The global demand for durable, high-performance fuel storage solutions continues to rise, driven by increasing defense spending, outdoor recreation, and emergency preparedness initiatives. According to a 2023 report by Mordor Intelligence, the global fuel container market is projected to grow at a CAGR of over 4.5% from 2023 to 2028, with NATO-standard gas cans gaining particular traction due to their strict compliance with safety, durability, and environmental regulations. These standardized fuel cans—recognized for their iconic trapezoidal shape, secure sealing mechanisms, and resistance to impact and corrosion—are essential in military, industrial, and off-grid applications. As governments and private sectors prioritize reliable logistics and fuel security, the need for certified, high-quality manufacturers has never been greater. Based on compliance standards, production scale, and market reputation, the following eight manufacturers have emerged as leading suppliers of NATO-specification gas cans worldwide.

Top 8 Nato Gas Can Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 to General Atomics

Domain Est. 1995

Website: ga.com

Key Highlights: General Atomics, based in San Diego, CA, develops advanced technology solutions for government and commercial applications. Privately owned and vertically ……

#2 Nato Metal Gas Cans Manufacturers

Domain Est. 2001

Website: jerrycans.org

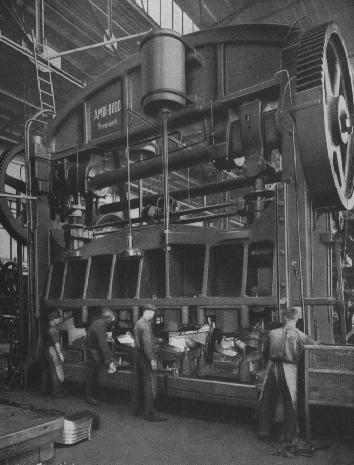

Key Highlights: A nato metal gas can is a robust fuel container made from pressed steel. It was originally designed in Germany in the 1930s for military use and holds 20 ……

#3 NATO Fuel Cans

Domain Est. 2019

Website: wavianfuelcans.com

Key Highlights: Our Wavian Steel Jerry Cans come direct from the factory that supplies many NATO countries. Available in all sizes and colors and based on the classic ……

#4 Olive Drab Jerry Can, Metal, 20 L, CARB Compliant

Domain Est. 1996

Website: roverparts.com

Key Highlights: In stock Rating 4.6 76 NATO Style Jerry Can (CARB-Approved / EPA-Approved) 20 Liter / 5 Gallon Metal, Olive Drab Green, Built To European Military Spec By Wavian · Price: $119.99…

#5 Wavian NATO Jerry Can

Domain Est. 1997

Website: colemans.com

Key Highlights: Buy a 5-gallon Wavian Jerry Can to safely transport or store fuel. This high-quality NATO Jerry Can is drop, pressure, & flame tested. Shop Coleman’s Today!…

#6 Jerry Can

Domain Est. 1998

#7 Nato Jerry Cans that are built to last …

Domain Est. 2009

Website: lexingtoncontainercompany.com

Key Highlights: Nato jerry can by Valpro/Wavian are the world’s best jerry can that money can buy, own one of the most durable nato fuel cans on the global market!…

#8 NATO Licensed Products

Domain Est. 2014

Website: natojerrycans.us

Key Highlights: NATO 10L Jerry Gas Can – Green. NATO 10L Jerry Gas Can – Green. $64.95 · NATO 10L Jerry Gas Can – Red. NATO 10L Jerry Gas Can – Red. $64.95 · NATO 20L Jerry Gas ……

Expert Sourcing Insights for Nato Gas Can

H2: Projected 2026 Market Trends for NATO Gas Cans

The market for NATO-specification (NATO STANAG-compliant) gas cans is expected to experience notable shifts by 2026, driven by evolving defense strategies, logistics modernization, and global energy dynamics. These durable, standardized fuel containers—originally designed for military use—are seeing increased demand across both defense and civilian sectors. Below are key market trends anticipated for NATO gas cans in 2026:

-

Increased Defense Spending and Military Procurement

With rising geopolitical tensions across Eastern Europe, the Indo-Pacific, and the Middle East, NATO member and allied nations are boosting defense budgets. This includes investment in logistics and fuel infrastructure, where NATO gas cans play a critical role. Standardized 20-liter jerry cans compliant with STANAG 4476 are expected to see higher procurement volumes, especially in countries expanding rapid deployment capabilities. -

Expansion into Civilian and Emergency Response Markets

The reliability and durability of NATO gas cans are attracting non-military users. By 2026, sectors such as disaster relief, off-grid energy, overlanding, and emergency preparedness are expected to represent a growing share of demand. Civilian versions of NATO-style cans—often made from high-density polyethylene (HDPE) with flame arrestors and child-resistant features—are gaining popularity due to their safety certifications and interoperability. -

Supply Chain Localization and Resilience

Global supply chain disruptions have prompted governments and manufacturers to prioritize domestic production. By 2026, NATO countries are likely to favor locally manufactured gas cans to reduce dependency on imports. This trend will encourage regional production hubs in North America and Europe, supporting job growth and reducing lead times. -

Material and Design Innovation

Environmental regulations and performance requirements are pushing innovation in materials. By 2026, expect wider adoption of recyclable HDPE, UV-resistant coatings, and lightweight composites. Enhanced features such as integrated spouts, improved sealing mechanisms, and RFID tags for inventory tracking may become standard in premium models. -

Focus on Safety and Environmental Compliance

Stricter emission standards (e.g., EPA and CARB regulations) are driving demand for vapor-tight, spill-proof containers. NATO gas cans with built-in vapor recovery and leak prevention systems will be favored in both military and commercial applications. This aligns with broader sustainability goals and reduces environmental contamination risks. -

Growth in Emerging Markets and Private Military Contractors (PMCs)

Non-NATO countries in Africa, Southeast Asia, and Latin America are adopting NATO-standard equipment for interoperability with Western forces. Additionally, the rise of PMCs and security firms using standardized gear will contribute to market expansion. These entities often source NATO-compliant logistics equipment, including fuel cans, for operational consistency. -

Digital Integration and Smart Logistics

While still emerging, smart fuel containers equipped with sensors to monitor fuel levels, temperature, and tampering are being tested. By 2026, early adopters in military and industrial sectors may integrate such technology into NATO-style cans, enabling real-time logistics tracking and improved fuel management.

Conclusion:

The NATO gas can market in 2026 will be shaped by defense modernization, civilian adoption, regulatory changes, and technological innovation. While rooted in military specifications, the product’s utility is expanding into commercial and humanitarian domains. Manufacturers who adapt to sustainability standards, regional supply demands, and smart logistics trends are likely to lead the market.

Common Pitfalls When Sourcing NATO Gas Cans (Focus on Quality and IP)

Sourcing genuine, high-quality NATO gas cans involves navigating several potential pitfalls, particularly concerning quality assurance and intellectual property (IP) rights. Being aware of these issues is crucial for procurement professionals and supply chain managers to avoid operational risks, safety hazards, and legal complications.

Quality-Related Pitfalls

Inconsistent Material Standards

NATO gas cans must adhere to strict material specifications, typically requiring high-density polyethylene (HDPE) resistant to fuels, UV degradation, and extreme temperatures. A common pitfall is sourcing cans made from substandard or recycled plastics that compromise durability and safety. These inferior materials may crack under stress, leak over time, or degrade when exposed to fuel, posing significant safety risks in military or emergency use scenarios.

Poor Manufacturing and Workmanship

Genuine NATO-spec cans are manufactured to precise tolerances ensuring leak-proof seals, robust handles, and reliable closure mechanisms. Counterfeit or low-quality alternatives often exhibit poor welding, misaligned threads, or weak structural integrity. These defects can lead to fuel spills, difficulty in handling, and failure during transport or storage—especially under rough field conditions.

Lack of Compliance with STANAG Standards

The defining characteristic of a true NATO gas can is compliance with NATO Standardization Agreements (STANAGs), particularly STANAG 4441 for 20-liter cans. Pitfalls arise when suppliers falsely claim STANAG compliance without independent certification. Without verified testing and documentation, buyers risk acquiring non-compliant cans unsuitable for interoperability with NATO logistics systems or partner forces.

Absence of Batch Testing and Traceability

Reputable manufacturers conduct rigorous batch testing and maintain full traceability for quality control. Sourcing from unverified suppliers often means missing quality documentation, batch numbers, or test reports. This lack of traceability increases the risk of receiving inconsistent products and complicates accountability in case of defects or failures.

Intellectual Property (IP) Pitfalls

Trademark Infringement and Brand Misrepresentation

The term “NATO gas can” is often used generically, but many legitimate designs are protected by trademarks or associated with specific licensed manufacturers. Sourcing from unauthorized producers may involve selling counterfeit products that infringe on registered trademarks. This exposes the buyer to legal liability, reputational damage, and potential seizure of goods by customs authorities.

Patented Design and Functional Features

Certain aspects of authentic NATO can designs—such as the spout mechanism, handle configuration, or stacking features—may be protected by patents. Unlicensed replication of these features constitutes patent infringement. Buyers who unknowingly source such products may become involved in IP litigation or be forced to recall and replace infringing inventory.

Misuse of Certification Marks and Logos

Unauthorized use of NATO emblems, certification marks, or military-standard labels on products is not only a breach of IP but also a violation of international regulations and national laws (e.g., the U.S. Stolen Valor Act or EU trademark directives). Suppliers that affix fake NATO logos to non-compliant cans mislead buyers and risk legal penalties, with liability potentially extending to end-users who knowingly distribute or use such items.

Supply Chain Transparency and IP Due Diligence

A major pitfall is inadequate due diligence on suppliers’ IP compliance. Buyers must verify that manufacturers have proper licensing agreements and are not reverse-engineering or copying protected designs. Failure to conduct IP audits or request proof of authorization increases the risk of sourcing infringing products, especially when dealing with third-party intermediaries or offshore suppliers.

Conclusion

Sourcing NATO gas cans requires vigilance beyond price and availability. Ensuring product quality demands verification of material standards, manufacturing consistency, and STANAG compliance. Equally important is protecting against IP risks by confirming trademark and patent legitimacy, avoiding counterfeit branding, and conducting thorough supplier due diligence. Partnering with certified, reputable manufacturers and demanding full documentation are essential steps to mitigate these common pitfalls.

Logistics & Compliance Guide for NATO Gas Cans

Overview of NATO Gas Cans

NATO gas cans, officially known as NATO Jerry Cans or STANAG 2265 fuel cans, are standardized 20-liter (5.3-gallon) containers used by NATO military forces for the safe transport and storage of fuel. These cans are designed for durability, ease of handling, and interoperability across allied forces. Proper logistics and compliance protocols are essential to ensure safe handling, legal transport, and adherence to international standards.

Design and Specifications

NATO gas cans are constructed from robust metal (typically galvanized steel or polyethylene) with a distinctive rectangular shape and built-in handle. Key features include:

– Capacity: 20 liters (5.3 US gallons)

– Color coding: Red for gasoline, yellow for diesel, blue for kerosene/jet fuel

– Built-in spout with threaded cap for controlled pouring

– Stackable design and standardized dimensions for efficient transport

– Compliance with STANAG 2265 and MIL-C-1281 (military specification)

Storage Requirements

Proper storage is crucial to prevent leaks, contamination, and safety hazards:

– Store in a well-ventilated, dry, and cool area away from direct sunlight and ignition sources

– Keep containers upright on a level, non-combustible surface

– Use secondary containment (e.g., spill trays) when storing multiple cans

– Segregate fuel types and avoid mixing with other hazardous materials

– Implement fire safety measures (e.g., fire extinguishers, no-smoking signs)

Transportation Guidelines

Transporting NATO gas cans—whether domestically or internationally—requires adherence to hazardous materials regulations:

– Ground Transport (e.g., ADR in Europe):

– Cans must be securely fastened to prevent movement

– Vehicles must display appropriate hazard class labels (Class 3: Flammable Liquids)

– Drivers require appropriate training and documentation

– Air Transport (IATA Dangerous Goods Regulations):

– Generally restricted; special permits and packaging may be required

– Typically not allowed in passenger aircraft cargo holds without special authorization

– Maritime Transport (IMDG Code):

– Must be declared as dangerous goods

– Proper stowage and separation from incompatible materials required

Regulatory Compliance

Organizations using NATO gas cans must comply with applicable regulations:

– OSHA (U.S.): 29 CFR 1910.106 – Flammable Liquids Standard

– EPA (U.S.): Spill Prevention, Control, and Countermeasure (SPCC) Plan if storing over 1,320 gallons

– REACH & CLP (EU): Registration, labeling, and safe handling of chemicals

– NFPA 30: Flammable and Combustible Liquids Code

– Military Standards: Compliance with STANAG 2265 and national defense directives

Handling and Safety Procedures

To minimize risks during use:

– Use approved grounding and bonding procedures when dispensing fuel

– Wear appropriate PPE (gloves, eye protection, flame-resistant clothing)

– Never use near open flames, sparks, or hot surfaces

– Inspect cans regularly for dents, corrosion, or leaks

– Train personnel in spill response and emergency procedures

Environmental and Disposal Considerations

- Prevent soil and water contamination by using drip trays and containment systems

- Report and clean up spills immediately using absorbent materials

- Dispose of empty or damaged cans as hazardous waste in accordance with local regulations

- Recycle metal cans through approved hazardous waste recyclers

Documentation and Recordkeeping

Maintain records to ensure compliance and traceability:

– Inventory logs of fuel and containers

– Safety Data Sheets (SDS) for all fuels stored

– Training records for personnel handling fuel

– Transport manifests and hazardous materials declarations

– Inspection and maintenance logs for containers

Conclusion

Proper logistics and compliance with regulations are critical when using NATO gas cans. Adherence to design standards, safe storage, transport regulations, and environmental protocols ensures operational effectiveness while minimizing risk to personnel, property, and the environment. Always consult the relevant national and international regulations applicable to your region and mission.

Conclusion on Sourcing NATO Gas Cans

In conclusion, sourcing NATO gas cans requires careful consideration of specification compliance, authenticity, and supplier credibility. These specialized fuel containers are designed to meet rigorous military standards—ensuring durability, leak resistance, and compatibility with NATO equipment and logistics systems. When procuring NATO gas cans, it is essential to verify compliance with relevant military specifications (such as STANAG standards) and to source from reputable, authorized suppliers to avoid counterfeit or substandard products.

Factors such as material quality (typically high-density polyethylene), secure closure mechanisms (e.g., NATO twist-and-lock spout), and resistance to environmental stressors play a crucial role in performance and safety. Additionally, end-user requirements—whether for military operations, emergency preparedness, or industrial applications—should guide the selection process.

Ultimately, reliable sourcing of NATO gas cans ensures operational readiness, fuel integrity, and adherence to international logistical standards. Investing in certified, high-quality containers not only supports mission success but also enhances safety and efficiency in fuel transportation and storage across diverse environments.