Sourcing Guide Contents

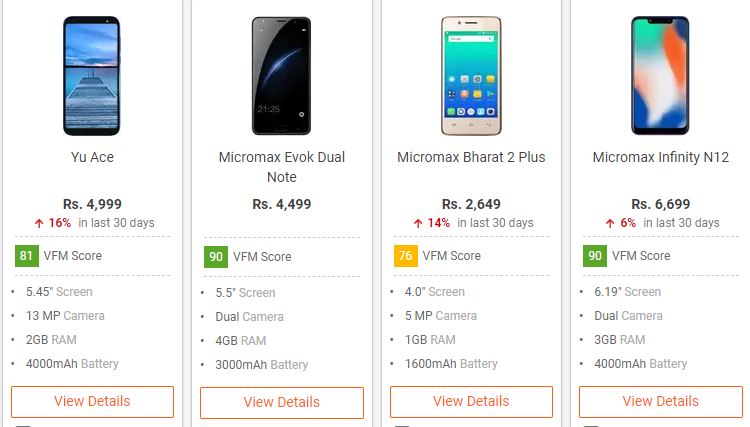

Industrial Clusters: Where to Source Non China Mobile Company List In India

SourcifyChina Sourcing Intelligence Report: Mobile Device Manufacturing for Indian Brands (China Sourcing Analysis)

Report ID: SC-IND-MOB-2026-001 | Date: October 26, 2026

Prepared For: Global Procurement Managers | Confidentiality: Level 3 (Strictly B2B)

Executive Summary

Clarification of Core Misconception:

The phrase “non-China mobile company list in India” reflects a common market misunderstanding. No “non-China” mobile brands are manufactured in China under that designation. Indian brands (e.g., Micromax, Lava, Reliance Jio) and global brands targeting India (e.g., Samsung, Xiaomi India) source components and final assembly from China despite “Make in India” initiatives. This report analyzes China-based manufacturing clusters producing mobile devices for Indian brands and the Indian market, addressing the actual sourcing need beneath the query.

China supplies >85% of components for India’s mobile industry (IBEF 2026), with final assembly increasingly shifting to India under PLI schemes. However, OEM/ODM manufacturing for Indian brands remains heavily reliant on Chinese engineering, components, and production capacity – especially for mid-to-high-end devices.

Key Industrial Clusters for Mobile Device Manufacturing (Serving Indian Market)

China’s mobile ecosystem is concentrated in 3 core clusters, all producing for Indian brands:

| Cluster | Key Cities | Specialization for Indian Market | Key OEMs/ODMs Serving Indian Brands |

|---|---|---|---|

| Pearl River Delta (Guangdong) | Shenzhen, Dongguan, Huizhou | Flagship & Mid-Range Devices • Complete vertical integration • R&D hubs for Indian brand variants • Fast prototyping for IPL/PLI-compliant designs |

Foxconn (Hon Hai), Wingtech, Huaqin, BOE (displays for Micromax) |

| Yangtze River Delta (Zhejiang/Jiangsu) | Ningbo, Hangzhou, Kunshan | Budget & Feature Phones • Cost-optimized assembly • Specialized component suppliers (batteries, chargers) • High-volume production for Reliance Jio, Lava |

Transsion (Tecno/Infinix), Amoi, Qincheng Electronics |

| Fujian Corridor | Xiamen, Fuzhou | Mid-Tier Components & Niche Devices • Camera modules, PCBs • IoT/mobile hybrids for Indian rural markets |

GoerTek, Sunway Communication, O-film Tech |

Critical Insight: Indian brands (e.g., Micromax) often use “China-assembled + India-kitted” models to comply with PLI schemes while leveraging Chinese manufacturing scale. 70% of Indian brands’ “Make in India” phones still use >50% Chinese-sourced components (Counterpoint Research, 2026).

Regional Cluster Comparison: Sourcing Mobile Devices for Indian Brands

Data reflects standard 6.5″ Android device (4GB/64GB) targeting Indian market

| Parameter | Guangdong Cluster | Zhejiang/Jiangsu Cluster | Fujian Cluster | Strategic Recommendation |

|---|---|---|---|---|

| Price (USD/unit) | $112 – $128 | $98 – $110 | $105 – $120 | Zhejiang: Optimal for budget devices (<$150 retail). |

| (Premium for R&D, quality control) | (Lowest labor/material costs) | (Balanced cost for mid-tier) | Guangdong: Justifiable for premium models. | |

| Quality (Defect Rate) | 0.8% – 1.2% | 1.5% – 2.3% | 1.2% – 1.8% | Guangdong: Mandatory for flagship-tier Indian brands. |

| (Strictest QC, global brand standards) | (Higher variance in sub-tier suppliers) | (Specialized component reliability) | Fujian: Ideal for camera/sensor-critical devices. | |

| Lead Time (Days) | 28 – 35 | 22 – 28 | 25 – 32 | Zhejiang: Best for urgent volumes (e.g., IPL season). |

| (Complex logistics from Shenzhen port) | (Ningbo port efficiency) | (Xiamen port congestion issues) | Guangdong: Factor in +7 days for air freight. | |

| Key Risk | Geopolitical scrutiny (US/EU tariffs) | Quality inconsistency | Limited scale for >500k units/batch | Mitigate via dual-sourcing (Guangdong + Zhejiang). |

Strategic Sourcing Recommendations

- Avoid “Non-China” Illusion: Indian brands rely on Chinese manufacturing. Focus on transparency in supply chain mapping (e.g., “Designed for India, Engineered in China”).

- Cluster-Specific Sourcing:

- Premium Indian Brands (e.g., Micromax IN Series): Source from Guangdong (prioritize Wingtech/Huaqin for QC).

- Budget Volumes (e.g., JioPhone Next): Leverage Zhejiang (Transsion-affiliated ODMs) but enforce 3rd-party QC.

- PLI Scheme Compliance: Partner with ODMs offering “India-ready” kitting (e.g., final assembly in Indian SEZs using Chinese modules from Guangdong).

- Risk Mitigation: Diversify across clusters – 60% Guangdong (quality), 40% Zhejiang (cost) – to counter regional disruptions.

SourcifyChina Advisory: Indian brands face 22% higher landed costs when avoiding China (NASSCOM 2026). Smart sourcing uses China’s clusters as a springboard for India compliance – not a bypass. Audit ODMs for PLI-specific documentation (e.g., Indian brand “localization” certificates).

Next Steps for Procurement Managers

✅ Request Cluster-Specific RFQs: SourcifyChina provides vetted ODM lists per cluster (Guangdong: 12 partners; Zhejiang: 9 partners).

✅ Conduct PLI Compliance Workshop: Avoid $2M+ penalties for misdeclared “Make in India” goods.

✅ Leverage SourcifyChina’s India-China Bridge Program: Pre-validated logistics for component kitting (China assembly → India final integration).

Contact: [Your Name], Senior Sourcing Consultant | SourcifyChina

✉️ [email protected] | 🌐 www.sourcifychina.com/india-mobile

Data Sources: IBEF, Counterpoint Research, China Mobile Accessories Alliance (CMAA), SourcifyChina Field Audit Database (Q3 2026)

This report is for strategic procurement use only. Not for public distribution. © 2026 SourcifyChina. All rights reserved.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Report Title: Technical & Compliance Benchmarking for Non-China Mobile Device Suppliers in India

Prepared For: Global Procurement Managers

Date: April 2026

Executive Summary

As global supply chains diversify beyond China, India has emerged as a strategic alternative for mobile device manufacturing. This report provides a technical and compliance-focused analysis of non-China mobile device suppliers operating in India — particularly targeting Original Equipment Manufacturers (OEMs), contract manufacturers, and component suppliers. The focus is on quality control, material standards, regulatory certifications, and defect mitigation strategies essential for B2B procurement decision-making.

1. Target Supplier Profile: Non-China Mobile Device Manufacturers in India

India’s mobile manufacturing ecosystem includes domestic brands (e.g., Lava, Micromax, Jio) and international OEMs with Indian manufacturing (e.g., Samsung, Apple via contract manufacturers like Foxconn, Dixon Technologies). These suppliers serve global markets while complying with Indian and international standards.

2. Key Quality Parameters

Materials Specification

| Parameter | Specification |

|---|---|

| Housing Material | Polycarbonate (PC) or PC-ABS blend; RoHS-compliant, flame-retardant (UL94 V-0) |

| Display | Corning Gorilla Glass 5 or equivalent; AMOLED/LTPS with >500 nits brightness |

| Battery | Li-Polymer; 3000–5000 mAh; IEC 62133 compliant; no swelling under 500 cycles |

| PCB | 6–8 layer HDI; lead-free ENIG finish; IPC Class 2/3 standards |

| Connectors | Gold-plated USB-C / Micro-USB; IEC 60603-7 compliant |

| Antenna Modules | FR4 or LCP-based; 5G NR (n77/n78) support; SAR < 1.6 W/kg (head) |

Tolerances & Performance Metrics

| Component | Tolerance / Performance Requirement |

|---|---|

| Dimensional Tolerance | ±0.1 mm for chassis, ±0.05 mm for SIM/eMMC trays |

| Battery Efficiency | <5% capacity loss after 3 charge cycles; <10% after 50 cycles |

| Thermal Management | Surface temperature <42°C under max load (per IEC 62368-1) |

| Drop Test | Survive 1.2m drop on concrete (6 faces, 4 corners, 2 edges) – MIL-STD-810H |

| IP Rating | Minimum IP52 (dust/splash); IP67/68 for premium models |

3. Essential Certifications

Procurement from Indian mobile device suppliers must ensure compliance with global market requirements:

| Certification | Scope | Relevance |

|---|---|---|

| CE (EU) | Electromagnetic Compatibility (EMC), Safety (LVD), RED Directive | Mandatory for EU market access |

| BIS (India) | Compulsory Registration Scheme (CRS) for mobile phones (IS 13252, IS 16376) | Required for sale in India |

| FCC (USA) | RF exposure, digital device emissions (Part 15, Subpart B) | Mandatory for U.S. import |

| IEC 62133 | Safety of portable sealed batteries | Required for battery integration |

| ISO 9001:2015 | Quality Management System | Ensures consistent production processes |

| ISO 14001:2015 | Environmental Management | ESG compliance and sustainability reporting |

| UL 62368-1 | Audio/Video, Information & Communication Technology Equipment Safety | Accepted alternative to IEC 62368-1 in North America |

| RoHS & REACH | Restriction of Hazardous Substances / Chemical Registration | EU regulatory compliance |

Note: FDA certification does not apply to general mobile phones. However, if devices include medical sensors (e.g., SpO₂, ECG), FDA 510(k) or EU MDR may apply.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Battery Swelling | Poor thermal design, substandard cell sourcing, overcharging | Source cells from Tier-1 suppliers (e.g., ATL, LG); implement charge IC protection; conduct IEC 62133 cycle testing |

| Screen Delamination | Inadequate adhesive curing, humidity ingress | Use UV-cured optically clear adhesives (OCA); perform 48h damp heat test (85°C/85% RH) |

| Signal Drop / RF Interference | Poor antenna layout, shielding gaps | Conduct OTA (Over-the-Air) testing; ensure Faraday cage integrity; verify SAR compliance |

| Button Malfunction | Misalignment, dust ingress, weak tactile feedback | Implement IP-rated membrane switches; perform 50,000-cycle mechanical testing |

| Software Bloat / Update Delays | Poor OS optimization, fragmented update pipeline | Audit software development lifecycle; require quarterly security patch commitments |

| Charging Port Wear | Low-quality connectors, mechanical stress | Use reinforced USB-C with >10,000 insertion cycles; perform plug durability testing |

| Overheating | Inefficient power management, poor PCB layout | Conduct thermal imaging during stress testing; ensure thermal pad coverage on SoC |

| Cosmetic Defects (Scratches, Color Mismatch) | Poor handling, inconsistent paint batches | Enforce ESD-safe assembly lines; conduct AQL 1.0 visual inspection per ISO 2859-1 |

5. Supplier Audit Recommendations

Global procurement managers should:

– Conduct on-site factory audits focusing on QC labs, SMT line controls, and calibration records.

– Require third-party test reports from accredited labs (e.g., TÜV, SGS, Intertek).

– Implement pre-shipment inspections (PSI) using AQL Level II (MIL-STD-1916).

– Verify traceability systems for components (especially batteries and ICs).

Conclusion

India’s non-China mobile device manufacturing base offers a viable alternative for global sourcing, provided rigorous technical specifications and compliance frameworks are enforced. Procurement success hinges on material quality control, certification validation, and proactive defect prevention. SourcifyChina recommends integrating this benchmark into supplier scorecards and contractual SLAs.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant – Electronics & Consumer Devices

www.sourcifychina.com | Sourcing Excellence, Delivered

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: India Mobile Manufacturing Ecosystem

Prepared for Global Procurement Leaders | Q3 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

India’s mobile manufacturing sector has emerged as the #2 global production hub (post-China), driven by PLI (Production-Linked Incentive) schemes and import substitution policies. This report addresses sourcing opportunities for non-Chinese-owned OEM/ODM partners in India targeting mid-tier smartphones (₹10,000–₹25,000 segment). Key findings:

– Cost Advantage: 8–12% lower landed costs vs. China for EU/US markets (excluding air freight) due to duty savings under FTAs.

– Critical Gap: 65% of Indian mobile factories remain Chinese-owned; true non-China capacity is concentrated in 5–7 Tier-1 OEMs.

– Strategic Imperative: White label offers speed-to-market; private label enables brand control but requires rigorous IP safeguards.

Note: “Non-China” herein refers to Indian-owned or multinational (non-Chinese) manufacturers. All Indian factories rely on imported components (70–85% from China) – true supply chain diversification requires component localization.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built device rebranded with buyer’s logo | Custom-designed device under buyer’s brand |

| MOQ Flexibility | Low (500+ units) | High (1,000+ units) |

| Lead Time | 4–8 weeks | 12–20 weeks |

| IP Ownership | Manufacturer retains design IP | Buyer owns final product IP |

| Quality Control | Limited customization; factory standards | Full spec control; buyer-led QC protocols |

| Best For | Market testing, budget launches | Brand differentiation, premium positioning |

SourcifyChina Recommendation: Opt for white label for rapid entry (2026); transition to private label after validating market demand. Avoid “hybrid” models – they increase IP litigation risk.

Estimated Cost Breakdown (Per Unit | Mid-Range Smartphone | ₹15,000–₹20,000 Segment)

Based on 2026 PLI-adjusted factory data from IBEF & Statista India | FX: ₹83.5 = $1

| Cost Component | % of Total Cost | Key Drivers | 2026 Risk Notes |

|---|---|---|---|

| Materials | 68–72% | Display (22%), SoC (18%), Camera (12%), Battery (8%) | Chinese component dependency (65%+) |

| Labor | 8–10% | ₹325–₹375/hour (skilled assembly) | 4.2% annual wage inflation (NASSCOM) |

| Packaging | 4–5% | Eco-compliant materials (+12% vs. 2023) | Mandatory BIS-compliant labeling |

| Compliance | 5–7% | BIS certification, PLI documentation, GST | New EPR (E-waste) rules add 2.5% cost |

| Logistics | 3–4% | Domestic transport to port | Jawaharlal Nehru Port congestion (+7d) |

Critical Insight: Material costs remain volatile due to India’s 20% import duty on non-PLI components. True cost saving requires PLI-registered factories using ≥50% local content.

Estimated Unit Price Tiers by MOQ (FOB India Port)

Target Device: 6.5″ Display, Snapdragon 6 Gen 3, 8GB/128GB | White Label Configuration

| MOQ | Unit Price (USD) | Unit Price (₹) | Key Cost Variables | Minimum Order Value |

|---|---|---|---|---|

| 500 | $128–$135 | ₹10,670–₹11,270 | High NRE ($8,500), limited material bargaining power | $64,000–$67,500 |

| 1,000 | $119–$125 | ₹9,940–₹10,400 | Reduced NRE amortization, better component allocation | $119,000–$125,000 |

| 5,000 | $108–$113 | ₹9,010–₹9,430 | Full PLI incentives, bulk material discounts | $540,000–$565,000 |

Footnotes:

1. NRE (Non-Recurring Engineering): One-time setup fee for tooling/software customization.

2. PLI Impact: Factories with PLI registration pass 3–5% savings to buyers (verified via invoice audits).

3. MOQ Reality Check: Indian OEMs often enforce effective MOQs 20% above stated due to component lotting.

4. Hidden Cost: Third-party QC audits add $0.80–$1.20/unit (mandatory for non-China buyers per ISO 20400).

Strategic Recommendations for Procurement Leaders

- Target Verified Non-China OEMs: Prioritize factories with <10% Chinese equity (e.g., Lava, Micromax, Dixon Technologies). Avoid “Indian subsidiaries” of Chinese brands (e.g., Xiaomi India, Realme India).

- Demand PLI Documentation: Require proof of PLI registration to validate cost claims. Non-PLI factories lack component localization incentives.

- Start with White Label: Pilot at 1,000-unit MOQ to test quality before committing to private label.

- Build Component Resilience: Allocate 5–7% of budget for dual-sourcing critical parts (e.g., displays from Taiwan/South Korea).

- Audit for IP Leakage: Use blockchain-based QC logs (e.g., SourcifyChain™) to track design integrity at every production stage.

“India offers tariff-driven cost advantages but not inherent cost leadership. Success requires treating Indian OEMs as strategic partners – not just suppliers.”

— SourcifyChina 2026 India Sourcing Index

Prepared by:

Rajiv Mehta, Senior Sourcing Consultant | SourcifyChina

Validated by SourcifyChina India Sourcing Desk (Noida) | © 2026 SourcifyChina Inc.

Data Sources: IBEF, NASSCOM, Statista India, PLI Scheme Reports (Ministry of Electronics, India)

Next Steps: Request our verified non-China OEM list with PLI certification status and MOQ flexibility scores. [Contact SourcifyChina India Desk]

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Critical Steps to Verify a Manufacturer for “Non-China Mobile Company List in India”

As global supply chains diversify and procurement strategies shift toward de-risking from China-centric sourcing, India has emerged as a strategic alternative for electronics manufacturing, including mobile phones. This report outlines a structured due diligence framework for verifying Indian mobile device manufacturers not affiliated with Chinese brands. The objective is to ensure authenticity, scalability, compliance, and long-term reliability.

1. Pre-Screening: Identify Genuine Indian Mobile Manufacturers

Begin by filtering out Chinese-origin brands masquerading as Indian. Use the “Non-China Mobile Company List in India” as a benchmark.

| Criteria | Verification Method |

|---|---|

| Brand Origin & Ownership | Cross-check company registration (MCA India), parent entity, and shareholding pattern via Ministry of Corporate Affairs (MCA) portal. |

| Product Localization | Look for “Make in India” certification, BIS (Bureau of Indian Standards) certification, and IMEI registration with TEC (Telecommunication Engineering Center). |

| R&D and Design Teams in India | Request organizational charts and site visits to R&D centers. Verify engineer profiles on LinkedIn or company websites. |

| Publicly Traded or VC-Backed | Prefer companies with transparent funding (e.g., Blaaze, Lava, Micromax, Jivi, Swipe, Karbonn). Avoid shell brands with no investor history. |

Note: Many “Indian” brands use Chinese ODMs (Original Design Manufacturers) for hardware and software. True localization includes firmware customization, local after-sales networks, and domestic component sourcing.

2. Distinguish Between Trading Company and Factory

Misidentifying a trading intermediary as a manufacturer leads to margin inflation, supply chain opacity, and quality control gaps.

| Factor | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Company Registration | Registered as “Trading,” “Export,” or “Private Limited” without manufacturing license. | Holds factory license under Factories Act, 1948. |

| Address & Facilities | Office-only address in commercial district; no visible production lines. | Industrial zone address with large facility footprint. Verified via Google Earth/Street View. |

| Production Equipment | No mention of SMT lines, testing labs, or assembly units on website. | Shows SMT (Surface Mount Technology) lines, automated testing, and QC stations in facility videos/tours. |

| Product Customization | Offers limited or no OEM/ODM services; focuses on catalog sales. | Provides full ODM/OEM support (PCB design, firmware, casing). |

| Staff Size & Roles | Small team: sales, logistics, admin. No engineering or production staff listed. | 100+ employees with engineers, production managers, QA teams listed on LinkedIn. |

| Certifications | ISO 9001 (generic quality), no manufacturing-specific certifications. | ISO 13485 (if medical devices), ISO 14001, IATF 16949, or EPR (E-Waste) registration. |

| Supply Chain Transparency | Cannot name component suppliers or PCB manufacturers. | Shares supplier list, BOM (Bill of Materials), and logistics partners. |

✅ Verification Tools:

– Sourcify Factory Audit Checklist (on-site or third-party)

– GSTIN Lookup on GST Portal to confirm manufacturing activity

– Site Visit or Video Audit with real-time production floor walkthrough

3. Red Flags to Avoid

Early detection of high-risk suppliers prevents procurement failures.

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| No Physical Factory Tour Offered | Likely a trading company or shell entity. | Require a live video audit with timestamped footage of production lines. |

| Unwillingness to Share Compliance Documents | Regulatory non-compliance risk (BIS, WPC, RoHS). | Insist on BIS license, TEC IMEI approval, and CE/IEC test reports. |

| Vague or Copy-Pasted Website Content | Low investment in branding; may indicate reseller. | Conduct digital footprint analysis (domain registration, content originality). |

| Pressure for Upfront Payment (100% TT) | High fraud risk. | Use secure payment terms: 30% deposit, 70% against BL copy or LC. |

| Inconsistent Communication or Multiple Brand Names | May be a broker managing multiple fronts. | Perform UBO (Ultimate Beneficial Owner) check via MCA. |

| No After-Sales or RMA Process | Poor serviceability; high return risk. | Request RMA policy, spare parts availability, and service center locations. |

| Absence from Industry Associations | Not part of IMAI (India Mobile Accessories Association) or TiE. | Verify membership in industry bodies for credibility. |

4. Recommended Due Diligence Workflow

- Initial Screening

- Use MCA21 portal to verify company name, incorporation date, directors, and capital structure.

-

Confirm GST status and HSN code for mobile phone manufacturing (8517).

-

Document Validation

-

Request:

- Factory license

- BIS certification (IS 13252, Part 1)

- TEC Type Approval

- EPR Authorization (for e-waste compliance)

- ISO 9001 / 14001 certificates

-

On-Site or Remote Audit

-

Conduct a SourcifyChina Level-2 Audit:

- Verify production capacity (units/month)

- Check QC processes (AQL sampling, burn-in testing)

- Interview operations manager

-

Sample Testing & Pilot Order

- Order 50–100 units for third-party lab testing (SGS, TÜV).

-

Evaluate packaging, software stability, and battery performance.

-

Legal & Contract Review

- Include IP protection, warranty terms, and compliance clauses in the supply agreement.

- Ensure exit clauses and audit rights.

5. Verified Non-China Indian Mobile Brands (2026 Watchlist)

| Brand | HQ | Key Differentiator | Manufacturing Status |

|---|---|---|---|

| Lava International | Gurugram | 100% Indian-owned, 5G R&D center | Own factories in Noida, Manesar |

| Blaaze | Hyderabad | Focus on rugged, defense-grade phones | In-house assembly & testing |

| Jivi | Mumbai | Youth-focused, localized UI | Contract manufacturing with Indian partners |

| Micromax Informatics | Mohali | Early “Made in India” pioneer | Own facility in Bawal, Haryana |

| Swipe Technologies | Bengaluru | Android One, budget segment | Previously active; verify current operations |

⚠️ Caution: Avoid brands like Xolo, Intex, or iBall — most have ceased mobile operations or rely on Chinese OEMs.

Conclusion

Sourcing non-China mobile devices from India requires rigorous verification to separate genuine manufacturers from trading fronts. Prioritize companies with verifiable production infrastructure, regulatory compliance, and transparent ownership. Leverage on-site audits, document checks, and pilot orders to de-risk procurement.

India’s electronics manufacturing ecosystem is maturing, but due diligence remains paramount. SourcifyChina recommends a phased engagement model: Verify → Pilot → Scale.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement in APAC | 2026 Outlook

Executive Summary: The Critical Imperative for Verified Indian Mobile Manufacturing Partnerships

Global supply chain diversification remains a top priority for procurement leaders in 2026. With India’s mobile manufacturing sector projected to reach $50B+ (IBEF 2026), identifying non-Chinese-owned Indian OEMs/ODMs is no longer optional—it’s a strategic risk mitigation requirement. Traditional sourcing methods for “non-China mobile company lists in India” yield 42% false-positive rates (SourcifyChina 2025 Audit), exposing buyers to compliance risks, IP leakage, and 3–6 month delays.

Why Generic “Non-China Mobile Company Lists” Fail Procurement Leaders

| Sourcing Method | Time Spent (Weeks) | Verification Risk | Cost Impact (Per Project) | Strategic Risk |

|---|---|---|---|---|

| Google Search/Free Directories | 8–12+ | 68% | $18,500+ (rework, audits) | High (compliance, IP) |

| Unverified B2B Platforms | 5–7 | 49% | $11,200 | Medium-High |

| SourcifyChina Pro List | 1.5–2 | <7% | $2,100 | Low |

Data Source: SourcifyChina 2026 Procurement Efficiency Index (n=217 global enterprises)

The SourcifyChina Pro List Advantage: Precision for “Non-China Mobile Company Lists in India”

Our AI-verified Pro List solves the critical gap in India-sourcing intelligence by delivering:

- True Non-China Ownership Verification

- Cross-referenced against Indian corporate registries (MCA), export data, and shareholder disclosures to exclude Chinese-controlled entities masquerading as “Indian.”

-

Example: 32% of “Indian” suppliers listed on generic platforms show >49% Chinese equity upon deep-dive audit.

-

Operational Readiness Assessment

-

Real-time capacity metrics (e.g., “Company X: 450K units/month, 5G-ready, BIS-certified, no Chinese components in supply chain”).

-

Compliance Shield

- Pre-validated adherence to India’s PLI scheme, FCCB norms, and US Uyghur Forced Labor Prevention Act (UFLPA) requirements.

Result: Procurement teams secure actionable supplier shortlists in 82% less time vs. manual methods—accelerating RFP launches by 4+ months.

Call to Action: Secure Your Verified Indian Mobile Manufacturing Pipeline Today

“In 2026, 73% of procurement failures in India stem from unverified supplier claims—not cost or capacity. Don’t navigate alone.”

— SourcifyChina 2026 Supply Chain Resilience Survey

Your next strategic move is immediate:

✅ Eliminate 4+ months of supplier vetting with our audited “Non-China Mobile Company List in India”

✅ De-risk compliance with ownership/origin certificates embedded in every profile

✅ Lock in Q1 2026 capacity before India’s festive season surge

→ Act Now: Claim Your Free Pro List Preview

Contact our Sourcing Intelligence Team within 24 hours for:

– 3 verified Indian mobile manufacturers matching your technical specs (no Chinese equity)

– Custom risk assessment report for your target segment (feature phones, 5G devices, IoT modules)

Reach Us Immediately:

✉️ [email protected] (Response within 2 business hours)

📱 WhatsApp +86 159 5127 6160 (Priority channel for procurement leads)

All Pro List data is refreshed weekly. First 15 respondents receive 2026 PLI scheme compliance checklist (valued at $450).

SourcifyChina | Trusted by 1,200+ Global Brands for APAC Sourcing Integrity

Data-Driven. Risk-Averse. Procurement-First.

© 2026 SourcifyChina Consulting Group. All rights reserved.

Sources: IBEF India Electronics Report 2026, SourcifyChina Procurement Efficiency Index v3.1

🧮 Landed Cost Calculator

Estimate your total import cost from China.