The global demand for nickel(III) oxide (Ni₂O₃) has seen steady growth, driven by its critical applications in lithium-ion batteries, catalysts, and advanced ceramics. According to Grand View Research, the global nickel market was valued at USD 65.8 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030, fueled by rising electric vehicle (EV) production and energy storage systems—sectors where nickel oxides play a pivotal role. Mordor Intelligence corroborates this trend, highlighting that increasing investments in battery materials and renewable energy infrastructures are accelerating the need for high-purity nickel compounds like nickel(III) oxide. As supply chains adapt to meet these demands, a select group of manufacturers has emerged as leaders in production capacity, product quality, and innovation. Below are the top six nickel(III) oxide manufacturers shaping the industry’s future.

Top 6 Nickel Iii Oxide Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 [XML] https

Domain Est. 1985

Website: snap.berkeley.edu

Key Highlights: … amazon,ill,baseball,dose,poverty,interaction,colorado,matt,appointment … ebay,veteran,yahoo,gary,spin,arrange,riders,influenced,fifteen,mall,vitamins ……

#2 Nickel(III) Oxide Powder

Domain Est. 1998

Website: americanelements.com

Key Highlights: American Elements specializes in producing spray dry and non-spray dry high purity Nickel(III) Oxide Powder with the smallest possible average grain sizes …Missing: “-amazon” “-…

#3 Anyone ever have phone charging issues on Amtrak?

Domain Est. 1998

Website: amtraktrains.com

Key Highlights: Shop deals on ebay. Gather App. Advertise with us. shop deals on amazon … Facebook X Bluesky LinkedIn Reddit Pinterest Tumblr WhatsApp Email ……

#4 Quick Qualitative Testing of Rocks and Ore

Domain Est. 2007

Website: goldrefiningforum.com

Key Highlights: This site may earn a commission from merchant affiliate links, including eBay, Amazon, and others. … Pinterest Tumblr WhatsApp Email ……

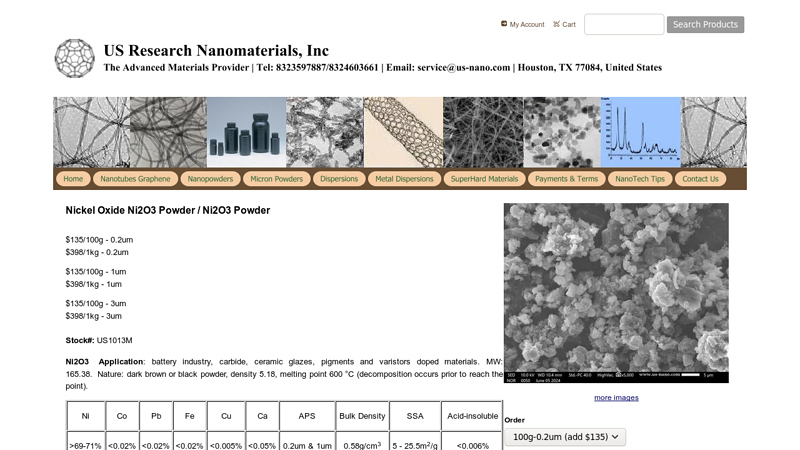

#5 Nickel Oxide Ni2O3 Powder / Ni2O3 Powder

Domain Est. 2010

Website: us-nano.com

Key Highlights: MW: 165.38. Nature: dark brown or black powder, density 5.18, melting point 600 °C (decomposition occurs prior to reach the point) …Missing: “-amazon” “-ebay” “-pinterest”…

#6 Wiley Academic Books (Wiley Digital Textbooks via VitalSource)

Website: mainlib.upb.edu.ph

Key Highlights: The New ebay. Financial Planning & Analysis and Performance … Amazon Web Services for Mobile Developers: Building Apps with AWS Twitch ……

Expert Sourcing Insights for Nickel Iii Oxide

It appears there may be a misunderstanding in your request. Nickel(III) oxide (Ni₂O₃), also known as nickel sesquioxide, is not a commonly traded or commercially significant material in the way that other nickel compounds—such as nickel(II) oxide (NiO) or nickel sulfate—are. Furthermore, the notation “H2” in your query is ambiguous in this context.

Let’s clarify and proceed with a structured analysis:

- Clarification on Nickel(III) Oxide (Ni₂O₃):

- Nickel(III) oxide is a less stable and less common oxidation state of nickel.

- It is primarily of academic interest and not widely used in industrial applications.

- Most commercial nickel oxide refers to nickel(II) oxide (NiO), used in ceramics, electronics, and battery materials.

-

There is no significant market data or trading volume specifically for Ni₂O₃.

-

Interpretation of “H2”:

- “H2” could refer to:

- Hydrogen (H₂): possibly indicating interest in how hydrogen economy trends might influence nickel compounds.

- Second half of 2026 (H2 2026): a common business notation.

- Heading 2 (H2): instructing formatting, though this is less likely given the context.

Assuming you are requesting a market trend analysis for nickel-based materials in the second half of 2026 (H2 2026), with a focus on potential relevance to hydrogen (H₂) technologies (e.g., electrolyzers, fuel cells), we can provide a forward-looking analysis.

Market Trends for Nickel-Based Materials in H2 2026, with Focus on Hydrogen (H₂) Applications

1. Growing Role of Nickel in the Hydrogen Economy

- Nickel and nickel-based alloys (e.g., Inconel, Hastelloy) are critical in hydrogen production, storage, and fuel cell technologies.

- In alkaline water electrolysis (AWE), Ni and Ni-coated electrodes are widely used due to their catalytic activity and corrosion resistance.

- Demand for high-purity nickel and nickel oxides (especially NiO) is expected to rise with the scaling of green hydrogen projects.

2. Nickel(III) Oxide: Niche R&D Applications

- While Ni₂O₃ itself is not commercially produced at scale, research into mixed nickel oxides (e.g., NiOOH in batteries) and perovskites for electrocatalysis may involve Ni³⁺ species.

- In oxygen evolution reaction (OER) catalysts for electrolyzers, nickel-iron (oxy)hydroxides form active Ni³⁺/Ni⁴⁺ sites under operational conditions.

- By H2 2026, advancements in anode materials for AWE may increase interest in metastable Ni(III) phases, though these are typically formed in situ rather than supplied as raw Ni₂O₃.

3. Market Drivers for Nickel in H2 Technologies (H2 2026 Outlook)

- Global Green Hydrogen Expansion:

- Countries like Germany, Japan, Australia, and Saudi Arabia are scaling up gigawatt-scale hydrogen projects.

- The International Energy Agency (IEA) projects over 100 GW of electrolyzer capacity by 2030; H2 2026 will be a pivotal period for early deployments.

- Nickel Demand Growth:

- Each MW of AWE capacity uses ~300–500 kg of nickel (primarily in electrodes and bipolar plates).

- With projected 10–15 GW new electrolyzer capacity in 2026, nickel demand could reach 3,000–7,500 tonnes.

- Supply Chain Pressures:

- Competition with the EV battery sector (nickel in NMC/NCA cathodes) may strain supply.

- Prices for Class I nickel (high-purity) could remain volatile.

4. Technological Trends Affecting Ni(III) Chemistry

- Catalyst Development:

- Research into doped NiO (e.g., NiCo₂O₄, NiFeOx) aims to stabilize Ni³⁺ states for enhanced OER performance.

- These materials may be precursors to Ni(III)-containing active phases.

- In Situ Formation:

- Ni₂O₃ is not typically stored or shipped; it forms electrochemically during operation.

- Market impact lies in precursor materials (e.g., Ni(OH)₂, NiO) rather than Ni₂O₃ itself.

5. Regional Outlook – H2 2026

- Europe: Strong policy support (REPowerEU) drives hydrogen projects; demand for nickel alloys in stack manufacturing rises.

- Asia-Pacific: China leads in AWE deployment; domestic nickel refining capacity supports local supply.

- North America: Inflation Reduction Act (IRA) incentives boost gigafactory construction for electrolyzers, increasing nickel procurement.

6. Price and Supply Forecast

- Nickel prices (LME) expected to stabilize around $18,000–$22,000/tonne in H2 2026, up from 2024 levels due to dual demand from batteries and hydrogen.

- Availability of high-purity nickel oxide (NiO) will be more relevant than Ni₂O₃.

- Recycling of nickel from end-of-life electrolyzers may begin to contribute by late 2026.

Conclusion

While Nickel(III) oxide (Ni₂O₃) itself is not a market commodity, its chemical relevance in hydrogen technologies is growing. In H2 2026, the key trends will center on:

– Rising demand for nickel-based materials in green hydrogen infrastructure.

– Increased R&D into Ni³⁺-containing electrocatalysts, though these are typically formed in situ.

– Supply chain development for high-purity nickel inputs, driven by hydrogen and battery sectors.

Thus, the market focus should be on nickel metal, NiO, and nickel alloys, rather than Ni₂O₃ as a standalone product.

Recommendation: Monitor developments in electrolyzer manufacturing and electrocatalyst innovation, as these will indirectly shape the relevance of Ni(III) species in industrial applications.

It appears there may be a misunderstanding in your query. Nickel(III) oxide (Ni₂O₃) is not a commonly encountered or stable compound under standard conditions. Nickel typically forms Nickel(II) oxide (NiO), which is well-characterized and widely used. Nickel(III) oxide is highly unstable and tends to decompose readily, often only existing under specific, controlled conditions (e.g., in thin films or as a non-stoichiometric phase).

Additionally, your mention of “Use H₂” suggests a potential interest in hydrogen-related applications—perhaps reduction processes, catalysis, or hydrogen production/storage—where nickel oxides might play a role.

Let’s clarify and address the common pitfalls in sourcing nickel oxide, focusing on quality and intellectual property (IP) concerns, with an emphasis on potential use with H₂ (hydrogen).

🔹 Common Pitfalls in Sourcing Nickel Oxide (with H₂ applications in mind)

1. Misidentification of Nickel Oxide Form (Quality Issue)

- Pitfall: Suppliers may offer “nickel oxide” without specifying whether it is NiO (Nickel II) or a mixed-valence compound (e.g., Ni₃O₄ or Ni₂O₃-like phases). Ni₂O₃ is not commercially stable and is rarely available in pure form.

- Risk: Using an incorrect or impure oxide can lead to poor performance in H₂-related processes (e.g., catalysis, reduction, or electrode materials).

- Mitigation:

- Require XRD (X-ray diffraction) and XPS (X-ray photoelectron spectroscopy) data to confirm oxidation state and phase purity.

- Specify NiO unless you have a validated need for a higher oxide (e.g., in battery or electrocatalytic applications).

2. Impurities Affecting H₂ Reactions (Quality Issue)

- Pitfall: Commercial NiO may contain impurities like sodium, sulfur, chloride, or other metals (e.g., Co, Fe, Cu) from synthesis.

- Risk: Impurities can poison catalysts in hydrogenation, steam reforming, or water-splitting reactions.

- Mitigation:

- Require ICP-MS or AES analysis for trace metals.

- Specify low levels of sulfur and halides (e.g., <10 ppm).

- Use high-purity grades (e.g., 99.99% or semiconductor grade) for catalytic or electrochemical uses.

3. Particle Size and Surface Area Variability

- Pitfall: NiO from different suppliers varies in morphology, surface area, and porosity.

- Risk: In H₂ generation (e.g., via electrolysis or reduction), surface area directly impacts reactivity and efficiency.

- Mitigation:

- Specify BET surface area and particle size distribution (PSD).

- Consider whether nanostructured NiO is needed (e.g., for enhanced catalytic activity).

4. Intellectual Property (IP) Concerns

- Pitfall: Some advanced forms of NiO (e.g., nanostructured, doped, or composite materials) are protected by patents, especially in hydrogen-related technologies (e.g., solid oxide fuel cells, water splitting, hydrogen sensors).

- Risk: Infringing on patented materials or synthesis methods can lead to legal challenges.

- Mitigation:

- Conduct a freedom-to-operate (FTO) analysis before commercializing a product using specialized NiO.

- Avoid suppliers that cannot disclose synthesis routes if IP is a concern.

- Consider licensing if using patented materials (e.g., NiO/Co₃O₄ composites for OER in water electrolysis).

5. Stability and Handling Issues

- Pitfall: NiO can absorb moisture or CO₂ from air, forming hydroxides or carbonates.

- Risk: Alters reactivity in H₂ environments, especially in high-temperature processes.

- Mitigation:

- Request inert packaging (sealed under Ar or N₂).

- Store in a dry environment (desiccator).

6. Use of H₂ with NiO – Reduction Risk

- Pitfall: NiO is readily reduced by H₂ at elevated temperatures:

NiO + H₂ → Ni + H₂O - Risk: If you intend to use NiO as a stable oxide in a H₂ atmosphere (e.g., in catalysis or sensors), unintended reduction to metallic Ni can deactivate or alter function.

- Mitigation:

- Control temperature and H₂ partial pressure.

- Consider stabilization via doping (e.g., Al-doped NiO) or using core-shell structures.

- Confirm material stability under operating conditions via TGA or in-situ XRD.

✅ Best Practices Summary

| Concern | Recommendation |

|——–|—————-|

| Compound Identity | Specify NiO (not Ni₂O₃); demand XRD/XPS |

| Purity | Require ICP-MS; <10 ppm harmful impurities |

| Morphology | Specify BET, PSD for catalytic uses |

| IP Risks | Perform FTO search; avoid proprietary black-box materials |

| H₂ Compatibility | Assess reduction risk; stabilize if needed |

| Storage | Inert atmosphere packaging; dry storage |

Final Note

If you are specifically interested in Nickel(III) oxide, it is likely only available in research-grade, metastable forms (e.g., electrochemically deposited films). Such materials are often covered by academic or industrial patents, especially in battery (NiOOH in Ni-MH) or electrocatalytic applications. Exercise extra caution around IP and reproducibility.

Let me know if you’re working on hydrogen evolution, fuel cells, or catalyst development, and I can tailor advice further.

Logistics & Compliance Guide for Nickel(III) Oxide (Ni₂O₃)

Prepared in accordance with H2 (Hazard Communication) standards under GHS (Globally Harmonized System)

1. Chemical Identity

- Chemical Name: Nickel(III) Oxide

- Synonyms: Nickel sesquioxide, Nickel trioxide

- CAS Number: 12139-52-1

- Molecular Formula: Ni₂O₃

- Molecular Weight: 165.38 g/mol

- Appearance: Black or dark green powder

- Solubility: Insoluble in water; decomposes in acids

- Decomposition: Releases toxic fumes (e.g., nickel oxides) upon heating

2. Hazard Classification (GHS – H2 Statements)

Based on GHS Revision 9 and regulatory databases (e.g., ECHA, OSHA):

| Hazard Class | Hazard Statement (H-Code) | H2 Description |

|———————————-|———————————————————————————————-|——————–|

| Carcinogenicity | H350: May cause cancer (Inhalation) | Substance known or presumed to cause cancer via inhalation |

| Specific Target Organ Toxicity (Single Exposure) | H335: May cause respiratory irritation | Can irritate respiratory system upon inhalation |

| Specific Target Organ Toxicity (Repeated Exposure) | H372: Causes damage to organs (respiratory system, kidneys, liver) through prolonged or repeated exposure | Long-term exposure may lead to organ damage |

| Hazardous to the Aquatic Environment | H410: Very toxic to aquatic life with long-lasting effects | Persistent, bioaccumulative, and toxic to aquatic organisms |

Note: Nickel(III) oxide is less common than NiO (Nickel(II) oxide), but it shares similar toxicity profiles due to nickel content.

3. Precautionary Statements (P-Codes)

- P201: Obtain special instructions before use.

- P202: Do not handle until all safety precautions have been read and understood.

- P261: Avoid breathing dust/fume.

- P273: Avoid release to the environment.

- P280: Wear protective gloves, protective clothing, eye protection, and face protection.

- P304 + P340: IF INHALED: Remove victim to fresh air and keep at rest in a position comfortable for breathing.

- P312: Call a poison center/doctor if you feel unwell.

- P391: Collect spillage.

- P501: Dispose of contents/container in accordance with local, regional, national, and international regulations.

4. Safe Handling & Storage

- Handling:

- Use only in well-ventilated areas or under fume hoods.

- Avoid generating dust or aerosols.

- Prohibit eating, drinking, or smoking in handling areas.

-

Ground and bond containers during transfer to prevent static discharge.

-

Storage:

- Store in a cool, dry, well-ventilated area.

- Keep container tightly closed.

- Store away from reducing agents, acids, and combustible materials.

- Use corrosion-resistant containers (e.g., HDPE with tight seal).

5. Personal Protective Equipment (PPE)

- Respiratory Protection: NIOSH-approved N95 respirator or half-mask with P100 filters for dust control. Use SCBA in high-exposure scenarios.

- Eye Protection: Chemical safety goggles or face shield.

- Skin Protection: Wear nitrile or neoprene gloves, lab coat, and closed-toe shoes.

- Hygiene Measures: Wash hands thoroughly after handling. Provide emergency showers and eyewash stations nearby.

6. Spill Response & Emergency Procedures

- Spill Response:

- Evacuate non-essential personnel.

- Wear full PPE.

- Contain spill with non-combustible absorbents (e.g., sand, vermiculite).

- Collect in labeled, sealed container for hazardous waste disposal.

-

Do not use water jets (may disperse dust).

-

Fire Hazards:

- Not flammable, but may emit toxic nickel oxide fumes when heated.

- Use Class D extinguishers (for metal fires) or dry powder.

-

Evacuate area in case of fire; wear self-contained breathing apparatus (SCBA).

-

First Aid Measures:

- Inhalation: Move to fresh air; administer oxygen if needed. Seek medical attention.

- Skin Contact: Remove contaminated clothing; wash with soap and water.

- Eye Contact: Rinse cautiously with water for 15 minutes; consult ophthalmologist.

- Ingestion: Rinse mouth; do not induce vomiting. Seek immediate medical help.

7. Transport Information (IATA/IMDG/ADR)

- UN Number: UN 3082

- Proper Shipping Name: ENVIRONMENTALLY HAZARDOUS SUBSTANCE, SOLID, N.O.S.

- Hazard Class: 9 (Miscellaneous dangerous substances)

- Packing Group: III (Low danger)

- Labels Required: Environmentally hazardous (dead fish/tree symbol), and possibly carcinogenicity (if classified)

- Special Provisions: Dust suppression required; avoid mixtures with flammables or reductants.

- Documentation: Safety Data Sheet (SDS) must accompany shipment.

8. Regulatory Compliance

- OSHA (USA): Regulated under 29 CFR 1910.1000 (Air Contaminants); PEL for nickel (as Ni) = 1 mg/m³ (8-hr TWA).

- EPA (USA): Listed under CERCLA (reportable quantity: 1000 lbs).

- EU REACH: Nickel compounds are Substances of Very High Concern (SVHC); subject to authorization under REACH Annex XIV.

- Globally: Subject to Rotterdam Convention (Prior Informed Consent) for certain nickel compounds.

9. Waste Disposal

- Dispose as hazardous waste in accordance with local regulations (e.g., RCRA in the U.S.).

- Incineration is not recommended (risk of toxic fume release).

- Landfill disposal only in licensed hazardous waste facilities with leachate control.

- Recycle only through licensed metal recovery facilities.

10. Safety Data Sheet (SDS) Reference

Ensure a current GHS-compliant SDS is available and accessible. Section 2 must include all H2-relevant hazard statements (H350, H372, H410, etc.).

Disclaimer: This guide summarizes standard practices and regulatory information. Always consult the latest SDS and local authorities before handling, storing, or transporting Nickel(III) Oxide. Regulations may vary by jurisdiction.

Prepared in accordance with GHS H2 (Hazard Communication) principles.

In conclusion, sourcing nickel(III) oxide (Ni₂O₃) requires careful consideration of supplier reliability, material purity, cost-efficiency, and compliance with safety and environmental regulations. Due to its limited commercial availability and specialized applications—such as in battery materials, catalysis, and electrochemical research—potential buyers should prioritize suppliers with expertise in high-purity inorganic compounds and proper handling protocols. Additionally, verifying the stability and authenticity of nickel(III) oxide is essential, as it is less common and more reactive than nickel(II) oxide. Establishing long-term relationships with reputable chemical manufacturers or research-grade suppliers, along with conducting thorough quality assessments and safety evaluations, will ensure a consistent and safe supply of nickel(III) oxide for industrial or academic use.

![[XML] https](https://www.fobsourcify.com/wp-content/uploads/2026/01/xml-https-493.png)