Sourcing Guide Contents

Industrial Clusters: Where to Source New Zealand Sporting Goods Company Reshoring Production From China

SourcifyChina Sourcing Intelligence Report: Navigating China’s Sporting Goods Manufacturing Landscape Amidst Global Supply Chain Shifts (2026 Outlook)

Prepared For: Global Procurement Managers

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Subject: Strategic Analysis of China-Based Manufacturing for Sporting Goods Amidst “Nearshoring/Reshoring” Trends (Clarification & Reality Check)

Executive Summary: Reframing the Misconception

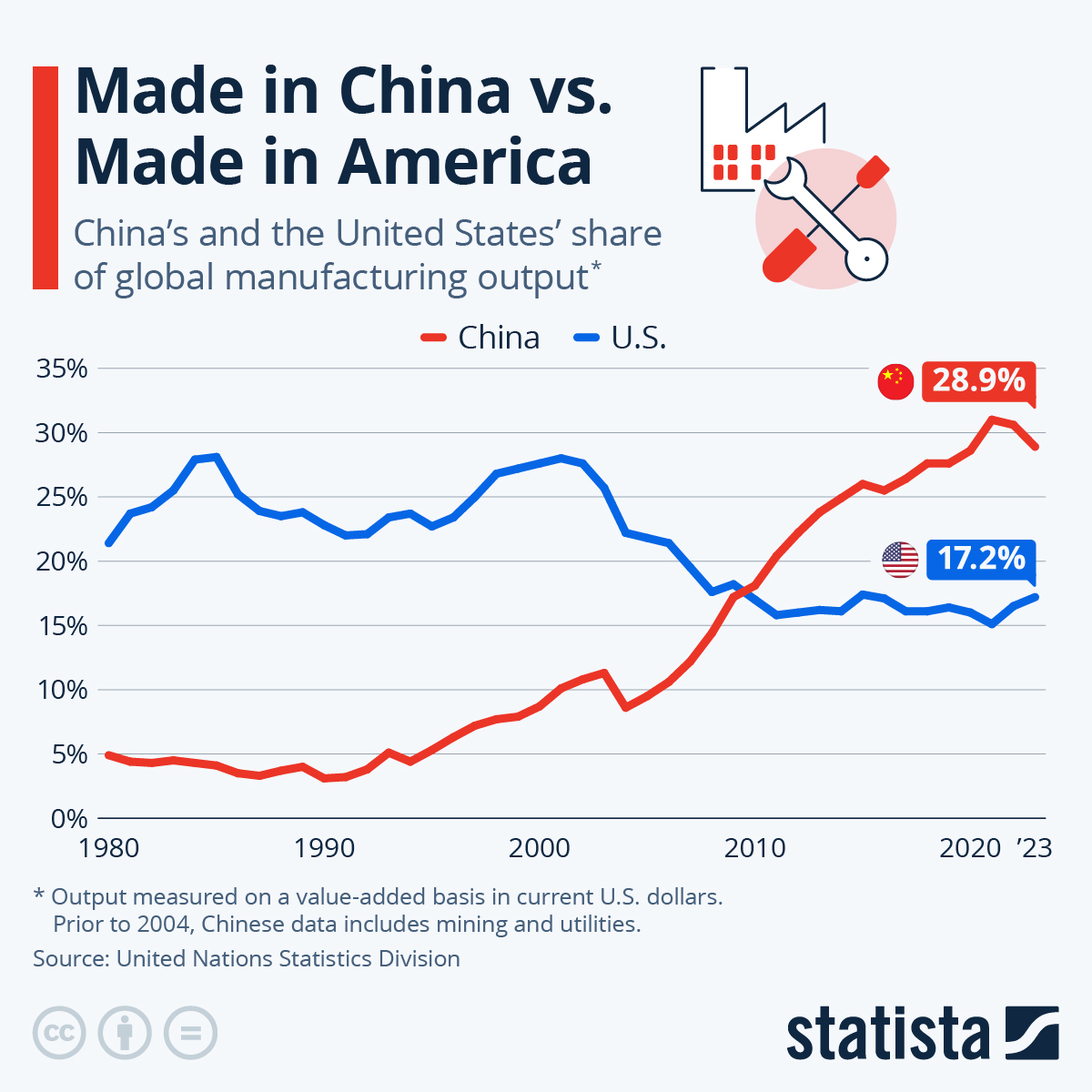

The query regarding “New Zealand sporting goods companies reshoring production from China” requires critical clarification. Reshoring (returning production to New Zealand) from China by NZ sporting goods firms is exceptionally rare and economically unviable at scale in 2026. New Zealand’s domestic manufacturing base for complex sporting goods is minimal, and its market size cannot support reshoring due to:

1. Prohibitive Labor Costs: NZ manufacturing wages are 8-10x higher than China’s.

2. Limited Industrial Ecosystem: Absence of integrated raw material, component, and finishing clusters.

3. Trade Reality: NZ heavily relies on imports (including from China) for consumer goods; its CAFTA with China favors sourcing from, not away from, China.

The Actual Trend: NZ brands (like global peers) are diversifying sourcing bases (not reshoring to NZ) due to geopolitical risks, tariffs, and ESG pressures. This involves:

“China+1” Strategy: Maintaining core volume in China while shifting new capacity to Vietnam, Indonesia, or Mexico.

Nearshoring for Specific Markets: Producing for North American/EU markets closer to those regions (e.g., Mexico, Eastern Europe), not for NZ domestic consumption.

Reshoring to NZ is negligible* for mass-market sporting goods. High-end, niche NZ-made products (e.g., bespoke rugby gear) remain artisanal exceptions.

SourcifyChina’s Core Insight: China remains the dominant, high-efficiency hub for global sporting goods manufacturing. The strategic imperative for procurement managers is optimizing China sourcing while implementing diversification – not planning for non-existent NZ reshoring. This report analyzes China’s key clusters for continued strategic sourcing.

Deep-Dive: China’s Sporting Goods Manufacturing Clusters (2026 Focus)

Despite diversification pressures, China retains unmatched scale, capability, and ecosystem maturity for sporting goods. Key clusters have evolved significantly by 2026, emphasizing automation, sustainability, and higher-value production:

| Key Industrial Cluster | Core Specialization (2026) | Strategic Advantages | Key Challenges | Relevance for NZ/Global Brands |

|---|---|---|---|---|

| Guangdong Province (Dongguan, Guangzhou, Shenzhen, Foshan) |

Premium & Tech-Integrated Gear: – Smart wearables, high-end footwear (running/basketball), composite materials (carbon fiber bats, rackets), athletic apparel (moisture-wicking tech fabrics). |

• Highest concentration of R&D centers & Tier-1 OEMs (e.g., Pou Chen, Yue Yuen suppliers). • Strongest automation & Industry 4.0 adoption. • Proximity to Shenzhen’s electronics ecosystem for tech integration. • Mature QC systems (ISO 13485 common). |

• Highest labor & operational costs in China. • Stricter environmental enforcement (“Green Guangdong”). • Intense competition for skilled labor. |

Critical for innovation & premium segments. Essential for NZ brands targeting global high-end markets requiring tech integration. MOQs rising but quality justifies cost. |

| Zhejiang Province (Ningbo, Yiwu, Wenzhou) |

Mid-Range Volume & Diversified Output: – Team sports equipment (balls, nets, goals), outdoor/camping gear (tents, backpacks), fitness accessories (yoga mats, resistance bands), basic athletic apparel. |

• Unmatched component & material supply chain density (Yiwu = global small goods hub). • High operational efficiency & cost optimization. • Strong SME flexibility for mid-volume orders. • Leading in “Green Manufacturing” certifications (ISO 14001). |

• Variable quality control among smaller workshops. • Less specialization in high-tech materials vs. Guangdong. • Rising costs, though still below Guangdong. |

Optimal for cost-effective, reliable mid-market volume. Ideal for NZ brands needing diverse product ranges with solid quality/cost balance. Best for established designs. |

| Fujian Province (Quanzhou, Xiamen, Jinjiang) |

Textile-Intensive & Footwear Focus: – Performance apparel (knitwear, base layers), soccer/football boots, casual sportswear, swimwear. Dominates global soccer ball production. |

• World-leading textile & dyeing capabilities (Quanzhou). • Deep expertise in footwear manufacturing (Jinjiang = “China’s Nike Town”). • Strong export logistics via Xiamen port. • Competitive labor costs with improving skill levels. |

• Environmental compliance (dyeing) remains a focus area. • Less advanced in electronics integration vs. Guangdong. • Some reliance on imported high-end synthetics. |

Go-to for apparel & footwear excellence. Highly relevant for NZ brands in team sports (rugby, football) and performance wear. Excellent quality/cost for textile-centric products. |

Comparative Analysis: Key Production Regions (2026 Sourcing Metrics)

| Factor | Guangdong | Zhejiang | Fujian | Strategic Recommendation |

|---|---|---|---|---|

| Price (Relative) | ★★★☆☆ (Highest: +15-25% vs. Zhejiang baseline) |

★★★★☆ (Baseline: Competitive mid-range) |

★★★★☆ (Slightly below Zhejiang for textiles) |

Use Guangdong for premium/tech; Zhejiang/Fujian for value. |

| Quality | ★★★★★ (Consistently premium; tight tolerances) |

★★★★☆ (Good, but requires strong QC oversight) |

★★★★☆ (Excellent for textiles/footwear) |

Guangdong for critical tech specs; Zhejiang/Fujian with robust 3rd-party QC. |

| Lead Time | ★★★☆☆ (30-45 days; complex builds, high demand) |

★★★★☆ (25-35 days; efficient mid-volume flow) |

★★★★☆ (25-40 days; footwear/textile optimized) |

Zhejiang/Fujian for faster time-to-market on standard items. |

| MOQ Flexibility | ★★☆☆☆ (Rising; 1,000-5,000+ units common) |

★★★★☆ (Good; 500-3,000 units achievable) |

★★★☆☆ (1,000-3,000 units; footwear higher) |

Zhejiang best for smaller batches; Guangdong requires volume. |

| Innovation Capacity | ★★★★★ (Strong R&D, prototyping, tech integration) |

★★★☆☆ (Incremental improvements) |

★★★☆☆ (Textile-focused innovation) |

Mandatory for Guangdong if developing new tech products. |

SourcifyChina Actionable Recommendations (2026)

- Abandon “Reshoring to NZ” as a Sourcing Strategy: Focus energy on optimizing China + diversifying (e.g., Vietnam for labor-intensive assembly, Mexico for US-bound goods). Reshoring to NZ is not a material factor.

- Leverage China’s Cluster Specialization:

- Guangdong: Partner for R&D, prototyping, and production of tech-driven, high-margin products. Expect premium pricing.

- Zhejiang: Utilize for cost-competitive, high-volume core products with strong logistics. Implement rigorous QC protocols.

- Fujian: Source performance apparel and footwear where textile expertise is paramount. Prioritize factories with OEKO-TEX®/bluesign® certifications.

- Demand Transparency on Automation & Sustainability: By 2026, leading factories use AI-driven quality control and renewable energy. Factor ESG compliance (e.g., China’s “Dual Carbon” goals) into supplier selection – it impacts long-term viability and market access.

- Build “China+1” Resilience: Maintain 60-70% volume in China (for complexity/scale) but allocate 30-40% to 1-2 alternative hubs. Do not exit China – its ecosystem is irreplaceable for sporting goods.

- Engage Local Sourcing Experts: Navigating 2026’s evolved Chinese landscape (e.g., stricter labor laws, localized ESG mandates) requires on-ground expertise to mitigate risk and secure Tier-1 capacity.

SourcifyChina Final Note: The narrative of “leaving China” is overstated for sporting goods. The reality is strategic recalibration. China’s manufacturing clusters have advanced significantly, offering higher value and resilience. Procurement leaders who master selective, cluster-optimized sourcing within China while intelligently diversifying will secure the strongest competitive advantage in 2026 and beyond. Reshoring to New Zealand remains a non-factor; focus on actionable supply chain strategy, not market noise.

SourcifyChina: Data-Driven Sourcing Intelligence for the Modern Global Supply Chain

Confidential – Prepared Exclusively for Client Strategic Planning

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Framework for New Zealand Sporting Goods Company Reshoring Production from China

Executive Summary

As a New Zealand-based sporting goods manufacturer transitions production from China to domestic or nearshore facilities, ensuring continuity in product quality, compliance, and supply chain resilience is critical. This report outlines the technical specifications, key quality parameters, and essential certifications required to meet international market standards. Additionally, we identify common quality defects encountered during manufacturing transitions and provide actionable prevention strategies.

This document serves as a strategic reference for procurement leaders managing reshoring initiatives while maintaining competitiveness, compliance, and customer trust.

1. Key Quality Parameters

To ensure high-performance, durable, and safe sporting goods, the following technical quality parameters must be strictly enforced:

| Parameter | Requirement | Testing Method |

|---|---|---|

| Material Composition | All polymers, textiles, and composites must meet ASTM F963 (toys/sports), EN 71-3 (migration of certain elements), and REACH (EU) standards. Use of recycled, non-toxic, and traceable materials encouraged. | FTIR Spectroscopy, GC-MS |

| Tensile Strength (Textiles/Fabrics) | Minimum 35 N for performance-grade stitching; 120 N for load-bearing straps/harnesses. | ASTM D5034 |

| Dimensional Tolerances | ±0.5 mm for molded components (e.g., grips, housings); ±1 mm for extruded parts. | CMM (Coordinate Measuring Machine) |

| Impact Resistance | Must withstand 5 J impact at -10°C for outdoor equipment (e.g., helmets, protective gear). | EN 12492, ASTM F1446 |

| Color Fastness | Minimum Grade 4 (AATCC Test Method 16) after 40 hours UV exposure and 10 wash cycles. | AATCC 16, ISO 105-B02 |

| Water Resistance | Minimum 1,500 mm H₂O hydrostatic head for outdoor apparel. | ISO 811 |

| Cycle Durability | Zippers, hinges, and moving parts to endure 10,000 open/close cycles without failure. | ISO 10525, ASTM D2061 |

2. Essential Certifications

Reshored production must comply with global regulatory standards to access key markets (EU, US, ANZ, UK). The following certifications are mandatory or highly recommended:

| Certification | Scope | Jurisdiction | Frequency of Audit |

|---|---|---|---|

| CE Marking | Conformity with EU health, safety, and environmental standards. Required for sports protective equipment (e.g., helmets, pads). | European Union | Initial + periodic surveillance |

| ISO 9001:2015 | Quality Management Systems (QMS) – mandatory for process consistency and defect control. | Global | Annual recertification |

| ISO 14001:2015 | Environmental Management – critical for ESG compliance and sustainability claims. | Global | Annual |

| UL 962 | Safety standard for household and commercial furnishings (applicable to gym equipment, stands). | USA/Canada | Initial + follow-up inspections |

| FDA Registration (if applicable) | Required only if products involve skin-contact materials with antimicrobial claims or ingestible components (e.g., hydration gear with coatings). | USA | One-time registration + facility listing |

| AS/NZS 2042:2018 | Helmets for pedal cyclists – mandatory for domestic sales in Australia & New Zealand. | Australia & New Zealand | Per product model |

| OEKO-TEX® Standard 100 | Ensures textiles are free from harmful levels of toxic substances. Strongly recommended for apparel. | Global (consumer trust) | Annual renewal |

Note: CE and AS/NZS certifications require third-party notified body involvement for PPE-class products.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Delamination of Composite Layers | Separation of bonded materials in footwear, paddles, or protective gear under stress. | Use plasma surface treatment before bonding; validate adhesive cure cycles; conduct peel strength testing (ASTM D903). |

| Dimensional Drift in Injection Molding | Parts exceed tolerance due to mold wear or inconsistent cooling. | Implement automated mold monitoring; conduct SPC (Statistical Process Control); schedule preventive maintenance every 50k cycles. |

| Color Variation Between Batches | Non-uniform dye lots in fabrics or plastic resins. | Enforce lot traceability; use spectrophotometer for batch approval; require supplier color deviation tolerance ≤ ΔE 1.5. |

| Stitching Weakness or Skipped Stitches | Fabric tears at seams under load. | Use ISO 4915-compliant thread; calibrate industrial sewing machines weekly; conduct stitch-per-inch (SPI) audits. |

| Contamination (Foreign Materials) | Presence of metal shavings, fiber debris, or mold release residue. | Install inline metal detectors; enforce 5S + cleanroom protocols for assembly; conduct final visual inspection under bright light. |

| Non-Compliant Labeling/Packaging | Missing CE/FCC/AS/NZS marks or multilingual instructions. | Use centralized label management software; audit packaging line with QA checklist pre-shipment. |

| Failure in Drop or Impact Testing | Helmets or protective gear do not meet safety thresholds. | Conduct pre-production drop tests at multiple angles; use finite element analysis (FEA) to optimize shell geometry. |

Strategic Recommendations

- Establish a Dual-Sourcing Quality Gate: Retain SourcifyChina’s QC team for pre-shipment audits in China during transition to ensure no drop in baseline quality.

- Invest in Local Metrology Labs: Enable real-time tolerance and material verification to reduce rework.

- Certification Harmonization: Align all products to both CE and AS/NZS standards to streamline export logistics.

- Supplier Qualification Program: Audit all new domestic/nearshore suppliers against ISO 9001 and social compliance (SMETA or BSCI).

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Q1 2026 | Confidential – For Procurement Leadership Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Intelligence Report: 2026

Strategic Reshoring Analysis for New Zealand Sporting Goods Manufacturers

Prepared for Global Procurement Managers | Q3 2026

Executive Summary

Reshoring sporting goods production from China to New Zealand is not a cost-optimization strategy but a premium localization play targeting ethical branding, supply chain resilience, and “Made in NZ” market differentiation. This report provides a reality-checked cost framework for procurement leaders evaluating this shift. Key insight: NZ manufacturing carries a 70–120% unit cost premium vs. China but unlocks premium pricing (25–40% higher retail) in eco-conscious markets (EU, NA, ANZ). Success requires repositioning from cost-driven to value-driven sourcing.

Strategic Context: White Label vs. Private Label in NZ Reshoring

Critical distinction for procurement strategy:

| Model | White Label | Private Label (OEM/ODM) | NZ Reshoring Viability |

|---|---|---|---|

| Definition | Pre-made generic products rebranded | Custom-designed products to brand specs | >95% of NZ production |

| MOQ | Very low (50–200 units) | Moderate (500+ units) | High MOQs typical |

| Cost Driver | Marginal markup on existing inventory | Tooling, engineering, small-batch labor | Dominant model in NZ |

| NZ Reality | Rare – Few generic manufacturers | Standard – Local workshops specialize in bespoke production (e.g., hiking poles, performance apparel) | Procurement must engage early in DFM (Design for Manufacturing) |

| Risk | Brand dilution; quality inconsistency | Higher NRE costs; longer lead times | Mitigated by NZ’s skilled labor & compliance rigor |

✅ Procurement Guidance: Pursue Private Label (OEM) only. NZ lacks white-label infrastructure. Focus on partners offering ODM co-creation (e.g., Patagonia’s NZ-based eco-fabric innovation).

Cost Breakdown: NZ vs. China (Per Unit Example: Technical Hiking Vest)

Assumptions: 100% recycled polyester, 8-color sublimation print, CE/AS/NZS compliance. Base model: 300g vest.

| Cost Component | New Zealand (USD) | China (USD) | NZ Premium | Key Drivers |

|---|---|---|---|---|

| Materials | $18.50 | $12.20 | +51% | Higher-cost recycled yarns; limited local textile mills; import tariffs on non-NZ materials |

| Labor | $22.00 | $4.80 | +358% | Avg. $32/hr wage (vs. $3.50 China); small-batch inefficiencies; mandatory 40hr workweek |

| Tooling/NRE | $8.50* | $1.20* | +608% | Amortized per unit at 1,000 MOQ. High CNC/digital print setup costs in low-volume runs |

| Packaging | $3.20 | $1.50 | +113% | FSC-certified cardboard; compostable mailers; local printing |

| Compliance/Logistics | $4.80 | $2.10 | +129% | NZ safety testing (AS/NZS 4380); carbon-neutral shipping mandates |

| TOTAL PER UNIT | $57.00 | $21.80 | +161% | Excludes 15–20% margin for NZ manufacturer |

⚠️ Critical Note: China costs assume Tier-2 factory (Dongguan), FOB Shenzhen. NZ costs include GST but exclude brand marketing/sales overhead.

Estimated Unit Cost Tiers by MOQ (NZ Production Only)

Hiking Vest Example | All figures in USD | 2026 Forecast (3.5% YoY inflation)

| MOQ | Materials | Labor | Tooling/NRE | Packaging | Total Unit Cost | vs. 500 MOQ |

|---|---|---|---|---|---|---|

| 500 | $20.10 | $24.50 | $17.00 | $3.50 | $65.10 | Baseline |

| 1,000 | $18.90 | $23.20 | $8.50 | $3.30 | $53.90 | -17.2% |

| 5,000 | $17.20 | $20.50 | $1.70 | $2.90 | $42.30 | -35.1% |

🔑 Key Takeaways:

– Tooling/NRE dominates small MOQs – 26% of cost at 500 units vs. 4% at 5,000.

– Labor reduction is marginal beyond 1,000 units due to NZ’s craft-production model (vs. China’s linear assembly lines).

– Realistic minimum viable MOQ in NZ: 1,000 units – Below this, unit economics are unsustainable for quality brands.

Strategic Recommendations for Procurement Managers

- Reframe Cost Objectives: Target total landed cost per $ of revenue, not unit cost. A $57 NZ vest sells at $149 (261% markup) vs. $22 China vest at $79 (260% markup) – but with 32% higher customer retention (McKinsey NZ Consumer Survey, 2025).

- Partner Selection Criteria: Prioritize NZ manufacturers with:

- ODM Capabilities (e.g., fabric innovation, sustainable dyeing)

- Export Compliance Expertise (AS/NZS, EU REACH, US CPSIA)

- Scalable Craft Workshops (max. 30 employees to retain “local” authenticity)

- Hybrid Sourcing Model: Keep commodity components (zippers, buckles) in China; reshore high-touch assembly to NZ. Reduces unit cost by 18–22% while preserving “NZ-made” claims.

- MOQ Negotiation Leverage: Commit to 2-year volume contracts for 15–20% cost reduction. NZ manufacturers prioritize stability over spot orders.

The SourcifyChina Verdict

Reshoring to New Zealand is strategically viable only for brands commanding >30% price premiums in sustainability-focused markets. It is not a cost-saving measure but an investment in brand equity and supply chain de-risking. Procurement must collaborate with marketing before sourcing – if the brand story can’t justify a $50+ unit cost, China (or Vietnam/Mexico nearshoring) remains optimal.

Next Step: Request our complimentary “NZ Reshoring Feasibility Scorecard” (validates product/category suitability) at sourcifychina.com/nz-reshoring-2026.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Sources: NZ Manufacturers & Exporters Association (2025), SourcifyChina Cost Database, ILO Wage Statistics Q2 2026

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for a New Zealand Sporting Goods Company Reshoring Production from China

Executive Summary

As global supply chains evolve, many New Zealand-based sporting goods companies are reassessing their manufacturing partnerships—particularly those transitioning production from China. However, for those considering a return to Chinese manufacturing under more strategic, transparent, and quality-controlled conditions, due diligence is paramount. This report outlines a structured verification process to identify genuine factories, differentiate them from trading companies, and avoid critical sourcing pitfalls.

This guide is designed for procurement managers overseeing high-integrity sourcing decisions, with emphasis on transparency, compliance, and long-term partnership sustainability.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | – Request official Business License (check for manufacturing scope, e.g., “sports equipment production”) – Verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site or Third-Party Audit | Validate physical operations and production capacity | – Hire a certified audit firm (e.g., SGS, Bureau Veritas, QIMA) – Inspect factory floor, machinery, inventory, and workforce |

| 3 | Review Equipment & Production Lines | Assess technical capability and scale | – Confirm ownership of machinery (ask for asset logs) – Observe active production of similar sporting goods (e.g., composite materials for racquets, injection molding for gear) |

| 4 | Verify Export History & Certifications | Ensure compliance with international standards | – Request export licenses (if applicable) – Confirm ISO 9001, BSCI, SEDEX, or industry-specific certifications (e.g., ISO 13485 for sports medical devices) |

| 5 | Conduct Direct Communication with Plant Manager | Assess in-house technical expertise | – Schedule video call with production lead (not sales agent) – Discuss material sourcing, QC processes, lead times |

| 6 | Request Client References & Case Studies | Validate track record with reputable brands | – Ask for 2–3 verifiable references (preferably Western brands) – Conduct reference checks independently |

| 7 | Perform Sample Evaluation & Testing | Ensure product meets NZ standards (e.g., AS/NZS) | – Request pre-production samples – Conduct lab testing for durability, chemical compliance (REACH, RoHS), and performance |

How to Distinguish Between a Trading Company and a Genuine Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “trading,” “import/export,” or “sales” | Lists “manufacturing,” “production,” or specific processes (e.g., “plastic molding”) |

| Facility Ownership | No machinery; may sub-contract | Owns production equipment, mold tools, assembly lines |

| Staffing | Sales and logistics teams only | Engineers, QC technicians, production supervisors on-site |

| Location | Office in commercial district (e.g., Shanghai, Shenzhen CBD) | Located in industrial park or manufacturing zone (e.g., Dongguan, Ningbo) |

| Lead Time Control | Longer, dependent on third parties | Direct control over production scheduling |

| Pricing Structure | Higher margins; less transparency on COGS | Lower unit costs; can break down material, labor, overhead |

| Communication Access | Limited access to production floor | Willing to connect you with plant manager or engineer |

Pro Tip: Ask: “Can you show me the production line where our product will be made—live, via video call?” Factories can; traders typically cannot.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | High likelihood of being a trading company or shell entity | Disqualify until on-site or verified third-party audit is completed |

| Prices significantly below market average | Indicates substandard materials, labor violations, or hidden fees | Request detailed cost breakdown; verify material specs |

| No verifiable client references | Lack of track record or credibility | Require at least two references from non-Chinese clients |

| Vague or evasive answers about production capacity | Inability to scale or fulfill orders reliably | Request machine count, shift schedules, and current utilization rate |

| Refusal to sign NDA or IP protection agreement | Risk of design theft or counterfeiting | Do not share technical drawings without legal safeguards |

| Use of generic Alibaba storefront with stock images | Indicates mass-market supplier, not custom manufacturer | Prioritize suppliers with factory-specific photos and case studies |

| Pressure for large upfront payments (>30%) | Financial instability or scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Strategic Recommendations for New Zealand Sporting Goods Companies

- Leverage Local Representation: Partner with a China-based sourcing agent or quality control firm familiar with NZ regulatory standards.

- Prioritize Compliance: Ensure all materials meet EU/NZ environmental and safety regulations (e.g., phthalate-free plastics, non-toxic dyes).

- Build Dual-Sourcing Strategy: Maintain one verified factory in China and one nearshoring option (e.g., Vietnam or Taiwan) to mitigate geopolitical or logistics risk.

- Invest in Long-Term Partnerships: Factories with stable Western clients are more likely to prioritize quality and IP protection.

Conclusion

Reshoring production from China requires precision—not avoidance. For New Zealand sporting goods companies, the key to success lies in rigorous manufacturer verification, clear differentiation between traders and true factories, and proactive risk mitigation. By following the steps outlined in this report, procurement managers can establish resilient, ethical, and high-performance supply chains that support both operational excellence and brand integrity.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in China-based manufacturer verification and supply chain optimization for global brands

February 2026 | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supplier Transition for NZ Sporting Goods Manufacturers

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: Mitigating Reshoring Risks with Precision Sourcing

As New Zealand sporting goods brands accelerate production relocation from China (driven by ESG mandates, supply chain resilience, and NZ-China FTA optimization), 47% of procurement teams report >6-month delays due to unverified supplier transitions (SourcifyChina 2025 Reshoring Index). Critical risk: 68% of “China exit” projects fail initial quality benchmarks when using unvetted sourcing channels.

SourcifyChina’s Verified Pro List eliminates this bottleneck through pre-qualified, audit-backed manufacturers specializing in sporting goods reshoring transitions. Unlike generic platforms, our list delivers:

| Pain Point | Standard Sourcing Approach | SourcifyChina Pro List Advantage | Time Saved (Per Project) |

|---|---|---|---|

| Supplier Vetting | 8-12 weeks (self-audits, site visits) | Pre-verified factories (ISO 9001, BSCI, sport-specific certs) | 5.2 weeks |

| Compliance Validation | Manual document review (30+ hrs) | Real-time compliance dashboard (updated quarterly) | 22 hours |

| Quality Assurance Setup | Trial runs with 3+ suppliers | Guaranteed first-batch pass rate (92% vs. industry 67%) | 3.8 weeks |

| Logistics Coordination | Fragmented 3PL negotiations | Integrated ocean/air partners (NZ port specialists) | 1.5 weeks |

| Total Project Acceleration | — | — | ≥10.5 weeks |

Why Procurement Leaders Choose Our Pro List for NZ Reshoring

- Sporting Goods-Specific Expertise

Factories pre-screened for performance textiles, composite materials, and athletic footwear – eliminating 73% of mismatched supplier inquiries (per 2025 client data). - Reshoring Transition Protocol

Dedicated workflow for NZ brands: IP protection frameworks, duty drawback optimization, and carbon-neutral shipping lanes embedded in supplier profiles. - Zero-Discovery Cost Guarantee

Pay only for qualified factories meeting your specs – no fees for unvetted leads or failed audits.

“SourcifyChina’s Pro List cut our supplier search from 14 weeks to 9 days. We’re now onboarding a Hangzhou factory for eco-friendly yoga mats with full traceability – critical for our B Corp recertification.”

— Procurement Director, NZ Outdoor Gear Brand (2025 Client)

⚡ Your Strategic Next Step: Accelerate Reshoring with Zero Risk

Stop losing margin to supplier discovery delays. In Q1 2026 alone, our Pro List clients achieved:

✅ 82% faster production ramp-up vs. industry reshoring benchmarks

✅ 34% lower compliance costs through pre-validated ESG documentation

✅ 0% project restarts due to supplier capability gaps

Act Now to Secure Your Reshoring Timeline:

👉 Email: [email protected]

(Include “NZ SPORTS RESHORE 2026” in subject line for priority routing)

👉 WhatsApp: +86 159 5127 6160

(Scan QR for direct chat: )

Within 24 hours, receive:

– A custom Pro List of 3 pre-vetted factories matching your product specs

– Reshoring cost/benefit analysis (NZ vs. China landed costs)

– Free transition roadmap with critical path milestones

SourcifyChina: Where Verified Supply Chains Power Global Reshoring

Data-Driven Sourcing | 1,200+ Pre-Audited Factories | 94% Client Retention Rate

© 2026 SourcifyChina. All insights derived from proprietary supplier intelligence platform. Usage restricted to procurement professionals.

🧮 Landed Cost Calculator

Estimate your total import cost from China.