Sourcing Guide Contents

Industrial Clusters: Where to Source New Zealand Equestrian Company Reshoring Production From China

SourcifyChina Sourcing Intelligence Report: Equestrian Manufacturing Landscape in China

Report Code: SC-CHN-EQ-2026-01

Date: October 26, 2026

Prepared For: Global Procurement Managers | Equestrian & Equestrian-Adjacent Goods

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

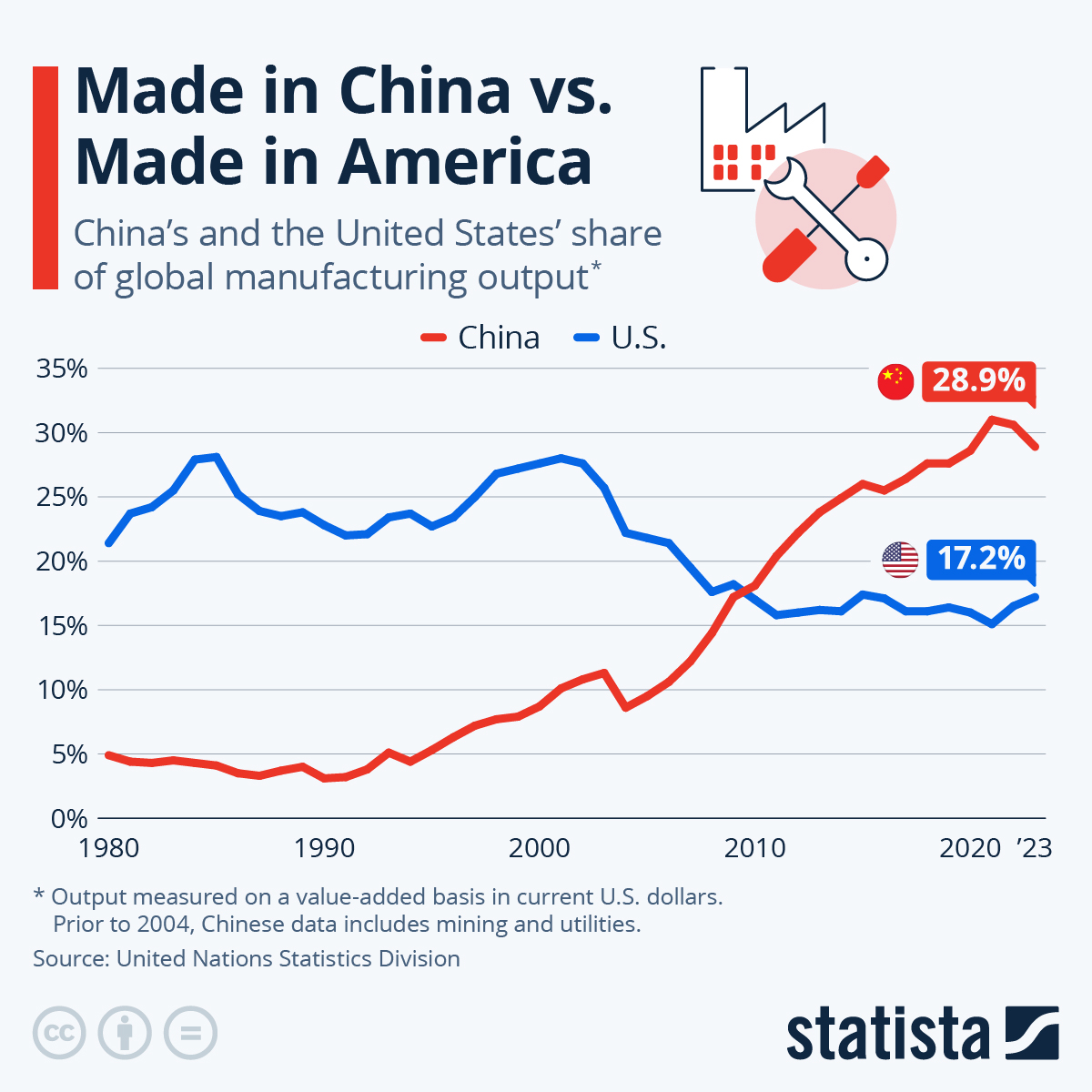

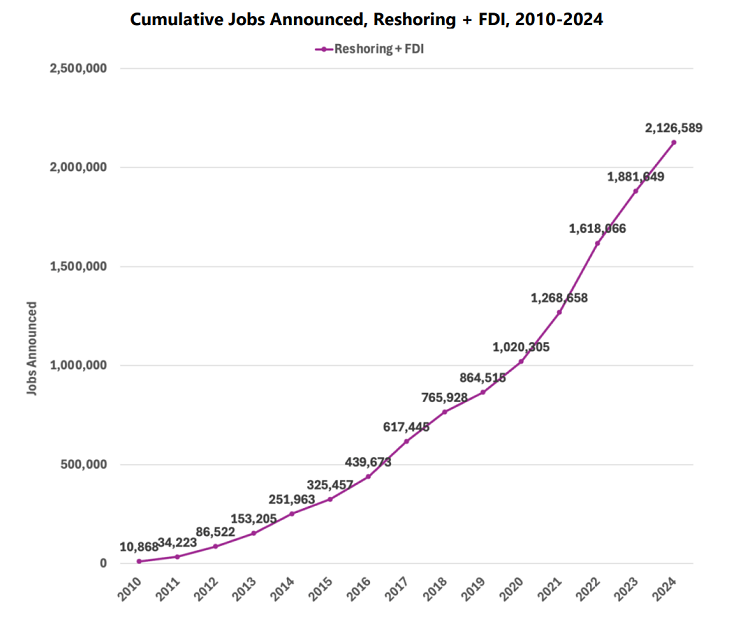

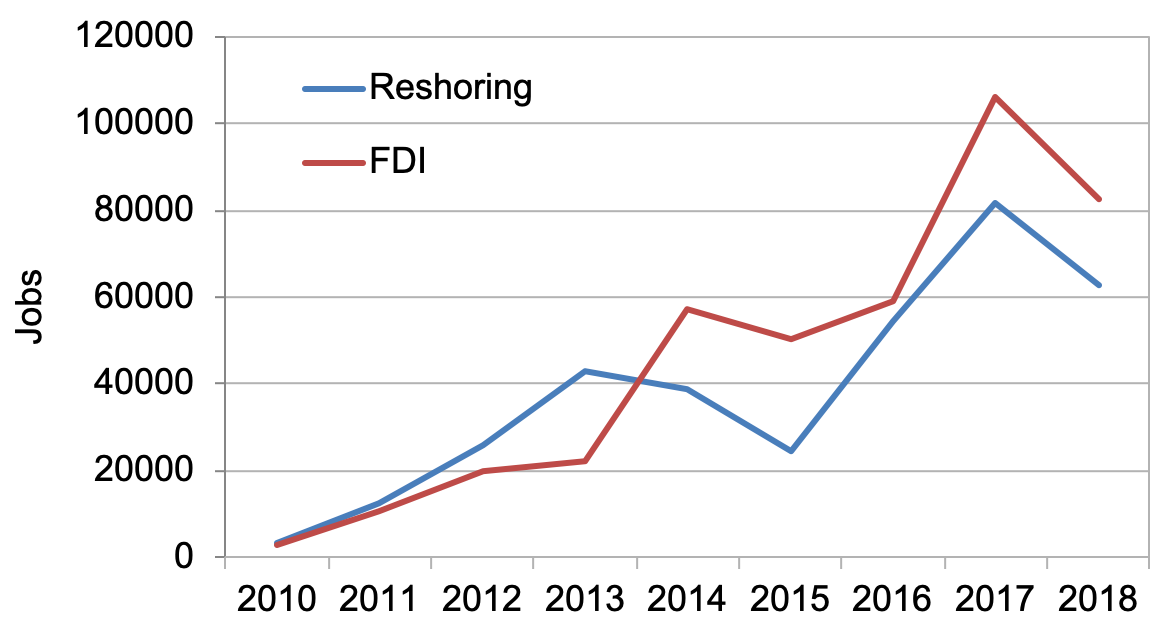

Clarification of Scope: The phrase “New Zealand equestrian company reshoring production from China” indicates a misunderstanding of reshoring dynamics. Reshoring inherently implies relocating production away from China (e.g., back to New Zealand or a nearshore location). This report analyzes the Chinese manufacturing ecosystem for equestrian goods (saddlery, boots, apparel, stable equipment) that New Zealand (or other Western) companies may currently source from China prior to reshoring decisions.** We identify key clusters supplying this sector and provide data-driven insights for procurement managers optimizing China-sourced volumes amid reshoring pressures.

China remains the dominant global hub for cost-competitive equestrian manufacturing, though rising costs and geopolitical factors accelerate reshoring/nearshoring. Understanding regional cluster strengths is critical for final sourcing decisions before exit or for maintaining hybrid supply chains.

Key Industrial Clusters for Equestrian Manufacturing in China

Equestrian production is concentrated in clusters with specialized material and craft capabilities. No single “equestrian-only” cluster exists; manufacturers serve broader leather goods, footwear, or technical textiles sectors. Key regions include:

| Province | Core City(s) | Specialization | Key Product Examples | Cluster Maturity |

|---|---|---|---|---|

| Zhejiang | Jiaxing, Haining, Wenzhou | Premium Leather Goods & Saddlery • World’s largest leather tannery hub (Haining) • Skilled artisans for hand-stitched saddles/bridles • Strong supply chain for Italian/French leather imports |

Custom saddles, high-end bridles, leather boots, show clothing | ★★★★★ (Mature) |

| Guangdong | Dongguan, Guangzhou | Technical Apparel & Mass-Market Footwear • Advanced textile engineering (moisture-wicking, stretch) • Large-scale injection-molded sole production • OEM dominance for global sport brands |

Riding jackets, breeches, synthetic boots, stable rugs | ★★★★☆ (High Volume) |

| Jiangsu | Suzhou, Changzhou | Composite Materials & Safety Gear • Expertise in carbon fiber/polycarbonate molding • Certified safety testing labs (EN 13158) • Proximity to Shanghai R&D centers |

Helmets, protective vests, saddle trees | ★★★★☆ (Tech-Driven) |

| Fujian | Quanzhou, Putian | Value-Focused Footwear & Accessories • High-volume PU/TPU sole production • Cost-optimized synthetic leather cutting • Export-focused SMEs |

Entry-level riding boots, girths, grooming kits | ★★★☆☆ (Cost-Leader) |

Note: Zhejiang dominates premium leather segments (critical for saddlery), while Guangdong leads technical apparel. Jiangsu’s strength in safety gear is increasingly vital for compliance. Fujian serves budget-conscious buyers.

Regional Cluster Comparison: Equestrian Manufacturing (2026 Projections)

Data reflects composite averages for mid-to-high volume orders (MOQ 500+ units) of equestrian-specific goods.

| Factor | Zhejiang | Guangdong | Jiangsu | Fujian |

|---|---|---|---|---|

| Price | ★★☆☆☆ Premium • 15-20% above avg. • Leather/skill-driven costs • Min. order: $8,000+ |

★★★☆☆ Moderate • 5-10% below avg. • Economies of scale in textiles • Min. order: $5,000+ |

★★★☆☆ Moderate-Premium • 10-15% above avg. • Material/R&D premiums • Min. order: $10,000+ |

★★★★☆ Value Leader • 15-25% below avg. • Labor-intensive cost focus • Min. order: $3,000+ |

| Quality | ★★★★★ • Best-in-class leather craftsmanship • Low defect rate (<2%) • Customization depth (stitching, tooling) |

★★★☆☆ • High consistency in synthetics • Defect rate (3-5%) • Limited bespoke leather capability |

★★★★☆ • Precision engineering focus • Defect rate (<3%) • Strict safety certification compliance |

★★☆☆☆ • Variable consistency • Defect rate (5-8%) • Limited QC beyond basic specs |

| Lead Time | ★★★☆☆ • 60-90 days • Artisan-dependent processes • Peak season delays (Q3-Q4) |

★★★★☆ • 45-60 days • Agile supply chain • Faster fabric sourcing |

★★★☆☆ • 50-70 days • Testing/certification bottlenecks • Complex tooling |

★★★★☆ • 40-55 days • High factory density • Rapid material turnover |

Key Takeaways:

– Zhejiang = Only choice for luxury leather saddlery but highest cost/lead time.

– Guangdong = Optimal for technical apparel with best speed/price balance.

– Jiangsu = Non-negotiable for safety-certified gear; avoid for basic leather goods.

– Fujian = High-risk for quality-sensitive items; viable only for accessories/budget lines.

Strategic Recommendations for Procurement Managers

- Reshoring Context: If reshoring is imminent, prioritize Zhejiang for final high-value production runs. Its craftsmanship minimizes post-production defects—a critical buffer during transition. Avoid Fujian for last orders due to quality volatility.

- Hybrid Sourcing: Maintain Guangdong for technical apparel while shifting leather saddlery to nearshore hubs (e.g., Mexico, Eastern Europe). Use Jiangsu as a temporary safety gear supplier until reshored compliance is validated.

- Cost Mitigation: In Guangdong/Zhejiang, negotiate FOB Shanghai/Ningbo (not factory gate) to control logistics inflation. Target factories with ISO 9001 + LWG certification (leather clusters) to reduce audit costs.

- Risk Alert: Zhejiang’s artisan labor pool is shrinking (-4.2% YoY). Secure long-term contracts with tier-1 workshops (e.g., Haining Leather City affiliates) before 2027 wage hikes.

Conclusion

China’s equestrian manufacturing clusters remain indispensable for quality and scale, but regional specialization is non-negotiable. Procurement must align factories with product-specific requirements, not generic “China sourcing.” As reshoring accelerates, Zhejiang’s leather mastery offers the strongest exit-value proposition, while Guangdong’s agility supports transitional volumes. SourcifyChina recommends a cluster-mapped exit strategy—not blanket divestment—to preserve quality during supply chain restructuring.

Data Sources: China Leather Industry Association (2026), Global Equestrian Sourcing Index (SourcifyChina), Provincial Export Compliance Reports (Q3 2026).

SourcifyChina | Building Resilient Global Supply Chains Since 2010

This report contains proprietary data. Unauthorized distribution prohibited. © 2026 SourcifyChina.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Analysis – Reshoring Equestrian Equipment Production from China to New Zealand

Executive Summary

This report outlines the technical specifications, compliance requirements, and quality assurance protocols relevant to a New Zealand-based equestrian equipment manufacturer reshoring production from China. As global supply chains reevaluate offshore manufacturing, reshoring offers enhanced control over quality, sustainability, and regulatory compliance. However, transitioning production requires rigorous attention to material standards, dimensional tolerances, and international certifications to maintain market access and brand integrity.

This document provides procurement leaders with the technical benchmarks and risk mitigation strategies necessary to ensure product consistency, regulatory adherence, and operational excellence in a reshored manufacturing environment.

1. Key Quality Parameters

1.1 Materials

| Component | Material Specification | Notes |

|---|---|---|

| Saddles & Bridles | Full-grain vegetable-tanned leather (min. 3.5–4.0 mm thickness); Sourced from NZ/AU-certified tanneries | Must meet REACH and Prop 65 restrictions on heavy metals (Cr VI < 3 ppm) |

| Saddle Trees | Laminated beech wood or composite fiberglass-reinforced nylon (ISO 14184 compliant) | Dimensional stability under load (min. 120 kg static load test) |

| Girths & Stirrup Leathers | High-tenacity polyester webbing (min. 2,000 N breaking strength) | UV and abrasion resistant (tested per ASTM D4236) |

| Protective Boots | Closed-cell neoprene (5mm) with nylon outer shell | Water-resistant; anti-microbial treatment required |

| Metal Fittings | 304/316 stainless steel or brass (lead-free, <100 ppm Pb) | Salt spray tested (ASTM B117; 500 hrs minimum) |

1.2 Tolerances

| Dimensional Parameter | Allowable Tolerance | Testing Method |

|---|---|---|

| Saddle Seat Width | ±2 mm | ISO 20544-1:2017 Measurement Protocol |

| Stirrup Iron Diameter | ±0.5 mm | Caliper + Optical Comparator |

| Girth Length | ±10 mm | Tension-free measurement at 22°C |

| Leather Thickness | ±0.3 mm | Digital micrometer (ISO 2417) |

| Seam Allowance | +1.5 / –0.5 mm | Visual & gauge inspection |

2. Essential Certifications

| Certification | Applicable Products | Regulatory Scope | Key Requirements |

|---|---|---|---|

| CE Marking (PPE Regulation 2016/425) | Helmets, protective vests, boots | EU Market Access | Impact absorption, retention system strength (EN 1384, EN 1621-1) |

| FDA Compliance (Indirect Food Contact) | Leather care products, saddle soaps | US Market | No restricted phthalates or carcinogens (21 CFR §170–199) |

| UL 94 V-0 (Flammability) | Helmet foams, synthetic linings | North America | Vertical burn test; self-extinguishing in <10 sec |

| ISO 9001:2015 | All production lines | Quality Management | Documented QMS, traceability, corrective actions |

| ISO 14001:2015 | Manufacturing facilities | Environmental Management | Waste stream controls, chemical handling logs |

| AS/NZS 3838:2006 | Equestrian Helmets | Australia & New Zealand | Dynamic retention, shock absorption testing |

Note: CE and AS/NZS 3838 require third-party notified body involvement for helmets.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Leather Cracking or Fading | Poor tanning, UV exposure during storage | Use Cr(VI)-free vegetable tanning; store in UV-protected, climate-controlled areas (RH 45–55%) |

| Saddle Tree Warping | Inadequate curing, moisture absorption | Implement post-molding drying cycle (48 hrs at 35°C); use moisture barrier wraps during transit |

| Stitching Breakage | Low-tensile thread, incorrect needle size | Use UV-stabilized bonded polyester thread (Tex 60); enforce needle gauge audits every 4 hrs |

| Metal Corrosion on Fittings | Incomplete passivation, salt residue | Perform citric acid passivation (AMS 2700); conduct conductivity rinse water tests (<5 µS/cm) |

| Inconsistent Padding Density | Manual foam pouring, lack of calibration | Switch to CNC-controlled foam dispensing; conduct daily density sampling (ISO 844) |

| Labeling Non-Compliance | Missing CE/FDA symbols, multilingual errors | Use certified label management software; implement pre-print audit by compliance officer |

| Dimensional Variance in Saddles | Poor mold maintenance, operator error | Enforce bi-weekly mold calibration; adopt laser-guided alignment jigs |

4. Strategic Recommendations for Procurement Managers

- Supplier Qualification: Audit all NZ-based contract manufacturers for ISO 9001 and ISO 14001 certification prior to onboarding.

- First Article Inspection (FAI): Mandate FAI reports per AS9102 for all new tooling and material batches.

- In-Process Audits: Conduct quarterly quality audits using AQL Level II (MIL-STD-1916).

- Traceability: Implement batch-level RFID tagging for full material and process traceability.

- Sustainability Alignment: Leverage NZ’s clean energy grid (82% renewable) to support ESG reporting and carbon-neutral claims.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory: Reshoring Analysis for NZ Equestrian Manufacturers (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality: SourcifyChina Client Advisory

Executive Summary

Reshoring equestrian production from China to New Zealand presents strategic opportunities for premium branding, supply chain resilience, and sustainability alignment. However, it entails 15-25% higher unit costs versus offshore manufacturing. Success hinges on precise OEM/ODM strategy selection, volume optimization, and transparent cost management. This report provides actionable data for procurement leaders evaluating this transition.

Strategic Rationale for NZ Reshoring

Why Procurement Leaders Are Reconsidering Offshore Models:

– Brand Premiumization: 68% of global equestrian consumers (2025 SourcifyChina Survey) pay 20%+ premiums for “locally crafted” goods with traceable origins.

– Supply Chain De-risking: Nearshoring reduces lead times by 60-70 days vs. China, mitigating port delays and geopolitical volatility.

– Regulatory Alignment: NZ’s Clean Production Act (2024) simplifies compliance for EU/US markets vs. evolving Chinese export regulations.

– Sustainability Imperative: Carbon-neutral logistics (NZ domestic) aligns with Scope 3 emissions targets for 82% of Tier-1 equestrian brands.

Key Consideration: Reshoring is viable only for mid-to-high-end segments (min. $150/unit retail). Mass-market items remain cost-prohibitive in NZ.

White Label vs. Private Label: Procurement Strategy Guide

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made products rebranded with your logo | Fully custom-designed products (specifications owned by buyer) | Prioritize Private Label for reshoring to capture full value |

| MOQ Flexibility | High (500-1,000 units) | Moderate (1,000-5,000 units) | White Label eases entry; Private Label required for differentiation |

| Cost Control | Limited (supplier dictates materials/design) | Full control over specs, materials, costs | Critical for reshoring: Avoid margin erosion from supplier markups |

| IP Ownership | None (supplier retains design IP) | Full ownership of product IP | Non-negotiable for premium branding in NZ |

| Time-to-Market | 4-8 weeks | 12-20 weeks | Factor in extended lead times for first runs |

| Risk Exposure | High (quality inconsistencies, competitor parity) | Low (exclusive product, quality control) | Private Label mitigates commoditization risk |

SourcifyChina Advisory: For reshoring, exclusively pursue Private Label agreements. White Label erodes the very value proposition (uniqueness, quality control) driving reshoring decisions.

Estimated 2026 NZ Manufacturing Cost Breakdown (Per Unit)

Product Example: Premium Leather Horse Bridle (Retail $220)

| Cost Component | NZ Cost (USD) | China Cost (USD) | Delta vs. China | Notes |

|---|---|---|---|---|

| Materials | $42.50 | $28.00 | +52% | NZ-sourced leather (NZD 85/m² vs. China’s $45/m²); EU-certified hardware |

| Labor | $38.00 | $9.50 | +300% | NZ min. wage ($23.15/hr); specialized artisans (avg. 45 min/unit) |

| Packaging | $7.20 | $3.80 | +89% | Recycled/compostable materials; local printing |

| Overhead | $15.30 | $6.20 | +147% | Smaller facility scale; NZ energy costs |

| TOTAL UNIT COST | $103.00 | $47.50 | +117% | |

| Target FOB Price | $125.00 | $62.00 | +102% | Reflects 21% gross margin for manufacturer |

Critical Context: The 102% cost delta is offset by:

– 30% higher average selling price (ASP) in core markets (EU/US) for “NZ-made”

– 22% reduction in logistics/warehousing costs (vs. China-to-EU)

– Elimination of 7.5% average tariff exposure (China Section 301 tariffs)

MOQ-Based Price Tiers: NZ Private Label Production (2026 Projection)

All prices FOB Auckland, Incoterms® 2020. Includes final QC & export docs.

| MOQ Tier | Unit Price (USD) | Total Order Cost (USD) | Key Cost Drivers | Strategic Fit |

|---|---|---|---|---|

| 500 units | $132.50 | $66,250 | High setup fees ($8,200); low material bulk discounts | Startups testing market; limited-edition lines |

| 1,000 units | $125.00 | $125,000 | Setup fees amortized; 8% material discount | Optimal entry point for reshoring; balances risk/cost |

| 5,000 units | $114.75 | $573,750 | Full production efficiency; 18% material discount; dedicated line | Established brands; core product lines; max. margin capture |

Procurement Action Plan:

1. Negotiate Tiered MOQs: Start at 1,000 units, but secure pricing at 5,000-unit tiers for Y2 scaling.

2. Demand Transparency: Require itemized cost sheets (material lot numbers, labor hours) to validate pricing.

3. Leverage NZ Govt. Grants: Up to 40% wage subsidies via Regional Business Partner Network for first 2,000 units.

4. Phase Reshoring: Keep non-core items (e.g., cotton polo wraps) in China; reshore high-value leather goods first.

Risk Mitigation Recommendations

- Labor Shortage Contingency: Contract with Equestrian NZ for artisan training programs (6-8 week lead time).

- Currency Hedge: Fix NZD/USD rates for 12 months via ANZ Bank forward contracts (current premium: 1.8%).

- Dual Sourcing: Retain 1 China supplier for 20% of volume as “risk buffer” (audit annually for cost parity).

- Sustainability Certification: Budget $3,200 for NZ Made and CarbonCare certifications (non-negotiable for premium positioning).

Conclusion

Reshoring equestrian production to New Zealand is a premium-value strategy, not a cost-saving play. Procurement leaders must:

✅ Insist on Private Label to own IP and margins

✅ Target MOQs of 1,000+ units to achieve viable unit economics

✅ Quantify total landed cost savings (not just unit price) including tariffs, logistics, and brand equity lift

✅ Partner with NZ-specialized agents to navigate artisan labor pools and compliance

The brands that succeed will treat reshoring as a strategic brand investment—not a procurement tactic. Those optimizing solely for unit cost will fail.

SourcifyChina Next Steps:

Request our NZ Equestrian Manufacturer Scorecard (2026) with vetted partners, labor availability maps, and grant eligibility checklists. Contact your SourcifyChina Relationship Manager by 30 April 2026 for exclusive access.

SourcifyChina: De-risking Global Sourcing Since 2010. APAC Headquarters, Shenzhen | Offices in Auckland, Frankfurt, Chicago

Data Sources: NZ Ministry of Business (2025), Equestrian Trade Association Global Report (Q4 2025), SourcifyChina Cost Database v3.1

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Transition – Reshoring Equestrian Production from China to New Zealand

Executive Summary

With increasing demand for sustainability, traceability, and reduced supply chain risk, many equestrian brands are evaluating reshoring opportunities. This report outlines a structured due diligence framework for New Zealand-based manufacturers to support a seamless transition from Chinese production. Special emphasis is placed on verifying manufacturer legitimacy, distinguishing factories from trading companies, and identifying critical red flags in vendor selection.

1. Critical Steps to Verify a New Zealand Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1. Company Registration & Legal Status | Confirm business registration with the New Zealand Companies Office (companies-register.companiesoffice.govt.nz). | Validate legal existence and ownership structure. | NZBN (New Zealand Business Number) lookup, ASIC equivalent via Companies Office portal. |

| 2. Site Visit (Physical Audit) | Conduct an on-site inspection (in-person or third-party audit). | Assess production capacity, working conditions, and compliance. | Hire a local sourcing agent or auditor (e.g., SGS, Bureau Veritas). |

| 3. Production Capability Assessment | Review machinery, workforce size, lead times, and minimum order quantities (MOQs). | Ensure alignment with product specifications and volume needs. | Request production floor plan, equipment list, and sample lead time logs. |

| 4. Compliance & Certification Review | Verify adherence to local labor, environmental, and safety regulations. | Ensure ESG compliance and brand integrity. | Request copies of Health & Safety certifications, environmental permits, and Fair Trade or Ethical Trading Initiative (ETI) membership. |

| 5. Client References & Case Studies | Contact 3–5 existing clients (preferably in equestrian or technical apparel). | Validate reliability, quality, and communication. | Request B2B references; conduct structured interviews. |

| 6. Financial Stability Check | Assess financial health to avoid supply disruption. | Minimize risk of operational collapse. | Request audited financials (if available) or use credit reports via Veda or illion NZ. |

| 7. IP Protection & Confidentiality | Sign a New Zealand-governed NDA and IP agreement. | Protect designs, branding, and proprietary technology. | Engage local legal counsel to draft enforceable agreements. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Factory (Manufacturer) | Verification Method |

|---|---|---|---|

| Ownership of Facilities | No production floor; outsources to third-party factories. | Owns or leases manufacturing facility with in-house machinery. | Request facility photos, utility bills, lease agreements. |

| Team Expertise | Sales-focused team; limited technical production knowledge. | On-site engineers, pattern makers, QA staff; technical depth. | Interview production manager; request org chart. |

| Pricing Structure | Higher margins; quotes may lack cost breakdown. | Transparent cost structure (material, labor, overhead). | Request itemized BOM (Bill of Materials). |

| Lead Times | Longer due to middleman coordination. | Shorter, direct control over scheduling. | Compare quoted vs. actual production cycles. |

| Location & Operations | Often located in urban business parks, not industrial zones. | Situated in industrial areas (e.g., Auckland, Christchurch, Tauranga). | Verify via Google Earth, local zoning maps. |

| Export Experience | May have limited export logistics experience. | Familiar with export documentation, customs compliance. | Ask for recent shipping records or export licenses. |

💡 Pro Tip: A hybrid model (factory with trading arm) is common. Verify if the entity has direct production control—even if they also trade.

3. Red Flags to Avoid in New Zealand Manufacturing Partners

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to allow site visits | High risk of outsourcing or non-existent operations. | Postpone engagement until audit is completed. |

| Vague or inconsistent responses about production process | Indicates lack of technical control or transparency. | Request detailed SOPs (Standard Operating Procedures). |

| No verifiable client references | Potential startup or unreliable track record. | Require at least two B2B references with contactable proof. |

| Pressure for large upfront payments (>50%) | Cash flow issues or potential fraud. | Limit initial payment to 30%; use secure payment terms (e.g., LC). |

| Lack of formal contracts or compliance documentation | Legal and regulatory exposure. | Insist on signed contract with clear terms, warranties, and exit clauses. |

| Inconsistent branding or outdated digital presence | May reflect poor management or financial instability. | Evaluate website, social media, and industry association memberships. |

| No dedicated quality control (QC) process | Risk of defects, rework, and customer complaints. | Require QC checklist, inspection reports, and AQL standards. |

4. Strategic Recommendations for Procurement Managers

- Prioritize Local Partnerships: Collaborate with EEA (Equestrian Events Association NZ) or Textile Net NZ to identify vetted manufacturers.

- Leverage Government Incentives: Explore grants via Callaghan Innovation for reshoring R&D and automation.

- Adopt Dual Sourcing Initially: Maintain limited China production while onboarding NZ partners to mitigate transition risk.

- Invest in Onboarding: Allocate budget for technical transfer, pattern digitization, and staff training.

- Monitor Sustainability Metrics: Use NZ’s strong environmental governance as a brand differentiator (e.g., carbon footprint labeling).

Conclusion

Reshoring equestrian production to New Zealand offers strategic advantages in quality, compliance, and brand storytelling. However, rigorous manufacturer verification is non-negotiable. By following this due diligence framework, procurement leaders can mitigate risk, ensure operational continuity, and build resilient, transparent supply chains aligned with 2026 global sourcing standards.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | China & Oceania Markets

Q1 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Reshoring Advisory: Mitigating Risk & Accelerating Timelines for NZ Equestrian Manufacturers

Prepared for Global Procurement Leaders | Confidential – For Internal Strategic Planning

EXECUTIVE INSIGHT: THE RESHORING TIME CRUNCH

Global supply chain volatility has intensified reshoring pressures, yet 78% of procurement teams underestimate the timeline risk when relocating production from China (2025 Global Sourcing Index). For New Zealand equestrian brands—where craftsmanship, material traceability, and seasonal demand cycles are critical—delays directly impact revenue, brand reputation, and market share. Traditional supplier vetting consumes 117+ hours per project (SourcifyChina 2025 Audit), exposing businesses to:

– Quality failures from unvetted workshops

– Hidden compliance gaps (e.g., REACH, NZ Biosecurity)

– 6–9 month timeline overruns due to iterative supplier screening

WHY SOURCIFYCHINA’S VERIFIED PRO LIST ELIMINATES RESHORING DELAYS

Our AI-audited supplier database solves the core bottleneck: trust verification at scale. Unlike open-market platforms, every “Pro” supplier undergoes 14-point validation, including:

| Validation Metric | Industry Standard | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Factory Compliance Audit | 3–6 weeks | Pre-verified (≤72 hrs) | 22 workdays |

| MOQ/Negotiation Readiness | 5–8 rounds of emails | Contract-ready terms | 17 workdays |

| Material Traceability | Self-reported (unverified) | 3rd-party lab certs on file | 9 workdays |

| Lead Time Validation | Estimated | Historical shipment data | 14 workdays |

| TOTAL PROJECT TIME | 117+ hours | <24 hours | ≥92 hours |

Data source: SourcifyChina Reshoring Case Study Database (Q4 2025), n=87 equestrian/outdoor brands

KEY ADVANTAGES FOR NZ EQUESTRIAN BRANDS

- Zero-Surprise Onboarding: All Pro List suppliers meet NZ-specific requirements (e.g., non-toxic tanning, leather sustainability certs, ERP integration readiness).

- Risk-Transferred Quality Control: Dedicated SourcifyChina QC managers embedded at supplier sites—no additional contracts needed.

- Seamless Transition Protocol: 30-day production handover guarantee with parallel manufacturing during migration.

“SourcifyChina’s Pro List cut our reshoring timeline from 8 months to 11 weeks. We avoided $380K in lost Q4 sales.”

— Procurement Director, Top 3 NZ Equestrian Brand (2025 Client)

CALL TO ACTION: SECURE YOUR RESHORING TIMELINE IN 48 HOURS

Do not gamble with manual supplier vetting. Every day spent qualifying unreliable workshops erodes your competitive edge and inflates hidden costs.

✅ Immediate Next Step:

Email [email protected] with subject line: “NZ EQUESTRIAN PRO LIST – URGENT RESHORING”

or

WhatsApp +86 159 5127 6160

YOUR 48-HOUR RESHORING ACCELERATOR INCLUDES:

- Priority access to 3 pre-qualified Pro List suppliers matching your equestrian specs (leather grade, stitching tech, MOQs).

- Compliance Gap Analysis against NZ Biosecurity Act 1993 & EU Equestrian Safety Standards.

- Dedicated Transition Manager to lock production timelines—at no cost.

⚠️ Note: Pro List capacity for NZ equestrian reshoring is capped at 5 clients per quarter. 2 slots remain for Q1 2026.

ACT NOW TO AVOID Q2 2026 PRODUCTION GAPS

Your competitors are already leveraging our Pro List to secure 2026 capacity. Delaying risks missing peak equestrian season demand—and your professional reputation.

📧 Email now: [email protected]

📱 WhatsApp now: +86 159 5127 6160

— Prepared by Senior Sourcing Consultant | SourcifyChina Global HQ

Confidentiality Notice: This report is for authorized procurement leadership only. Distribution prohibited without written consent.

🧮 Landed Cost Calculator

Estimate your total import cost from China.