The industrial coatings market is experiencing steady expansion, driven by rising demand for protective and decorative finishes across construction, automotive, and manufacturing sectors. According to Mordor Intelligence, the global coatings market is projected to grow at a CAGR of over 5.2% from 2024 to 2029, fueled by innovations in eco-friendly formulations and increasing infrastructure investments. In this growing landscape, regional manufacturers—particularly those in industrially active areas like Niagara, New York—are playing a pivotal role. Leveraging proximity to key supply chains and end-user industries, top coatings producers in the Niagara region have emerged as leaders in performance-driven, sustainable solutions. Drawing on production data, market share estimates, and regional economic reports, here are the top three coatings manufacturers shaping the industry in Niagara.

Top 3 Niagara Coatings Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Niagara Protective Coatings (NPC)

Domain Est. 2004

Website: niacoat.com

Key Highlights: As a 100% Canadian, family-owned business, we take immense pride in manufacturing top-quality architectural coatings for commercial, industrial, and ……

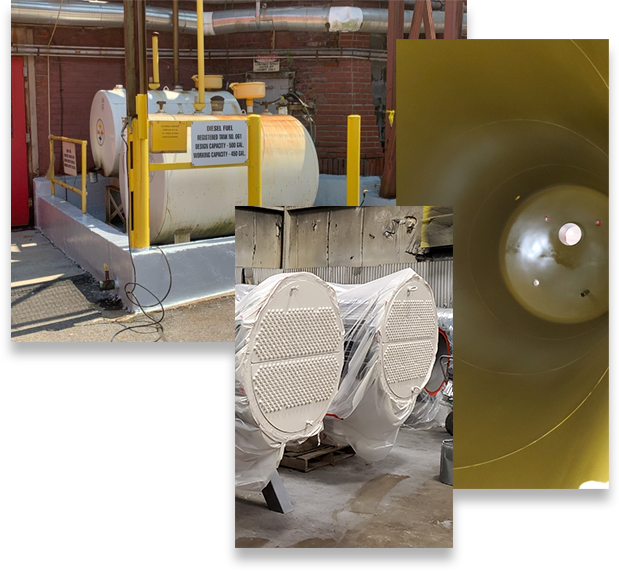

#2 Niagara Coatings Services

Domain Est. 2008

Website: niagaracoatings.com

Key Highlights: We perform industrial surface preparation and coatings as well as provide a turnkey service, from completing applications at our facility or on your site….

#3 Niagara Concrete Coatings

Domain Est. 2023

Website: niagaraconcretecoatings.com

Key Highlights: With over a decade of experience with concrete coatings. We carry everything from cleaners to concrete sealers, asphalt sealers, interlock/paver sealers….

Expert Sourcing Insights for Niagara Coatings

H2: Market Trends Forecast for Niagara Coatings in 2026

As the global industrial and manufacturing sectors evolve, Niagara Coatings—specializing in high-performance protective and functional coatings—is poised to navigate a dynamic market landscape in 2026. Driven by regulatory changes, technological innovation, sustainability imperatives, and shifting end-user demands, several key trends are expected to shape the company’s strategic direction and market positioning.

-

Increased Demand for Sustainable and Eco-Friendly Coatings

By 2026, environmental regulations across North America and Europe will tighten significantly, particularly around volatile organic compound (VOC) emissions and chemical safety. Niagara Coatings is expected to see growing demand for water-based, low-VOC, and bio-based coating formulations. The company’s investment in R&D for sustainable alternatives—such as plant-derived resins and recyclable coating systems—will become a major competitive advantage, especially in automotive, architectural, and consumer electronics markets. -

Expansion in Electric Vehicle (EV) and Battery Technologies

The global surge in EV production will directly impact coating demand for corrosion protection, thermal management, and electrical insulation. Niagara Coatings is likely to benefit from partnerships with EV manufacturers and battery producers seeking advanced dielectric and heat-dissipating coatings. Anticipated growth in North American EV manufacturing, supported by government incentives, presents a significant market opportunity for the company’s specialty coatings in under-the-hood and battery enclosure applications. -

Digitalization and Smart Coating Technologies

Advancements in smart and functional coatings—such as self-healing, anti-microbial, and anti-icing formulations—will gain traction in aerospace, defense, and infrastructure sectors. By 2026, Niagara Coatings may leverage digital tools like AI-driven formulation optimization and IoT-enabled quality control to accelerate product development and ensure consistency. Integration of digital twins in coating performance simulation could enhance customer-specific solutions and reduce time-to-market. -

Resilience in Industrial and Infrastructure Markets

With increased public and private investment in infrastructure modernization (e.g., bridges, pipelines, and renewable energy installations), demand for durable, corrosion-resistant coatings will remain strong. Niagara Coatings’ expertise in heavy-duty industrial coatings positions it well to capture market share in government-backed infrastructure projects in the U.S. and Canada, particularly as climate resilience becomes a procurement priority. -

Supply Chain Localization and Raw Material Volatility

Ongoing geopolitical tensions and supply chain disruptions are pushing manufacturers to localize production. Niagara Coatings may expand regional sourcing of raw materials and consider nearshoring production facilities to mitigate risks. Strategic partnerships with local chemical suppliers and investment in alternative feedstocks (e.g., recycled or bio-based monomers) will be critical to maintaining cost stability and sustainability goals. -

Consolidation and Competitive Pressures

The coatings industry is expected to see further consolidation by 2026, with larger players acquiring niche innovators. Niagara Coatings may face intensified competition but can differentiate through specialized product lines, technical service excellence, and agility in serving regional markets. Building strong B2B relationships with OEMs and contractors will be essential for long-term growth.

Conclusion

In 2026, Niagara Coatings will operate in a market defined by sustainability, technological innovation, and evolving customer expectations. By aligning its product portfolio with eco-conscious trends, expanding into high-growth sectors like EVs and smart infrastructure, and enhancing operational resilience, the company can solidify its position as a leader in performance coatings. Strategic foresight and adaptability will be key to capitalizing on emerging opportunities and navigating an increasingly complex global marketplace.

Common Pitfalls When Sourcing Niagara Coatings (Quality, IP)

Sourcing specialized coatings like those from Niagara Coatings requires careful due diligence to avoid significant risks related to quality consistency and intellectual property (IP) protection. Overlooking these areas can lead to production delays, product failures, and legal exposure.

Quality-Related Pitfalls

Inconsistent Coating Performance

Niagara Coatings are often engineered for specific performance characteristics (e.g., corrosion resistance, thermal stability). A common pitfall is assuming batch-to-batch consistency without verified quality control processes. Suppliers may alter formulations or raw materials without notification, leading to coating failures in critical applications. Always require certified test reports and conduct incoming quality inspections.

Lack of Process Control Oversight

The application process (surface prep, curing cycle, thickness control) significantly impacts coating performance. Sourcing the material without ensuring end users or contract applicators follow Niagara’s approved procedures can result in substandard results. Verify that application protocols are documented, trained on, and audited.

Insufficient Long-Term Validation

Short-term testing may not reveal long-term durability issues such as delamination or degradation under environmental stress. Relying solely on supplier claims without independent lifecycle testing (e.g., salt spray, thermal cycling) can lead to premature field failures.

Intellectual Property-Related Pitfalls

Unlicensed Use of Proprietary Formulations

Niagara Coatings often involve patented chemistries or trade secrets. Sourcing from unauthorized distributors or third parties may result in the use of counterfeit or reverse-engineered products, exposing your company to IP infringement claims. Always confirm the supplier is an authorized distributor with proper licensing.

Ambiguous Contract Terms on IP Ownership

When custom formulations are developed, unclear contracts may leave IP rights undefined. Without explicit agreements, Niagara—or a third party—may retain rights to the formulation, limiting your freedom to use, modify, or transfer the coating. Ensure IP ownership and usage rights are clearly outlined in sourcing agreements.

Failure to Protect Internal Application Know-How

Your proprietary processes for applying Niagara Coatings may also be valuable IP. Sharing application details with unvetted suppliers or partners without non-disclosure agreements (NDAs) risks exposure of trade secrets. Implement strict confidentiality protocols during the sourcing and qualification phases.

Avoiding these pitfalls requires rigorous supplier qualification, clear contractual terms, and ongoing quality and compliance monitoring.

Logistics & Compliance Guide for Niagara Coatings

This guide outlines the essential logistics and compliance procedures for Niagara Coatings to ensure efficient operations, regulatory adherence, and customer satisfaction. All employees and partners must follow these guidelines to maintain safety, quality, and legal compliance.

Transportation & Shipping

All product shipments must comply with federal, state, and international transportation regulations, including the Department of Transportation (DOT) and International Maritime Dangerous Goods (IMDG) Code where applicable. Hazardous materials, including flammable coatings and solvents, must be properly classified, labeled, and packaged in UN-rated containers. Drivers and carriers must be trained in handling hazardous goods and carry appropriate documentation, including Safety Data Sheets (SDS) and shipping manifests.

Warehouse Management

Inventory must be stored in designated, well-ventilated areas that are free from ignition sources. Flammable liquids must be stored in approved flammable storage cabinets or rooms compliant with NFPA 30 standards. All materials should be segregated by chemical compatibility, and aisleways must remain clear for emergency access. Regular inspections and housekeeping audits are required to maintain a safe and compliant environment.

Regulatory Compliance

Niagara Coatings is committed to compliance with all relevant environmental, health, and safety regulations, including the Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA), and local jurisdictional requirements. Key compliance areas include:

- EPA Regulations: Adherence to Clean Air Act (CAA) standards, especially for VOC emissions, and proper waste disposal under Resource Conservation and Recovery Act (RCRA) guidelines.

- OSHA Standards: Implementation of Hazard Communication (HazCom) programs, maintaining up-to-date SDS for all products, and providing required employee training.

- TSCA Compliance: Ensure all chemical substances are listed and reported under the Toxic Substances Control Act.

Packaging & Labeling

All product containers must be sealed, leak-proof, and labeled with the following:

– Product name and identifier

– Hazard pictograms and signal words (per GHS standards)

– Precautionary and hazard statements

– Lot number and batch date

– Net quantity

– Niagara Coatings contact information

Labels must be durable and resistant to environmental conditions during transport and storage.

Import/Export Compliance

International shipments require adherence to customs regulations, proper documentation (commercial invoices, packing lists, certificates of origin), and compliance with export control laws, including the Export Administration Regulations (EAR). Dual-use chemicals must be screened against denied party lists and export license requirements.

Recordkeeping & Audits

Maintain accurate records for a minimum of five years, including:

– Shipping logs and manifests

– SDS files and chemical inventories

– Training records (HazCom, HAZMAT, forklift operations)

– Inspection reports and incident logs

Internal audits will be conducted quarterly to verify compliance and identify areas for improvement.

Emergency Response

In the event of a spill, fire, or exposure:

1. Activate site emergency procedures.

2. Evacuate and secure the area.

3. Notify supervisor and emergency response team.

4. Contact local authorities if necessary (e.g., fire department or spill response).

5. Document the incident and complete required reports (OSHA Form 300, EPA reporting if applicable).

All employees must be trained in emergency response procedures annually.

Continuous Improvement

Niagara Coatings will review and update this Logistics & Compliance Guide annually or in response to regulatory changes, operational shifts, or audit findings. Employee feedback is encouraged to enhance safety and efficiency.

Conclusion for Sourcing Niagara Coatings

In conclusion, sourcing Niagara Coatings presents a strategic opportunity to enhance product quality, durability, and performance across various industrial and commercial applications. With a reputation for innovation, environmental responsibility, and a robust portfolio of protective and specialty coatings, Niagara Coatings offers reliable solutions tailored to diverse industry needs—from automotive and manufacturing to architectural and infrastructure projects.

Their commitment to R&D, regulatory compliance, and sustainable practices aligns with evolving market demands and environmental standards. By partnering with Niagara Coatings, businesses can benefit from high-performance products, technical support, and consistent supply chain reliability.

However, due diligence is recommended in evaluating specific product suitability, lead times, regional distribution capabilities, and total cost of ownership. When these factors are aligned with organizational requirements, Niagara Coatings emerges as a competitive and dependable supplier in the coatings market. Ultimately, sourcing from Niagara Coatings supports long-term operational efficiency, product excellence, and sustainability goals.