The global naphtha solvent market is experiencing steady growth, driven by rising demand across key industries such as paints and coatings, adhesives, rubber processing, and petrochemicals. According to Grand View Research, the global naphtha market size was valued at approximately USD 178.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of over 4.5% during the forecast period of 2023–2028, underpinned by increased industrial activity in Asia-Pacific and the Middle East. With naphtha serving as a critical feedstock in refining and chemical manufacturing, particularly in ethylene production and solvent applications, the competitive landscape is dominated by vertically integrated energy and chemical firms. As demand for high-purity solvents rises, manufacturers are investing in refining efficiency and sustainability initiatives to maintain market share. This has led to the emergence of a select group of leading naphtha solvent producers that combine large-scale production, global distribution networks, and technological innovation.

Top 6 Naphtha Solvent Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 VM&P Naphtha

Domain Est. 2005

Website: aglayne.com

Key Highlights: VM&P Naphtha is primarily used in the Paint and Coatings industry as well as a Lacquer Diluent/Lacquer Thinner….

#2 Aromatic Naphtha Packaging

Domain Est. 2015

Website: solvchemcustompack.com

Key Highlights: Aromatic naphtha is primarily known as a liquid solvent. Its common industrial applications include aromatic fuel additives, paints and coatings, pesticide ……

#3 VM&P Naphtha

Domain Est. 1995

Website: kleanstrip.com

Key Highlights: Klean-Strip® VM&P Naphtha can be used in place of Paint Thinner for oil-based paint, varnish and enamel when a faster drying time is desired….

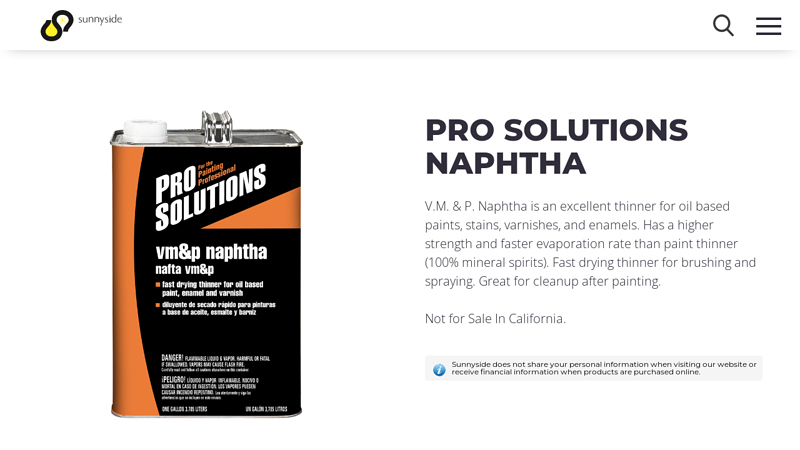

#4 PRO SOLUTIONS NAPHTHA

Domain Est. 1998

Website: sunnysidecorp.com

Key Highlights: Naphtha is an excellent thinner for oil based paints, stains, varnishes, and enamels. Has a higher strength and faster evaporation rate than paint thinner (100% ……

#5 [PDF] ExxonMobil™ Solvent Naphtha M ND

Domain Est. 1999

Website: exxonmobilchemical.com

Key Highlights: This product contains approximately 16 ppm BHT as added to the manufacturing site certified storage tank. ExxonMobil’s sampling and testing procedures in ……

#6 VM&P Naphtha

Domain Est. 2018

Website: univarsolutions.com

Key Highlights: VM&P (Varnish Makers and Painter) Naphtha is a versatile solvent boasting a high evaporation rate and is similar in strength to mineral spirits….

Expert Sourcing Insights for Naphtha Solvent

It seems there may be a misunderstanding in your request. “H2” typically refers to the second half of a calendar year (i.e., July–December), but you are asking for an analysis of market trends in the year 2026 for Naphtha Solvent. If you are requesting a forecast for the global naphtha solvent market in 2026, with a focus on trends expected during the second half of that year (H2 2026), I can provide a forward-looking analysis based on current industry dynamics, projected economic conditions, and sectoral demand drivers.

Here is a comprehensive analysis of the expected 2026 market trends for Naphtha Solvent, with emphasis on H2 2026 developments:

Naphtha Solvent Market Trends – 2026 Outlook (H2 Focus)

1. Global Demand Outlook: Steady Growth in H2 2026

By H2 2026, the global naphtha solvent market is expected to experience moderate but steady growth, driven by recovering industrial activity and sustained demand from key end-use sectors. Global demand is projected to grow at a CAGR of 2.8–3.5% from 2023 to 2026, reaching an estimated market size of USD 18–19 billion by end-2026.

Key demand drivers in H2 2026:

– Paints & Coatings: Expected seasonal uptick in construction activity in North America, Europe, and parts of Asia will boost solvent demand.

– Adhesives & Sealants: Increasing use in automotive and packaging industries, particularly in emerging markets.

– Printing Inks: Growth in e-commerce continues to fuel packaging demand, supporting ink production.

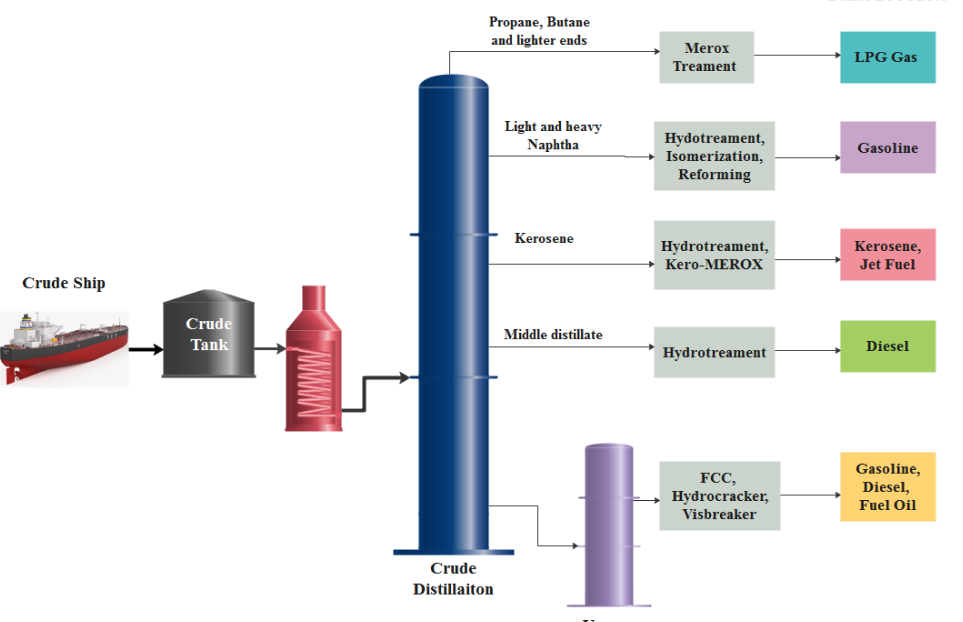

– Chemical Intermediates: Naphtha remains a key feedstock for ethylene and propylene production via steam cracking, especially in regions with fluid catalytic cracking (FCC) integration.

2. Regional Dynamics in H2 2026

-

Asia-Pacific (Dominant Market): China, India, and Southeast Asia will remain the largest consumers. In H2 2026, India’s infrastructure push and China’s gradual post-COVID industrial recovery are expected to increase naphtha solvent uptake. However, China’s shift toward coal-to-olefins (CTO/MTO) may temper naphtha-based ethylene growth.

-

Middle East: Low-cost naphtha production and expanding petrochemical complexes (e.g., in Saudi Arabia and UAE) will support export-oriented solvent and feedstock markets. Aramco and SABIC are expected to maintain robust naphtha utilization.

-

North America: Demand will be stable, supported by shale-based petrochemicals. However, natural gas liquids (NGLs) continue to displace naphtha as a preferred cracker feedstock, limiting growth. Environmental regulations may further pressure solvent-grade naphtha use in coatings.

-

Europe: The market will be constrained by stringent VOC (volatile organic compound) regulations under the EU Solvents Emissions Directive. Formulators are increasingly switching to bio-based or low-VOC alternatives, reducing traditional naphtha solvent demand. However, niche industrial applications will sustain baseline consumption.

3. Feedstock & Crude Oil Price Influence

- H2 2026 oil prices are projected to stabilize between USD 75–90 per barrel (Brent), influenced by OPEC+ supply discipline, geopolitical factors (e.g., Middle East tensions), and global economic recovery patterns.

- Naphtha solvent pricing will remain correlated with crude and refined gasoline markets. Margins may tighten in Q3 due to seasonal refinery maintenance in key regions (e.g., U.S. Gulf Coast and Asia), potentially causing short-term supply tightness.

4. Sustainability & Regulatory Pressures

- In H2 2026, the EU’s Green Deal and REACH regulations will accelerate the shift toward bio-based solvents and recycled hydrocarbons.

- Companies like Shell, BP, and INEOS are expected to launch low-carbon naphtha products derived from waste plastics or renewable feedstocks.

- Voluntary sustainability certifications (e.g., ISCC PLUS) will become more common in solvent supply chains, especially for export to Europe.

5. Technological & Supply Chain Trends

- Digitalization: Wider adoption of AI-driven logistics and inventory management in naphtha distribution, improving supply reliability in H2 peak demand months.

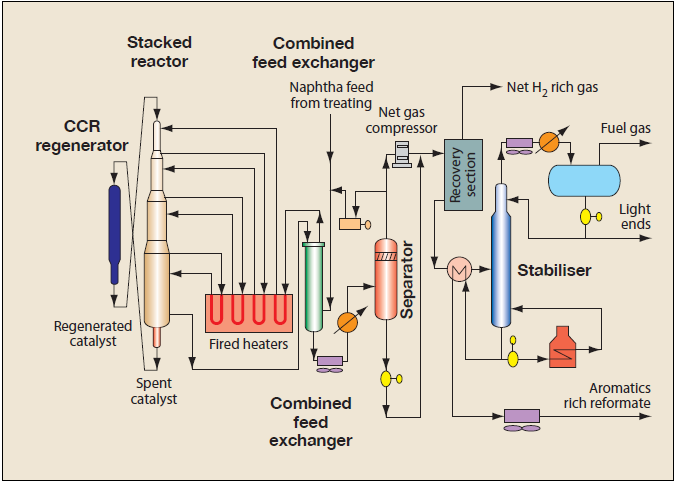

- Integration with Refineries: Refinery-petrochemical integration (especially in China and the Gulf) will enhance on-purpose solvent production efficiency.

- Alternative Solvents: Isoparaffinic and bio-based solvents (e.g., d-limonene) are gaining share, but naphtha remains cost-competitive in high-volume industrial applications.

6. H2 2026 Specific Outlook (July–December)

- Seasonal Demand Surge: Q3 and Q4 typically see increased activity in construction, automotive, and packaging—key sectors using naphtha solvents. This will support higher regional demand, particularly in North America and Asia.

- Refinery Turnarounds: Late summer maintenance cycles may reduce naphtha availability, leading to temporary price spikes.

- Inventory Replenishment: After lean inventories in H1 due to cautious spending, restocking in H2 is expected to drive spot market activity.

- Geopolitical Risks: Escalations in the Red Sea or Persian Gulf could disrupt shipping lanes, affecting naphtha flows from the Middle East to Asia.

7. Price Forecast for H2 2026

- Average naphtha solvent prices (FOB Asia) are projected to range between USD 780–850/ton, depending on crude volatility and regional demand strength.

- Premiums for high-purity, low-sulfur solvent naphtha will persist in regulated markets.

Conclusion:

In H2 2026, the naphtha solvent market will operate in a balanced but evolving landscape. While traditional demand remains resilient, structural shifts—such as feedstock competition, environmental regulations, and sustainability trends—are reshaping the market. Asia will lead growth, while Europe faces contraction due to regulation. Market participants should prepare for seasonal volatility, focus on compliance, and explore opportunities in circular chemistry and low-carbon solvent solutions.

Note: This forecast is based on current trends, macroeconomic projections (IMF, IEA), and industry reports as of 2024. Actual 2026 conditions may vary due to unforeseen geopolitical, economic, or technological developments.

When sourcing Naphtha Solvent, especially in industrial or petrochemical contexts where it may be used in processes involving hydrogen (H₂)—such as hydrotreating, hydrocracking, or hydrogenation—there are several common pitfalls related to quality and specifications (IP – Inspection & Process) that can lead to operational inefficiencies, safety hazards, or catalyst poisoning. Below is a detailed breakdown of these pitfalls, with a focus on compatibility with H₂-containing systems:

🔴 Common Pitfalls Sourcing Naphtha Solvent (with H₂ considerations):

1. Unclear or Inconsistent Specifications (IP Gaps)

- Pitfall: Suppliers may provide vague or inconsistent quality data (e.g., boiling range, aromatic content, sulfur levels) without standardized test methods (e.g., ASTM, IP, or ISO).

- Impact on H₂ Systems: In hydrotreating units, inconsistent feed properties can affect H₂ consumption, reactor temperature control, and catalyst life.

- Mitigation: Define strict IP (Inspection Procedure) requirements including:

- Boiling range (e.g., 60–100°C, 90–150°C)

- Aromatics content (GC analysis)

- Sulfur, nitrogen, chlorine, and olefin content

- Use of standardized test methods (e.g., IP 391 for sulfur, IP 543 for aromatics)

2. High Sulfur and Nitrogen Content

- Pitfall: Off-spec naphtha may contain high levels of sulfur (e.g., mercaptans, thiophenes) and nitrogen compounds (e.g., pyridines).

- Impact on H₂ Systems:

- Catalyst poisoning in hydrotreating/hydrocracking units.

- Increased H₂ consumption due to hydrodesulfurization (HDS) and hydrodenitrogenation (HDN).

- Risk of ammonia formation (from nitrogen), which can cause corrosion or salt deposition.

- Mitigation:

- Enforce strict limits (e.g., S < 10 ppm, N < 1 ppm) in supply contracts.

- Require certificates of analysis (CoA) with trace element data.

3. Presence of Chlorides and Metals

- Pitfall: Contamination with chlorides (organic or inorganic) or metals (e.g., Na, Ca, Fe, As).

- Impact on H₂ Systems:

- Chlorides can form HCl under H₂/hydroprocessing conditions, leading to corrosion (e.g., in preheat exchangers or piping).

- Arsenic and lead can permanently poison noble metal catalysts (e.g., in reformers or hydrogenation units).

- Mitigation:

- Specify chloride content < 1 ppm (by IP 346 or ASTM D4929).

- Require ICP-MS analysis for trace metals.

- Include guard beds or pretreatment steps if supply consistency is questionable.

4. Olefins and Diolefins (Instability)

- Pitfall: Some naphtha streams (e.g., from FCC units) contain reactive olefins/diolefins.

- Impact on H₂ Systems:

- Can lead to gum and coke formation in feed lines or reactors.

- May consume excess H₂ during saturation.

- Reduce catalyst cycle length.

- Mitigation:

- Specify low olefin content (< 2% vol) via bromine number (ASTM D1159) or GC analysis.

- Prefer straight-run naphtha over cracked naphtha for H₂-intensive processes.

5. Water Content and Phase Separation

- Pitfall: Moisture ingress during storage or transport.

- Impact on H₂ Systems:

- Water can cause catalyst damage (e.g., alumina-based supports) or freeze in H₂ lines.

- Promotes corrosion under H₂ partial pressure.

- Mitigation:

- Set water content limit (e.g., < 50 ppm, ASTM D6304).

- Require closed-loop sampling and nitrogen blanketing.

6. Aromatic Content Mismatch

- Pitfall: High aromatics (e.g., BTX) in solvent naphtha.

- Impact on H₂ Systems:

- Aromatics are hydrogen-intensive to saturate.

- May not be desirable if feedstock is for reforming or solvent extraction.

- Can affect product quality (e.g., in polymer or chemical applications).

- Mitigation:

- Define aromatic limits (e.g., < 10% vol, per IP 543 or ASTM D5769).

- Use detailed hydrocarbon analysis (DHA) for critical applications.

7. Inadequate Chain of Custody and Traceability

- Pitfall: Lack of transparency in sourcing (e.g., re-blended or off-spec material resold).

- Impact on H₂ Systems:

- Unpredictable feed composition → process upsets.

- Difficulty in root cause analysis during upsets.

- Mitigation:

- Require batch traceability and origin documentation.

- Conduct fingerprinting tests (e.g., carbon isotope analysis) if counterfeiting is a concern.

8. Storage and Handling Contamination

- Pitfall: Use of contaminated or incompatible storage tanks (e.g., residual diesel, solvents).

- Impact on H₂ Systems:

- Introduce particulates, rust, or incompatible hydrocarbons.

- Risk of catalyst fouling or plugging.

- Mitigation:

- Audit supplier storage practices.

- Require clean-dedicated tanks and filtration (e.g., 10 µm filters).

✅ Best Practices When Sourcing for H₂-Involved Processes:

| Practice | Reason |

|——–|——–|

| Define clear spec sheet with IP references | Ensures consistency and auditability |

| Require pre-shipment inspection (PSI) | Validates quality before dispatch |

| Use third-party lab verification | Reduces supplier bias |

| Conduct compatibility testing with H₂/catalyst systems | Prevents unexpected deactivation |

| Establish supplier qualification program | Ensures reliability and traceability |

Summary (H₂ Context):

When sourcing Naphtha Solvent for use in hydrogen environments (e.g., hydrotreating, hydrogenation), quality assurance is critical. Key risks include heteroatom contamination (S, N, Cl), unsaturates, moisture, and inconsistent composition—all of which can increase H₂ consumption, damage catalysts, or cause corrosion. Robust Inspection & Process (IP) controls, clear specifications, and supplier vetting are essential to avoid operational disruptions.

🔧 Pro Tip: Always test a representative sample under simulated process conditions (e.g., bench-scale hydrotreating) before full-scale adoption.

Logistics & Compliance Guide for Naphtha Solvent (H2)

Version: H2 | Effective Date: [Insert Date]

1. Product Overview

Product Name: Naphtha Solvent (Aliphatic Hydrocarbon Solvent)

Chemical Family: Petroleum Distillates (C5–C12 hydrocarbons)

Common Uses: Industrial cleaning, paint thinning, rubber processing, adhesives, and chemical synthesis.

UN Number: UN 1268

Proper Shipping Name: NAPHTHA, PLASTICIZER, or PETROLEUM NAPHTHA (depending on flash point and specific composition)

Hazard Class: 3 (Flammable Liquid)

Packing Group: II or III (depending on flash point and boiling point)

Flash Point: Typically 38°C to 60°C (100°F to 140°F) — varies by cut

Boiling Range: ~90°C to 200°C (194°F to 392°F)

Appearance: Clear, colorless to pale yellow liquid

Odor: Characteristic petroleum-like odor

⚠️ Note: Specific properties depend on refinery source and cut. Always refer to the Safety Data Sheet (SDS) of the exact product.

2. Regulatory Classification (H2 Compliance)

| Regulation | Classification |

|———-|—————-|

| GHS (Globally Harmonized System) | H226: Flammable liquid and vapor |

| OSHA HCS 2012 | Flammable Liquid Category 3 |

| DOT 49 CFR (USA) | Hazard Class 3, PG II or III |

| ADR (Europe) | Class 3, UN 1268, PG II |

| IMDG Code (Sea) | Class 3, UN 1268, PG II |

| IATA (Air) | Class 3, UN 1268, PG II (Limited to 5 L per inner package for passenger aircraft; may be forbidden on some passenger flights) |

3. Storage Requirements

- Temperature Control: Store in a cool, well-ventilated area away from heat, sparks, and open flame.

- Ventilation: Use explosion-proof ventilation systems in storage areas.

- Containers: Use approved, grounded, and sealed metal containers or approved HDPE drums.

- Segregation:

- Keep away from oxidizers (e.g., nitrates, peroxides), strong bases, and halogens.

- Do not store near food, beverages, or animal feed.

- Secondary Containment: Required for bulk storage (e.g., pallets with spill trays, bunded tanks). Minimum 110% capacity of largest container.

- Fire Protection: Fire-rated storage cabinets for quantities over 60 L (16 gal). Fire suppression systems recommended for large facilities.

4. Handling Procedures

- Personal Protective Equipment (PPE):

- Chemical-resistant gloves (nitrile or neoprene)

- Safety goggles or face shield

- Flame-resistant clothing

- Respiratory protection (organic vapor cartridge) if ventilation is inadequate

- Grounding & Bonding: Required during transfer to prevent static discharge.

- No Smoking: Strictly prohibited in handling and storage areas.

- Spill Prevention: Use drip trays, funnels, and spill kits. Avoid contact with drains or soil.

5. Transportation (H2 Logistics Guidelines)

Packaging:

- Steel drums (200 L / 55 gal), IBCs (1000 L), or tank trucks.

- Must meet UN certification (e.g., UN 1A1/Y for drums).

- Seals must be vapor-tight.

Labeling & Marking:

- Primary Label: Class 3 Flammable Liquid (red diamond)

- Subsidiary Risk (if applicable): Health Hazard or Aspiration Toxicity

- Placarding (Bulk): Class 3 placard required when ≥ 454 kg (1001 lbs) net weight

- Markings: Proper shipping name, UN number, PG, and shipper/consignee info

Documentation:

- Shipping Papers: Include UN 1268, NAPHTHA, PLASTICIZER, 3, PG II, (D/E)

- Safety Data Sheet (SDS): Must accompany shipment per regulations (e.g., OSHA, REACH)

- Emergency Response Information: Required (e.g., CHEMTREC number in USA)

Modes of Transport:

- Road (ADR/DOT): Tank vehicles must be labeled and equipped with emergency shut-offs.

- Marine (IMDG): Stow away from heat and living quarters. Segregate from foodstuffs.

- Air (IATA): Limited quantity allowed (e.g., 5 L max per inner packaging, 60 L per outer). Often restricted on passenger aircraft.

6. Environmental & Emergency Response

Spill Response:

- Eliminate ignition sources.

- Evacuate non-essential personnel.

- Contain spill with absorbent pads, sand, or vermiculite.

- Collect waste in approved hazardous containers.

- Report large spills to local authorities (e.g., EPA, local fire department).

🛑 Do NOT flush into sewers or waterways.

Fire Response:

- Extinguishing Media: Alcohol-resistant foam, dry chemical, CO₂.

- Avoid: Water jet (may spread fire). Use water spray to cool exposed containers.

- Evacuation: Minimum 100 m (328 ft) in all directions during fire.

- Firefighters: Wear full SCBA and protective gear.

Environmental Precautions:

- High aquatic toxicity. Prevent release to soil or water.

- Biodegradable but slow; can persist in groundwater.

7. Regulatory Compliance (Region-Specific)

| Region | Key Regulations |

|——-|—————–|

| USA | EPA (RCRA), OSHA (29 CFR 1910), DOT (49 CFR), CERCLA (reportable quantity: 1000 lbs) |

| EU | REACH, CLP, ADR, Seveso III (for large storage) |

| Canada | TDG, WHMIS 2015, CEPA |

| Australia | ADG Code, NICNAS, state WHS laws |

8. Disposal

- Hazardous Waste: Naphtha solvent waste is typically classified as hazardous (D001 – Ignitable).

- Disposal Methods: Licensed incineration, reclamation, or fuel blending.

- Never: Pour down drain, onto ground, or into regular trash.

9. Training & Documentation

- Required Training:

- HAZMAT handling (DOT)

- GHS/SDS comprehension

- Spill and fire response

- PPE use

- Recordkeeping: Maintain SDS, training logs, spill reports, and shipping documents for minimum 3 years.

10. Contact Information

- Emergency Hotline: [Insert 24/7 Emergency Number, e.g., CHEMTREC: 1-800-424-9300]

- Regulatory Compliance Officer: [Name, Email, Phone]

- SDS Access: [Link or location]

Disclaimer:

This guide (H2) is based on typical naphtha solvent properties. Always verify the exact product specifications and local regulations. Regulatory requirements may vary by jurisdiction and product formulation.

Prepared by: [Your Company Name] – Health, Safety & Environmental (HSE) Department

Approved: [HSE Manager Name], [Date]

🔐 Version Control: H2 — Supersedes H1. Reviewed annually or after regulatory change.

Conclusion on Sourcing Naphtha Solvent

In conclusion, sourcing naphtha solvent requires a strategic approach that balances cost, quality, supply chain reliability, and regulatory compliance. As a versatile hydrocarbon solvent used across industries such as petrochemicals, rubber, adhesives, and paints, the selection of the appropriate naphtha grade—whether aliphatic or aromatic—must align with specific application requirements.

Key considerations in sourcing include identifying reputable suppliers with consistent product specifications, ensuring compliance with environmental and safety standards (such as REACH, OSHA, and local regulations), and evaluating logistical factors to minimize transportation risks and costs. Additionally, market volatility tied to crude oil prices necessitates strong supplier relationships and, where possible, long-term supply agreements to mitigate price fluctuations.

Regional availability, import/export regulations, and sustainability trends are also shaping sourcing decisions, with growing interest in cleaner, more sustainable solvent alternatives. However, naphtha remains a critical industrial solvent due to its effectiveness and wide compatibility.

Ultimately, a well-structured sourcing strategy—supported by thorough due diligence, technical evaluation, and supply chain resilience—will ensure a reliable, efficient, and compliant supply of naphtha solvent, supporting operational continuity and product quality.

![[PDF] ExxonMobil™ Solvent Naphtha M ND](https://www.fobsourcify.com/wp-content/uploads/2026/01/pdf-exxonmobil-solvent-naphtha-m-nd-478.png)