The global adhesive market is experiencing robust growth, driven by expanding applications across electronics, automotive, and medical device manufacturing—sectors where non-conductive glue plays a critical role in ensuring electrical insulation and material bonding without interfering with circuit integrity. According to Grand View Research, the global adhesives and sealants market was valued at USD 68.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This growth is fueled by rising demand for high-performance, specialty adhesives in miniaturized electronics and advanced manufacturing processes. As reliance on precision bonding solutions increases—especially in printed circuit boards, sensors, and consumer electronics—the need for reliable non-conductive adhesives has surged. In response, a cadre of manufacturers has emerged as leaders in developing formulations that offer strong adhesion, thermal stability, and electrical insulation. The following list highlights the top 10 non-conductive glue manufacturers shaping this evolving landscape through innovation, product quality, and global reach.

Top 10 Non-Conductive Glue Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Dow Inc.

Domain Est. 1992

Website: dow.com

Key Highlights: Dow is a materials science company that offers a wide range of products and services, including agricultural films, construction materials, ……

#2 Adhesives, Sealants and Coatings

Domain Est. 1996

Website: masterbond.com

Key Highlights: Master Bond is a leading manufacturer of epoxy adhesives, sealants, coatings, potting and encapsulation compounds. Master Bond specializes in epoxies, ……

#3 Tekra: Converting Services

Domain Est. 1996

Website: tekra.com

Key Highlights: As a manufacturer and full-service distributor of high-performance polyester and polycarbonate films, adhesives, and conductive inks, Tekra understands the ……

#4 Adhesives Research

Domain Est. 1996

Website: adhesivesresearch.com

Key Highlights: Adhesives Research is your expert developer and manufacturer of high-performance adhesive tapes, specialty films, coatings, laminates, release liners and drug ……

#5 Loctite Non

Domain Est. 1995

Website: mouser.com

Key Highlights: $4.99 delivery 30-day returnsJan 20, 2020 · LOCTITE Non-Conductive Adhesives are ideal for several deposition methods, including needle dispensing, jetting, and stencil printing. F…

#6 Conductive Adhesive & Non

Domain Est. 1997

Website: gpd-global.com

Key Highlights: Rating 5.0 · Review by adminNon-Conductive Adhesive is used for holding a device to a substrate without an electrical connection or can be used as an insulator between pads. W…

#7 Mikrostik Non

Domain Est. 1999

Website: agarscientific.com

Key Highlights: Mikrostik Non-Conductive Adhesive, 14ml. Fast drying, ultrathin clear adhesive suitable for mounting small particles which can be submerged in other adhesives….

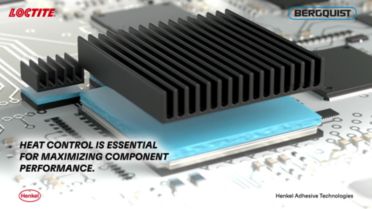

#8 Thermal management materials

Domain Est. 2000

Website: henkel-adhesives.com

Key Highlights: A packshot of LOCTITE 315 showing a blue 25ML syringe and a blue 300ML semco cartridge. Thermally conductive adhesives. LOCTITE® 315….

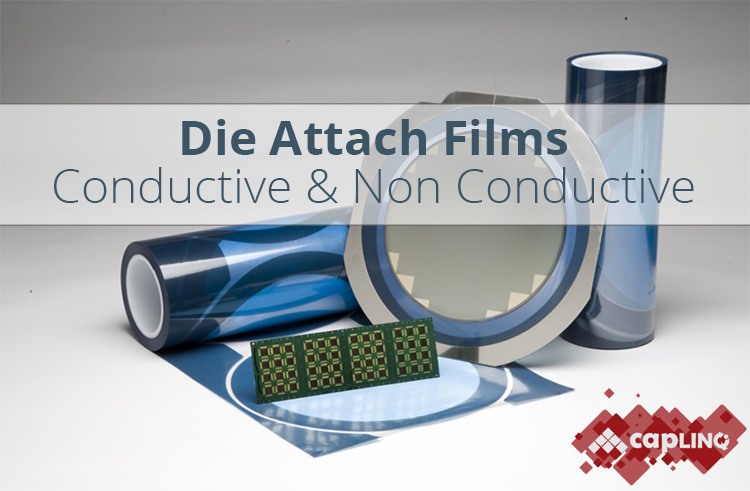

#9 Die Attach Materials

Domain Est. 2006

Website: caplinq.com

Key Highlights: Non-conductive adhesives (NCAs) are useful in applications where the mechanical bond from the die attach is more important than its electrical conductivity. A ……

#10 China Best Non Conductive Glue Manufacturer, Exporters

Domain Est. 2024

Website: santams.com

Key Highlights: Shop non conductive glue at Chengdu Santam Technology Co., Ltd. Our high quality adhesive offers strong bonding and non conductive properties….

Expert Sourcing Insights for Non-Conductive Glue

H2: 2026 Market Trends for Non-Conductive Glue

The global non-conductive glue market is poised for steady growth through 2026, driven by increasing demand in electronics, automotive, and renewable energy sectors. As miniaturization of electronic devices continues and advanced manufacturing techniques become more prevalent, non-conductive adhesives are gaining importance for their ability to provide reliable bonding without interfering with electrical circuits.

One of the primary drivers of the 2026 market trend is the rapid expansion of the consumer electronics industry. With the proliferation of smartphones, wearable devices, and IoT (Internet of Things) products, manufacturers require adhesives that offer strong mechanical bonding while maintaining electrical insulation. Non-conductive glues are ideal for dielectric layering, component mounting, and encapsulation processes, particularly in environments where electrical isolation is critical.

Another significant trend is the adoption of non-conductive adhesives in electric vehicles (EVs). As EV production surges worldwide, automakers are integrating advanced electronics and battery management systems that rely on precise, reliable insulation materials. Non-conductive glues are used to bond sensors, insulate battery components, and secure connectors, contributing to the safety and efficiency of EV systems. This trend is expected to accelerate through 2026, supported by government incentives and sustainability goals.

The renewable energy sector, particularly solar panel manufacturing, is also fueling demand. Non-conductive adhesives are essential in photovoltaic module assembly, where they protect sensitive circuitry from moisture and electrical leakage. With global investments in solar infrastructure rising, especially in Asia-Pacific and North America, this application is projected to expand significantly.

Technological advancements are shaping product development, with manufacturers focusing on eco-friendly, low-outgassing, and thermally stable formulations. UV-curable and epoxy-based non-conductive glues are gaining traction due to their fast curing times and durability under extreme conditions. Additionally, the integration of smart manufacturing and Industry 4.0 is pushing demand for adhesives compatible with automated dispensing systems, further influencing R&D efforts.

Regionally, Asia-Pacific dominates the market due to its robust electronics manufacturing base in China, South Korea, and Japan. However, North America and Europe are witnessing growth due to innovation in high-performance materials and strict regulatory standards for electronic safety and environmental impact.

In summary, by 2026, the non-conductive glue market will be shaped by technological innovation, expanding applications in high-growth industries, and a shift toward sustainable materials. Companies that invest in R&D and align with evolving industry standards are likely to capture significant market share in this competitive landscape.

Common Pitfalls When Sourcing Non-Conductive Glue (Quality, IP)

Sourcing non-conductive glue for electronic or high-voltage applications requires careful attention to both quality consistency and intellectual property (IP) considerations. Overlooking these aspects can lead to product failures, legal risks, and supply chain disruptions. Below are key pitfalls to avoid:

Inadequate Quality Control and Material Consistency

One of the most frequent issues is inconsistent quality across batches. Non-conductive glue must maintain stable dielectric strength, viscosity, curing time, and thermal resistance. Poor quality control from suppliers can result in:

- Variable dielectric properties, risking electrical breakdown in high-voltage environments.

- Inconsistent curing behavior, leading to unreliable adhesion or incomplete bonding.

- Presence of ionic contaminants (e.g., chlorides, sodium), which can compromise insulation over time, especially in humid conditions.

To mitigate: Require suppliers to provide full material test reports (MTRs), conduct incoming quality inspections, and perform long-term reliability testing (e.g., HAST, thermal cycling).

Misrepresentation of Electrical Properties

Some suppliers may overstate or ambiguously define electrical performance metrics such as volume resistivity, dielectric strength, or surface resistivity. Claims like “non-conductive” without quantified test data are insufficient.

Pitfalls include:

- Relying on generic datasheets not validated for your operating conditions (e.g., temperature, humidity, frequency).

- Using glues tested under ideal lab conditions that don’t reflect real-world use.

Solution: Insist on standardized test results (e.g., ASTM D257, IEC 60243) under application-specific conditions and verify with third-party labs if necessary.

Lack of IP Clarity and Infringement Risks

When sourcing proprietary adhesives, unclear IP ownership or unauthorized formulations can expose your company to legal liability. Common IP-related pitfalls:

- Reverse-engineered or knockoff products that mimic branded glues but violate patents.

- Unclear licensing terms, especially when using formulations developed jointly with a supplier.

- Supplier reliance on patented chemistries without proper authorization, risking supply chain disruption if litigation occurs.

Best practice: Conduct IP due diligence, review supplier contracts for IP indemnification clauses, and ensure formulations are either licensed, public domain, or developed under clear ownership agreements.

Supply Chain Opacity and Traceability Gaps

Many non-conductive glues involve complex formulations with multiple raw material sources. Lack of traceability increases risks:

- Inability to verify banned substances (e.g., RoHS, REACH compliance).

- Difficulty in root cause analysis during field failures.

- Vulnerability to counterfeit or substandard materials entering the supply chain.

Mitigation: Choose suppliers with full traceability systems, request bills of materials (BOMs), and conduct audits of critical vendors.

Inadequate Environmental and Regulatory Compliance

Glues may meet electrical specs but fail environmental standards. Pitfalls include:

- Unverified claims of halogen-free, low-outgassing, or biocompatibility.

- Non-compliance with industry-specific standards (e.g., UL 94 flammability, NASA outgassing for space apps).

Always validate compliance certifications and request up-to-date compliance documentation.

By proactively addressing these quality and IP pitfalls, companies can ensure reliable performance, regulatory adherence, and protection against legal and operational risks when sourcing non-conductive glues.

Logistics & Compliance Guide for Non-Conductive Glue

Regulatory Classification & Documentation

Non-conductive glue is typically classified as an adhesive compound that does not facilitate electrical conductivity. Depending on its chemical composition, it may be subject to regulations under transportation, workplace safety, and environmental protection frameworks. Accurate classification is essential for compliant handling and shipping.

- GHS Classification: Determine if the glue is flammable, contains hazardous substances, or poses health/environmental risks. Most non-conductive glues are solvent-free or low-VOC, but exceptions exist. Always consult the Safety Data Sheet (SDS) for GHS pictograms, hazard statements, and precautionary measures.

- UN Number & Transport Classification: If flammable (e.g., cyanoacrylate-based), it may fall under UN 1133 (Adhesives, flammable) or UN 1866 (Other regulated liquids). Water-based or non-flammable formulations may be non-regulated for transport.

- SDS & Labeling: Maintain up-to-date Safety Data Sheets (SDS) compliant with local regulations (e.g., OSHA HazCom in the U.S., CLP in the EU). Ensure containers are labeled with product identifier, hazard pictograms, signal words, and supplier information.

Storage & Handling Procedures

Proper storage and handling minimize risks to personnel and ensure product integrity.

- Storage Conditions: Store in a cool, dry, well-ventilated area away from direct sunlight and heat sources. Ideal temperature range: 15–25°C (59–77°F). Keep containers tightly sealed to prevent moisture absorption or solvent evaporation.

- Shelf Life: Most non-conductive glues have a shelf life of 6–12 months. Monitor expiration dates and practice FIFO (First In, First Out) inventory rotation.

- Handling Precautions: Use in well-ventilated areas. Wear appropriate PPE including nitrile gloves, safety goggles, and, if aerosolized, respiratory protection. Avoid skin and eye contact.

Transportation Requirements

Transport protocols depend on the glue’s physical and chemical properties.

- Ground & Air Transport (e.g., IATA, ADR, DOT):

- Non-hazardous formulations: May be shipped as general cargo; no special labeling required.

- Flammable formulations: Must be packaged in UN-certified containers, labeled with proper hazard class (e.g., Class 3 Flammable Liquid), and accompanied by a Shipper’s Declaration for Dangerous Goods if required.

- Packaging: Use original manufacturer containers or compatible secondary packaging to prevent leakage. Include absorbent materials for added safety when shipping flammable types.

- International Shipments: Comply with destination country regulations. For exports, verify requirements under REACH (EU), TSCA (U.S.), or other regional chemical inventories.

Workplace Safety & Environmental Compliance

Ensure operational use aligns with health, safety, and environmental standards.

- Ventilation: Use local exhaust ventilation when dispensing large volumes or working in confined spaces.

- Spill Response: In case of spill, contain with inert absorbent material (e.g., vermiculite). Do not flush into drains. Clean residue with appropriate solvent (check SDS).

- Disposal: Dispose of waste glue and contaminated packaging as hazardous or non-hazardous waste per local regulations. Consult SDS Section 13 for disposal considerations. Never dispose of down drains or in regular trash unless explicitly permitted.

Import/Export Considerations

Cross-border movement may require additional documentation and regulatory checks.

- Customs Documentation: Provide accurate HS (Harmonized System) code. Common codes for adhesives include 3506.91 (reactive adhesives) or 3506.99 (other adhesives), depending on composition.

- Chemical Registration: Confirm compliance with destination country chemical laws (e.g., REACH pre-registration in the EU, K-REACH in South Korea).

- Restricted Substances: Verify that the glue does not contain substances banned or restricted under RoHS, REACH SVHC, or Prop 65 (California).

Training & Recordkeeping

Maintain compliance through proper training and documentation.

- Employee Training: Train staff on SDS interpretation, PPE usage, spill response, and proper disposal procedures.

- Record Retention: Keep SDS files, shipping manifests, training logs, and disposal records for a minimum of 3–5 years, or as required by local law.

Adherence to this guide ensures safe, legal, and efficient management of non-conductive glue throughout its lifecycle—from procurement to disposal. Always consult the manufacturer’s SDS and local regulatory authorities for product-specific requirements.

In conclusion, sourcing non-conductive glue requires careful consideration of application requirements, material compatibility, curing method, and performance under environmental conditions such as temperature, humidity, and exposure to chemicals. It is essential to select a glue that maintains strong adhesion without compromising electrical insulation properties, especially in electronics, circuit assembly, or other sensitive applications where conductivity must be avoided. Key suppliers should offer consistent quality, technical support, and compliance with industry standards (e.g., RoHS, UL). Evaluating samples, verifying specifications, and considering long-term reliability will ensure the chosen non-conductive adhesive meets both functional and safety requirements. Ultimately, a well-informed sourcing decision enhances product performance, durability, and safety.