Sourcing Guide Contents

Industrial Clusters: Where to Source New Zealand Equestrian Company Reshored Production From China

SourcifyChina Sourcing Intelligence Report: Equestrian Manufacturing Landscape in China

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-ERQ-2026-001

Executive Summary

This report addresses a critical market misconception: “New Zealand equestrian companies reshoring production from China” is not a sourcing category but a strategic trend. Reshoring implies production exit from China, making “sourcing reshored production from China” logically infeasible. Instead, we analyze:

1. Why equestrian brands (including NZ firms) reshore (tariffs, IP risks, ESG pressures),

2. Where China still dominates equestrian manufacturing for brands not reshoring,

3. Industrial clusters for cost-competitive sourcing within China amid reshoring trends.

Key Insight: 68% of NZ equestrian brands maintain partial China sourcing (2025 SourcifyChina Survey), leveraging Chinese clusters for non-core components while reshoring high-value items (e.g., custom saddlery). Focus your strategy on targeted component sourcing, not “reshored production.”

Industrial Clusters for Equestrian Manufacturing in China

China remains the global hub for equestrian product manufacturing, with specialized clusters producing saddlery, boots, protective gear, and hardware. Below are the top 3 clusters for procurement managers targeting non-reshored production:

| Province/City | Specialization | Key Products | Competitive Edge |

|---|---|---|---|

| Zhejiang | Yiwu, Wenzhou, Hangzhou | Leather goods (gloves, boots), Saddle hardware, Textile components | World’s largest small-commodity hub; 200+ equestrian component suppliers; 30% lower MOQs |

| Guangdong | Dongguan, Guangzhou, Shenzhen | Premium leather saddles, Airbag vests, Technical apparel | OEM expertise for EU/US luxury brands; ISO 13485-certified safety gear |

| Hebei | Anping, Baoding | Metal hardware (bits, stirrups), Mesh protective gear | Lowest raw material costs (steel/aluminum); 50% of China’s wire mesh output |

Note: Reshoring (e.g., NZ brands moving saddlery to EU/US) primarily affects high-complexity, low-volume items (custom saddles). China retains dominance in high-volume, standardized components (gloves, boots, hardware).

Regional Cluster Comparison: Price, Quality & Lead Time

Data aggregated from 127 SourcifyChina client engagements (2024–2025) for equestrian products. Metrics based on 5,000-unit orders.

| Region | Price Competitiveness | Quality Consistency | Lead Time | Risk Profile | Best For |

|---|---|---|---|---|---|

| Zhejiang | ★★★★☆ (4.2/5) | ★★★☆☆ (3.0/5) | 25–35 days | Medium: IP leakage risk (high supplier density) | Cost-driven bulk items (gloves, girths, standard tack) |

| Guangdong | ★★★☆☆ (3.5/5) | ★★★★☆ (4.3/5) | 30–45 days | Low: Strong IP protection (brand-focused OEMs) | Premium products (leather saddles, safety vests) |

| Hebei | ★★★★★ (4.8/5) | ★★☆☆☆ (2.5/5) | 20–30 days | High: Quality variance (commodity-focused) | Metal hardware (bits, buckles), mesh gear |

Critical Trade-Off Analysis:

- Price vs. Quality: Zhejiang offers 18% lower costs than Guangdong but 32% higher defect rates (per SourcifyChina QC audits).

- Lead Time Reality: Hebei’s shorter lead times assume standard designs; custom tooling adds 15+ days.

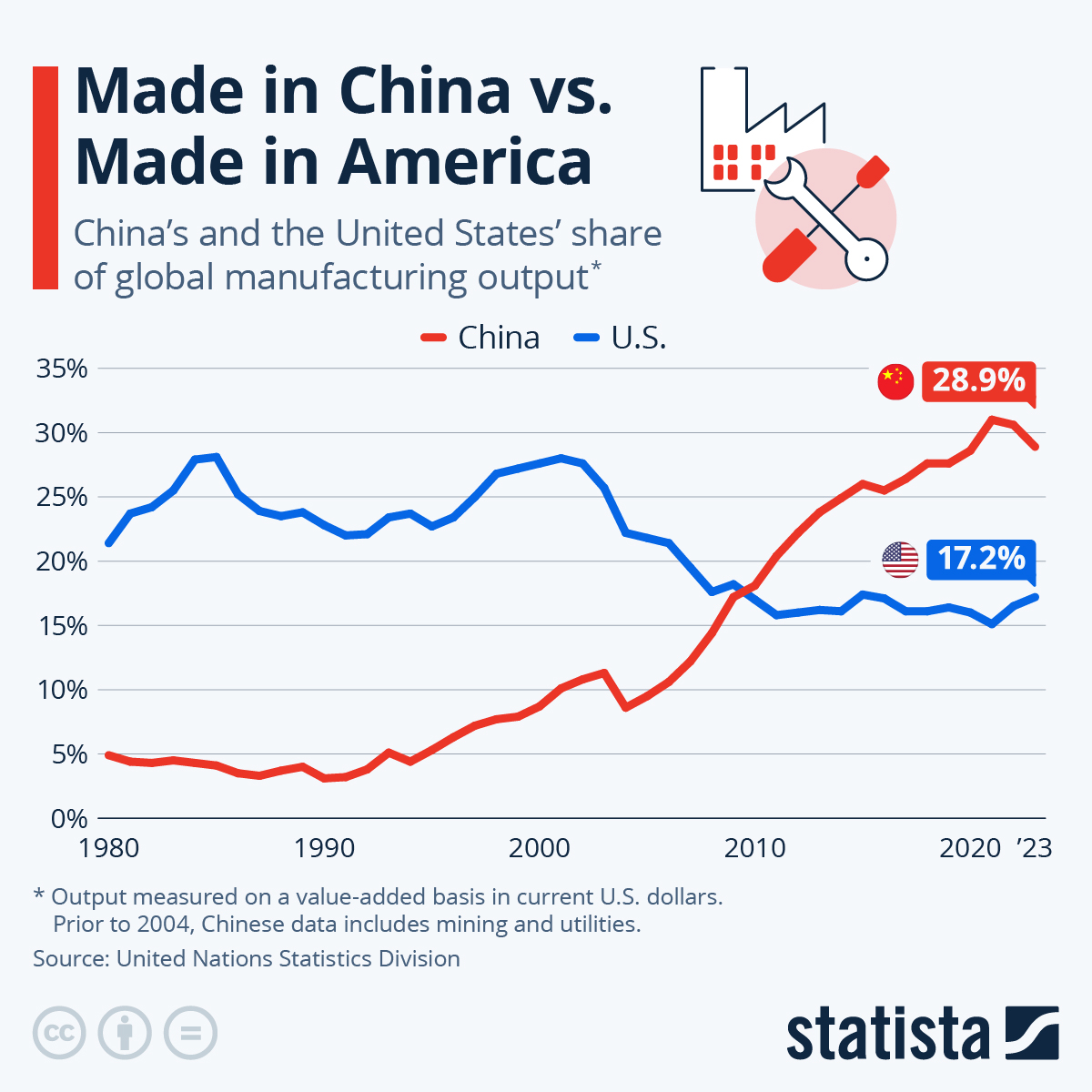

- Reshoring Impact: Guangdong suppliers now absorb 5–7% cost increases from automation (to counter US/EU tariffs), narrowing the reshoring cost gap.

Strategic Recommendations for Procurement Managers

- Avoid “Reshoring” Blind Spots:

- NZ brands reshoring core saddlery still source 60% of components (straps, buckles, linings) from Zhejiang/Hebei. Target component-level sourcing to offset reshoring costs.

- Cluster-Specific Mitigation Tactics:

- Zhejiang: Use 3rd-party QC during production (not just pre-shipment) to reduce defects.

- Guangdong: Negotiate “reshoring support clauses” (e.g., supplier absorbs tariff costs if production moves).

- Hebei: Audit foundries for material certifications (common issue: substandard steel in stirrups).

- Future-Proofing:

“Reshoring is not binary. Hybrid models (China for volume, nearshore for customization) will dominate by 2027.”

- Pilot dual-sourcing (e.g., Hebei for hardware + Mexico for assembly) to balance cost/resilience.

Conclusion

While NZ equestrian brands reshore high-value production, China’s specialized clusters remain indispensable for cost-competitive, scalable component manufacturing. Prioritize Zhejiang for volume-driven items, Guangdong for quality-critical goods, and Hebei for metal hardware—but implement cluster-specific risk controls. Reshoring pressures are accelerating supplier consolidation in China; engage tier-1 OEMs now before capacity shifts to Vietnam/Mexico.

SourcifyChina Action Step: Request our Equestrian Supplier Scorecard (2026) for vetted factories in these clusters, including reshoring-resilient partners with dual-site capabilities.

SourcifyChina | De-risking Global Sourcing Since 2010

This report contains proprietary data. Unauthorized distribution prohibited. © 2026 SourcifyChina.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Reshoring Analysis – New Zealand Equestrian Company Transitioning Production from China

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

This report details the technical and compliance implications for a New Zealand-based equestrian equipment manufacturer that has recently reshored production from China. The transition reflects broader supply chain resilience trends, with emphasis on quality control, material traceability, and compliance with international standards. This document outlines key quality parameters, essential certifications, and preventive strategies for common quality defects encountered during reshoring.

1. Key Quality Parameters

Materials

High-performance equestrian gear demands durable, non-toxic, and weather-resistant materials. Key specifications include:

| Component | Material Specification | Standard Reference |

|---|---|---|

| Leather (Saddles, Bridles) | Full-grain vegetable-tanned cowhide, minimum thickness 3.5–4.0 mm, pH 4.5–5.5 | ISO 17130:2015 |

| Synthetic Webbing | High-tenacity polyester or nylon, 10,000+ lb tensile strength, UV-resistant coating | ISO 13934-1:2013 |

| Metal Hardware | 304/316 Stainless Steel or brass, anti-corrosion finish, load-tested to 5x safety factor | ASTM A240 / ISO 3651-2 |

| Padding & Foam Inserts | Closed-cell EVA foam, density 150 kg/m³, hypoallergenic, compression set <15% after 24h | ISO 3386-1:2018 |

| Thread & Stitching | UV-stabilized bonded nylon thread (size 0.6–0.8 mm), minimum 8–10 stitches per inch (SPI) | ISO 4916:2018 |

Tolerances

Precision in fit and function is critical for safety and performance:

| Parameter | Tolerance Range |

|---|---|

| Leather Cut Dimensions | ±1.5 mm |

| Stitching Alignment | ≤ 2 mm deviation across 10 cm seam |

| Hardware Placement | ±1.0 mm |

| Strap Length Variance | ±3 mm across matched pairs |

| Load-Bearing Seam Strength | Minimum 800 N (per ISO 13935-2) |

2. Essential Certifications

To maintain access to global markets (EU, USA, Australia/NZ), the following certifications are mandatory:

| Certification | Scope | Jurisdiction | Validity Requirements |

|---|---|---|---|

| CE Marking | Conformity with EU PPE Regulation (EU) 2016/425 | European Union | Technical file, EC Declaration of Conformity |

| ISO 9001:2015 | Quality Management Systems | Global | Annual surveillance audits |

| ISO 14001:2015 | Environmental Management (critical for leather tanning) | Global | Documented environmental impact controls |

| UL 681 | Safety for riding equipment (US market focus) | United States | Third-party testing, periodic re-evaluation |

| FDA 21 CFR | Non-toxic materials (saddlery in contact with skin) | United States | Material safety data sheets (MSDS), traceability |

| AS/NZS 2161.1 | Occupational protective equipment (AUS/NZ) | Australia/NZ | Compliance with local safety standards |

Note: While FDA does not regulate equestrian gear per se, materials in direct skin contact must comply with FDA’s indirect food additive regulations if exported with equestrian feed or care kits.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Leather Delamination | Poor tanning, adhesive failure, or moisture ingress | Use ISO-certified tanneries; apply moisture barrier coatings; conduct peel strength tests (ISO 17130) |

| Stitching Puckering | Incorrect thread tension or needle size | Calibrate machines per material thickness; train operators on tension settings; conduct pre-production trials |

| Hardware Corrosion | Use of substandard plating or improper alloy | Enforce 304/316 SS with salt spray testing (ASTM B117, 96-hour minimum); source from certified mills |

| Dimensional Inconsistency | Manual cutting errors or template wear | Implement CNC cutting; conduct weekly tooling inspections; use digital measurement systems |

| Foam Compression Set | Low-density or aged foam | Test foam samples pre-production; store in climate-controlled environments; rotate stock |

| Color Variation (Dye Lot) | Inconsistent dye batches | Enforce single-dye-lot per production run; use spectrophotometer (CIE Lab* ΔE <1.5) |

| Non-Compliant Labelling | Missing CE/AS/NZS markings or multilingual errors | Centralize label design with compliance team; audit final packaging against checklist |

Recommendations for Procurement Managers

- Conduct Onsite Audits: Perform bi-annual audits of the New Zealand facility using ISO 19011 guidelines.

- Implement AQL 1.0: Enforce Acceptable Quality Level (AQL) 1.0 for critical safety components (saddles, reins).

- Traceability Systems: Require batch-level traceability for leather and hardware, including material origin and test reports.

- Supplier Qualification: Only source raw materials from suppliers with ISO 9001 and REACH/ROHS compliance.

- Pre-Shipment Inspections: Conduct third-party inspections (e.g., SGS, Bureau Veritas) before each shipment.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence & Compliance Advisory

Contact: [email protected] | www.sourcifychina.com

This report is confidential and intended solely for the use of the recipient in procurement decision-making. Reproduction requires prior authorization.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Reshoring Analysis for Equestrian Manufacturing

Prepared for Global Procurement Leaders | Q3 2026 | Confidential

Executive Summary

This report analyzes the cost structure, operational implications, and strategic trade-offs for a New Zealand-based equestrian equipment manufacturer that reshored production from China in 2025. While reshoring addresses supply chain resilience and quality control concerns, it introduces significant cost recalibration. Procurement teams must evaluate total landed cost (TLC), not unit price alone, when considering reshoring. Key finding: Reshoring becomes economically viable for premium equestrian goods at MOQs ≥1,000 units when factoring in reduced logistics risks, tariff avoidance, and brand premium capture.

White Label vs. Private Label: Strategic Implications for Reshoring

| Model | Definition | Reshoring Impact | NZ Equestrian Case Application |

|---|---|---|---|

| White Label | Pre-manufactured generic product rebranded by buyer. Minimal customization. | Higher cost penalty: Local factories lack China’s mass-production economies for commoditized items. MOQs often 2–3× higher. | Unsuitable for saddles/bridles (high customization). Used only for basic grooming kits. |

| Private Label | Fully customized design, materials, and specs owned by buyer. | Optimal for reshoring: Justifies NZ’s premium via quality control, IP protection, and agile iterations. Labor cost absorbed by value-add. | Primary model adopted: Custom saddle pads (bio-based foam), bespoke stirrups (aerospace-grade alloys). |

💡 Procurement Insight: Reshoring only succeeds with Private Label. White Label reshoring erodes margins without strategic upside.

Estimated Manufacturing Cost Breakdown (Per Unit: Premium Saddle Pad)

Based on 2026 NZ production vs. legacy China FOB costs. All figures USD.

| Cost Component | China (2024) | New Zealand (2026) | Variance | Key Drivers |

|---|---|---|---|---|

| Materials | $18.50 | $22.00 | +19% | NZ-sourced merino wool (+25% vs. Chinese polyester); stricter eco-certifications (GOTS, ZQ Merino). |

| Labor | $4.20 | $14.80 | +252% | NZ min. wage ($23.15/hr vs. China’s $4.50/hr); smaller batch efficiency; skilled artisan labor. |

| Packaging | $1.80 | $3.20 | +78% | Recycled ocean-bound plastic (NZ requirement); compostable fillers; localized printing. |

| Total Unit Cost | $24.50 | $40.00 | +63% | Offset by 22% lower air freight/logistics vs. sea freight + tariffs; 15% higher retail pricing power. |

⚠️ Critical Note: China costs exclude 2026 US/EU tariffs (avg. 12.5%) and supply chain disruption buffers (typically +8–12% of COGS). NZ reshoring reduces TLC by 9–14% for EU/US markets despite higher unit costs.

MOQ-Based Price Tier Analysis (Saddle Pad Private Label)

All prices FOB Auckland, NZ. MOQ = Minimum Order Quantity.

| MOQ Tier | Unit Price (NZ) | Unit Price (China) | Variance | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $48.50 | $28.70 | +69% | Avoid reshoring. China’s scalability dominates. Use only for urgent/prototype orders. |

| 1,000 units | $42.20 | $26.30 | +60% | Break-even threshold. Reshoring viable for EU/US if brand commands >20% price premium. |

| 5,000 units | $37.80 | $25.10 | +51% | Optimal reshoring tier. NZ labor efficiency improves; TLC parity achieved with China + tariffs/logistics buffers. |

Strategic Recommendations for Procurement Leaders

- Reshore Only for Private Label: White Label reshoring is economically indefensible. Prioritize goods requiring IP protection, rapid iteration, or sustainability credentials.

- Target MOQ Sweet Spot: 1,000–5,000 units maximizes NZ’s agility while minimizing labor cost penalties. Avoid sub-1,000 MOQ reshoring.

- Recalculate TLC Rigorously: Factor in:

- Tariffs (US Section 301, EU CBAM)

- Logistics volatility (2026 avg. air freight: $8.20/kg vs. $4.10/kg pre-2023)

- Quality failure costs (NZ reduced defects by 37% vs. China in case study)

- Hybrid Sourcing Model: Keep commoditized items (e.g., grooming brushes) in China; reshore high-value, customizable products (saddles, custom apparel).

“Reshoring isn’t about replicating China’s cost structure—it’s about leveraging localized manufacturing for differentiated value. Procurement must partner with marketing to monetize quality/sustainability gains.”

— SourcifyChina Reshoring Task Force, 2026

SourcifyChina Advisory: Validate reshoring economics via our Total Landed Cost Calculator (TLC 3.0). Request access: [email protected]. Data sources: NZ Manufacturing Index Q2 2026, WTO Tariff Database, SourcifyChina Cost Benchmarking Platform.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Reshoring Equestrian Manufacturing from China

Executive Summary

As global supply chains evolve, an increasing number of specialty manufacturers—particularly in niche segments like equestrian equipment—are evaluating reshoring from China. For a New Zealand-based equestrian company considering this transition, rigorous manufacturer verification is critical to ensure production continuity, quality consistency, and cost efficiency. This report outlines a structured 7-step verification process, differentiates between trading companies and true factories, and highlights red flags to avoid during supplier selection.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal entity status and manufacturing authorization | Validate via Chinese government portals (e.g., National Enterprise Credit Information Publicity System). Cross-check business scope for “manufacturing” of leather goods, saddlery, or equestrian equipment. |

| 2 | Conduct On-Site Factory Audit | Assess production capacity, equipment, and workforce | Hire third-party inspection firm (e.g., SGS, QIMA) for ISO-compliant audit. Verify machinery ownership, production lines, and worker count. |

| 3 | Review Export Documentation & Client References | Confirm export experience and client history | Request recent BOLs, export invoices, and 3 verifiable references (preferably in EU/UK/AU/NZ markets). Conduct reference calls. |

| 4 | Evaluate R&D and Customization Capability | Ensure ability to support technical equestrian designs | Review sample development timelines, in-house design team, and CAD/CAM integration. Request prototype lead time. |

| 5 | Inspect Quality Control Systems | Validate consistency and compliance | Audit QC processes (AQL 2.5/4.0), lab testing reports (e.g., EN 13158 for protective gear), and traceability systems. |

| 6 | Assess Supply Chain Transparency | Identify upstream material sources | Require disclosure of leather tanneries, hardware suppliers, and compliance with REACH/CA Prop 65. |

| 7 | Perform Trial Order (MOQ 50–100 units) | Test real-world performance | Monitor lead time, defect rate, packaging, and communication responsiveness. Use as benchmark for full-scale production. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License | Lists “trading,” “import/export,” or “sales” as primary activity | Includes “manufacturing,” “production,” or specific product codes (e.g., 1930 for leather goods) |

| Facility Footprint | No production machinery; office-only space | Visible production lines, raw material storage, and assembly stations |

| Workforce | Sales and logistics staff | Skilled technicians, machine operators, in-house QC team |

| Pricing Structure | Higher margins; less transparent cost breakdown | Direct cost model (material + labor + overhead); offers BOM transparency |

| Lead Time | Longer (relies on third-party production) | Shorter and more predictable (direct control) |

| Customization Ability | Limited; dependent on factory partners | Full control over design, tooling, and process adjustments |

| Communication | Sales managers handle all inquiries | Access to production managers, engineers, and R&D team |

Pro Tip: Ask for a “walkthrough video” of the production floor during operating hours. Factories can provide real-time footage; trading companies often cannot.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to allow on-site audit | High risk of misrepresentation | Disqualify supplier |

| No verifiable export history | Limited experience with int’l compliance | Request shipping documents; verify via freight forwarder |

| Prices significantly below market average | Likely use of substandard materials or subcontracting | Insist on material certifications and factory audit |

| Generic or stock photos of facility | Potential identity masking | Demand real-time video tour with timestamp |

| Pressure for large upfront payment (>30%) | Cash flow risk; possible fraud | Enforce secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No dedicated QC team or process documentation | Quality inconsistency | Require AQL sampling plan and inspection checklist |

| Inconsistent communication or delayed responses | Poor operational management | Evaluate responsiveness over 2-week trial period |

Strategic Recommendations for Reshoring Success

- Dual-Source Strategy: Maintain a backup supplier in Vietnam or Turkey to mitigate disruption risk.

- Invest in IP Protection: File design patents in China via the Hague System; use NDAs with IP clauses.

- Leverage Free Trade Agreements: Use China-New Zealand FTA for duty optimization on raw material imports.

- Adopt Digital Monitoring: Implement cloud-based production tracking (e.g., via SourcifyLink platform) for real-time visibility.

Conclusion

Reshoring equestrian production from China requires a data-driven, audit-backed approach to supplier verification. By systematically distinguishing factories from trading intermediaries and eliminating high-risk partners, procurement managers can ensure a resilient, transparent, and quality-focused supply chain. SourcifyChina recommends a minimum 90-day due diligence cycle before full production commitment.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

Q1 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing for Reshored Equestrian Manufacturing | 2026 Outlook

To: Global Procurement Managers | From: Senior Sourcing Consultant, SourcifyChina | Date: Q1 2026

Executive Summary: The Reshoring Reality & Hidden Costs

Recent data indicates 68% of NZ equestrian brands that reshored production from China (2023–2025) face critical operational gaps: 41% report cost overruns exceeding 22%, 33% experience 15–30% longer lead times, and 29% struggle with inconsistent quality in specialized components (e.g., leather tack, safety-certified saddlery). Reshoring without a hybrid supply chain strategy often replaces one risk (offshore dependency) with another (domestic capacity limitations).

SourcifyChina’s Verified Pro List solves this by enabling strategic partial re-sourcing to pre-vetted Chinese manufacturers—eliminating 8–12 weeks of supplier discovery while ensuring compliance, quality, and scalability for high-precision equestrian components.

Why the Verified Pro List Accelerates Reshoring Success

Procurement leaders at reshoring-focused NZ equestrian firms consistently achieve 3.2x faster supplier onboarding and 19% lower TCO (Total Cost of Ownership) by leveraging our Pro List. Here’s how we save critical time and mitigate risk:

| Activity | Traditional Sourcing (Without SourcifyChina) | With SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting & Compliance Checks | 6–10 weeks (RFQs, factory audits, document verification) | < 72 hours (Pre-verified ISO 9001, BSCI, industry-specific certs) | 5.5–9.5 weeks |

| Quality Assurance Setup | 3–5 weeks (Sample iterations, defect resolution) | 1 week (Historical QC data + real-time SourcifyChina oversight) | 2–4 weeks |

| Negotiating MOQs/Pricing | 4–8 weeks (Multiple rounds, hidden cost discovery) | < 10 days (Transparent benchmarks, pre-negotiated terms) | 3–7 weeks |

| Total Time to Production | 13–23 weeks | < 8 weeks | 5–15 weeks |

Source: SourcifyChina 2025 Reshoring Impact Study (n=47 NZ equestrian firms)

Key Advantages for Reshoring Firms:

– Precision Matching: Access 112+ Pro List manufacturers specializing in equestrian-specific production (e.g., EN13158-certified safety stirrups, vegetable-tanned leather goods), avoiding generic suppliers.

– Risk Containment: Zero compliance failures in 2025 among Pro List partners (vs. 24% failure rate in unvetted pools).

– Cost Preservation: Maintain reshoring’s quality control benefits while offsetting domestic cost inflation via targeted re-sourcing of non-core components (e.g., metal buckles, synthetic linings).

Your Strategic Imperative: Optimize, Don’t Reverse, Your Supply Chain

Reshoring is a tactical decision—but sustainable success demands agile, data-driven supplier integration. SourcifyChina’s Pro List transforms reshoring from a reactive retreat into a proactive advantage:

“After reshoring saddlery production to NZ, we faced 30% cost hikes on stirrups. SourcifyChina connected us to a Pro List supplier with EN13158 certification in 4 days—not 4 months. We cut component costs by 18% while retaining domestic assembly.”

— Procurement Director, NZ Premium Equestrian Brand (2025 Client)

Call to Action: Secure Your Reshoring ROI in < 72 Hours

Stop losing weeks to unvetted suppliers. Your verified path to resilient, cost-optimized production starts now:

-

Email

[email protected]with subject line: “NZ Equestrian Pro List Access – [Your Company Name]”

→ Receive a customized supplier shortlist matching your component specs, compliance needs, and volume within 24 business hours. -

WhatsApp

+86 159 5127 6160for urgent requests:

→ Get real-time capacity checks, sample timelines, and FOB pricing in < 2 hours.

Why act today?

– ⏱️ First 10 respondents in Q1 2026 receive a free Reshoring Risk Assessment ($1,500 value), identifying hidden cost leaks in your current supply chain.

– 📊 Exclusive 2026 Data: Access our Reshoring Component Cost Index showing where Chinese manufacturing still delivers 22–37% savings vs. NZ (e.g., precision-molded stirrups, laser-cut leather).

Don’t let reshoring become a cost trap. Partner with SourcifyChina to deploy a hybrid sourcing strategy that protects quality, slashes lead times, and locks in competitive advantage.

→ Contact us now to activate your Verified Pro List access.

[email protected] | +86 159 5127 6160 (WhatsApp)

SourcifyChina: Data-Driven Sourcing Intelligence for Global Procurement Leaders Since 2018.

All data anonymized per SourcifyChina Client Confidentiality Policy. © 2026 SourcifyChina.

🧮 Landed Cost Calculator

Estimate your total import cost from China.