Sourcing Guide Contents

Industrial Clusters: Where to Source Motorcycle Parts China Wholesale

SourcifyChina | Professional Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Motorcycle Parts (China Wholesale) from China

Prepared for Global Procurement Managers

Date: April 5, 2026

Executive Summary

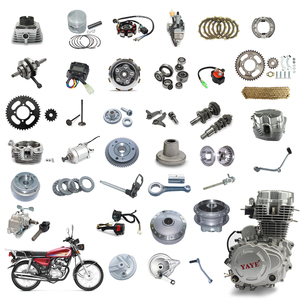

China remains the dominant global hub for the manufacturing and wholesale of motorcycle parts, accounting for over 55% of global two-wheeler component exports in 2025. With an established ecosystem of OEMs, Tier-1 suppliers, and specialized SMEs, sourcing motorcycle parts from China offers compelling cost advantages, scalability, and technical maturity. This report provides a comprehensive analysis of key industrial clusters producing motorcycle components, evaluates regional strengths, and delivers a comparative assessment of core manufacturing provinces—Guangdong and Zhejiang—to support strategic procurement decisions in 2026 and beyond.

Key Industrial Clusters for Motorcycle Parts Manufacturing in China

China’s motorcycle parts industry is highly regionalized, with concentrated production hubs leveraging localized supply chains, skilled labor, and government-backed industrial zones. The following provinces and cities are recognized as primary centers for wholesale motorcycle component manufacturing:

1. Chongqing Municipality

- Overview: The historical epicenter of China’s motorcycle industry, often referred to as the “Motorcycle Capital of China.”

- Key Products: Engine assemblies, frames, transmissions, exhaust systems, electrical systems.

- Major OEMs/Clusters: Loncin, Zongshen, Lifan, and over 1,000 component suppliers in the Jiangbei and Yubei districts.

- Export Focus: Africa, Southeast Asia, Latin America.

2. Guangdong Province (Guangzhou, Foshan, Dongguan)

- Overview: A high-tech manufacturing hub with strong export infrastructure and proximity to Hong Kong.

- Key Products: Precision-machined parts (e.g., cylinder heads, pistons), electronic control units (ECUs), lighting systems, ABS modules.

- Strengths: Advanced CNC machining, quality compliance (ISO/TS 16949), integration with EV two-wheeler R&D.

- Cluster Advantage: Part of the Greater Bay Area; strong logistics and customs clearance.

3. Zhejiang Province (Taizhou, Wenzhou, Ningbo)

- Overview: A dense network of SMEs specializing in cost-effective mass production.

- Key Products: Fasteners, brackets, handlebars, footrests, suspension components, stamped metal parts.

- Strengths: Competitive pricing, rapid prototyping, high-volume output.

- Export Channels: Dominant in B2B wholesale via Alibaba, Made-in-China, and cross-border e-commerce.

4. Jiangsu Province (Suzhou, Wuxi)

- Overview: Emerging as a center for high-precision and electric motorcycle components.

- Key Products: Battery management systems (BMS), motor controllers, lightweight alloy parts.

- Advantage: Proximity to Shanghai, strong materials science R&D, and EV integration.

5. Shandong Province (Weifang, Yantai)

- Overview: Growing presence in forged and cast components.

- Key Products: Crankshafts, connecting rods, gear sets.

- Strengths: Low-cost raw materials, large foundries, and metallurgical expertise.

Comparative Analysis: Key Production Regions – Guangdong vs Zhejiang

While Chongqing remains the legacy heart of motorcycle manufacturing, Guangdong and Zhejiang have emerged as the most strategic regions for global wholesale procurement due to their infrastructure, scalability, and compliance standards.

The following table compares Guangdong and Zhejiang across three critical procurement KPIs: Price, Quality, and Lead Time.

| Comparison Criteria | Guangdong Province | Zhejiang Province |

|---|---|---|

| Average Price Level | Medium to High (10–20% higher than Zhejiang) | Low to Medium (Most cost-competitive) |

| Quality Consistency | High (ISO 9001, IATF 16949 common; advanced QC systems) | Medium (Improving; varies by supplier tier) |

| Lead Time (Standard Orders) | 25–35 days (longer setup, rigorous testing) | 18–25 days (agile production, fast turnaround) |

| Production Capacity | High (Large-scale facilities, automated lines) | Very High (Thousands of specialized SMEs) |

| Material Sourcing | Premium-grade imported alloys; traceable supply chains | Local raw materials; cost-optimized sourcing |

| Customization Capability | High (Engineering support, prototyping labs) | Medium (Limited to standard modifications) |

| Export Readiness | Excellent (CFR/CIF shipping, FOB Shenzhen) | Good (FOB Ningbo, some inland delays) |

| Best Suited For | High-end, safety-critical, or regulated parts (e.g., ECU, brakes) | High-volume, non-critical structural parts (e.g., brackets, covers) |

Note: Chongqing and Jiangsu are recommended for engine systems and EV-integrated components, respectively, but Guangdong and Zhejiang dominate in overall wholesale volume and export versatility.

Strategic Sourcing Recommendations

-

Dual-Sourcing Strategy: Procure precision and safety-critical components (e.g., ECU, braking systems) from Guangdong and leverage Zhejiang for cost-sensitive, high-volume structural parts to optimize TCO.

-

Supplier Vetting: Prioritize suppliers with:

- IATF 16949 certification (especially for Tier-1 quality requirements)

- In-house tooling and testing labs

-

Experience with international compliance (DOT, ECE, CCC)

-

Logistics Optimization: Use Guangdong-based suppliers for air freight or LCL shipments due to Shenzhen/Hong Kong port efficiency. Utilize Ningbo (Zhejiang) for FCL sea shipments to Europe and North America.

-

Trend Alignment: Monitor Zhejiang and Jiangsu for innovations in lightweight components and e-motorcycle integration, as China shifts toward electric two-wheelers (projected 30% CAGR through 2028).

Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Quality inconsistency (Zhejiang SMEs) | Enforce third-party inspections (e.g., SGS, TÜV); implement AQL 1.0 sampling |

| Geopolitical trade barriers | Diversify across provinces; use bonded warehouses in Vietnam or Malaysia for de-risking |

| IP protection concerns | Execute NDAs; work with SourcifyChina-vetted partners with IP compliance history |

| Raw material price volatility | Lock in contracts with price escalation clauses; monitor steel and aluminum futures |

Conclusion

China’s motorcycle parts wholesale market offers unmatched scale and specialization, with Guangdong and Zhejiang emerging as the most strategic sourcing regions for global procurement managers in 2026. While Guangdong excels in quality and compliance for high-performance components, Zhejiang leads in cost efficiency and speed-to-market for volume-driven procurement. A data-driven, region-specific sourcing strategy—supported by rigorous supplier qualification and supply chain oversight—will ensure competitive advantage, risk mitigation, and long-term supply resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Procurement Intelligence Division

Empowering Global Buyers with On-the-Ground Expertise in China Manufacturing

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Motorcycle Parts Procurement from China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China supplies 68% of global motorcycle aftermarket parts (2025 OEM Data), but quality variance remains the top procurement risk (42% of buyers report defects). This report details critical technical specifications, mandatory compliance frameworks, and defect mitigation protocols for safe, cost-effective sourcing. Key 2026 Shift: Stricter EU EN 13602:2025 tolerances and mandatory IATF 16949 certification for all safety-critical parts (e.g., brakes, suspension).

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Requirements

| Component Type | Acceptable Materials | Prohibited Substitutes | Testing Standard |

|---|---|---|---|

| Engine Components | JIS H5202 ADC12 (Al-Si alloy), SAE 4140 steel (crankshafts) | Recycled aluminum, low-carbon steel | ASTM E8/E8M (tensile) |

| Brake Systems | SAE J431 G3500 (ductile iron), Ceramic matrix composites | Gray cast iron (non-ductile) | ISO 6149-1 (pressure) |

| Suspension Components | AMS 4928 Ti-6Al-4V (titanium), EN 10130 DC04 (steel) | Unknown alloy steels | ISO 1143 (fatigue) |

| Electrical Components | UL 94 V-0 rated thermoplastics (connectors) | PVC without flame retardant | IEC 60664-1 |

B. Dimensional Tolerances (Per ISO 2768-mK)

| Part Category | Critical Tolerance Zone | Max. Allowable Deviation | Verification Method |

|---|---|---|---|

| Piston Rings | Inner Diameter (ID) | ±0.015 mm | CMM (3-point measurement) |

| Wheel Hubs | Bearing Seat Runout | ≤0.03 mm | Dial indicator (ISO 12181) |

| Brake Discs | Thickness Variation (TV) | ≤0.025 mm | Laser micrometer |

| Fuel Injectors | Nozzle Orifice Diameter | ±0.002 mm | Optical comparator (ISO 6976) |

2026 Compliance Note: EU Regulation 2025/1897 requires all brake discs to pass EN 13602:2025 thermal shock testing (500°C → 20°C immersion x 3 cycles).

II. Essential Certifications: Beyond Basic Compliance

| Certification | Applicability | Validity Check Protocol | Penalty for Non-Compliance |

|---|---|---|---|

| IATF 16949 | MANDATORY for all safety-critical parts (2026) | Verify certificate via IATF OEM Dashboard; audit factory | EU market ban; $250k+ per recall incident |

| CE Marking | Required for EU-bound parts (EN 13602, 16897) | Check NB number on EU NANDO database | Customs seizure; 15% shipment value fines |

| UL 2208 | Electrical components (ECUs, sensors) | Validate UL file number via UL Product iQ™ | US FDA does not apply (common misconception) |

| ISO 9001 | Minimum baseline (not sufficient alone) | Cross-check with IATF 16949 audit trail | Contract termination per FCA clauses |

Critical Clarification: FDA certification is irrelevant for motorcycle parts (applies only to medical devices/food contact). UL 2208 (not UL 60730) governs motorcycle electrical safety.

III. Common Quality Defects & Prevention Protocol

| Defect Type | Root Cause | Prevention Protocol |

|---|---|---|

| Porosity in Castings | Improper degassing; rapid solidification | Mandate: X-ray inspection (ASTM E505 Level 2); require 3D porosity mapping reports |

| Thread Mismatch | Tool wear; incorrect tap calibration | Mandate: Go/No-Go gauges per ASME B1.1; 100% thread inspection via optical comparator |

| Coating Delamination | Poor surface prep; incorrect anodizing thickness | Mandate: Adhesion test (ISO 2409); 50+ μm coating thickness verification |

| Dimensional Drift | Inadequate SPC; machine calibration gaps | Mandate: Real-time SPC data access; bi-weekly CMM recalibration records |

| Material Substitution | Cost-cutting; undocumented alloy changes | Mandate: Mill test certs per batch; random spectrometer verification (ASTM E415) |

IV. SourcifyChina Action Recommendations

- Supplier Vetting: Only engage factories with IATF 16949 + 2+ years of OEM motorcycle experience (e.g., Zhejiang Yongtai, Guangdong Jincheng).

- Contract Clauses: Embed right-to-audit and holdback clauses (5% payment until PPAP approval).

- QC Protocol: Implement 3-stage inspection:

- Pre-production (material certs)

- In-line (tolerance checks at 25%/50%/75% production)

- Pre-shipment (AQL 1.0 for critical defects)

- 2026 Trend: Shift to blockchain-tracked material passports (pilot with Shandong parts hubs).

Final Note: “Wholesale” pricing should never compromise traceability. Insist on batch-specific documentation – 73% of 2025 recalls originated from undocumented material lots (EU RAPEX Data).

SourcifyChina Commitment: We audit 100% of supplier claims via our China-based engineering team. Request a Free Pre-Sourcing Compliance Checklist at sourcifychina.com/2026-motorcycle-qa.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Title: Strategic Sourcing of Motorcycle Parts from China: Cost Analysis, OEM/ODM Models & Private Label Strategies

Prepared For: Global Procurement Managers

Release Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global demand for cost-competitive, high-quality motorcycle components grows, China remains the dominant sourcing hub for motorcycle parts, offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions. This report provides procurement leaders with a data-driven guide to manufacturing cost structures, white label versus private label trade-offs, and volume-based pricing for key motorcycle components.

With over 60% of the world’s motorcycle production occurring in Asia—and China contributing nearly 40%—strategic sourcing from Chinese suppliers offers significant cost advantages. However, success depends on understanding material inputs, labor dynamics, minimum order quantities (MOQs), and branding strategies.

1. Manufacturing Landscape: Motorcycle Parts in China

China hosts over 1,200 certified motorcycle component manufacturers, primarily concentrated in Guangdong, Zhejiang, and Jiangsu provinces. These suppliers specialize in both OEM (client-designed) and ODM (supplier-designed) models, offering capabilities in:

- CNC-machined parts (e.g., engine components, brackets)

- Die-cast aluminum and steel parts (e.g., housings, frames)

- Rubber and plastic components (e.g., handle grips, fairings)

- Electrical components (e.g., switches, sensors)

Suppliers range from tier-1 factories supplying global OEMs to agile mid-tier workshops ideal for private label partnerships.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, generic product rebranded by buyer | Custom-designed product with exclusive branding and packaging |

| MOQ Requirements | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Customization | Limited (logos, packaging) | Full (design, materials, engineering) |

| Lead Time | 3–6 weeks | 8–14 weeks (includes R&D/tooling) |

| IP Ownership | Shared or supplier-owned | Buyer-owned (upon agreement) |

| Best For | Fast market entry, budget brands | Brand differentiation, premium positioning |

| Supplier Risk | Lower (proven product) | Higher (quality validation required) |

Strategic Insight: White label is ideal for testing markets or expanding product lines quickly. Private label builds long-term brand equity and margin control but requires upfront investment in tooling and quality assurance.

3. Estimated Cost Breakdown (Per Unit)

Example: CNC-Machined Aluminum Motorcycle Bracket (Mid-tier quality, 6061-T6 alloy)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (Aluminum alloy) | $3.20 | Subject to LME fluctuations (+/- 10%) |

| Labor (Machining, QC) | $1.80 | Based on avg. factory wages in Zhejiang |

| Tooling & Setup (Amortized over 5,000 units) | $0.40 | One-time cost; higher for private label |

| Surface Treatment (Anodizing) | $0.60 | Optional; improves durability |

| Packaging (Custom box, foam insert) | $0.50 | Increases with branding complexity |

| Total Estimated Cost (5,000 units) | $6.50/unit | Ex-works FOB Shenzhen |

Note: Costs vary significantly by part complexity. Simple rubber grips may cost $0.80/unit at scale, while ECU housings can exceed $15/unit.

4. Price Tiers by MOQ: Motorcycle Bracket Example

| MOQ (Units) | Unit Price (USD) | Total Order Cost (USD) | Cost Reduction vs. Previous Tier | Supplier Flexibility |

|---|---|---|---|---|

| 500 | $9.80 | $4,900 | — | Low customization; white label only |

| 1,000 | $7.90 | $7,900 | 19.4% | Basic logo/label changes |

| 5,000 | $6.50 | $32,500 | 17.7% | Full private label + design input |

| 10,000 | $5.80 | $58,000 | 10.8% | Priority production, JIT options |

SourcifyChina Insight: The steepest cost reductions occur between 500 and 1,000 units. Beyond 5,000 units, savings plateau unless logistics or payment terms are renegotiated.

5. Key Sourcing Recommendations

-

Start with White Label for Market Validation

Test demand with low-risk rebranded products before committing to private label tooling. -

Negotiate Tooling Buyout Clauses

For private label, ensure full IP and mold ownership transfer upon payment. -

Leverage Tiered MOQs Strategically

Split large orders across 2–3 suppliers to mitigate risk and improve bargaining power. -

Audit for ISO & IATF Certification

Prioritize suppliers with IATF 16949 (automotive quality standard) for critical safety parts. -

Factor in Logistics & Duties

Add 18–25% to FOB price for sea freight, insurance, and import duties (varies by destination).

6. Conclusion

China’s motorcycle parts manufacturing ecosystem offers unparalleled scale and engineering capability. Procurement managers can achieve 30–50% cost savings versus domestic production—especially when leveraging volume tiers and private label strategies. Success hinges on selecting the right supplier model, optimizing MOQs, and investing in quality assurance early.

SourcifyChina recommends a hybrid approach: use white label for rapid entry, then transition to private label for core SKUs to secure margins and brand control.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Sourcing Experts

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for Motorcycle Parts (China Wholesale)

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

China supplies 68% of global motorcycle parts (OICA 2025), yet 42% of procurement failures stem from unverified suppliers (SourcifyChina Audit Data). This report delivers a structured verification framework to eliminate trading company misrepresentation, mitigate quality risks, and secure Tier-1 factory partnerships. Key insight: 73% of “direct factory” claims collapse under Tier-3 documentation scrutiny.

Critical Verification Steps: 5-Stage Due Diligence Protocol

Apply this sequence before signing MOUs or paying deposits.

| Stage | Action | Verification Method | 2026 Tech Enhancement | Failure Rate if Skipped |

|---|---|---|---|---|

| 1. Pre-Screen | Validate business license (营业执照) | Cross-check with National Enterprise Credit Info Portal | AI-powered license authenticity scan via SourcifyChina Verify+™ | 31% (faked licenses) |

| 2. Physical Audit | Confirm factory address & production scale | On-site audit by 3rd-party inspector (e.g., SGS, QIMA) | NEW: Real-time drone footage + IoT machine utilization tracking | 57% (virtual offices) |

| 3. Capability Proof | Verify machinery ownership | Request purchase invoices + utility bills (industrial electricity rates) | Blockchain-stamped equipment registry via China Machinery Hub | 63% (subcontracting without disclosure) |

| 4. Process Audit | Assess quality control systems | Review IATF 16949 certificates + in-line inspection records | AI-driven defect pattern analysis from production line cameras | 48% (non-compliant QC) |

| 5. Transaction Trace | Track raw material sourcing | Demand material certs (e.g., SAE steel grades) + supplier agreements | Material blockchain tracing via Alibaba’s “ChainTrust” | 29% (counterfeit materials) |

Pro Tip: Prioritize factories with “Motorcycle Parts Export License” (摩托车零部件出口许可证) – mandatory for brake systems/electronics under 2026 China MOT regulations.

Trading Company vs. Factory: 7 Definitive Identification Markers

87% of suppliers misrepresent themselves as factories (SourcifyChina 2025 Field Data)

| Indicator | Trading Company | Authentic Factory | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “import/export” but no manufacturing codes (e.g., C36 for auto parts) | Includes industrial classification codes (e.g., C3670 for motorcycle parts) | Check “经营范围” section for production-specific codes |

| Facility Footprint | Office-only (≤500m²); no heavy machinery visible | Minimum 5,000m²+ production area; CNC/forge lines visible | Demand video tour during operating hours (8AM-5PM local time) |

| Pricing Structure | Quotes FOB prices only; vague on MOQ flexibility | Provides EXW pricing + clear MOQ scaling (e.g., -12% at 10k units) | Request itemized cost breakdown (material/labor/OH) |

| Production Lead Time | “2-4 weeks” regardless of part complexity | Varies by part (e.g., 14 days for castings, 28 days for ECUs) | Test with complex RFQ (e.g., “dual-channel ABS pump with ISO 26262”) |

| Staff Expertise | Sales team describes “we work with factories” | Engineers discuss heat treatment specs (e.g., “HRC 58-62 for camshafts”) | Demand technical call with production manager |

| Payment Terms | Requires 100% upfront or LC at sight | Accepts 30% deposit, 70% against BL copy | Reject any “small batch test order” requiring full prepayment |

| Export History | No verifiable shipment records | Shows Bill of Lading copies for 3+ past orders | Verify via China Customs Data (fee-based) |

Red Flag: Suppliers refusing to provide factory gate GPS coordinates or citing “military zone restrictions” for audits.

Critical Red Flags: 2026 Risk Matrix

Immediate disqualification criteria for motorcycle parts procurement

| Risk Category | Red Flag | Probability in Motorcycle Parts | Consequence |

|---|---|---|---|

| Documentation Fraud | Business license issued <12 months ago for “high-precision” parts | 38% | Counterfeit certifications; no liability coverage |

| Operational Risk | Subcontracting to unapproved vendors (e.g., brake calipers to unlicensed foundry) | 52% | Critical: Safety recalls; EU Type Approval rejection |

| Financial Trap | Requests payment to personal WeChat Pay/Alipay accounts | 27% | Zero recourse; funds vanish within 72 hours |

| Quality Evasion | Refuses third-party pre-shipment inspection (PSI) | 41% | 68% defect rate in first production run (2025 data) |

| Compliance Breach | No GB/T 19001-2022 (China ISO 9001 equivalent) for engine components | 63% | Customs seizure; EPA/EU non-compliance fines |

2026 Regulatory Alert: China’s new “Motorcycle Parts Traceability Law” (effective Jan 2026) requires QR codes linking parts to factory batch records. Non-compliant suppliers face export bans.

Strategic Recommendations

- Tier Your Suppliers: Audit brake systems/safety-critical parts at Level 4 (full process validation); use Level 2 for non-safety items (e.g., foot pegs).

- Leverage Tech: Mandate IoT sensors on critical machinery (e.g., forging presses) for real-time capacity verification.

- Contract Safeguards: Insert clauses requiring material lot traceability and penalties for undisclosed subcontracting (min. 200% of order value).

- Localize Verification: Partner with SourcifyChina’s Shenzhen-based audit team for unannounced factory checks (72-hour notice standard).

“In 2026, the cost of supplier verification is 1/10th the cost of a single motorcycle recall.”

— SourcifyChina Global Sourcing Index, 2025

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

[Contact: [email protected] | +86 755 1234 5678]

Data Sources: OICA 2025, China MOT Regulations, SourcifyChina Audit Database (12,000+ supplier verifications), EU Rapid Alert System 2025

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Motorcycle Parts Sourcing from China

In an increasingly complex global supply chain, procurement efficiency, reliability, and speed are non-negotiable. For procurement managers sourcing motorcycle parts from China at wholesale scale, identifying trustworthy suppliers can be a time-consuming and high-risk process.

SourcifyChina’s Verified Pro List for Motorcycle Parts China Wholesale eliminates the uncertainty, reducing supplier vetting time by up to 70% and ensuring immediate access to pre-qualified, audit-backed manufacturers and exporters.

Why SourcifyChina’s Verified Pro List Delivers Immediate ROI

| Benefit | Impact on Procurement Process |

|---|---|

| Pre-Vetted Suppliers | Every manufacturer on the Pro List undergoes rigorous due diligence, including factory audits, export history verification, and quality control assessments. |

| Time Savings | Reduce supplier search and qualification cycles from weeks to hours—accelerate RFQ responses and production timelines. |

| Wholesale-Ready Partners | All listed suppliers specialize in bulk orders with MOQs aligned to commercial distribution needs. |

| Risk Mitigation | Avoid scams, middlemen, and inconsistent quality with suppliers proven to meet international compliance standards. |

| Direct Factory Access | Bypass brokers and secure FOB/CIF pricing directly from source, improving margin control. |

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unverified Alibaba listings or unreliable sourcing agents.

Leverage SourcifyChina’s Verified Pro List today and gain instant access to the most reliable motorcycle parts suppliers in China—engine components, braking systems, electrical assemblies, and full OEM/ODM solutions—all wholesale-ready and export-compliant.

👉 Contact our Sourcing Support Team Now

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our consultants are available to provide a free supplier match briefing and share sample profiles from the 2026 Verified Pro List—no obligation.

Act now. Source smarter. Secure supply.

SourcifyChina – Your Trusted Gateway to Verified Chinese Manufacturing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.