The global surgical instruments market is experiencing steady expansion, driven by rising surgical volumes, technological advancements, and increasing demand for minimally invasive procedures. According to a report by Mordor Intelligence, the surgical instruments market was valued at USD 16.8 billion in 2023 and is projected to grow at a CAGR of 7.2% over the forecast period (2024–2029). As a critical component in general and abdominal surgeries, retractors—particularly the Nathanson retractor, widely used in laparoscopic procedures—play a vital role in ensuring optimal surgical exposure with minimal tissue trauma. This growth trajectory has spurred innovation and competition among manufacturers specializing in high-quality, ergonomic, and reusable surgical retractors. In this landscape, the top four Nathanson retractor manufacturers have distinguished themselves through product reliability, precision engineering, and regulatory compliance, meeting the evolving needs of modern surgical suites worldwide.

Top 4 Nathanson Retractor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 NATHANSON Liver Retractor

Domain Est. 1995

Website: karlstorz.com

Key Highlights: Product details ; Author, NATHANSON ; Autoclavable, Yes ; Length of distal tip, 59 mm ; Length from blade to handle, 218 mm ; Contact surface, Small….

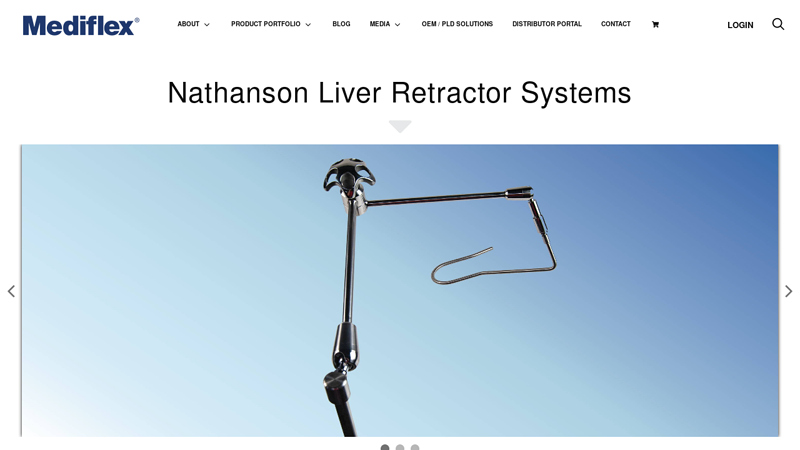

#2 Nathanson Liver Retractor Systems

Domain Est. 1998

Website: mediflex.com

Key Highlights: Nathanson Liver Retractors from Mediflex have proven to be ideal for laparoscopic liver retraction as they support the entire liver to provide atraumatic ……

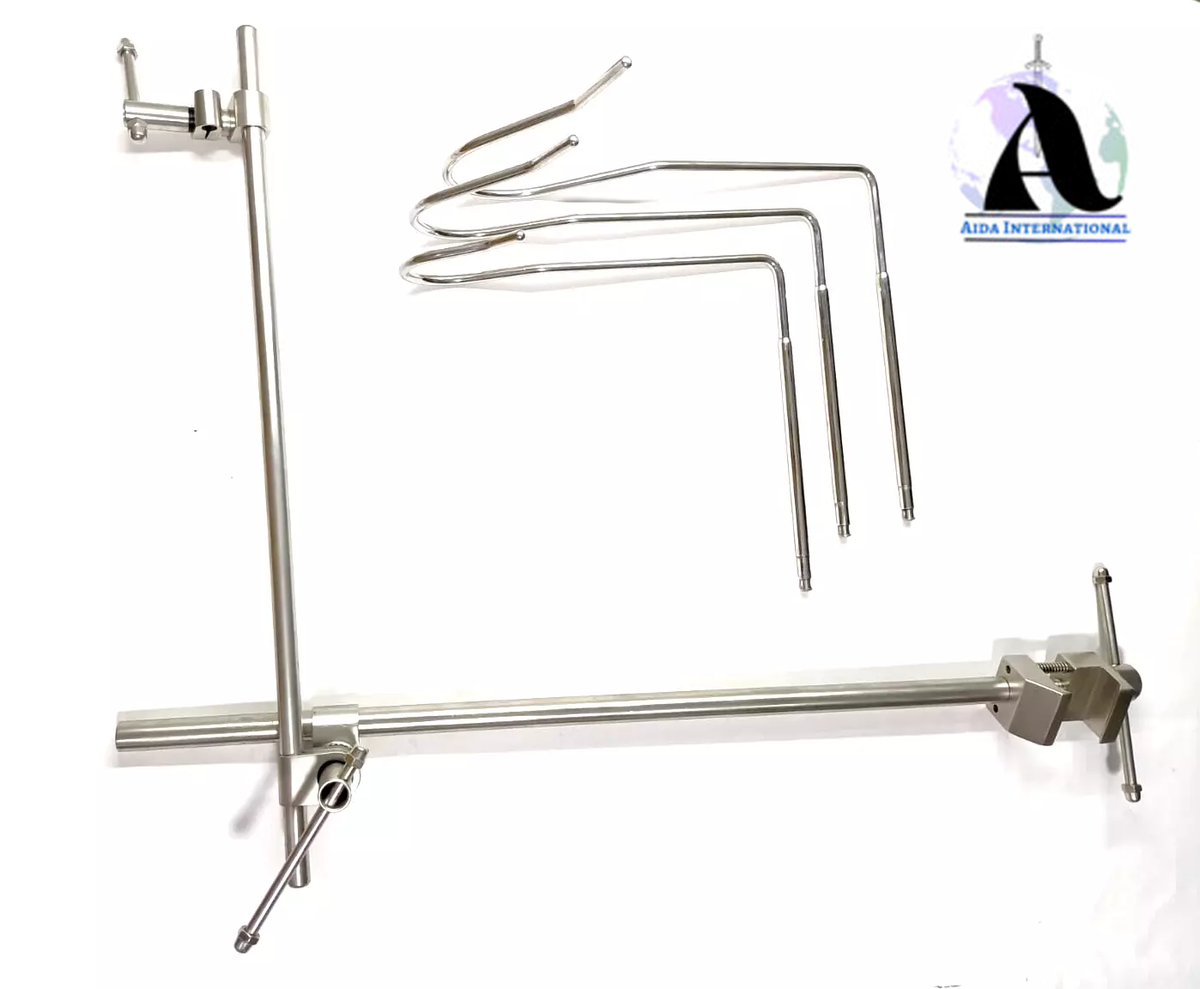

#3 Nathanson Liver Retractor Large 6.5Mm

Domain Est. 2001

Website: surgicalinstruments.com

Key Highlights: Nathanson Liver Retractor Large 6.5Mm. Millennium Number: 72-5242003; Description: Large Nathanson Hook Liver Retractor. 6.5 millimeters. For more ……

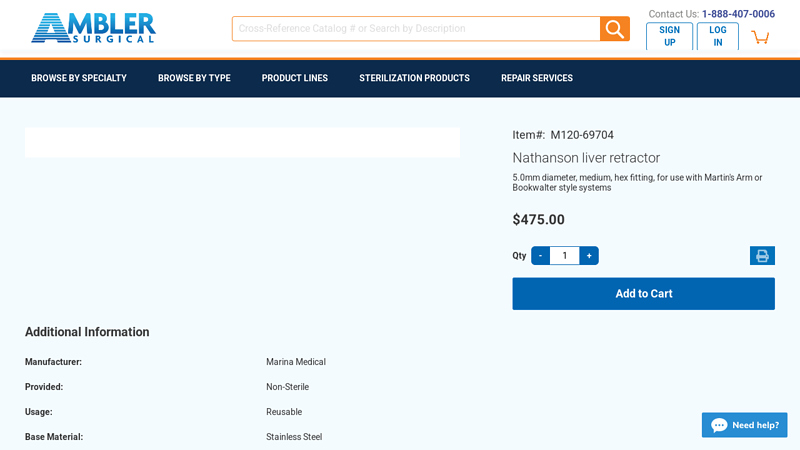

#4 Nathanson liver retractor, 5.0mm diameter M120

Domain Est. 2003

Website: amblersurgical.com

Key Highlights: In stock $56.79 delivery 30-day returnsNathanson liver retractor 5.0mm diameter, medium, hex fitting, for use with Martin’s Arm or Bookwalter style systems. $475.00. Item# M120-697…

Expert Sourcing Insights for Nathanson Retractor

H2: 2026 Market Trends for Nathanson Retractors

While the Nathanson retractor (a specialized liver retractor used primarily in laparoscopic and open abdominal surgeries like cholecystectomies) operates within a niche segment of the broader surgical instrument market, several key trends are expected to shape its landscape by 2026:

-

Continued Shift Towards Minimally Invasive Surgery (MIS): The dominant trend driving demand for laparoscopic instruments, including the Nathanson retractor, remains the global preference for MIS. Benefits like reduced patient trauma, shorter hospital stays, faster recovery, and lower infection rates will sustain demand for high-quality laparoscopic retractors. The Nathanson’s role in providing optimal liver retraction during common procedures like laparoscopic cholecystectomy ensures its relevance.

-

Focus on Ergonomics and Surgeon Safety: By 2026, manufacturers will increasingly prioritize ergonomic design. Expect refinements in handle shape, grip texture, and weight distribution of Nathanson retractors to reduce surgeon fatigue, improve control, and minimize the risk of repetitive strain injuries during prolonged procedures. Integration with robotic-assisted platforms may also see exploration, requiring compatible designs.

-

Material Innovation and Reusability vs. Single-Use Debate:

- High-Grade Reusable Instruments: Premium manufacturers will continue to focus on durable, biocompatible materials (like advanced stainless steel alloys) and superior surface finishes to enhance corrosion resistance, facilitate easier cleaning/sterilization (critical for infection control), and extend instrument lifespan. Demand for reliable reusable retractors from hospitals focused on cost-per-use and sustainability will persist.

- Single-Use Options: The market for single-use (disposable) Nathanson retractors will grow, driven by concerns over sterilization failures (especially with complex instruments), the rising cost of reprocessing, and the need for guaranteed sterility in high-volume or resource-limited settings. By 2026, expect more sophisticated single-use designs using biocompatible polymers and metals, potentially offering cost advantages in specific scenarios despite higher per-unit cost.

-

Integration with Advanced Visualization and Imaging: As surgical suites incorporate advanced imaging (e.g., intraoperative ultrasound, fluorescence imaging) and 3D/4K/8K laparoscopy, there will be a subtle push for instrument designs that minimize obstruction of these critical views. While the Nathanson’s primary function is retraction, its design may subtly evolve to be “camera-friendly,” potentially through slimmer profiles or strategic shaping, to complement these technologies.

-

Regional Market Dynamics and Cost Pressures:

- Established Markets (North America, Western Europe): Focus will remain on premium reusable instruments, advanced materials, ergonomics, and integration with high-tech surgical suites. Regulatory compliance (FDA, CE Mark) is paramount.

- Emerging Markets (Asia-Pacific, Latin America): These regions will see significant growth, driven by expanding healthcare access and surgical volumes. Cost-effectiveness will be a major driver, boosting demand for reliable mid-tier reusable instruments and increasingly affordable single-use options. Local manufacturing may rise to meet this demand.

-

Consolidation and Competitive Landscape: The surgical instrument market is seeing ongoing consolidation. Larger medical device companies may acquire or partner with specialized instrument manufacturers, potentially impacting the branding, distribution, and innovation pipeline for niche instruments like the Nathanson retractor. Competition will center on quality, reliability, ergonomics, and total cost of ownership (balancing purchase price with reprocessing costs and lifespan).

-

Sustainability Considerations: Environmental concerns will influence decisions. While reusable instruments have a lower environmental footprint per use, the energy and water consumption of sterilization is significant. The debate between the environmental impact of manufacturing single-use plastics/metals versus the reprocessing burden of reusable metal will continue, potentially influencing procurement policies in environmentally conscious institutions.

Conclusion for 2026: The Nathanson retractor market will remain stable but evolve. Demand will be underpinned by the enduring need for liver retraction in core abdominal surgeries. Key trends include the dominance of MIS, a bifurcation between high-end reusable instruments (emphasizing ergonomics and durability) and growing single-use adoption, regional variations in demand drivers, and ongoing competition focused on performance, cost-effectiveness, and meeting surgeon needs in increasingly technologically advanced operating rooms. Innovation will be incremental, focusing on refinement rather than radical redesign, within the constraints of the instrument’s established and effective function.

Common Pitfalls Sourcing a Nathanson Retractor: Quality and Intellectual Property Concerns

When sourcing a Nathanson Retractor—a specialized surgical retractor used primarily in laparoscopic procedures—buyers, hospitals, and procurement teams must be vigilant to avoid critical pitfalls related to product quality and intellectual property (IP) rights. Overlooking these aspects can lead to compromised patient safety, legal exposure, and operational inefficiencies.

Quality-Related Pitfalls

Substandard Materials and Manufacturing

One of the most significant risks when sourcing Nathanson retractors, especially from non-OEM or low-cost suppliers, is receiving devices made from inferior-grade stainless steel or with poor surface finishing. Subpar materials can lead to corrosion, pitting, or weakening during use, increasing the risk of instrument failure during surgery. Additionally, imprecise manufacturing may result in misaligned blades or improper spring tension, reducing retraction effectiveness and potentially causing tissue trauma.

Lack of Regulatory Compliance

Non-compliant retractors may not meet essential regulatory standards such as FDA 510(k), CE marking (under MDR), or ISO 13485 for quality management systems. Sourcing devices from manufacturers without proper certifications exposes healthcare providers to regulatory audits, recalls, and liability in the event of adverse incidents.

Inconsistent Sterilization and Biocompatibility

Reprocessing and sterilization resistance are critical for reusable surgical instruments. Poorly manufactured retractors may degrade after repeated autoclaving. Furthermore, lack of proper biocompatibility testing (e.g., ISO 10993) can pose risks of allergic reactions or toxicological harm to patients.

Counterfeit or Non-Authorized Replicas

The market includes unauthorized copies that mimic the design of the original Nathanson retractor but lack performance validation. These replicas often have dimensional inaccuracies or inferior ergonomics, leading to poor surgical outcomes and increased handling fatigue for surgeons.

Intellectual Property (IP) Pitfalls

Infringement of Patented Design

The original Nathanson retractor design may be protected by patents or design rights (depending on jurisdiction and expiration status). Sourcing from manufacturers producing unauthorized copies—even if they are functionally similar—can expose the purchaser or distributor to intellectual property litigation. This is particularly relevant if the supplier markets the device using names or branding too close to the original.

Trademark and Brand Confusion

Using or distributing devices labeled as “Nathanson-style” or bearing similar names without authorization risks trademark infringement. Even if the device design is not patented, the name “Nathanson” may be a registered trademark, and its unauthorized use can lead to legal action by the rights holder.

Lack of IP Due Diligence in Supply Chain

Purchasers often assume that suppliers have legitimate rights to manufacture the device. However, failing to verify the supplier’s IP clearance—such as licensing agreements or freedom-to-operate opinions—can result in liability being passed down the supply chain. Institutions found using infringing devices may face cease-and-desist orders or financial damages.

Gray Market and Unauthorized Distribution

Procuring from third-party distributors not authorized by the IP holder increases the risk of receiving counterfeit or diverted products. These instruments may lack proper documentation, traceability, or post-market support, further complicating compliance and patient safety efforts.

Conclusion

To mitigate these risks, buyers should prioritize sourcing from reputable, authorized manufacturers or distributors with verifiable regulatory certifications and clear IP rights. Conducting thorough due diligence—including material specifications, compliance documentation, and IP validation—is essential to ensure both the safety and legality of the devices used in surgical settings.

Logistics & Compliance Guide for Nathanson Retractor

Product Overview

The Nathanson Retractor is a medical device used in surgical procedures, primarily in abdominal and thoracic surgeries, to provide optimal exposure by retracting liver tissue or other organs. It is typically made of stainless steel and designed for repeated sterilization and reuse. Proper handling, transportation, and compliance with regulatory standards are critical to ensure patient safety and device efficacy.

Regulatory Classification

The Nathanson Retractor is classified as a Class I or Class II medical device under the U.S. Food and Drug Administration (FDA) regulations, depending on its intended use and design modifications. It is listed under FDA product code FRA. Compliance with 21 CFR Part 888 (Orthopedic Devices) and applicable sections of the Medical Device Amendments is required. In the European Union, it must bear the CE mark and comply with the Medical Device Regulation (MDR) (EU) 2017/745, typically under Class I (reusable surgical instrument).

Labeling and Packaging Requirements

All packaging must include:

– Device name: “Nathanson Retractor”

– Manufacturer or distributor name and address

– Lot number or serial number (if applicable)

– Sterile status (e.g., “Non-Sterile – For Terminal Sterilization” or “Sterile – Use Before…”)

– Reusable device symbol (if applicable)

– IFU (Instructions for Use) reference

– CE mark (for EU market) and FDA establishment registration number (for U.S. market)

Packaging must be durable, tamper-evident, and suitable for sterilization processes such as steam autoclaving.

Storage and Handling

Store the Nathanson Retractor in a clean, dry environment free from moisture and corrosive agents. Devices should be kept in protective packaging or instrument trays to prevent physical damage. After use, the retractor must undergo thorough cleaning, decontamination, and inspection before reprocessing to prevent cross-contamination and ensure functionality.

Reprocessing and Sterilization

As a reusable surgical instrument, the Nathanson Retractor must be reprocessed according to validated protocols. Recommended steps include:

1. Pre-cleaning: Immediate rinsing at point of use to prevent drying of biological material.

2. Cleaning: Manual or automated (washer-disinfector) cleaning using enzymatic detergents.

3. Inspection: Visual and functional check for damage, corrosion, or wear.

4. Sterilization: Steam autoclaving at 121°C for 15–20 minutes or 134°C for 3–4 minutes (gravity displacement or prevacuum cycle). Follow AAMI ST79 guidelines for steam sterilization.

Ensure compatibility with sterilization methods; avoid ultrasonic cleaning unless validated by the manufacturer.

Transportation and Distribution

During shipping, devices must be protected from physical impact, moisture, and contamination. Use sealed, labeled containers suitable for medical devices. For international shipments, comply with IATA Dangerous Goods Regulations (if applicable) and ensure customs documentation includes HS code 9018.90 (other medical instruments). Maintain temperature-controlled logistics if required by regional regulations.

Import/Export Compliance

Exporters and importers must adhere to destination country regulations:

– United States: FDA registration, listing, and adherence to Quality System Regulation (21 CFR Part 820).

– European Union: CE certification via Notified Body (if Class I non-sterile, self-certification may apply), Technical File maintenance.

– Other Markets: Check local requirements (e.g., Health Canada license, ANVISA registration in Brazil, TGA in Australia).

Accompany shipments with a Certificate of Conformity, Certificate of Free Sale (if requested), and commercial invoice indicating medical device classification.

Post-Market Surveillance and Reporting

Manufacturers and distributors are responsible for monitoring device performance and reporting adverse events. In the U.S., report malfunctions, injuries, or deaths via the FDA MedWatch program (Form 3500A) under Medical Device Reporting (MDR) regulations (21 CFR Part 803). In the EU, report incidents through the EUDAMED database per MDR Article 87. Maintain a Quality Management System (QMS) compliant with ISO 13485.

Training and Instructions for Use (IFU)

Provide comprehensive IFUs in the language(s) of the target market. The IFU must include:

– Indications for use

– Contraindications

– Warnings and precautions

– Detailed reprocessing instructions

– Maintenance and inspection guidelines

– Contact information for the manufacturer or authorized representative

Ensure clinical and sterile processing staff are trained in proper use, handling, and reprocessing of the device.

Environmental and Disposal Considerations

At end-of-life, the Nathanson Retractor should be disposed of in accordance with local biohazard and medical waste regulations. As a metal instrument, it may be recyclable through approved medical device recycling programs. Do not discard in general waste streams.

Conclusion for Sourcing Nathanson Retractor:

After a thorough evaluation of available suppliers, product specifications, quality standards, and cost considerations, sourcing the Nathanson retractor requires a strategic approach focused on reliability, sterility, and compliance with medical device regulations. It is essential to partner with certified manufacturers or distributors who adhere to ISO standards and FDA guidelines to ensure patient safety and surgical efficacy. Additionally, prioritizing suppliers offering consistent product quality, timely delivery, and competitive pricing will support long-term operational efficiency in healthcare settings. Ultimately, selecting a reputable source for the Nathanson retractor not only enhances surgical outcomes but also reinforces trust in the medical supply chain.