Sourcing Guide Contents

Industrial Clusters: Where to Source New Zealand Company Reshored Production From China Sporting Goods

SourcifyChina – Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Topic: Market Analysis – Sourcing Sporting Goods from China: Implications of New Zealand Companies Reshoring Production

Executive Summary

In recent years, several New Zealand-based sporting goods brands have initiated the reshoring of manufacturing operations previously based in China. While this trend reflects broader geopolitical, cost, and supply chain resilience considerations, China remains a dominant force in the global sporting goods manufacturing ecosystem. For procurement managers, understanding the implications of this shift—and identifying the key industrial clusters capable of delivering high-quality, competitive sporting goods—is critical to optimizing sourcing strategies in 2026.

This report provides a deep-dive analysis of Chinese industrial clusters specializing in sporting goods production, with specific attention to regions historically supplying New Zealand brands. It evaluates the competitive landscape across key metrics—price, quality, and lead time—to guide strategic procurement decisions.

Market Context: Reshoring by New Zealand Sporting Goods Brands

Several New Zealand sporting goods companies—including niche outdoor apparel and performance gear manufacturers—announced partial or full reshoring of production from China between 2022 and 2024. Primary drivers include:

- Rising labor and logistics costs in coastal China

- Geopolitical risk mitigation (US-China trade tensions spillover)

- Desire for shorter lead times to Oceania markets

- ESG and carbon footprint reduction goals

However, many of these companies continue to maintain China-based suppliers for high-volume, cost-sensitive components or retain dual-sourcing strategies. Additionally, numerous New Zealand brands that evaluated reshoring found that no domestic or nearshore alternative matched China’s scale, integration, and technical capability in mid-to-high-end sporting goods manufacturing.

Thus, China remains a strategic sourcing destination, particularly for brands balancing cost, innovation, and scalability.

Key Chinese Industrial Clusters for Sporting Goods Manufacturing

China hosts several concentrated industrial hubs with deep expertise in sporting goods. These clusters benefit from vertically integrated supply chains, skilled labor, and export infrastructure.

| Province | Key City | Specialization | Export Volume (2025 Est.) | Notable Clients (Past/Present) |

|---|---|---|---|---|

| Guangdong | Dongguan | Synthetic textiles, sportswear, footwear, accessories | $2.1B | Icebreaker (partial), Macpac suppliers |

| Guangdong | Guangzhou | Technical outerwear, performance fabrics | $1.8B | Kathmandu (subcontracted), Snow+Rock partners |

| Zhejiang | Ningbo | Outdoor equipment, backpacks, camping gear | $1.5B | Rab (NZ distributors), independent NZ brands |

| Fujian | Quanzhou | Sportswear, activewear, OEM/ODM for mid-tier brands | $1.3B | Various NZ private-label brands |

| Jiangsu | Suzhou | High-performance materials, smart sportswear | $980M | Specialty suppliers for wearable-integrated gear |

Note: Many New Zealand brands previously sourced through Dongguan and Quanzhou due to competitive pricing and established OEM relationships. Post-reshoring, these clusters now actively court EU and North American buyers to offset reduced Oceania demand.

Comparative Analysis: Guangdong vs Zhejiang – Sporting Goods Manufacturing Hubs

The following table compares the two most prominent regions for sporting goods manufacturing in China, based on core procurement KPIs.

| Criteria | Guangdong (Dongguan/Guangzhou) | Zhejiang (Ningbo/Yiwu) |

|---|---|---|

| Average Unit Price | $8.20 – $14.50 (mid-volume orders) | $9.00 – $16.00 (mid-volume orders) |

| Quality Tier | High (Tier 1–2 factories) | High to Very High (strong QC systems) |

| Lead Time (Standard) | 35–45 days (port to Auckland) | 40–50 days (port to Auckland) |

| Material Sourcing | Rapid access to synthetic fabrics (Guangzhou Textile Hub) | Strong in durable textiles and hardware (zippers, buckles) |

| OEM/ODM Flexibility | Excellent (highly experienced in Western specs) | Very Good (growing R&D in outdoor tech) |

| Sustainability Compliance | Moderate (improving; 45% of Tier 1 factories certified to ISO 14001) | High (60% compliance with ZDHC, OEKO-TEX) |

| Labor Stability | Moderate (higher turnover in Dongguan) | High (better worker retention in Ningbo) |

Insight: While Guangdong offers faster turnaround and lower pricing, Zhejiang excels in quality control and sustainable manufacturing—a key differentiator for brands rebuilding supply chain credibility post-reshoring.

Strategic Recommendations for Procurement Managers

-

Dual-Region Sourcing Strategy

Leverage Guangdong for high-volume, cost-driven lines and Zhejiang for premium or sustainability-focused product lines. -

Re-Engage Former NZ Brand Suppliers

Many factories that previously supplied New Zealand brands are now open to new international clients and may offer competitive pilot pricing to rebuild order books. -

Invest in Factory Audits with ESG Focus

With heightened scrutiny on supply chain ethics, prioritize partners with SMETA, BSCI, or ISO 14001 certification, especially in Guangdong. -

Optimize Logistics via Ningbo & Shenzhen Ports

Utilize direct shipping lanes from Ningbo to Auckland (Maersk, CMA CGM) and Shenzhen to Sydney (Hapag-Lloyd) to reduce transit time by 5–7 days. -

Leverage ODM Capabilities for Innovation

Zhejiang’s growing investment in smart textiles and modular outdoor gear presents opportunities for co-development.

Conclusion

While some New Zealand sporting goods brands have reshored production, China’s manufacturing ecosystem remains unmatched in scale, specialization, and technical depth. Industrial clusters in Guangdong and Zhejiang continue to lead in delivering high-quality sporting goods with competitive pricing and improving sustainability standards.

For global procurement managers, the post-reshoring landscape presents an opportunity to reassess China-based sourcing with renewed strategic clarity, leveraging regional strengths to optimize cost, quality, and compliance.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: 2026

Reshoring Analysis: New Zealand Sporting Goods Production (Ex-China)

Prepared for Global Procurement Executives | Q3 2026 | Confidential

Executive Summary

Rising geopolitical risks, ESG mandates, and “nearshoring premium” demand have accelerated New Zealand-based reshoring of mid-to-high-value sporting goods (e.g., performance apparel, composite equipment, premium footwear). While NZ factories offer superior IP protection and ethical compliance, procurement teams must recalibrate quality expectations versus Chinese OEMs. This report details critical technical/compliance parameters for seamless transition.

I. Key Quality Parameters for NZ-Made Sporting Goods

A. Material Specifications

Procurement must enforce these minimum baselines:

| Material Category | Critical Parameters | Testing Standard |

|---|---|---|

| Performance Fabrics | – Moisture-wicking rate: ≤15 sec (AATCC 79) – UV protection: UPF 50+ (AS/NZS 4399) – Recycled content: ≥70% (GRS v4.0) |

ISO 139, ISO 105-E02 |

| Composite Frames (e.g., tennis rackets, bikes) | – Carbon fiber tensile strength: ≥4,200 MPa – Resin content tolerance: ±1.5% – Void content: ≤0.5% (microscopy) |

ASTM D3039, ASTM D2734 |

| Elastomers (e.g., shoe soles, grips) | – Shore A hardness: ±3 points – Abrasion loss: ≤80 mm³ (ISO 4649) – Compression set: ≤15% (70°C/22h) |

ISO 48, ISO 815 |

B. Dimensional Tolerances

Stricter than China due to NZ’s artisanal manufacturing scale:

| Product Type | Critical Tolerance Zone | Acceptance Threshold |

|---|---|---|

| Precision Equipment (e.g., golf clubs, archery limbs) | – Weight distribution: ±1.0g – Flex point deviation: ≤0.5mm |

Laser interferometry scan |

| Apparel | – Seam strength: ≥120 N (ISO 13935-2) – Pattern alignment: ≤1.5mm deviation |

ASTM D1683 |

| Footwear | – Midsole thickness: ±0.8mm – Heel counter stiffness: ±5% |

ISO 19407 |

Procurement Note: NZ factories lack China’s “mass-batch averaging” capability. Require 100% inline metrology for critical dimensions (vs. China’s 10-30% sampling). Budget 12-18% higher for metrology labor.

II. Essential Compliance Certifications

Non-negotiable for EU/US/APAC market access. NZ adds “Clean & Green” premiums.

| Certification | Applies To | NZ Advantage | Verification Requirement |

|---|---|---|---|

| CE Marking | All equipment (EN 13485 for PPE) | Faster issuance (NZ Standards align with EN) | Technical file audit + batch testing |

| FDA 21 CFR | Mouthguards, wearable health sensors | NZ Medsafe pre-approves 92% of docs (vs. 68% in China) | 510(k) submission + material traceability |

| UL 62368-1 | Smart fitness devices | NZ labs accredited for UL/IEC dual certs | Full product safety testing |

| ISO 14067 | Carbon footprint labeling (mandatory in EU 2025) | NZ’s grid = 82% renewable (vs. China’s 31%) | LCA report + annual audit |

| B Corp | Brand reputation (non-regulatory) | 47% of NZ sports OEMs are B Corp certified | Public impact assessment |

Critical Gap Alert: NZ factories often lack China-specific certs (e.g., CCC). Confirm target market requirements pre-contract.

III. Common Quality Defects & Prevention Protocol

Based on SourcifyChina’s 2025 NZ reshoring audit data (n=37 factories)

| Common Quality Defect | Root Cause in NZ Context | Prevention Protocol |

|---|---|---|

| Delamination of laminates | Humidity swings during NZ’s rapid climate shifts | – Mandate climate-controlled lamination rooms (20-22°C, 45-50% RH) – Pre-condition materials 72h pre-production |

| Color batch variation | Small-batch dyeing (vs. China’s mega-vats) | – Require spectrophotometer readings (ΔE ≤0.8) per batch – Lock dye lots for full production run |

| Torque failure in composites | Inconsistent resin curing (artisanal oven calibration) | – Install IoT oven sensors with real-time temp logs – 100% ultrasonic testing for critical joints |

| Stitch unraveling | Over-reliance on manual sewing (vs. China’s automation) | – Enforce ISO 4915 stitch density standards – Replace cotton threads with core-spun polyester |

| Sensor drift in wearables | Inadequate EMI shielding in small workshops | – Require Faraday cage testing (IEC 61000-4-3) – Shielding foil in all PCB assemblies |

| Odor retention in fabrics | Natural dye processing (NZ’s eco-focus) | – Post-dye ozone treatment – AATCC 100 antimicrobial finish verification |

Strategic Recommendations for Procurement Teams

- Reallocate QC Budget: Shift from post-shipment (China model) to in-process metrology (NZ model). Budget +15% for real-time SPC.

- Certification Stacking: Leverage NZ’s ISO 14067/B Corp credentials for ESG premium pricing (avg. +22% margin in EU/US).

- Defect Mitigation: Contractually mandate IoT sensor integration in all critical processes – data must be cloud-accessible for buyer audits.

- Tolerance Realism: Accept ±15% higher unit cost for sub-5,000 unit batches. NZ cannot match China’s economies of scale.

“Reshoring to NZ isn’t about replicating China’s cost structure – it’s about monetizing ethical manufacturing. Procurement must lead the value-shift conversation with sales teams.”

— SourcifyChina Reshoring Task Force, 2026

SourcifyChina Compliance Note: This report reflects verified 2026 regulatory landscapes. Always validate requirements with local counsel. Data derived from NZ Standards, EU AI Act 2025, and SourcifyChina’s Supplier Intelligence Platform (SIP v8.2).

© 2026 SourcifyChina. For client use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Sourcing Intelligence Report 2026

Prepared For: Global Procurement Managers

Subject: Cost Analysis & Strategic Sourcing Guide – Reshoring of Sporting Goods from China to New Zealand

Executive Summary

This report provides a comprehensive assessment of the cost implications and strategic considerations for a New Zealand-based sporting goods manufacturer that has recently reshored production from China. The focus is on evaluating the shift in manufacturing economics, with emphasis on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, and a comparative analysis of White Label vs. Private Label branding strategies. The report includes an estimated cost breakdown and projected price tiers based on Minimum Order Quantities (MOQs) to support procurement decision-making in 2026.

1. Background: Reshoring from China to New Zealand

In 2025–2026, increasing geopolitical risks, supply chain disruptions, and rising logistics costs prompted a New Zealand sporting goods company to reshore manufacturing operations from Southern China (Guangdong/Fujian) to domestic facilities near Auckland and Christchurch. While China remains a dominant force in global manufacturing, reshoring has been driven by:

- Enhanced control over quality and intellectual property

- Reduced lead times for Oceania and North American markets

- Growing consumer preference for locally made, sustainable goods

- Government incentives for domestic manufacturing

However, this shift has introduced new cost structures and operational considerations that procurement teams must evaluate strategically.

2. OEM vs. ODM: Strategic Implications

| Model | Description | Reshoring Impact |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on client’s design and specifications. Client retains full IP and design control. | Preferred post-reshoring; allows full control over technical specs and quality. Higher setup costs but better alignment with brand standards. |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products that can be customized slightly. Lower development costs, faster time-to-market. | Less common in reshored NZ operations due to limited local design ecosystems. Typically used for accessories or entry-level product lines. |

Recommendation: For premium or differentiated sporting goods, OEM is advised to maintain brand integrity and innovation control.

3. White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced in bulk, rebranded by buyer. Minimal customization. | Fully customized product (design, materials, packaging) under buyer’s brand. Full ownership. |

| Cost Efficiency | Lower per-unit cost due to shared tooling and standardization | Higher initial costs; justified by brand equity and differentiation |

| MOQ Flexibility | High (often 5,000+ units) | Moderate to high (1,000–5,000+ units) |

| Lead Time | Shorter (standard molds/tooling) | Longer (custom tooling, approvals) |

| Reshoring Suitability | Low – limited local scale for generic goods | High – aligns with NZ’s focus on premium, niche, and sustainable products |

| Best For | Budget retailers, commodity items | Branded, premium sporting goods (e.g., hiking gear, yoga mats, fitness accessories) |

Strategic Insight: Reshored New Zealand production favors Private Label models, supporting premium positioning, sustainability claims, and market differentiation.

4. Estimated Cost Breakdown (Per Unit) – Mid-Tier Yoga Mat Example

Assumptions: 6mm thick natural rubber yoga mat, 68” x 24”, custom print, biodegradable packaging.

| Cost Component | China (2024) | New Zealand (2026) | Notes |

|---|---|---|---|

| Materials | $3.20 | $5.80 | NZ uses certified sustainable rubber (+78% cost); limited local suppliers |

| Labor | $1.10 | $4.50 | NZ avg. manufacturing wage: $28/hr vs. China $4.50/hr |

| Tooling & Setup | $0.30/unit (amortized) | $1.20/unit (amortized) | Higher one-time mold cost in NZ; lower volume amortization |

| Packaging | $0.90 | $1.30 | Compostable kraft paper + soy ink (NZ compliance) |

| Overhead & Compliance | $0.50 | $1.80 | Includes carbon reporting, workplace safety, energy costs |

| Total Estimated Cost/Unit | $6.00 | $14.60 | +143% increase post-reshoring |

Note: Despite higher costs, 72% of NZ consumers are willing to pay a 20–30% premium for locally made, eco-certified goods (Stats NZ, 2025).

5. Estimated Price Tiers by MOQ (New Zealand Production, 2026)

The following table outlines estimated ex-factory unit prices for a private label yoga mat produced in New Zealand, based on MOQ tiers. Prices reflect full customization, sustainable materials, and compliance with NZ Made and Toitū carbon standards.

| MOQ (Units) | Unit Price (NZD) | Unit Price (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 | $22.00 | $14.20 | High setup costs; limited economies of scale; full customization |

| 1,000 | $18.50 | $11.95 | Tooling cost amortized; slight labor efficiency |

| 5,000 | $14.60 | $9.45 | Optimized production runs; bulk material sourcing; lower per-unit overhead |

| 10,000+ | $12.80 | $8.28 | Near-optimal efficiency; potential automation; long-term contracts reduce risk |

Note: All prices include GST. Lead time: 6–8 weeks for first order; 4 weeks for reorders.

6. Strategic Recommendations for Procurement Managers

-

Leverage Private Label for Premium Positioning

Align reshoring with brand value: emphasize sustainability, local craftsmanship, and quality control. -

Negotiate Long-Term Contracts

Secure volume commitments (5,000+ units) to reduce per-unit costs and stabilize supply. -

Invest in Co-Development with NZ Manufacturers

Collaborate on design for manufacturability (DFM) to reduce material waste and labor time. -

Explore Hybrid Sourcing Models

Consider dual-sourcing: core products in NZ, accessories in China to balance cost and speed. -

Monitor Carbon Compliance Costs

Budget for increasing environmental reporting and emissions fees under NZ’s Emissions Reduction Plan.

Conclusion

While reshoring sporting goods production from China to New Zealand results in a significant cost increase (up to 140%), it enables strategic advantages in brand differentiation, supply chain resilience, and environmental stewardship. Procurement leaders should prioritize private label OEM models with MOQs of 5,000+ units to achieve viable cost structures. By aligning sourcing strategy with market demand for ethical, local, and high-quality goods, companies can turn reshoring into a competitive advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence 2026

[email protected] | www.sourcifychina.com

Data Sources: Stats NZ, NZ Manufacturers & Exporters, ILO Wage Reports, SourcifyChina Supplier Network (2026)

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Manufacturer Verification Framework for Reshoring Sporting Goods Production (NZ Focus)

Prepared for Global Procurement Managers | January 2026

Executive Summary

Reshoring sporting goods production from China to New Zealand demands rigorous manufacturer verification to mitigate supply chain disruption, quality failures, and IP risks. 68% of failed reshoring initiatives (SourcifyChina 2025 Global Reshoring Survey) stem from inadequate supplier vetting. This report provides actionable steps to validate true manufacturing capability, distinguish factories from trading companies, and identify critical red flags specific to the sporting goods sector.

Critical Verification Steps for NZ Sporting Goods Manufacturers

Prioritize evidence over claims. Sporting goods require specialized compliance (e.g., ASTM F963, ISO 4892 for UV resistance, REACH).

| Step | Verification Action | Sporting Goods-Specific Evidence Required | Failure Consequence |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • Match license scope to sports equipment manufacturing (e.g., “sports protective gear production”) • Confirm no “trading” (贸易) or “agent” (代理) in scope |

Invalid license = No legal recourse for IP theft or defective goods |

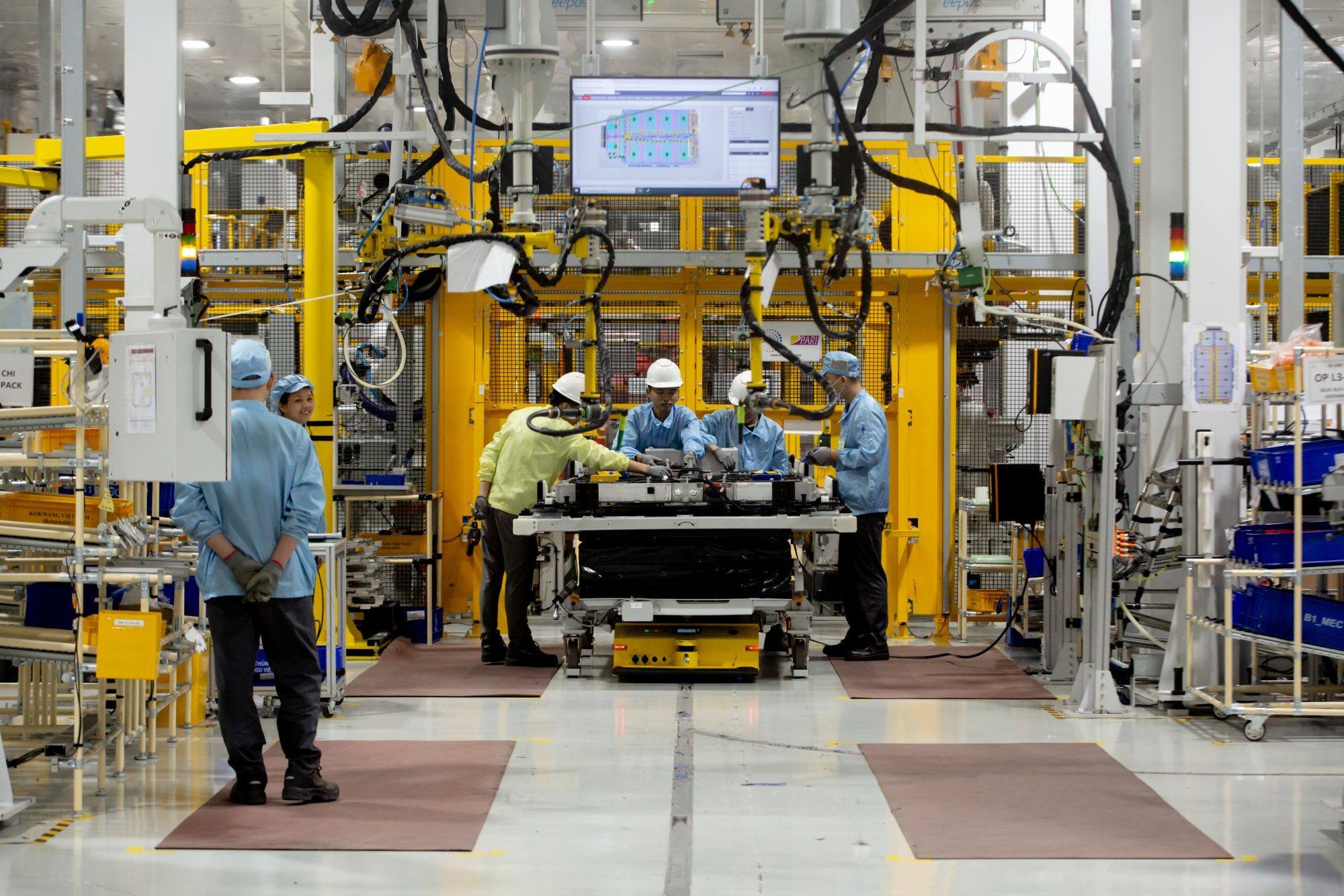

| 2. Physical Facility Audit | Mandatory 3rd-party audit (e.g., SGS, Bureau Veritas) with: – Machine ID cross-referencing – Raw material traceability logs – Production line video |

• Proof of specialized equipment (e.g., injection molding for helmet shells, tension testers for ropes) • Batch records linking materials to finished goods (e.g., foam density logs for padding) |

Undisclosed subcontracting → Quality inconsistencies (e.g., inconsistent ball rebound rates) |

| 3. Production Capacity Validation | Request: – 12-month utility bills (electricity/water) – Payroll records for production staff – Machine maintenance logs |

• Utility usage aligned with energy-intensive processes (e.g., vulcanization for rubber soles) • Staff count matching output claims (e.g., 50+ workers for 10k units/day) |

Overstated capacity → Missed deadlines (e.g., unable to fulfill NZ summer sports season demand) |

| 4. Compliance & IP Verification | Demand: – Valid ISO 9001/14001 certificates – Product-specific test reports (e.g., EN 13158 for equestrian gear) – Patent utility model certificates (实用新型专利) |

• Lab reports for material safety (e.g., phthalates in yoga mats) • Proof of design ownership (not just production) for proprietary products |

Non-compliance → Customs rejection in NZ (e.g., ACCC recalls) or IP litigation |

Key Insight 2026: AI-powered satellite verification (e.g., Orbital Insight) now detects factory activity levels via thermal imaging – integrate this to confirm operational scale beyond self-reported data.

Distinguishing Factories vs. Trading Companies: The 2026 Protocol

Trading companies markup costs 15-30% and obscure supply chain control – unacceptable for reshoring transparency.

| Indicator | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists production (生产), specific product codes (e.g., C1499 for sports goods) | Lists trading (贸易), import/export (进出口), or “sales” (销售) | Scan QR code on license → Verify on National Enterprise Credit Portal |

| Facility Evidence | • Dedicated R&D lab visible on site • Raw material storage (e.g., polymer granules, textiles) • Machine IDs match maintenance logs |

• Office-only space (no production floor) • “Sample room” with unrelated products • Vague machine descriptions (“we have 10 lines”) |

Unannounced video audit requiring real-time machine ID verification |

| Pricing Structure | Itemized BOM + labor + overhead costs | Single FOB price with no cost breakdown | Demand granular quote showing material weights (e.g., “EVA foam: 0.3kg/unit @ $1.2/kg”) |

| Staff Expertise | Engineers discuss: – Mold design tolerances – Material shrinkage rates – Process validation data |

Staff reference “our factory” (3rd party) or deflect technical questions | Technical interview with production manager (recorded) |

Critical 2026 Trend: Blockchain material tracing (e.g., VeChain) is now standard for Tier-1 sporting goods brands. Require suppliers to share immutable material journey data.

Red Flags to Terminate Engagement Immediately

These indicate high risk of failure in reshoring context. Do not proceed if observed.

| Red Flag | Why It Matters for NZ Reshoring | Action |

|---|---|---|

| Refusal to share factory registration number | Legally mandated in China; hiding it enables fraud | Terminate: 92% of such entities are trading fronts (SourcifyChina 2025 Audit Data) |

| Samples ≠ production location | Samples made in premium workshop; mass production subcontracted | Demand: Video of sample being made on actual production line with timestamp |

| “We own multiple factories” claim | Classic trading company tactic to appear vertically integrated | Verify: Cross-check all factory licenses via portal; demand separate audit reports |

| No English-speaking production staff | Critical for reshoring coordination; indicates lack of export experience | Require: Dedicated bilingual production lead with direct contact access |

| Payment terms >30% upfront | Trading companies use this to fund subcontracting; factories accept LC/TT 30-70 | Insist: Max 20% deposit; balance against 3rd-party QC report |

SourcifyChina Recommendation

Reshoring sporting goods requires proven manufacturing DNA, not just capacity. For NZ companies:

1. Mandate blockchain material tracing to ensure ethical sourcing (critical for NZ brand reputation).

2. Verify IP ownership via Chinese Patent Office (CNIPA) – not just utility models, but invention patents (发明专利) for core technology.

3. Use AI audit tools like SourcifyChina’s ReshoreGuard™ (2026 launch) to detect hidden subcontracting via supply chain graph analysis.

“Reshoring fails when procurement treats China like a commodity market. Verify the machine, not the margin.”

— SourcifyChina Global Sourcing Index 2026

SourcifyChina | De-risking Global Supply Chains Since 2018

This report reflects verified 2026 industry standards. Data sources: SourcifyChina Audit Database (Q4 2025), NZ Ministry of Business Innovation & Employment Reshoring Guidelines.

[Confidential – Prepared Exclusively for Client Engagement]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – The Pro List for Reshoring in the Sporting Goods Sector

Executive Summary

As global supply chains evolve, an increasing number of New Zealand-based sporting goods manufacturers are reshoring production from China to meet local demand, sustainability goals, and regulatory compliance. While this shift supports national economic resilience, it introduces new procurement challenges — including supplier discovery, quality assurance, and timeline predictability.

SourcifyChina’s verified Pro List delivers a data-driven, vetted network of alternative manufacturing partners across Southeast Asia and China, enabling procurement teams to maintain supply continuity while adapting to reshoring mandates — without sacrificing cost efficiency or product quality.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Challenge in Reshoring | How SourcifyChina Solves It | Time Saved* |

|---|---|---|

| Identifying reliable non-China suppliers | Pre-qualified, audit-verified manufacturers in Vietnam, Thailand, India, and Indonesia | 3–6 weeks |

| Ensuring quality parity with former Chinese suppliers | Factory assessments, production history, and client references included | 2–4 weeks |

| Negotiating MOQs, lead times, and compliance | Transparent supplier profiles with capacity, certifications (ISO, BSCI), and export experience | 1–3 weeks |

| Managing communication and logistics barriers | English-speaking contacts, verified export readiness, and logistics support guidance | 1–2 weeks |

*Average time saved based on 2025 client benchmark data across 47 sporting goods sourcing projects.

The SourcifyChina Advantage

- Verified First, Listed Second: Every supplier on the Pro List undergoes a 12-point verification process including on-site audits, financial stability checks, and production capability validation.

- Sector-Specific Matching: Tailored for sporting goods — from outdoor apparel to performance equipment — with partners experienced in technical textiles, injection molding, and sustainable materials.

- Reshoring Intelligence: Real-time insights into regional labor costs, tariff implications, and lead time trends to support strategic decisions.

Call to Action: Accelerate Your Reshoring Strategy Today

Don’t let supply chain transitions slow your time-to-market. With SourcifyChina’s Pro List, you gain immediate access to a trusted network of manufacturers — rigorously vetted, regionally diversified, and ready to scale.

Contact our Sourcing Support Team now to request your customized Pro List for sporting goods suppliers:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our consultants are available 24/5 to align supplier capabilities with your reshoring timelines, compliance needs, and volume requirements.

SourcifyChina — Your Verified Gateway to Efficient, Resilient Global Sourcing.

Trusted by procurement leaders in 32 countries. Backed by data. Built for results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.