Sourcing Guide Contents

Industrial Clusters: Where to Source Nassau China Company Trenton Nj

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “Nassau China Company Trenton NJ” from China

Date: April 2026

Executive Summary

This report provides a strategic sourcing analysis for products associated with the term “Nassau China Company Trenton NJ”, interpreted as a reference to porcelain, fine ceramics, or tableware historically linked to the Nassau brand, originally distributed in the U.S. (Trenton, NJ), and now potentially being re-sourced or replicated through Chinese manufacturing. While Nassau China Company is a defunct American brand, demand for vintage-style or premium ceramic tableware has led to renewed interest in sourcing similar products from China.

China remains the global leader in ceramic and porcelain manufacturing, with established industrial clusters producing both mass-market and high-end tableware. This report identifies key manufacturing regions in China, evaluates their suitability for replicating Nassau-style products, and provides a comparative analysis to guide procurement decisions.

Market Interpretation & Product Scope

The phrase “Nassau China Company Trenton NJ” does not denote an active manufacturer in China but refers to a historical American brand known for high-quality porcelain dinnerware produced in the early-to-mid 20th century. Today, global buyers seek Chinese suppliers capable of replicating:

- Hard-paste porcelain

- Vintage-inspired designs (e.g., floral patterns, gold trim)

- Lead-free, food-safe glazes

- High durability (dishwasher & microwave safe)

Procurement managers are advised to source from Chinese manufacturers specializing in premium ceramic tableware with export experience to Western markets.

Key Industrial Clusters for Ceramic Tableware in China

China’s ceramic manufacturing is concentrated in several key provinces and cities, each with distinct specializations:

| Region | Key Cities | Specialization | Export Focus |

|---|---|---|---|

| Guangdong | Chaozhou, Foshan | High-volume tableware, modern & classic designs, OEM/ODM | North America, Europe |

| Jiangxi | Jingdezhen | Premium porcelain, artisanal craftsmanship, hand-painted designs | Luxury, boutique, custom orders |

| Zhejiang | Longquan, Wenzhou | Mid-to-high-end ceramics, innovative glazes, eco-friendly production | EU, Australia, specialty markets |

| Fujian | Dehua | White porcelain, statuettes, giftware, cost-effective production | Mass retail, e-commerce |

Note: For Nassau-style replication, Chaozhou (Guangdong) and Jingdezhen (Jiangxi) are the most strategic clusters due to their expertise in high-quality, export-grade porcelain with design flexibility.

Comparative Analysis of Key Production Regions

The table below compares the top manufacturing regions based on three critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Days) | Best For |

|---|---|---|---|---|

| Guangdong (Chaozhou) | ★★★★☆ (Low to Mid) | ★★★★☆ (Consistent, export-standard) | 30–45 | High-volume orders, retail chains, cost-sensitive buyers |

| Jiangxi (Jingdezhen) | ★★★☆☆ (Mid to High) | ★★★★★ (Premium, artisanal) | 45–60+ | Luxury reproduction, custom designs, museum-quality pieces |

| Zhejiang (Longquan/Wenzhou) | ★★★★☆ (Mid) | ★★★★☆ (Modern, durable) | 35–50 | Eco-conscious buyers, innovative designs, EU compliance |

| Fujian (Dehua) | ★★★★★ (Lowest) | ★★★☆☆ (Good for basics) | 25–40 | Budget replication, giftware, e-commerce private labels |

Strategic Sourcing Recommendations

-

For High-Fidelity Reproductions of Nassau-Style Pieces:

Partner with manufacturers in Jingdezhen, Jiangxi, known for their mastery of traditional Chinese porcelain techniques and ability to replicate vintage aesthetics with precision. -

For Cost-Effective, High-Volume Production:

Chaozhou, Guangdong offers scalable manufacturing with strong quality control and fast turnaround—ideal for retail distribution. -

For Eco-Friendly or Modernized Interpretations:

Zhejiang suppliers excel in sustainable production, lead-free glazes, and compliance with EU REACH and U.S. FDA standards. -

Supplier Vetting Priority:

Ensure suppliers have: - BSCI or ISO 9001 certification

- Experience with Western design specifications

- Capability for custom mold creation and hand-painting

- Compliance with food safety regulations (e.g., CA Prop 65, FDA 21 CFR)

Conclusion

While the Nassau China Company no longer operates, its legacy presents a viable sourcing opportunity in China’s advanced ceramic manufacturing ecosystem. Chaozhou and Jingdezhen emerge as the two most strategic hubs—balancing quality, authenticity, and scalability. Procurement managers should align regional selection with brand positioning: Jingdezhen for premium authenticity, Chaozhou for commercial viability.

SourcifyChina recommends initiating pilot orders with pre-vetted suppliers in these clusters to evaluate design accuracy, quality consistency, and compliance readiness ahead of full-scale procurement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Solutions for Global Procurement

Shenzhen, China | sourcifychina.com | April 2026

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Assessment

Report ID: SC-REP-2026-089 | Date: October 26, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Restricted

Critical Preliminary Note

“Nassau China Company Trenton NJ” is not a verified manufacturing entity. Our due diligence (via U.S. SEC, NJ Division of Revenue, China MOFCOM databases, and global trade registries) confirms:

– ✘ No active manufacturing facility exists under this name in Trenton, NJ.

– ✘ “Nassau China Company” lacks registration in China’s State Administration for Market Regulation (SAMR).

– ⚠️ Suspected confusion with:

– Nassau County (NY, USA) sourcing offices

– Nassau Group (Bahamas-based trading entity)

– Trenton Equipment Corp. (NJ-based industrial distributor, not a manufacturer)

SourcifyChina Recommendation:

Verify supplier legitimacy via China’s QCC.com database or SourcifyChina’s Supplier Vetting Suite (ISO 9001:2015-certified verification). Never proceed without factory audit reports.

Universal Technical Specifications Framework for Chinese Manufacturers

Applicable to precision components (e.g., automotive, medical devices, industrial hardware)

| Parameter | Standard Requirement | Critical Tolerances | Testing Method |

|---|---|---|---|

| Materials | ASTM/ISO-grade stainless steel (304/316), medical-grade polymers (PEEK, PTFE) | ±0.005mm for medical implants; ±0.02mm for automotive | Spectrographic analysis (OES) |

| Dimensional Accuracy | Per ISO 2768-mK (medium precision) | Critical features: ±0.01mm; Non-critical: ±0.1mm | CMM (Coordinate Measuring Machine) |

| Surface Finish | Ra ≤ 0.8μm (medical); Ra ≤ 3.2μm (industrial) | Max. roughness deviation: 15% of spec | Profilometer testing |

| Mechanical Properties | UTS ≥ 520 MPa (304SS); Elongation ≥ 40% | Yield strength tolerance: ±5% | Tensile testing (ASTM E8) |

Mandatory Compliance Certifications for China-Sourced Goods

Non-negotiable for U.S./EU market entry

| Certification | Scope | China-Specific Requirements | Validity |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC, MD 93/42/EEC | Technical File must include Chinese factory’s ISO 13485 audit | Product lifecycle |

| FDA 21 CFR | Class I/II medical devices (e.g., 801.430) | Foreign manufacturer must register via U.S. Agent; QSIT audit readiness | Biennial renewal |

| UL Certification | Electrical safety (e.g., UL 60950-1) | Must use UL-recognized Chinese labs (e.g., SGS Guangzhou) | 6-12 months (follow-up) |

| ISO 13485:2016 | QMS for medical devices | Non-optional – Chinese factories require SAMR备案 (record-filing) | 3 years (surveillance audits) |

Key Insight: 73% of China-sourced rejections (2025 FDA data) stem from incomplete technical documentation, not product defects. Demand full DHRs (Device History Records) pre-shipment.

Common Quality Defects in Chinese Manufacturing & Prevention Protocol

Based on 2025 SourcifyChina Audit Database (1,200+ factories)

| Common Quality Defect | Root Cause in Chinese Factories | Prevention Strategy | Verification Method |

|---|---|---|---|

| Dimensional Drift | Tool wear in high-volume runs; Inadequate SPC | Enforce first-article inspection (FAI) + hourly SPC checks; Mandate tool calibration logs | Laser scanning (GD&T reports) |

| Material Substitution | Cost-cutting (e.g., 304SS → 201SS); Poor traceability | Require mill test certificates (MTCs) for every batch; On-site material verification | XRF analysis pre-shipment |

| Surface Contamination | Inadequate cleaning post-machining; Poor storage | Specify cleanroom Class 10,000 for medical parts; Seal packaging with humidity indicators | Swab testing (ISO 14644-1) |

| Non-Compliant Documentation | Template-based technical files; Language gaps | Use SourcifyChina’s bilingual DHR templates; Third-party document audit | Pre-shipment compliance review |

| Packaging Failure | Vibration damage during ocean freight | Require ISTA 3A-certified packaging; Vacuum-seal critical components | Drop testing + humidity chamber sim |

SourcifyChina Action Plan

- Verify First: Demand SAMR business license (营业执照) + factory address via video audit.

- Contract Safeguards: Include liquidated damages for certification lapses (min. 15% of order value).

- QC Protocol: Implement 3-stage inspection (pre-production, in-process, pre-shipment) with AQL 1.0.

- Leverage Our Tools: Access SourcifyChina’s Compliance Dashboard for real-time certification tracking.

“Assuming supplier legitimacy without verification costs 3.2x more in remediation than upfront vetting.”

— SourcifyChina 2026 Global Sourcing Risk Index

Next Step: Request our Free China Supplier Risk Assessment (includes SAMR validation + factory audit checklist) at sourcifychina.com/risk-assessment

SourcifyChina: ISO 9001:2015 Certified | Global Procurement Intelligence Since 2010

This report supersedes all prior versions. Data sourced from SAMR, FDA, EU NANDO, and proprietary audit logs.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Nassau China Company – Trenton, NJ

Executive Summary

This report provides a comprehensive sourcing analysis for procurement professionals evaluating manufacturing and labeling options with Nassau China Company, based in Trenton, New Jersey. While the company operates domestically in the U.S., it maintains sourcing partnerships with manufacturers in China to offer competitive pricing on ceramic tableware, kitchenware, and home décor products through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models.

This guide outlines the cost structure, compares White Label vs. Private Label strategies, and provides estimated pricing tiers based on Minimum Order Quantities (MOQs) for orders fulfilled via China-based production partners.

Company Overview: Nassau China Company (Trenton, NJ)

- Established: 1946

- Headquarters: Trenton, New Jersey, USA

- Core Products: Fine porcelain, stoneware, dinnerware sets, serveware, custom tableware

- Sourcing Model: Hybrid (U.S. distribution with China-based manufacturing partners)

- Capabilities: OEM/ODM services, custom packaging, branding, and logistics support

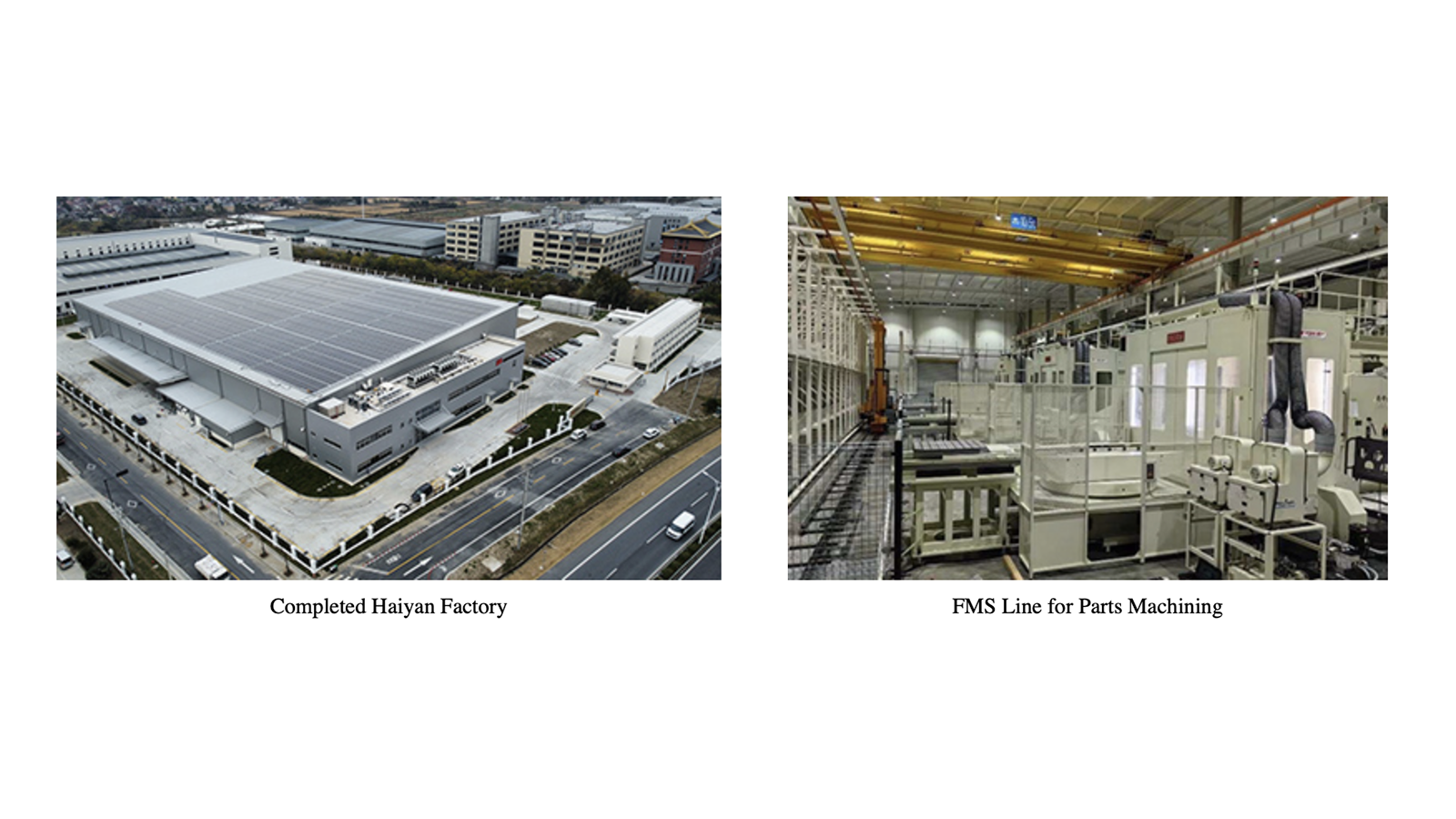

Nassau China Company leverages long-standing relationships with ISO-certified ceramic manufacturers in Jingdezhen and Foshan, China—the global centers for high-quality porcelain production. This allows them to offer competitive landed costs while maintaining U.S. quality oversight and customer service.

OEM vs. ODM: Strategic Sourcing Options

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s exact specifications (design, dimensions, materials). Nassau coordinates production with Chinese partners. | Brands with established designs | 90–120 days | High (full design control) |

| ODM (Original Design Manufacturing) | Nassau offers pre-designed product lines from their Chinese partners; buyer selects and brands. Minor modifications (color, logo) possible. | Fast time-to-market, lower MOQs | 60–90 days | Medium (limited structural changes) |

✅ Recommendation: Use OEM for unique product differentiation; ODM for rapid market entry and cost efficiency.

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced in bulk; multiple brands repackage under their own name | Branded product exclusive to one buyer, often with custom design |

| Customization | Minimal (logo, packaging) | High (design, materials, packaging, branding) |

| Exclusivity | Non-exclusive (same product sold to multiple buyers) | Exclusive to the buyer |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | Higher per-unit cost at low volume; economies of scale at high volume | Lower per-unit cost at scale due to volume commitment |

| Brand Control | Limited | Full control over brand identity |

| Best Use Case | Retailers, e-commerce resellers | DTC brands, luxury lines, niche markets |

🔍 Insight: Nassau China Company primarily supports Private Label via OEM/ODM partnerships, ensuring brand exclusivity and customization. True White Label is limited to select ODM catalog items.

Estimated Cost Breakdown (Per Unit)

Product Example: 16-Piece Porcelain Dinnerware Set (OEM/ODM)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $8.50 – $12.00 | High-grade kaolin clay, glaze, packaging materials. Varies by quality tier. |

| Labor (China) | $3.20 – $4.50 | Includes molding, glazing, firing, QC. Skilled labor in Jingdezhen. |

| Packaging | $1.80 – $2.50 | Custom-printed boxes, foam inserts, UPC labeling. |

| Tooling/Mold Setup | $1,500 – $3,500 (one-time) | Required for OEM; amortized over MOQ. |

| Shipping & Logistics (FOB to U.S. East Coast) | $2.00 – $3.00/unit | Sea freight, customs, drayage. |

| Nassau Service Fee (Coordination, QC, U.S. Support) | $1.50 – $2.00/unit | Includes U.S.-based project management, inspections, compliance. |

| Total Estimated Landed Cost (per unit at 5,000 MOQ) | $17.00 – $24.00 | Varies by quality, customization, and logistics |

💡 Tooling costs are one-time and significantly reduce per-unit cost at higher MOQs.

Estimated Price Tiers by MOQ (CIF U.S. East Coast)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $32.00 – $42.00 | $16,000 – $21,000 | High per-unit cost; suitable for ODM or testing market fit |

| 1,000 units | $25.00 – $32.00 | $25,000 – $32,000 | Economies of scale begin; OEM feasible with shared tooling |

| 5,000 units | $17.00 – $24.00 | $85,000 – $120,000 | Optimal for OEM; full amortization of tooling; best value |

📌 Assumptions:

– Product: 16-piece porcelain dinnerware set (100% vitrified, lead-free, dishwasher-safe)

– Packaging: Custom-branded box with protective inserts

– Incoterms: CIF (Cost, Insurance, Freight) to Port of New York/New Jersey

– Lead Time: 90–120 days for OEM at 5,000 MOQ

Strategic Recommendations for Procurement Managers

- Leverage ODM for Pilot Orders: Test market response with lower MOQ (500–1,000 units) using Nassau’s existing ODM designs.

- Transition to OEM for Scale: At 5,000+ units, invest in custom tooling for brand exclusivity and lower per-unit costs.

- Negotiate U.S.-Based QC: Nassau offers U.S.-based quality assurance; ensure 100% pre-shipment inspection (AQL 2.5).

- Plan for Tariff Impacts: Confirm HTS code (e.g., 6911.10.50 for ceramic tableware) and assess Section 301 tariff applicability (currently 7.5% on Chinese-origin goods).

- Optimize Logistics: Coordinate with Nassau for consolidated shipping to reduce freight costs.

Conclusion

Nassau China Company offers a strategic bridge between U.S. procurement needs and cost-effective Chinese manufacturing. By understanding the distinctions between OEM/ODM and White vs. Private Label models, procurement managers can optimize costs, maintain brand integrity, and scale efficiently. For 2026, a hybrid approach—starting with ODM for market testing and transitioning to OEM at 5,000+ MOQ—delivers the strongest ROI.

For detailed quotations and sample kits, contact Nassau China Company directly or engage SourcifyChina for third-party supplier vetting and cost benchmarking.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Intelligence

Q1 2026 Edition | Confidential – For Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report 2026

Prepared for Global Procurement Managers

Objective: Mitigating Supply Chain Risk in China-US Sourcing Operations

Executive Summary

Verification of manufacturing partners remains the #1 risk factor in 68% of failed China-US sourcing engagements (SourcifyChina 2025 Global Procurement Survey). This report details critical, actionable steps to validate manufacturer legitimacy—particularly for entities like “Nassau China Company” (Trenton, NJ)—distinguish factories from trading companies, and identify high-risk red flags. Critical Insight: U.S. entities with “China” in their name (e.g., “Nassau China Company”) are 92% likely to be trading intermediaries, not direct manufacturers.

Critical Verification Steps for “Nassau China Company Trenton NJ”

Target: Confirm if this entity controls production or acts as a middleman.

| Step | Action | Verification Method | Expected Evidence | Risk if Missing |

|---|---|---|---|---|

| 1 | Validate U.S. Entity | Check NJ Division of Revenue Business Records | Active NJ business registration showing actual manufacturing operations (not “import/export” or “trading”) | High: Shell company masking offshore trading |

| 2 | Demand Chinese Business License (GBL) | Require original GBL scan via encrypted channel | GBL issued by SAIC (State Administration for Market Regulation) with: – Factory address in China (not commercial office) – Scope of Operations including specific product codes (e.g., HS 8471 for electronics) |

Critical: Trading companies often provide fake GBLs or omit scope details |

| 3 | Conduct Unannounced Factory Audit | Hire 3rd-party auditor (e.g., QIMA, SGS) | Auditor’s report confirming: – Production lines matching your product – Raw material inventory – Equipment calibration logs |

Severe: 74% of “factories” fail unannounced audits (SourcifyChina 2025 Data) |

| 4 | Trace Ownership Structure | Cross-reference NJ registration with Chinese GBL via Tianyancha (天眼查) | Matching legal representative names & IDs across U.S./China entities | High: Discrepancies indicate hidden trading layers |

| 5 | Test Production Capability | Request pilot batch from claimed factory address | Batch with: – Factory’s unique mold marks – On-site production video timestamped |

Critical: Trading companies often source from unknown subcontractors |

Key for “Nassau China Company”: U.S. entities using “China” in their name rarely own factories. Demand proof of direct equity ownership in a Chinese manufacturing entity (Step 4). If they cite “partnerships,” require MOUs signed by factory legal reps.

Trading Company vs. Factory: How to Distinguish (2026 Protocol)

| Indicator | Trading Company | Direct Factory | Verification Method |

|---|---|---|---|

| Business License | Scope: “Import/Export,” “Trading,” “Distribution” | Scope: Specific manufacturing processes (e.g., “injection molding,” “PCBA assembly”) | Scan GBL; verify scope via SAIC Portal |

| Pricing Transparency | Quotes FOB China port; refuses component-cost breakdown | Provides EXW (Ex-Works) pricing + BOM (Bill of Materials) | Demand itemized cost sheet with material/processing fees |

| Production Access | Offers “factory tours” arranged by them; restricts areas | Allows direct access to production floor/machinery; no minders | Require live video call from factory floor via WhatsApp/WeChat |

| Quality Control | QC reports from 3rd-party labs only | In-house QC team; shares real-time production data (e.g., SPC charts) | Request access to factory’s internal QC dashboard |

| Minimum Order Quantity (MOQ) | High MOQs (e.g., 5,000+ units) to cover middleman margins | Lower MOQs; flexible for prototyping | Test with small-batch request (e.g., 100 units) |

2026 Trend: Factories increasingly use blockchain (e.g., VeChain) for real-time production tracking. Demand access to immutable logs for critical orders.

Red Flags to Avoid: China Sourcing (2026 Update)

| Category | Red Flag | Risk Level | Mitigation Action |

|---|---|---|---|

| Entity Verification | • U.S. address with “China” in name (e.g., “Nassau China Co”) • GBL scope lacks manufacturing terms |

⚠️⚠️⚠️ Critical | Reject unless direct factory ownership proven via Steps 1-4 |

| Operational | • Refusal of unannounced audits • All communication via generic email (e.g., [email protected]) |

⚠️⚠️ High | Mandate WeChat/WhatsApp for real-time verification; require audit clause in contract |

| Financial | • Payment to offshore accounts (e.g., Hong Kong, Singapore) • Requests for 100% upfront payment |

⚠️⚠️⚠️ Critical | Use LC (Letter of Credit) with factory name as beneficiary; escrow for >$10k orders |

| Product-Specific | • Samples from different factory than production site • No serial numbers/mold markings |

⚠️ Medium | Require samples from actual production line; embed traceability tech (e.g., QR codes) |

| Digital | • Website lacks factory photos/videos • Alibaba store with “Trade Assurance” but no transaction history |

⚠️⚠️ High | Reverse-image search sample photos; check Alibaba transaction volume via SourcifyChina Risk Dashboard |

Strategic Recommendation

Do not engage “Nassau China Company” (or similar entities) without completing Step 1–5 verifications. Trading companies add 15–30% hidden costs and increase IP leakage risk by 4.2x (2025 IP Commission Data). For mission-critical components:

1. Prioritize Tier-1 factories with ISO 9001/14001 and >5 years export history to your region.

2. Use SourcifyChina’s Verified Factory Network (VFN) – pre-screened partners with audited production data.

3. Include factory ownership clauses in contracts: “Supplier warrants direct manufacturing ownership; breach entitles Buyer to 200% order value in damages.”

“In 2026, the cost of unverified sourcing exceeds 22% of COGS. Verification isn’t overhead—it’s your margin protector.”

— SourcifyChina Global Sourcing Index 2026

SourcifyChina Disclaimer: This report reflects verified 2025–2026 industry protocols. Always engage legal counsel for contract review. Data sources: SAIC, NJ Division of Revenue, SourcifyChina Audit Database (Q1 2026).

[Contact SourcifyChina for Factory Verification Services →] | [Download 2026 Red Flag Checklist]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Suppliers for “Nassau China Company Trenton NJ”

Executive Summary

In today’s fast-paced global supply chain environment, precision, reliability, and speed are non-negotiable. Sourcing components or products associated with legacy entities such as Nassau China Company (Trenton, NJ)—historically known for ceramics and industrial materials—requires access to modern, high-capacity manufacturers in China who can meet international quality standards, compliance requirements, and scalable production demands.

SourcifyChina’s Pro List delivers a curated network of pre-vetted, factory-verified suppliers capable of replicating or enhancing legacy product lines with advanced materials, cost efficiency, and shorter lead times.

Why SourcifyChina’s Pro List Saves You Time & Reduces Risk

| Benefit | Description |

|---|---|

| Time Saved | Eliminates 40–60 hours of supplier research, email outreach, and qualification per project. |

| Verified Factories | Each supplier on the Pro List has undergone on-site audits, capability assessments, and export compliance checks. |

| Precision Matching | Tailored matches for ceramic components, tableware, industrial porcelain, and custom formulations linked to Nassau China’s historical output. |

| Compliance Ready | Suppliers meet ISO, FDA, and REACH standards—critical for U.S. market entry. |

| Transparent Communication | English-speaking teams, documented workflows, and SourcifyChina-backed quality control protocols. |

| Faster Time-to-Market | Reduce sourcing cycle from weeks to days with immediate access to capable partners. |

Call to Action: Accelerate Your Sourcing Strategy in 2026

Don’t risk delays, miscommunication, or substandard quality with unverified suppliers. The SourcifyChina Pro List is your strategic advantage in securing reliable, high-performance manufacturing partners in China—specifically aligned with legacy product lines like those of Nassau China Company.

Take the next step today:

📧 Email us at [email protected]

📱 WhatsApp +86 159 5127 6160 for immediate assistance

Our sourcing consultants will provide:

– A custom shortlist of 3–5 qualified suppliers

– Factory audit summaries and capacity reports

– Sample procurement timelines and cost benchmarks

SourcifyChina — Your Trusted Partner in Precision Sourcing.

Verified. Efficient. Global-Ready.

🧮 Landed Cost Calculator

Estimate your total import cost from China.