The U.S. boiler market is experiencing steady growth, driven by rising demand for energy-efficient heating solutions and infrastructure modernization. According to Mordor Intelligence, the North American boiler market is projected to grow at a CAGR of over 4.5% from 2023 to 2028, with commercial and residential segments leading adoption. As New York enforces stricter energy codes and pushes toward decarbonization, local manufacturers are stepping up with innovative, high-efficiency hydronic and steam boilers tailored to dense urban environments. These homegrown companies combine compliance with state-specific standards—like those set by the New York State Energy Research and Development Authority (NYSERDA)—with advanced combustion technologies and sustainability goals. In this rapidly evolving landscape, five New York-based boiler manufacturers have emerged as leaders in engineering, reliability, and market responsiveness.

Top 5 New Yorker Boilers Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 New Yorker Boiler

Domain Est. 2000

Website: newyorkerboiler.com

Key Highlights: New Yorker Boiler manufactures residential heating products, such as high efficiency water and steam boilers and water heaters….

#2 U.S. Boiler Company

Domain Est. 2010

Website: usboiler.net

Key Highlights: US Boiler Company is a leading manufacturer of home heating equipment, water boilers, steam boilers, hot water heaters, radiators and boiler control systems….

#3 Fulton: High

Domain Est. 1996

Website: fulton.com

Key Highlights: Trusted globally, Fulton engineers high-efficiency steam and hydronic boilers, thermal fluid heaters, and custom heat transfer systems….

#4 New York Boiler S

Domain Est. 1999

Website: forum.heatinghelp.com

Key Highlights: We own an oil fired New York Boiler S-154-AP that at times has a small puddle around the base. I’d say 2 cups. Drues up then comes back….

#5 NTI Boilers

Domain Est. 2013

Website: ntiboilers.com

Key Highlights: Residential. Gas Boilers · Water Heating · Combi Furnaces · Heat Pumps · Oil & Wood Boilers · Accessories · Discontinued · View All · Compare. Commercial….

Expert Sourcing Insights for New Yorker Boilers

H2: 2026 Market Trends for New Yorker Boilers

As the heating, ventilation, and air conditioning (HVAC) industry evolves toward greater energy efficiency, digital integration, and sustainability, New Yorker Boiler Company is poised to navigate significant market shifts by 2026. Known for its reliable residential and commercial hydronic heating systems, New Yorker Boilers will likely face both challenges and opportunities driven by regulatory changes, consumer preferences, technological advancements, and competitive pressures.

-

Increased Demand for High-Efficiency and Condensing Boilers

By 2026, energy efficiency standards are expected to become more stringent across the United States, particularly in the Northeast—New Yorker’s core market. The U.S. Department of Energy (DOE) continues to push for higher Annual Fuel Utilization Efficiency (AFUE) ratings, driving demand for condensing boilers. New Yorker has already expanded its lineup of high-efficiency models, and continued innovation in this space will be critical to maintaining market share. Consumers and contractors will increasingly favor boilers that exceed current efficiency benchmarks to future-proof installations. -

Electrification and Decarbonization Pressures

With growing emphasis on reducing carbon emissions from buildings, states like New York and Massachusetts are advancing policies to phase out fossil fuel-based heating systems. While this presents a threat to traditional gas-fired boilers, New Yorker can adapt by investing in hybrid systems, low-NOx technologies, and compatibility with renewable energy sources. The company may also explore integration with heat pumps or offer dual-fuel solutions to remain competitive in a transitioning market. -

Smart Home and IoT Integration

The HVAC industry is increasingly embracing smart technology, and by 2026, consumers will expect boilers to be part of connected home ecosystems. New Yorker can enhance its value proposition by incorporating Wi-Fi-enabled controls, remote diagnostics, and predictive maintenance features. Partnerships with smart thermostat providers (e.g., Nest, Ecobee) could help position New Yorker boilers as intelligent, user-friendly systems that optimize comfort and energy use. -

Supply Chain Resilience and Domestic Manufacturing

Ongoing supply chain volatility and a push for domestic manufacturing may benefit New Yorker, which has a long-standing presence in the U.S. market. By emphasizing its American-made products and localized distribution network, the company can appeal to contractors and municipalities prioritizing resilient, domestically sourced equipment. This could be a key differentiator against international competitors facing logistical or tariff-related challenges. -

Workforce and Contractor Support

As the skilled trades face labor shortages, manufacturers that provide robust training, technical support, and digital tools for contractors will gain favor. New Yorker’s 2026 success will depend on strengthening its relationships with HVAC professionals through certification programs, mobile apps for sizing and troubleshooting, and faster parts availability. -

Sustainability and Lifecycle Management

Environmental, social, and governance (ESG) considerations will influence procurement decisions, especially in commercial and municipal projects. New Yorker can position itself as a leader by offering recyclable components, reduced refrigerant use (in hybrid applications), and transparent lifecycle assessments. Extended warranties and take-back programs may also enhance brand loyalty.

In summary, the 2026 market for New Yorker Boilers will be shaped by a convergence of regulatory, technological, and consumer-driven forces. To thrive, the company must balance its legacy of durability and reliability with forward-looking investments in efficiency, connectivity, and sustainability. By doing so, New Yorker can maintain its reputation as a trusted name in hydronic heating while adapting to the clean energy transition.

Common Pitfalls When Sourcing New Yorker Boilers

Quality Concerns with Offshore Counterparts

One major pitfall when sourcing New Yorker boilers is encountering lower-quality imitations, especially from overseas manufacturers. These off-brand units may mimic the design and branding but often use inferior materials and construction methods. Issues such as thinner heat exchangers, substandard burners, and poor insulation can lead to reduced efficiency, shorter lifespans, and increased maintenance costs. Buyers may unknowingly compromise system reliability and safety by selecting units that fail to meet the original manufacturer’s performance standards.

Intellectual Property and Brand Authenticity Risks

Another significant risk involves intellectual property (IP) infringement and counterfeit products. Unauthorized manufacturers may replicate New Yorker boiler designs, logos, and model numbers, selling them as genuine or compatible units. These counterfeit products not only violate trademarks but also lack proper certifications and compliance with U.S. safety codes (such as ASME and ANSI). Sourcing from unverified suppliers increases legal exposure and may void warranties, leaving contractors and end-users without recourse in case of failure. Always verify distributor authorization and product authenticity through the official manufacturer channels.

Logistics & Compliance Guide for New Yorker Boilers

When shipping, installing, and maintaining New Yorker Boilers, adherence to logistics best practices and regulatory compliance is essential for safety, efficiency, and legal operation. This guide outlines key considerations for handling New Yorker Boiler products from distribution through to end-user installation and ongoing compliance.

Shipping and Transportation

New Yorker Boilers are heavy, high-value industrial appliances that require careful handling during transit. Follow these logistics protocols to ensure safe delivery:

- Secure Packaging: Ensure boilers are shipped in manufacturer-approved packaging with protective corner guards, skid bases, and weather-resistant wraps to prevent damage.

- Proper Loading: Use forklifts or cranes with appropriate lifting capacity. Always lift from designated lifting points to avoid deformation.

- Transport Compliance: Adhere to DOT regulations for load securing when transporting via commercial carriers. Use tie-downs and load bars to prevent shifting.

- Delivery Verification: Inspect units upon receipt for visible damage. Document and report any discrepancies immediately to the carrier and supplier.

Storage and Handling

Prior to installation, proper storage safeguards product integrity:

- Indoor Storage: Store boilers in a dry, covered area to prevent corrosion from moisture and weather exposure.

- Elevation: Keep units on skids or pallets off the ground to avoid water damage and facilitate handling.

- Ventilation: Ensure adequate airflow around stored units to prevent condensation buildup.

- Inventory Management: Track serial numbers and model types to support warranty claims and compliance documentation.

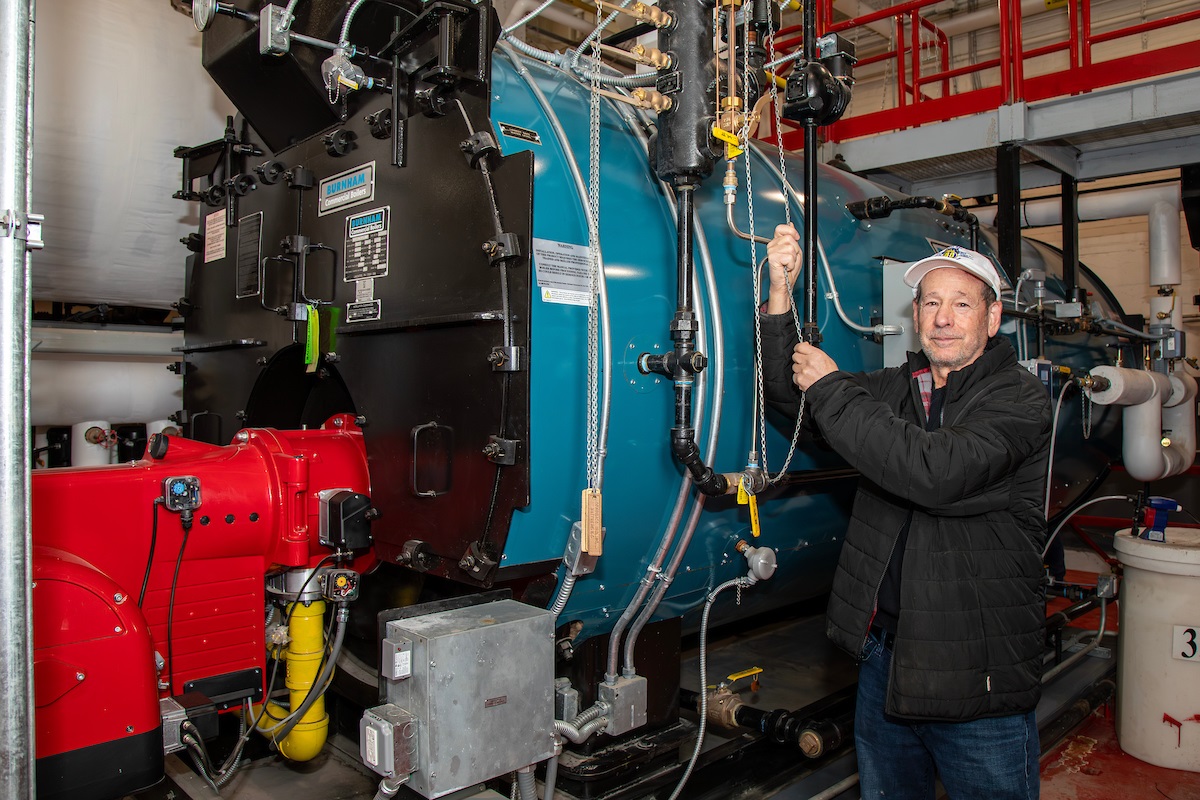

Installation Requirements

Installation must comply with federal, state, and local codes. Only licensed professionals should perform installations:

- Permitting: Obtain necessary permits from local authorities before beginning installation.

- Code Compliance: Install in accordance with the National Fuel Gas Code (NFPA 54), International Mechanical Code (IMC), and local building codes.

- Clearances: Maintain manufacturer-specified clearances to combustibles as outlined in the installation manual.

- Venting Systems: Use listed and approved venting materials (e.g., Category III stainless steel for condensing models) and follow slope and run length guidelines.

Safety and Operational Compliance

Ensure systems operate safely and efficiently throughout their lifecycle:

- Certification: Verify that installed boilers meet ASME (American Society of Mechanical Engineers) and ANSI/ASHRAE standards.

- Emissions Regulations: Confirm compliance with EPA and state environmental regulations, particularly for NOx and CO2 emissions.

- Inspection & Testing: Conduct initial safety checks, including pressure relief valve testing, gas leak detection, and combustion analysis.

- Labeling: Ensure all warning labels, model tags, and certification marks remain intact and visible.

Documentation and Recordkeeping

Maintain thorough records to support compliance and warranty service:

- Installation Manuals: Keep original manuals on-site for reference.

- Inspection Reports: Archive signed inspection and commissioning reports.

- Warranty Registration: Register the boiler with New Yorker within 30 days of installation to activate warranty coverage.

- Service Logs: Document all maintenance, repairs, and part replacements.

Ongoing Maintenance and Inspections

Regular maintenance ensures compliance with safety standards and optimal efficiency:

- Annual Inspections: Schedule professional inspections per manufacturer recommendations and local code requirements.

- Efficiency Testing: Perform combustion efficiency tests to ensure the boiler operates within design parameters.

- Component Checks: Inspect burners, heat exchangers, controls, and safety devices for wear or malfunction.

By following this logistics and compliance guide, distributors, contractors, and facility managers can ensure New Yorker Boilers are handled, installed, and maintained to the highest standards of safety, performance, and regulatory adherence. Always consult the official New Yorker Boiler documentation and local authorities for project-specific requirements.

In conclusion, sourcing New Yorker boilers requires a thorough evaluation of product quality, supplier reliability, energy efficiency, and long-term support. As a reputable manufacturer with a strong presence in the hydronic heating industry, New Yorker offers durable and efficient boiler solutions suitable for residential and commercial applications. When sourcing these boilers, it is essential to work with authorized distributors or direct partners to ensure genuine products, factory warranties, and access to technical support and service. Additionally, considering factors such as heating demands, installation requirements, and local building codes will help in selecting the right model and configuration. Ultimately, investing in New Yorker boilers through trusted sourcing channels ensures reliable performance, energy savings, and peace of mind for end-users.