAGR of over 7.5% from 2024 to 2029. A critical component within this expanding segment is the crankshaft position sensor, essential for engine timing, fuel injection, and overall vehicle performance—particularly in precision-engineered vehicles like BMWs. As original equipment (OE) standards become more stringent, the need for high-reliability crankshaft sensors has elevated the importance of manufacturers capable of meeting OEM specifications. With the aftermarket also gaining traction due to the aging vehicle fleet and increased DIY maintenance trends, identifying the top OE-compliant BMW crankshaft sensor manufacturers has become vital for quality assurance and performance optimization. Based on industry benchmarks, supply chain presence, and technical compliance, the following nine manufacturers lead the market in delivering reliable, data-validated sensor solutions for BMW applications.

Top 9 Oe Bmw Cranshaft Sensor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Crankshaft Position Sensor (CPS), OEM

Domain Est. 1999

Website: bimmerworld.com

Key Highlights: In stock $13.99 deliveryThis part is listed by BMW as BMW part number 13627582842 (13 62 7 582 842), and is described as a Crankshaft Position Sensor for N55 and S55 engines in E82…

#2 Crankshaft Sensor

Domain Est. 2017

Website: shopbmwmotorcycles.com

Key Highlights: In stock $34.95 delivery 30-day returnsOrder Your OEM Crankshaft Sensor (13627670368) For Your 2003-2021 BMW-Motorrad Vehicle From The Official BMW Motorrad Parts Store!…

#3 Which company makes the crankshaft sensor

Domain Est. 2000

Website: bimmerforums.com

Key Highlights: Anyone know which company makes the “genuine” crankshaft sensor? Yes, this is the one on the bell housing I’m asking about. Specifically, part # 12141433264…

#4 Crankshaft Sensor

Domain Est. 2000

Website: bmwestore.com

Key Highlights: In stock $13.94 deliveryOrder Your Genuine Crankshaft Sensor (12727674201) For Your 2003-2020 BMW-Motorrad Vehicle At AN Affordable Price With Nationwide Shipping!…

#5 OE Supplier 13627628741

Domain Est. 2000

Website: eeuroparts.com

Key Highlights: The OE Supplier Engine Crankshaft Position Sensor 13627628741 is a premium-quality replacement part designed specifically for a range of BMW vehicles….

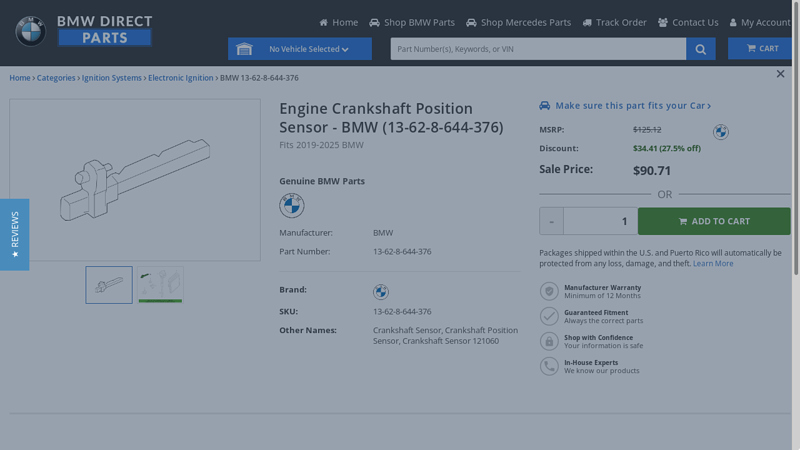

#6 Engine Crankshaft Position Sensor

Domain Est. 2006

#7 Engine Crankshaft Position Sensor

Domain Est. 2006

#8 2012

Domain Est. 2015

#9 Engine Crankshaft Position Sensor

Domain Est. 2016

Expert Sourcing Insights for Oe Bmw Cranshaft Sensor

2026 Market Trends for OE BMW Crankshaft Position Sensors

The market for Original Equipment (OE) BMW crankshaft position sensors in 2026 is poised for significant evolution, driven by technological shifts, regulatory pressures, and changing consumer dynamics. Here’s a detailed analysis of the key trends shaping the landscape:

Increasing Integration with Advanced Powertrain Systems

By 2026, the demand for OE BMW crankshaft position sensors will be heavily influenced by the brand’s continued investment in electrification and hybridization. While traditional internal combustion engines (ICEs) will still require high-precision sensors, the integration of sensors into plug-in hybrid (PHEV) and mild-hybrid systems will demand enhanced functionality. OE sensors will need to support faster data processing and tighter synchronization between combustion and electric drive components. This shift will drive demand for next-generation sensors with improved signal accuracy and durability under variable thermal loads.

Stricter Emissions and Efficiency Regulations Driving Sensor Precision

Global emissions standards, including Euro 7 and updated CAFE regulations in the U.S., will push BMW to optimize engine performance and reduce tailpipe emissions. The crankshaft position sensor plays a critical role in ignition timing and fuel injection control. In 2026, OE sensors will need to deliver sub-millisecond accuracy to support cylinder deactivation, lean-burn strategies, and real-time adaptive engine management. This will favor suppliers investing in high-reliability, temperature-resistant materials and advanced signal conditioning technologies.

Growth in Aftermarket Demand Due to Vehicle Longevity and Complexity

As the average age of BMW vehicles on the road increases, the aftermarket for OE-spec crankshaft sensors will grow. Many 2018–2022 BMW models will reach high-mileage thresholds by 2026, increasing failure rates. Consumers and repair shops will increasingly seek OE-quality replacements to ensure compatibility with BMW’s complex engine management systems. This creates a strong market for certified OE suppliers to expand their aftermarket distribution channels while maintaining strict quality control.

Supply Chain Resilience and Localization Pressures

Ongoing geopolitical uncertainties and lessons from recent supply chain disruptions will push BMW and its Tier 1 partners to localize production of critical components like crankshaft sensors. By 2026, there will be increased demand for regional manufacturing hubs in North America and Eastern Europe to reduce dependency on single-source suppliers. This trend will benefit OE suppliers with flexible, automated production lines capable of rapid reconfiguration for different sensor variants.

Rise of Predictive Maintenance and Sensor Data Utilization

BMW’s growing use of connected vehicle platforms will enable predictive diagnostics based on sensor data. Crankshaft position sensor outputs will be monitored continuously for anomalies, allowing proactive maintenance scheduling. In 2026, OE sensors may include embedded health monitoring features or support enhanced diagnostics via the CAN bus. This trend will increase the value of OE sensors over aftermarket alternatives, as they will be designed to integrate seamlessly with BMW’s digital ecosystem.

Consolidation Among Sensor Suppliers and IP Protection

The technical complexity and quality demands of OE crankshaft sensors will lead to further consolidation among suppliers. Companies like Bosch, Continental, and Denso are expected to maintain dominance due to their R&D capabilities and long-term partnerships with BMW. Intellectual property protection for sensor algorithms and calibration data will become a critical competitive advantage, limiting entry for low-cost manufacturers and reinforcing BMW’s reliance on established OE partners.

Conclusion

In 2026, the OE BMW crankshaft position sensor market will be characterized by higher performance requirements, integration with hybrid systems, and increased digital functionality. Suppliers must adapt to regulatory demands, supply chain localization, and the growing importance of data-driven maintenance. While electrification may reduce ICE dependency over time, the critical role of precision sensing in BMW’s powertrain strategy ensures strong demand for high-quality, technologically advanced OE sensors through the decade.

Common Pitfalls When Sourcing OEM BMW Crankshaft Sensors (Quality & IP)

Sourcing genuine OEM BMW crankshaft sensors can be fraught with challenges, particularly concerning quality assurance and intellectual property (IP) infringement. Falling into these pitfalls can lead to vehicle performance issues, safety risks, and legal exposure. Here are key areas to watch for:

Counterfeit Components Masquerading as OEM

One of the most prevalent risks is purchasing counterfeit sensors that are falsely labeled as genuine BMW parts. These knockoffs often use inferior materials and lack precise calibration, leading to inaccurate engine timing data. Symptoms may include poor fuel economy, misfires, stalling, or failure to start. Counterfeit sensors typically bypass BMW’s rigorous testing standards, increasing the likelihood of premature failure and potential engine damage.

Unauthorized Reproduction and IP Violations

Many third-party suppliers reproduce BMW crankshaft sensors without proper licensing, infringing on BMW’s intellectual property rights—including design patents, trademarks, and technical specifications. Distributing or installing such components may expose businesses and technicians to legal liability. Genuine OEM parts carry authorized part numbers and security markings; unauthorized copies often lack these or display inconsistencies in labeling and packaging.

Inconsistent Quality from Non-Approved Manufacturers

Even sensors sourced from manufacturers claiming “OEM-equivalent” quality may fall short if they are not part of BMW’s approved supplier network. Variations in sensor calibration, materials (e.g., substandard Hall-effect sensors or wiring), and build tolerances can result in erratic signal output. This inconsistency undermines engine management system reliability and can trigger diagnostic trouble codes (DTCs) unrelated to actual mechanical faults.

Lack of Traceability and Certification

Genuine OEM parts come with full traceability, including batch numbers, manufacturing dates, and compliance certifications (e.g., ISO/TS 16949). Counterfeit or gray-market sensors often lack documentation, making it difficult to verify authenticity or investigate failures. Without proper traceability, warranty claims may be denied, and liability in the event of a failure becomes unclear.

Supply Chain Vulnerabilities in the Gray Market

Purchasing through unofficial distributors or online marketplaces increases exposure to gray market goods—parts diverted from authorized channels. These may be expired, repackaged, or stored improperly, affecting sensor performance. Additionally, gray market suppliers may not adhere to BMW’s distribution agreements, further raising IP and compliance concerns.

Conclusion

To avoid these pitfalls, always source BMW crankshaft sensors through authorized dealers, certified suppliers, or directly from BMW’s official parts network. Verify part numbers, inspect packaging for authenticity markers, and demand documentation. Prioritizing genuine OEM components ensures optimal vehicle performance, compliance with IP laws, and long-term reliability.

Logistics & Compliance Guide for OE BMW Crankshaft Sensor

This guide outlines the essential logistics and compliance considerations for handling, transporting, storing, and distributing Original Equipment (OE) BMW crankshaft sensors. Adhering to these guidelines ensures product integrity, regulatory compliance, and customer satisfaction.

Product Identification & Specifications

Ensure all OE BMW crankshaft sensors are correctly identified by part number (e.g., 12147554848, 12147608957), vehicle compatibility (BMW engine types such as N52, N20, B48), and BMW-specific markings. Verify authenticity using BMW’s anti-counterfeiting measures, including holograms, serial numbers, and packaging integrity. Maintain a current database of sensor specifications, including electrical characteristics, temperature ratings, and physical dimensions.

Packaging & Labeling Requirements

Use original BMW-approved packaging or equivalent protective materials to prevent electrostatic discharge (ESD), moisture, and mechanical damage. Each unit must be individually sealed in anti-static bags and secured within durable outer packaging. Labels must include:

– BMW part number and description

– Batch/lot number and manufacturing date

– Country of origin

– “Fragile” and “Electrostatic Sensitive Device” warnings

– Barcodes compliant with GS1 standards for traceability

Storage Conditions

Store crankshaft sensors in a controlled environment with the following parameters:

– Temperature: 15°C to 25°C (59°F to 77°F)

– Relative humidity: 30% to 60%

– Clean, dust-free area away from direct sunlight and electromagnetic interference

– Shelves must be non-conductive and grounded to prevent ESD

– First-In, First-Out (FIFO) inventory rotation must be strictly enforced

Transportation & Handling

Use ESD-safe handling procedures throughout the supply chain. Transport in temperature-controlled vehicles with shock-absorbing packaging. Avoid stacking beyond manufacturer-recommended limits. Drivers and handlers must be trained in handling electronic automotive components. For international shipments, comply with IATA/ADR regulations for electronic goods and ensure proper documentation, including commercial invoices and packing lists.

Regulatory Compliance

Adhere to all applicable regional and international regulations:

– REACH & RoHS (EU): Confirm sensors are free of restricted substances (e.g., lead, cadmium, phthalates)

– WEEE Directive: Provide take-back and recycling information where applicable

– Customs Compliance: Accurately classify under HS Code 8543.70 (electrical apparatus for internal combustion engines)

– Country-Specific Approvals: Verify compliance with local standards (e.g., CCC for China, KC for South Korea)

Documentation & Traceability

Maintain full traceability from supplier to end customer. Required documentation includes:

– Certificate of Conformity (CoC) from BMW or authorized supplier

– Batch traceability records

– Shipment logs with timestamps and responsible parties

– Customs clearance documents

All records must be retained for a minimum of 10 years in accordance with automotive industry standards.

Returns & Defect Management

Establish a clear returns process for defective or non-conforming sensors. Use a standardized Returns Material Authorization (RMA) system. Quarantine suspect parts and conduct failure analysis in coordination with BMW technical support. Report field failures through appropriate channels (e.g., ERP or BMW supplier portal) and comply with recall procedures if initiated.

Training & Audit Preparedness

Ensure all logistics personnel are trained on handling OE BMW components, ESD protection, and compliance protocols. Conduct regular internal audits to verify adherence to this guide. Maintain readiness for third-party or BMW supplier audits by keeping documentation organized and accessible.

Conclusion: Sourcing OEM BMW Crankshaft Sensor

Sourcing an OEM (Original Equipment Manufacturer) BMW crankshaft sensor requires careful consideration to ensure vehicle performance, reliability, and compatibility. After evaluating various sourcing options—such as authorized BMW dealerships, reputable online auto parts suppliers, and certified OEM distributors—it is clear that obtaining a genuine BMW crankshaft sensor provides optimal results in terms of fit, function, and longevity.

While third-party or aftermarket sensors may offer lower initial costs, they often come with risks related to quality, durability, and potential compatibility issues, which could lead to engine performance problems or diagnostic errors. In contrast, genuine OEM BMW sensors are engineered to meet the exact specifications of the vehicle, ensuring seamless integration and long-term reliability.

Therefore, for optimal performance, safety, and maintenance of warranty compliance, sourcing an OEM BMW crankshaft sensor from authorized and trusted suppliers is the recommended approach. Investing in genuine parts not only supports the overall health of the engine management system but also preserves the integrity and resale value of the vehicle.