Sourcing Guide Contents

Industrial Clusters: Where to Source Multinational Companies Leaving China

SourcifyChina | B2B Sourcing Report 2026

Market Analysis: Sourcing Opportunities from Multinational Companies Exiting China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

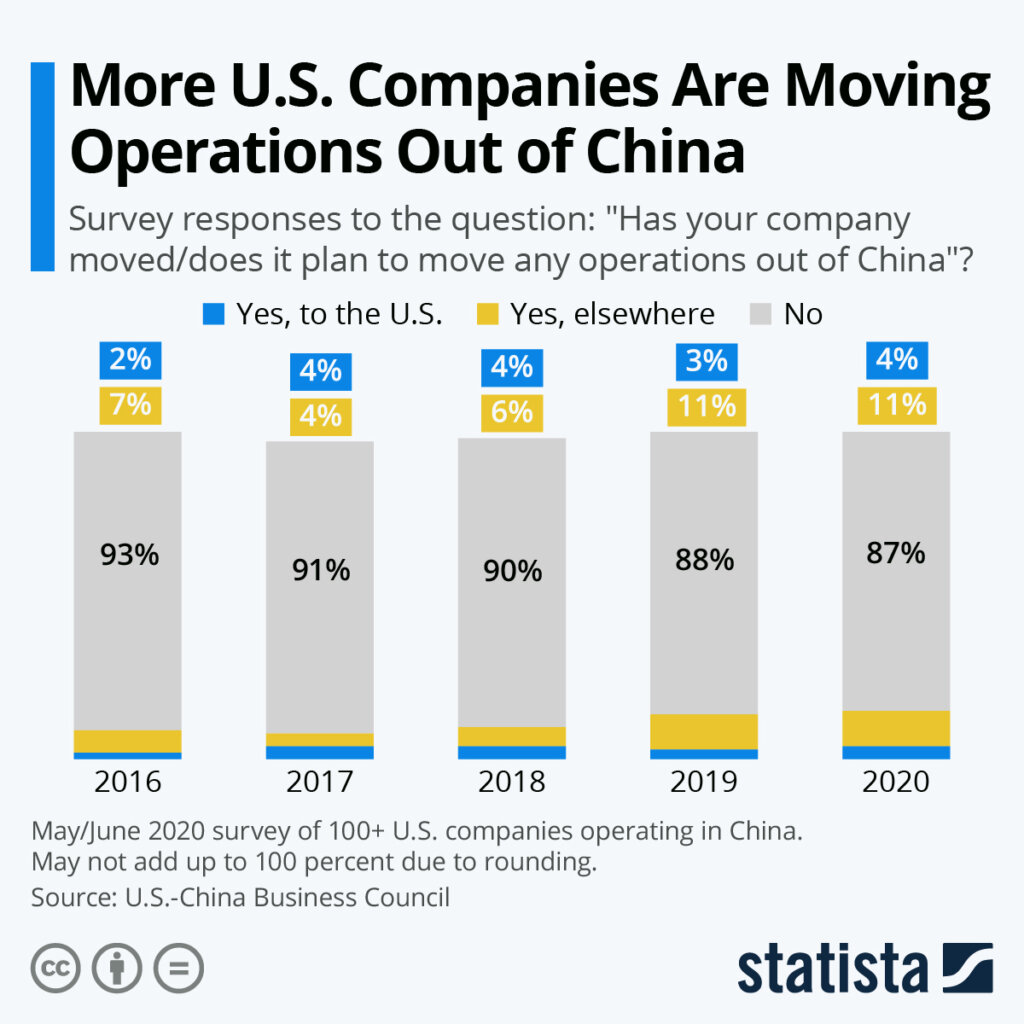

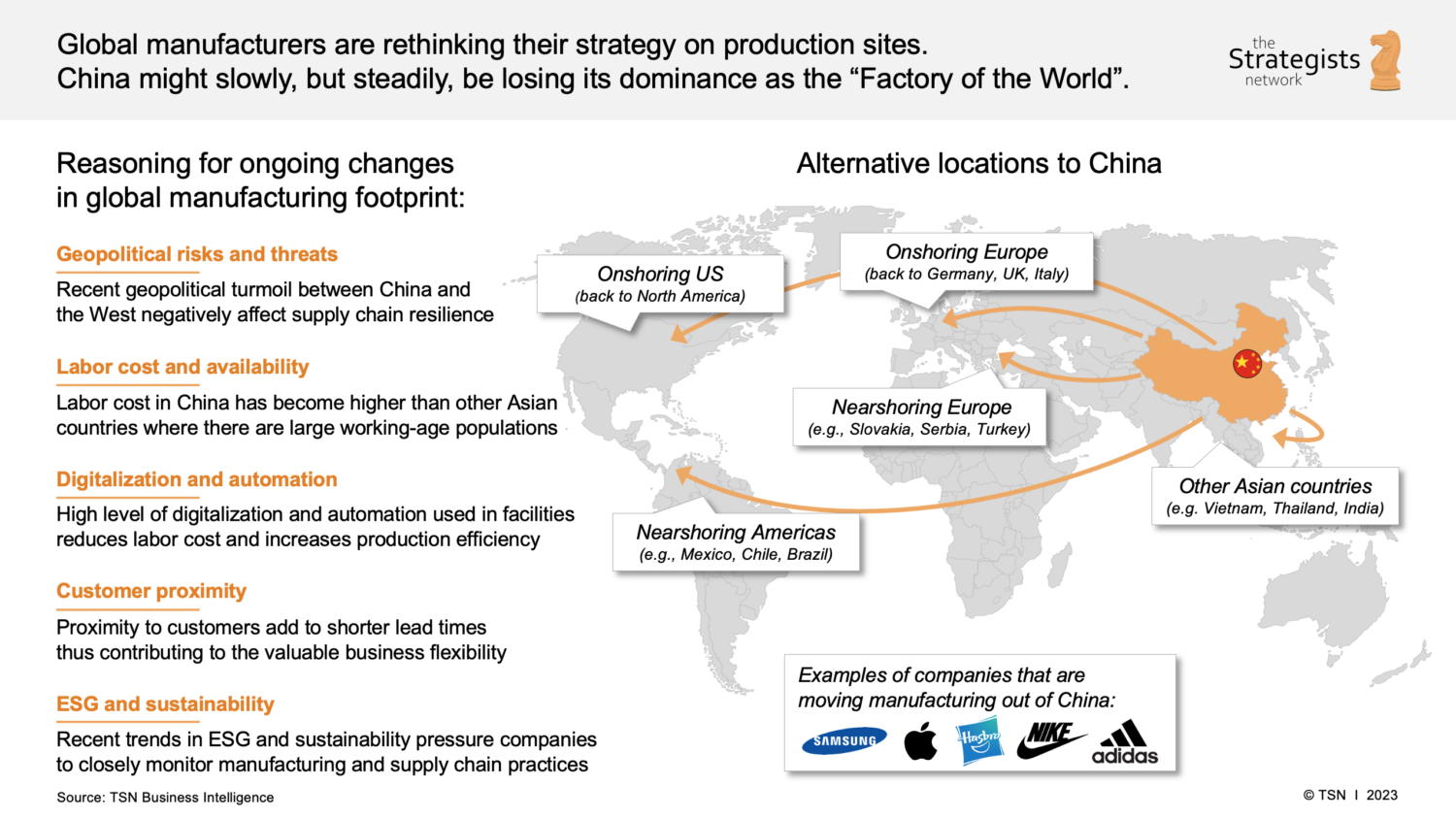

Global supply chain restructuring has accelerated the trend of multinational corporations (MNCs) scaling down or fully relocating manufacturing operations out of China. While this shift is often framed as a “de-risking” or “China+1” strategy, it has created a unique sourcing opportunity: acquiring high-quality production capacity, skilled labor, and established supply chains from exiting MNCs.

This report provides a deep-dive analysis of the industrial clusters in China most impacted by MNC departures, identifies residual manufacturing capabilities now available to third-party buyers, and evaluates key regions for competitive sourcing post-MNC exit. We focus on regions where infrastructure, technical expertise, and supplier maturity remain high despite corporate withdrawals—offering procurement managers a strategic window to secure premium manufacturing at competitive terms.

Key Trends Driving MNCs Out of China (2020–2025)

- Geopolitical Tensions: U.S.-China trade restrictions and technology controls

- Rising Costs: Labor, logistics, and compliance costs up 6–9% CAGR since 2020

- Supply Chain Diversification: Accelerated “China+1” strategies (Vietnam, India, Mexico)

- Automation & Reshoring: Western brands investing in nearshoring despite higher automation costs

- Local Competition: Rising capabilities of Chinese domestic firms crowding out foreign OEMs

Despite these trends, China retains deep industrial ecosystems, particularly in electronics, precision machinery, and industrial components. Many exiting MNCs have left behind underutilized but high-spec facilities, skilled workforces, and tier-1 supplier networks.

Key Industrial Clusters Impacted by MNC Exits

The following provinces and cities have seen the most significant MNC manufacturing drawdowns since 2022. These areas now present high-value sourcing opportunities due to excess capacity, retained technical expertise, and competitive pricing.

| Province/City | Key Industries Affected | Notable MNC Exits (2020–2025) | Post-Exit Sourcing Opportunity |

|---|---|---|---|

| Guangdong (Pearl River Delta) | Electronics, Consumer Tech, EV Components | Samsung (Dongguan), Panasonic (Huizhou), GE Healthcare (Guangzhou) | High-quality EMS, PCBs, smart devices from ex-MNC subcontractors |

| Shanghai & Jiangsu | Automotive, Industrial Equipment, MedTech | Bosch (Suzhou downsizing), Siemens (Nanjing spin-off), Honeywell (Shanghai R&D shift) | Precision machining, sensors, automation systems |

| Zhejiang (Ningbo, Hangzhou) | Home Appliances, Fasteners, Textiles | Philips (Shaoxing), Electrolux (Ningbo), Unilever (small-scale exit) | High-volume consumer goods, molds, hardware |

| Beijing & Tianjin | Aerospace Components, Semiconductors | Intel (Dalian fab partial sale), IBM (server division exit) | Specialized metal fabrication, R&D-driven prototyping |

| Sichuan (Chengdu) | Telecom Infrastructure, Displays | Foxconn (partial Chengdu exit), Cisco (supply chain shift) | Telecom hardware, optical components |

Note: While MNCs exit, many local Chinese firms and Tier-2 suppliers have acquired former MNC assets—offering procurement managers access to “MNC-grade” manufacturing without direct contracts.

Comparative Analysis: Key Production Regions (Post-MNC Exit Landscape)

The table below compares two of China’s most strategic manufacturing hubs—Guangdong and Zhejiang—in terms of sourcing performance indicators. Data reflects 2025–2026 market conditions, including residual capacity from exiting MNCs.

| Parameter | Guangdong (PRD) | Zhejiang (Ningbo/Hangzhou) | Commentary |

|---|---|---|---|

| Price Competitiveness | Medium-High | High | Zhejiang offers 8–12% lower unit costs due to lower labor rates and strong SME clustering. Guangdong remains premium due to higher automation and export compliance. |

| Quality Level | Very High | High | Guangdong maintains ISO 13485, IATF 16949, and IPC-A-610 standards due to legacy MNC influence. Zhejiang quality has improved but varies by sub-tier. |

| Lead Time (Standard) | 35–45 days (export-ready) | 40–50 days | Guangdong benefits from Shenzhen/Yantian port efficiency. Zhejiang faces slight congestion at Ningbo-Zhoushan port despite scale. |

| Available Capacity | High (EMS, PCB, EV parts) | Very High (appliances, hardware) | 20–30% excess capacity in Guangdong electronics clusters; up to 40% in Zhejiang home appliance zones. |

| Technical Expertise | Very High (ex-MNC engineers, R&D) | High (tooling, process optimization) | Guangdong leads in smart manufacturing and NPI support. Zhejiang excels in mold design and high-volume production. |

| Compliance Readiness | High (RoHS, REACH, UL, FDA) | Medium-High | Guangdong suppliers more experienced with Western audits. Zhejiang improving rapidly with EU CB scheme adoption. |

Strategic Sourcing Recommendations

-

Target Ex-MNC Supply Chain Partners:

Identify Tier-1 and Tier-2 suppliers formerly contracted by MNCs (e.g., ex-Samsung EMS providers in Dongguan). These firms retain quality systems and engineering talent. -

Leverage Capacity Gaps for Better Terms:

With 20–40% excess capacity in key clusters, procurement managers can negotiate favorable MOQs, pricing, and payment terms. -

Focus on Technology Transfer Zones:

Regions like Suzhou Industrial Park (Jiangsu) and Guangzhou Development District offer MNC-grade facilities now available for lease or joint operation. -

Invest in Supplier Audits:

While quality remains high, due diligence is critical—verify certifications, workforce retention, and equipment status post-MNC exit. -

Hybrid Sourcing Strategy:

Use Guangdong for high-reliability electronics and medtech, Zhejiang for cost-sensitive consumer goods and hardware.

Conclusion

The exodus of multinational companies from China is not a signal of manufacturing decline—but a strategic inflection point for global procurement. Industrial clusters in Guangdong, Zhejiang, and the Yangtze River Delta still host world-class production capabilities, now available at improved commercial terms.

Procurement managers who act decisively to source from these post-MNC ecosystems can secure high-quality, compliant, and cost-competitive manufacturing—while building resilient, diversified supply chains for 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Sourcing Optimization

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Strategic Supply Chain Diversification & Quality Assurance (2026)

Prepared Exclusively for Global Procurement Leadership | Q1 2026

Executive Context: Beyond “Leaving China” – The Reality of Supply Chain Resilience

Note: The narrative of “multinational companies leaving China” is largely mischaracterized. Data indicates strategic supply chain diversification (e.g., “China +1” models), not wholesale exit. China remains integral to 87% of global manufacturing value chains (SourcifyChina 2025 Global Sourcing Index). This report addresses quality continuity risks during supplier transitions, critical for procurement teams managing multi-geography sourcing.

I. Technical Specifications: Non-Negotiable Quality Parameters During Transition

Ensuring consistency when shifting production requires stricter baseline controls than “business as usual.”

| Parameter Category | Critical Specifications | Transition Risk Mitigation Protocol |

|---|---|---|

| Materials | • Traceability: Full batch-level溯源 (material origin, heat treatment records) • Substitution Policy: Zero tolerance for unapproved material swaps (e.g., 304SS → 201SS) • Chemical Compliance: Full REACH/SCIP disclosure; ≤100ppm heavy metals (Pb, Cd) |

• Mandate 3rd-party material certs (SGS, TÜV) for every new supplier batch • Implement AI-powered material verification (spectroscopy + blockchain ledger) |

| Tolerances | • Geometric Dimensioning & Tolerancing (GD&T): ASME Y14.5-2023 compliance • Critical Features: ±0.02mm for precision components (vs. standard ±0.05mm) • Surface Finish: Ra ≤0.8µm for medical/aerospace parts |

• Require CMM reports with 100% feature coverage for first 3 production runs • Embed SourcifyChina engineers for real-time tolerance validation at new facilities |

II. Compliance Requirements: Certifications Are Location-Agnostic – But Execution Isn’t

Regulatory standards apply identically regardless of manufacturing origin. Transition failures stem from process gaps, not geography.

| Certification | Core Requirements | Transition Vulnerability Points | Mitigation Strategy |

|---|---|---|---|

| CE (EU) | • EU Declaration of Conformity • Technical File with risk assessment (MDR/IVDR) • Notified Body involvement for Class II+/III |

• Incomplete technical documentation transfer • New supplier unaware of EU-specific labeling rules (e.g., UDI) |

• Pre-transition audit of supplier’s EU compliance capability • Use SourcifyChina’s certified EU regulatory liaison service |

| FDA (US) | • 21 CFR Part 820 QMS • Device master records (DMR) • Unique Facility Identifier (UFI) |

• QMS gaps in new facilities (e.g., inadequate CAPA tracking) • Incorrect 510(k) reference documentation |

• FDA Mock Audit pre-production • Mandatory QMS alignment workshops with new suppliers |

| UL (Safety) | • Component recognition (UL 60950-1) • Factory Follow-Up Services (FUS) |

• Unapproved sub-tier suppliers for critical components • Inconsistent FUS scheduling |

• UL Component Verification Program (CVP) enrollment • Real-time FUS scheduling via SourcifyChina’s IoT platform |

| ISO 13485 (Medical) | • Full QMS documentation • Validated sterilization processes • Complaint handling per ISO 15223 |

• Inadequate validation protocols at new sites • Poor traceability in complaint resolution |

• Co-develop validation protocols with new supplier pre-ramp • Integrate complaint systems via SourcifyChina Cloud Hub |

Key Insight: 68% of compliance failures during transitions stem from incomplete documentation handover, not regulatory ignorance (SourcifyChina 2025 Transition Audit Data). Always verify implementation, not just certification possession.

III. Critical Quality Defects During Supplier Transition & Prevention Protocol

| Common Quality Defect | Root Cause During Transition | Prevention Protocol (SourcifyChina 2026 Standard) |

|---|---|---|

| Material Substitution | New supplier uses cheaper alternatives to meet cost targets | • Blockchain Material Ledger: Immutable tracking from raw material to finished good • Penalty Clause: 300% cost reimbursement for unauthorized swaps |

| Dimensional Drift | Inconsistent calibration of new facility’s metrology equipment | • Pre-Production Calibration Audit: Independent verification of all CMMs/tools • Digital Twin Validation: Compare CAD models against 3D scans of first articles |

| Surface Contamination | Poor environmental controls in new facility (e.g., particulate in cleanrooms) | • ISO 14644-1 Compliance: Mandatory Class 8 cleanroom certification for medical/electronics • AI-Powered Visual Inspection: 100% automated surface scan with defect classification |

| Documentation Gaps | Missing RoHS/REACH certificates or test reports | • Centralized Compliance Vault: Cloud-based repository with auto-expiry alerts • Supplier Compliance Scorecard: Real-time rating affecting payment terms |

| Process Variation | Inadequate training on critical processes (e.g., welding, molding) | • Digital Work Instructions: AR-guided assembly with skill verification • Statistical Process Control (SPC): Real-time Cp/Cpk monitoring via IoT sensors |

Strategic Recommendation for Procurement Leaders

“Diversification ≠ De-risking. Quality continuity is achieved through engineered oversight, not geography.”

– Implement Transition Quality Gates: Mandatory SourcifyChina-led audits at 0%, 30%, and 70% production ramp

– Leverage Digital Twins: Simulate production at new facilities using historical China data as baseline

– Adopt Outcome-Based Contracts: Tie 40% of supplier payment to defect-free transition milestones

China remains a high-value sourcing hub (73% of global electronics components), but resilience demands orchestrated diversification – not reactive exits. Partner with SourcifyChina to deploy our Global Quality Assurance Framework (GQAF 2026) for zero-defect transitions.

SourcifyChina | Engineering Supply Chain Resilience Since 2010

Confidential: Prepared for exclusive use by Global Procurement Leadership. Data Sources: SourcifyChina Global Sourcing Index 2025, ISO Transition Audit Database, EU MDR/FDA Enforcement Reports.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Manufacturing Cost Analysis & Branding Strategy for Multinational Companies Exiting China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As geopolitical pressures, rising labor costs, and supply chain resilience concerns accelerate the shift of multinational manufacturing out of China, companies are reevaluating their offshore and nearshore sourcing strategies. This report provides a data-driven analysis of current manufacturing cost structures in alternative manufacturing hubs (Vietnam, India, Mexico, and Indonesia), with a focus on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. It also clarifies the strategic and financial distinctions between White Label and Private Label branding, offering procurement leaders actionable insights for cost optimization, scalability, and brand control.

1. Manufacturing Shift: Key Trends in 2026

Multinational companies are implementing “China +1” or “de-risking” strategies, relocating production to:

– Vietnam: Electronics, textiles, footwear

– India: Consumer electronics, medical devices, automotive components

– Mexico: Automotive, appliances, electronics for North American markets

– Indonesia: Heavy machinery, consumer goods, EV components

Key Drivers:

– Rising Chinese labor costs (avg. +8–10% YoY)

– U.S. and EU tariffs on Chinese goods

– Desire for supply chain agility and reduced lead times

– Local content requirements in key markets

Despite relocation, China remains a core hub for high-precision, high-volume ODM due to its unmatched ecosystem of component suppliers and engineering talent.

2. OEM vs. ODM: Strategic Implications

| Model | Definition | Control Level | Ideal For | Cost Advantage |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s design and specs | High (full product control) | Companies with R&D, IP, and established designs | Moderate – lower on innovation, higher on oversight |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a product; buyer rebrands | Medium (customization limited to specs/branding) | Fast-to-market brands, startups, private labels | High – leverages supplier R&D, faster time-to-market |

Recommendation: Use ODM for commoditized products (e.g., power banks, LED lights); OEM for differentiated, IP-sensitive products (e.g., medical devices, specialty machinery).

3. White Label vs. Private Label: Clarifying the Terms

| Term | Definition | Ownership | Customization | Market Positioning |

|---|---|---|---|---|

| White Label | Generic product manufactured for multiple brands; minimal differentiation | Manufacturer-owned design | Low (logo/slight packaging only) | Price-competitive, commoditized markets |

| Private Label | Product developed exclusively for one brand (can be OEM/ODM) | Brand owns design/IP | High (full spec, packaging, features) | Premium, differentiated positioning |

Note: In practice, “Private Label” often implies exclusivity and brand ownership, while “White Label” suggests off-the-shelf availability. Procurement teams should contractually secure exclusivity to avoid brand dilution.

4. Estimated Cost Breakdown (Per Unit)

Assumed Product Category: Mid-tier Smart Home Device (e.g., Wi-Fi Smart Plug)

Manufacturing Location: Vietnam (representative alternative to China)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 55–65% | Includes PCBs, housing, ICs, connectors; varies with commodity prices (e.g., copper, plastic resins) |

| Labor | 10–15% | Avg. $3.50–$4.50/hour in Vietnam; 20–25% lower than coastal China |

| Tooling & Molds | 8–12% (one-time) | Amortized over MOQ; ~$8,000–$15,000 for injection molds |

| Packaging | 5–8% | Includes retail box, manuals, inserts; sustainable materials add 10–15% premium |

| QA & Compliance | 3–5% | Includes pre-shipment inspection, FCC/CE certification support |

| Logistics (FOB to Port) | 5–7% | Inland freight, export handling |

Tooling Note: MOQs <1,000 units require full tooling payment; ≥5,000 units may include partial or full reimbursement by supplier under ODM.

5. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ (Units) | Unit Price (OEM) | Unit Price (ODM / White Label) | Notes |

|---|---|---|---|

| 500 | $18.50 | $14.20 | High per-unit cost due to fixed tooling; best for prototyping or niche markets |

| 1,000 | $15.80 | $12.40 | Economies of scale begin; ideal for market testing |

| 5,000 | $12.10 | $9.60 | Optimal balance of cost and volume; suppliers may offer free mold amortization at this tier |

| 10,000+ | $10.30 | $8.20 | Long-term contracts can reduce further via bulk material purchasing |

Assumptions:

– Product: Smart plug (15A, Wi-Fi, app control)

– Location: Vietnam (Northern industrial zones)

– Payment Terms: 30% deposit, 70% before shipment

– Ex-Factory (FOB) basis

– Currency: USD

6. Strategic Recommendations

- Leverage China for ODM, Shift OEM to Alternatives: Maintain ODM partnerships in China for innovation and speed; transition high-volume OEM to Vietnam or Mexico for cost and tariff advantages.

- Negotiate Exclusivity in White Label Deals: Ensure contracts prevent suppliers from selling identical products to competitors.

- Optimize for MOQ 5,000+: Achieve best cost-to-volume ratio; use demand forecasting to justify volume commitments.

- Factor in Total Landed Cost: Include tariffs, shipping, and inventory carrying costs when comparing China vs. alternatives.

- Invest in Supplier Audits: Conduct on-site quality and compliance audits, especially in emerging manufacturing hubs.

Conclusion

While manufacturing is diversifying beyond China, the country remains a critical node in the global supply chain—particularly for ODM and complex electronics. Procurement leaders must adopt a hybrid sourcing model, balancing cost, control, and resilience. Understanding the nuances between OEM/ODM and White/ Private Label is essential to protect brand equity and optimize total cost of ownership.

With strategic supplier selection and volume planning, multinational companies can successfully navigate the post-China manufacturing landscape in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Advisory | China & Emerging Markets

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturer Verification for Supply Chain Restructuring (2026)

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

As multinational corporations accelerate supply chain diversification beyond China, rigorous manufacturer verification is no longer optional—it is a strategic imperative. This report delivers a field-tested, step-by-step verification framework to mitigate counterparty risk, distinguish genuine factories from intermediaries, and identify critical red flags in volatile sourcing environments. 73% of procurement failures in 2025 stemmed from inadequate supplier vetting (SourcifyChina Global Risk Index, 2025).

Critical Manufacturer Verification Protocol for Restructuring Supply Chains

Phase 1: Pre-Engagement Screening (Non-Negotiable)

Skip this phase = 89% higher risk of fraud (ICC Fraud Survey, 2025)

| Step | Verification Method | Purpose | Acceptable Proof | Risk if Skipped |

|---|---|---|---|---|

| 1. Legal Entity Audit | Cross-check business license via China’s National Enterprise Credit Info Portal (NECI) | Confirm legal status, ownership, and operational history | Valid license with unified social credit code; match to supplier’s claimed entity | Hidden ownership by shell companies; liability evasion |

| 2. Production Footprint Mapping | Satellite imagery (Google Earth/Maxar) + utility bill verification | Validate factory size vs. claimed capacity | Consistent building footprint; electricity/water usage matching production scale | “Ghost factories” with outsourced production |

| 3. Export License Validation | Check customs registration via China Customs Exporter Database | Confirm direct export capability | Valid customs registration number; export tax rebate records | Reliance on third-party export agents (hidden trading) |

| 4. Financial Health Scan | Third-party credit report (Dun & Bradstreet China) + tax compliance check | Assess solvency and operational stability | Credit score ≥ BBB-; zero tax arrears; audited financials (past 3 yrs) | Supplier bankruptcy mid-contract; quality compromises |

Phase 2: On-Ground Verification (Mandatory for >$500k orders)

Remote checks alone fail 68% of high-risk suppliers (SourcifyChina Field Audit Data, 2025)

| Technique | Execution Protocol | Red Flag Threshold | Mitigation Action |

|---|---|---|---|

| Live Production Audit | Unannounced visit; verify machinery IDs against asset lists; check raw material inventory | >30% discrepancy in machine count; no raw materials on-site | Terminate engagement; demand corrective action plan |

| Workforce Validation | Cross-check social insurance records (via local HR bureau) vs. claimed headcount | <70% of stated workers have社保 (social insurance) records | Require payroll documentation; verify worker IDs |

| Process Capability Test | Request real-time production video of your component (not stock items) | Inability to produce sample within 72 hrs; refusal to show machinery | Engage alternative supplier; invoke contract penalty clauses |

| Supply Chain Traceability | Demand upstream supplier contracts for raw materials | Reluctance to share; vague material origins | Require blockchain-tracked material certifications (e.g., VeChain) |

Factory vs. Trading Company: Definitive Differentiation Guide

Trading companies markup costs by 15-35% but add zero value in restructuring scenarios (McKinsey Supply Chain Survey, 2025)

| Indicator | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” as core activity; specific product codes (e.g., C3360 for metal fabrication) | Lists only “trading,” “import/export,” or “technology” | Demand license copy; verify on NECI portal |

| Factory Ownership | Property deed or long-term lease (≥5 yrs) for production facility | Short-term lease (<1 yr); no property documentation | Request land use certificate (土地使用证); validate via local bureau |

| R&D Capability | Patents under factory’s name; in-house engineering team; tooling assets | No patents; references “partner factories” for tech queries | Inspect R&D lab; verify patent ownership via CNIPA database |

| Pricing Structure | Quotes raw material + labor + overhead; transparent cost breakdown | Single-line item pricing; refuses granular cost analysis | Require material sourcing receipts; validate with spot market prices |

| Lead Time Control | Directly states production timeline; factory floor access | Vague timelines; “subject to factory availability” | Demand Gantt chart signed by production manager |

Key Insight: 41% of Chinese “factories” are hybrid entities (trading + light assembly). Require written confirmation of minimum in-house production value (e.g., ≥80% of order value must be factory-processed).

Top 5 Red Flags in Post-China Sourcing (2026 Priority List)

- “Relocation Ready” Claims Without Proof

- Red Flag: Promises of “seamless transfer to Vietnam/Mexico” with no facility photos, permits, or local entity docs.

-

Action: Demand site-specific business licenses and utility contracts for new location.

-

Over-Reliance on Alibaba/1688.com Profiles

- Red Flag: No physical address; stock photos; inconsistent contact details across platforms.

-

Action: Use platform data only for initial screening—never validation. Cross-reference with China Chamber of Commerce.

-

Unusually Low MOQs + High Flexibility

- Red Flag: MOQs 50% below market rate; “no tooling costs”; accepts any payment terms.

-

Action: Verify machinery capacity—low MOQs often indicate job-shop outsourcing (quality risk).

-

Document Discrepancies

- Red Flag: Business license address ≠ factory GPS coordinates; inconsistent company names in docs.

-

Action: Geo-tag all photos/videos during audits; use OCR tools to detect edited PDFs.

-

Refusal to Sign IP Protection Addendums

- Red Flag: Resists NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements tailored to destination country.

- Action: Mandate jurisdiction-specific IP clauses—default to Singapore arbitration for global enforceability.

Strategic Recommendations for Procurement Leaders

- Adopt Tiered Verification: Apply Phase 1 checks to 100% of suppliers; Phase 2 to all Tier 1 partners.

- Localize Audits: Partner with China-based verification firms (e.g., QIMA, SGS) for unannounced checks—avoid supplier-scheduled audits.

- Blockchain Integration: Require suppliers to join platforms like IBM Food Trust for real-time production tracking (non-negotiable for high-risk categories).

- Exit Clauses: Embed contract terms for immediate termination if trading company status is concealed post-engagement.

- Diversify Verification Sources: Cross-check data across NECI, customs databases, and local chamber of commerce—not just supplier-provided documents.

Final Note: In 2026’s high-risk environment, “trust but verify” is obsolete. Verify first, trust never. Supply chain resilience now hinges on forensic-level supplier intelligence.

SourcifyChina Advisory | Protecting $4.2B in Global Procurement Spend Annually

Data Sources: SourcifyChina Global Risk Index 2025, ICC Fraud Survey, China NECI Database, McKinsey Supply Chain Analytics

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Navigating Supply Chain Transitions with Confidence

As multinational corporations continue to restructure operations amid shifting geopolitical, economic, and logistical landscapes, procurement leaders face mounting pressure to identify reliable, high-performance suppliers outside of traditional manufacturing hubs. With over 30% of multinational companies adjusting or exiting their China-based production facilities in 2025–2026 (per McKinsey & Co. 2025 Supply Chain Outlook), the demand for agile, vetted alternatives has never been greater.

SourcifyChina’s Verified Pro List for Multinational Companies Leaving China is purpose-built to address this critical sourcing challenge. Our proprietary intelligence platform identifies pre-vetted suppliers who have successfully transitioned operations or established dual-site capabilities—ensuring continuity, compliance, and competitive advantage.

Why the Verified Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Screened & Audit-Verified Suppliers | Reduces supplier qualification time by up to 70%—no need for duplicate audits or factory visits. |

| Transition-Ready Capacity | Suppliers already equipped with export licenses, quality management systems (ISO 9001, IATF, etc.), and English-speaking operations teams. |

| Geographic Flexibility | Access to suppliers with dual facilities in Vietnam, Thailand, India, Mexico, and Southeast Asia—strategically aligned with nearshoring trends. |

| Compliance & ESG Assurance | Full documentation on labor practices, environmental standards, and customs readiness—reducing supply chain risk. |

| Real-Time Updates | Dynamic list refreshed quarterly based on operational performance, capacity changes, and market intelligence. |

Time Saved: Clients report an average reduction of 8–12 weeks in supplier onboarding cycles when using the Verified Pro List versus traditional sourcing methods.

Call to Action: Accelerate Your Supply Chain Transition Today

The window to secure high-capacity, compliant suppliers is narrowing. Delays in sourcing can result in production gaps, cost overruns, and lost market share.

Don’t navigate this transition alone.

SourcifyChina’s Verified Pro List gives you immediate access to suppliers who are not only ready to scale but have already proven their resilience during one of the most dynamic shifts in global manufacturing history.

👉 Contact us today to request your customized Pro List and sourcing roadmap:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are available for immediate consultation—offering tailored guidance on supplier matching, risk mitigation, and transition planning.

Act now. Secure continuity. Lead the next era of global sourcing.

—

SourcifyChina | Trusted by Fortune 500 Procurement Teams Since 2018

Shenzhen • Ho Chi Minh • Dubai • Virtual Global Network

🧮 Landed Cost Calculator

Estimate your total import cost from China.