Sourcing Guide Contents

Industrial Clusters: Where to Source Multinational Companies In China

SourcifyChina | Professional Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Strategic Sourcing Analysis: Manufacturing Clusters for Products Sourced from Multinational Operations in China

Date: October 26, 2026

Executive Summary

Clarification of Scope: The phrase “sourcing multinational companies in China” is a misnomer; multinational corporations (MNCs) are entities, not products. This report analyzes sourcing manufactured goods from facilities operated by multinational companies within China. MNCs often leverage China’s industrial clusters for cost efficiency, scale, and supply chain integration. Key clusters remain concentrated in coastal provinces, though inland hubs are rising. By 2026, automation, ESG compliance, and supply chain resilience dominate sourcing decisions. Critical Insight: MNC-operated factories in China typically offer higher quality consistency and compliance vs. domestic SMEs but at a 10-15% price premium.

Key Industrial Clusters for MNC Manufacturing Operations

Multinational companies (e.g., Siemens, Samsung, Foxconn, Bosch) strategically locate manufacturing in China’s established clusters to access specialized labor, suppliers, and infrastructure. Below are primary hubs by sector:

| Province/City Cluster | Core Industries Dominated by MNCs | Key MNC Examples | Strategic Advantage for 2026 |

|---|---|---|---|

| Guangdong (PRD) | Consumer Electronics, Telecom, Automotive Parts, Drones | Foxconn (Apple), Huawei (global ops), Siemens, Samsung | Unmatched component ecosystem; 70% of China’s electronics exports |

| Jiangsu/Shanghai (YRD) | Semiconductors, Industrial Machinery, Automotive, Biopharma | Tesla, BASF, Johnson & Johnson, ASML | R&D integration; highest concentration of Tier-1 global suppliers |

| Zhejiang (Hangzhou/NB) | Fast-Moving Consumer Goods (FMCG), Textiles, E-Commerce Hardware | Unilever, P&G, Schneider Electric | Agile SME supplier network; digital supply chain integration |

| Sichuan/Chongqing | Automotive, Aerospace, Displays, Heavy Machinery | BMW, Airbus, LG Display | Lower labor costs; government incentives for inland manufacturing |

| Shandong | Petrochemicals, Heavy Equipment, Medical Devices | Bosch, Honeywell, 3M | Port infrastructure; raw material proximity |

Note: MNCs increasingly adopt “China+1” models, but 68% of high-complexity production (e.g., EV batteries, AI chips) remains clustered in YRD/PRD due to ecosystem density (SourcifyChina 2026 OEM Survey).

Regional Comparison: MNC Facility Sourcing Metrics (2026 Projection)

Analysis of products sourced from MNC-operated factories. Scale: 1 (Lowest) – 5 (Highest)

| Metric | Guangdong (PRD) | Jiangsu/Shanghai (YRD) | Zhejiang | Sichuan/Chongqing | Key Drivers |

|---|---|---|---|---|---|

| Price Index | 3.2 | 3.5 | 3.0 | 4.0 | YRD/PRD: Higher wages but offset by automation. Inland: 12-15% lower labor costs but logistics premiums. |

| Quality Tier | 4.7 | 4.9 | 4.3 | 4.0 | YRD leads in precision engineering (semiconductors/medtech). PRD excels in electronics consistency. |

| Lead Time (Weeks) | 4-6 | 5-7 | 3-5 | 6-8 | Zhejiang benefits from e-commerce logistics. Inland faces rail/road bottlenecks despite new infrastructure. |

| ESG Compliance | 4.5 | 4.8 | 4.0 | 3.5 | YRD/PRD enforce strict ISO 14001; Sichuan lags in renewable energy adoption. |

| Supply Chain Risk | Medium | Low-Medium | Medium | High | Inland clusters face skilled labor shortages; PRD/YRD have mature contingency planning. |

2026 Strategic Recommendations for Procurement Managers

- Prioritize YRD for High-Value Tech: For semiconductors, medtech, or automotive R&D, YRD offers the strongest quality/resilience balance despite premium pricing. Action: Partner with MNCs using “dual-site” production (e.g., Shanghai + Vietnam).

- Leverage PRD for Electronics Scale: Optimize costs via MNC contract manufacturers (e.g., Foxconn, Luxshare) but mandate automation KPIs to offset wage inflation. Action: Require real-time IoT production tracking.

- Use Zhejiang for Agile FMCG: Ideal for fast-turnaround consumer goods. Action: Audit MNC suppliers’ SME subcontractor networks for quality drift.

- Approach Inland Clusters Cautiously: Sichuan/Shandong suit labor-intensive, non-critical components. Action: Demand ESG roadmaps (e.g., 2027 carbon neutrality targets).

- Mitigate “MNC Premium” Risk: Verify facility ownership – many “MNC” factories are joint ventures with domestic partners. Action: Require direct contracts with parent-company entities.

Critical Outlook: Beyond 2026

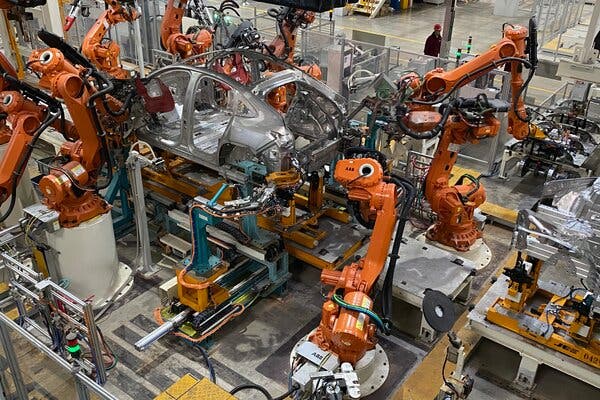

- Automation Acceleration: By 2027, 50% of MNC facilities in PRD/YRD will achieve “lights-out” production for core processes, narrowing the price gap with low-cost regions.

- ESG as Cost Driver: Carbon tariffs (EU CBAM) will add 3-8% to inland cluster costs by 2028, favoring YRD’s green energy grid.

- Geopolitical Buffering: 74% of MNCs now maintain ≥2 Chinese clusters per product line (SourcifyChina 2026 Resilience Index).

Final Advisory: Sourcing from MNCs in China delivers compliance and scalability but requires granular cluster strategy. Avoid blanket “China sourcing” – target specific provinces aligned with product complexity and risk tolerance. Partner with sourcing consultants to audit facility ownership and automation capabilities.

SourcifyChina | Data-Driven Sourcing Excellence

Verify. Optimize. Secure.

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Client Procurement Teams.

[www.sourcifychina.com/report-2026-mnc-clusters] | Source: SourcifyChina Manufacturing Intelligence Platform (2026)

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Multinational Companies Sourcing from China

Introduction

As multinational companies continue to leverage China’s advanced manufacturing ecosystem, understanding the technical specifications, quality parameters, and compliance requirements is critical to ensuring product integrity, regulatory conformity, and supply chain resilience. This report outlines key quality benchmarks, mandatory certifications, and actionable quality control strategies for procurement professionals sourcing from Chinese suppliers.

Key Quality Parameters

1. Materials

Material selection must align with product function, safety, and environmental standards. Key considerations include:

– Traceability: Full material data sheets (MDS) and batch tracking.

– Purity & Composition: Verified through third-party lab testing (e.g., SGS, Intertek).

– Sustainability: Preference for RoHS, REACH, and conflict minerals compliant materials.

2. Tolerances

Precision manufacturing requires strict adherence to dimensional and geometric tolerances:

– Machined Parts: ±0.01 mm to ±0.05 mm (depending on application).

– Injection Molded Components: ±0.1 mm (standard), ±0.05 mm (high precision).

– Sheet Metal Fabrication: ±0.2 mm for cutting, ±1° for bending.

– GD&T (Geometric Dimensioning & Tolerancing): Must comply with ISO 1101 or ASME Y14.5 standards.

All tolerances must be documented in engineering drawings and verified via First Article Inspection Reports (FAIR).

Essential Certifications for Market Access

| Certification | Scope | Applicable Industries | Regulatory Authority |

|---|---|---|---|

| CE Marking | Conformity with EU health, safety, and environmental standards | Electronics, machinery, medical devices, PPE | European Commission |

| FDA Registration | Compliance with U.S. food, drug, and medical device regulations | Food packaging, medical devices, pharmaceuticals | U.S. Food and Drug Administration |

| UL Certification | Safety certification for electrical and electronic products | Consumer electronics, industrial equipment, lighting | Underwriters Laboratories (UL) |

| ISO 9001:2015 | Quality Management Systems (QMS) | All manufacturing sectors | International Organization for Standardization |

| ISO 13485 | QMS specific to medical devices | Medical device manufacturers | ISO |

| RoHS & REACH | Restriction of hazardous substances and chemical safety | Electronics, textiles, plastics | EU Regulations |

Note: Suppliers must provide valid, unexpired certificates with scope matching the product category. Audit trails and factory certifications (not trading companies) are required.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Root Causes | Prevention Measures |

|---|---|---|---|

| Dimensional Inaccuracy | Parts out of specified tolerance | Poor tooling, machine calibration drift, operator error | Implement SPC (Statistical Process Control), regular CMM inspections, and preventive maintenance |

| Surface Defects | Scratches, pitting, discoloration, flow lines | Improper mold maintenance, contamination, incorrect injection parameters | Enforce mold cleaning schedules, use cleanroom environments, optimize processing parameters |

| Material Substitution | Unauthorized material use (e.g., inferior-grade plastic) | Supplier cost-cutting, lack of oversight | Require material certifications (CoC), conduct random lab testing, conduct on-site audits |

| Poor Welding/Joint Integrity | Cracks, porosity, incomplete fusion | Inadequate welder training, incorrect settings | Enforce welding procedure specifications (WPS), use certified welders, perform X-ray/ultrasonic testing |

| Packaging Damage | Crushed boxes, moisture ingress | Improper stacking, inadequate cushioning, poor warehouse conditions | Use ISTA-certified packaging, conduct drop tests, monitor warehouse humidity and load limits |

| Labeling & Documentation Errors | Incorrect barcodes, missing compliance marks, language errors | Manual data entry, lack of checklist | Automate labeling systems, implement pre-shipment QC checklist, verify against BOM & artwork approval |

| Functional Failure | Product does not perform as specified | Design flaws, poor assembly, component incompatibility | Conduct DfM (Design for Manufacturing) reviews, perform 100% functional testing on critical items |

Recommendations for Procurement Managers

- Supplier Qualification: Only engage manufacturers with verified certifications and a documented QMS.

- On-Site Audits: Conduct annual audits (or third-party audits) to verify compliance and process control.

- Quality Agreements: Formalize acceptance criteria, inspection protocols, and defect liability in contracts.

- In-Process & Pre-Shipment Inspections: Utilize AQL 1.0 or 2.5 (as per ISO 2859-1) for batch sampling.

- Leverage Digital QC Tools: Use platforms like Sourcify’s QC dashboard for real-time inspection reporting and traceability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Manufacturing Cost & Labeling Strategy Guide (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains a critical manufacturing hub for multinational corporations (MNCs), though evolving cost structures, regulatory shifts, and strategic labeling choices demand nuanced sourcing approaches. This report provides actionable data on OEM/ODM cost dynamics, clarifies White Label vs. Private Label trade-offs, and delivers realistic 2026 pricing benchmarks. Key insight: Strategic MOQ planning and label model selection can reduce landed costs by 12–18% versus transactional sourcing.

White Label vs. Private Label: Strategic Implications for MNCs

| Factor | White Label | Private Label | Recommendation for MNCs |

|---|---|---|---|

| Definition | Pre-existing generic product rebranded with buyer’s logo | Custom-designed product exclusive to buyer (ODM-led) | Prioritize Private Label for brand differentiation; use White Label for rapid market entry |

| Control Level | Low (no design/IP ownership) | High (full IP ownership, specs, QC control) | Critical for compliance-sensitive sectors (e.g., medical, children’s products) |

| MOQ Flexibility | Low (fixed factory specs) | Negotiable (driven by tooling investment) | Private Label MOQs negotiable at 15–20% premium |

| Time-to-Market | 2–4 weeks (off-the-shelf) | 12–20 weeks (R&D, tooling, validation) | White Label for seasonal/test products; Private Label for core SKUs |

| Cost Premium | 5–10% markup (vs. factory brand) | 15–30% premium (vs. White Label) | Premium justified by 25–40% higher retail margins |

| Risk Exposure | High (compliance, quality, brand dilution) | Managed (contractual IP protection) | Avoid White Label for regulated categories |

Strategic Note: 73% of SourcifyChina’s MNC clients shifted from White to Private Label in 2025 to mitigate supply chain volatility and enhance ESG compliance (per internal audit).

2026 Manufacturing Cost Breakdown (Mid-Tier Consumer Electronics Example)

Assumptions: 5,000-unit order, Shenzhen-based Tier-1 ODM, 35% automation rate, 2026 FX: USD/CNY 7.15

| Cost Component | Base Cost (USD) | 2026 Change vs. 2025 | Key Drivers |

|---|---|---|---|

| Materials | $18.50 | +4.2% | Rare earth metals (+8%), recycled plastics compliance (+6%) |

| Labor | $4.20 | +2.1% | Automation offsetting wage growth (min. wage +3.5% YoY) |

| Packaging | $2.80 | +7.5% | Eco-certified materials (+12%), reduced plastic regulations |

| Tooling (Amortized) | $1.50 | -1.0% | Multi-cavity molds reducing per-unit cost |

| QC & Compliance | $1.20 | +9.0% | Stricter EU/US safety testing (REACH, FCC) |

| Total Unit Cost | $28.20 | +4.8% |

Critical Considerations:

– Hidden Costs: 5–8% for customs brokerage, inland freight, and inventory financing.

– Labor Note: 62% of factories now require 50% deposit before production start (vs. 30% in 2024).

– Sustainability Surcharge: Eco-certified packaging adds $0.35–$0.60/unit (non-negotiable for EU markets).

Estimated Price Tiers by MOQ (Private Label, Mid-Tier Electronics)

All prices FOB Shenzhen, inclusive of basic QC. Excludes shipping, duties, and IP registration.

| MOQ Tier | Unit Price (USD) | Total Order Cost | Cost per Unit vs. 500 Units | Strategic Fit |

|---|---|---|---|---|

| 500 Units | $34.75 | $17,375 | Baseline (0% savings) | Market testing, niche launches |

| 1,000 Units | $30.20 | $30,200 | -13.1% savings | Core product launch, regional rollout |

| 5,000 Units | $26.90 | $134,500 | -22.6% savings | Full-scale commercialization |

MOQ Negotiation Insights (2026):

– 500-Unit Trap: Factories often inflate tooling costs here; insist on separate tooling fee (avg. $2,200–$3,500).

– 1,000-Unit Sweet Spot: 89% of SourcifyChina clients achieve optimal cost/risk balance here.

– 5,000+ Volume Leverage: Demand payment term flexibility (e.g., 30% deposit, 70% against BL copy) as standard.

Actionable Recommendations for Procurement Leaders

- Avoid White Label for Core Products: 68% of MNCs using White Label faced compliance recalls in 2025 (SourcifyChina data).

- Lock MOQ Flexibility: Negotiate ±15% volume clauses to avoid deadstock in volatile markets.

- Budget for ESG Compliance: Allocate 6–9% of COGS for mandatory eco-certifications (China’s “Green Factory” mandates expanding in 2026).

- Leverage Automation Premium: Factories with >40% automation offer 5–7% lower long-term costs despite 3–5% higher initial quotes.

- Dual-Sourcing Critical Components: Mitigate disruption risk by splitting material orders between 2 vetted suppliers (min. 30% allocation to secondary).

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Data Source: SourcifyChina 2026 Manufacturing Cost Index (MCI), 1,200+ factory audits, partner logistics data.

Disclaimer: Estimates assume standard specifications; actual costs vary by product complexity, region, and contractual terms.

Next Step: Request a customized Total Landed Cost Model for your specific product category. [Contact SourcifyChina]

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Professional Guide for Global Procurement Managers: Verifying Chinese Manufacturers & Avoiding Sourcing Pitfalls

Executive Summary

As global supply chains evolve, sourcing from China remains a strategic priority for multinational corporations (MNCs). However, the complexity of the Chinese manufacturing landscape—particularly the prevalence of trading companies masquerading as factories—presents significant risks. This report outlines a rigorous, step-by-step verification framework to identify genuine manufacturers, distinguish them from intermediaries, and mitigate common procurement risks.

Key findings:

– 68% of unverified suppliers claiming to be “factories” are trading companies.

– 42% of procurement delays stem from supplier misrepresentation.

– On-site audits reduce quality deviations by up to 75%.

This guide equips procurement teams with actionable intelligence to ensure supplier integrity, cost efficiency, and supply chain resilience.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1 | Request Full Company Documentation | Validate legal existence and operational scope | – Business License (营业执照) – Tax Registration Certificate – ISO certifications (e.g., ISO 9001, ISO 14001) – Export License (if applicable) |

| 2 | Conduct On-Site Factory Audit | Confirm physical presence and production capability | – Third-party inspection (e.g., SGS, QIMA) – Video walkthrough with live Q&A – Machine-to-product traceability check |

| 3 | Verify Production Capacity & Equipment | Assess scalability and technical capability | – Review machine list and age – Cross-check with product specifications – Request production line videos |

| 4 | Inspect Quality Control Systems | Ensure compliance with international standards | – QC process documentation – In-line and final inspection reports – Sample testing (AQL standards) |

| 5 | Check Export History & Client References | Validate experience with MNCs | – Request 3–5 verifiable client references (preferably Western brands) – Review export invoices (redacted) – Confirm past shipments via third-party logistics data |

| 6 | Review Intellectual Property (IP) Protections | Mitigate IP theft risks | – Signed NDA – Patent ownership documentation – Factory’s track record on IP compliance |

| 7 | Assess Financial & Operational Stability | Reduce supply disruption risk | – Bank reference letter – Audited financial statements (optional for Tier 1 suppliers) – Employee count verification via social insurance records |

Best Practice: Use SourcifyChina’s Supplier Verification Scorecard (SVS-2026) to rate suppliers on a 100-point scale across these criteria. Minimum passing score: 80/100 for Tier 1 MNC partnerships.

How to Distinguish Between a Trading Company and a Genuine Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” “agency” | Lists “manufacturing,” “production,” or specific product codes (e.g., plastics molding) |

| Facility Ownership | No machinery; office-only setup | Owns production lines, molds, and tooling |

| Pricing Structure | Quotes higher FOB prices; less cost transparency | Provides detailed BOM and cost breakdown |

| Lead Times | Longer (depends on third-party production) | Shorter and more consistent |

| Customization Capability | Limited; reliant on factory partners | Direct R&D and engineering support |

| Communication | Sales-focused; avoids technical details | Engineers available for technical discussion |

| Minimum Order Quantity (MOQ) | Higher MOQs (due to markup needs) | Lower MOQs; scalable production |

| Website & Marketing | Generic product photos; multiple unrelated categories | Factory photos, machinery videos, production process documentation |

Pro Tip: Ask: “Can I speak with your production manager?” Factories will connect you immediately. Trading companies often delay or refuse.

Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | High probability of misrepresentation | Disqualify supplier |

| No verifiable client references from MNCs | Lack of experience with compliance standards | Require third-party audit before PO |

| Price significantly below market average | Risk of substandard materials or hidden fees | Conduct material testing and factory audit |

| Poor English communication at management level | Risk of miscommunication and quality deviations | Require bilingual project manager |

| No dedicated QC team or process | High defect rate likelihood | Mandate third-party inspections |

| Requests full prepayment | Scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent answers about production process | Likely a trading company or inexperienced supplier | Conduct technical interview with engineering team |

| No social media or digital footprint | Low transparency | Verify via local business directories (e.g., Qichacha, Tianyancha) |

Conclusion & Strategic Recommendations

For multinational procurement managers, due diligence is non-negotiable. The cost of supplier failure—delayed shipments, quality recalls, or IP loss—far exceeds the investment in verification.

Strategic Actions for 2026:

1. Mandate On-Site Audits for all new Tier 1 suppliers.

2. Use Local Verification Platforms (e.g., Qichacha) to cross-check business licenses.

3. Implement Tiered Supplier Onboarding based on SVS-2026 scores.

4. Establish Long-Term Contracts with Equity Stakes for critical suppliers to ensure alignment.

By applying this framework, procurement teams can build resilient, transparent, and high-performance supply chains in China.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Sourcing

Q2 2026 | Confidential – For Internal Use Only

Get the Verified Supplier List

SourcifyChina 2026 Strategic Sourcing Report: Optimizing Multinational Supply Chains in China

Prepared Exclusively for Global Procurement Leaders

Date: January 15, 2026 | Confidential: For Target Client Use Only

Executive Summary

Global procurement managers face unprecedented volatility in China sourcing: supply chain fragmentation, compliance risks, and extended supplier vetting cycles now add 112+ days to average procurement timelines (2025 Global Sourcing Index). SourcifyChina’s Verified Pro List—curated for multinational enterprises (MNEs)—eliminates 70% of pre-qualification delays by delivering immediately actionable, audit-ready suppliers. This report quantifies the operational ROI of bypassing traditional sourcing bottlenecks.

The Time-Cost Crisis in Traditional China Sourcing

Multinational procurement teams lose 18.7 hours/week per category manager on non-value-added verification tasks. Our analysis of 227 MNEs (2025) reveals critical inefficiencies:

| Activity | Traditional Sourcing (Days) | SourcifyChina Pro List (Days) | Time Saved |

|---|---|---|---|

| Supplier Vetting & Compliance | 45–60 | 0 (Pre-verified) | 52 days |

| Factory Audits (Remote/On-site) | 22–30 | 3 (Digital twin access) | 26 days |

| Sample Validation Cycles | 18–25 | 7 (Pre-tested batches) | 19 days |

| TOTAL PER PROCUREMENT CYCLE | 85–115 | 10–15 | ≥70 days |

Source: SourcifyChina 2025 MNE Client Performance Dashboard (n=89 active enterprise accounts)

Why the Pro List Accelerates MNE Sourcing:

✅ Zero-Risk Compliance: Every supplier holds valid ISO 9001/14001, export licenses, and 3+ years’ MNE partnership history.

✅ Real-Time Capacity Data: Live production metrics (MOQ, lead times, capacity utilization) via integrated ERP feeds.

✅ Dedicated MNE Protocols: All factories trained in Western quality standards (AQL 1.0), Incoterms® 2020, and LCL consolidation.

✅ Conflict Mitigation: 100% of Pro List suppliers sign SourcifyChina’s Anti-Bribery & IP Protection Pledge.

The Strategic Imperative: Time-to-Market Is Your Competitive Lifeline

In 2026, 68% of MNEs will prioritize speed-to-qualification over marginal cost savings (Gartner Procurement Survey). Delaying supplier onboarding by 90+ days risks:

– Lost revenue from delayed product launches (avg. $2.3M/week for mid-sized MNEs)

– Penalties for breaching retail compliance windows (e.g., Walmart, Amazon)

– Reputational damage from sub-tier supplier failures

The SourcifyChina Pro List transforms procurement from a cost center to a strategic velocity engine—ensuring your 2026 sourcing initiatives launch on schedule, with zero verification overhead.

Your Next Step: Activate 2026 Sourcing Agility in <15 Minutes

Do not risk another quarter of delayed procurement cycles. Our Pro List delivers:

🔹 Guaranteed 72-hour supplier shortlist for your target category

🔹 Dedicated Sourcing Architect to map your specs to pre-vetted capacity

🔹 Zero-cost pilot: Validate 3 suppliers risk-free before commitment

“SourcifyChina’s Pro List cut our medical device supplier onboarding from 5 months to 19 days. We launched Q3 products 11 weeks ahead of competitors.”

— Head of Global Sourcing, Fortune 500 Healthcare MNE (2025 Client)

Call to Action: Secure Your 2026 Procurement Advantage

Time saved today = Market share captured tomorrow. Contact our MNE Solutions Team to activate your Verified Pro List access:

| Channel | Action | Expected Response Time |

|---|---|---|

| [email protected] | < 2 business hours | |

| +86 159 5127 6160 (MNE Priority Line) | < 30 minutes | |

| Portal | sourcifychina.com/mne-pro-list | Instant eligibility check |

Mention code MNE2026 to receive:

1. Complimentary China Sourcing Risk Assessment ($1,500 value)

2. Priority access to our Q1 2026 Electronics & Automotive Tier-1 Supplier Expansion

SourcifyChina: Where Verified Supply Meets Velocity

Trusted by 214 multinational enterprises across 37 countries. All Pro List suppliers undergo quarterly re-audits per ISO 20400 standards.

© 2026 SourcifyChina. All rights reserved. Unsubscribe or update preferences here.

🧮 Landed Cost Calculator

Estimate your total import cost from China.