The global Mylar capacitor market is experiencing steady growth, driven by rising demand across consumer electronics, automotive, and industrial applications. According to Mordor Intelligence, the market is projected to grow at a CAGR of approximately 5.2% from 2023 to 2028, fueled by increasing adoption of compact, high-performance capacitors in power supplies, lighting systems, and electric vehicles. Mylar capacitors—known for their stability, low cost, and excellent moisture resistance—are particularly favored in timing circuits, audio applications, and noise filtering. As industries continue to prioritize energy efficiency and miniaturization, the need for reliable film capacitors has intensified. This growth trajectory, supported by technological advancements and expanding electronics manufacturing, has strengthened the competitive landscape. Below, we profile eight leading Mylar capacitor manufacturers that are shaping innovation and supply reliability in this evolving market.

Top 8 Mylar Capacitor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mylar Specialty Films

Domain Est. 1997

Website: mylar.com

Key Highlights: Mylar Specialty Films, global premier producer of differentiated polyester films, Melinex®, Mylar®, Hongji® PET, and Kaladex® PEN film….

#2 Mylar Capacitors

Domain Est. 1997

Website: futurlec.com

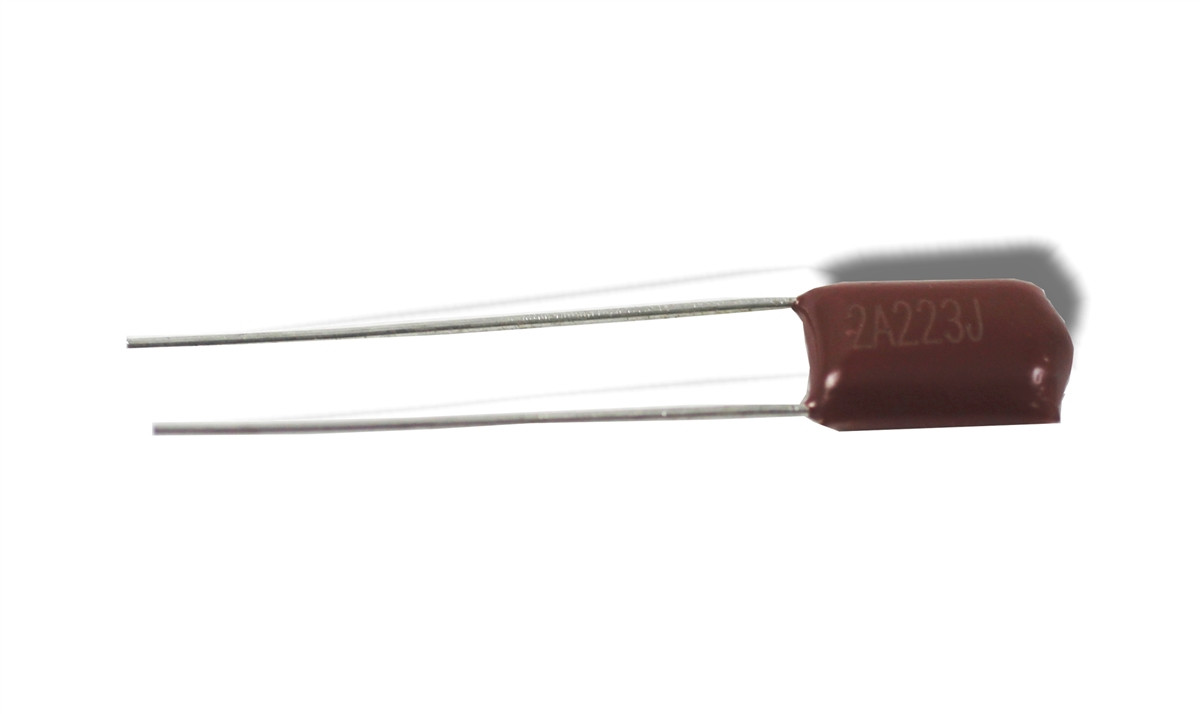

Key Highlights: Standard Mylar Capacitors from Leading Capacitor Manufacturers. High Quality Standard Mylar Capacitor for use in Electronic Circuits….

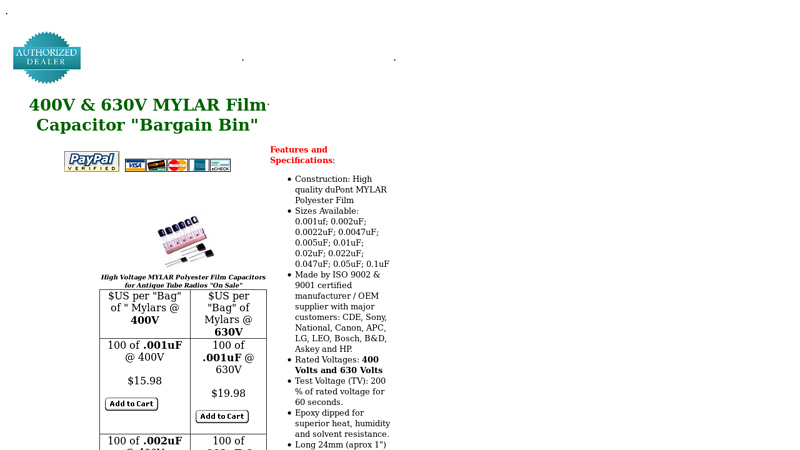

#3 400V & 630V MYLAR Film Capacitor “Bargain Bin”

Domain Est. 1999

Website: justradios.com

Key Highlights: Superior replacement for old paper/wax capacitors in antique tube radios. Good reputation in use with consumer and industrial electronics….

#4 Mylar Capacitors by Arizona Capacitors, Inc.

Domain Est. 2013

Website: mylarcapacitor.com

Key Highlights: Arizona Capacitors, Inc. is the first name in quality mylar capacitors. Mylar capacitors have a distinct advantage. They are both smaller and stronger….

#5 Film,Metal Polyester (Mylar) Capacitors

Domain Est. 1998

Website: jameco.com

Key Highlights: Free delivery over $50Electronic components distributor offering Passive Components, including Film, Metal Polyester (Mylar) Capacitors. Products in stock and ready to ship….

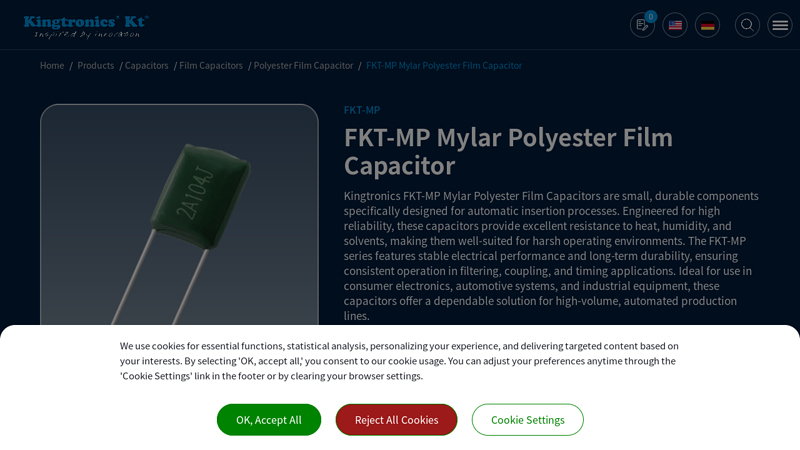

#6 FKT

Domain Est. 2002

#7 Mylar / Film Caps

Domain Est. 2020

Website: theelectronicgoldmine.com

Key Highlights: 8–11 day delivery 30-day returnsExplore a treasure trove of rare electronic circuits, robot kits, LEDs, and more. Explore a vast collection of components including transformers, re…

#8 WIMA Mylar Film Caps Discontinued 2025

Domain Est. 2021

Website: modwiggler.com

Key Highlights: Due to an unavailability of Mylar film, WIMA has announced they are discontinuing a range of popular film capacitors….

Expert Sourcing Insights for Mylar Capacitor

H2: 2026 Market Trends for Mylar Capacitors – Navigating Evolution and Niche Resilience

The Mylar capacitor market in 2026 is poised at a critical juncture, characterized by stable demand in established niches, significant technological displacement in high-performance applications, and strategic adaptation by manufacturers. While facing intense competition from more advanced dielectrics, Mylar’s inherent advantages ensure it remains a relevant, albeit specialized, component.

1. Consolidation & Niche Dominance

- Established Applications Hold Strong: Mylar capacitors will maintain a dominant position in cost-sensitive, non-critical applications where their specific blend of properties is sufficient. Key growth areas include:

- Consumer Electronics: Power supplies in TVs, audio equipment, lighting (LED drivers), and basic appliances where cost and moderate performance are paramount.

- Industrial Controls & Power Supplies: Filtering and coupling in motor drives, power tools, and general-purpose power conversion where reliability over decades and cost-effectiveness are key.

- Automotive (Non-Critical): Cabin electronics (infotainment, lighting controls) and body electronics, benefiting from Mylar’s reliability in moderate-temperature environments and tolerance to voltage fluctuations.

- Market Consolidation: Expect further consolidation among Mylar capacitor manufacturers. Smaller players unable to innovate or achieve scale will likely exit or be acquired, leaving larger, diversified electronics component suppliers (e.g., KEMET (now part of Yageo), Vishay, TDK, WIMA) to dominate the remaining market share through economies of scale and integrated product portfolios.

2. Persistent Pressure from Advanced Alternatives

- Polypropylene (PP) Supremacy: PP capacitors continue to displace Mylar in applications demanding higher efficiency, lower losses (DF), better temperature stability, and higher voltage ratings (especially AC). This is particularly evident in:

- Industrial Power Electronics: Inverters, UPS systems, renewable energy (solar/wind) power conditioning.

- High-Fidelity Audio: Coupling and timing circuits where ultra-low distortion is critical.

- Automotive Powertrain & Charging: Traction inverters, on-board chargers (OBCs), DC-DC converters requiring high reliability and temperature performance.

- Ceramic (MLCC) Encroachment: While MLCCs dominate high-frequency decoupling and miniaturization, advancements in high-capacitance, high-voltage X7R and new dielectrics (e.g., X8G) continue to push into traditional Mylar applications for DC blocking and filtering in compact spaces, especially in consumer and telecom.

3. Strategic Adaptation & Value-Add Innovation

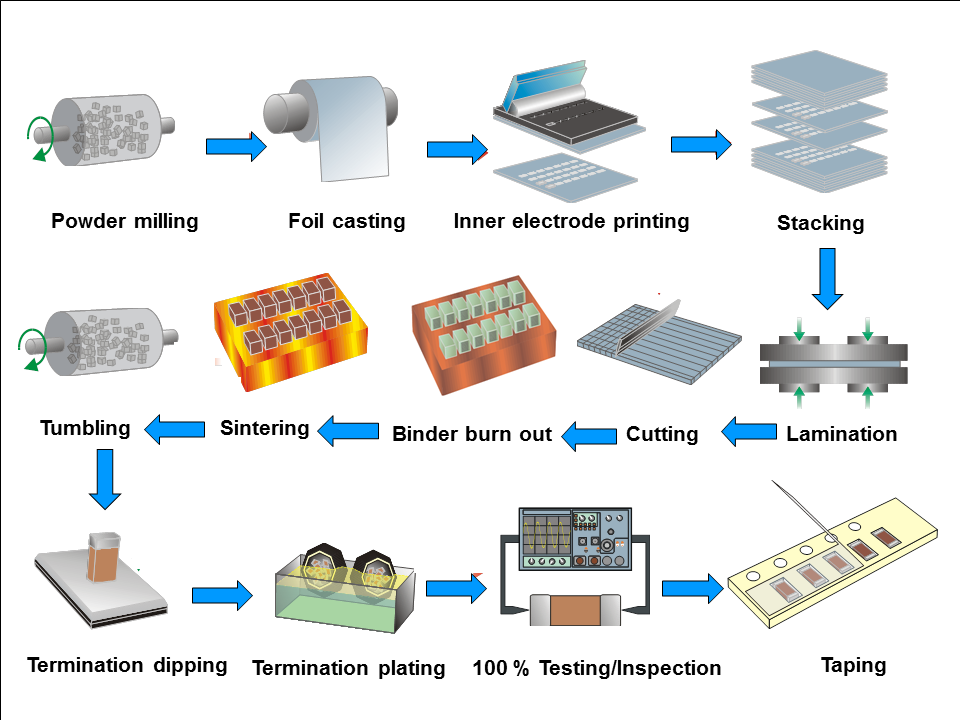

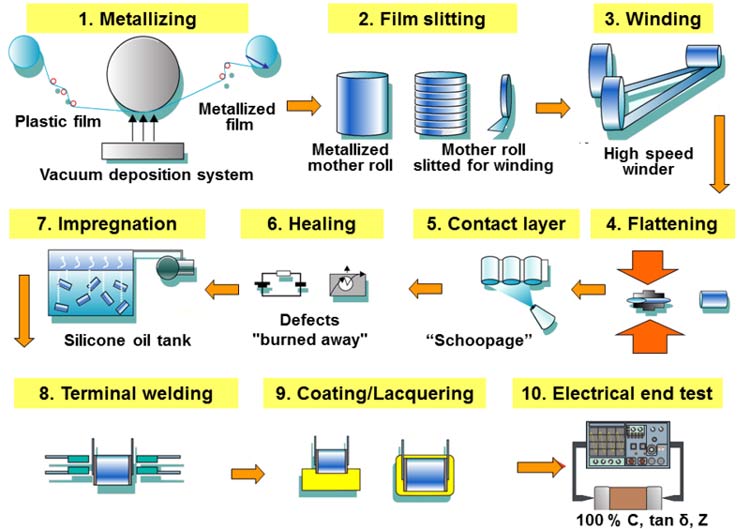

- Focus on Cost-Performance Optimization: Manufacturers will prioritize optimizing the Mylar production process (metallization, winding, impregnation) to maintain the lowest possible cost while ensuring baseline reliability, solidifying its position as the “value” film capacitor.

- Enhanced Reliability & Longevity: Incremental improvements in metallization (e.g., zinc-aluminum alloys, patterned electrodes for self-healing), edge termination, and impregnation techniques will focus on extending lifespan and improving robustness in harsher environments (e.g., higher humidity, temperature cycling) within Mylar’s inherent limitations.

- Form Factor & Integration: Development of more compact radial-leaded and axial-leaded designs, and potentially limited surface-mount (SMD) variants for specific applications, to compete with the miniaturization trend, though this remains challenging due to Mylar’s physical properties compared to ceramics.

4. Regional Dynamics & Supply Chain

- Asia-Pacific Dominance: Production will remain heavily concentrated in Asia (China, Taiwan, Japan, South Korea, Southeast Asia), driven by established manufacturing infrastructure and proximity to major electronics OEMs. Cost pressures will keep this trend strong.

- Supply Chain Resilience: Geopolitical tensions and past disruptions will push manufacturers towards dual-sourcing strategies and potentially regional diversification (e.g., increased production in Southeast Asia or India) to mitigate risks, though the core technology expertise remains concentrated.

5. Sustainability & Environmental Pressures

- End-of-Life & Recyclability: Scrutiny on electronic waste will increase. While film capacitors are generally more recyclable than mixed-material components, the focus will grow on designing for easier disassembly and promoting recycling programs. Mylar (PET) itself is technically recyclable, but practical recycling streams for small components are limited.

- “Green” Materials: Research into bio-based or more easily degradable polyester films might emerge, but significant commercial adoption in capacitors by 2026 is unlikely due to performance and cost hurdles.

Conclusion for 2026:

The Mylar capacitor market in 2026 will not be a high-growth segment but one defined by resilience in its core niches and efficient management. Growth will be modest, primarily tied to overall electronics production volume increases in cost-sensitive sectors. Success will depend on manufacturers’ ability to:

1. Defend the Cost-Performance Sweet Spot: Unwavering focus on cost efficiency and reliability in established applications.

2. Execute Strategic Consolidation: Streamlining operations and portfolios.

3. Manage Displacement: Clearly communicate value proposition against PP and MLCCs, targeting applications where Mylar’s specific balance (cost, volumetric efficiency, reliability history) is optimal.

4. Adapt Incrementally: Improve longevity and explore form factors without fundamentally altering the core technology.

Mylar capacitors will remain a vital, reliable component in the electronics ecosystem, but their future lies in being the pragmatic choice for non-demanding applications, not the cutting-edge solution.

Common Pitfalls When Sourcing Mylar Capacitors (Quality and IP)

Sourcing Mylar (polyester) capacitors may seem straightforward, but several critical pitfalls related to quality and intellectual property (IP) can compromise product reliability and expose companies to legal and reputational risks. Understanding and avoiding these issues is essential.

Inadequate Quality Verification

One of the most prevalent pitfalls is failing to rigorously verify the quality of sourced Mylar capacitors. Counterfeit or substandard components often mimic reputable brands but fail under real-world conditions. These capacitors may exhibit poor tolerance, rapid capacitance drift, higher ESR (Equivalent Series Resistance), or premature failure due to inferior dielectric materials or manufacturing processes. Without proper testing—such as capacitance, dissipation factor, insulation resistance, and life-cycle stress testing—buyers risk integrating unreliable components into their designs, leading to field failures and increased warranty costs.

Lack of Traceability and Authenticity

Purchasing from unauthorized distributors or gray market suppliers increases the risk of receiving re-marked, salvaged, or counterfeit parts. Genuine Mylar capacitors from trusted manufacturers come with full traceability, including lot numbers and certifications. A lack of documentation makes it difficult to verify authenticity and trace defects back to their source. This absence of traceability not only impacts quality assurance but can also void warranties and certifications required in regulated industries like medical or automotive.

Overlooking Compliance and Certifications

Many Mylar capacitor applications require compliance with international standards such as RoHS, REACH, AEC-Q200 (for automotive), or UL/CSA safety certifications. Sourcing components without proper compliance documentation can result in non-compliant end products, leading to delays in market entry, regulatory penalties, or product recalls. Buyers must confirm that suppliers provide up-to-date compliance certifications relevant to their application.

Intellectual Property (IP) and Brand Misrepresentation

Another significant risk involves IP infringement through the unauthorized use of brand names, logos, or part numbers. Some suppliers may falsely label generic or cloned Mylar capacitors as products from well-known manufacturers (e.g., Panasonic, Vishay, WIMA) to command higher prices or gain buyer trust. This misrepresentation not only violates trademark laws but also undermines technical performance expectations tied to genuine components. Using such components can expose the buyer to legal liability, especially if failures lead to downstream damages.

Insufficient Supplier Vetting

Relying solely on price and availability without evaluating a supplier’s reputation, manufacturing practices, or quality management systems (e.g., ISO 9001 certification) can lead to poor-quality procurement. Reputable suppliers invest in quality control and provide technical support, whereas unreliable ones may lack consistent production standards. Skipping due diligence on suppliers increases the likelihood of receiving inconsistent batches or components that do not meet datasheet specifications.

Conclusion

To mitigate these pitfalls, buyers should source Mylar capacitors only from authorized distributors or directly from OEMs, demand full traceability and compliance documentation, conduct incoming quality inspections, and verify supplier credentials. Protecting against counterfeit parts and IP violations not only ensures product reliability but also safeguards the buyer’s legal and commercial interests.

Logistics & Compliance Guide for Mylar Capacitors

Overview

Mylar capacitors, also known as polyester film capacitors, are widely used in electronic circuits due to their stability, reliability, and cost-effectiveness. Ensuring safe and compliant logistics for these components requires adherence to international shipping standards, proper packaging, and regulatory compliance. This guide outlines key considerations for the transportation and regulatory handling of Mylar capacitors.

Packaging & Handling

- Moisture Protection: Use moisture barrier bags (MBBs) with desiccant packs and humidity indicator cards, especially for surface-mount (SMD) variants, to prevent moisture absorption.

- ESD Protection: Package components in static-dissipative or conductive materials to prevent electrostatic discharge damage.

- Mechanical Protection: Use rigid inner packaging (e.g., plastic trays, tubes) and cushioning materials to prevent physical damage during transit.

- Labeling: Clearly label packages with ESD-sensitive and fragile warnings. Include product identifiers, lot numbers, and handling instructions.

Shipping & Transportation

- Temperature Control: Avoid exposure to extreme temperatures (>40°C or <–10°C) during storage and transit to prevent dielectric degradation.

- Humidity Limits: Maintain relative humidity below 60% to minimize moisture-related risks.

- Stacking & Weight Limits: Follow manufacturer guidelines for stacking to avoid crushing lower layers.

- Regulated Transport: Mylar capacitors are generally non-hazardous and not classified as dangerous goods under IMDG, IATA, or ADR regulations when shipped standalone. However, confirm with the manufacturer’s Safety Data Sheet (SDS).

Regulatory Compliance

- RoHS (EU Directive 2011/65/EU): Ensure capacitors are lead-free and compliant with restrictions on hazardous substances (e.g., Pb, Cd, Hg, Cr⁶⁺).

- REACH (EC 1907/2006): Confirm that no substances of very high concern (SVHCs) are present above threshold levels.

- Conflict Minerals (U.S. Dodd-Frank Act): Suppliers should disclose the use of tin, tantalum, tungsten, and gold (3TG) and their sourcing from conflict-free regions.

- WEEE (2012/19/EU): Provide information for proper end-of-life disposal and recycling.

- Export Controls: Verify compliance with ITAR, EAR, or other national export regulations, especially for military or aerospace-grade components.

Documentation Requirements

- Commercial Invoice: Include detailed product description, quantity, value, and country of origin.

- Packing List: Specify packaging types, weights, and dimensions.

- Certificate of Compliance (CoC): Provide RoHS, REACH, and other relevant compliance certifications.

- Safety Data Sheet (SDS): Required for customs or industrial safety purposes, even though Mylar capacitors are typically non-hazardous.

Storage Recommendations

- Environment: Store in a dry, clean, temperature-controlled environment (15–30°C, 30–60% RH).

- Shelf Life: Observe manufacturer-recommended shelf life, especially for moisture-sensitive devices (MSL ratings apply to SMD types).

- Rotation: Practice FIFO (First In, First Out) inventory management to prevent aging.

Environmental & Disposal Considerations

- Mylar capacitors are not classified as hazardous waste under most regulations.

- Recycle through certified e-waste handlers. Do not incinerate, as burning plastic film may release toxic fumes.

- Follow local regulations for electronic component disposal.

Conclusion

Proper logistics and compliance management ensure the safe delivery and regulatory acceptance of Mylar capacitors across global supply chains. Adherence to packaging standards, environmental controls, and regulatory frameworks minimizes risks and supports sustainable operations. Always consult manufacturer specifications and local regulatory authorities for region-specific requirements.

Conclusion for Sourcing Mylar Capacitors:

After evaluating various suppliers, specifications, and market options, sourcing Mylar (polyester) capacitors requires a balanced approach that considers quality, reliability, cost, and long-term supply chain stability. Mylar capacitors remain a cost-effective solution for applications requiring stable performance across a wide temperature range, moderate tolerance, and good insulation resistance, particularly in audio circuits, timing devices, and filtering applications.

Key takeaways from the sourcing process include the importance of selecting reputable manufacturers or distributors with consistent quality control—such as Panasonic, Vishay, KEMET, or AVX—to ensure product reliability and compliance with industry standards (e.g., RoHS, AEC-Q200 where applicable). Additionally, verifying parameters like capacitance tolerance, voltage rating, temperature coefficient, and lead spacing is essential to meet application-specific requirements.

For large-scale production, establishing long-term agreements with suppliers offering stable lead times and competitive pricing can mitigate risks related to component shortages or price volatility. For smaller projects or prototyping, trusted electronic component distributors like Digi-Key, Mouser, or RS Components provide flexibility and fast delivery.

In conclusion, successful sourcing of Mylar capacitors demands due diligence in supplier assessment, a clear understanding of technical specifications, and proactive supply chain management. By aligning component selection with project needs and partnering with reliable suppliers, you can ensure optimal performance, cost-efficiency, and continuity in your electronic designs.