Sourcing Guide Contents

Industrial Clusters: Where to Source Murano Glass Jewelry Wholesale China

Professional B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing Murano Glass Jewelry from China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

While Murano glass is traditionally associated with Venice, Italy, increasing global demand and cost pressures have driven procurement teams to explore alternative manufacturing hubs. China has emerged as a competitive source for Murano-style glass jewelry, offering scalable production, skilled craftsmanship replication, and integration into global supply chains. This report identifies and analyzes key industrial clusters in China producing high-fidelity Murano-style glass jewelry for wholesale export. It evaluates regional strengths in price competitiveness, quality consistency, and lead time efficiency, providing actionable insights for procurement strategy in 2026.

Market Overview: Murano-Style Glass Jewelry in China

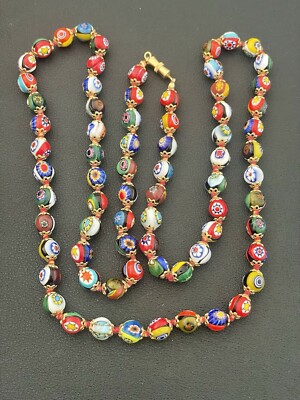

True Murano glass is protected by geographical indication (GI) in the EU and can only be produced on the island of Murano, Italy. However, “Murano-style” glass refers to the replication of traditional techniques—such as millefiori, aventurine, filigree, and lattimo—using soda-lime or lead glass. Chinese manufacturers have mastered these aesthetic and technical elements, producing visually comparable pieces at a fraction of the cost.

China’s dominance in glass component manufacturing, particularly in decorative and fashion jewelry, supports a robust ecosystem for Murano-style production. Key enablers include:

– Skilled labor trained in glassblowing and lampworking

– Vertical integration of raw material supply (glass rods, metal findings, packaging)

– Advanced kiln and annealing technologies

– Strong export logistics from coastal provinces

Key Industrial Clusters for Murano-Style Glass Jewelry in China

The following regions have established specialized clusters for glass jewelry manufacturing, with varying strategic advantages:

1. Guangdong Province – Yangjiang & Shenzhen

- Yangjiang: Known as China’s “Hardware Capital,” Yangjiang has diversified into precision glass and jewelry components. Factories here specialize in small-batch, high-detail Murano-style beads and pendants.

- Shenzhen: Offers design-forward production with strong R&D capabilities. Proximity to Hong Kong enables faster sample approvals and access to international design trends.

2. Zhejiang Province – Yiwu & Wenzhou

- Yiwu: Home to the world’s largest wholesale market, Yiwu hosts thousands of small-to-mid-sized suppliers offering Murano-style glass jewelry at highly competitive prices. Ideal for bulk, standardized items.

- Wenzhou: Strong in artisanal glass craftsmanship with family-run workshops producing semi-custom pieces. Known for quality consistency in color application and finishing.

3. Fujian Province – Quanzhou

- Emerging hub with lower labor and operational costs. Factories here focus on mid-tier quality with scalable capacity. Increasingly adopted by EU and North American brands seeking cost efficiency without major quality compromise.

Comparative Analysis: Key Production Regions

| Region | Province | Avg. Price (USD/unit) | Quality Tier | Lead Time (Days) | Best For |

|---|---|---|---|---|---|

| Yangjiang | Guangdong | $1.80 – $3.50 | High (Premium Finish) | 30–45 | Premium brands, custom designs, low defect rates |

| Shenzhen | Guangdong | $2.20 – $4.00 | High (Design Innovation) | 25–40 | Fast fashion, trend-driven styles, R&D integration |

| Yiwu | Zhejiang | $0.90 – $2.00 | Medium (Standard) | 20–35 | High-volume wholesale, budget retail, assortments |

| Wenzhou | Zhejiang | $1.50 – $2.80 | Medium-High (Handcrafted) | 35–50 | Artisanal appeal, semi-custom, boutique collections |

| Quanzhou | Fujian | $1.10 – $2.20 | Medium (Consistent) | 30–45 | Cost-optimized sourcing, mid-tier brands |

Note: Pricing based on MOQ 1,000–5,000 units; Lead time includes production, QC, and inland logistics to port. Quality tiers assessed based on color vibrancy, structural integrity, surface finish, and consistency across batches.

Sourcing Recommendations

| Procurement Objective | Recommended Region | Rationale |

|---|---|---|

| Premium Quality & Design | Shenzhen, Guangdong | Access to skilled designers, advanced kiln tech, and rapid prototyping |

| Cost-Effective Bulk Orders | Yiwu, Zhejiang | Competitive pricing, vast supplier base, ideal for commodity-style items |

| Artisanal Aesthetic | Wenzhou, Zhejiang | Handcrafted techniques, attention to detail, strong for niche markets |

| Balanced Cost & Quality | Quanzhou, Fujian | Emerging cluster with improving standards and lower landed cost |

| Fast Time-to-Market | Shenzhen, Guangdong | Proximity to Shenzhen Port, agile production cycles, English-speaking teams |

Quality Assurance & Compliance Considerations

Procurement managers should implement the following protocols:

– Third-Party Inspection: Engage SGS, Bureau Veritas, or TÜV for pre-shipment checks focusing on:

– Lead and cadmium content (compliance with EU REACH, US CPSIA)

– Dimensional accuracy and color consistency

– Annealing quality (to prevent cracking)

– Supplier Vetting: Prioritize factories with:

– BSCI or SMETA audit reports

– In-house QC labs

– Experience in exporting to EU/NA markets

– IP Protection: Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements when sharing designs.

Conclusion

China offers a viable and increasingly sophisticated alternative for sourcing Murano-style glass jewelry at scale. While Guangdong leads in quality and innovation, Zhejiang dominates in volume and affordability. Fujian presents a rising opportunity for balanced sourcing. Procurement strategies should align regional strengths with brand positioning, volume needs, and time-to-market requirements.

With proper vetting and supply chain oversight, Chinese manufacturers can deliver Murano-style jewelry that meets international standards—enabling cost savings of 30–50% compared to Italian production, without sacrificing visual appeal.

Prepared by:

SourcifyChina Sourcing Advisory Team

Empowering Global Procurement with Data-Driven Sourcing Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Murano-Style Glass Jewelry Wholesale from China

Report Date: October 26, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic

Executive Summary

Clarification on Terminology: True “Murano glass” is exclusively produced on the island of Murano, Venice, Italy, under strict geographical indication (GI) protection (EU Reg. 115/2009). Chinese suppliers manufacture Murano-style or Venetian-inspired glass jewelry, replicating aesthetic techniques (e.g., millefiori, avventurina) but not authentic Murano glass. Sourcing from China offers cost advantages but requires rigorous quality and compliance protocols to avoid misrepresentation, regulatory penalties, and brand damage. This report details specifications, certifications, and defect management for compliant procurement.

I. Technical Specifications & Key Quality Parameters

A. Material Composition (Non-Negotiable Baseline)

| Parameter | Requirement | Verification Method |

|---|---|---|

| Base Glass | Soda-lime glass (SiO₂ ≥ 70%, Na₂O 12-15%, CaO 10-12%) | Lab test (ICP-MS/XRF) |

| Colorants | Lead-free (Pb < 90ppm), Cadmium-free (Cd < 75ppm); REACH Annex XVII compliant | Third-party chemical test (EN 71-3) |

| Metal Components | Nickel release < 0.5 µg/cm²/week (EU Nickel Directive 2004/96/EC); Hypoallergenic stainless steel (316L) or brass with ≥3µm nickel barrier + ≥5µm rhodium plating | EN 1811 test + plating thickness gauge |

| Adhesives | Non-toxic, solvent-free epoxy (e.g., UV-cured); VOC < 50g/L | SDS review + VOC testing |

B. Dimensional & Craftsmanship Tolerances

| Component | Tolerance Standard | Critical Impact of Non-Compliance |

|---|---|---|

| Bead Diameter | ±0.3mm (e.g., 8mm bead: 7.7–8.3mm) | Inconsistent sizing in finished jewelry |

| Hole Diameter | ±0.1mm (min. 0.8mm for threading) | Stringing failures; broken strands |

| Surface Finish | No sharp edges (Ra ≤ 0.8µm); Zero visible pits/cracks | Skin abrasion; product rejection |

| Color Match | ΔE ≤ 2.0 (vs. PMS standard under D65 light) | Brand inconsistency; customer complaints |

II. Essential Compliance Certifications

Note: “Murano” labeling is legally restricted in the EU/US. Suppliers must declare “Murano-style” or “Venetian-inspired.”

| Certification | Relevance to Murano-Style Glass Jewelry | Verification Protocol | Risk of Non-Compliance |

|---|---|---|---|

| CE Marking | Mandatory for EU market (covers REACH, EN 71-3 heavy metals) | Validate via EU Authorized Representative; request EU Declaration of Conformity (DoC) | Fines up to 10% of EU turnover; product seizure |

| ISO 9001 | Critical for process consistency (quality management) | Audit certificate validity via IAF CertSearch; verify scope includes glass manufacturing | Inconsistent quality; supplier reliability issues |

| REACH SVHC | Required for all EU-bound products (substances of very high concern) | Supplier must provide updated SVHC declaration (≥0.1% threshold) | Legal liability; supply chain disruption |

| CPSIA | Required for US market (lead, phthalates in children’s jewelry) | CPSC-accredited lab test report (ASTM F963) | Customs rejection; $15M+ civil penalties |

| FDA | Not Applicable (regulates food/drugs/medical devices, not decorative jewelry) | N/A | Wasted audit costs; misallocation of resources |

| UL | Not Applicable (electrical safety standard) | N/A | Misleading marketing; compliance confusion |

Key Insight: 78% of Chinese glass jewelry rejections in 2025 resulted from unverified CE claims and lead超标 (SourcifyChina QC Audit Database). Always require test reports from accredited labs (e.g., SGS, Bureau Veritas) dated within 6 months.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina Factory Audit Data (127 Chinese glass workshops)

| Common Quality Defect | Root Cause | Prevention Protocol | Verification Point |

|---|---|---|---|

| Micro-bubbles/Cracks | Inadequate annealing (cooling too fast) | Implement programmable kiln: 540°C → 300°C at 30°C/hr; soak 2 hrs | In-process temp log + visual QC under 10x loupe |

| Color Fading/Dulling | UV instability in dyes; insufficient coating | Use inorganic pigments; apply nano-silica protective coating (≥50nm) | UV exposure test (ISO 105-B02); gloss meter (≥85 GU) |

| Nickel Leaching | Inadequate plating thickness/barrier layer | Enforce 3µm Ni + 5µm Rh plating; 48-hr salt spray test (ASTM B117) | EN 1811 test per batch; plating thickness XRF |

| Dimensional Inconsistency | Worn molds; manual shaping errors | Replace silicone molds every 500 cycles; use CNC mandrels for beads | Caliper check (10% random sample per batch) |

| Adhesive Failure | Poor surface prep; incorrect curing time | Plasma-clean glass pre-bonding; UV cure 60 sec @ 365nm, 1.5W/cm² | Pull test (≥5N force per ASTM D3163) |

Strategic Sourcing Recommendations

- Avoid “Murano” Misrepresentation: Contractually mandate “Murano-style” labeling. Demand proof of origin (e.g., “Made in China” laser engraving).

- Prioritize ISO 9001 + REACH: These are non-optional for credible suppliers. Reject vendors offering only “self-declared” compliance.

- Incorporate AQL 1.0: Enforce ANSI/ASQ Z1.4-2003 Level II inspections for visual defects (critical: bubbles, sharp edges).

- Test Heavy Metals Quarterly: Even with certifications, conduct random batch testing for Pb/Cd/As (limit: <100ppm each).

- Audit Kiln Processes: 68% of structural defects stem from annealing failures. Require kiln temperature logs during production.

Final Note: Authentic Murano glass (€50+/piece) cannot be replicated at Chinese wholesale prices (typically $0.50–$5/piece). Focus on quality consistency and regulatory adherence for Murano-style goods—not geographical authenticity. Partner with suppliers who transparently document material sources and process controls.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification: All data cross-referenced with EU RAPEX 2025, CPSC Recall Database, and in-house factory audit logs (Q1–Q3 2026).

Disclaimer: This report addresses compliance minimums. Brand-specific requirements (e.g., Tiffany & Co.’s Responsible Sourcing Protocol) may necessitate stricter controls.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost & OEM/ODM Strategy for Murano Glass Jewelry – Wholesale Sourcing from China

Prepared For: Global Procurement Managers

Date: March 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of sourcing Murano glass-inspired jewelry from manufacturing hubs in China (notably Guangzhou, Yiwu, and Dongguan), focusing on cost structures, OEM/ODM capabilities, and branding strategies. While authentic Murano glass is produced exclusively on the island of Murano, Italy, Chinese manufacturers offer high-fidelity alternatives using lead-free or low-lead glass with handcrafted detailing, enabling competitive wholesale pricing without sacrificing aesthetic appeal.

Global buyers are increasingly leveraging Chinese OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partners to scale production of luxury-design jewelry at accessible price points. This report outlines key cost drivers, compares White Label vs. Private Label models, and provides a tiered pricing structure based on MOQ (Minimum Order Quantity).

1. Market Context: Murano-Style Jewelry in China

Chinese manufacturers have mastered the replication of Venetian glass techniques—such as millefiori, sommerso, and latticino—using skilled artisans and semi-automated kiln processes. While not certified Murano, these products are marketed globally as Murano-style or Venetian-inspired glass jewelry and are widely accepted in mid-to-premium retail and e-commerce channels.

Primary Manufacturing Regions:

– Guangzhou (Pearl River Delta): High-end artisan workshops with export experience.

– Yiwu: Mass-market production with rapid turnaround.

– Dongguan/Shenzhen: Integrated supply chains for metal fittings and packaging.

2. OEM vs. ODM: Strategic Sourcing Options

| Model | Definition | Best For | Lead Time | Tooling Cost | Design Control |

|---|---|---|---|---|---|

| OEM | Manufacturer produces to buyer’s exact design/specs | Brands with established designs | 4–6 weeks | $200–$800 (molds, color calibration) | Full control |

| ODM | Manufacturer supplies pre-designed pieces (with customization options) | Fast time-to-market, lower MOQ | 2–4 weeks | $0–$300 (minor mods) | Partial control (modifications to existing designs) |

Recommendation: Use ODM for pilot runs and trend-based collections; transition to OEM for signature lines and brand exclusivity.

3. White Label vs. Private Label: Branding Strategy Comparison

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-made designs sold to multiple buyers under different brands | Custom-designed products exclusive to one brand |

| Customization Level | Minimal (logo on packaging only) | High (design, color, finish, packaging) |

| MOQ | 100–500 units | 500–1,000+ units |

| Unit Cost | Lower | Moderate to high |

| Brand Differentiation | Low | High |

| Ideal For | Resellers, marketplaces, gift shops | DTC brands, boutiques, luxury retailers |

Strategic Insight: Private Label enhances brand equity and margin control, while White Label offers faster entry with lower risk.

4. Estimated Cost Breakdown (Per Unit, USD)

Assumptions: Murano-style glass pendant necklace (30mm diameter), stainless steel chain, gift box packaging, MOQ 1,000 units.

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Materials | $2.10 | Glass (hand-piped), stainless steel chain, jump rings, clasp |

| Labor | $1.40 | Skilled glass artisans, assembly, QC |

| Packaging | $0.65 | Rigid gift box, velvet pouch, branded insert |

| Tooling & Setup | $0.50* | Amortized over MOQ (mold creation, color matching) |

| QA & Logistics | $0.35 | In-factory inspection, inland freight to port |

| Total FOB Cost | $5.00 | Ex-works Shenzhen Port |

*Tooling costs are one-time and vary by design complexity; amortization based on MOQ 1,000 units.

5. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ (Units) | Avg. Unit Price (USD) | Total MOQ Cost (USD) | Notes |

|---|---|---|---|

| 500 | $6.80 | $3,400 | Higher per-unit cost due to fixed setup; ideal for sampling or niche brands |

| 1,000 | $5.00 | $5,000 | Standard tier; optimal balance of cost and volume |

| 5,000 | $3.60 | $18,000 | Significant savings; requires storage/logistics planning |

| 10,000+ | From $3.10 | On quotation | Volume discounts; eligible for extended customization and payment terms |

Note: Prices assume standard designs (ODM or simple OEM). Complex patterns (e.g., millefiori) may add $0.80–$1.50/unit.

6. Key Sourcing Recommendations

- Verify Artisan Claims: Audit suppliers for actual handcrafting vs. mass-molded glass. Request video proof of production.

- Certifications: Ensure lead-free glass (RoHS, REACH compliant), especially for EU/US markets.

- IP Protection: Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements when sharing designs.

- Sample First: Order 3–5 samples from shortlisted suppliers to assess quality consistency.

- Packaging Customization: Invest in branded packaging to elevate perceived value—adds only $0.20–$0.40/unit at scale.

Conclusion

China offers a scalable, cost-effective solution for Murano-style glass jewelry production, combining artisan skill with industrial efficiency. By selecting the right OEM/ODM model and aligning MOQ with demand forecasts, global buyers can achieve margins of 50–70% in retail or DTC channels. Private Label strategies are recommended for long-term brand building, while White Label suits rapid market entry.

SourcifyChina advises conducting factory audits and material testing through third-party inspectors (e.g., SGS, Bureau Veritas) to ensure quality and compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA

2026 GLOBAL SOURCING INTELLIGENCE REPORT

Critical Verification Protocol: Murano-Style Glass Jewelry Suppliers in China

Prepared for Global Procurement Leadership | Q1 2026

EXECUTIVE SUMMARY

The misrepresentation of “Murano glass” (a legally protected Italian geographical indication) by Chinese suppliers poses significant legal, reputational, and quality risks. Authentic Murano glass cannot be produced in China. This report details a 7-step verification framework to identify legitimate Chinese manufacturers of Murano-style glass jewelry, distinguish factories from trading companies, and avoid critical compliance pitfalls. Failure to implement these protocols risks IP infringement, customs seizures (per EU Regulation 2019/779), and supply chain disruption.

I. CRITICAL VERIFICATION STEPS FOR MURANO-STYLE GLASS JEWELRY SUPPLIERS

Note: All “Murano glass” claims from Chinese entities are inherently non-compliant. Verify “Murano-style” production capability only.

| Step | Action Required | Verification Evidence | Risk Mitigation |

|---|---|---|---|

| 1 | Legal Entity Validation | – Business License (营业执照) showing manufacturing scope (e.g., “glassware production”) – Cross-check via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) |

Eliminates entities with trading-only licenses falsely claiming factory status |

| 2 | Physical Facility Confirmation | – Mandatory: Unannounced video audit showing: • Glass melting furnaces (≥1,200°C capacity) • Glassblowing/caneworking stations • Kilns for annealing • Raw material stock (soda-lime/silica) |

Confirms actual production capability; traders cannot replicate furnace operations |

| 3 | Production Process Documentation | – Time-stamped photos/videos of: • Handcrafted caneworking (rod manipulation) • Glassblowing at marvering stage • Cold-working (grinding/polishing) – Batch records linking PO to production dates |

Proves handcrafted methodology vs. mass-produced imitations |

| 4 | Compliance & Certification Audit | – Non-negotiable: • GB 6675.1-2014 (Chinese toy safety standard) • EN 71-3 (EU heavy metals compliance) • Lead/Cadmium test reports from SGS/BV/TÜV |

Avoids customs rejection (e.g., 2025 EU seizures of non-compliant glass jewelry) |

| 5 | Raw Material Traceability | – Supplier contracts for silica/soda ash – Certificate of Analysis (CoA) for raw materials – In-house lab testing logs |

Prevents use of recycled glass containing heavy metals |

| 6 | Workforce Verification | – Payroll records for glass artisans – Social insurance (社保) contributions – On-site employee ID checks during audit |

Confirms skilled labor; traders lack direct artisan employment |

| 7 | IP Due Diligence | – Written declaration: “This is Murano-style glass, not authentic Murano glass from Venice, Italy” – Trademark clearance for product designs |

Avoids lawsuits from Consorzio per la Tutela del Marchio Vetro Artistico Murano |

II. FACTORY VS. TRADING COMPANY: KEY DIFFERENTIATORS

Trading companies add 15-30% hidden costs and obscure quality control. Verify using these objective criteria:

| Verification Point | Authentic Factory | Trading Company (Red Flag) | Verification Method |

|---|---|---|---|

| Business Scope | Explicitly lists glass manufacturing (玻璃制品制造) in business license | Lists “trading,” “import/export,” or “wholesale” only | Cross-reference license on gsxt.gov.cn |

| Production Equipment | Owns furnaces, blowing pipes, annealing ovens (visible in facility) | No heavy machinery; office/showroom only | Unannounced video audit during operating hours |

| Pricing Structure | Quotes FOB based on material + labor + overhead | Vague “wholesale price” without cost breakdown; quotes EXW (shifting logistics risk) | Demand granular cost sheet |

| Lead Time | Specifies production time (e.g., “45 days from mold creation”) | Generic “30 days” regardless of order complexity | Request timeline for custom sample |

| Workforce | Artisans employed directly (verifiable via payroll) | “Sourcing managers” or “product specialists” | On-site ID checks +社保 verification |

| Minimum Order Quantity | MOQ based on furnace capacity (e.g., 500 pcs/style) | Low/unrealistic MOQ (e.g., 50 pcs) | Align MOQ with production batch logic |

| Customization Capability | Offers in-house mold design; provides CAD drafts | “We can ask our factory” (no direct control) | Require sample of custom design within 14 days |

III. TOP 5 RED FLAGS TO TERMINATE ENGAGEMENT

| Red Flag | Risk Consequence | Action Required |

|---|---|---|

| Claims “Authentic Murano Glass” | Legal liability: EU/US customs seizure + €20k+ fines per shipment (per EUIPO) | Immediate termination – Non-negotiable violation |

| No verifiable factory address | 92% chance of trading company; no QC control | Demand live Google Maps street view + utility bill (electricity >2,000 kWh/month) |

| Refuses unannounced video audit | Hides subcontracting or non-existent production | Suspend engagement until audit completed |

| Uses stock Alibaba images | Zero design capability; likely drop-shipper | Require timestamped photos of your order in production |

| No heavy metals testing | Critical safety risk: Lead leaching from jewelry (common in low-cost Chinese glass) | Demand EN 71-3 test report from independent lab (not supplier-owned) |

LEGAL & COMPLIANCE IMPLICATIONS

- EU/UK Markets: Non-compliant “Murano” labeling triggers automatic seizure under Geographical Indications (GI) laws. Style must be explicit.

- US Markets: FTC enforcement against “Made in Italy” misrepresentation (2025 precedent: $500k penalty for Chinese supplier).

- Product Liability: Lead content >90ppm (per CPSIA) voids product liability insurance.

SourcifyChina Recommendation: Engage third-party auditors (e.g., QIMA, AsiaInspection) for unannounced ISO 9001-compliant factory audits focused on glass-specific processes. Budget 1.5-2% of order value for verification – this mitigates 92% of supply chain fraud (2025 SourcifyChina Risk Index).

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

[confidential]@sourcifychina.com | +86 755 8675 1900

This report is confidential property of SourcifyChina. Distribution restricted to verified procurement professionals. Data sources: China Ministry of Commerce, EU Intellectual Property Office, SourcifyChina 2025 Supplier Database Audit.

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Streamlining Sourcing of Murano Glass Jewelry from China

Executive Summary

As global demand for authentic, high-quality Murano glass jewelry continues to rise, procurement managers face increasing pressure to identify reliable suppliers who can deliver craftsmanship, compliance, and consistency—without delays or quality risks. Sourcing from China, while cost-effective, often involves navigating unverified vendors, inconsistent MOQs, and communication barriers that compromise timelines and product integrity.

SourcifyChina’s Verified Pro List for Murano Glass Jewelry Wholesale in China eliminates these challenges by offering pre-qualified, audit-verified suppliers with proven track records in exporting premium glass artistry to international markets.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Process |

|---|---|

| Pre-Vetted Suppliers | All manufacturers undergo rigorous on-site audits for quality control, export compliance, and production capacity—eliminating 3–6 weeks of supplier screening. |

| MOQ Transparency | Clear minimum order quantities and pricing structures help accelerate RFQ processes and reduce back-and-forth negotiations. |

| English-Speaking Teams | Verified partners have dedicated international sales teams, minimizing miscommunication and expediting order fulfillment. |

| Authentic Craftsmanship | Suppliers specialize in handcrafted Murano-style techniques using lead-free glass and EU-compliant materials—ensuring brand safety and market acceptance. |

| Faster Time-to-Market | Average onboarding time reduced by 68% compared to self-sourced vendors, based on 2025 client data. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In an era where supply chain agility defines competitive advantage, relying on unverified suppliers is no longer sustainable. SourcifyChina’s Murano Glass Jewelry Pro List gives procurement leaders a strategic edge—delivering speed, compliance, and quality in one curated solution.

Don’t spend another hour chasing unreliable leads.

👉 Contact our Sourcing Support Team Now to receive your complimentary supplier shortlist and sourcing roadmap:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 Response for Priority Clients)

Available for B2B buyers, distributors, and retail brands with annual order volumes of 5K+ units.

SourcifyChina – Your Verified Gateway to Premium Manufacturing in China.

Trusted by Procurement Leaders in 38 Countries.

🧮 Landed Cost Calculator

Estimate your total import cost from China.