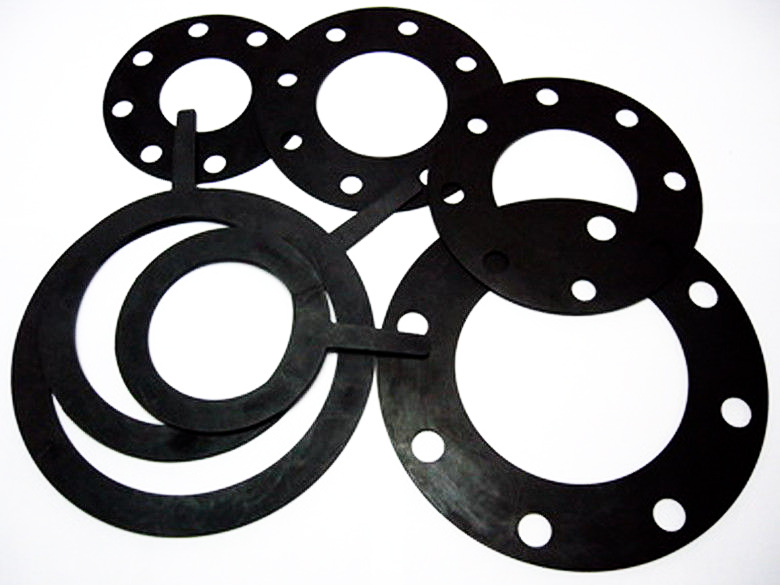

The global nitrile rubber (NBR) gasket market is experiencing consistent growth, driven by rising demand across automotive, industrial manufacturing, and oil & gas sectors. According to Grand View Research, the global nitrile rubber market was valued at USD 2.41 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030, fueled by NBR’s superior resistance to oil, fuel, and extreme temperatures. This expanding demand has intensified competition among manufacturers, prompting innovation in material performance, customization, and production scalability. As industries prioritize reliability and cost-efficiency in sealing solutions, identifying leading nitrile gasket manufacturers becomes critical for procurement and supply chain optimization. Below, we profile the top 10 companies shaping this market through product quality, global reach, and technical expertise.

Top 10 Nitrile Gasket Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Gaskets and Seals

Domain Est. 2012

Website: klinger-international.com

Key Highlights: As the world’s leading manufacturer and provider of industrial sealing materials, KLINGER’s product portfolio of gaskets remains at the forefront of sealing ……

#2 NBR

Domain Est. 1996

Website: trelleborg.com

Key Highlights: Our range includes nitrile rubber sheeting specifically created to withstand contact with industrial oils, hydrocarbons, kerosene and high temperatures….

#3 Nitrile Gaskets

Domain Est. 1996

Website: accutrex.com

Key Highlights: AccuTrex manufactures nitrile rubber, NBR, gaskets for the aerospace, defense, and petrochemical industries. We specialize in manufacturing custom gaskets….

#4 Soft Gaskets

Domain Est. 2004

Website: robco.com

Key Highlights: Robco 9863 Nitrile has very good resistance to oil and gasoline; superior resistance to petroleum-based hydraulic fluids; good resistance to hydrocarbon ……

#5 Premlene Sheet Rubber:

Domain Est. 2010

Website: premlene.com

Key Highlights: Premlene, a brand by GCP Industrial Products, is one of North America’s leading providers of industrial sheet rubber. In particular neoprene, nitrile, EPDM, ……

#6 Nitrile Rubber Gaskets and Seals

Domain Est. 1999

Website: atlanticgasket.com

Key Highlights: Atlantic Gasket Corporation manufactures custom rubber Nitrile gaskets of the highest sealing quality and reliability from a variety of rubber Nitrile ……

#7 Nitrile (Buna

Domain Est. 1999

Website: henniggasket.com

Key Highlights: Nitrile (Buna-N) Gaskets manufactured in 24hrs or less with no tooling charges. An industry leader in the sealing business for over 100 years….

#8 Buna N Gaskets

Domain Est. 2000

Website: gasketsales.com

Key Highlights: Nitrile is one of the most common and least expensive materials for gaskets to be made of. It has an excellent compression set and exceptional tear and abrasion ……

#9 Nitrile Rubber (NBR)

Domain Est. 2001

Website: plastiservice.com

Key Highlights: Customization and Ease of Manufacturing. Nitrile rubber gaskets can be manufactured in a variety of shapes and sizes, allowing for great design flexibility….

#10 Nitrile Rubber Gaskets Material

Domain Est. 2013

Website: therubbercompany.com

Key Highlights: We can manufacture our nitrile rubber gaskets from a wide selection of material grades and compounds as standard. This gives you almost complete control over ……

Expert Sourcing Insights for Nitrile Gasket

H2: Projected Market Trends for Nitrile Gaskets in 2026

The global nitrile gasket market is poised for steady growth by 2026, driven by increasing demand across key industrial sectors, technological advancements in material performance, and regional manufacturing shifts. Nitrile butadiene rubber (NBR), the primary material used in these gaskets, is valued for its excellent resistance to oils, fuels, and a wide range of chemicals, making it indispensable in automotive, oil & gas, HVAC, and industrial machinery applications.

-

Rising Demand in Automotive and Transportation

The automotive industry remains the largest consumer of nitrile gaskets, particularly for engine seals, fuel systems, and transmission components. As global vehicle production rebounds and electric vehicle (EV) infrastructure expands, hybrid systems and auxiliary components still require oil-resistant sealing solutions. Nitrile gaskets are expected to maintain a strong foothold in internal combustion engine (ICE) vehicles and transitional technologies, supporting market growth through 2026. -

Growth in Oil & Gas and Industrial Manufacturing

Ongoing investments in oil refining, petrochemical processing, and pipeline infrastructure—especially in emerging economies—will boost demand for reliable sealing materials. Nitrile gaskets are preferred in moderate-temperature, oil-exposed environments, ensuring continued relevance despite competition from specialty fluoropolymers. Industrial automation and machinery modernization will further accelerate adoption. -

Regional Market Dynamics

Asia-Pacific is projected to dominate the nitrile gasket market by 2026, fueled by rapid industrialization in China, India, and Southeast Asia. Localized production of automotive and industrial goods, coupled with expanding oil & gas activities, will drive regional demand. North America and Europe will see moderate growth, supported by maintenance, repair, and operations (MRO) activities and regulatory emphasis on equipment reliability and safety. -

Material Innovation and Sustainability Pressures

While nitrile rubber is cost-effective and widely available, environmental regulations are pushing manufacturers to develop bio-based or recyclable elastomers. Although fully sustainable nitrile alternatives are still in early stages, some producers are investing in low-emission formulations and extended-life gasket designs to meet ESG goals. These innovations may enhance product differentiation and open new market niches. -

Competitive Landscape and Supply Chain Adjustments

The market is fragmented, with numerous regional and global players competing on price, performance, and customization. Vertical integration and strategic partnerships with end-users are expected to increase. Supply chain resilience—particularly after disruptions seen in prior years—will remain a priority, with greater emphasis on localized sourcing and inventory optimization.

In summary, the nitrile gasket market in 2026 will be shaped by sustained industrial demand, geographic shifts in manufacturing, and incremental improvements in material technology. While facing long-term competition from advanced elastomers, nitrile gaskets will retain a critical role in cost-sensitive, high-volume applications, ensuring stable market performance through the mid-decade.

Common Pitfalls When Sourcing Nitrile Gaskets (Quality, IP)

Sourcing nitrile (NBR) rubber gaskets involves navigating several quality and intellectual property (IP) challenges. Avoiding these common pitfalls is essential to ensure performance, regulatory compliance, and supply chain integrity.

Poor Material Quality and Inconsistent Formulation

One of the most prevalent issues is receiving gaskets made from substandard or inconsistently formulated nitrile rubber. Low-quality suppliers may use excessive fillers, recycled rubber, or incorrect acrylonitrile content, compromising key properties such as oil resistance, temperature tolerance, and compression set. This results in premature seal failure, leaks, and equipment damage—especially in demanding environments.

Misrepresentation of Material Specifications

Suppliers may falsely claim compliance with international standards (e.g., ASTM D2000, ISO 3601) or misstate critical parameters like durometer hardness, tensile strength, or acrylonitrile percentage. Without proper material certifications or third-party validation, buyers risk receiving non-conforming products unsuitable for the intended application.

Lack of Traceability and Certifications

Reputable sourcing requires full traceability, including material batch numbers, Certificates of Conformance (CoC), and test reports. Many suppliers, particularly from less-regulated markets, lack robust documentation systems. This absence complicates quality audits, regulatory submissions (e.g., FDA, NSF for food or pharmaceutical use), and root cause analysis during failures.

Intellectual Property (IP) Infringement Risks

Sourcing from unauthorized or counterfeit manufacturers can expose buyers to IP violations. Some suppliers replicate proprietary gasket designs, logos, or patented geometries without licensing. Using such components may lead to legal liability, especially in regulated industries or when supplying to OEMs with strict IP policies.

Inadequate IP Protection in Supplier Agreements

Buyers often overlook including clear IP clauses in procurement contracts. Without explicit terms protecting custom designs or co-developed tooling, suppliers may replicate and resell the gaskets to competitors. This undermines competitive advantage and can devalue product differentiation.

Counterfeit or Grey Market Products

The market includes counterfeit nitrile gaskets falsely branded as premium products. These may mimic packaging and documentation but fail to meet performance standards. Grey market goods—originally produced for one region but diverted—may also lack proper validation for local regulations, increasing compliance and safety risks.

Insufficient Testing and Quality Control

Low-cost suppliers may lack in-house testing capabilities or skip routine quality checks. Without verification of physical properties (e.g., compression set, fluid resistance), dimensional accuracy, and visual defects, the risk of field failures increases significantly.

Supply Chain Opacity and Subcontracting

Suppliers may outsource production to unvetted subcontractors without notifying the buyer. This lack of transparency obscures quality control and increases exposure to inconsistent manufacturing practices, unapproved material substitutions, and undetected IP breaches.

Conclusion

To mitigate these pitfalls, buyers should conduct thorough supplier audits, require complete material certifications, perform independent testing, and establish clear IP agreements. Partnering with reputable, transparent manufacturers ensures reliable performance and protects against legal and operational risks.

Logistics & Compliance Guide for Nitrile Gasket

Storage and Handling

Nitrile gaskets must be stored in a cool, dry, and well-ventilated environment, away from direct sunlight, ozone sources (e.g., electric motors), and extreme temperatures. Ideal storage conditions are between 10°C and 25°C (50°F–77°F) with relative humidity below 65%. Gaskets should remain in their original packaging until ready for use to protect against dust, moisture, and physical damage. Avoid stacking heavy materials on gasket packaging to prevent deformation. When handling, use clean gloves to minimize contamination from oils or chemicals on hands.

Transportation Requirements

During transportation, nitrile gaskets must be protected from environmental exposure and mechanical stress. Use sealed, moisture-resistant packaging and ensure shipments are secured to prevent shifting. Avoid exposure to prolonged high temperatures (above 40°C/104°F), freezing conditions, or direct UV radiation. If transporting in containers or vehicles for extended periods, ensure adequate ventilation and temperature control. Comply with carrier-specific regulations for rubber or elastomeric materials, especially when shipping internationally.

Regulatory Compliance

Nitrile gaskets must comply with relevant industry and regional standards depending on their application. Key regulatory considerations include:

- REACH (EU): Confirm that the nitrile compound does not contain Substances of Very High Concern (SVHC) above threshold levels. Provide Safety Data Sheets (SDS) as required.

- RoHS (EU): Ensure compliance if used in electrical or electronic equipment; verify absence of restricted substances like lead, cadmium, or certain phthalates.

- FDA Compliance: For food, beverage, or pharmaceutical applications, use nitrile formulations compliant with FDA 21 CFR §177.2600 for rubber articles.

- NSF/ANSI 61: Required for gaskets in potable water systems; confirm material certification for drinking water contact.

- ATEX/IECEx: If used in explosive atmospheres, ensure gasket materials meet relevant directives for equipment safety.

Material Safety and Documentation

Provide a current Safety Data Sheet (SDS) compliant with GHS standards for all nitrile gasket products. The SDS should include information on composition, handling, first aid, and disposal. Although nitrile rubber is generally stable and low-hazard, proper ventilation is recommended during machining or high-temperature exposure to avoid inhalation of decomposition byproducts (e.g., nitrogen oxides).

Import/Export Considerations

When shipping internationally, verify customs tariff classifications (e.g., HS Code 4016.93 for other articles of vulcanized rubber). Some countries may require conformity assessments or certifications (e.g., CE marking in Europe, CRN in Canada). Ensure all export documentation includes accurate product descriptions, material composition, and compliance statements where applicable.

Disposal and Environmental Guidelines

Dispose of nitrile gaskets in accordance with local, national, and international waste regulations. Nitrile rubber is not biodegradable; incineration should be conducted in controlled facilities with emission controls. Recycling through specialized elastomer reprocessing is preferred where available. Avoid landfill disposal when sustainable alternatives exist.

Conclusion for Sourcing Nitrile Gaskets

In conclusion, sourcing nitrile (NBR) gaskets proves to be a reliable and cost-effective solution for applications requiring resistance to oils, fuels, and a range of chemicals, as well as moderate temperature variations. Nitrile rubber’s excellent mechanical properties, including good compression set resistance and durability, make it an ideal choice for sealing solutions in industries such as automotive, manufacturing, and oil & gas.

When sourcing nitrile gaskets, it is essential to consider factors such as material composition (acrylonitrile content), hardness (Shore A), temperature range, and compatibility with specific fluids to ensure optimal performance. Working with reputable suppliers who provide certified materials, consistent quality control, and customization options enhances reliability and supply chain efficiency.

Overall, nitrile gaskets offer a balanced combination of performance, availability, and cost, making them a preferred choice for many industrial sealing applications. Proper sourcing strategies focusing on quality, technical specifications, and supplier credibility will ensure long-term operational efficiency and reduced maintenance costs.