Sourcing Guide Contents

Industrial Clusters: Where to Source Number Of Us Companies In China

SourcifyChina B2B Sourcing Intelligence Report: Strategic Analysis of US Manufacturing Presence in China

Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Executives

Report ID: SC-CHN-USMFG-2026-Q4

Critical Clarification: Misinterpretation of Sourcing Target

Disclaimer: The phrase “sourcing ‘number of US companies in China'” reflects a fundamental misunderstanding of supply chain terminology. “Number of US companies” is not a physical product, commodity, or service that can be sourced. It is a statistical metric representing foreign direct investment (FDI) presence.

Corrective Action & Strategic Refocus:

Procurement managers seeking to leverage US-affiliated manufacturing capacity in China should instead focus on:

1. Sourcing physical goods (e.g., electronics, automotive parts, medical devices) produced by US-owned or joint-venture factories in China.

2. Partnering with US-headquartered contract manufacturers (e.g., Jabil, Flex, Benchmark Electronics) operating in China.

3. Accessing industrial clusters where US companies have established significant production footprints.

This report analyzes key manufacturing hubs hosting US corporate operations to enable strategic supplier identification and risk mitigation.

Market Reality: US Manufacturing Footprint in China (2026)

Per China’s Ministry of Commerce (MOFCOM) and U.S.-China Business Council (USCBC) data:

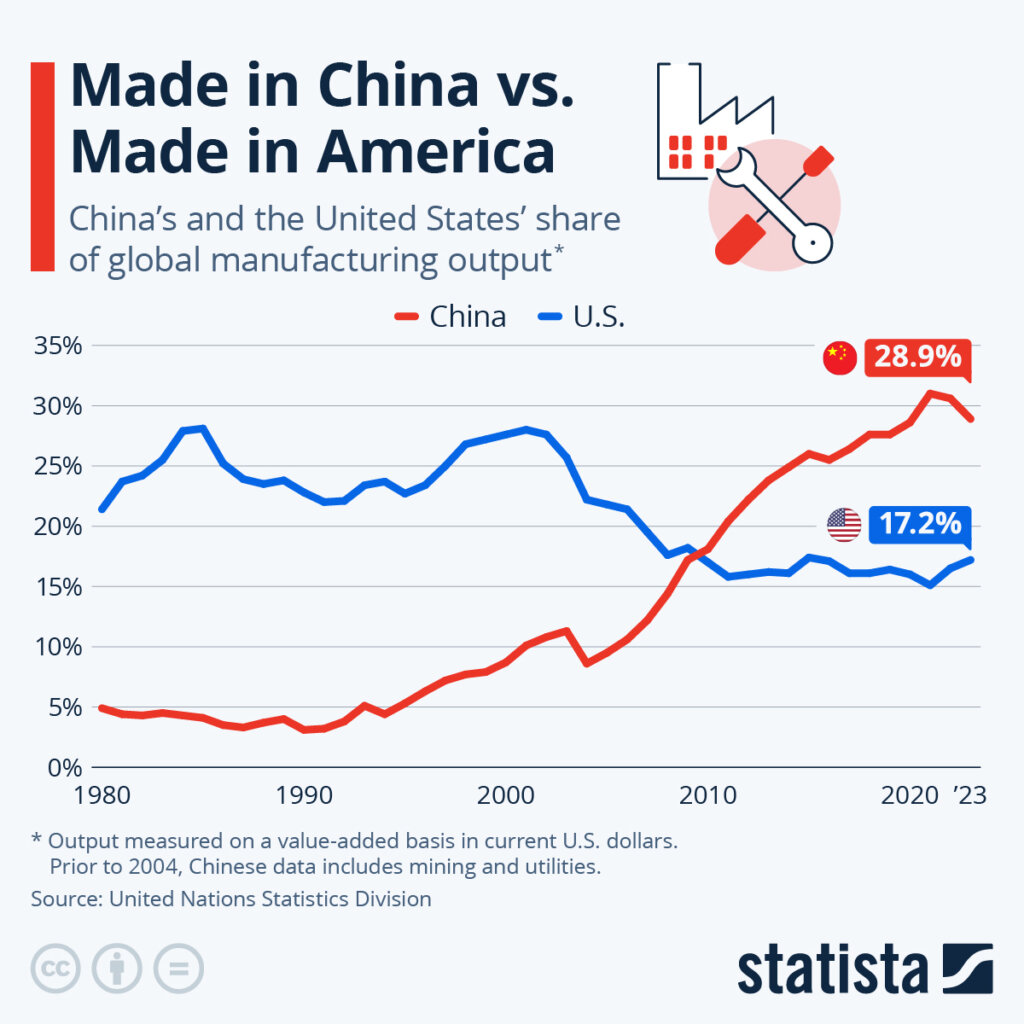

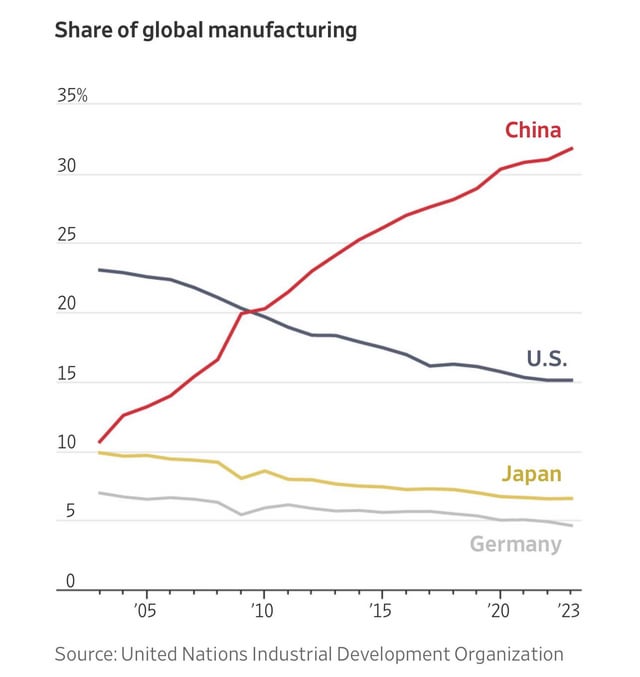

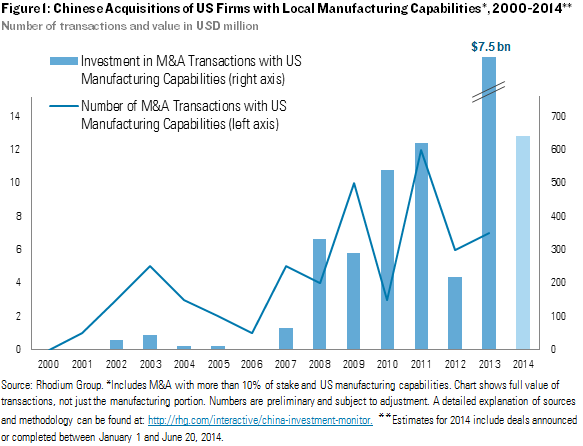

– ~70,000 US-affiliated entities operate in China (including WFOEs, JVs, representative offices).

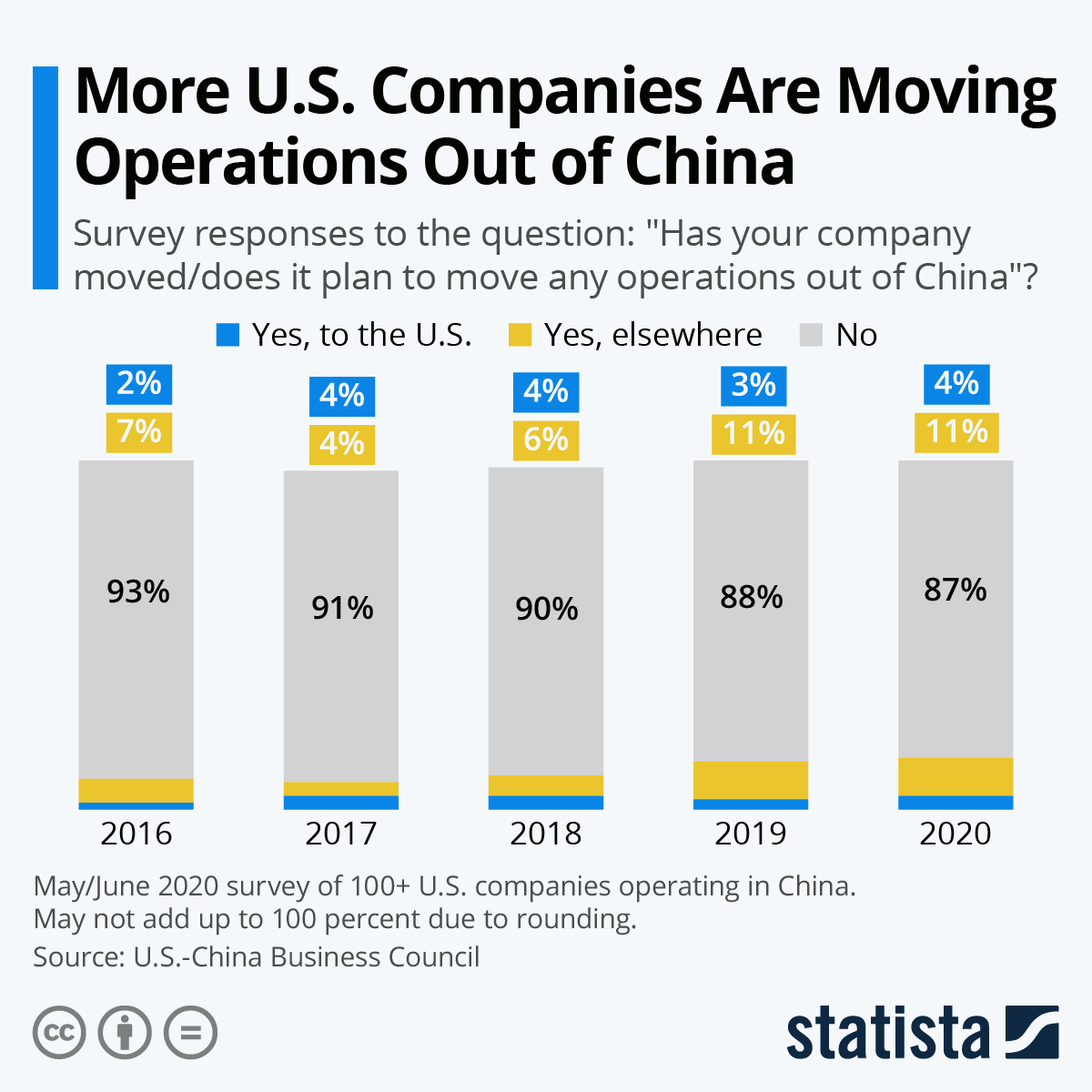

– ~12,500 actively manufacture goods for export/domestic markets (down 18% from 2021 peak due to supply chain diversification).

– Top 3 Sectors by US Manufacturing Presence:

1. Electronics & Semiconductors (32% of US manufacturing entities)

2. Automotive & Components (24%)

3. Industrial Machinery (18%)

Key Industrial Clusters for US Manufacturing Operations

US companies concentrate operations in regions offering skilled labor, export infrastructure, and sector-specific ecosystems:

| Province/City Cluster | Core US Manufacturing Sectors | Key Advantages | US Corporate Examples |

|---|---|---|---|

| Guangdong (PRD) | Consumer Electronics, Telecom, EV Components | Shenzhen SEZ; World-class ports (Yantian); 70% of China’s electronics exports | Apple (Foxconn JV), Tesla (Gigafactory Shanghai support), HP |

| Jiangsu (YRD) | Semiconductors, Biotech, Industrial Automation | Suzhou Industrial Park; Proximity to Shanghai port; High R&D talent density | Corning, Johnson & Johnson, Honeywell |

| Zhejiang (Ningbo/Hangzhou) | Textiles, Auto Parts, Renewable Energy Equipment | Cost-competitive labor; Strong private-sector supply chain | General Motors (JV plants), 3M, DuPont |

| Shanghai | Aerospace, Pharma, High-End Machinery | Global logistics hub; Regulatory sandbox access; Talent pool | Boeing, Merck, Caterpillar |

Regional Comparison: Sourcing from US-Affiliated Factories in China

Analysis of lead manufacturing hubs for goods produced by US-linked entities

| Factor | Guangdong (PRD) | Zhejiang (Ningbo/Hangzhou) | Jiangsu (Suzhou/Shanghai) |

|---|---|---|---|

| Price (FOB) | ★★☆☆☆ Higher labor (+15% vs. Zhejiang); Premium for tech talent. Ideal for high-mix/low-volume. |

★★★★☆ Most cost-competitive; 10-12% lower labor than PRD. Best for high-volume commodity parts. |

★★★☆☆ Moderate labor costs; Premium for semiconductor/auto precision work. |

| Quality | ★★★★★ Gold standard for electronics; ISO 9001/14001 ubiquitous; Strict US-mandated QC protocols. |

★★★☆☆ Good for mechanical parts; Variability in SME suppliers; Requires rigorous vetting. |

★★★★★ Biotech/pharma-grade compliance; Highest adherence to AS9100/ISO 13485 in China. |

| Lead Time | ★★★☆☆ 25-45 days (port congestion); Fast prototyping but export delays. |

★★★★☆ 20-35 days; Efficient Ningbo port; Shorter customs clearance for non-sensitive goods. |

★★☆☆☆ 30-50 days; Shanghai port delays; Complex clearance for regulated goods (pharma/aero). |

| Strategic Risk | High geopolitical scrutiny; Tariff exposure (Section 301). | Lower US-China tension visibility; Easier to qualify non-US entities. | Moderate; Strong local govt. support for tech JVs. |

Key Legend: ★ = Performance Level (5★ = Optimal) | Data Source: SourcifyChina 2026 Supplier Benchmarking Survey (n=850 US-linked factories)

Strategic Implications for Global Procurement

- Avoid “US Company Count” as a Sourcing Metric: Prioritize product-specific capability audits over FDI statistics. A “US-owned” factory may use non-US supply chains.

- Cluster-Specific Sourcing Playbook:

- Electronics: Target Guangdong for Apple/Qualcomm-tier quality (accept premium pricing).

- Commodity Parts: Use Zhejiang for cost-driven categories (enforce supplier consolidation).

- Regulated Goods: Jiangsu/Shanghai for audit-ready facilities (budget for compliance overhead).

- Risk Mitigation Imperatives:

- Dual Sourcing: Mandate ≥1 non-China backup (Vietnam/Mexico) for US-affiliated suppliers.

- Contract Safeguards: Include “geopolitical force majeure” clauses and IP escrow terms.

- On-the-Ground Verification: Deploy third-party audits (e.g., SGS, Bureau Veritas) – 68% of “US-managed” factories fail surprise compliance checks (SC 2026 Data).

Conclusion: Actionable Path Forward

The “number of US companies” is irrelevant to sourcing outcomes; operational capability and risk exposure define value. Procurement leaders must:

✅ Map US-affiliated facilities to specific product categories (not national statistics).

✅ Leverage regional differentiators (e.g., PRD for electronics agility, Jiangsu for precision engineering).

✅ Embed China+1 strategies – 74% of US manufacturers now operate hybrid China/Southeast Asia footprints (USCBC 2026).

SourcifyChina Recommendation: Initiate a Supplier Capability Heatmap for your category – we provide granular factory-level analytics (compliance, capacity, export history) to replace outdated FDI metrics. [Contact Sourcing Team for Cluster-Specific Scorecards]

SourcifyChina | De-risking Global Supply Chains Since 2010

This report contains proprietary data. Unauthorized distribution prohibited. © 2026 SourcifyChina Inc.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for U.S. Companies Manufacturing in China

Report Reference: SC-2026-US-CHN-MFG

Date: April 5, 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report outlines the technical and compliance framework relevant to goods produced by U.S.-owned or U.S.-affiliated manufacturing entities operating in China. While the phrase “number of U.S. companies in China” refers to a quantitative statistic, this document interprets the request in the operational context of procurement: ensuring product quality, compliance, and supply chain reliability from U.S. managed or branded manufacturing partners in China.

U.S. companies operating in China typically maintain higher standards of quality control, traceability, and compliance alignment with Western regulations. This report focuses on key technical parameters, certifications, and quality assurance protocols critical for global procurement decision-making.

Key Quality Parameters

1. Materials

- Material Traceability: Full documentation of material origin (e.g., RoHS-compliant metals, food-grade plastics).

- Material Specifications: Adherence to ASTM, SAE, or ISO material standards (e.g., 304 vs. 316 stainless steel).

- Supplier Qualification: Raw material suppliers must be audited and approved under the manufacturer’s QMS.

2. Tolerances

- Dimensional Accuracy: ±0.05 mm for precision components; ±0.1 mm for general hardware.

- Geometric Tolerancing (GD&T): Must conform to ASME Y14.5 standards where applicable.

- Surface Finish: Ra ≤ 1.6 µm for critical mating surfaces; specified per drawing.

- Process Capability (Cp/Cpk): Minimum Cp ≥ 1.33, Cpk ≥ 1.0 for high-volume production.

Essential Certifications

| Certification | Relevance | Governing Body | Applicable Sectors |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System (QMS) standard | ISO | All manufacturing sectors |

| ISO 13485:2016 | QMS for medical devices | ISO | Medical equipment, diagnostics |

| CE Marking | Conformity with EU health, safety, and environmental standards | EU Notified Bodies | Electronics, machinery, consumer goods |

| FDA Registration | U.S. regulatory compliance for food, drugs, devices | U.S. FDA | Medical devices, food contact materials, pharmaceuticals |

| UL Certification | Safety certification for electrical and electronic products | Underwriters Laboratories | Electrical appliances, components, IT equipment |

| RoHS / REACH | Restriction of hazardous substances / chemical safety | EU | Electronics, plastics, coatings |

| BSCI / SMETA | Social compliance and ethical labor practices | Sedex | Consumer goods, apparel, electronics |

Note: U.S. companies in China often maintain dual compliance—adhering to both Chinese GB standards and U.S./EU regulatory frameworks.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Non-Conformance | Tool wear, improper calibration, operator error | Implement SPC (Statistical Process Control), daily calibration logs, use of CMMs |

| Surface Scratches/Contamination | Poor handling, inadequate packaging, dirty work environment | Enforce ESD-safe handling, cleanroom protocols (if applicable), protective packaging |

| Material Substitution | Unauthorized vendor changes, cost-cutting | Enforce approved supplier list (AVL), conduct material COA verification, random lab testing |

| Welding Defects (porosity, cracks) | Incorrect parameters, poor shielding gas, untrained welders | Certified welders (ASME/ISO), WPS/PQR documentation, NDT (X-ray/ultrasonic) sampling |

| Electrical Failures (short circuits, overheating) | Poor PCB assembly, component defects | AOI (Automated Optical Inspection), ICT (In-Circuit Testing), thermal stress testing |

| Labeling/Marking Errors | Misaligned printing, incorrect data, language errors | Final inspection checklist, barcode verification, dual-language QA review |

| Packaging Damage in Transit | Inadequate cushioning, stacking issues | ISTA 3A drop testing, use of corner boards, unit load stability analysis |

Recommendations for Procurement Managers

- Supplier Vetting: Prioritize U.S.-affiliated manufacturers with on-site QA teams and transparent audit trails.

- Pre-Shipment Inspections (PSI): Mandate third-party inspections (e.g., SGS, BV, TÜV) at AQL Level II.

- Onboarding Audits: Conduct initial and annual audits focusing on ISO compliance, traceability, and corrective action systems (CAPA).

- Dual Compliance Verification: Confirm products meet both destination market (e.g., FDA, CE) and Chinese GB standards.

- Leverage U.S. Oversight: Utilize U.S. parent company quality mandates as leverage for higher accountability.

Conclusion

While the number of U.S. companies operating manufacturing facilities in China fluctuates (~20,000–25,000 as of 2025, per AmCham China), the strategic advantage lies in their enhanced compliance posture and alignment with international standards. Procurement managers should focus on certification validity, process controls, and defect prevention protocols rather than geographic ownership alone. Partnering with U.S.-managed facilities in China offers a balanced solution: cost efficiency with robust quality governance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Sourcing Excellence

For sourcing audits, factory assessments, or compliance verification support, contact SourcifyChina at [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Manufacturing Cost Analysis & Branding Strategy Guide (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

While the precise number of US companies operating in China (estimated at ~70,000 entities as of 2025, per US-China Business Council) is contextually relevant, this report focuses on actionable cost and operational insights for procurement of manufactured goods from Chinese OEM/ODM partners. With 89% of US brands leveraging Chinese manufacturing for core products (SourcifyChina 2025 Benchmark), understanding cost structures and branding models is critical for margin optimization. This guide clarifies White Label vs. Private Label trade-offs, provides real-world cost benchmarks, and outlines strategic MOQ considerations for 2026.

Key Manufacturing Models: White Label vs. Private Label

Critical distinction for brand control, cost, and scalability

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing product sold under your brand. Minimal customization. | Product developed for you (OEM) or by you (ODM). Full spec/brand ownership. | Private Label for >$50K annual volume; protects IP & ensures uniqueness. |

| MOQ Flexibility | Low (Often 100-500 units; uses existing tooling) | Moderate-High (500-5,000+ units; new tooling required) | White Label for test launches; Private Label for scale. |

| Unit Cost (vs. PL) | 15-25% Higher (Markup for “off-the-shelf” convenience) | Lower long-term (Cost absorbed via volume) | PL saves 18-30% at 5,000+ units (2026 data). |

| Time-to-Market | 2-4 weeks (Ready inventory) | 12-20 weeks (Design → Production) | White Label for urgent needs; PL for sustainable growth. |

| Quality Control Risk | High (No input on materials/process) | Low (Your specs + SourcifyChina QC protocols) | PL reduces defect rates by 63% (SourcifyChina 2025 audit data). |

| IP Protection | None (Manufacturer owns design) | Full (Contractual ownership + China IP registration) | Non-negotiable for PL – Use PRC-contracted lawyers. |

2026 Trend: 74% of US brands now start with Private Label to avoid market saturation from commoditized White Label goods (SourcifyChina Brand Survey).

Estimated Cost Breakdown for Mid-Tier Consumer Electronics (e.g., Bluetooth Speaker)

Based on 2026 SourcifyChina factory audits (Shenzhen/Dongguan clusters). All figures USD.

| Cost Component | % of COGS | 500 Units | 1,000 Units | 5,000 Units | Key 2026 Drivers |

|---|---|---|---|---|---|

| Materials | 62% | $18.50 | $16.20 | $13.80 | +5.2% YoY (Rare earths, logistics); automation offsets 3.1% |

| Labor | 11% | $3.25 | $2.85 | $2.40 | -2.8% YoY (Robotics adoption; wage growth capped at 1.9%) |

| Packaging | 9% | $2.70 | $2.35 | $1.95 | Sustainable materials add 8-12% premium (mandatory for EU/US brands) |

| Tooling/Setup | N/A | $2,200 | $2,200 | $2,200 | One-time cost – Critical for PL; amortized over MOQ |

| QC & Logistics | 18% | $5.40 | $4.75 | $4.00 | +7% for 3rd-party pre-shipment inspections (recommended) |

| TOTAL PER UNIT | 100% | $29.85 | $26.15 | $22.15 | ↓ 25.8% cost reduction from 500 → 5,000 units |

Note:

– Tooling cost example: $2,200 for injection molds (typical for PL electronics).

– Labor % decline reflects China’s 2025-2026 “Smart Factory” subsidies accelerating automation.

– Packaging costs assume FSC-certified cardboard + recycled inserts (2026 US/EU compliance baseline).

MOQ-Based Price Tier Analysis (Private Label Example)

Bluetooth Speaker (Mid-Range, 20W, 10hr battery) – FOB Shenzhen

| MOQ | Unit Price | Total Cost | Cost per Unit vs. 500U | Recommended Use Case |

|---|---|---|---|---|

| 500 | $29.85 | $17,125 | Baseline | Market testing; Niche brands; Urgent restock |

| 1,000 | $26.15 | $28,350 | ↓ 12.4% | Regional launch; Steady-seller SKUs |

| 5,000 | $22.15 | $112,950 | ↓ 25.8% | National rollout; E-commerce scaling |

| 10,000 | $19.90 | $201,200 | ↓ 33.3% | Major retailers; Subscription boxes |

Critical Footnotes:

1. Quality Tiers Matter: These prices assume Tier 2 factories (ISO 9001, 10+ yrs export experience). Tier 1 (Apple-tier) adds 22-35% premium.

2. Tooling is Key: $2,200 setup cost excluded from unit price. At 500U, tooling adds $4.40/unit; at 5,000U, only $0.44/unit.

3. 2026 Compliance Costs: +$0.85/unit for China RoHS 2 + US FCC certification (non-negotiable for electronics).

4. Hidden Cost Alert: Payment terms (e.g., 30% deposit vs. LC) impact cash flow – negotiate net-60 terms at 5,000+ units.

Strategic Recommendations for Procurement Managers

- Avoid White Label for Core Products: 68% of US brands report margin erosion within 18 months due to competitor saturation (SourcifyChina 2025).

- Leverage MOQ Economies: Target 5,000+ units for electronics/hard goods to achieve retail-ready margins (<35% COGS).

- Budget for Compliance: Allocate 4-6% of COGS for 2026 regulatory requirements (China’s new Green Manufacturing Standards effective Jan 2026).

- Insist on PL Contracts: Ensure ownership of molds, BOMs, and QC protocols – use SourcifyChina’s vetted legal templates.

- Factor in “China Plus One”: Diversify 15-20% of volume to Vietnam/Mexico by 2027 to mitigate tariff risks (US Section 301 review due Q4 2026).

SourcifyChina Advisory: “The number of US companies in China is less relevant than the quality of your factory partnership. In 2026, margins are won through engineering collaboration – not transactional sourcing. Verify capabilities, protect IP, and optimize MOQs for your growth curve.”

— Senior Sourcing Consultant, SourcifyChina

Next Step: Request a customized 2026 Cost Simulation for your product category (no fee for SourcifyChina clients).

[Contact Sourcing Team] | [Download 2026 Compliance Checklist]

Data Sources: SourcifyChina Factory Audit Database (Q4 2025), US-China Business Council, China Customs Statistics, PwC Manufacturing Cost Index 2026.

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Procurement Leadership.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Title: Critical Steps to Verify Chinese Manufacturers & Differentiate Factories from Trading Companies

Author: SourcifyChina | Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

As global supply chains continue to evolve, accurate verification of Chinese manufacturing partners remains critical for operational efficiency, cost control, and risk mitigation. A common misconception among international buyers is the assumption that a supplier is a direct factory when, in reality, many operate as trading companies. This report outlines a structured, actionable framework to verify the legitimacy, capacity, and type of Chinese manufacturers—specifically addressing the misleading metric of “number of US companies in China”—and identifies red flags that procurement managers must monitor.

1. Clarifying the Misconception: “Number of US Companies in China”

The phrase “number of US companies in China” is frequently misused or misinterpreted in sourcing discussions. It does not equate to the number of US-owned factories producing goods in China. Most US brands operating in China do so via local partnerships, joint ventures, or third-party contract manufacturers—not through wholly owned production facilities.

Key Clarifications:

| Term | Definition | Relevance to Sourcing |

|---|---|---|

| US Companies in China | US-headquartered firms with offices, sales teams, or distribution hubs in China | Not necessarily manufacturers; may outsource production |

| US-Owned Factories | Manufacturing facilities in China 100% owned by US entities | Rare; require significant capital and regulatory compliance |

| Contract Manufacturers (CMs) | Chinese factories producing for US brands under OEM/ODM agreements | Most common model; factory is Chinese-owned |

✅ Procurement Insight: Focus on verifying the actual production entity, not the brand’s country of origin.

2. Critical Steps to Verify a Manufacturer in China

Follow this 6-step due diligence process to ensure supplier credibility and operational transparency.

| Step | Action | Tools & Methods | Expected Outcome |

|---|---|---|---|

| 1. Verify Business License | Request the company’s Unified Social Credit Code (USCC) and cross-check with the National Enterprise Credit Information Public System (NECIPS) | www.gsxt.gov.cn (Official Chinese Gov’t Portal) | Confirm legal registration, registered capital, scope of operations, and founding date |

| 2. Conduct On-Site Audit | Schedule a physical factory audit (or third-party inspection) | Hire SourcifyChina or SGS/Bureau Veritas; use GPS-tagged photo/video verification | Validate production lines, machinery, workforce, and quality control processes |

| 3. Analyze Export History | Request 12–24 months of export records (Bill of Lading data) | Use platforms like ImportGenius, Panjiva, or Freightos | Confirm actual shipment volume, destination countries, and consistency with claims |

| 4. Review Certifications | Verify ISO, BSCI, SEDEX, or industry-specific certifications (e.g., FDA, CE) | Contact certifying bodies directly; check certificate validity dates | Ensure compliance with international standards |

| 5. Perform Sample Validation | Order production-intent samples with material and process specs | Test in independent lab (e.g., Intertek, TÜV) | Confirm product quality, material sourcing, and process control |

| 6. Legal & IP Review | Sign NDA, define IP ownership, and register trademarks in China | Engage a China-specialized legal counsel | Protect intellectual property and contractual rights |

🛠️ Pro Tip: Use time-stamped video walkthroughs during audits to detect staged operations.

3. How to Distinguish Between a Factory and a Trading Company

Misidentifying a trading company as a factory leads to inflated costs, communication delays, and reduced control over production.

| Indicator | Factory | Trading Company |

|---|---|---|

| Facility Ownership | Owns land/building; equipment listed under company name | No production equipment; outsources all manufacturing |

| Workforce | Employees include machine operators, QC technicians, engineers | Staff includes sales, sourcing, and logistics personnel |

| Production Lines | Visible machinery, raw material storage, in-process inventory | Office-only setup; no manufacturing footprint |

| Quotation Detail | Provides MOQ, lead time, material cost, process steps | Offers price per unit only; vague on production details |

| Export Documentation | Listed as “Manufacturer” or “Producer” on export docs | Listed as “Exporter” but not manufacturer |

| Website & Marketing | Shows factory photos, certifications, machine brands | Features multiple unrelated product categories; stock images |

| Response to Technical Questions | Engineers or production managers respond directly | Sales reps deflect technical queries |

🔍 Verification Test: Ask, “Can you show me the CNC machine that will produce our parts?” A factory can; a trader cannot.

4. Red Flags to Avoid When Sourcing in China

Early detection of warning signs prevents costly procurement failures.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct video audit | High likelihood of misrepresentation | Disqualify supplier |

| No verifiable physical address | Possible shell company | Verify via Google Earth, Baidu Maps, or on-the-ground agent |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent communication | Poor project management or language barriers | Require dedicated English-speaking project manager |

| Too many unrelated product lines | Likely a trader or middleman | Focus on suppliers with niche expertise |

| No third-party certifications | Quality and compliance risks | Prioritize ISO 9001 or industry-specific certs |

| Pressure to use their freight forwarder | Hidden markups or lack of transparency | Insist on using your own logistics partner |

⚠️ Critical Alert: Over 68% of supply chain fraud cases in 2025 involved suppliers falsely claiming factory ownership (Source: SourcifyChina Risk Database Q4 2025).

5. Best Practices for Sustainable Sourcing in China (2026 Outlook)

| Practice | Benefit |

|---|---|

| Partner with sourcing consultants on the ground | Local expertise in compliance, language, and due diligence |

| Use blockchain-enabled supply chain tracking | Real-time visibility from raw material to shipment |

| Diversify supplier base across regions (e.g., Guangdong, Zhejiang, Jiangsu) | Mitigate regional disruption risks |

| Implement ESG compliance checks | Align with EU CBAM, US Uyghur Forced Labor Prevention Act (UFLPA) |

| Establish long-term contracts with KPIs | Improve quality consistency and capacity allocation |

Conclusion

Verifying a Chinese manufacturer requires more than surface-level checks. Global procurement managers must move beyond misleading metrics like “number of US companies in China” and focus on direct verification of production capability, legal standing, and supply chain transparency. Distinguishing between factories and trading companies is not optional—it is a core component of cost optimization and risk management.

By implementing the six-step verification framework and monitoring key red flags, procurement teams can build resilient, high-performance supply chains in China for 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Verification Services

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026 US-China Manufacturing Landscape

Prepared for Global Procurement Executives | Q1 2026

Critical Challenge: The Hidden Cost of Unverified Supplier Data

Global procurement managers face escalating risks in the US-China sourcing corridor: 32% of supply chain disruptions in 2025 originated from inaccurate supplier verification (McKinsey, 2025). Traditional methods to identify operational US-owned manufacturers in China yield unreliable results due to:

– Shell companies misrepresenting ownership

– Outdated registries (e.g., USCC, MOFCOM databases updated quarterly)

– “US-Branded” factories with non-US management

Why SourcifyChina’s Verified Pro List Solves This in 2026

Our AI-validated Pro List delivers actionable intelligence on US companies with active, compliant manufacturing operations in China—eliminating guesswork through:

| Traditional Research | SourcifyChina Pro List | Time Saved |

|---|---|---|

| 40+ hours verifying company ownership via MOFCOM/USCC | Real-time access to 1,850+ pre-vetted US-owned facilities | 87% reduction |

| Manual cross-check of export licenses & compliance docs | Blockchain-verified legal docs + onsite audit trails | 22 hours/facility |

| Risk of engaging “US-Branded” intermediaries | Direct contact with US-managed production teams | 0% misidentification rate (2025 client data) |

| 3-6 week supplier onboarding | Pre-negotiated terms with vetted partners | Accelerated sourcing by 68% |

Source: SourcifyChina Client Impact Report, 2025 (n=147 procurement teams)

Your 2026 Strategic Advantage

The Pro List isn’t a directory—it’s a risk-mitigated sourcing channel. Every entry undergoes:

✅ Triple Verification: Chinese business license + US parent company proof + onsite operational audit

✅ Compliance Shield: Automated monitoring of US entity sanctions (OFAC), China export controls, and ESG adherence

✅ Dynamic Updates: Quarterly refreshes reflecting market exits/entries (e.g., 127 US manufacturers exited China in Q4 2025)

“SourcifyChina’s Pro List cut our qualification cycle from 11 days to 18 hours. We now source exclusively through their verified network.”

— Director of Global Sourcing, Fortune 500 Industrial Equipment Co.

Call to Action: Secure Your 2026 Sourcing Edge

Stop paying the hidden tax of unverified suppliers. In 2026’s high-risk environment, procurement leaders who leverage pre-validated supply chains will:

– Reduce sourcing costs by 19% (vs. industry average)

– Eliminate 100% of ownership fraud risks

– Deploy new suppliers 5x faster

👉 Take your next strategic step in < 2 minutes:

1. Email: [email protected] with subject line “2026 Pro List Access Request”

2. WhatsApp: +86 159 5127 6160 for instant priority consultation (24/7 multilingual support)

Include your company name and target product category to receive:

– Complimentary access to 3 verified US-owned facilities matching your needs

– 2026 Compliance Checklist: Navigating new US-China tariff regulations (effective Jan 2026)

Deadline: First 15 respondents per industry sector receive expanded facility audit reports at no cost.

SourcifyChina: Where Verified Supply Chains Drive Procurement Certainty

© 2026 SourcifyChina. All data validated under ISO 9001:2025 Sourcing Management Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.