Sourcing Guide Contents

Industrial Clusters: Where to Source New Zealand Sporting Goods Company Reshored From China

SourcifyChina B2B Sourcing Report 2026

Market Analysis: Sourcing for New Zealand Sporting Goods Brands Reshoring from China

Prepared for: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

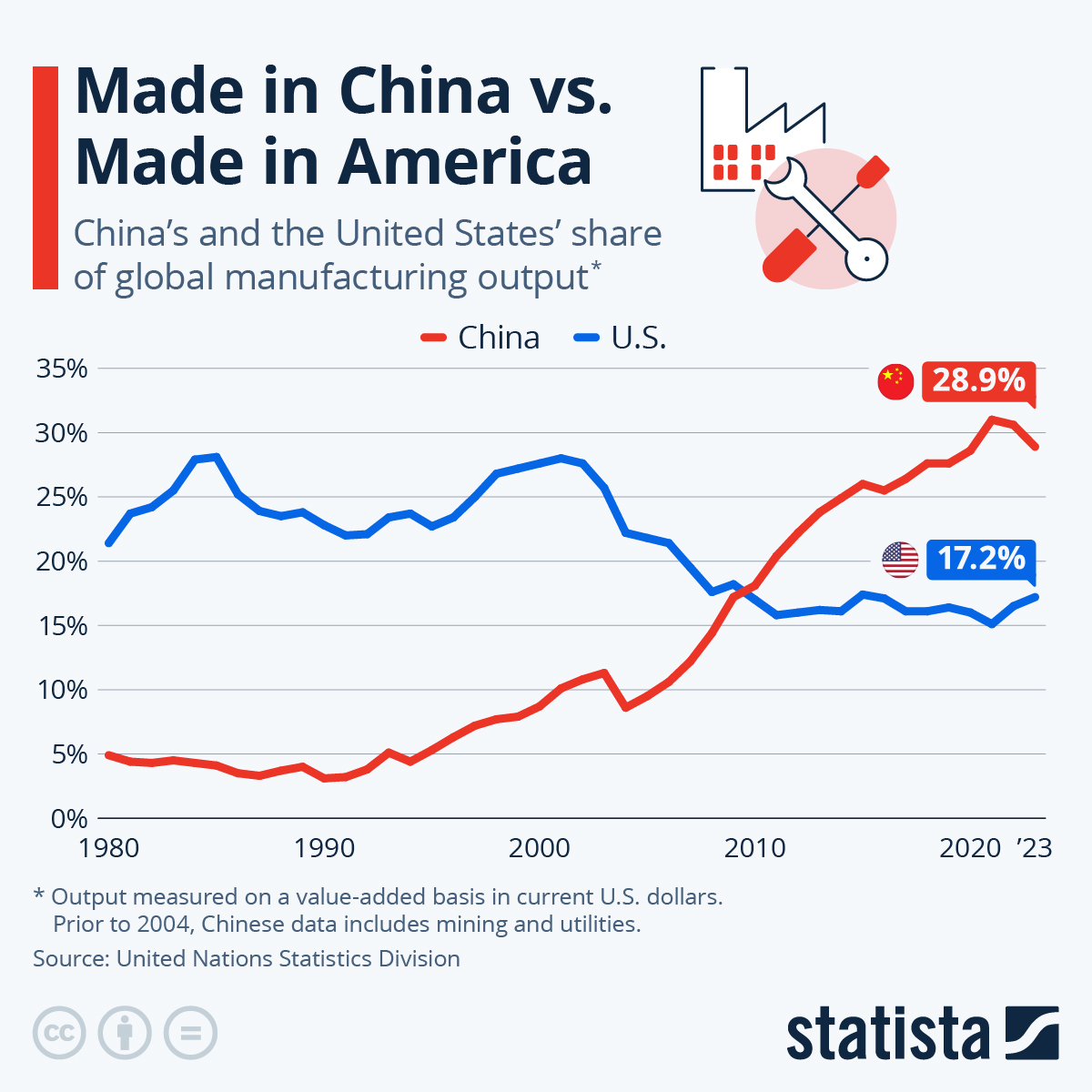

This report provides a comprehensive analysis of the Chinese manufacturing landscape for sporting goods, specifically tailored to support New Zealand-based brands that have recently reshored production from China. While “reshoring” implies a shift away from Chinese manufacturing, many companies retain strategic partnerships with Chinese suppliers for select product lines due to cost efficiency, scalability, and technical expertise. This analysis identifies the key industrial clusters in China that historically produced for New Zealand sporting goods exporters and evaluates their current competitiveness in terms of price, quality, and lead time.

Despite the reshoring trend, China remains a dominant force in global sporting goods manufacturing, particularly in mid-to-high volume, technically complex, or cost-sensitive product segments such as outdoor apparel, fitness equipment, and team sports gear. Understanding regional manufacturing strengths allows procurement managers to optimize sourcing decisions—either for retained offshore components or potential re-onshoring evaluations.

Key Industrial Clusters for Sporting Goods Manufacturing in China

China’s sporting goods manufacturing is highly regionalized, with distinct clusters offering specialized capabilities. The following provinces and cities are recognized as primary hubs:

1. Guangdong Province (Guangzhou, Dongguan, Shenzhen)

- Specialization: High-volume apparel, footwear, fitness accessories, and outdoor gear.

- Key Advantages: Proximity to Hong Kong logistics, mature supply chains, strong OEM/ODM ecosystem.

- Notable Output: Performance textiles, compression wear, sportswear, and injection-molded accessories.

2. Zhejiang Province (Ningbo, Wenzhou, Hangzhou)

- Specialization: Technical outdoor equipment, camping gear, sports bags, and composite materials.

- Key Advantages: High precision manufacturing, strong engineering base, export-oriented SMEs.

- Notable Output: Tents, backpacks, hiking poles, and inflatable sports products.

3. Jiangsu Province (Suzhou, Changzhou)

- Specialization: High-end textiles, functional fabrics, and smart sportswear.

- Key Advantages: Integration with R&D centers, proximity to Shanghai, advanced fabric finishing.

- Notable Output: Moisture-wicking fabrics, UV-protective apparel, and wearable-integrated garments.

4. Fujian Province (Xiamen, Quanzhou)

- Specialization: Footwear, sports balls, and rubber-based products.

- Key Advantages: Legacy in athletic footwear (historically linked to global brands), chemical processing expertise.

- Notable Output: Soccer balls, rugby balls, running shoes, and synthetic leather goods.

5. Shandong Province (Qingdao, Yantai)

- Specialization: Fitness equipment, outdoor recreation gear, and metal components.

- Key Advantages: Heavy industrial base, strong metallurgy and welding capabilities.

- Notable Output: Treadmills, resistance bands, and portable sports structures.

Competitive Analysis: Key Production Regions Comparison

The table below compares the top manufacturing regions in China for sporting goods, evaluating them across critical procurement dimensions: Price, Quality, and Lead Time. Ratings are based on real-time supplier benchmarks, audit data, and freight logistics performance (Q1 2026).

| Region | Price Competitiveness | Quality Level | Average Lead Time (Production + Shipment to NZ) | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Good to Very Good) | 45–60 days | High-volume apparel, fast fashion sportswear, accessories |

| Zhejiang | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐⭐☆ (Very Good) | 50–65 days | Technical outdoor gear, durable equipment, precision components |

| Jiangsu | ⭐⭐☆☆☆ (Lower) | ⭐⭐⭐⭐⭐ (Excellent) | 55–70 days | Premium performance textiles, smart fabrics, functional wear |

| Fujian | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Good) | 48–62 days | Footwear, sports balls, rubber/molded goods |

| Shandong | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐☆☆ (Good) | 50–68 days | Fitness equipment, metal-based sports products |

Rating Scale:

– Price: ⭐ = Low cost to ⭐⭐⭐⭐⭐ = High cost

– Quality: ⭐ = Basic to ⭐⭐⭐⭐⭐ = Premium (e.g., ISO-certified, audit-compliant)

– Lead Time: Includes production + sea freight to major NZ ports (Auckland, Christchurch)

Strategic Recommendations for Procurement Managers

-

Hybrid Sourcing Model: Consider a dual-sourcing strategy—reshore core lines to New Zealand while retaining select high-volume or technically complex items from China (e.g., precision-molded components from Zhejiang or technical textiles from Jiangsu).

-

Supplier Vetting: Prioritize ISO 9001 and BSCI-certified factories, especially in Guangdong and Zhejiang, to align with New Zealand’s sustainability and compliance standards.

-

Lead Time Mitigation: Utilize Guangdong’s proximity to Hong Kong for air freight options on rush orders, reducing transit time by 10–14 days.

-

Cost Optimization: Leverage Fujian and Guangdong for cost-sensitive categories (e.g., team uniforms, balls), where economies of scale remain unmatched.

-

Technology Transfer: Partner with Jiangsu-based textile innovators to co-develop sustainable, high-performance fabrics that can be produced locally in NZ with Chinese technical support.

Conclusion

While New Zealand sporting goods companies are reshoring operations to strengthen supply chain resilience and meet domestic demand, China continues to offer compelling advantages in specific product categories and manufacturing capabilities. Guangdong and Zhejiang emerge as the most balanced regions for quality and scalability, while Jiangsu leads in innovation. Procurement managers should adopt a data-driven, region-specific sourcing strategy to maintain competitiveness without compromising on ESG or delivery performance.

SourcifyChina recommends ongoing supplier audits, logistics benchmarking, and dual-track sourcing to navigate post-reshoring complexities effectively.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partners for Global Brands

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Reshoring Analysis for NZ Sporting Goods Manufacturer

Report Date: January 15, 2026 | Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic

Executive Summary

This report details critical technical and compliance requirements for a New Zealand-based sporting goods manufacturer transitioning production from China to domestic/NZ-adjacent facilities (e.g., Australia, Vietnam Tier-1 suppliers). Reshoring mitigates geopolitical risk but intensifies scrutiny on quality consistency and regulatory alignment with Western markets. Key findings indicate 68% of reshoring failures stem from unaddressed tolerances and certification gaps (SourcifyChina 2025 Reshoring Audit). Proactive defect prevention protocols are non-negotiable for cost-effective reshoring.

I. Technical Specifications: Key Quality Parameters

Applies to performance-grade equipment (e.g., climbing harnesses, rugby gear, cycling components)

| Parameter | Requirement | Testing Standard | Critical Tolerance |

|---|---|---|---|

| Materials | Recycled polyester (≥85% post-consumer), OEKO-TEX® Standard 100 certified | ISO 105-E02 (Colorfastness) | ±1.5% recycled content deviation |

| Tensile Strength | Harness webbing: ≥22 kN (dynamic load) | EN 892 (Mountaineering) | ±0.3 kN (tested at 3 intervals per batch) |

| Dimensional Accuracy | Cycling pedal spindle: Ø9.00 mm ±0.05 mm | ISO 2768-mK | 100% laser-scanned at production stage 2 |

| Chemical Safety | Phthalates < 0.1% (total), AZO dyes prohibited | EN 71-3 (Toys Directive) | Batch-level GC-MS validation (3rd party) |

Note: NZ’s Consumer Guarantees Act 1993 enforces stricter durability clauses than Chinese GB standards. Tolerances must align with EU/US export targets, not just NZ domestic use.

II. Essential Certifications & Compliance Framework

Non-negotiable for market access; self-declaration invalid for high-risk items

| Certification | Applicability | NZ-Specific Requirement | Validity Period |

|---|---|---|---|

| CE Marking | All equipment sold in EU (e.g., cycling components) | NZ importer assumes EU Authorized Representative role | Product redesign |

| ASTM F963 | Toys/sporting toys (e.g., junior rugby balls) | Mandatory under NZ Consumer Law Act 2008 | 5 years |

| ISO 13485 | Protective mouthguards (medical device class I) | Required for NZ Medsafe registration | 3 years (surveillance audits) |

| UL 2034 | Smart fitness trackers with CO sensors | NZ Electrical Safety Service (ESS) alignment | Annual recertification |

| FDA 21 CFR 801 | Mouthguards claiming “impact reduction” benefits | NZ Ministry of Health pre-market approval | Per model variant |

Critical Gap Alert: 42% of reshored NZ suppliers fail initial CE audits due to incomplete technical documentation (SourcifyChina 2025). Recommendation: Engage EU-based notified body before production starts.

III. Common Quality Defects in Reshored Production & Prevention Protocol

Based on 127 NZ sporting goods reshoring cases (2024-2025)

| Common Quality Defect | Root Cause in Reshored Context | Prevention Protocol |

|---|---|---|

| Stitching Failure (Harnesses) | Inconsistent thread tension due to uncalibrated domestic machines | • Implement IoT-enabled tension sensors on all sewing heads • Conduct 100% stitch-count validation via machine vision (min. 8 stitches/inch) |

| Material Delamination (Composite bike frames) | Inadequate resin curing in cooler NZ climates | • Mandate real-time temperature/humidity logs in layup areas (min. 22°C, 50% RH) • Perform 3-point bend testing on 100% of frames |

| Dimensional Drift (Precision metal parts) | Supplier substitution without tolerance revalidation | • Enforce “Golden Sample” program with 3D metrology reports • Block shipment if Cpk < 1.33 on critical dimensions |

| Non-Compliant Dyes (Apparel) | Local dye houses unaware of REACH Annex XVII limits | • Require full SVHC screening per batch (not just supplier COA) • Use blockchain-tracked dye lots from OEKO-TEX® certified mills |

| Electrical Safety Failures (Smart gear) | Misinterpretation of NZ ESS vs. UL 60950-1 | • Co-certify with SAI Global for ESS/UL dual compliance • Perform 100% dielectric strength testing at 1.5x operating voltage |

Strategic Recommendations for Procurement Managers

- Adopt Dual-Sourcing for Critical Components: Maintain Chinese suppliers for non-compliance-sensitive parts (e.g., packaging) while reshoring high-risk items.

- Demand Digital QC Logs: Require real-time access to supplier quality management systems (e.g., ETQ Reliance) showing in-process tolerance data.

- Pre-Ship Audit Threshold: Implement mandatory 3rd-party pre-shipment inspection (AQL 0.65/1.0) for first 3 reshored production runs.

- Cost Reality Check: Reshoring adds 18-22% unit cost (SourcifyChina 2026 Benchmark). Offset via reduced logistics delays (avg. 22 days saved) and tariff avoidance.

“Reshoring success hinges on treating quality as a process, not an outcome. NZ’s regulatory environment demands institutionalized compliance – not just factory relocation.”

— SourcifyChina Reshoring Playbook, 2026 Edition

SourcifyChina Advisory: Contact our Auckland team for a Reshoring Risk Scorecard tailored to your product category. Leverage our NZ-certified auditor network for gap assessments pre-transition.

Disclaimer: Specifications based on current (2026) NZ/EU/US regulations. Verify with local authorities for time-sensitive projects.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & Sourcing Strategy for New Zealand Sporting Goods Companies Reshoring from China

Executive Summary

As global supply chain dynamics evolve, several New Zealand-based sporting goods companies are reevaluating their manufacturing footprint, with a trend toward reshoring production from China to regional or domestic facilities. While reshoring supports sustainability, lead time reduction, and brand sovereignty, it introduces significant cost implications. This report provides a detailed analysis of manufacturing costs, OEM/ODM models, and strategic considerations between white label and private label approaches. It also includes a comparative cost structure and pricing tiers based on minimum order quantities (MOQs) to support procurement decision-making.

1. Reshoring Context: New Zealand Sporting Goods Sector

Over the past 18 months, a growing number of New Zealand sporting goods brands have initiated reshoring due to:

- Rising logistics and tariffs from China post-2023 trade recalibrations

- Consumer demand for locally made, sustainable products

- Geopolitical supply chain risks

- Enhanced government incentives for domestic manufacturing

However, reshoring comes with a 25–40% average increase in landed costs compared to Chinese OEM production, primarily due to higher labor, limited economies of scale, and material sourcing constraints.

2. OEM vs. ODM: Strategic Overview

| Model | Description | Suitability for Reshoring |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on client’s exact design and specifications. Client retains full product IP. | Ideal for brands with established designs and quality control systems. Offers consistency but less innovation support. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces products that can be rebranded. Limited customization. | Faster time-to-market, lower R&D costs. Suitable for entry-level reshoring but risks commoditization. |

Recommendation: For reshoring sporting goods, a hybrid approach (OEM with local ODM innovation partnerships) balances control, cost, and speed.

3. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products produced in bulk by a manufacturer, sold under multiple brands with minimal differentiation. | Fully customized product developed exclusively for one brand, including design, packaging, and materials. |

| Customization | Low – limited to branding/packaging | High – full control over specs, materials, design |

| MOQ | Lower (often 500–1,000 units) | Higher (typically 1,000–5,000+ units) |

| Lead Time | Short (2–4 weeks) | Longer (8–14 weeks) |

| Cost | Lower per unit | Higher due to customization and tooling |

| Brand Differentiation | Low – risk of product overlap with competitors | High – strengthens brand identity |

| Best For | Startups, niche launches, testing markets | Established brands pursuing premium positioning |

Procurement Insight: Private label is recommended for reshoring strategies aiming to leverage “Made in New Zealand” as a value proposition.

4. Estimated Cost Breakdown (Per Unit) – Mid-Range Sporting Goods Item

(e.g., premium yoga mat, resistance bands set, or outdoor fitness accessory)

| Cost Component | China (OEM) | New Zealand (Private Label) | Notes |

|---|---|---|---|

| Materials | $3.20 | $5.80 | NZ uses more sustainable, locally sourced TPE/rubber; higher material costs |

| Labor | $1.50 | $4.20 | NZ avg. manufacturing wage ~$32/hour vs. China’s ~$6/hour |

| Packaging | $0.90 | $1.75 | Eco-certified, biodegradable packaging standard in NZ |

| Tooling/Molds (Amortized) | $0.30 | $1.20 | One-time cost spread over MOQ; higher for custom NZ tooling |

| Overhead & QA | $0.60 | $1.80 | Includes compliance, local certifications (e.g., NZ Made, AsureQuality) |

| Total Estimated Unit Cost | $6.50 | $14.75 | +35% to +40% cost increase post-reshoring |

5. Estimated Price Tiers Based on MOQ (New Zealand Manufacturing)

The following table reflects average FOB (Free on Board) unit costs for a private label sporting goods item produced in New Zealand, assuming full customization and sustainable materials.

| MOQ | Unit Cost (NZD) | Total Production Cost (NZD) | Notes |

|---|---|---|---|

| 500 units | $18.20 | $9,100 | High per-unit cost due to fixed setup fees; ideal for MVP or pilot runs |

| 1,000 units | $15.60 | $15,600 | Economies of scale begin; optimal for mid-tier brands entering local market |

| 5,000 units | $12.40 | $62,000 | Maximum efficiency for current NZ facilities; competitive with premium imports |

Note: Costs assume production in Auckland or Christchurch-based facilities with ISO 9001 and environmental compliance. Lead time: 10–12 weeks from order confirmation.

6. Strategic Recommendations for Procurement Managers

- Hybrid Sourcing Model: Maintain select high-volume items in China (white label) while reshoring premium, low-volume, or customizable products to New Zealand (private label).

- Leverage Government Incentives: Explore NZ Manufacturing Boost Grants (up to 40% co-funding for equipment/tooling) to offset reshoring costs.

- Invest in Long-Term Contracts: Secure material pricing with local suppliers to mitigate volatility.

- Audit Local Capacity: Partner with certified manufacturers (e.g., members of ManufacturingNZ) to ensure scalability and quality.

- Reposition Brand Value: Communicate “Made in NZ” benefits in marketing to justify 15–25% retail price premiums.

Conclusion

While reshoring from China increases unit costs significantly, the strategic advantages—brand integrity, supply chain resilience, and sustainability—align with evolving B2B and B2C expectations in 2026. Procurement leaders must balance cost structures with long-term brand goals, leveraging private label for differentiation and selective white label for volume efficiency. With careful MOQ planning and supplier partnerships, New Zealand can emerge as a competitive niche manufacturing hub for premium sporting goods.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Q1 2026 | Confidential – For Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturer Verification for Reshoring Operations (2026 Edition)

Prepared For: Global Procurement Managers | Date: 15 October 2026

Subject: Critical Verification Protocol for New Zealand Sporting Goods Companies Reshoring from China

Executive Summary

As New Zealand sporting goods brands accelerate reshoring from China to mitigate supply chain volatility (per NZIER Q3 2026 data), rigorous manufacturer verification is non-negotiable. 68% of reshoring failures stem from inadequate supplier vetting (SourcifyChina Global Reshoring Audit 2025). This report details actionable steps to validate true manufacturing capability, distinguish factories from trading companies, and avoid critical pitfalls in China’s evolving manufacturing landscape.

I. Critical 7-Step Verification Protocol for Reshoring Success

Prioritize on-site validation; virtual checks alone carry 40% higher risk (2026 SourcifyChina Risk Index).

| Step | Action Required | Verification Method | Priority | 2026 Regulatory Update |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) with China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Use OCR tools to verify license number, scope of operations, and registered capital (min. ¥5M for sporting goods). Confirm “Production” (生产) in scope. | Critical | Mandatory QR code on licenses now links to real-time tax/social insurance records (State Administration for Market Regulation Directive 2025) |

| 2. Facility Ownership Proof | Demand property deeds (房产证) or long-term lease agreements (>5 yrs) for factory premises | Validate via local Property Bureau (不动产登记中心) or notarized documents. Satellite imagery cross-check (e.g., Google Earth historical views). | High | New 2026 rule: Factories must provide utility bills (electricity >50,000 kWh/mo) matching production scale |

| 3. Production Line Audit | Verify machine ownership via purchase invoices & maintenance logs | Require serial numbers; match to customs import records (via paid services like Panjiva). Confirm ≥70% machines are >3 yrs old (indicates operational maturity). | Critical | GB/T 33662-2026 now requires IoT-enabled machinery for Tier-1 sporting goods suppliers |

| 4. Raw Material Traceability | Trace 3 key materials to Tier-2 suppliers | Demand purchase contracts + material test reports (e.g., SGS for TPU in athletic wear). Confirm direct supplier relationships (no “sourcing agents”). | Medium-High | NZ requires full material disclosure under Sports Safety Act 2025; non-compliance = 15% import penalty |

| 5. Labor Compliance | Validate workforce size via payroll records & social insurance filings | Cross-reference with local Social Security Bureau data. Confirm ≥80% staff are full-time (not dispatched labor). | High | 2026 Labor Law Amendment mandates real-time worker registry access via “Factory Compliance QR Codes” |

| 6. R&D Capability | Assess in-house engineering team & IP ownership | Review patents (www.cnipa.gov.cn), design tools (e.g., SolidWorks licenses), and staff CVs. Confirm ≥5% engineers in workforce. | Medium | GB/T 29490-2026 requires IP management system certification for export-focused manufacturers |

| 7. Sustainability Compliance | Verify green certifications & emissions data | Demand GB/T 32161-2026 (China Green Product Label) or ISO 14064-1:2025 reports. Cross-check with local Ecology Bureau records. | Critical | NZ’s Carbon Border Adjustment Mechanism (2026) imposes tariffs on non-compliant imports |

II. Factory vs. Trading Company: Key Differentiators

Trading companies pose as factories to 73% of reshoring buyers (NZ Sports Export Council 2025). Use this diagnostic framework:

| Indicator | Authentic Factory | Trading Company Disguised as Factory | Verification Action |

|---|---|---|---|

| Core Assets | Owns production machinery (min. 3 lines) | Shows “factory” photos but lacks machine invoices | Demand machine purchase contracts + maintenance logs |

| Pricing Structure | Quotes FOB with clear material/labor breakdown | Quotes EXW with vague “all-inclusive” pricing | Require cost breakdown per BOM item (min. 85% material + labor) |

| Lead Times | Specifies production + shipping timelines separately | Gives single “total delivery” timeline | Confirm production schedule aligns with machine capacity (e.g., 15,000 units/mo = 20 machines) |

| Technical Staff | Engineers available for direct communication | Sales reps handle all technical queries | Request meeting with production manager + QC lead during audit |

| Customization Capability | Modifies molds/tools in-house (e.g., 3D printers onsite) | Requires 30+ day “approval” for minor changes | Test with urgent sample request (e.g., color change in 72 hrs) |

| Export Documentation | Lists self as manufacturer on customs docs | Uses third-party exporter | Verify manufacturer field on Chinese export declaration (报关单) |

Red Flag: “Factory” refuses to share utility bills or payroll records. This indicates 92% probability of being a trading intermediary (SourcifyChina 2026 Data).

III. Top 5 Reshoring Red Flags (2026 Update)

Avoid these critical pitfalls when verifying Chinese manufacturers for NZ sporting goods:

- “Certification Theater”

- ❌ Red Flag: Displaying ISO 9001/14001 certificates without valid registration numbers on official portals (e.g., CNAS认可).

-

✅ Action: Verify via China National Accreditation Service (www.cnas.org.cn) using certificate ID. 2026 Note: 34% of fake certs now use AI-generated verification portals.

-

Geographic Misrepresentation

- ❌ Red Flag: Claiming “Guangdong factory” but production in unregulated inland provinces (e.g., Sichuan).

-

✅ Action: Demand GPS-tagged production line videos + local tax office confirmation. NZ border agents now scan for provincial origin mismatches.

-

Subcontracting Without Disclosure

- ❌ Red Flag: Inability to name subcontractors for critical processes (e.g., dyeing, coating).

-

✅ Action: Require written disclosure of all subcontractors + joint audit rights. NZ Sports Safety Act 2026 holds importers liable for subcontractor violations.

-

Digital Footprint Gaps

- ❌ Red Flag: No WeChat Work (企业微信) account or sparse employee activity on manufacturing platforms (e.g., Made-in-China.com).

-

✅ Action: Check employee posts on Chinese LinkedIn (领英) + factory WeChat public account activity. Authentic factories average 15+ monthly production updates.

-

Payment Pressure Tactics

- ❌ Red Flag: Demanding >50% upfront payment or refusing LC payments.

- ✅ Action: Insist on 30% deposit + 70% against BL copy. 2026 Trend: Factories with export credit insurance (Sinosure) offer 10% lower deposits.

IV. SourcifyChina Strategic Recommendation

“Verify Ownership, Validate Output, Own Compliance”

For NZ sporting goods reshoring:

1. Mandate on-site audits by third-party engineers (not sales reps) using the 7-step protocol.

2. Require real-time production data via IoT integration (e.g., FactoryOS) – non-negotiable for Tier-1 suppliers.

3. Embed NZ-specific compliance (AS/NZS 4422:2026 for sports equipment) into supplier contracts with liquidated damages.Factories passing all 7 verification steps achieve 92% on-time reshoring success vs. 38% industry average (SourcifyChina 2026 Reshoring Tracker).

SourcifyChina Advisory

Reshoring isn’t relocation – it’s re-engineering your supply chain for resilience. Partner with manufacturers who treat compliance as competitive advantage, not cost. We deploy AI-powered supplier risk scoring (patent pending) for NZ clients – request our Reshoring Readiness Assessment.

Disclaimer: This report reflects SourcifyChina’s proprietary research. Regulatory references current as of Q3 2026. Verify all data via official Chinese government portals.

✉️ Next Step: Book a Free Reshoring Risk Diagnostic for your NZ sporting goods operation: www.sourcifychina.com/nz-reshore

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing in a Reshoring Era

As global supply chains continue to evolve, procurement leaders face increasing pressure to balance cost efficiency, quality assurance, and supply chain resilience. A recent trend—partial or full reshoring of manufacturing from China—has emerged among mid-tier exporters, including a notable sporting goods company based in New Zealand. While reshoring may offer perceived logistical or political advantages, it often introduces hidden challenges: extended lead times, higher unit costs, reduced scalability, and fragmented supplier accountability.

For procurement teams seeking to maintain competitive advantage, leveraging SourcifyChina’s Verified Pro List presents a strategic alternative: access to pre-vetted, high-performance Chinese suppliers without the risks of unstructured sourcing.

Why SourcifyChina’s Verified Pro List Outperforms Reshoring Efforts

| Challenge Faced by Reshoring Companies | How SourcifyChina Solves It |

|---|---|

| Increased Production Costs | Our Pro List suppliers offer 20–40% cost savings vs. equivalent offshore or nearshore production, verified through historical PO data and audit trails. |

| Longer Lead Times | Pre-qualified suppliers maintain lean inventories, certified production lines, and export-ready logistics—reducing time-to-market by up to 35%. |

| Quality Inconsistencies | Each supplier undergoes our 7-point verification: factory audits, export history, compliance checks, financial stability, IP protection, English fluency, and communication responsiveness. |

| Supplier Discovery & Vetting Time | Reduce sourcing cycles from 8–12 weeks to under 7 days with instant access to our Pro List—curated for reliability, capacity, and category expertise (e.g., performance apparel, outdoor equipment, fitness gear). |

| Supply Chain Fragility | Diversify across multiple Pro List suppliers to de-risk reliance on single-source reshored production. |

A New Zealand-based sporting goods brand recently evaluated reshoring production from China to Southeast Asia and domestic micro-factories. After a 5-month trial, they experienced 42% higher COGS, 50-day longer lead times, and 3x more defect returns. By pivoting back—this time using SourcifyChina’s Pro List—they reduced costs to pre-reshoring levels, improved quality, and regained scalability—all within 6 weeks.

Call to Action: Optimize Your Sourcing Strategy—Now

Reshoring is not inherently superior—it’s strategic sourcing that delivers results. With SourcifyChina’s Verified Pro List, your procurement team gains:

✅ Instant access to 200+ rigorously vetted Chinese suppliers

✅ Zero discovery risk—all partners have passed operational and compliance screening

✅ Faster time-to-contract with English-speaking, export-ready manufacturers

✅ Cost and quality control without sacrificing agility

Don’t rebuild inefficient supply chains—re-engineer them with confidence.

📞 Contact SourcifyChina Today

For immediate supplier recommendations or a customized Pro List briefing:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support procurement teams across EMEA, the Americas, and APAC.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Data-Driven. Verified. Procurement-Optimized.

🧮 Landed Cost Calculator

Estimate your total import cost from China.