The global nickel silver wire market is experiencing steady expansion, driven by rising demand across industries such as electronics, automotive, and telecommunications. According to a report by Mordor Intelligence, the global silver alloys market—which includes nickel silver wire—was valued at USD 1.85 billion in 2022 and is projected to grow at a CAGR of over 4.2% from 2023 to 2028. This growth is fueled by the material’s excellent electrical conductivity, corrosion resistance, and mechanical strength, making it ideal for precision applications. Nickel silver wire, despite containing no actual silver, offers a favorable combination of durability and performance, particularly in electrical contacts, instrument components, and resistive heating elements. With increasing industrialization and technological advancements, especially in Asia-Pacific and North America, the demand for high-quality nickel silver wire continues to rise. As the market becomes more competitive, a select group of manufacturers have emerged as leaders, setting benchmarks in production capacity, innovation, and global reach.

Top 7 Nickel Silver Wires Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 TW Metals: Specialty Metals Suppliers

Domain Est. 1997

Website: twmetals.com

Key Highlights: TW Metals stocks and processes Tube, Pipe, Bar, Extrusions, Sheet, and Plate in stainless, aluminum, nickel, titanium, and carbon alloy….

#2 Buy Nickel Silver Wire from the Manufacturer

Domain Est. 2020

Website: sundwiger-mw.com

Key Highlights: Buy nickel silver wire directly from the manufacturer: Copper-Based Alloys for Industry – We supply nickel silver wire ✓crown rods ✓rings ✓coils….

#3 Nickel Wire

Domain Est. 1996

Website: calfinewire.com

Key Highlights: California Fine Wire offers custom nickel wire and alloys with high corrosion and heat resistance. Request a quote today….

#4 Nickel silver

Domain Est. 1997

Website: wieland.com

Key Highlights: Nickel silver. Products. Wire; Rods; Strip; Sectional rod; Sheets and Plates; Foil. Wieland, EN Designation, EN No. ASTM UNS-No. eco N59, CuNi9Zn41FeMn*, -, -….

#5 Nickel Wire Suppliers

Domain Est. 1997

Website: smithmetal.com

Key Highlights: We stock products include pure nickel and nickel silver wire in a variety of grades and sizes to suit your business….

#6 Nickel Silver Wire

Domain Est. 1999

#7 Wholesale Nickel Silver Round Soft Wire Supplier and Bulk Jewelry

Domain Est. 2004

Website: rossmetals.com

Key Highlights: Explore high-quality Nickel Silver Round Soft Wire in bulk at competitive prices. Buy wholesale Chains from Ross Metals a reputable wholesaler to elevate ……

Expert Sourcing Insights for Nickel Silver Wires

H2: Market Trends for Nickel Silver Wires in 2026

As we approach 2026, the global market for nickel silver wires is poised for notable transformation, driven by evolving industrial demands, technological advancements, and shifting supply chain dynamics. Nickel silver wire—despite its name, a copper alloy containing nickel and zinc, known for its strength, corrosion resistance, and electrical conductivity—is finding renewed relevance across several high-growth sectors. Below is an analysis of key market trends expected to shape the nickel silver wire industry in 2026.

1. Rising Demand in Electrical and Electronics Applications

The expansion of consumer electronics, particularly in smart devices, wearables, and IoT (Internet of Things) applications, is driving demand for reliable, conductive, and durable materials. Nickel silver wires are increasingly used in connectors, switch components, and sensor leads due to their stable electrical properties and resistance to oxidation. As miniaturization trends continue, manufacturers are favoring nickel silver for its formability and mechanical strength at small diameters.

2. Growth in Automotive and EV Components

The automotive sector, especially in electric vehicles (EVs), is emerging as a critical end-user. Nickel silver wires are utilized in sensors, heating elements, and control systems where moderate conductivity and high durability are required. With global EV production expected to rise significantly by 2026, demand for specialty alloys like nickel silver is projected to grow, particularly in battery management systems and onboard electronics.

3. Expansion in Industrial and Aerospace Applications

Nickel silver’s resistance to wear and tarnish makes it ideal for industrial instrumentation and aerospace components. In 2026, increased investment in automation, robotics, and next-generation aircraft systems will further stimulate demand. Its use in thermocouples and precision instruments is expected to grow, especially in high-temperature or corrosive environments.

4. Sustainability and Recycling Initiatives

Environmental regulations and corporate sustainability goals are influencing material selection across industries. Nickel silver, being fully recyclable and containing no actual silver, offers a cost-effective and eco-conscious alternative to precious metal alloys. In 2026, we anticipate more manufacturers highlighting the recyclability of nickel silver wires in their ESG (Environmental, Social, and Governance) reporting, boosting market appeal.

5. Regional Market Shifts

Asia-Pacific, led by China, Japan, and South Korea, will remain the dominant consumer and producer of nickel silver wires, supported by strong electronics manufacturing. However, North America and Europe are expected to see growth due to reshoring of electronics production and investments in clean energy technologies. Localized supply chains will reduce lead times and enhance responsiveness to market demands.

6. Price Volatility and Raw Material Sourcing

Fluctuations in the prices of copper, nickel, and zinc—key constituents of nickel silver—will continue to impact production costs. In 2026, suppliers are likely to adopt hedging strategies and long-term contracts to mitigate risks. Additionally, geopolitical tensions and mining restrictions may prompt a shift toward diversified sourcing and increased recycling of scrap alloy materials.

7. Technological Innovation and Product Differentiation

To remain competitive, leading producers are investing in R&D to develop enhanced nickel silver alloys with improved conductivity, higher tensile strength, or specialized coatings. Customized wire solutions for niche applications—such as medical devices or undersea sensors—are expected to gain traction, creating opportunities for premium pricing and market segmentation.

Conclusion

By 2026, the nickel silver wire market will be shaped by a confluence of technological innovation, sectoral growth in electronics and EVs, and sustainability imperatives. While challenges related to raw material costs and supply chain resilience persist, the alloy’s versatile properties position it favorably for sustained demand across high-performance industries. Companies that invest in R&D, vertical integration, and sustainable practices are likely to lead the market in the coming years.

Common Pitfalls When Sourcing Nickel Silver Wires: Quality and Intellectual Property Concerns

Sourcing nickel silver wires (also known as German silver or cupronickel) involves navigating several potential pitfalls, particularly concerning material quality consistency and intellectual property (IP) risks. Overlooking these aspects can lead to product failures, supply chain disruptions, or legal complications.

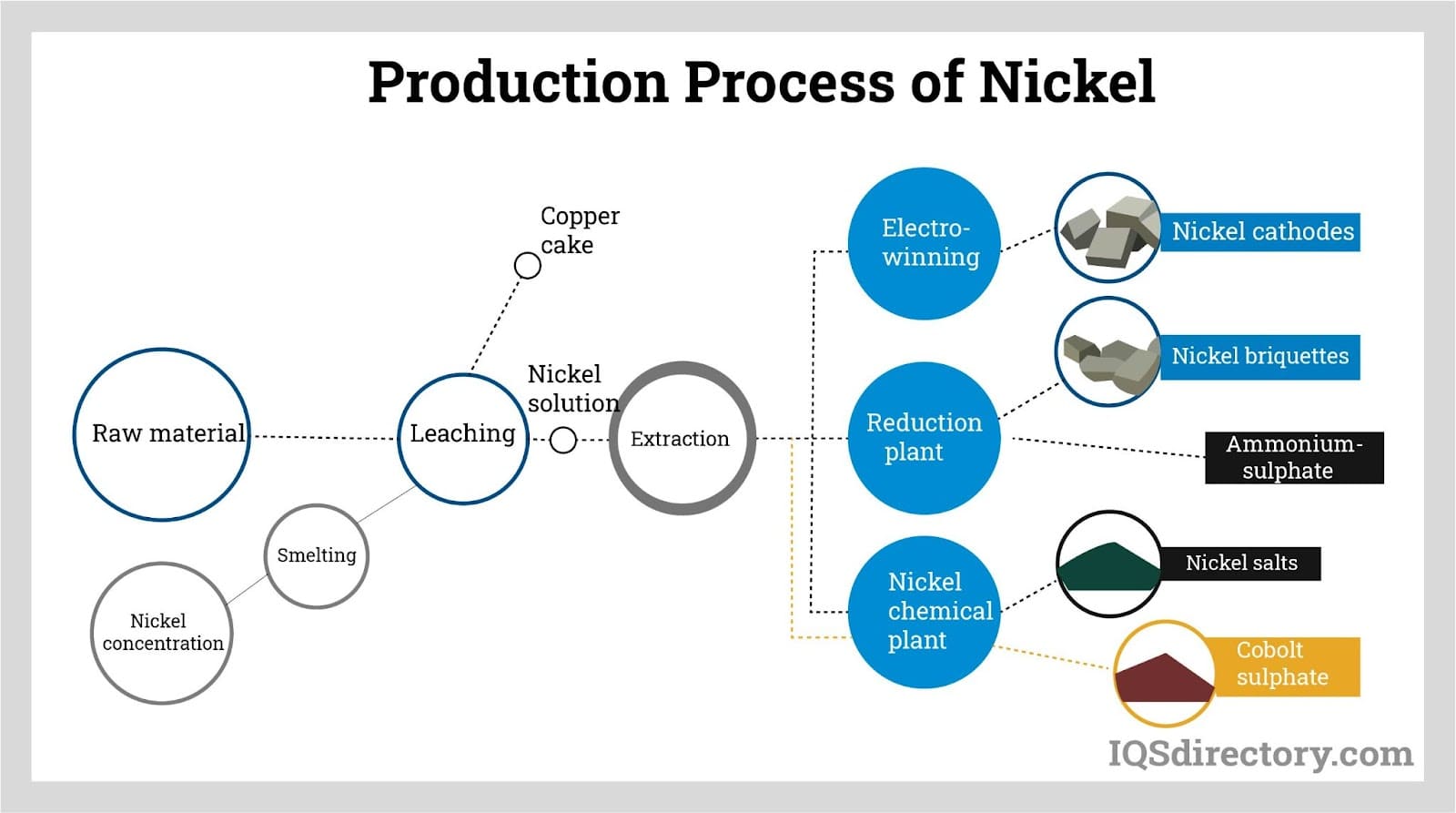

Inconsistent Material Composition and Purity

Nickel silver is an alloy typically composed of copper, nickel, and zinc, but the exact ratios vary (e.g., 60/20/20 or 55/18/27). A common quality pitfall is receiving wires with inconsistent or off-spec alloy composition due to poor process control by suppliers. This affects critical properties such as electrical conductivity, tensile strength, and corrosion resistance. Buyers may unknowingly receive material that does not meet ASTM B121 or other relevant standards, leading to performance issues in applications like electrical contacts or musical instruments.

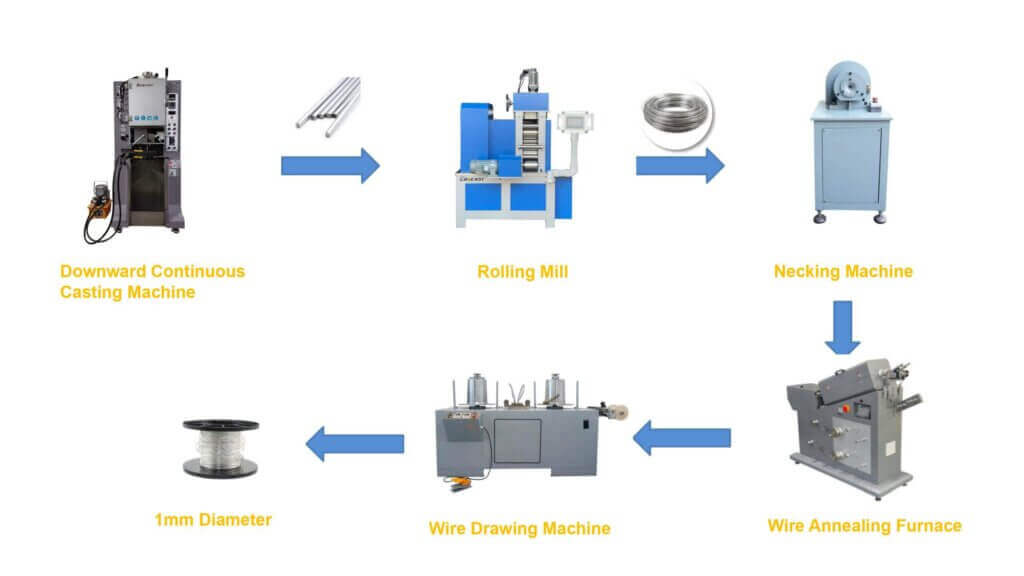

Poor Surface Finish and Dimensional Tolerances

Low-quality nickel silver wires often exhibit surface defects such as scratches, pits, or oxidation from improper drawing or annealing processes. Additionally, suppliers may fail to maintain tight dimensional tolerances, especially for fine-gauge wires. This can cause problems in precision applications like sensor manufacturing or medical devices, where consistent diameter and smooth surface finish are essential for reliability and assembly.

Inadequate Certification and Traceability

Many suppliers, especially in less regulated markets, provide insufficient or falsified material test reports (MTRs). Lack of traceability back to the heat number or batch increases the risk of counterfeit or substandard materials entering the supply chain. Without proper documentation, verifying compliance with industry standards or customer specifications becomes challenging, exposing the buyer to liability in regulated industries.

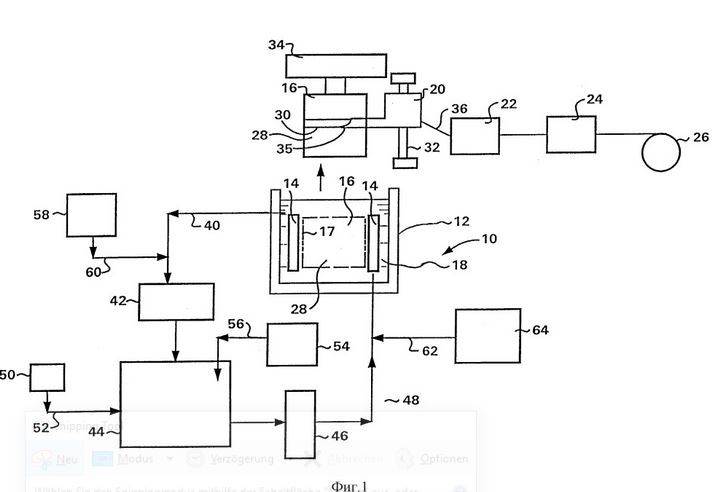

Intellectual Property Infringement Risks

When sourcing proprietary nickel silver wire formulations or specialized processing techniques (e.g., for enhanced fatigue resistance or conductivity), there is a risk of unintentional IP infringement. Some suppliers may use patented alloys or manufacturing methods without licensing, putting downstream users at risk of legal action. Additionally, custom-developed wire specifications shared with suppliers without proper non-disclosure agreements (NDAs) or IP clauses in contracts can lead to misappropriation or unauthorized use.

Supply Chain Transparency and Ethical Sourcing

Nickel and copper used in nickel silver may originate from regions with poor labor or environmental practices. Failing to audit suppliers for compliance with ethical sourcing standards (e.g., conflict minerals regulations) can result in reputational damage and non-compliance with corporate social responsibility (CSR) policies. Lack of transparency in the supply chain increases vulnerability to disruptions and regulatory penalties.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Require third-party material certifications and conduct independent testing.

– Audit suppliers for process controls, quality management systems (e.g., ISO 9001), and IP compliance.

– Use contracts with clear specifications, IP protection clauses, and audit rights.

– Prioritize suppliers with full traceability and adherence to ethical sourcing standards.

Proactive due diligence is essential to ensure both the technical performance and legal integrity of sourced nickel silver wires.

Logistics & Compliance Guide for Nickel Silver Wires

Nickel silver wires, despite their name, contain no elemental silver but are copper-nickel-zinc alloys known for their strength, corrosion resistance, and electrical conductivity. Proper logistics and compliance management are essential to ensure safe handling, transportation, regulatory adherence, and supply chain efficiency.

Overview of Nickel Silver Wires

Nickel silver wires are widely used in electrical components, musical instruments, connectors, and industrial applications. Typical alloy compositions include 60% copper, 20% nickel, and 20% zinc (e.g., C77000), though variations exist. These wires are non-ferromagnetic and offer good solderability and durability. Understanding material specifications is crucial for compliance and logistics planning.

International Trade Classification

Accurate classification under international trade systems ensures correct tariffs and regulatory oversight.

Harmonized System (HS) Code

The most common HS code for nickel silver wires is 7408.29, which covers “Wire of alloys of copper” (specific to non-silver copper alloys like nickel silver). National subheadings may vary—e.g., in the U.S., this may fall under HTSUS 7408.29.0000. Confirm local codes based on alloy composition and wire diameter.

Export Control Classification Number (ECCN)

Nickel silver wires typically fall under EAR99 (Export Administration Regulations) in the U.S., meaning they are not specifically listed for control. However, if exported in conjunction with controlled technologies (e.g., aerospace or defense components), license requirements may apply. Always screen end-use and end-user.

Regulatory Compliance

Adherence to international and regional regulations is mandatory to avoid penalties and shipment delays.

REACH (EU)

Under the EU’s REACH regulation (Registration, Evaluation, Authorization, and Restriction of Chemicals), nickel silver must comply with restrictions on nickel release (Annex XVII, Entry 27) if used in items that come into prolonged contact with skin, such as jewelry or musical instruments. Suppliers must provide SVHC (Substances of Very High Concern) declarations if applicable.

RoHS (EU)

Although primarily targeting cadmium, lead, mercury, and certain flame retardants, nickel silver wires generally comply with RoHS (2011/65/EU) as they do not contain restricted substances above threshold levels. However, verify plating or coatings applied to the wire.

Conflict Minerals (U.S. SEC Rule 13p-1)

Copper is a “conflict mineral” under the Dodd-Frank Act. Companies must conduct due diligence if nickel silver wires are sourced from or exported to conflict-affected regions (e.g., DRC and adjoining countries). Reporting may be required if copper is necessary to the functionality of the final product.

Packaging and Labeling Requirements

Proper packaging and labeling help prevent damage and ensure regulatory compliance.

Packaging Standards

- Use moisture-resistant, anti-corrosive packaging (e.g., VCI paper or sealed plastic wraps) to prevent oxidation.

- Spools or reels must be robust to prevent deformation during transit.

- For air freight, ensure packaging meets IATA crush and stacking requirements.

Labeling

- Clearly mark alloy type (e.g., C77000), diameter, tensile strength, and manufacturer details.

- Include handling symbols (e.g., “Fragile,” “Do Not Stack”).

- For international shipments, provide bilingual labels (e.g., English and destination country language).

- Include country of origin and HTS/ECCN classification on commercial invoices.

Transportation and Shipping

Select appropriate transport modes and carriers based on volume, destination, and urgency.

Air Freight

- Best for high-value or time-sensitive shipments.

- Subject to IATA Dangerous Goods Regulations; nickel silver wires are generally non-hazardous (UN 3089, environmentally hazardous substance, may apply if contaminated).

- Ensure proper documentation: Air Waybill, commercial invoice, packing list.

Ocean Freight

- Cost-effective for bulk shipments.

- Use dry containers with desiccants to mitigate humidity.

- Comply with IMDG Code; nickel silver wires are typically non-regulated but declare accurately.

Ground Transport (Domestic/Regional)

- Follow local regulations (e.g., ADR in Europe, 49 CFR in the U.S.).

- Secure loads to prevent shifting; use load bars or straps.

Import and Customs Clearance

Successful customs clearance depends on accurate documentation and compliance verification.

Required Documents

- Commercial invoice (with value, quantity, HS code)

- Packing list

- Bill of Lading or Air Waybill

- Certificate of Origin (preferential if claiming FTAs)

- Material Test Report (MTR) or Certificate of Conformance (CoC)

- SDS (Safety Data Sheet) – although not hazardous, often requested

Duties and Taxes

- Apply most-favored-nation (MFN) tariffs based on HS code.

- Leverage free trade agreements (e.g., USMCA, EU-South Korea FTA) if eligible.

- VAT or GST applies in most destinations.

Storage and Handling

Proper warehousing ensures product integrity.

Storage Conditions

- Store in a dry, temperature-controlled environment (<60% RH recommended).

- Keep off concrete floors using pallets to prevent moisture absorption.

- Avoid contact with acidic or sulfur-containing materials.

Handling Practices

- Use gloves to minimize skin contact with nickel (potential allergen).

- Use appropriate lifting equipment for heavy spools.

- Rotate stock using FIFO (First In, First Out) to prevent aging.

Environmental and Safety Considerations

Although not classified as hazardous, nickel silver requires responsible handling.

Safety Data Sheet (SDS)

- Nickel silver is generally non-hazardous in solid form.

- Dust from cutting or grinding may contain nickel compounds—use local exhaust ventilation and PPE (respirators, gloves).

- Refer to SDS Section 8 (Exposure Controls/Personal Protection).

Waste Disposal

- Recyclable as non-ferrous scrap.

- Follow local regulations for metal recycling; do not dispose of in landfills.

- Recycling reduces environmental impact and supports circular economy goals.

Summary and Best Practices

- Verify HS and ECCN codes for every shipment.

- Maintain up-to-date compliance documentation (CoC, MTR, RoHS/REACH declarations).

- Partner with certified freight forwarders experienced in metal commodities.

- Train staff on handling, labeling, and regulatory requirements.

- Conduct regular audits of suppliers and logistics providers.

By following this guide, businesses can ensure the safe, compliant, and efficient logistics of nickel silver wires across global supply chains.

Conclusion on Sourcing Nickel Silver Wires:

Sourcing nickel silver wires requires a strategic approach that balances quality, cost, supplier reliability, and application-specific requirements. Nickel silver, despite its name, contains no elemental silver but is valued for its excellent mechanical strength, corrosion resistance, and electrical conductivity, making it suitable for applications in electronics, musical instruments, and industrial components.

After evaluating potential suppliers, material specifications, and supply chain logistics, it is evident that sourcing from certified manufacturers with consistent quality control processes is crucial to ensure performance and reliability. Factors such as alloy composition (e.g., 70/20/10 Cu-Ni-Zn), wire gauge tolerance, tensile strength, and surface finish must align with technical requirements.

Additionally, considering geographic location, lead times, and scalability supports long-term supply stability. Establishing partnerships with suppliers who offer technical support and material traceability enhances product integrity and regulatory compliance.

In conclusion, a successful sourcing strategy for nickel silver wires involves selecting reliable suppliers, verifying material certifications, conducting performance testing, and maintaining flexibility to adapt to market fluctuations, ensuring a continuous and cost-effective supply for intended applications.