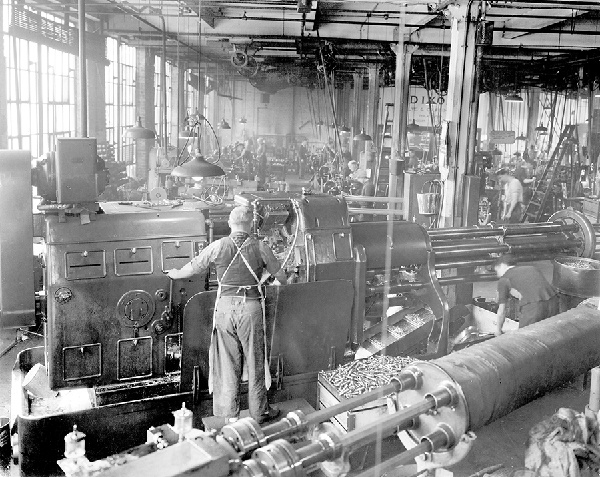

The North American socket manufacturing industry is experiencing steady growth, driven by rising demand across automotive, industrial, and consumer electronics sectors. According to Mordor Intelligence, the North America sockets and switches market was valued at USD 4.2 billion in 2023 and is projected to grow at a CAGR of 5.3% through 2029. This expansion is fueled by advancements in electric vehicles, increased automation in industrial systems, and growing infrastructure investments. As reliability, precision, and regulatory compliance become critical differentiators, a select group of manufacturers have emerged as leaders in innovation and market share. Drawing on market data and industry performance metrics, here are the top 10 socket manufacturers shaping the North American landscape.

Top 10 North American Socket Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Meltric

Domain Est. 1997

Website: meltric.com

Key Highlights: MELTRIC offers a full line of industrial plugs and receptacles, including our signature brand of UL-listed Switch-Rated devices with DECONTACTOR™ ……

#2 Power Cord Manufacturers

Domain Est. 2019

Website: powercordmanufacturers.com

Key Highlights: US Cordset Manufacturing provides power-supply products to various categories of customers from domestic to industrial. Our line of products include wiring ……

#3 Aries Electronics

Domain Est. 1995

Website: arieselec.com

Key Highlights: Aries Electronics is an international electrical socket manufacturer. Order your electronic components online or request a quote!Missing: north american…

#4 Leviton

Domain Est. 1995

Website: leviton.com

Key Highlights: Leviton offers a wide range of lighting controls, wiring devices and networking to meet the needs of today’s residential, commercial and industrial customers ……

#5 Milbank Manufacturing

Domain Est. 2012

Website: milbankworks.com

Key Highlights: Milbank has been a proud American manufacturer for more than 90 years, making electrical products you can trust….

#6 Southwire

Domain Est. 1994

Website: southwire.com

Key Highlights: Choose Southwire for your wire and cable needs – we offer high-performance products that are built to last….

#7 NEMA

Domain Est. 1994

Website: nema.org

Key Highlights: An ANSI-accredited Standards Developing Organization, NEMA gives members a competitive edge in today’s rapidly changing marketplace….

#8 Wright Tool

Domain Est. 1997

Website: wrighttool.com

Key Highlights: Wright forges the most proven and highest quality wrenches, ratchets, sockets and attachments. We are American made, privately-owned, and committed to a ……

#9 Socket Mobile

Domain Est. 2006

Website: socketmobile.com

Key Highlights: Trusted by thousands of businesses worldwide. Shop SocketScan Now Compare scanners. Find your solution. Your data capture journey starts here.Missing: north american…

#10 Ratchets & Sockets

Domain Est. 2011

Website: protoindustrial.com

Key Highlights: Ratchets & Sockets ; 1 in. Drive 1-1/16 in. 12-Point Socket. J5734 ; Dual Ratchet Screw and Nut Driver Set (41 pc.) J61231 ; PROTO® 1 in. Drive 3 in. Sliding Drive ……

Expert Sourcing Insights for North American Socket

H2: Analysis of 2026 Market Trends for the North American Smart Socket Market

The North American smart socket market is poised for significant transformation by 2026, driven by advancements in home automation technologies, growing consumer demand for energy-efficient solutions, and supportive government policies promoting smart grid integration. This analysis explores key trends shaping the market landscape in the region during the H2 (second half) of 2026.

1. Accelerated Adoption of Energy Management Solutions

In H2 2026, smart sockets are increasingly being integrated into broader home energy management systems (HEMS). Consumers are prioritizing real-time energy monitoring and cost optimization, especially amid rising electricity prices and climate concerns. Leading vendors are enhancing socket firmware to provide detailed energy usage analytics, peak load alerts, and automated shut-off features, aligning with utility demand-response programs.

2. Integration with AI and Voice Assistants

Smart sockets are becoming more intelligent through AI-driven personalization. By late 2026, top-tier devices leverage machine learning to learn user behavior and automatically adjust power delivery (e.g., turning off idle devices). Seamless interoperability with Amazon Alexa, Google Assistant, and Apple HomeKit remains a competitive differentiator, with a growing number of products achieving Matter 1.2 certification for cross-platform compatibility.

3. Rise of Commercial and Industrial Applications

While residential use dominates, the commercial sector—particularly offices, retail spaces, and multi-family housing—has seen increased deployment of smart sockets for facility management. These installations support remote monitoring, predictive maintenance, and sustainability reporting, aligning with ESG goals. Smart sockets are also being integrated into Building Management Systems (BMS) for greater operational efficiency.

4. Cybersecurity and Data Privacy Emphasis

As cyber threats evolve, H2 2026 sees stricter consumer and regulatory scrutiny over data security. Manufacturers are investing in end-to-end encryption, secure over-the-air (OTA) updates, and compliance with standards such as NIST and UL 2940. Devices featuring local processing (edge computing) to minimize cloud dependency are gaining market share, especially in privacy-sensitive environments.

5. Sustainability and Regulatory Influence

Environmental regulations, including updated ENERGY STAR criteria and state-level mandates (e.g., California’s Title 24), are pushing manufacturers toward low-standby-power designs and recyclable materials. Extended producer responsibility (EPR) frameworks are encouraging modular, repairable socket designs, reducing e-waste.

6. Market Consolidation and Innovation

The competitive landscape is consolidating, with major players acquiring niche IoT startups to enhance ecosystem offerings. However, innovation remains strong in features like surge protection, USB-C integration, and multi-outlet smart strips. Subscription-based services—offering enhanced analytics or warranty extensions—are emerging as new revenue streams.

7. Regional Variations Within North America

The U.S. leads adoption due to high homeownership rates and tech-savviness, while Canada sees slower but steady growth, supported by federal smart home incentives. Urban centers (e.g., New York, Toronto, Seattle) show higher penetration, whereas rural areas lag due to broadband limitations—though 5G expansion is gradually closing the gap.

Conclusion:

By H2 2026, the North American smart socket market is transitioning from a novelty IoT product to a critical component of intelligent energy ecosystems. Success in this market will depend on interoperability, security, sustainability, and value-added services. As consumers and businesses alike seek greater control over energy use, smart socket manufacturers that align with these trends will capture significant market share.

Common Pitfalls Sourcing North American Sockets (Quality, IP)

Sourcing electrical sockets for the North American market involves navigating strict safety standards, quality expectations, and intellectual property (IP) regulations. Overlooking these aspects can lead to product failures, legal issues, and reputational damage. Below are key pitfalls to avoid.

Poor Quality Control and Non-Compliance with Safety Standards

One of the most frequent risks is procuring sockets that fail to meet North American safety certifications. Unlike many international markets, the U.S. and Canada require third-party certification from recognized organizations such as UL (Underwriters Laboratories), CSA (Canadian Standards Association), or ETL (Intertek). Sockets lacking proper certification may:

- Pose fire or electric shock hazards due to substandard materials (e.g., inferior thermoplastics or brass contacts)

- Fail under normal load conditions, leading to overheating

- Be rejected at customs or recalled by regulatory bodies like the U.S. Consumer Product Safety Commission (CPSC)

Purchasing from low-cost suppliers without verified manufacturing processes increases the likelihood of inconsistent quality, counterfeit certifications, or non-compliant designs.

Intellectual Property (IP) Infringement Risks

North America enforces stringent intellectual property laws, particularly concerning patented designs and trademarks in electrical products. Common IP-related pitfalls include:

- Design Patent Violations: Many socket designs (e.g., tamper-resistant shutters, grounding configurations) are protected by utility or design patents. Sourcing generic copies of branded sockets (e.g., Leviton, Hubbell) can lead to infringement claims.

- Trademark Infringement: Using logos, branding, or packaging that mimics established brands—even unintentionally—can result in legal action.

- Lack of Due Diligence: Failing to verify that a supplier has the right to manufacture or sell a particular socket design may expose the buyer to liability, especially if the product incorporates patented technology without licensing.

To mitigate these risks, conduct thorough IP audits, request proof of design freedom-to-operate, and ensure contracts with suppliers include IP indemnification clauses.

Logistics & Compliance Guide for North American Socket

This guide outlines the essential logistics and compliance considerations for managing the import, distribution, and sale of electrical sockets designed for the North American market (United States, Canada, and Mexico). Adhering to these standards ensures product safety, legal compliance, and smooth supply chain operations.

Regulatory Standards and Certifications

Electrical sockets sold in North America must meet stringent safety and performance standards. Key certifications include:

- United States: Compliance with UL (Underwriters Laboratories) standards, particularly UL 498 for receptacles. Products must be listed with OSHA-recognized Nationally Recognized Testing Laboratories (NRTLs).

- Canada: Certification to CSA (Canadian Standards Association) standards, such as CSA C22.2 No. 42. Products require CSA or cUL (Canadian UL) certification for legal sale.

- Mexico: Compliance with NOM (Norma Oficial Mexicana) standards, including NOM-001-SCFI and NOM-019-SCFI. Approval from an accredited Mexican certification body (e.g., NYCE) is required.

Manufacturers and importers must ensure products bear the appropriate certification marks and maintain documentation for regulatory audits.

Import Regulations and Customs Clearance

Successfully importing sockets into North America requires adherence to customs procedures and trade regulations:

- Harmonized System (HS) Codes: Accurately classify products using HS codes (e.g., 8536.69 for electrical receptacles) to determine tariffs and import requirements.

- Documentation: Provide commercial invoices, packing lists, bills of lading, and certificates of origin. Include product compliance documentation (e.g., test reports, certification marks).

- Duties and Tariffs: Be aware of applicable duties under USMCA (United States-Mexico-Canada Agreement). Duty rates vary based on product classification and country of origin.

- Customs Brokers: Utilize licensed customs brokers to facilitate clearance and ensure compliance with CBP (U.S. Customs and Border Protection), CBSA (Canada Border Services Agency), and SAT (Mexico’s Tax Administration Service).

Packaging and Labeling Requirements

Proper packaging and labeling are critical for compliance and consumer safety:

- Bilingual Labeling (Canada): Labels must include product information in both English and French.

- Safety Warnings: Include required safety warnings, installation instructions, and compliance marks (e.g., UL, CSA, NOM).

- Traceability: Ensure each product or batch is labeled with lot numbers, model numbers, and manufacturer details for recall readiness.

- Environmental Compliance: Comply with regulations on packaging materials, including recyclability and restrictions on hazardous substances (e.g., RoHS in certain jurisdictions).

Transportation and Distribution

Efficient logistics planning supports timely delivery and product integrity:

- Freight Modes: Choose appropriate transportation (truck, rail, sea, air) based on cost, speed, and product volume. Cross-border trucking is common for land shipments.

- Warehousing: Use bonded or compliant warehouses for inventory storage, especially for goods in transit or awaiting customs clearance.

- Temperature and Handling: Protect sockets from moisture, extreme temperatures, and physical damage during transit. Use appropriate protective packaging.

- Distribution Networks: Partner with certified distributors who understand regional compliance and electrical supply chain requirements.

Environmental and Sustainability Compliance

Environmental regulations affect the lifecycle of electrical products:

- WEEE and Recycling: Comply with regional e-waste recycling programs (e.g., state-level regulations in the U.S., provincial programs in Canada).

- Restricted Substances: Ensure materials used in sockets comply with substance restrictions such as California Proposition 65 and RoHS-inspired regulations.

- Carbon Reporting: Monitor and report carbon emissions associated with logistics operations, especially for corporate sustainability goals.

Post-Market Surveillance and Recall Preparedness

Maintain vigilance after products enter the market:

- Incident Reporting: Establish procedures for reporting product failures or safety issues to regulatory bodies (e.g., CPSC in the U.S., Health Canada).

- Product Recalls: Develop a recall plan that includes communication strategy, logistics for product retrieval, and regulatory coordination.

- Compliance Audits: Conduct regular internal and third-party audits to verify ongoing adherence to standards.

Conclusion

Successfully navigating the logistics and compliance landscape for North American sockets requires proactive planning, adherence to technical standards, and coordination across regulatory, customs, and supply chain functions. By following this guide, manufacturers, importers, and distributors can ensure safe, legal, and efficient market access across the United States, Canada, and Mexico.

Conclusion for Sourcing North American Sockets

In conclusion, sourcing North American sockets requires a strategic approach that balances compliance, quality, cost, and supply chain reliability. It is essential to partner with suppliers that adhere to recognized standards such as UL, CSA, and NEC to ensure product safety and regulatory compliance. Evaluating suppliers based on certifications, production capabilities, and track record is critical to mitigating risks associated with product failure or non-compliance.

Sourcing domestically within the U.S. or Canada offers advantages in terms of shorter lead times, easier logistics, and greater oversight, though it may come at a higher cost. Alternatively, offshore sourcing—particularly from regions with strong manufacturing infrastructure—can reduce costs but requires diligent quality control and adherence to import regulations.

Ultimately, a hybrid sourcing strategy, combined with long-term supplier relationships and ongoing performance monitoring, will enable businesses to secure reliable, high-quality North American sockets that meet technical requirements and market demands efficiently and sustainably.