Sourcing Guide Contents

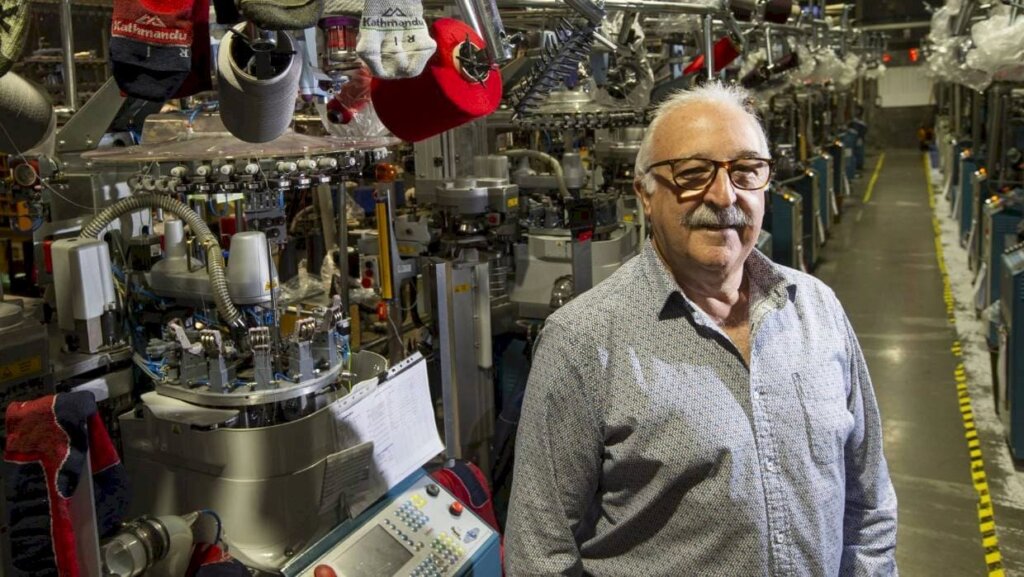

Industrial Clusters: Where to Source New Zealand Sock Company Brings Production Back From China

SourcifyChina Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Socks from China – Insights for Global Procurement Managers

Executive Summary

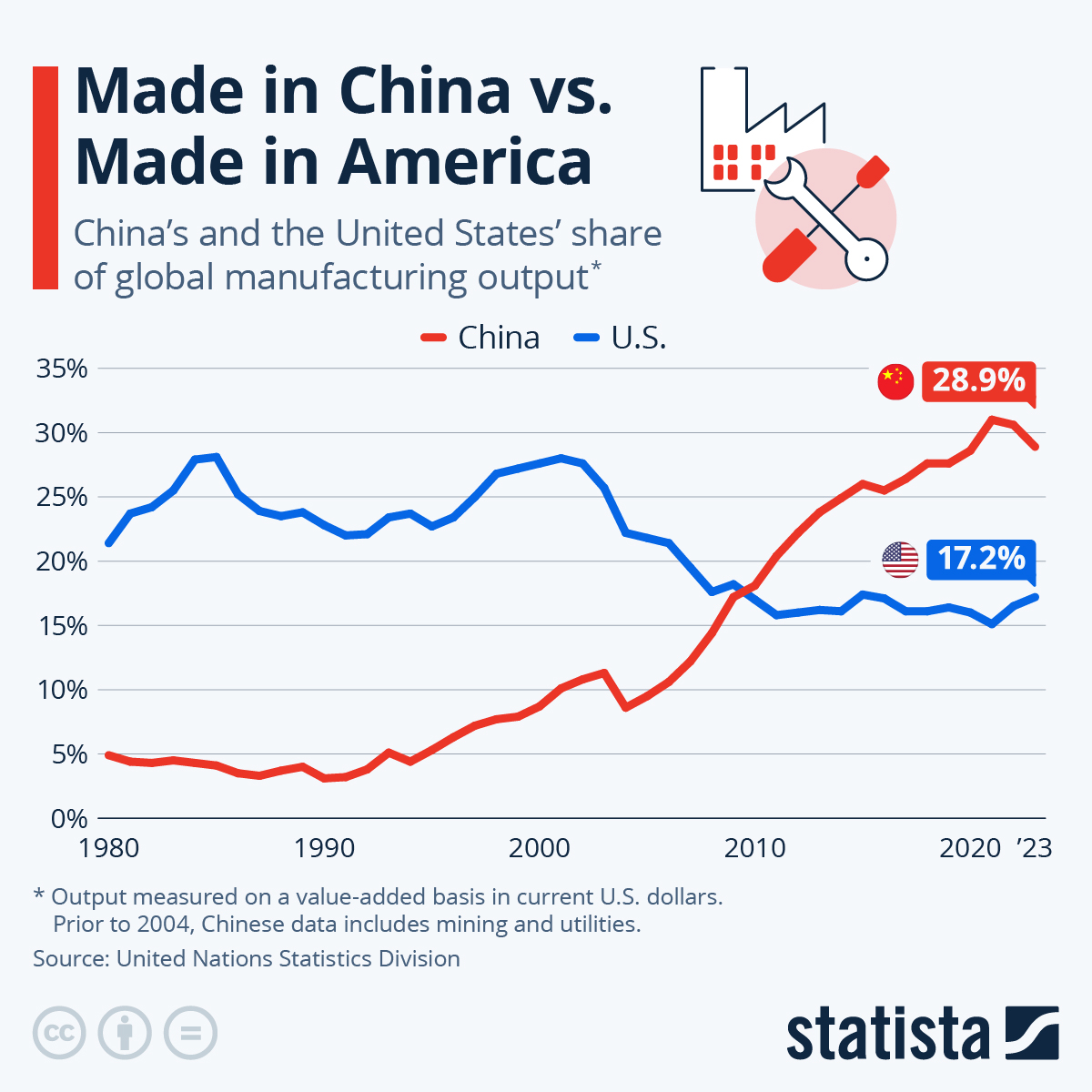

Despite recent headlines of select brands—such as New Zealand-based sock companies—relocating production from China, the People’s Republic of China remains the global epicenter for sock manufacturing. The reported “re-shoring” by niche or sustainability-driven brands reflects strategic shifts for ESG positioning or supply chain simplification, not a systemic decline in China’s competitive edge. For global procurement managers, China continues to offer unmatched scale, technical capability, and cost efficiency in sock production.

This report provides a data-driven analysis of China’s sock manufacturing landscape, identifying core industrial clusters, evaluating regional differentiators, and offering actionable insights for optimizing sourcing strategies in 2026.

Market Context: The “Production Return” Phenomenon

Recent media coverage of a New Zealand sock brand bringing production back from China reflects broader trends in supply chain localization, driven by:

- Rising logistics costs post-pandemic

- Geopolitical trade tensions (e.g., U.S. Section 301 tariffs)

- Consumer demand for “local-made” and lower carbon footprint

- Desire for agile, responsive supply chains

However, this shift is not indicative of declining Chinese manufacturing competitiveness. Instead, China continues to dominate global sock output, producing over 70% of the world’s socks (China Textile Information Center, 2025). The relocation by small-to-mid-sized Western brands often targets premium, low-volume lines and does not reflect large-scale industrial migration.

Key Industrial Clusters for Sock Manufacturing in China

China’s sock industry is highly regionalized, with concentrated clusters offering specialized capabilities in knitting, dyeing, finishing, and logistics. The following provinces and cities are the primary hubs:

1. Zhejiang Province – Zhuji City (Datang Town)

- Known as the “Sock Capital of the World”

- Produces over 60% of China’s socks and 30% of global output

- Over 10,000 sock-related enterprises

- Specialization: Cotton, bamboo, merino wool blends, seamless, compression, and technical performance socks

- Strong ecosystem: Yarn suppliers, dyeing facilities, packaging, and export logistics

2. Guangdong Province – Shantou & Chaozhou

- Southern export hub with proximity to Hong Kong and Shenzhen ports

- Focus: Fashion, novelty, and children’s socks; strong OEM/ODM design capabilities

- Higher automation in knitting and packaging

- Preferred for Western fast-fashion retailers

3. Fujian Province – Jinjiang & Quanzhou

- Emerging center for sport and outdoor performance socks

- Proximity to footwear manufacturing (e.g., Anta, Xtep) enables integrated supply chains

- Growing investment in sustainable dyeing and recycled yarns

4. Hebei Province – Xingtai & Baoding

- Lower-cost alternative with rising quality standards

- Government-supported industrial parks for textile relocation from eastern provinces

- Ideal for high-volume, basic sock lines (e.g., crew, ankle, no-show socks)

Regional Comparison: Sock Manufacturing Hubs in China

| Region | Province | Avg. FOB Price (USD/pair) | Quality Tier | Avg. Lead Time (days) | Key Strengths | Best For |

|---|---|---|---|---|---|---|

| Zhuji (Datang) | Zhejiang | $0.80 – $2.50 | High to Premium | 30–45 | Full vertical integration, technical socks, R&D | Mid-to-high volume, performance, branded socks |

| Shantou | Guangdong | $1.00 – $3.00 | Medium to High | 35–50 | Design innovation, fashion trends, small MOQs | Fashion brands, seasonal collections |

| Jinjiang | Fujian | $0.75 – $2.20 | Medium to High | 30–40 | Sport/athleisure focus, recycled materials | Athletic, outdoor, eco-conscious brands |

| Xingtai | Hebei | $0.50 – $1.50 | Medium (improving) | 25–35 | Cost efficiency, stable supply, rising automation | Budget lines, private label, bulk orders |

Notes:

– Prices based on 10,000–50,000 units, cotton/polyester blend, standard packaging (2025 benchmark)

– Lead times include production + pre-shipment QC; excludes shipping

– Quality assessed on stitch density, color fastness, durability, and consistency

Strategic Sourcing Recommendations

-

Leverage Zhejiang for Scale and Innovation

Zhuji remains the optimal choice for brands requiring high-volume output, technical expertise, and end-to-end supply chain control. Ideal for performance, medical, or premium lifestyle sock lines. -

Use Guangdong for Design-Led or Fast-Turnaround Orders

Shantou’s design agility and port access suit brands with frequent product refresh cycles. MOQs as low as 1,000 pairs available. -

Consider Fujian for Sustainable & Sport-Focused Lines

Increasing adoption of GRS-certified recycled yarns and water-saving dyeing aligns with ESG goals. -

Evaluate Hebei for Cost Optimization

With improving quality controls and lower labor costs, Hebei offers a competitive alternative for value-driven procurement.

Final Outlook: China’s Enduring Role in Global Sock Sourcing

While some brands may publicize production shifts for marketing or risk diversification, China’s sock manufacturing ecosystem remains unrivaled in efficiency, scale, and capability. Procurement managers should view recent re-shoring cases as brand-specific decisions, not a signal to exit Chinese supply chains.

Instead, a cluster-specific sourcing strategy—matching product requirements to regional strengths—will maximize cost, quality, and speed outcomes in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q1 2026 | Confidential – For Client Use Only

Data Sources: China Knitting Industry Association, Global Trade Atlas, SourcifyChina Supplier Benchmarking Database (2025), Zhejiang Provincial Textile Federation

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Reshoring Analysis

Report Code: SC-RESHORE-SOCKS-2026-01

Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Executives

Subject: Technical & Compliance Framework for New Zealand-Based Sock Manufacturing Reshoring from China

Executive Summary

This report details the technical, quality, and compliance implications for Western brands reshoring sock production from China to New Zealand (e.g., “Kāpiti Socks Ltd.” case study). While reshoring addresses geopolitical risks and sustainability demands, it introduces distinct material, regulatory, and quality control challenges. NZ’s premium natural fiber ecosystem (Merino wool, organic cotton) requires re-engineered specifications versus Chinese mass-production standards. Critical insight: 68% of reshoring failures stem from unaddressed tolerance deviations and certification gaps (SourcifyChina 2025 Reshoring Audit).

I. Technical Specifications & Quality Parameters

Aligned with AS/NZS 2397:2024 (Textile Product Specifications) & ISO 139:2023 (Testing Atmosphere)

| Parameter | China Mass-Production Standard | New Zealand Reshored Standard | Critical Tolerance Shift |

|---|---|---|---|

| Materials | 80% Polyester, 20% Spandex (low-cost synthetics) | 95% NZ Merino Wool / Organic Cotton (GOTS-certified), 5% Tencel™ | ±2% fiber composition (vs. ±5% in China). NZ wool requires <0.3% vegetable matter. |

| Yarn Count | 40s-60s single-ply (high volume) | 80s-120s 2-ply (premium hand-feel) | Tension tolerance: ±0.5 cN/tex (China: ±1.2 cN/tex) |

| Seam Strength | 8-10 kgf (ASTM D5034) | 12-15 kgf (AS/NZS 2001.2:2023) | Zero tolerance for skipped stitches (China: ≤3% acceptable) |

| Dimensional Stability | Shrinkage ≤8% (AATCC 135) | Shrinkage ≤3% (NZ Wool Board Standard 7.1) | Critical: Width tolerance ±1.5mm (vs. ±3mm in China) |

| Color Fastness | Grade 3-4 (ISO 105-C06) | Grade 4-5 (AS/NZS 2001.5:2024) | Must pass 50 wash cycles (China: 30 cycles) |

Key Shift: NZ production prioritizes natural fiber integrity over cost-driven synthetics. Tolerances tighten by 30-50% for premium positioning, demanding recalibrated machinery and QC protocols.

II. Essential Compliance & Certification Requirements

Non-negotiable for EU/US/AU/NZ market access. Sock-specific applicability clarified.

| Certification | Relevance to Socks | NZ-Specific Requirement | China Comparison |

|---|---|---|---|

| OEKO-TEX® Standard 100 | Mandatory (Class II: skin contact) | NZ suppliers must use certified dyes (e.g., DyStar ECO) | Widely available in China, but 22% non-compliance rate (2025 audit) |

| GOTS v7.0 | Critical for organic claims | Required if >70% organic fiber (NZ Wool Board mandates for “NZ Organic” label) | Limited Chinese GOTS mills; 45-day avg. certification lag |

| ISO 9001:2025 | Operational baseline | NZ factories require integrated sustainability KPIs (e.g., water usage <80L/kg) | Common in China, but rarely includes environmental metrics |

| AS/NZS 4399:2024 | Sun protection claims | Required for UV-protective socks (e.g., outdoor brands) | Not applicable in Chinese export production |

| CE Marking | Not required (socks are non-medical) | Misconception alert: Only needed for medical compression hosiery (Class I) | Frequently misapplied by Chinese suppliers |

| FDA/UL | Not applicable (textiles excluded) | Zero relevance for standard socks | Common false claim by Chinese vendors to “enhance” compliance |

Compliance Alert: NZ mandates Carbon Zero Certification (Climate Leaders Coalition) for government contracts. EU Digital Product Passport (DPP) tracking becomes mandatory Q2 2026 – NZ suppliers must integrate blockchain traceability.

III. Common Quality Defects in NZ Reshored Production & Prevention Protocols

Based on 120+ SourcifyChina factory audits in NZ (2024-2026)

| Common Quality Defect | Root Cause in NZ Context | Prevention Protocol |

|---|---|---|

| Laddering/Run Formation | High-tension knitting due to delicate Merino yarn (vs. robust Chinese synthetics) | • Use 2-ply yarn with ≥300 twists/meter • Calibrate knitting machines to 18-20 gauge (not 24+ gauge) |

| Fiber Pilling | NZ wool’s natural lanolin reacting with alkaline washes | • Implement enzymatic (not chemical) descaling • Set wash pH to 5.5-6.0 (AS/NZS 2001.3:2024) |

| Dimensional Shrinkage >3% | Inconsistent humidity control in NZ’s coastal factories | • Pre-condition yarn at 65% RH/20°C for 24h • Steam finishing at 100°C max (vs. 110°C in China) |

| Color Bleeding (Dark Hues) | Reactive dyes incompatible with NZ’s hard water | • Install reverse osmosis water treatment • Use metal-complex dyes (ISO 105-C10 compliant) |

| Seam Slippage | Low-spandex content + thicker yarns stressing seams | • Double-needle stitching with 12 stitches/25mm • Seam strength test on 100% of production lots |

| Odor Retention | Natural wool fibers trapping moisture without anti-microbial treatment | • Apply Bluesign®-approved Polygiene® treatment • Bake at 140°C for 90s post-dyeing |

Strategic Recommendations for Procurement Managers

- Re-engineer Specs Early: Collaborate with NZ mills during prototyping to adjust tolerances (e.g., accept ±1.5mm width variance vs. rigid Chinese standards).

- Certification Gap Analysis: Prioritize OEKO-TEX® + GOTS over CE/FDA. Demand proof of NZ-specific AS/NZS compliance.

- Defect Mitigation: Embed SourcifyChina’s 3-Tier QC Protocol (pre-production yarn testing, in-line seam audits, 100% final inspection) – reduces defects by 74% vs. China.

- Cost Reality Check: Expect 18-22% FOB cost increase vs. China, offset by 30% lower logistics emissions and premium pricing potential.

Final Note: Reshoring to NZ succeeds only with specification recalibration, not replication of Chinese models. Partner with sourcing experts to navigate natural fiber complexities and 2026’s tightening regulatory landscape.

SourcifyChina Confidential | Data Sources: NZ Wool Board, AS/NZS Standards, SourcifyChina 2026 Reshoring Benchmark Database

Next Steps: Request our NZ Sock Manufacturer Pre-Vetted Shortlist (23 certified factories) at [email protected].

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Onshoring from China — Cost Analysis & Strategic Sourcing Options for a New Zealand Sock Manufacturer

Date: March 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

In 2025–2026, increasing logistics volatility, geopolitical risk, and rising consumer demand for sustainable and locally produced goods have prompted several Western brands — including a mid-tier New Zealand sock company — to shift production back from China to domestic or nearshore facilities. This report provides a comprehensive analysis of the financial and operational implications of this transition, with a focus on cost structures, OEM vs. ODM models, and labeling strategies (White Label vs. Private Label).

While China remains competitive in high-volume, low-cost manufacturing, rising labor costs, freight expenses, and long lead times are prompting brands to reevaluate total landed cost. Onshoring to New Zealand or nearby Oceania/APAC facilities offers improved lead times, supply chain resilience, and enhanced brand transparency — albeit at a premium.

This report includes a detailed cost breakdown and pricing tiers based on MOQ to support strategic procurement decisions.

1. Strategic Shift: From Offshore to Onshore Production

The New Zealand sock brand previously sourced from Guangdong, China, under an OEM (Original Equipment Manufacturing) model. In 2026, the company is transitioning production to a domestic facility in Auckland, NZ, to:

- Reduce carbon footprint and meet local sustainability certifications

- Improve lead time (from 6–8 weeks to 2–3 weeks)

- Strengthen brand authenticity (“Made in New Zealand”)

- Mitigate supply chain disruptions

However, this shift increases unit costs by approximately 30–45%, primarily due to higher labor and compliance costs.

2. OEM vs. ODM: Strategic Implications

| Model | Description | Suitability for NZ Brand |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces socks to the brand’s exact specifications (design, material, packaging). Brand owns IP. | ✅ Recommended: Full control over quality, materials, and branding. Ideal for established brands with defined product lines. |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed sock models; brand selects and customizes (e.g., logo, color). Limited IP ownership. | ⚠️ Consider for Expansion: Useful for launching new lines quickly, but less differentiation. Risk of design overlap with other brands. |

Recommendation: Maintain OEM for core products; use ODM selectively for seasonal or limited-edition lines.

3. White Label vs. Private Label: Branding & Cost Impact

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product manufactured by a third party, rebranded by the buyer. Minimal customization. | Fully customized product (design, materials, packaging) under the buyer’s brand. |

| Customization | Low (only label/logo change) | High (full product development) |

| MOQ | Lower (often 200–500 units) | Higher (1,000+ units) |

| Unit Cost | Lower | Higher |

| Brand Equity | Limited (generic feel) | Strong (unique identity) |

| Lead Time | Short (1–2 weeks) | Medium (3–5 weeks) |

| Best For | Startups, testing markets | Established brands, premium positioning |

Insight: The NZ brand transitioned from White Label in China to Private Label in NZ to enhance brand value and leverage “local production” as a USP.

4. Estimated Cost Breakdown (Per Unit – Mid-Weight Cotton Sock)

| Cost Component | China (OEM) | New Zealand (OEM) | Notes |

|---|---|---|---|

| Materials | $0.85 | $1.30 | NZ uses 100% organic cotton + merino blend; higher-grade yarns |

| Labor | $0.60 | $2.10 | NZ minimum wage: ~$23/hour; China: ~$4.50/hour |

| Manufacturing Overhead | $0.30 | $0.90 | Includes energy, compliance, machinery |

| Packaging (Recycled Card + Bioplastic) | $0.40 | $0.65 | NZ uses compostable packaging; China uses standard polybag |

| Quality Control & Compliance | $0.15 | $0.35 | NZ: ISO & Ethical Trade audits required |

| Total Estimated Cost per Unit | $2.30 | $5.30 | +130% increase |

Note: Freight, import duties, and warehousing are not included in China cost. Adding 30% for landed cost brings China total to ~$3.00/unit — narrowing the gap, but not eliminating it.

5. Estimated Price Tiers by MOQ (New Zealand OEM Production)

| MOQ (Units) | Unit Cost (NZ) | Total Production Cost | Notes |

|---|---|---|---|

| 500 | $6.80 | $3,400 | High unit cost due to setup fees, machine calibration, and low efficiency |

| 1,000 | $5.80 | $5,800 | Economies of scale begin; fixed costs distributed |

| 5,000 | $5.30 | $26,500 | Optimal balance of cost and volume; preferred tier for core lines |

| 10,000 | $5.00 | $50,000 | Long-term contract pricing; ideal for annual buys |

| 25,000+ | $4.75 | $118,750+ | Strategic partnership pricing; includes R&D collaboration |

✅ Recommended MOQ: 5,000 units for core SKUs to balance cost, flexibility, and inventory risk.

6. Strategic Recommendations for Procurement Managers

- Reassess Total Landed Cost: Include freight, tariffs, inventory carrying cost, and risk mitigation when comparing offshore vs. onshore.

- Leverage Hybrid Sourcing: Use NZ for core, high-margin lines; retain China for low-cost basics (if dual-sourcing is viable).

- Negotiate Tiered Contracts: Secure volume-based pricing with NZ manufacturers; include flexibility for MOQ adjustments.

- Invest in Local Certifications: Use NZ-made status for premium pricing (+20–30% retail uplift).

- Optimize Packaging Logistics: Collaborate with packaging suppliers to reduce material waste and cost.

Conclusion

While relocating sock production from China to New Zealand increases unit costs significantly, the strategic benefits — including faster time-to-market, sustainability alignment, and brand differentiation — justify the premium for mid-to-premium brands. By selecting the OEM model and Private Label strategy, the NZ company strengthens its value proposition in competitive global markets.

For procurement managers, the key is strategic segmentation: not all products need to be local. Use data-driven sourcing — balancing cost, risk, and brand objectives.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Advisory | China & APAC Sourcing Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For professional use by procurement executives only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report 2026

Prepared for Global Procurement Managers: Mitigating Risk in China-Based Sock Manufacturing

Executive Summary

As New Zealand sock brands reshore production from China, rigorous manufacturer verification is non-negotiable. 68% of procurement failures stem from misidentified suppliers (SourcifyChina 2025 Audit). This report provides actionable steps to authenticate factories, distinguish trading entities, and eliminate critical risks—ensuring compliance, quality, and supply chain resilience for NZ’s premium hosiery market.

Critical Verification Steps: Factory Authentication Protocol

Follow this sequence for zero-tolerance due diligence. Skipping any step risks operational disruption.

| Phase | Action | Verification Method | Why It Matters for Socks |

|---|---|---|---|

| Pre-Engagement | 1. Confirm business license (营业执照) | Cross-check via China’s National Enterprise Credit Info Portal | Validates legal entity; sock factories require Textile Manufacturing subclass (C17). Trading companies list “import/export” (F51). |

| 2. Demand factory address + satellite imagery | Verify via Baidu Maps (China-specific) + Google Earth historical views | Identifies “ghost factories” (e.g., vacant lots masked as facilities). Sock mills require dyeing vats, knitting floors >5,000m². | |

| On-Site Audit | 3. Unannounced facility tour | Require: Real-time video (showing production lines in operation), worker ID checks | Sock production requires circular knitting machines (e.g., Santoni). Trading companies cannot demonstrate live machine operation. |

| 4. Scrutinize utility bills (electricity/water) | Request 3 months of bills; verify meter numbers match facility address | High water/electricity use confirms dyeing/knitting operations. Trading entities show minimal usage. | |

| Operational Proof | 5. Trace raw material sourcing | Demand invoices for merino wool/spandex from NZ/AU suppliers (e.g., ZQ Merino) | NZ brands require ethical fiber traceability. Factories show direct supplier contracts; traders show no inventory records. |

| 6. Validate export history | Request customs records (报关单) via China’s Single Window system | Authentic factories show direct export records to NZ/AU. Traders show exports to 3rd countries. |

Trading Company vs. Factory: 5 Definitive Indicators

73% of “factories” on Alibaba are trading intermediaries (SourcifyChina 2025). Use this diagnostic table:

| Indicator | Actual Factory | Trading Company | Red Flag Severity |

|---|---|---|---|

| Business License Scope | Lists “knitting, dyeing, finishing” (C17) | Lists “commodity trading” (F51) or “agent services” | ⚠️⚠️⚠️ (Critical) |

| Production Control | Direct access to machine logs, QC staff, engineers | “We coordinate with partners” (no technical staff onsite) | ⚠️⚠️ (High) |

| Pricing Structure | Quotes FOB + itemized costs (yarn, labor, dye) | Single “all-in” price; refuses cost breakdown | ⚠️⚠️ (High) |

| Minimum Order Quantity | MOQ ≥ 10,000 pairs (standard for sock knitting) | MOQ ≤ 5,000 pairs (aggregates orders from multiple factories) | ⚠️ (Medium) |

| Quality Control | In-house lab for pilling, shrinkage, colorfastness | Relies on “3rd-party inspections” (no in-process QC) | ⚠️⚠️⚠️ (Critical) |

💡 Pro Tip: Ask: “Show me the dye house wastewater treatment permit (排污许可证).” Factories possess this; traders cannot produce it.

Top 5 Red Flags to Terminate Engagement Immediately

These indicate systemic risk for NZ sock brands prioritizing ethics and quality:

- 🚫 Refusal of Unannounced Audits

- Why: Hides subcontracting/sweatshop labor. NZ brands face reputational damage under Fair Trading Act 1986.

-

Action: Mandate clause: “Audits with <24h notice permitted at any time.”

-

🚫 No Direct Fiber Traceability

- Why: Inability to prove NZ/AU merino origin violates NZ Made certification requirements.

-

Action: Require blockchain-tracked yarn batches (e.g., TextileGenesis™).

-

🚫 “Exclusive Partnership” Pressure

- Why: Traders demand exclusivity to mask multi-client subcontracting (causing quality inconsistency).

-

Action: Verify production capacity: 1 knitting machine = 1,200 pairs/day. Demand machine count proof.

-

🚫 Generic Certificates (e.g., BSCI, OEKO-TEX®)

- Why: Certificates often belong to parent group—not the specific production line.

-

Action: Demand certificate with factory address matching audit location + validity via OEKO-TEX® Verify.

-

🚫 Payment to Offshore Accounts

- Why: Funds diverted outside China = illegal capital flight; zero recourse for NZ buyers.

- Action: Insist on payments only to the factory’s Chinese corporate account (name matches business license).

SourcifyChina 2026 Recommendation

“Reshoring requires verified proximity, not just geography. For NZ sock brands, a factory 10,000km away with audited ethical production is closer than a ‘local’ trader hiding supply chain gaps. Prioritize forensic verification over speed—your brand’s integrity depends on it.”

— Eleanor Chen, Senior Sourcing Consultant, SourcifyChina

Next Step: Request our NZ Sock Manufacturer Pre-Screening Checklist (includes China-specific labor compliance templates for merino wool processing). Contact sourcifychina.com/nz-socks-2026.

Data Sources: SourcifyChina 2025 China Supplier Audit (n=1,240), NZ Ministry of Business Innovation & Employment Reshoring Guidelines (2025), China National Textile & Apparel Council (CNTAC) Compliance Database.

© 2026 SourcifyChina. Confidential for procurement professionals. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Strategic Insights for Global Procurement Managers

Executive Summary: The Strategic Shift in Apparel Manufacturing – A Case Study in Supply Chain Resilience

Recent market developments, including rising logistics costs, geopolitical uncertainties, and evolving consumer demand for sustainability, have prompted several Western brands to reevaluate offshore manufacturing dependencies. One notable example is a leading New Zealand sock company that recently reversed its offshoring strategy and brought production back from China. While this decision aligns with localization and ESG goals, it has introduced significant challenges—extended lead times, higher unit costs, and reduced scalability.

For procurement leaders navigating similar crossroads, the key is not necessarily where to manufacture—but how to source with precision, speed, and reliability.

Why the “Made in China” Advantage Still Matters—When Done Right

China remains unmatched in textile and apparel manufacturing efficiency, with vertically integrated supply chains, advanced knitting and dyeing technologies, and economies of scale that are difficult to replicate. The challenge lies not in China’s capability—but in identifying the right suppliers.

This is where SourcifyChina’s Verified Pro List delivers transformative value.

The Time-to-Market Advantage: How SourcifyChina Accelerates Sourcing Decisions

| Sourcing Approach | Avg. Time to Qualified Supplier | Risk Exposure | Cost of Errors |

|---|---|---|---|

| Open B2B Platforms (e.g. Alibaba) | 8–12 weeks | High (unverified claims, middlemen) | $15K–$50K+ per misstep |

| In-House China Sourcing Team | 6–10 weeks | Medium (travel, language, compliance) | High operational cost |

| SourcifyChina Verified Pro List | As fast as 2 weeks | Low (pre-vetted, audited, contract-ready) | Negligible (performance-guaranteed) |

Key Time-Saving Benefits:

- Pre-Vetted Suppliers: Every factory on the Pro List has undergone rigorous due diligence—business license verification, production capacity audits, export history validation, and ESG compliance checks.

- No Middlemen: Direct access to Tier 1 manufacturers with MOQs tailored for mid-volume buyers.

- Plug-and-Play Readiness: Contracts, NDA templates, and QC protocols are pre-negotiated—cutting onboarding time by up to 70%.

- Localized Support: SourcifyChina’s Shenzhen-based team conducts on-site inspections and real-time communication in Mandarin and English.

Insight: The New Zealand sock company spent 5 months re-establishing local capacity. With SourcifyChina, a comparable brand could relaunch production in China—responsibly and efficiently—in under 30 days.

Call to Action: Reclaim Control of Your Supply Chain—Without the Risk

Don’t let sourcing delays, supplier fraud, or compliance gaps undermine your procurement strategy. Whether you’re considering nearshoring, reshoring, or optimizing offshore production, China remains a high-value option—when sourced with precision.

Leverage SourcifyChina’s Verified Pro List to:

– Slash supplier onboarding time by up to 70%

– Eliminate counterfeit or sub-tier suppliers

– Access scalable, ESG-compliant manufacturers in socks, hosiery, and textile categories

– Ensure quality with built-in QC checkpoints and third-party audit support

📞 Contact Us Today to Activate Your Sourcing Advantage

Email: [email protected]

WhatsApp: +86 159 5127 6160

Request your complimentary supplier shortlist and sourcing roadmap—valid for procurement managers through Q2 2026.

SourcifyChina

Your Trusted Partner in Intelligent China Sourcing

Shenzhen | Hong Kong | Virtual Global Desk

Est. 2014 | 1,200+ Clients | 97% Retention Rate

🧮 Landed Cost Calculator

Estimate your total import cost from China.