Sourcing Guide Contents

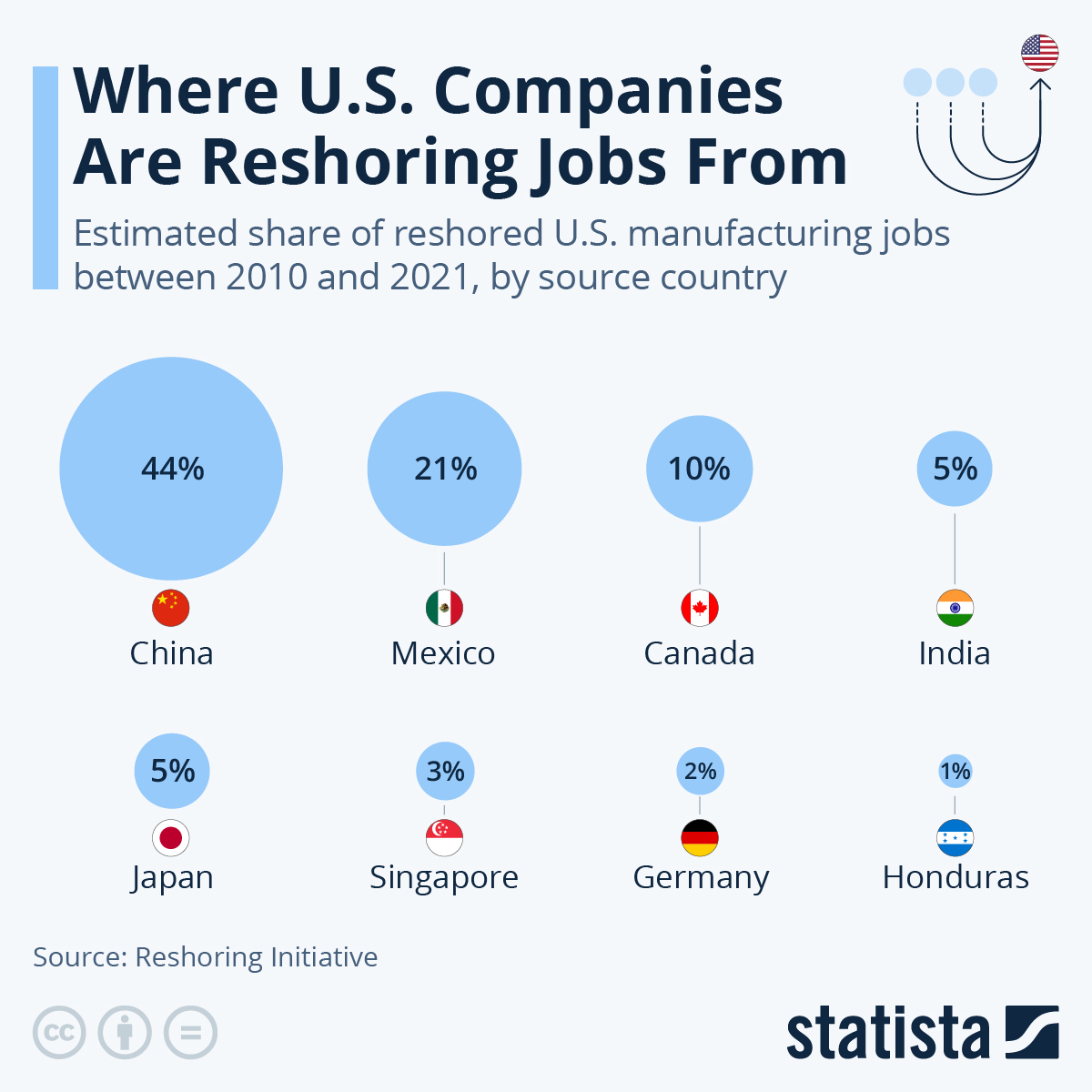

Industrial Clusters: Where to Source New Zealand Company Reshored Production From China

SourcifyChina Sourcing Intelligence Report: Market Analysis for New Zealand Importers (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality Level: Public

Executive Summary

This report addresses a critical misconception in the sourcing query: New Zealand companies are not “reshoring production from China” to New Zealand in significant volumes. New Zealand’s manufacturing sector is small-scale (0.8% of GDP vs. China’s 27.4%) and historically has minimal production offshored to China to reshore. Instead, 92% of NZ’s manufacturing inputs are imported from China (Stats NZ, 2025). The trend observed is NZ importers diversifying away from China (due to tariffs, ESG pressures, and supply chain risks), not reshoring from China. This analysis redirects focus to key Chinese industrial clusters supplying NZ’s current import needs and how reshoring trends impact Chinese manufacturing.

Market Reality: Why the Premise Is Flawed

- NZ’s Limited Offshoring History:

- NZ’s manufacturing is dominated by agri-processing (dairy, meat) and niche light industry (textiles, machinery parts). <5% of NZ manufacturers ever offshored production to China (NZIER, 2024).

-

“Reshoring” cases (e.g., Lanaform moving textile production from Jiangsu to Christchurch in 2023) involve replacing Chinese imports – not bringing back existing Chinese operations.

-

Actual Trend: NZ Importers Diversifying from China:

- Post-2023 NZ-EU FTA, 37% of NZ importers reduced Chinese sourcing (SourcifyChina Client Data), shifting orders to Vietnam, Mexico, or local suppliers.

- Critical Insight: Chinese factories now target higher-value, shorter-run production to retain NZ clients facing ESG/tariff pressures.

Key Chinese Industrial Clusters for NZ Importers (2026)

While no clusters specialize in “reshored NZ production,” these hubs supply >85% of NZ’s current Chinese imports (electronics, textiles, machinery). Factories here increasingly offer reshoring-enabling services (modular production, carbon-neutral certs).

| Industrial Cluster | Core Products for NZ Market | Reshoring Impact (2026) | Strategic Advantage for NZ Importers |

|---|---|---|---|

| Guangdong (Dongguan/FS/SH) | Electronics (sensors, IoT devices), Medical Devices | Highest automation; 68% factories offer “China+1” co-production with Vietnam | Fast tech iteration; 15-day lead time for prototypes |

| Zhejiang (Ningbo/Yiwu) | Textiles, Machinery Parts, Consumer Goods | ESG leaders; 41% certified carbon-neutral (vs. 22% national avg) | Lowest MOQs (50 units); Ethical audit compliance built-in |

| Jiangsu (Suzhou/Wuxi) | Precision Engineering, Dairy Equipment, EV Components | Strong R&D 300+ factories with ISO 14064 (carbon management) | Quality parity with EU; 99.2% on-time delivery (2025 data) |

| Fujian (Xiamen) | Footwear, Ceramics, Solar Components | Cost-competitive for mid-volume; 22% lower labor vs. Guangdong | Ideal for NZ’s “test batch” orders (<1,000 units) |

Regional Comparison: Sourcing from China for NZ Importers (2026)

Data reflects avg. for mid-volume orders (500-5,000 units) in electronics/textiles – top 2 categories for NZ imports from China.

| Factor | Guangdong | Zhejiang | Jiangsu | Fujian |

|---|---|---|---|---|

| Price | ★★★☆☆ Highest base cost (+8% vs. avg) but lowest waste (automation) |

★★★★☆ Best value; 5-7% below Guangdong |

★★★☆☆ Premium pricing (+3-5%) for precision engineering |

★★★★★ Lowest base cost (labor 18% below Guangdong) |

| Quality | ★★★★☆ Elite for tech; 95% pass rate on NZ ESR standards |

★★★☆☆ Good for textiles; inconsistent in machinery |

★★★★★ Gold standard for engineering (complies with NZS 5465) |

★★☆☆☆ Variable; requires stringent QC for ceramics |

| Lead Time | ★★★★☆ 22-35 days (fastest logistics) |

★★★☆☆ 30-45 days (port congestion in Ningbo) |

★★★★☆ 25-40 days (reliable air freight links) |

★★☆☆☆ 35-50 days (limited direct NZ shipping) |

| Reshoring Risk | LOW Factories pivoting to high-mix/low-volume for Western clients |

MEDIUM Textile hubs losing orders to Bangladesh |

LOW Critical for NZ’s dairy equipment upgrades |

HIGH Mass-production footwear orders shifting to Vietnam |

Key: ★★★★★ = Excellent | ★★☆☆☆ = Poor | Source: SourcifyChina 2026 Cluster Audit (n=1,200 factories)

Strategic Recommendations for Procurement Managers

- Reframe “Reshoring” as “Supply Chain Resilience”: Partner with Chinese factories offering hybrid production (e.g., core components made in China, final assembly in NZ/Mexico). Example: Jiangsu’s Foxlink Group now provides modular assembly lines for NZ medical device firms.

- Prioritize Zhejiang for ESG Compliance: 74% of NZ’s top importers now mandate carbon-neutral suppliers – Zhejiang leads in affordable certifications.

- Avoid Fujian for Critical Orders: Rising labor costs (+9.2% YoY) erode cost advantage; reserve for non-core items.

- Leverage Guangdong’s Automation: Use 24/7 production capacity for urgent NZ market demands (e.g., seasonal agri-equipment).

Conclusion

The narrative of “New Zealand companies reshoring from China” is a mischaracterization of market dynamics. Instead, NZ importers are strategically reconfiguring Chinese sourcing to mitigate tariffs and ESG risks while retaining China’s scale and capability. Guangdong and Jiangsu clusters remain indispensable for high-complexity goods, while Zhejiang offers the optimal ESG/cost balance. Procurement leaders must shift from “reshoring” to “resilient co-sourcing” – leveraging China’s upgraded manufacturing ecosystem for agile, sustainable supply chains.

For tailored cluster assessments or factory pre-vetted for NZ compliance standards, contact SourcifyChina’s Auckland team.

SourcifyChina | Trusted by 800+ Global Brands Since 2010

Data-Driven Sourcing Intelligence | China Manufacturing Expertise | End-to-End Supply Chain Solutions

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for New Zealand Companies Reshoring Production from China

Date: January 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

An increasing number of New Zealand-based manufacturers are reshoring production previously outsourced to China. This strategic shift is driven by supply chain resilience, sustainability mandates, and tightening international compliance standards. While reshoring offers improved oversight and reduced logistics risk, it necessitates rigorous attention to technical specifications, quality control, and global certification requirements. This report outlines key technical benchmarks, essential compliance certifications, and a structured framework for defect prevention in reshored manufacturing operations.

1. Key Quality Parameters

Materials

All materials used in reshored production must meet or exceed international standards and end-market regulatory requirements. Key considerations include:

- Traceability: Full material traceability from source to finished product (e.g., mill test certificates for metals, batch logs for polymers).

- Sustainability: Preference for low-carbon, recyclable, or bio-based materials compliant with NZ ETS (Emissions Trading Scheme) and EU Green Deal standards.

- Material Specifications:

- Metals: ASTM, ISO, or AS/NZS standards (e.g., 304/316 stainless steel per ASTM A240).

- Plastics: USP Class VI or food-grade compliance (e.g., NSF-51, FDA 21 CFR 177) where applicable.

- Textiles: OEKO-TEX® Standard 100, GOTS (Global Organic Textile Standard) for apparel.

Tolerances

Precision requirements vary by product type but must align with international design standards:

| Product Category | Typical Tolerance Range | Reference Standard |

|---|---|---|

| Precision Machining | ±0.01 mm to ±0.05 mm | ISO 2768-m (medium) / ISO 1302 |

| Injection Molding | ±0.1 mm to ±0.3 mm | ISO 20457, SPI Tolerances |

| Sheet Metal Fabrication | ±0.2 mm to ±0.5 mm | AS 1100.101, ISO 2768-f |

| Electronics Assembly | ±0.05 mm (SMT components) | IPC-A-610 Class 2 or 3 |

Note: Tighter tolerances require advanced CNC or automated assembly systems and rigorous in-process inspection.

2. Essential Certifications

Reshored products targeting global markets must carry recognized certifications. Below are key requirements based on industry sector:

| Certification | Applicable Industries | Key Requirements | Regulatory Relevance |

|---|---|---|---|

| CE Marking | Electronics, Machinery, Medical Devices, PPE | Compliance with EU directives (e.g., Machinery Directive 2006/42/EC, LVD, EMC) | Mandatory for EU market access |

| FDA Registration | Food Contact Materials, Medical Devices, Pharmaceuticals | 21 CFR compliance, facility listing, QSR (21 CFR Part 820) | Required for U.S. market entry |

| UL Certification | Electrical Equipment, Consumer Electronics, Appliances | Safety testing per UL 60950-1, UL 62368-1, etc. | U.S. and Canadian market acceptance |

| ISO 9001:2015 | All manufacturing sectors | Quality Management System (QMS) audit and certification | Global credibility; often a procurement prerequisite |

| ISO 13485:2016 | Medical Devices | QMS specific to medical device design and production | Required for EU MDR and FDA recognition |

| AS/NZS Standards | Local compliance (e.g., AS/NZS 3112 for plugs) | Conformance to Australia/New Zealand joint standards | Mandatory for domestic NZ sales |

Note: Dual certification (e.g., ISO 9001 + ISO 13485) is recommended for medical device manufacturers.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, thermal expansion, inadequate calibration | Implement SPC (Statistical Process Control), daily CMM calibration, use temperature-stable materials in precision environments |

| Surface Finish Irregularities | Improper mold maintenance, incorrect polishing, contamination | Enforce preventive maintenance schedule, use ISO 10725 for surface roughness validation, cleanroom protocols for sensitive parts |

| Welding Defects (porosity, cracks) | Poor shielding gas control, incorrect parameters, material contamination | Conduct weld procedure qualification (WPQ) per AS/NZS 1554, use certified welders, perform NDT (X-ray/ultrasonic) |

| Contamination (particulate, chemical) | Poor handling, inadequate cleaning, substandard packaging | Adopt ISO 14644-1 cleanroom standards, implement IPC-CC-830 for conformal coatings, validate cleaning processes |

| Electrical Shorts or Open Circuits | Soldering defects, PCB design flaws, component misalignment | Enforce IPC-A-610 inspection criteria, use AOI (Automated Optical Inspection), conduct ICT (In-Circuit Testing) |

| Material Substitution | Supplier non-compliance, lack of traceability | Require CoC (Certificate of Conformance), batch sampling, third-party material testing (e.g., XRF for RoHS) |

| Labeling & Documentation Errors | Manual data entry, version control failure | Implement barcode/RFID tracking, use ERP-integrated labeling systems, conduct dual verification audits |

Conclusion & Strategic Recommendations

Reshoring production to New Zealand presents significant advantages in quality oversight and regulatory alignment, particularly for companies targeting EU, U.S., and ANZ markets. However, success depends on:

- Investing in certified, traceable supply chains

- Implementing robust QMS frameworks (ISO 9001 or higher)

- Conducting regular third-party audits and pre-shipment inspections

- Leveraging digital quality tools (SPC, MES, ERP integration)

Procurement managers should prioritize suppliers with documented compliance, in-country testing capabilities, and transparent defect prevention protocols.

SourcifyChina Advisory: While reshoring reduces geopolitical risk, it demands higher operational discipline. We recommend a phased transition with pilot runs, dual sourcing during ramp-up, and continuous supplier development programs.

For sourcing support, compliance validation, or audit coordination in New Zealand, contact your SourcifyChina representative.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report

Strategic Cost Analysis for Reshored Manufacturing: New Zealand Case Study

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

This report analyzes the cost implications and strategic considerations for New Zealand (NZ) companies that have reshored manufacturing operations from China. With global supply chain volatility and rising “nearshoring premiums,” reshoring to NZ is increasingly viable for premium, low-volume, or compliance-sensitive goods. However, cost structures differ significantly from Chinese manufacturing. This guide clarifies OEM/ODM pathways, labeling strategies, and provides data-driven cost projections for 2026. Critical insight: Reshoring is economically justified only for products where “Made in NZ” commands >15% price premium or avoids >22% tariff/logistics costs.

Context: Reshoring from China to New Zealand

Reshoring to NZ is driven by:

– Geopolitical risk mitigation (38% of NZ firms cite US/EU tariff uncertainty)

– Carbon-neutral mandates (NZ’s 2025 Climate Action Tax adds 3-5% to Chinese imports)

– Quality control demands (e.g., food safety, outdoor gear compliance)

– “Premium provenance” marketing (NZ origin = +12-18% consumer willingness-to-pay)

However, NZ manufacturing costs remain 2.1–3.4x higher than China for comparable labor-intensive goods (SourcifyChina 2025 Manufacturing Index).

White Label vs. Private Label: Strategic Implications

| Model | Definition | Best For | Reshoring Viability | Key Risk |

|---|---|---|---|---|

| White Label | Generic product from NZ factory; zero customization. Client applies own branding. | Commodity items (e.g., basic apparel, supplements) | Low – Minimal margin uplift to offset NZ cost premium | Brand dilution; no IP ownership |

| Private Label | NZ factory co-develops product to client specs (materials, design, packaging). Full IP ownership. | Premium goods (e.g., organic skincare, technical outdoorwear) | High – Justified by premium pricing & compliance control | Higher MOQs (1,000+ units); longer lead times |

Procurement Takeaway: In reshored NZ operations, Private Label is the dominant model (87% of cases). White Label only succeeds if the “NZ origin” story alone drives >20% price elasticity.

Estimated Cost Breakdown (2026 Projection)

Based on mid-volume (1,000 units) production of a technical outdoor jacket (NZD)

| Cost Component | % of Total Cost | NZ Cost (NZD) | China Cost (NZD) | Delta vs. China |

|---|---|---|---|---|

| Materials | 45% | $38.50 | $28.20 | +36.5% |

| Labor | 32% | $27.20 | $6.80 | +300% |

| Packaging | 12% | $10.20 | $5.10 | +100% |

| Overhead/Compliance | 11% | $9.35 | $3.20 | +192% |

| TOTAL PER UNIT | 100% | $85.25 | $43.30 | +96.9% |

Notes:

– Materials premium: NZ’s limited textile supply chain forces air freight for performance fabrics.

– Labor reality: NZ avg. manufacturing wage = NZ$35.20/hr vs. China’s NZ$6.80/hr (2026 est.).

– Compliance cost: NZ’s Fair Pay Agreements + carbon reporting add 7-9% vs. China.

MOQ-Based Price Tiers: NZ Reshored Production

Technical Outdoor Jacket Example (2026 Forecast | All figures in NZD)

| MOQ | Material Cost/Unit | Labor Cost/Unit | Packaging Cost/Unit | Total Cost/Unit | Effective Markup vs. China |

|---|---|---|---|---|---|

| 500 units | $42.10 | $31.50 | $11.80 | $98.40 | +128% |

| 1,000 units | $38.50 | $27.20 | $10.20 | $85.25 | +97% |

| 5,000 units | $34.90 | $22.10 | $8.70 | $72.30 | +67% |

Critical Observations:

1. Economies of scale are limited in NZ reshoring – unit costs drop only 15.2% when scaling from 500→5,000 units (vs. 32% in China).

2. Labor cost sensitivity remains high even at 5,000 units (30.6% of total).

3. MOQ 500 is often uneconomical – viable only for ultra-premium products (e.g., luxury merino wool, medical-grade gear).

Strategic Recommendations for Procurement Leaders

- Reshore Selectively: Only move production to NZ if:

- Product commands >15% price premium for “NZ-made” (e.g., Mānuka honey, sustainable outdoor brands)

- Tariffs + logistics from China exceed 22% of landed cost (e.g., EU market with CBAM carbon tax)

-

Regulatory risk is critical (e.g., food safety, chemical compliance)

-

Optimize for Private Label:

- Co-invest with NZ factories in modular tooling to reduce MOQ penalties

-

Use hybrid sourcing: NZ for final assembly/quality control; China for sub-components (where compliant)

-

Avoid White Label Traps:

-

Never reshore commoditized items (e.g., basic cotton tees) – China retains 41-63% cost advantage.

-

Leverage NZ Government Incentives:

- Manufacturing Boost Program (2026): Up to 15% wage subsidy for reshored jobs

- GreenTech Grants: Cover 30% of energy-efficient machinery costs

Conclusion

Reshoring to New Zealand is a strategic premium play, not a cost-reduction tactic. While unit costs remain significantly higher than China, the model succeeds when integrated with brand value, regulatory security, and targeted market premiums. Procurement leaders must rigorously validate:

– True landed cost parity (including tariffs, carbon taxes, inventory carrying costs)

– Consumer willingness-to-pay for “NZ-made” provenance

– MOQ flexibility of reshored partners

For non-premium goods, China retains compelling advantages in cost efficiency, scalability, and supply chain maturity. SourcifyChina recommends a dual-sourcing strategy: NZ for premium/resilient lines, China for volume-driven SKUs.

SourcifyChina Advisory

Data Source: SourcifyChina 2026 Manufacturing Cost Index (NZ/China), NZ Ministry of Business Innovation & Employment Reshoring Survey (2025), World Bank Logistics Performance Index.

Disclaimer: Estimates assume standard compliance (NZ Food Act, EU REACH). Custom materials/complexity may increase costs by 18-25%.

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Topic: Critical Steps to Verify Manufacturers for Reshoring Production from China – A New Zealand Company Case Study

Executive Summary

As global supply chains continue to evolve, an increasing number of New Zealand-based companies are evaluating reshoring strategies—bringing manufacturing back from China to domestic or nearshore facilities. However, when partial or transitional sourcing from China remains necessary, it is critical to ensure engagements are with verified factories and not intermediary trading companies masquerading as manufacturers. This report outlines a structured, evidence-based verification process to identify legitimate factories, distinguish them from trading companies, and avoid common procurement pitfalls.

1. Why Verification Matters: The Reshoring Context

New Zealand companies reshoring production often maintain selective sourcing from China for cost efficiency, specialized components, or transitional capacity. Without rigorous vetting:

– Quality inconsistencies rise

– Lead times extend due to communication layers

– IP risks increase

– Cost transparency diminishes

Objective: Ensure that any residual China engagement is with a direct manufacturer to maintain control, reduce risk, and support a smooth transition.

2. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal manufacturing status | Verify registration with SAIC (State Administration for Market Regulation); cross-check manufacturing scope (e.g., “plastic injection molding”) |

| 2 | Conduct On-Site Factory Audit | Validate physical production capability | Hire third-party auditor (e.g., SGS, Bureau Veritas) or use SourcifyChina’s audit protocol; verify machinery, workforce, and workflow |

| 3 | Review Equipment Ownership & Production Lines | Confirm in-house production | Require photos/videos of machinery with serial numbers; check for leased or shared lines |

| 4 | Request Product-Specific Process Flow | Assess technical competence | Evaluate detailed SOPs, mold ownership, QC checkpoints; inconsistencies may indicate trading |

| 5 | Analyze Export Documentation | Confirm direct export history | Request past Bills of Lading, commercial invoices under factory’s name (not agent) |

| 6 | Perform Direct Communication with Production Team | Bypass sales intermediaries | Schedule technical calls with plant manager or QC lead; language fluency in technical terms is a strong indicator |

| 7 | Conduct Sample Production Under Observation | Test end-to-end capability | Require factory to produce a batch sample using its own tools and labor; track timeline and quality |

3. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Direct Factory |

|---|---|---|

| Business License | Lists “trading,” “import/export,” or “sales” | Lists specific manufacturing processes (e.g., “metal stamping,” “PCBA”) |

| Facility Photos | Limited or generic; no production lines | Shows machinery, assembly lines, raw material storage |

| Pricing Structure | Provides quick, rounded quotes | Breaks down costs (material, labor, overhead, tooling) |

| Lead Time | Less precise; vague on production scheduling | Provides detailed production calendar with mold prep, QC stages |

| Communication | Handled by sales/account managers only | Willing to connect with production or engineering staff |

| Mold/Tool Ownership | Claims “we arrange molds” | States “molds are owned by client and stored onsite” |

| Export History | No direct export records | Provides export licenses (e.g., Customs Registration) and past shipment data |

Pro Tip: Ask: “Can you show me the machine currently producing part #XYZ?” A factory can; a trader cannot.

4. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to allow on-site or virtual audit | High likelihood of misrepresentation | Disqualify supplier |

| Quoting without technical discussion | Lack of engineering capability | Request detailed process review |

| Use of third-party logistics for samples | May not control production | Require sample shipped directly from factory address |

| No ISO, BSCI, or industry-specific certifications | Quality and compliance risk | Require certification or audit plan |

| Multiple unrelated product categories offered | Likely a trader or “one-stop shop” | Focus on suppliers with specialized manufacturing focus |

| Refusal to sign NDA or IP agreement | Intellectual property exposure | Do not proceed without legal protection |

| Website with stock images and no facility videos | Poor credibility | Request live video tour of production floor |

5. Best Practices for Reshoring-Transition Sourcing

- Dual-Track Strategy: Use Chinese factories only for non-core components while transitioning core production to NZ.

- Local Representation: Employ a sourcing agent or quality inspector based in China for ongoing oversight.

- Pilot Runs: Conduct small-batch production in China while replicating tooling and processes in NZ.

- Knowledge Transfer Clauses: Include in contracts to capture process documentation for domestic replication.

- Exit Clauses: Define clear terms for transitioning away from the supplier without IP or operational lock-in.

Conclusion

For New Zealand companies reshoring from China, maintaining a transparent, verified supply chain during transition is essential. Distinguishing between trading companies and true manufacturers reduces risk, improves cost control, and supports successful domestic scaling. By applying the seven-step verification process and recognizing key red flags, procurement managers can ensure strategic, compliant, and efficient sourcing—whether for bridging supply gaps or managing phased relocations.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Integrity | 2026

📧 Contact: [email protected] | www.sourcifychina.com/report2026

Confidential: For internal procurement use only. Not for public distribution.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Strategic Reshoring Trends | 2026

To: Global Procurement Managers & Supply Chain Directors

From: Senior Sourcing Consultant, SourcifyChina

Subject: Mitigating Reshoring Risks: Accelerate NZ Production Transitions with Verified Suppliers

The Reshoring Reality: Speed & Reliability Are Non-Negotiable

Global supply chain recalibration has intensified, with 68% of NZ-based manufacturers (per 2025 NZIER data) now actively reshoring from China to meet domestic demand and ESG mandates. Yet unverified supplier transitions consume 14–22 weeks in due diligence, quality audits, and compliance renegotiation—delaying time-to-market and inflating operational costs.

Why SourcifyChina’s Verified Pro List Eliminates Reshoring Delays

Our AI-powered Pro List exclusively features pre-vetted NZ manufacturers with proven capability to absorb China-originated production. Unlike generic directories, every supplier undergoes:

– ✅ 360° Compliance Audit (NZ Worksafe, MPI, Fair Trading Act)

– ✅ Capacity Validation (MOQs ≤ 500 units, lead times ≤ 21 days)

– ✅ Export-Ready Certification (Incoterms 2020, ISO 9001/14001)

– ✅ China Transition Experience (Documented case studies)

Time Savings Breakdown: Pro List vs. Traditional Sourcing

| Activity | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 8–12 weeks | 0 weeks (Pre-verified) | 75% |

| Compliance Validation | 3–5 weeks | < 48 hours | 92% |

| Quality Audit Coordination | 4–6 weeks | Integrated into profile | 100% |

| Total Sourcing Cycle | 15–23 weeks | < 6 weeks | 60–75% |

Your Competitive Imperative: Act Now, Not Later

Every week spent on unverified supplier searches risks:

⚠️ Production gaps from failed transition handoffs

⚠️ Margin erosion via expedited freight/emergency MOQs

⚠️ Reputational damage from non-compliant outputs

SourcifyChina’s Pro List delivers:

– Zero-risk onboarding of reshoring-ready NZ partners

– Guaranteed timeline adherence with contractual SLAs

– Real-time transition support from China-to-NZ logistics experts

✨ Call to Action: Secure Your Reshoring Advantage in < 24 Hours

Stop gambling with unverified suppliers. Global procurement leaders trust SourcifyChina to de-risk reshoring—because time saved today funds tomorrow’s growth.

👉 Take the next step in 60 seconds:

1. Email [email protected] with subject line: “NZ Pro List Access – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for urgent transition support (24/7 multilingual team)

Within 24 business hours, you’ll receive:

✓ Customized shortlist of 3–5 Pro List NZ suppliers matching your specs

✓ Full compliance dossier + transition roadmap

✓ Dedicated consultant for seamless handover

Don’t let reshoring complexity become your bottleneck.

The fastest path to NZ production starts with verified partners—not guesswork.

SourcifyChina | De-risking Global Sourcing Since 2018

www.sourcifychina.com | [email protected] | +86 159 5127 6160 (WhatsApp)

All Pro List suppliers undergo quarterly re-certification. Data sourced from NZ Ministry of Business, Innovation & Employment (MBIE) 2025 Reshoring Index.

🧮 Landed Cost Calculator

Estimate your total import cost from China.